Home>Finance>What Is Commonwealth Finance On My Credit Report

Finance

What Is Commonwealth Finance On My Credit Report

Modified: March 6, 2024

Learn what Commonwealth Finance is and how it can impact your credit report. Discover key information about finance and its effects on your financial profile.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Commonwealth Finance?

- Understanding Your Credit Report

- How Does Commonwealth Finance Appear on Your Credit Report?

- Impact of Commonwealth Finance on Your Credit Score

- How to Interpret Commonwealth Finance on Your Credit Report

- Steps to Resolve Issues with Commonwealth Finance on Your Credit Report

- Frequently Asked Questions about Commonwealth Finance on Credit Reports

- Conclusion

Introduction

Welcome to the world of credit reporting, where every financial move you make can end up on your credit report. It’s crucial to understand the information displayed on your credit report, as it can have a profound impact on your financial well-being.

One of the items that may appear on your credit report is Commonwealth Finance. If you’ve come across this term and are unsure about what it means or how it affects your credit score, you’ve come to the right place. In this article, we’ll provide a comprehensive overview of Commonwealth Finance and its significance on your credit report.

Credit reporting agencies are responsible for collecting and maintaining information about your financial history. They gather data from various sources, including lenders, credit card companies, and other financial institutions. This information is then compiled into your credit report, which is used by lenders and creditors to assess your creditworthiness.

Understanding the details on your credit report is essential, as it enables you to take control of your financial future. Commonwealth Finance is just one of the many items that may appear on your credit report, and by familiarizing yourself with it, you can make informed decisions to improve your credit standing.

In the following sections, we’ll delve deeper into what Commonwealth Finance is, how it appears on your credit report, and the impact it can have on your credit score. We’ll also provide guidance on interpreting Commonwealth Finance on your credit report and steps you can take to address any issues that may arise.

What is Commonwealth Finance?

Commonwealth Finance is a term that refers to a financial institution or entity that is associated with the Commonwealth Bank of Australia. The Commonwealth Bank is one of the largest and most established banks in Australia, offering a wide range of financial products and services to individuals, businesses, and institutions.

While Commonwealth Finance may encompass various financial activities, it is most commonly associated with loans and lending services. This can include personal loans, home loans, car loans, and credit card accounts offered by the Commonwealth Bank.

When you borrow money from the Commonwealth Bank or have a credit account with them, this information is recorded and reported to credit bureaus. As a result, Commonwealth Finance may appear on your credit report as an indicator of your borrowing and repayment history with the Commonwealth Bank.

It’s important to note that Commonwealth Finance may also appear on your credit report if you have any joint accounts or loans with someone who is a customer of the Commonwealth Bank. In such cases, the borrowing activity and repayment behavior of the joint account holder will also be reflected under Commonwealth Finance on your credit report.

Additionally, Commonwealth Finance may include other financial services provided by the Commonwealth Bank, such as investment products, insurance policies, and savings accounts. These may not have a direct impact on your credit report, but they are a part of the broader range of services offered by the institution.

Understanding what Commonwealth Finance signifies is crucial for managing your credit effectively and monitoring your overall financial health. By being aware of its presence on your credit report, you can ensure that your borrowing and repayment activities with the Commonwealth Bank are accurately reported and reflected in your credit history.

Understanding Your Credit Report

Your credit report is a detailed summary of your credit history and financial activities. It provides a snapshot of your borrowing and repayment behavior, as well as other factors that can impact your creditworthiness. Understanding the components of your credit report is essential for managing your finances and making informed decisions.

When you apply for loans, credit cards, or any other type of credit, lenders request a copy of your credit report from one or more credit bureaus. These bureaus collect and compile information from various sources, including financial institutions, lenders, and public records. The resulting credit report helps lenders assess your creditworthiness and determine the terms and conditions of your credit.

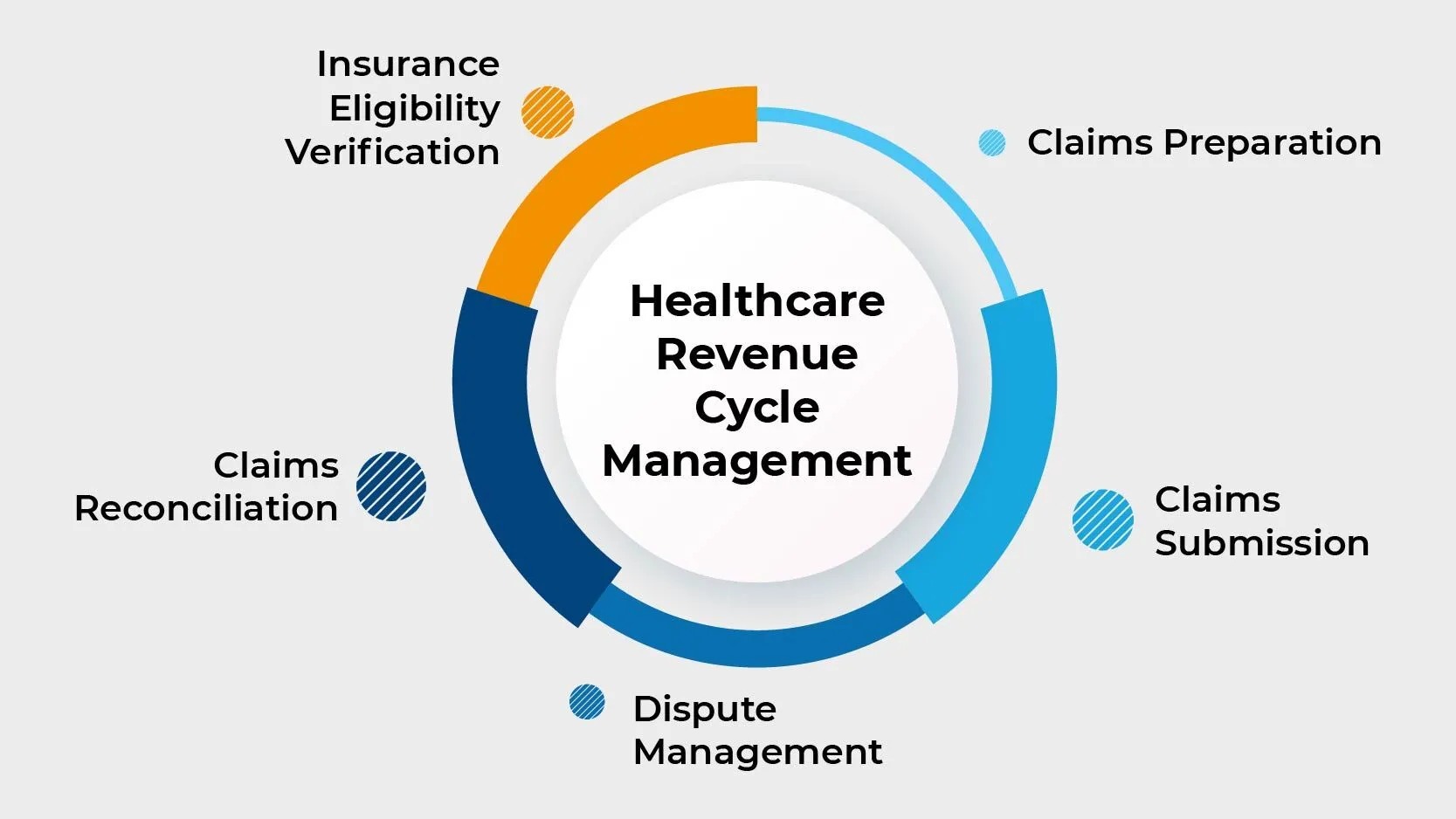

Key components of a credit report include:

- Personal Information: This section includes your name, date of birth, Social Security number, and current and previous addresses. It helps verify your identity and ensure accurate reporting.

- Credit Accounts: This section lists all your credit accounts, including mortgages, loans, credit cards, and lines of credit. It provides details about the account, such as the lender, account type, credit limit or loan amount, and payment history.

- Payment History: This section shows your payment behavior for each credit account. It includes information about whether payments were made on time, any late payments or defaults, and any accounts that have been sent to collections.

- Credit Inquiries: This section shows a list of lenders or creditors who have requested a copy of your credit report. There are two types of inquiries: hard inquiries, which occur when you apply for new credit, and soft inquiries, which occur when you check your own credit or when lenders pre-approve you for offers.

- Public Records: This section includes information from public records, such as bankruptcies, tax liens, and civil judgments. These negative records can have a significant impact on your credit score.

By reviewing your credit report regularly, you can ensure its accuracy and identify any errors or discrepancies. It’s important to note that you have the right to dispute any inaccurate information and have it corrected or removed from your credit report.

Monitoring your credit report allows you to track your progress in building good credit and identify areas that need improvement. It also helps you identify possible instances of identity theft or fraudulent activity. Many credit bureaus offer free annual credit reports, or you can subscribe to credit monitoring services to stay updated on any changes in your credit profile.

Now that we have a basic understanding of credit reports, let’s explore how Commonwealth Finance appears on your credit report and its impact on your credit score.

How Does Commonwealth Finance Appear on Your Credit Report?

When it comes to your credit report, Commonwealth Finance will be listed as an account or trade line associated with the Commonwealth Bank of Australia. The specific details of how Commonwealth Finance appears on your credit report may vary depending on the type of credit account you have with the bank.

If you have a loan with the Commonwealth Bank, such as a personal loan or a home loan, the credit account will be listed on your credit report under Commonwealth Finance. The report will include information such as the loan balance, the original loan amount, the payment history, and the status of the account (active, closed, or paid off).

If you have a credit card account with the Commonwealth Bank, your credit report will show the credit card details under Commonwealth Finance. It will include information such as the credit limit, the current balance, the payment history, and the account status.

In some cases, if you have any joint accounts or loans with someone who is a customer of the Commonwealth Bank, those accounts may also be listed under Commonwealth Finance on your credit report. It’s important to note that the credit information for joint accounts will be reported for both account holders, so any late payments or defaults will affect both parties’ credit scores.

Each entry under Commonwealth Finance on your credit report will provide a comprehensive overview of your borrowing and repayment activities with the Commonwealth Bank. Lenders and creditors who check your credit report will be able to see your payment history, including any missed payments, late payments, or defaults, which can impact your creditworthiness.

It’s crucial to review the information under Commonwealth Finance on your credit report regularly to ensure its accuracy. If you notice any errors or discrepancies, such as incorrect payment history or account statuses, you should take immediate steps to address them.

Remember, your credit report serves as a reflection of your financial behavior and can greatly impact your ability to secure loans, credit, or even rent a home. By understanding how Commonwealth Finance appears on your credit report, you can stay informed about your credit standing and take proactive measures to maintain a healthy credit profile.

Impact of Commonwealth Finance on Your Credit Score

The presence of Commonwealth Finance on your credit report can have a significant impact on your credit score. Your credit score is a three-digit number that is calculated based on various factors in your credit history, including your payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries.

One of the most influential factors in determining your credit score is your payment history. This includes how consistently you make your payments on time and whether you have any late payments or defaults. Commonwealth Finance, as part of your credit accounts with the Commonwealth Bank, will reflect your payment behavior.

If you make timely payments on your Commonwealth Finance accounts and maintain a good credit history overall, it can have a positive impact on your credit score. On the other hand, if you have a history of missed or late payments on your Commonwealth Finance accounts, it can negatively affect your credit score.

In addition, the credit utilization ratio, which is the amount of credit you are using compared to your total available credit, is another important factor in calculating your credit score. If you have high credit card balances or a large outstanding loan balance with Commonwealth Finance, your credit utilization ratio may be high, which can lower your credit score.

Diversification of credit accounts is also considered in your credit score calculation. Having a mix of different types of credit accounts, such as loans and credit cards, can be beneficial. Having Commonwealth Finance listed as a credit account on your credit report can contribute to a well-rounded credit profile.

It’s important to note that the impact of Commonwealth Finance on your credit score is not limited to just the presence of the account. The payment history, credit utilization, and other factors associated with Commonwealth Finance will play a significant role in determining your creditworthiness.

Understanding the impact of Commonwealth Finance on your credit score emphasizes the importance of responsibly managing your credit. By making timely payments, keeping credit card balances low, and maintaining a diverse credit portfolio, you can positively influence your credit score and increase your chances of qualifying for better loan terms and interest rates in the future.

How to Interpret Commonwealth Finance on Your Credit Report

Interpreting Commonwealth Finance on your credit report involves understanding the information presented and its implications for your creditworthiness. Here are some key points to keep in mind when analyzing Commonwealth Finance on your credit report:

- Account Status: The status of your Commonwealth Finance account indicates whether it is active, closed, or paid off. An active account shows that you currently have a credit relationship with the Commonwealth Bank. A closed or paid-off account means that you have completed your obligations and no longer owe any money on that particular account.

- Payment History: Your payment history reveals how consistently you have made payments on your Commonwealth Finance account. It reflects whether you have made payments on time, missed any payments, or defaulted. A positive payment history demonstrates responsible credit management, while late payments or defaults can have a negative impact on your creditworthiness.

- Credit Limit or Loan Amount: The credit limit on your Commonwealth Finance credit card or the loan amount for other types of loans reflects the maximum amount you are allowed to borrow. It’s important to keep your credit card balances or loan balances within a reasonable percentage of the available credit limit or loan amount to maintain a healthy credit utilization ratio.

- Outstanding Balance: The outstanding balance on your Commonwealth Finance account indicates the amount of money you still owe. It’s essential to keep track of this balance and make regular payments to reduce it over time. A high outstanding balance can negatively impact your credit score and creditworthiness.

- Credit History Length: The length of time you have held your Commonwealth Finance account will contribute to the length of your credit history. A longer credit history generally indicates more experience in managing credit. Keeping your Commonwealth Finance accounts open for an extended period and making consistent payments can positively impact your creditworthiness.

When interpreting Commonwealth Finance on your credit report, it’s important to assess how it aligns with your overall credit goals and financial objectives. Is the account being reported accurately? Are there any discrepancies or errors that need to be addressed? Identifying and resolving any issues can help ensure the accuracy and integrity of your credit report.

Remember, your credit report is a crucial tool that lenders use to evaluate your creditworthiness. By understanding the information related to Commonwealth Finance on your credit report, you can take steps to improve your credit behavior, manage debt responsibly, and maintain a positive credit profile.

Steps to Resolve Issues with Commonwealth Finance on Your Credit Report

If you notice any errors, discrepancies, or issues related to Commonwealth Finance on your credit report, it’s important to take prompt action to resolve them. Here are some steps you can follow to address and rectify any problems:

- Request a Copy of Your Credit Report: Start by obtaining a copy of your credit report from one of the major credit bureaus. You are entitled to a free copy of your credit report annually from each bureau, so take advantage of this opportunity to review the information listed under Commonwealth Finance.

- Review the Information Carefully: Examine the details of the Commonwealth Finance account on your credit report. Look for any inaccuracies, such as incorrect payment history, account status, or outstanding balances. Compare the information with your own records and statements to ensure its accuracy.

- Dispute Inaccurate Information: If you identify any errors or discrepancies, you have the right to dispute them with both the credit bureau and the Commonwealth Bank. Contact the credit bureau in writing and provide them with the necessary documentation to support your dispute. Simultaneously, notify the Commonwealth Bank of the issue and request that they correct the information reported to the credit bureaus.

- Follow up with the Credit Bureau and Commonwealth Bank: The credit bureau has a specific time frame to investigate your dispute and make corrections if necessary. Stay in touch with them to ensure that the matter is resolved appropriately. Similarly, communicate with the Commonwealth Bank to ensure they update their reporting to the credit bureaus with the corrected information.

- Monitor Your Credit Report: After disputing any inaccuracies, continue monitoring your credit report to confirm that the corrections have been made. It’s recommended to review your credit report regularly to keep track of any further changes.

- Seek Professional Assistance if Needed: If you encounter difficulties resolving the issues with Commonwealth Finance on your credit report, consider seeking help from a reputable credit repair agency or a consumer attorney who specializes in credit reporting issues.

Resolving issues with Commonwealth Finance on your credit report may take time and persistence. However, it is important to be proactive in addressing inaccuracies, as they can have a significant impact on your creditworthiness and financial opportunities.

Remember, maintaining an accurate credit report is your right as a consumer, and taking action to correct any errors will help you build a strong credit history and improve your overall financial well-being.

Frequently Asked Questions about Commonwealth Finance on Credit Reports

Here are some commonly asked questions regarding Commonwealth Finance on credit reports:

- What does Commonwealth Finance on my credit report mean?

- Does Commonwealth Finance affect my credit score?

- Can I remove Commonwealth Finance from my credit report?

- How long does Commonwealth Finance stay on my credit report?

- Does Commonwealth Finance impact my ability to get credit in the future?

- Can I improve my credit score with Commonwealth Finance on my credit report?

Commonwealth Finance on your credit report indicates a credit account or trade line associated with the Commonwealth Bank of Australia. It includes various financial products such as loans, credit cards, and other credit-related services offered by the bank.

Yes, Commonwealth Finance can impact your credit score. Your payment history, credit utilization ratio, and other factors associated with your Commonwealth Finance accounts are taken into consideration when calculating your credit score. Responsible management of these accounts can positively influence your credit score, while missed payments or high debt levels can have a negative impact.

You cannot remove accurate information regarding Commonwealth Finance from your credit report. However, if you spot any errors or inaccuracies, you have the right to dispute them with the credit bureaus and request the necessary corrections.

The length of time that Commonwealth Finance information remains on your credit report typically depends on the type of account and the credit bureau’s reporting practices. In general, positive account information can stay on your report for up to 10 years, while negative information such as missed payments or defaults may remain for up to 7 years.

Yes, Commonwealth Finance can impact your ability to obtain credit in the future. Lenders and creditors consider your credit history, including the behavior related to your Commonwealth Finance accounts, when evaluating your creditworthiness. A positive credit history can increase your chances of obtaining credit, while negative information may make it more challenging to qualify for loans or credit cards.

Absolutely! By making timely payments, keeping your credit utilization low, and managing your Commonwealth Finance accounts responsibly, you can improve your credit score over time. Consistent positive behavior will demonstrate your creditworthiness and may result in better credit opportunities in the future.

It’s essential to stay informed about Commonwealth Finance and its impact on your credit report to effectively manage your credit and make informed financial decisions. If you have further questions or concerns, it is advisable to consult with a financial advisor or credit counseling service for personalized guidance based on your specific circumstances.

Conclusion

Understanding Commonwealth Finance and its presence on your credit report is crucial for managing your credit effectively. Whether it’s a loan, a credit card, or another financial service provided by the Commonwealth Bank of Australia, Commonwealth Finance can impact your credit score and overall creditworthiness.

By reviewing your credit report regularly, you can ensure the accuracy of the information concerning Commonwealth Finance and identify any errors or discrepancies that need to be addressed. Taking steps to resolve any issues and maintaining responsible credit behavior can help improve your credit score and open up better financial opportunities in the future.

Remember, paying your bills on time, keeping your credit utilization ratio low, and maintaining a diverse credit portfolio are all essential factors in building a strong credit profile. Monitoring your credit report and taking proactive measures to rectify any inaccuracies will contribute to a healthy credit history and financial well-being.

If you have concerns or questions about Commonwealth Finance or your credit report in general, consider seeking guidance from a financial advisor or credit counseling service. They can provide personalized advice based on your individual situation and help you navigate the complexities of credit reporting.

Keep in mind that managing your credit is an ongoing process that requires diligence and responsible financial habits. By staying informed, being proactive, and making informed decisions, you can take control of your credit and pave the way for a secure financial future.