Home>Finance>How Is Depreciation Expense Reported In The Financial Statements

Finance

How Is Depreciation Expense Reported In The Financial Statements

Modified: February 21, 2024

Learn how depreciation expense is reported in the financial statements and its impact on finance. Find out more about financial reporting and accounting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Defining Depreciation Expense

- Importance of Depreciation Expense Reporting

- Methods of Depreciation Expense Calculation

- Recording Depreciation Expense in the Income Statement

- Reporting Depreciation Expense in the Balance Sheet

- Impact of Depreciation Expense on Cash Flow Statement

- Understanding the Role of Depreciation Expense in Financial Analysis

- Conclusion

Introduction

Welcome to the world of finance, where numbers and reports play a crucial role in understanding the financial health of companies. One important aspect of financial reporting is the proper recognition and reporting of depreciation expense in the financial statements.

Depreciation expense refers to the allocation of the cost of tangible assets over their estimated useful lives. It represents the wear and tear, obsolescence, or other factors that reduce the value of an asset over time. By recognizing depreciation expense, companies can accurately reflect the decline in value of their assets and allocate this expense against their revenues.

Understanding how depreciation expense is reported in the financial statements is essential for investors, creditors, and other stakeholders to assess a company’s profitability, financial position, and cash flow. In this article, we will delve into the various aspects of depreciation expense reporting, including its calculation, recording in the income statement, reporting in the balance sheet, and its impact on the cash flow statement.

Moreover, we will explore the different methods used to calculate depreciation expense and examine the significance of depreciation expense in financial analysis. By the end of this article, you will have a comprehensive understanding of how depreciation expense is reported and its implications in assessing a company’s financial performance.

Defining Depreciation Expense

Depreciation expense is a fundamental concept in finance and accounting that represents the systematic allocation of the cost of a tangible asset over its estimated useful life. Tangible assets can include buildings, machinery, vehicles, equipment, and furniture, among others.

When a company purchases a tangible asset, it recognizes the cost of the asset as an expense on its balance sheet. However, rather than deducting the entire cost in one go, the cost is spread out over the useful life of the asset. This is done through the process of calculating and recording depreciation expense.

The rationale behind this practice is that tangible assets are not expected to last indefinitely. Over time, they wear out, become obsolete, or lose value due to factors such as technological advancements or changes in market demand. Depreciation expense recognizes this decrease in value and allocates it as an expense over the asset’s useful life.

Depreciation expense is considered a non-cash expense because it does not involve an actual outflow of cash from the company. It is purely an accounting measure to accurately reflect the decline in value of the asset. However, even though it is a non-cash expense, it still has a significant impact on a company’s financial statements and financial analysis.

It is important to note that while depreciation expense is primarily associated with tangible assets, there are other similar concepts for intangible assets. For example, amortization is the term used for spreading out the cost of intangible assets, such as patents or copyrights, over their estimated useful lives. The principles of recording and reporting depreciation expense also apply to these intangible assets.

Next, we will explore why the reporting of depreciation expense is crucial in financial statements and its importance in assessing a company’s financial position and profitability.

Importance of Depreciation Expense Reporting

The reporting of depreciation expense in the financial statements serves several important purposes and provides valuable insights to stakeholders. Let’s explore the key reasons why depreciation expense reporting is crucial:

- Accurate Financial Position: Depreciation expense helps in presenting a more accurate and realistic financial position of a company. By allocating the cost of assets over their useful lives, it reflects the true value of those assets. This allows stakeholders to have a clearer understanding of the company’s net worth and the value of its assets.

- Profitability Assessment: Depreciation expense is deducted from revenues in the income statement, reducing reported net income. This deduction reflects the wear and tear of assets used in generating revenue. By separating out depreciation expense, stakeholders can analyze the company’s profitability excluding this non-cash expense, providing a more accurate measure of operational performance.

- Asset Replacement Planning: Depreciation expense estimation helps companies plan for asset replacement. By knowing the estimated useful life of an asset and the corresponding depreciation expense, management can make informed decisions about when to replace or upgrade an asset. This information is critical for budgeting and capital expenditure planning.

- Taxation and Compliance: Depreciation expense has significant implications for tax calculations. Tax authorities often allow companies to deduct a portion of the asset’s cost as depreciation expense, reducing taxable income. Proper reporting of depreciation helps ensure compliance with tax regulations and minimizes the tax liability of the company.

- Comparison Across Industries: Depreciation expense reporting enables stakeholders to compare companies within the same industry. Industries with significant asset-intensive operations tend to have higher depreciation expenses. Understanding the differences in depreciation expense among companies can provide insights into their investment in assets and overall operational efficiency.

Overall, depreciation expense reporting is essential for providing transparency, accuracy, and meaningful financial information to stakeholders. It allows for a comprehensive assessment of a company’s financial position, profitability, and future asset replacement needs. Depreciation expense serves as a valuable tool in financial analysis and decision-making processes for investors, creditors, and management alike.

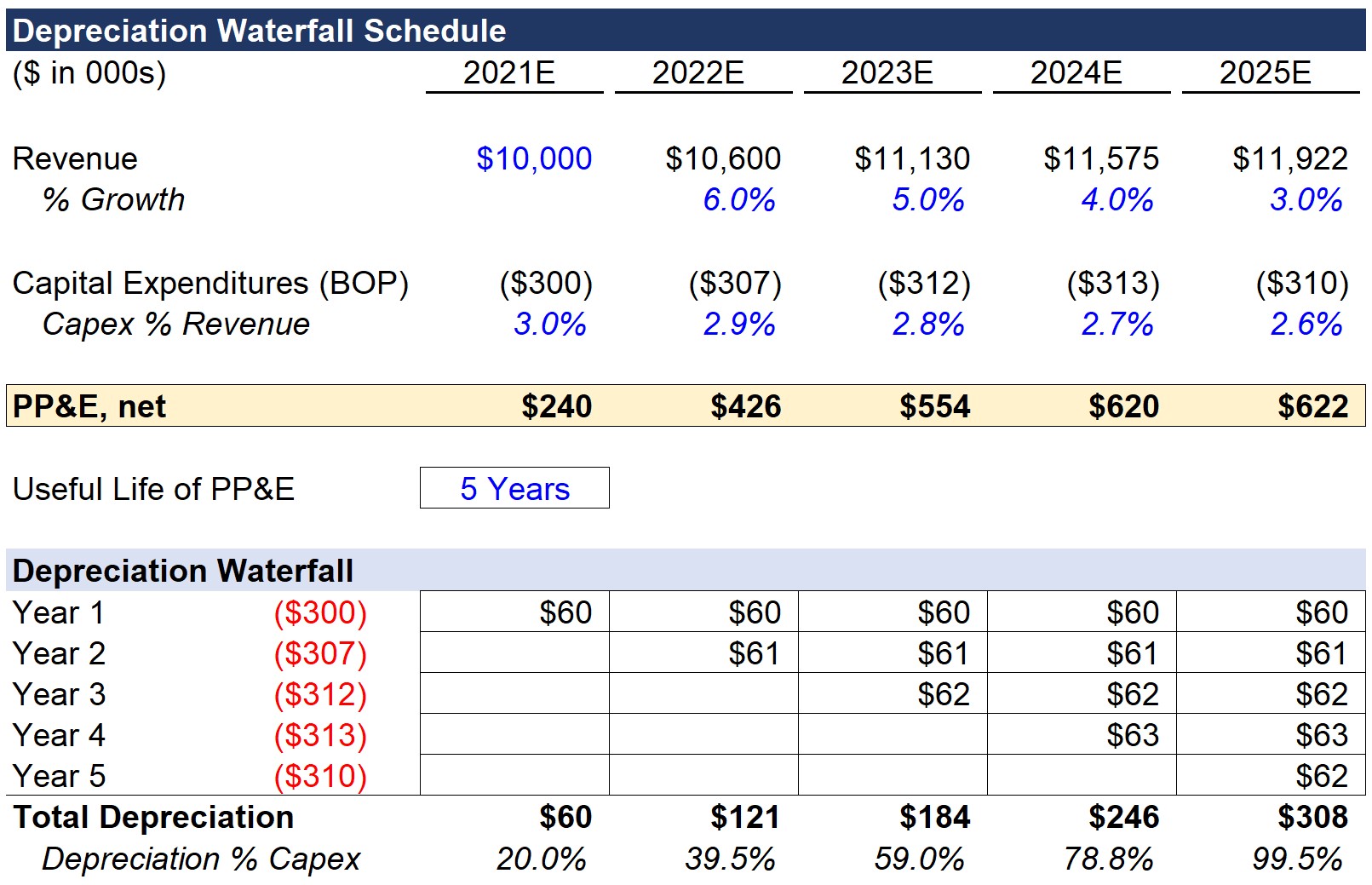

Methods of Depreciation Expense Calculation

There are several methods available for calculating depreciation expense, each with its own advantages and suitability for different types of assets. The choice of depreciation method depends on factors such as the nature of the asset, its expected useful life, and the desired pattern of allocating depreciation expense over time. Let’s explore some commonly used methods:

- Straight-line depreciation: This is the most straightforward and commonly used method. It allocates an equal amount of depreciation expense each year over the useful life of the asset. The formula for straight-line depreciation is: (Cost of Asset – Salvage Value) / Useful Life. This method is suitable when the asset’s usefulness declines evenly over time.

- Declining balance depreciation: This method allocates a higher depreciation expense in the early years of an asset’s life and gradually decreases it over time. It is based on the assumption that assets are more productive in their early years and depreciate at a faster rate. There are two variations of declining balance depreciation: double-declining balance (DDB) and 150% declining balance (150% DB).

- Units of production depreciation: This method measures depreciation based on the asset’s usage or productivity. It allocates higher depreciation expense when the asset is utilized more and vice versa. The formula for units of production depreciation is: (Cost of Asset – Salvage Value) / Total Units of Production. This method is suitable for assets that are primarily used in production or have varying levels of usage.

- Sum-of-the-years’ digits depreciation: This method accelerates depreciation expense by using a fraction based on the sum of the asset’s useful life. The formula for sum-of-the-years’ digits depreciation is: (Remaining Useful Life / Sum of the Years’ Digits) x (Cost of Asset – Salvage Value). This method is suited for assets that are expected to have a higher productivity in the early years of their useful life.

- MACRS depreciation: This method is specifically used for tax purposes in the United States. It follows the Modified Accelerated Cost Recovery System (MACRS) whereby assets are grouped into classes with predetermined depreciation rates and recovery periods. The MACRS method allows for accelerated depreciation in the early years of an asset’s life, which provides tax benefits.

It’s important to note that each method has its advantages and disadvantages. The choice of depreciation method should align with the nature of the asset, industry practices, tax considerations, and the reporting requirements of the company. Consistency in the use of the selected method is crucial for accurate and meaningful financial reporting.

Next, we will explore how depreciation expense is recorded in the income statement.

Recording Depreciation Expense in the Income Statement

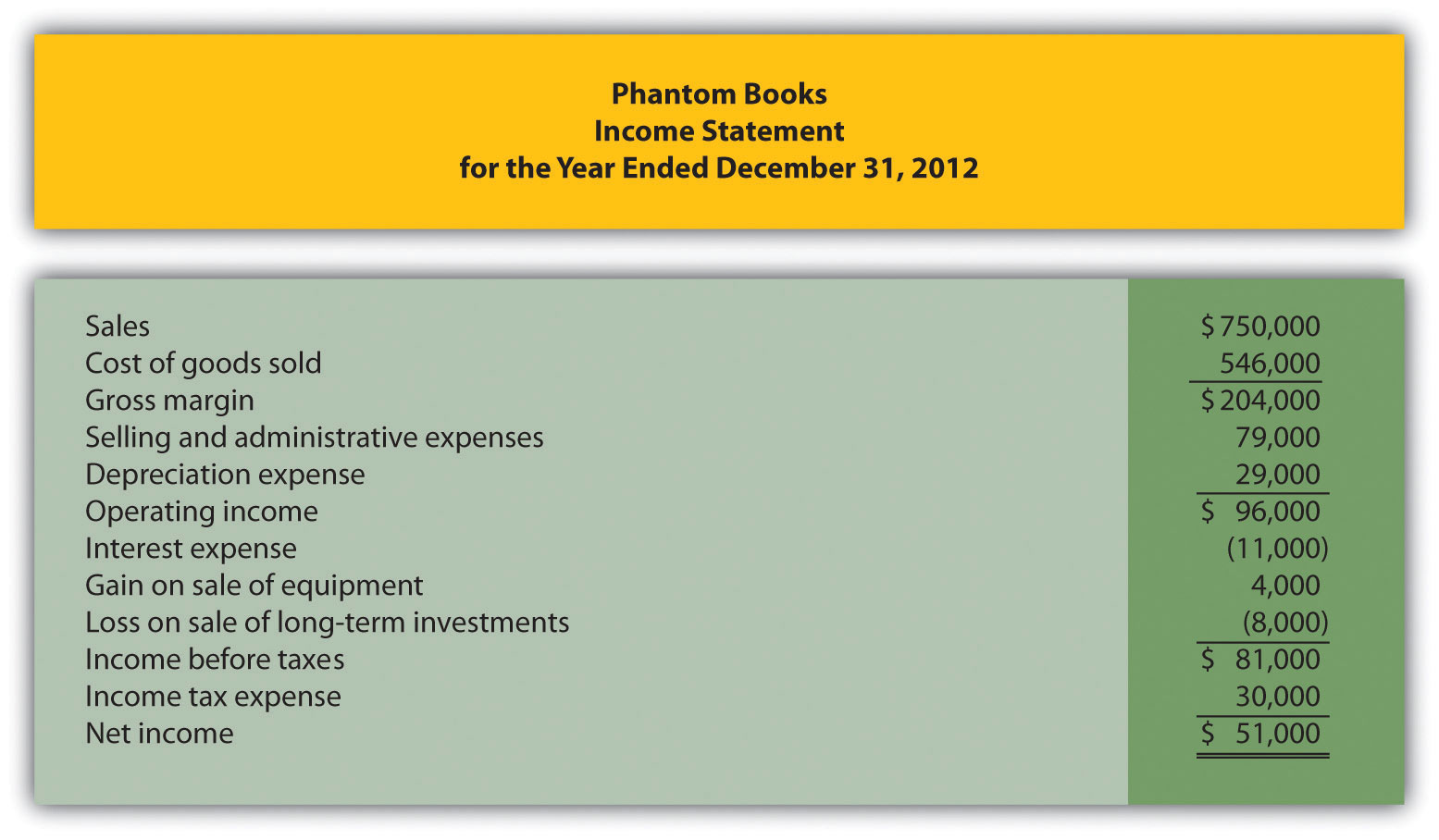

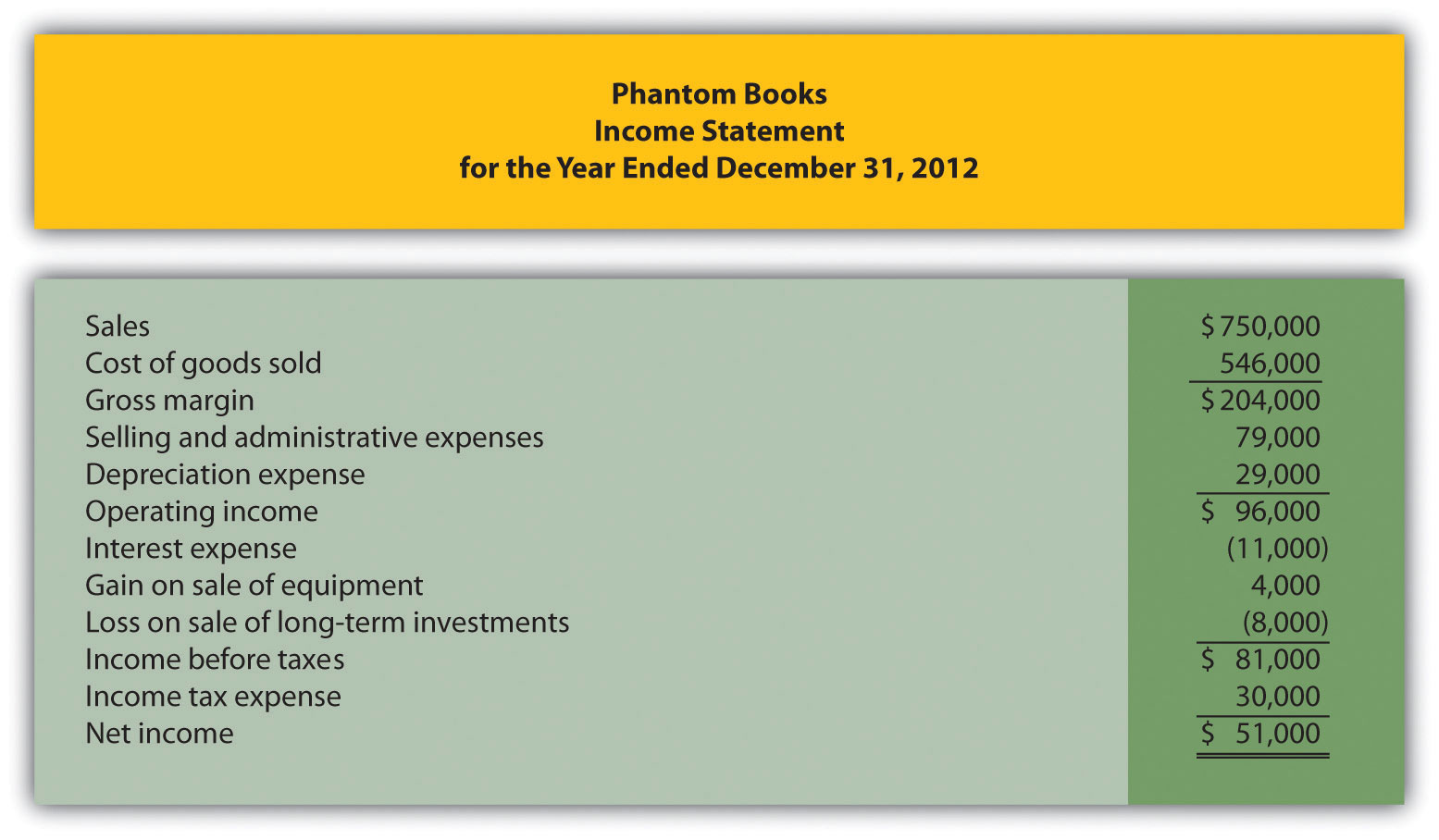

Depreciation expense is recorded in the income statement as an operating expense. It represents the portion of an asset’s cost that is allocated as an expense within a specific accounting period. The recording of depreciation expense follows the matching principle, where expenses are recognized in the same period as the revenue they help generate.

The amount of depreciation expense recorded in the income statement depends on the chosen depreciation method and the asset’s cost, useful life, and residual value. For example, under the straight-line depreciation method, an equal amount of depreciation expense is recognized each year over the asset’s useful life.

Typically, depreciation expense is included in the operating expense section of the income statement, along with other expenses incurred in the normal course of business. However, in some cases, depreciation may be separated and categorized under a specific line item such as “Depreciation and Amortization” to provide clearer visibility.

The recognition of depreciation expense in the income statement has several implications:

- Reduced Net Income: Depreciation expense is subtracted from the revenue earned to calculate net income. Therefore, higher depreciation expense leads to lower net income, as it reflects the cost of using the assets to generate revenue. This reduction in net income is a non-cash expense and does not impact cash flows.

- Impact on Earnings per Share (EPS): Lower net income due to depreciation expense reduces the numerator of the EPS calculation. This can result in a lower EPS figure, which is an important metric for investors to assess a company’s profitability on a per-share basis.

- Effect on Profit Margin: Depreciation expense, when expressed as a percentage of revenue, affects the profit margin of a company. Higher depreciation expense relative to revenue results in a lower profit margin, as it indicates higher costs incurred to generate the revenue.

- Comparison with Peers: The amount and trend of depreciation expense in the income statement allow for comparisons with industry peers. It helps stakeholders evaluate a company’s asset utilization, efficiency, and the impact of depreciation on its overall profitability.

By recording depreciation expense in the income statement, companies provide a more accurate representation of their operational costs and profitability. It enables stakeholders to assess the true economic impact of using assets in generating revenue. Next, let’s explore how depreciation expense is reported in the balance sheet.

Reporting Depreciation Expense in the Balance Sheet

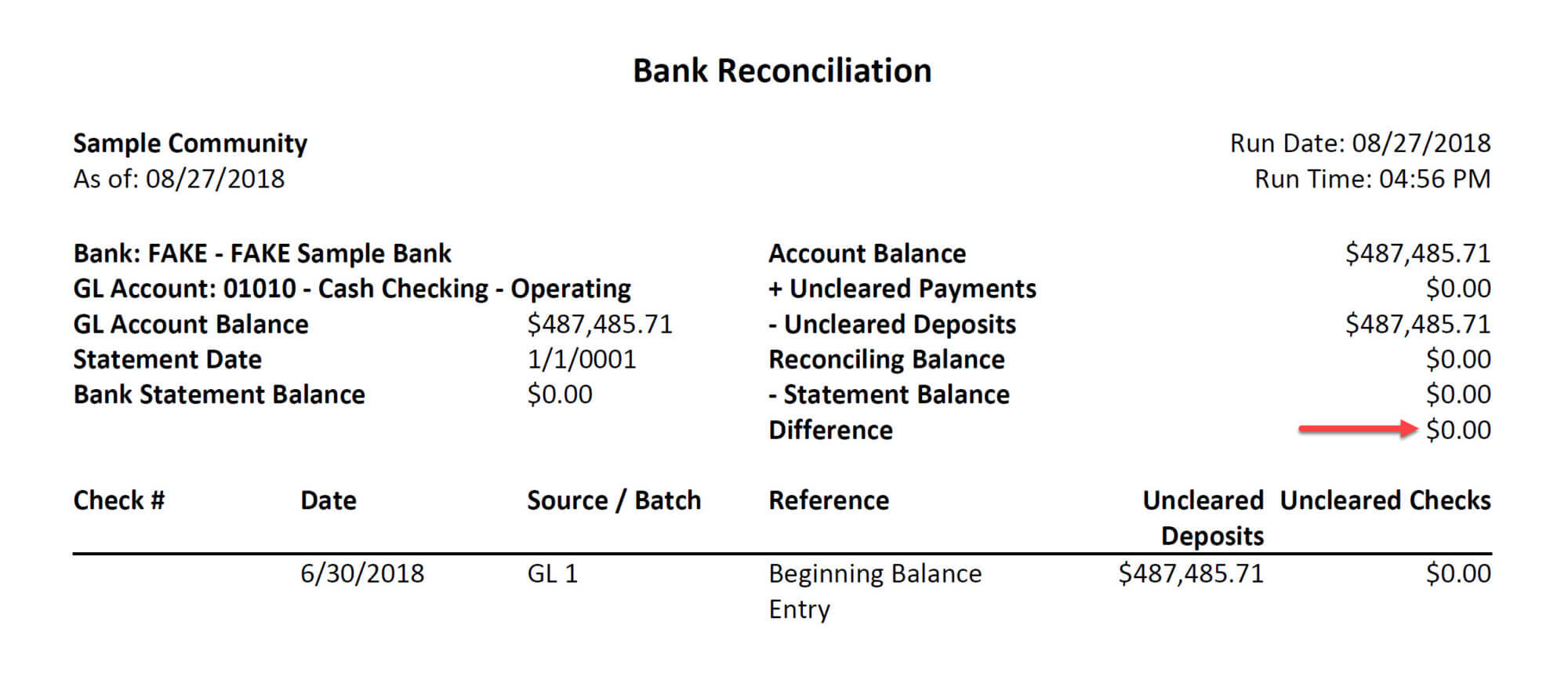

Depreciation expense is not directly reported in the balance sheet. However, its impact is reflected in two key components of the balance sheet: the accumulated depreciation and the carrying value of the assets.

The accumulated depreciation is a contra-asset account that represents the total amount of depreciation expense that has been recorded over the useful life of an asset. It is a running total and is reported as a deduction from the original cost of the asset.

The carrying value, also known as the net book value or the net carrying amount, is calculated by subtracting the accumulated depreciation from the original cost of the asset. The carrying value represents the remaining value of the asset after accounting for its depreciation.

Both the accumulated depreciation and the carrying value are reported in the balance sheet to provide stakeholders with information about the current value and the historical cost of the company’s assets:

- Accumulated Depreciation: Accumulated depreciation is reported as a negative amount or a reduction from the original cost of the assets. It is typically displayed as a separate line item below the specific asset accounts in the property, plant, and equipment section of the balance sheet. This allows stakeholders to see the total depreciation recognized in relation to various categories of assets.

- Carrying Value of Assets: The carrying value of assets is calculated by subtracting the accumulated depreciation from the original cost of the assets. It represents the net value of the assets that the company still holds. Carrying values are reported either for individual assets or in aggregate for specific asset categories.

The reporting of depreciation expense in the balance sheet has a few important implications:

- Asset Valuation: The accumulated depreciation account reduces the reported value of the assets. This reflects the portion of the asset’s cost that has been allocated as an expense and acknowledges the reduction in the asset’s value over time. The carrying value provides stakeholders with a more realistic estimate of the asset’s current worth.

- Impact on Financial Ratios: Depreciation expense and the corresponding accumulated depreciation affect financial ratios such as return on assets (ROA) and asset turnover. These ratios assess how effectively a company utilizes its assets and generate profits. Higher depreciation expenses may result in lower ratios, indicating a decrease in asset efficiency.

- Implications for Asset Aging and Replacement: Accumulated depreciation balances can provide insights into the age and condition of a company’s assets. Higher balances may indicate the need for future asset replacement or repairs, highlighting potential capital expenditure requirements.

By reporting depreciation expense through the accumulated depreciation and the carrying value of assets, the balance sheet provides stakeholders with valuable information about the ongoing depreciation of assets and their impact on the company’s financial position. Next, let’s explore the impact of depreciation expense on the cash flow statement.

Impact of Depreciation Expense on Cash Flow Statement

Depreciation expense has an important impact on the cash flow statement, specifically in the operating activities section. Although depreciation expense is a non-cash expense, it indirectly affects a company’s cash flow statement in the following ways:

- Increase in Net Income: As depreciation expense is deducted from revenue in the income statement, it reduces the reported net income. However, in terms of cash flow, since depreciation is a non-cash item, it does not require an actual outflow of cash. Therefore, depreciation expense is added back to net income in the operating activities section of the cash flow statement to reflect the non-cash nature of the expense.

- Cash Flow from Operations: The add-back of depreciation expense to net income increases the net cash flow from operating activities. This adjustment is necessary to reconcile the non-cash expenses with the actual cash flow generated by the business. By adding back depreciation, the cash flow statement provides a more accurate representation of the cash generated or used by the company’s operating activities.

- Cash Flow Coverage: Depreciation expense positively impacts a company’s cash flow coverage ratios. It increases the cash flow from operations, which is used to assess a company’s ability to generate sufficient cash to cover its operating expenses, debt obligations, and capital expenditures. Higher cash flow from operations indicates a stronger cash flow position and better cash flow coverage.

- Investment and Financing Activities: In the cash flow statement, depreciation expense does not directly impact the cash flows related to investment activities or financing activities. However, it indirectly affects these sections by influencing the reported net income and subsequent cash flow from operations. The cash flow statement as a whole provides a comprehensive view of a company’s cash inflows and outflows across all activities.

It is important to note that while depreciation expense is added back to net income in the operating activities section, the cash expended to acquire assets is reported in the investing activities section under “Cash Flow from Purchase of Property, Plant, and Equipment.” This distinction separates the non-cash expense from the actual cash outlay involved in purchasing or replacing assets.

By understanding the impact of depreciation expense on the cash flow statement, stakeholders gain insights into a company’s cash-generating ability and its capacity to fund operations, investments, and debt obligations. The cash flow statement provides a holistic view of the company’s cash flows, reconciling the non-cash nature of depreciation with the actual cash movement.

Now, let’s delve into the role of depreciation expense in financial analysis.

Understanding the Role of Depreciation Expense in Financial Analysis

Depreciation expense plays a crucial role in financial analysis as it provides valuable insights into a company’s financial performance, asset utilization, and overall profitability. By understanding the impact of depreciation expense, financial analysts can make informed assessments and comparisons. Here’s how depreciation expense contributes to financial analysis:

- Asset Efficiency: Evaluating depreciation expense helps assess how efficiently a company utilizes its assets. Higher depreciation expense relative to revenue may indicate increased asset usage and potential asset wear and tear. Lower depreciation expense, on the other hand, could suggest underutilized assets or longer asset lifespans.

- Profitability Assessment: Depreciation expense is subtracted from revenue in the income statement, influencing the reported net income. By examining depreciation alongside net income, analysts can evaluate the proportion of expenses incurred in generating the reported profits. This analysis provides a more accurate assessment of a company’s profitability from core operations.

- Trend Analysis: Comparing depreciation expense over time helps identify trends and patterns. A consistent increase in depreciation expense may indicate a need for asset replacements or upgrades, affecting future capital expenditures. Significant decreases in depreciation expense might reflect changes in asset utilization strategies or write-down adjustments.

- Capital Expenditure Planning: The estimation of future depreciation expense assists in capital expenditure planning. By understanding the expected depreciation for existing assets, companies can project the need for new investments to replace or upgrade depreciated assets. This allows for better financial planning and budgeting.

- Industry Comparison: Analyzing depreciation expense across companies within the same industry provides insights into industry practices and asset utilization efficiency. Comparing depreciation as a percentage of revenue or across asset categories helps stakeholders assess the relative performance of companies and identify potential areas for improvement or investment.

Financial analysts use depreciation expense as a tool to assess a company’s asset management, profitability, and future investment needs. By understanding the role of depreciation expense in financial analysis, stakeholders gain a comprehensive view of a company’s financial health and can make more informed decisions related to investment, lending, or potential partnerships.

Now, let’s conclude our discussion on the importance of depreciation expense reporting.

Conclusion

Depreciation expense reporting plays a critical role in understanding a company’s financial performance, asset utilization, and overall financial health. By accurately recognizing and reporting depreciation expense in the financial statements, stakeholders can make informed assessments and decisions.

Depreciation expense represents the systematic allocation of the cost of tangible assets over their estimated useful lives. It provides a realistic reflection of the decline in value of assets due to wear and tear, obsolescence, or other factors. Depreciation expense calculation involves various methods such as straight-line, declining balance, units of production, sum-of-the-years’ digits, or the MACRS method.

Depreciation expense is recorded as an operating expense in the income statement, reducing net income and impacting profitability measures. It is also reported in the balance sheet through accumulated depreciation and the carrying value of assets, providing insights into the remaining value of assets and their depreciation history.

Depreciation expense indirectly affects the cash flow statement, as it is added back to net income in the operating activities section to reflect its non-cash nature. Understanding the role of depreciation expense in financial analysis helps evaluate asset efficiency, assess profitability, analyze trends, plan for capital expenditures, and make industry comparisons.

In conclusion, accurate and transparent reporting of depreciation expense is crucial for stakeholders to make informed decisions about a company’s financial position, profitability, and asset management. By understanding the impact of depreciation expense, stakeholders can gain a comprehensive view of a company’s financial performance and make well-informed decisions on investment, credit, or strategic partnerships.