Home>Finance>What Is Bonus Depreciation? Definition And How It Works

Finance

What Is Bonus Depreciation? Definition And How It Works

Published: October 18, 2023

Learn all about bonus depreciation in finance, including its definition and how it works. Explore the benefits of this tax deduction for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Discover the Power of Bonus Depreciation in Finance

Are you looking for ways to maximize your tax savings in your business? One strategy you should definitely consider is bonus depreciation. In this blog post, we will dive deep into the definition and workings of bonus depreciation so that you can make the most of this powerful tool in your financial planning.

Key Takeaways:

- Bonus depreciation allows businesses to accelerate depreciation deductions on certain qualifying assets.

- It can provide significant tax savings and boost cash flow for eligible businesses.

What exactly is bonus depreciation?

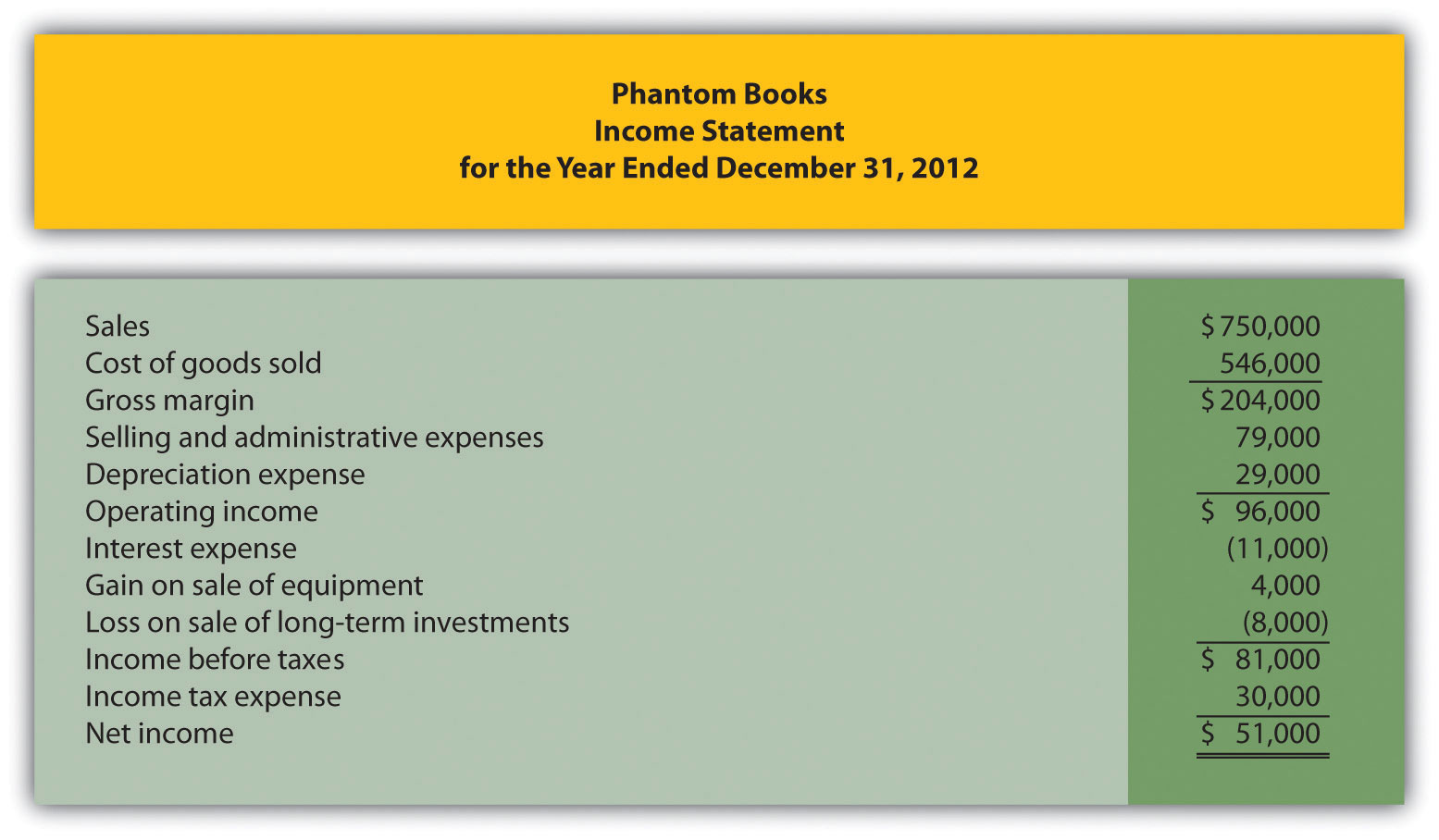

Bonus depreciation is a tax incentive established by the government to stimulate business investment. It allows eligible businesses to deduct a larger portion of the cost of qualifying assets in the year they are placed in service, rather than spreading the deduction over the asset’s useful life.

This means that instead of depreciating an asset over several years, you can take a larger upfront deduction, which provides a significant tax benefit and boosts your cash flow. The bonus depreciation percentage can vary from year to year depending on government regulations and policies.

How does bonus depreciation work?

When you acquire qualifying assets and place them in service during the specific time period designated by the government, you can claim 100% bonus depreciation. This means you can deduct the full cost of the qualifying asset in the year it is put to use.

The qualifying assets usually include tangible property such as machinery, equipment, computers, furniture, and even certain improvements to your business property. The benefit of bonus depreciation is not limited to new assets; it can also apply to used property acquired in specific circumstances.

It’s important to note that bonus depreciation is only available for businesses and is not applicable for personal use assets.

Now, let’s break down the steps involved in using bonus depreciation:

- Identify the qualifying assets that are eligible for bonus depreciation.

- Determine when these assets are placed in service during the tax year.

- Calculate the total cost of the assets eligible for bonus depreciation.

- Claim the bonus depreciation deduction on your tax return.

What are the benefits of bonus depreciation?

The benefits of utilizing bonus depreciation are twofold: tax savings and improved cash flow. By taking advantage of this tax incentive, businesses can reduce their taxable income for the year and potentially save significant amounts on their tax bill.

Additionally, by accelerating the depreciation deductions, businesses can free up more cash in the present, allowing for reinvestment, expansion, or other financial opportunities.

In conclusion,

Bonus depreciation is a tax strategy that provides businesses with a powerful tool to boost their cash flow and save on taxes. By taking advantage of this incentive, eligible businesses can deduct a larger portion of the cost of qualifying assets in the year of purchase, rather than over time.

Whether you’re a small business owner or an executive at a large corporation, bonus depreciation can offer considerable benefits. So, don’t overlook this valuable tax-saving opportunity, and consult with your tax professional to determine how you can leverage bonus depreciation to optimize your financial planning.

Remember, utilizing bonus depreciation effectively can be complex, so it’s crucial to seek professional advice to ensure you navigate the rules and regulations successfully and maximize your tax savings.