Home>Finance>Collateral Value: Definition, How It’s Used, And LTV Ratios

Finance

Collateral Value: Definition, How It’s Used, And LTV Ratios

Published: October 29, 2023

Understanding the concept of collateral value, its significance in finance, and the calculation of loan-to-value (LTV) ratios.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is Collateral Value and How is it Used?

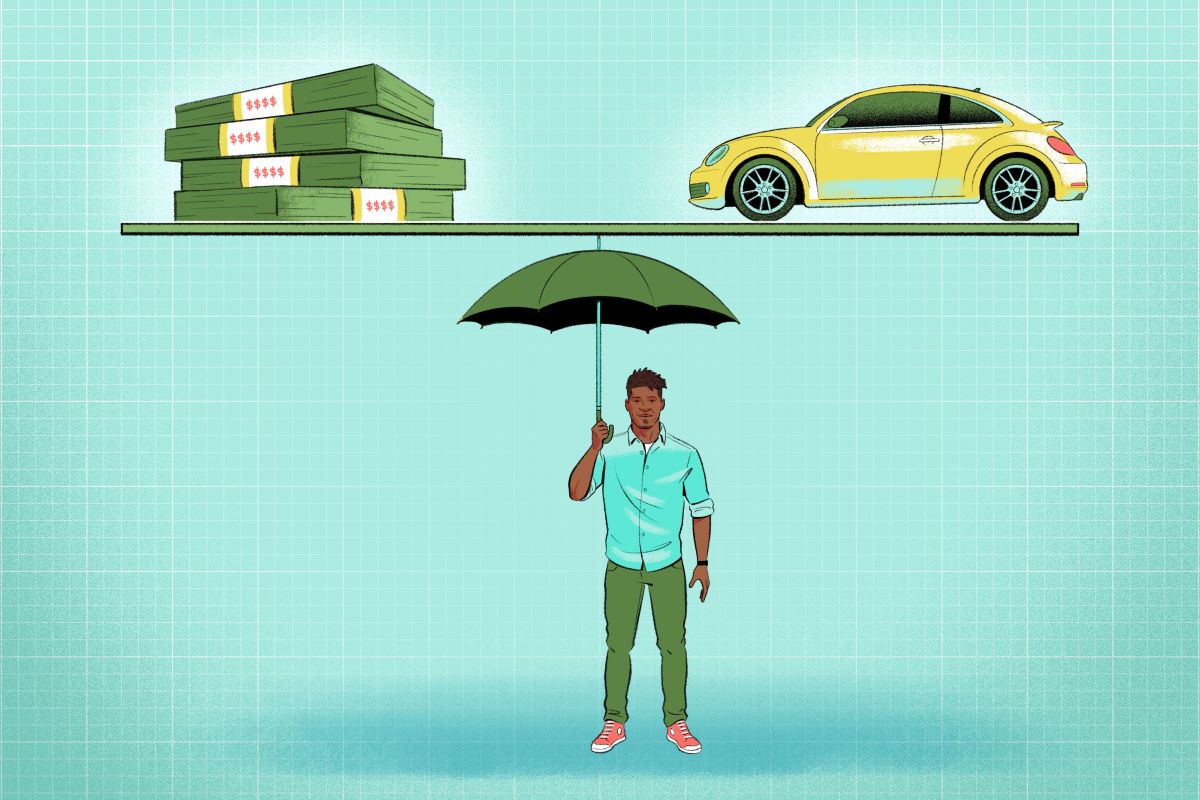

Collateral value is a term often used in the world of finance and lending. It refers to the estimated worth or value of an asset that is used as collateral for a loan. When a borrower wants to secure a loan, they need to provide a valuable asset, such as real estate, a vehicle, or even stocks and bonds, as collateral. This collateral serves as a form of security for the lender in case the borrower defaults on the loan.

Key Takeaways:

- Collateral value is the estimated worth of an asset used as security for a loan.

- Lenders use collateral value to determine the maximum loan amount they are willing to provide.

Now, let’s dig deeper into the concept of collateral value and how it is used in practice:

How Collateral Value is Determined

The process of determining collateral value can vary depending on the type of asset being used as collateral. Here are a few common methods used:

- Appraisal: Real estate properties or other assets like art or antiques are often appraised by professionals to determine their current market value.

- Assessment: Vehicles such as cars or boats may be assessed using factors like mileage, condition, and market demand to estimate their worth.

- Market Value: If the asset being used as collateral is easily traded in the market, its market value can be used as the collateral value.

Once the collateral value is determined, it is used by the lender to calculate the loan-to-value ratio (LTV ratio), which is the ratio of the loan amount to the collateral value. This ratio helps lenders assess the risk associated with the loan and determine the maximum loan amount they are willing to provide.

Loan-to-Value (LTV) Ratio

The loan-to-value ratio (LTV ratio) is a crucial factor in the loan approval process. It represents the percentage of the collateral value that the lender is willing to lend to the borrower. The formula to calculate LTV ratio is:

LTV ratio = (Loan Amount / Collateral Value) * 100%

For example, if the collateral value is $200,000 and the loan amount is $150,000, the LTV ratio would be:

($150,000 / $200,000) * 100% = 75%

The lower the LTV ratio, the lower the risk for the lender. Lenders typically set a maximum LTV ratio that they are comfortable with, depending on factors such as the type of loan, the borrower’s creditworthiness, and the economic climate.

Securing a Loan with Collateral

One of the primary benefits of providing collateral for a loan is that it can increase the borrower’s chances of approval, even if they have a less-than-perfect credit history. Here are a few key points to remember when securing a loan with collateral:

- Collateral provides added security for lenders, as they have recourse in case of default.

- Borrowers can often negotiate better terms, such as lower interest rates, longer repayment periods, or higher loan amounts, when they offer valuable collateral.

- If a borrower defaults on the loan, the lender may seize and sell the collateral to recover the outstanding debt.

In conclusion, collateral value plays a crucial role in the lending process. It helps lenders assess the risk associated with a loan and determine the maximum loan amount they are willing to provide. Understanding the concept of collateral value and the LTV ratio can be beneficial for both borrowers and lenders, as it allows for better decision-making and negotiation when it comes to securing loans.