Finance

What Is Life Insurance’s Face Value?

Published: October 15, 2023

Discover the significance of life insurance's face value and its impact on your financial future. Explore the ins and outs of finance and ensure your loved ones' security.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of life insurance! If you’re new to this financial territory, you may have come across the term “face value” during your research. Understanding what life insurance’s face value means is essential in making informed decisions when it comes to choosing the right policy for your needs.

Simply put, the face value of a life insurance policy is the amount of money that will be paid out to the beneficiary upon the death of the insured. It is also commonly referred to as the death benefit. This financial payout can provide crucial support to your loved ones, helping them manage any outstanding debts, funeral expenses, or replace lost income.

However, it’s important to note that the face value is not the same as the cash value of a life insurance policy. The cash value represents the accumulated savings within a policy, which can be accessed or borrowed against. On the other hand, the face value solely relates to the death benefit.

Now that you have a basic understanding of what the face value of a life insurance policy represents, let’s explore the factors that can influence its calculation and how it can be determined.

Understanding Life Insurance Face Value

Life insurance face value is a crucial aspect of any life insurance policy. It is the amount of money that the beneficiary will receive upon the death of the insured individual. The face value is predetermined when you purchase the policy and is typically chosen based on your financial needs and objectives. Understanding the key elements of life insurance face value is essential in ensuring that you select the right coverage for your loved ones.

The face value serves as financial protection for your beneficiaries, providing them with the means to cover various expenses such as funeral costs, outstanding debts, and ongoing living expenses. It acts as a safety net to ensure that your loved ones are financially secure even in your absence.

When determining the face value of a life insurance policy, one important factor to consider is the financial obligations that your loved ones would need to cover. This could include mortgage payments, outstanding loans, or funding children’s education. By assessing these financial needs, you can estimate an appropriate face value that will provide adequate financial support to your beneficiaries.

In addition to your financial obligations, it’s crucial to consider your income replacement needs. The face value should be sufficient to replace your income for a certain period, ensuring that your loved ones can maintain their standard of living without financial strain.

Keep in mind that the face value you choose will also affect your premium payments. Generally, the higher the face value, the higher the premium you will pay. It’s important to strike a balance between choosing a face value that adequately meets your needs and aligning it with your budget.

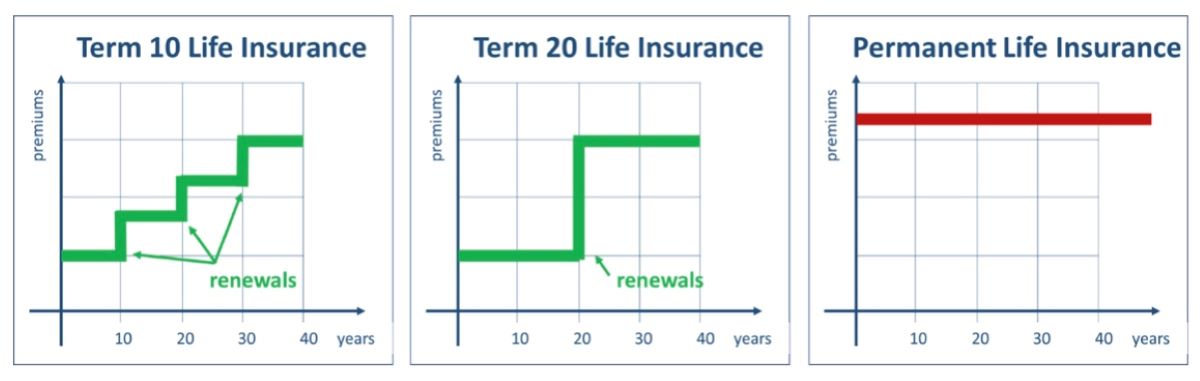

Lastly, it’s important to understand that the face value of a life insurance policy is typically fixed for the duration of the policy. However, some policies may offer options for increasing the face value over time. These policies often come with higher premiums, but they can provide added financial protection as your needs evolve.

Now that you have a better understanding of what life insurance face value represents, let’s take a closer look at the factors that can impact its calculation.

Factors Affecting Life Insurance Face Value

The determination of a life insurance policy’s face value takes into account several key factors that can influence the amount of coverage provided to your beneficiaries. Understanding these factors can help you make informed decisions when selecting a policy that aligns with your financial goals and needs.

1. Age and Health: Your age and health are significant factors in determining the face value of your life insurance policy. Generally, younger and healthier individuals are eligible for higher face value coverage as they are considered to have a lower risk of death during the policy term.

2. Income and Financial Obligations: Your income and financial obligations also play a role in determining the appropriate face value. If you have significant financial responsibilities such as a mortgage, outstanding debts, or dependents, you may need a higher face value to ensure that these obligations are adequately covered.

3. Lifestyle and Occupation: Your lifestyle choices and occupation can impact the calculation of the face value. If you engage in high-risk activities or have a hazardous occupation, such as a pilot or firefighter, the insurance company may assign a higher premium or limit the face value accordingly.

4. Desired Coverage Period: The length of time you want the coverage to remain in effect, also known as the policy term, can affect the face value. If you opt for a longer coverage period, you may need a higher face value to account for inflation and changing financial needs over time.

5. Medical History: Your medical history, including any pre-existing medical conditions or family history of hereditary diseases, can impact the face value and premium of your life insurance policy. The insurance company may assess your health risks and adjust the coverage accordingly.

6. Gender: While gender equality has made significant strides in many areas, the impact of gender on life insurance face value remains. Historically, women have been assigned lower face values due to their statistically longer life expectancy. However, this gap has narrowed in recent years.

It’s important to note that these factors will vary between insurance companies, and each provider may have different criteria for calculating the face value of their policies. To ensure you receive the most accurate and suitable coverage, it’s advisable to consult with an experienced insurance agent who can assess your specific circumstances and guide you through the process.

Next, let’s explore how the face value of a life insurance policy can be determined.

Determining the Face Value of Your Life Insurance Policy

When it comes to determining the face value of your life insurance policy, several factors are taken into consideration. The goal is to ensure that the coverage adequately meets your financial needs and provides sufficient support to your beneficiaries in the event of your passing. Understanding the process of determining the face value can help you make an informed decision when selecting a policy.

1. Assessing Financial Obligations: Start by evaluating your financial obligations. Consider any outstanding debts, such as mortgages, loans, or credit card balances, that you want the policy to cover. Additionally, factor in any anticipated future financial responsibilities, such as college expenses for your children or ongoing financial support for your spouse.

2. Income Replacement: Consider how much income your loved ones would need to maintain their standard of living without your financial contributions. Calculate the amount required to cover monthly expenses, such as housing, utilities, food, healthcare, and education. Multiply this by the number of years you want the coverage to provide income replacement.

3. Funeral Expenses: Plan for the costs associated with a funeral and burial or cremation. These expenses can vary significantly depending on your location and preferences. Including this in the face value of the policy ensures that your loved ones won’t have to worry about the financial burden during a difficult time.

4. Future Needs and Inflation: Consider the impact of inflation on the cost of living over time. The face value should account for the potential increase in expenses so that your beneficiaries can maintain their quality of life even years after your passing.

5. Consultation with Professionals: To ensure accuracy and thoroughness in determining the face value, it’s advisable to consult with an experienced insurance agent or financial advisor. They can help you assess your financial situation, goals, and potential risks to recommend an appropriate face value that aligns with your needs.

Once you have determined the appropriate face value for your life insurance policy, you can proceed with purchasing a policy that meets your requirements. Remember to review and update your coverage periodically as your financial circumstances evolve over time.

In the next section, we will explore the importance of evaluating your life insurance face value and making necessary adjustments as needed.

Importance of Evaluating Your Life Insurance Face Value

Evaluating the face value of your life insurance policy is crucial to ensure that it provides adequate financial protection for your loved ones. Life circumstances and financial needs can change over time, making it essential to regularly review and reassess your coverage. Here are some key reasons why evaluating your life insurance face value is important:

1. Adequate Financial Protection: Life insurance is designed to provide financial support to your beneficiaries in the event of your passing. By evaluating your face value, you can ensure that the coverage amount is sufficient to cover outstanding debts, funeral expenses, and ongoing financial obligations. Regular evaluation ensures that your loved ones will not face financial hardships after you’re gone.

2. Lifestyle and Income Changes: As your life progresses, your financial situation can change. Perhaps you’ve experienced a promotion and a significant increase in income, or maybe you’ve paid off a substantial amount of debt. These changes can impact the amount of coverage you need. By evaluating your face value, you can adjust it to reflect your current financial circumstances and ensure that your loved ones are adequately protected.

3. Financial Responsibilities: Over time, your financial responsibilities may evolve. You may have additional dependents or new financial obligations such as a mortgage or education expenses. Regularly assessing your life insurance face value allows you to factor in these changes and ensure that the coverage adequately meets your family’s needs.

4. Inflation and Cost of Living: Inflation can erode the purchasing power of money over time. What may seem like a substantial face value today may not be sufficient to meet future financial needs. Evaluating your coverage periodically allows you to account for inflation and adjust the face value accordingly, ensuring that your loved ones can maintain their standard of living even in the face of rising costs.

5. Peace of Mind: Regularly reviewing and evaluating your life insurance face value provides peace of mind. Knowing that your loved ones will be financially protected and supported in your absence can offer a sense of security. It allows you to focus on other aspects of life, knowing that your family’s financial future is taken care of.

It is recommended to review your life insurance policies and evaluate your face value at least once a year or whenever significant life changes occur. This can be done in consultation with an insurance professional who can guide you through the process and ensure that your coverage remains adequate and aligned with your objectives.

Now, let’s explore the options for adjusting the face value of your life insurance policy.

Adjusting the Face Value of Your Life Insurance Policy

Life is constantly changing, and so are your financial needs. If you find that the face value of your life insurance policy no longer aligns with your current situation, don’t worry – there are options available to adjust it accordingly. Here’s what you need to know about adjusting the face value of your life insurance policy:

1. Increasing the Face Value: In some cases, you may realize that the current face value of your policy is not sufficient to cover your financial obligations or provide adequate protection for your loved ones. You can choose to increase the face value by contacting your insurance provider and requesting a policy amendment. Keep in mind that increasing the face value will likely result in higher premium payments.

2. Decreasing the Face Value: On the other hand, you may find that your financial situation has improved, and you no longer need the same level of coverage. In such cases, you can request to decrease the face value of your policy. Lowering the face value could help reduce your premium payments while still providing the necessary financial protection for your beneficiaries.

3. Policy Riders: Some life insurance policies offer riders that allow you to customize your coverage. These riders can enhance or modify the face value based on specific needs. For example, a term conversion rider may allow you to convert a term policy with a lower face value to a permanent policy with a higher face value.

4. Policy Replacement: If you find that your current life insurance policy no longer meets your needs, you have the option to replace it with a new one. This involves terminating your existing policy and acquiring a new policy with a different face value that better aligns with your financial goals. However, it’s important to carefully consider the terms and conditions of the new policy before making the switch.

5. Consultation with an Insurance Professional: Adjusting the face value of your life insurance policy can be a complex decision. It’s advisable to consult with an experienced insurance professional who can assess your financial situation, goals, and any potential risks. They can guide you through the process and provide valuable insights to help you make an informed decision.

Remember, adjusting the face value of your life insurance policy should be done strategically and in consideration of your overall financial plan. It’s important to evaluate your needs periodically and align your coverage with your changing circumstances to ensure that your loved ones are adequately protected.

Next, let’s wrap up our discussion on the importance of evaluating your life insurance face value.

Conclusion

Understanding the concept of life insurance face value is essential in ensuring that your loved ones are financially protected in the event of your passing. The face value represents the amount of money that will be paid out to your beneficiaries, providing support for funeral expenses, outstanding debts, and ongoing financial obligations. By evaluating and adjusting the face value of your life insurance policy, you can ensure that it aligns with your current financial needs and goals.

Factors such as age, health, financial obligations, and income replacement needs play a significant role in determining the appropriate face value. Regularly evaluating your coverage allows you to consider any changes in your financial situation, such as lifestyle adjustments, additional dependents, or changes in income. It also ensures that your coverage keeps up with inflation and rising costs of living.

Adjusting the face value of your life insurance policy can be done by increasing or decreasing the coverage, utilizing policy riders, or considering policy replacement. Consulting with an insurance professional can provide valuable insights and guidance during this process.

Remember, life insurance is designed to provide peace of mind, knowing that your loved ones will have financial stability in your absence. By evaluating and adjusting the face value of your policy when necessary, you can ensure that your family’s financial future is protected.

Now that you have a comprehensive understanding of life insurance face value and its importance, use this knowledge to make informed decisions when selecting, evaluating, and adjusting your life insurance coverage to meet your specific needs and provide the financial security your loved ones deserve.