Finance

What Is BPP In Insurance?

Published: November 10, 2023

Discover what BPP in insurance means and how it relates to finance. Uncover the significance of BPP in ensuring financial security and risk management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to protecting your business from potential risks and losses, it’s essential to have the right insurance coverage in place. One type of insurance that is crucial for businesses is Business Personal Property (BPP) insurance. BPP insurance provides coverage for the physical assets that a business owns, such as furniture, equipment, inventory, and other personal property.

BPP insurance is an important component of a comprehensive commercial insurance policy. It offers financial protection against perils like fire, theft, vandalism, or natural disasters that can damage or destroy your business’s physical assets. Whether you own a small retail store, a restaurant, or a large manufacturing facility, BPP insurance ensures that your essential business equipment and property are covered.

Understanding the coverage and importance of BPP insurance can help you make informed decisions about your insurance needs and adequately protect your business assets. In this article, we will delve into the definition, coverage, claim process, and other crucial aspects of BPP insurance, providing you with the knowledge you need to safeguard your business effectively.

Definition of BPP

Business Personal Property (BPP) refers to the movable or tangible assets that are owned by a business entity. These assets can include but are not limited to furniture, machinery, computers, inventory, tools, fixtures, equipment, and other personal property that is necessary for the operations of the business.

BPP insurance is designed to protect these physical assets from a variety of risks, such as theft, fire, vandalism, natural disasters, or damage caused by accidents. The coverage provided by BPP insurance typically extends to the assets located at the business premises, as well as those temporarily outside of the premises, such as when they are being transported or stored elsewhere.

In addition to protecting against physical damage or loss, BPP insurance can also offer coverage for associated expenses like the costs of removing debris, repairing damaged property, or replacing lost equipment. The specific coverage and limits of BPP insurance can vary depending on the insurance company and the policy terms.

It is important to note that BPP insurance typically only covers the physical assets and property owned by the business. It does not include coverage for the building structure itself, which is typically covered under a separate policy such as commercial property insurance. It is common for businesses to have both BPP insurance and property insurance to ensure comprehensive protection for their assets.

Importance of BPP in Insurance

BPP insurance plays a crucial role in providing financial protection for businesses and mitigating the risks associated with owning and operating a business. Here are some key reasons why BPP insurance is important:

- Asset Protection: Business personal property represents a significant investment for any business. By having BPP insurance, you can protect your assets from various perils such as fire, theft, natural disasters, or accidents. This insurance coverage ensures that any damage or loss to your business’s physical assets does not result in a significant financial burden or disrupt your operations.

- Business Continuity: In the event of a covered loss, BPP insurance helps to minimize the impact on your business operations. With the financial assistance provided by the insurance, you can quickly replace or repair damaged property and resume your operations without incurring significant downtime or financial strain.

- Liability Protection: BPP insurance can also provide liability protection for third-party claims related to your business personal property. For example, if a visitor to your business is injured due to a faulty equipment that you own, your BPP insurance may cover the resulting medical expenses or legal costs. This coverage helps to safeguard your business’s financial well-being in the face of potential liability claims.

- Peace of Mind: Running a business comes with inherent risks, and having BPP insurance gives you the peace of mind knowing that your valuable assets are protected. Whether it’s damage from a fire or a burglary, you can focus on running your business, knowing that you have insurance coverage to help you recover and rebuild if necessary.

- Compliance: Depending on your industry and regulatory requirements, having BPP insurance may be mandatory. Lenders or landlords may also require businesses to have BPP insurance as a condition for obtaining financing or leasing commercial space. By having the appropriate insurance coverage, you can meet these requirements and fulfill your contractual obligations.

Overall, BPP insurance is a fundamental component of a comprehensive risk management strategy for businesses. It not only protects your valuable assets but also provides you with the necessary financial means to recover from unforeseen events and maintain the continuity of your business operations.

Coverage and Limits of BPP

BPP insurance provides coverage for a wide range of physical assets and personal property that are essential for the operations of a business. The coverage typically includes but is not limited to the following:

- Building Contents: BPP insurance covers the contents of the building or premises, such as furniture, fixtures, and equipment.

- Business Equipment: This includes machinery, computers, printers, tools, and other equipment necessary for the business operations.

- Business Inventory: BPP insurance can cover the value of your inventory, including raw materials, finished goods, and products for sale.

- Off-Premises Property: Some BPP insurance policies may extend coverage to property temporarily located away from the business premises, such as property in transit or stored off-site.

- Improvements and Additions: If you have made any additions or improvements to the building or premises, BPP insurance can cover the cost to repair or replace them in the event of damage or loss.

- Business Records: BPP insurance can also provide coverage for the cost of restoring or reproducing business records that are damaged or lost due to a covered peril.

It is important to review the specific coverage details and policy limits provided by your insurance provider. The limits of BPP insurance typically depend on factors such as the value of your assets, the industry you operate in, and the potential risks associated with your business. It is essential to accurately assess the value of your business personal property and ensure that your coverage limits adequately protect your assets.

In addition to the coverage provided, BPP insurance may also include additional endorsements or riders that tailor the policy to your specific needs. For example, you may want to include coverage for business interruption, which compensates for lost income and additional expenses incurred if your business is temporarily unable to operate due to a covered loss.

Keep in mind that certain perils may be excluded from coverage, such as floods or earthquakes. If your business is located in an area prone to these perils, you may need to consider purchasing separate coverage or additional endorsements to ensure comprehensive protection.

Always work closely with an insurance professional to assess your specific needs and customize your BPP insurance policy to provide the optimal coverage and limits for your business assets.

Factors Affecting BPP Insurance Premiums

Several factors can influence the premium you pay for your Business Personal Property (BPP) insurance. Insurance providers consider these factors to assess the level of risk associated with your business and determine the appropriate premium. Here are some key factors that can affect BPP insurance premiums:

- Value of Property: The overall value of your business personal property is a significant factor in determining premiums. The higher the value of your assets, the higher the premium is likely to be.

- Property Location: The location of your business can impact insurance premiums. Areas with higher crime rates or increased risk of natural disasters may result in higher premiums due to the increased likelihood of property damage or theft.

- Property Characteristics: The characteristics of your property, such as the age, size, construction materials, and security features, can influence your premiums. Older buildings or those with higher risk features may result in higher premiums.

- Business Operations: The nature of your business activities can affect premiums. Hazardous operations or businesses involving higher risks may lead to increased insurance costs. For example, a manufacturing facility with hazardous materials will likely have higher premiums compared to a retail store.

- Prior Claims: Your claims history can impact BPP insurance premiums. If you have filed previous claims or experienced significant losses, insurance providers may view your business as a higher risk and charge higher premiums as a result.

- Deductible Amount: The deductible you choose can affect your premiums. A higher deductible means you will pay more out of pocket in the event of a claim, resulting in lower premiums. Conversely, a lower deductible will lead to higher premiums.

- Policy Limits and Coverages: The specific coverage limits and additional endorsements you include in your BPP insurance policy will impact premiums. The more extensive the coverage and higher the limits, the higher the premiums will typically be.

It is essential to work closely with an insurance professional to assess your specific business needs, accurately estimate the value of your assets, and understand the factors that contribute to your insurance premiums. By managing these factors effectively, you can help optimize coverage while keeping BPP insurance premiums within your budget.

Types of BPP Insurance Policies

Business Personal Property (BPP) insurance offers various policy options to cater to different business needs and industries. Here are some common types of BPP insurance policies:

- Standard BPP Policy: This is the most common type of BPP insurance policy, providing coverage for a wide range of perils, including fire, theft, vandalism, and certain natural disasters. It covers the essential assets and property owned by the business.

- All-Risk Policy: An all-risk BPP policy provides coverage for all potential perils, except for those specifically excluded in the policy. This type of policy offers broader coverage than a standard policy and provides a higher level of protection for your business personal property.

- Named Peril Policy: Named peril policies provide coverage only for the specific perils that are listed in the policy. Perils can vary depending on the policy and can include events like fire, lightning, explosion, smoke, windstorm, hail, vandalism, or theft.

- Replacement Cost Policy: This type of policy provides coverage for the cost of replacing damaged or destroyed assets with new ones of similar kind and quality, without deducting for depreciation. It ensures that you can replace your business personal property at today’s market prices.

- Actual Cash Value Policy: An actual cash value policy provides coverage based on the current value of the property, considering depreciation. In the event of a covered loss, the insurance company will assess the value of the damaged or lost property and provide compensation based on its depreciated value.

- Agreed Value Policy: With an agreed value policy, you and your insurance provider agree on the value of your business personal property at the time the policy is written. In the event of a covered loss, the agreed-upon value is what you will be compensated, without considering depreciation.

- Blanket Policy: A blanket policy is suitable for businesses with multiple locations or varying asset values. It provides coverage for all locations or a group of assets under a single limit, eliminating the need for separate policies for each location or asset.

It’s important to carefully evaluate your business needs and consult with an insurance professional to determine the best type of BPP insurance policy for your specific circumstances. Consider factors such as the value of your assets, the risks associated with your industry, and the level of coverage you require to protect your business personal property effectively.

Claim Process for BPP Insurance

In the unfortunate event of damage or loss to your business personal property, it is crucial to understand the claim process for your Business Personal Property (BPP) insurance. While the specific details can vary depending on your insurance provider and policy terms, here is a general overview of the typical claim process:

- Notify your insurance provider: As soon as you discover the damage or loss, it is important to notify your insurance provider promptly. Contact the designated claims department or your insurance agent to initiate the claims process. Provide them with all the necessary details and documentation to support your claim.

- Document the damage: Take photos or videos of the damaged property as evidence for your claim. Create an inventory of the damaged or lost items, including their descriptions, quantities, and values. This documentation will help to substantiate your claim and facilitate a smoother claims process.

- Cooperate with the investigation: Your insurance provider may conduct an investigation to assess the cause and extent of the damage. Cooperate fully with the investigation process and provide any requested information or documentation. This may include providing receipts, invoices, or other proof of ownership or value for the affected property.

- Obtain repair or replacement estimates: If repairs or replacement of damaged property are necessary, obtain detailed estimates from reputable contractors. These estimates will assist in determining the cost of the claim and help ensure accurate reimbursement.

- Submit the claim documentation: Prepare and submit your claim documentation to your insurance provider, including the completed claim form, supporting evidence, and any estimates or invoices for repairs or replacement. Ensure that all required information is included and accurate to expedite the claims process.

- Review and settlement: Once your insurance provider reviews your claim and the associated documentation, they will determine the appropriate settlement amount based on your coverage limits and policy terms. If the claim is approved, you will receive the settlement, which may be issued as a one-time payment or in installments.

- Replace or repair the property: Use the settlement funds to replace or repair the damaged or lost property. Keep records of the expenses incurred for repairs or replacements, as you may need to submit these for reimbursement if your policy covers them.

- Follow up and close the claim: Throughout the claim process, maintain regular communication with your insurance provider and promptly respond to any additional requests for information or documentation. Once your claim is settled and your property is replaced or repaired, ensure that the claim is officially closed with your insurance provider.

It is essential to remember that each insurance provider may have specific requirements and timelines for the claims process. Familiarize yourself with your policy terms and contact your insurance provider for detailed instructions on how to file a claim and what to expect during the process. Working closely with your insurance provider will help ensure a smooth and efficient claims experience.

Common Exclusions in BPP Insurance

While Business Personal Property (BPP) insurance provides coverage for a wide range of perils and risks, there are certain exclusions that are commonly found in insurance policies. Exclusions specify situations or events for which coverage will not be provided. It is important to be aware of these exclusions to fully understand the limitations of your insurance coverage. Here are some common exclusions in BPP insurance:

- Flood and Earthquake: BPP insurance typically excludes coverage for damage or loss caused by floods and earthquakes. If your business is located in an area prone to these perils, you may need to consider obtaining separate coverage or endorsements specifically for these risks.

- Intentional Acts: Damage or loss caused by intentional acts, such as vandalism or arson committed by the insured or with their consent, is typically excluded from coverage.

- Acts of War or Terrorism: BPP insurance typically does not cover damage or loss resulting from acts of war, terrorism, or civil unrest. Separate insurance policies or endorsements may be required to address these risks.

- Wear and Tear: Normal wear and tear, deterioration, or depreciation of property over time is typically not covered by BPP insurance. Insurance coverage is designed to address sudden and unforeseen events that cause damage or loss.

- Employee Dishonesty: BPP insurance usually does not cover losses resulting from fraudulent or dishonest acts committed by employees. Employers may need to consider separate coverage, such as employee dishonesty or fidelity bonds, to protect against these risks.

- Mechanical Breakdown: BPP insurance may exclude coverage for mechanical breakdown of equipment or machinery. Separate mechanical breakdown or equipment breakdown coverage can be obtained to address these specific risks.

- Computer Viruses and Cyber Attacks: Damage or losses caused by computer viruses, hacking, cyber attacks, or data breaches are often excluded from BPP insurance coverage. Cyber insurance policies can provide specific coverage for these types of risks.

- Nuclear Hazard: Damage or loss caused by nuclear radiation, nuclear reactions, or radioactive contamination is typically excluded from BPP insurance coverage. Separate coverage may be necessary to address these risks.

It is important to review the specific exclusions listed in your BPP insurance policy and assess whether additional coverage or endorsements are needed to address any excluded risks. Work closely with your insurance provider to understand your policy terms, exclusions, and available options to ensure comprehensive coverage for your business personal property.

BPP Insurance vs Property Insurance

Business Personal Property (BPP) insurance and Property insurance are both crucial components of a comprehensive insurance portfolio for businesses. While they provide coverage for physical assets, there are key differences between the two. Let’s explore the distinctions between BPP insurance and Property insurance:

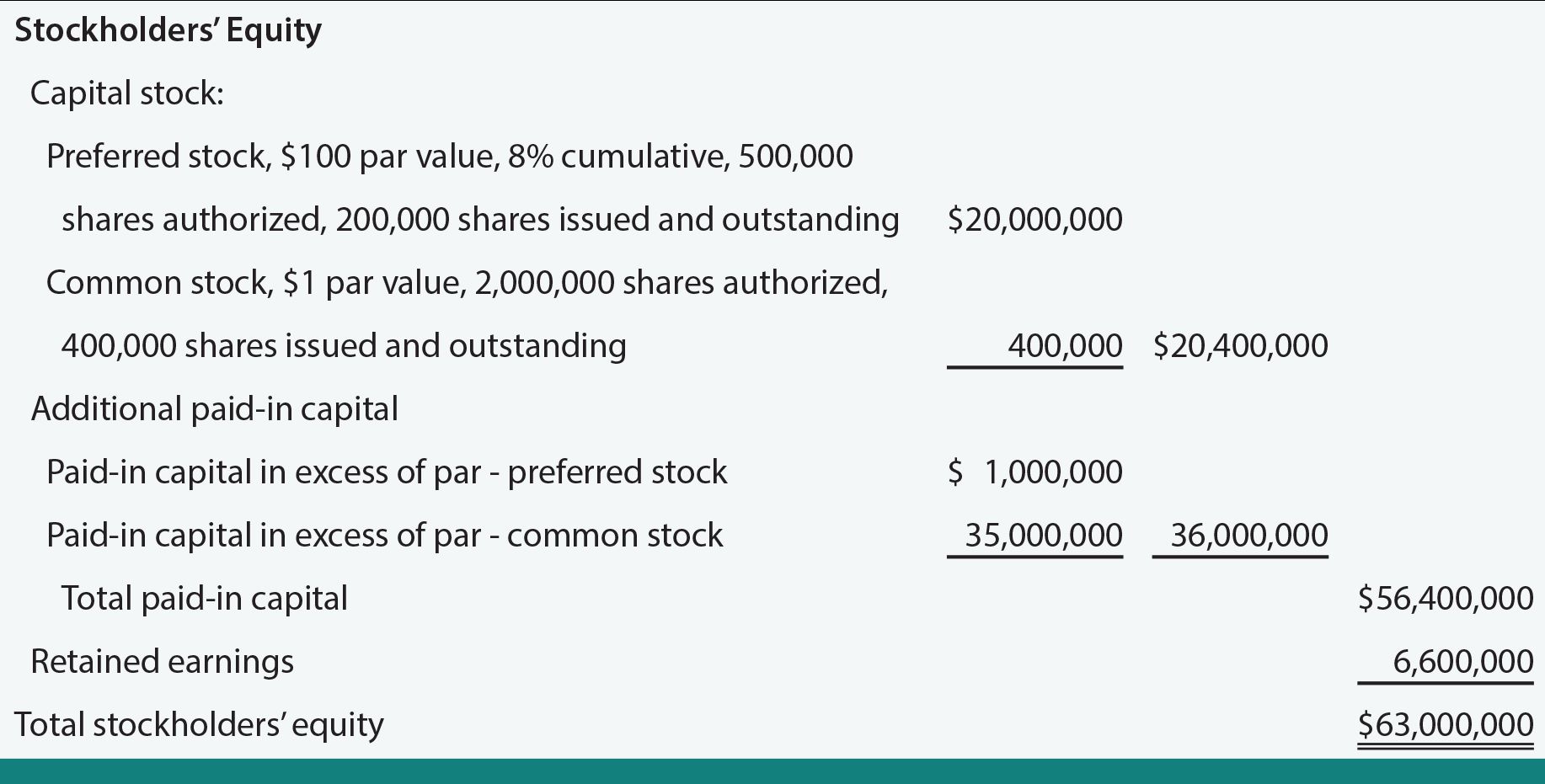

BPP Insurance: BPP insurance specifically covers the movable or tangible assets owned by a business. It includes assets such as furniture, equipment, inventory, and other personal property that are essential for business operations. BPP insurance protects these assets from a variety of perils, including fire, theft, vandalism, or natural disasters. It focuses on the contents of the building or premises and does not include coverage for the building structure itself, which is typically covered by Property insurance.

Property Insurance: Property insurance, also known as Commercial Property insurance, provides coverage for the physical structure of the building or premises. It protects the building itself, along with permanent fixtures, improvements, and additions. Property insurance covers perils such as fire, vandalism, weather-related damage, and other covered events that may cause damage or loss to the structure. It also includes coverage for business interruption, loss of income, and additional expenses incurred due to a covered loss, ensuring the business can recover from the interruption in its operations.

While the specific coverage and terms of BPP insurance and Property insurance can vary, here are some key differences:

- Focus: BPP insurance focuses on the movable assets and personal property owned by a business, while Property insurance focuses on the building structure and its permanent fixtures.

- Coverage: BPP insurance covers the value of business personal property and may include additional coverage for associated expenses like debris removal or data restoration. Property insurance covers the building structure, as well as business interruption, loss of income, and additional expenses resulting from a covered loss.

- Limits: The coverage limits and sub-limits may vary for BPP insurance and Property insurance. BPP insurance limits are typically based on the value of the assets, while Property insurance limits are based on the value of the building and the estimated cost to rebuild or repair it.

- Required Coverage: BPP insurance may be required by lenders or landlords or mandated by regulatory requirements. Property insurance is typically required for businesses that own or lease commercial property and is often a condition for obtaining financing or leasing commercial space.

- Combined Coverage: Many businesses opt to have both BPP insurance and Property insurance to ensure comprehensive protection for their assets. Having both policies covers both the movable assets and the building structure, providing a combined and holistic coverage for a business.

It is essential for businesses to assess their specific needs and risks to determine the most appropriate insurance coverage. Consulting with an insurance professional can help you understand the coverage options, select the right policy limits, and ensure that your business is adequately protected against both property and personal property risks.

Conclusion

Business Personal Property (BPP) insurance is a critical component of a comprehensive insurance strategy for businesses. It provides coverage for the tangible assets and personal property that are essential for business operations. By protecting these assets from a range of perils such as fire, theft, vandalism, or natural disasters, BPP insurance helps safeguard businesses against potential financial losses.

Understanding the coverage, limits, and exclusions of BPP insurance is essential for business owners to ensure they have the appropriate level of protection for their assets. It is important to assess the value of your business personal property accurately, review policy terms and conditions, and work closely with an insurance professional to tailor the coverage to your specific needs.

In addition to BPP insurance, businesses should also consider Property insurance to protect the physical structure of their premises and provide coverage for business interruption and additional expenses that may arise during a covered loss. Having a combination of BPP insurance and Property insurance ensures comprehensive protection for both movable assets and the building structure.

Remember to regularly review and update your insurance coverage as your business grows and evolves. Changes in assets, locations, or operations may require adjustments to your policy to maintain adequate protection. Stay informed about any changes in industry regulations or requirements that may impact your insurance needs.

Insurance plays a crucial role in managing risk and protecting the financial well-being of businesses. By investing in BPP insurance and property insurance, businesses can have peace of mind knowing their valuable assets and operations are protected, allowing them to focus on their core activities and achieve their goals.