Home>Finance>Withdrawal: Definition In Banking, How It Works, And Rules

Finance

Withdrawal: Definition In Banking, How It Works, And Rules

Published: February 18, 2024

Learn the definition and rules of withdrawal in banking with our comprehensive finance guide. Discover how it works and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Withdrawal: Definition in Banking, How It Works, and Rules

Have you ever wondered what happens when you withdraw money from your bank account? How does it work, and are there any rules you need to keep in mind? In this blog post, we’ll dive into the world of withdrawals in banking, providing you with a clear understanding of the process, the rules, and everything you need to know. So, buckle up and let’s explore!

Key Takeaways:

- Withdrawal is the process of taking money out of a bank account.

- There are different ways to withdraw money, such as ATM withdrawals, electronic transfers, or visiting a bank branch.

What is a Withdrawal?

A withdrawal, in the context of banking, refers to the process of taking money out of a bank account. It is an essential aspect of personal finance, allowing individuals to access their funds to meet their daily needs, make payments, or simply have cash on hand.

How Does Withdrawal Work?

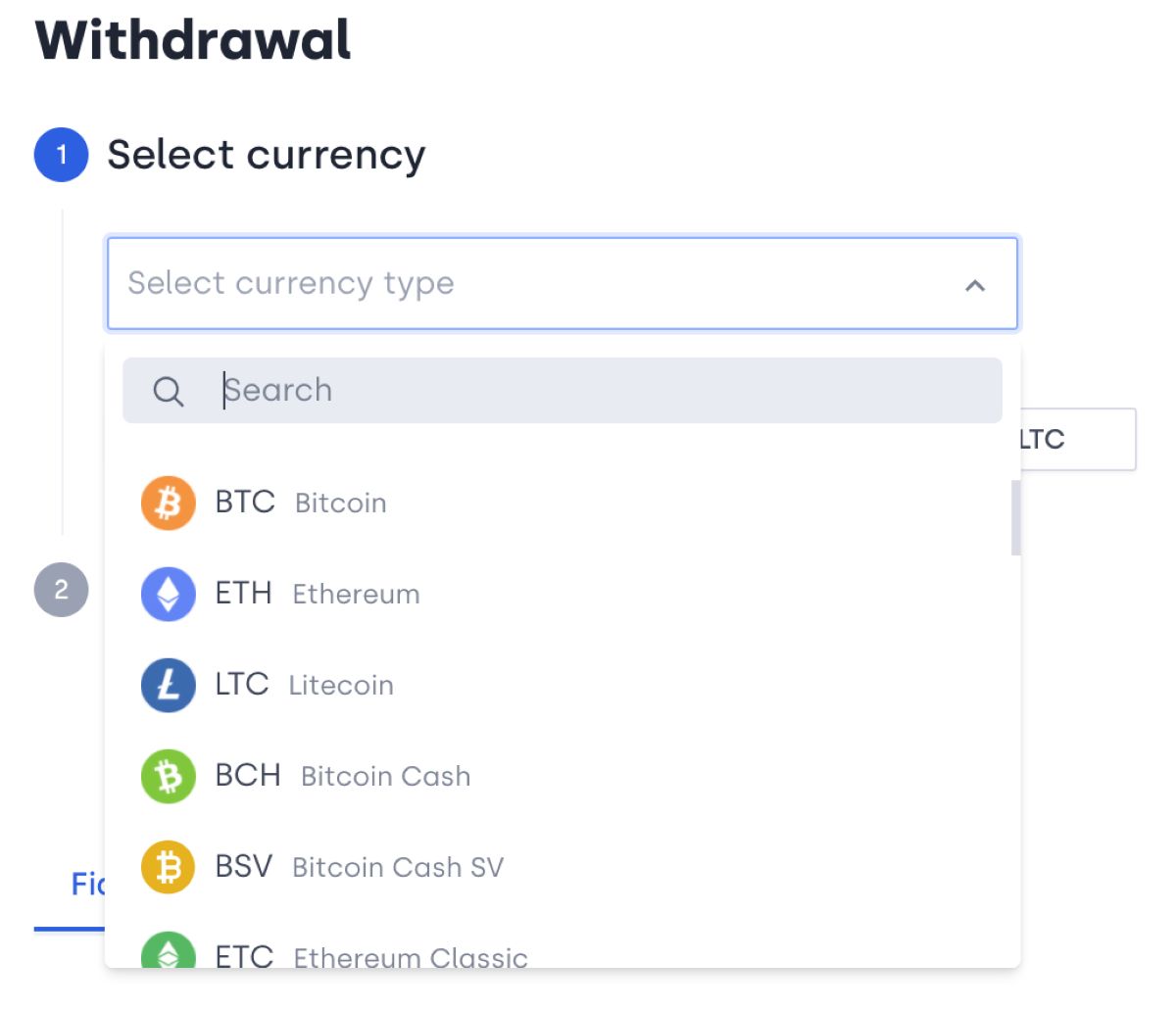

Withdrawals can be made using various methods, depending on the convenience and preferences of the account holder. Here are a few common ways to make a withdrawal:

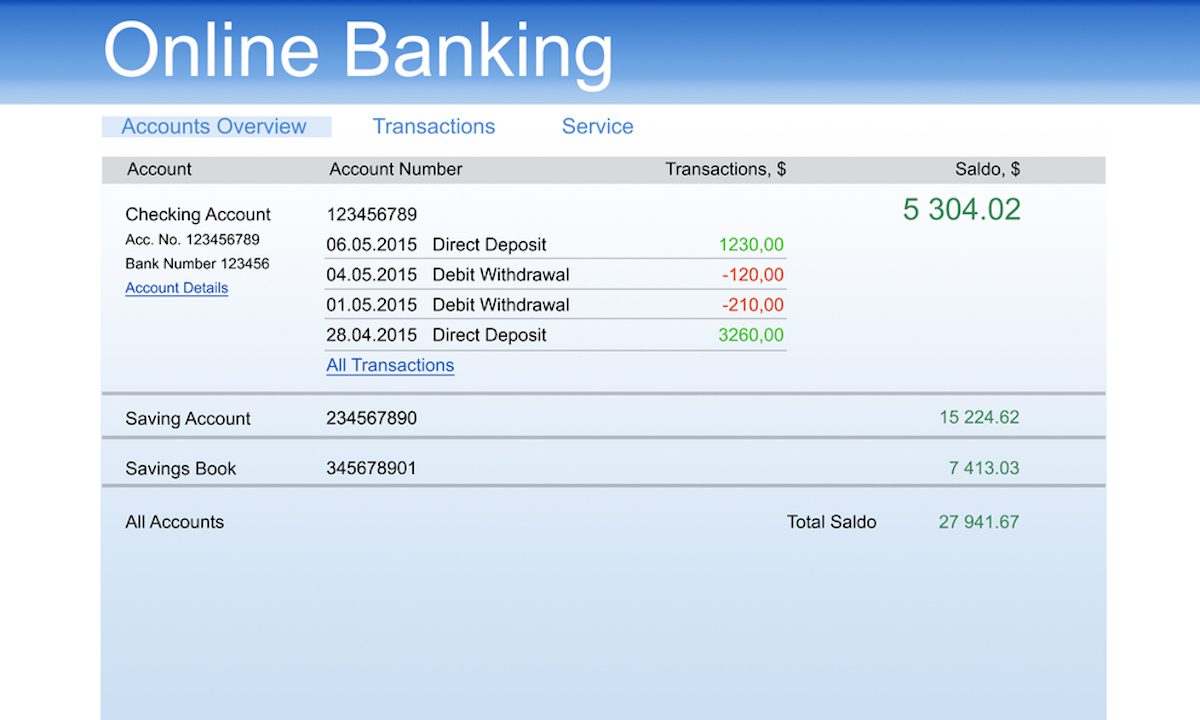

- ATM Withdrawals: Automated Teller Machines (ATMs) are a popular and convenient option for withdrawing money. You can use your bank card and Personal Identification Number (PIN) to access your account and withdraw cash.

- Electronic Transfers: Many banks offer online and mobile banking platforms that allow you to transfer money from your account to another bank account or make payments directly to merchants or vendors.

- Bank Branch Visits: If you prefer a more personal approach, you can visit your bank branch and speak to a teller. They will assist you in making a withdrawal and provide any necessary documentation.

Rules for Withdrawal:

While the withdrawal process may seem straightforward, there are some rules and considerations to keep in mind:

- Withdrawal Limits: Your bank may have daily or monthly limits on the amount you can withdraw. These limits are put in place for security reasons and to prevent fraud.

- Transaction Fees: Some banks charge fees for certain types of withdrawals, such as ATM withdrawals from non-affiliated banks or international money transfers. Make sure to check your bank’s fee schedule to avoid surprises.

- Available Funds: Before making a withdrawal, ensure that you have sufficient funds in your account to cover the amount you wish to withdraw. Overdrawing your account can result in fees or rejected transactions.

- Timing: Different banks have specific cutoff times for withdrawals. If you need immediate access to your funds, make sure to plan your withdrawals accordingly.

Understanding the ins and outs of withdrawals in banking is a crucial part of managing your personal finances. By being aware of the rules and options available, you can make informed decisions and ensure smooth and hassle-free access to your money.

Remember, whether you choose an ATM withdrawal, an electronic transfer, or a visit to your bank branch, the ultimate goal is to make your money easily accessible when you need it. So go ahead, withdraw wisely and enjoy the convenience that modern banking offers!