Finance

What Is Credit Strong And How Does It Work

Modified: March 5, 2024

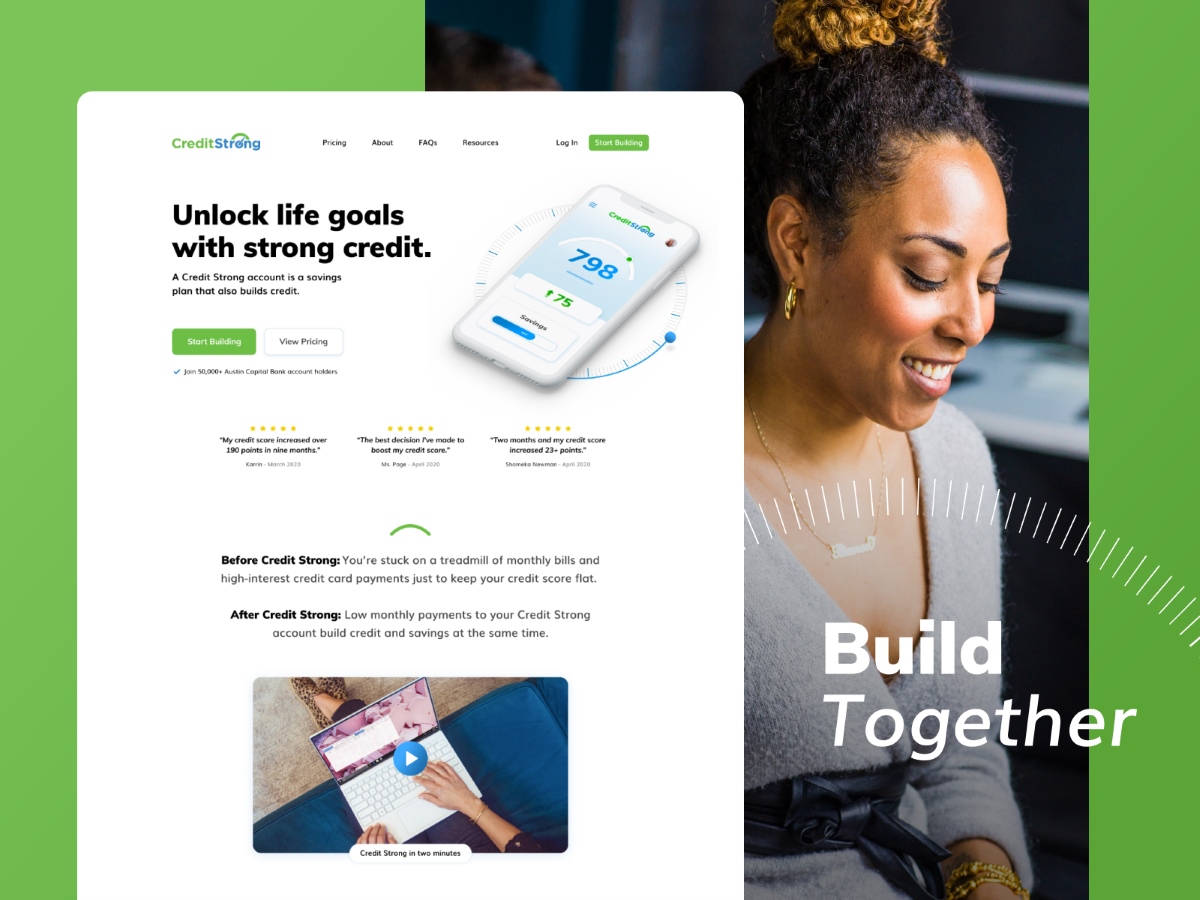

Discover how Credit Strong, a finance platform, works and helps improve your credit. Join now to strengthen your financial future and achieve your goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of personal finance and credit building! In today’s fast-paced financial landscape, having a solid credit history is more important than ever. It can be the difference between securing that dream home or being turned away by lenders.

But building credit can be challenging, especially if you’re new to the world of credit or have had past difficulties. That’s where Credit Strong comes in. As a leading provider of credit building solutions, Credit Strong offers a unique platform to help individuals establish and improve their credit scores.

Whether you’re looking to build credit from scratch or repair damaged credit, Credit Strong provides a range of tools and resources to help you achieve your financial goals. In this article, we’ll explore what Credit Strong is, how it works, and the benefits it offers.

So, if you’re ready to take control of your credit journey and create a brighter financial future, let’s dive in and discover everything there is to know about Credit Strong!

What is Credit Strong?

Credit Strong is a financial technology company that specializes in providing credit-building solutions to individuals seeking to establish or improve their credit scores. It offers a unique program that combines the benefits of installment loans and savings accounts to help users build creditworthiness.

Unlike traditional credit repair services, Credit Strong takes a proactive approach to credit building. Instead of simply disputing negative items on your credit report, Credit Strong focuses on helping you establish positive credit history through responsible borrowing and saving.

With Credit Strong, you can choose from two primary credit building products: the Credit Strong Installment Loan and the Credit Strong Savings Account.

The Credit Strong Installment Loan is designed to simulate the experience of borrowing money and repaying it over time, just as you would with a traditional loan. The loan amount is deposited into a locked savings account, and you make monthly payments towards the loan. As you make on-time payments, your positive payment history is reported to the major credit bureaus, helping to build your credit.

The Credit Strong Savings Account, on the other hand, is a secured savings account that allows you to save money and build credit simultaneously. You make regular deposits into the account, and your payment history is reported to the credit bureaus, boosting your credit score over time.

Whether you choose the installment loan or the savings account, Credit Strong’s credit building products are designed to provide a positive impact on your credit score. By demonstrating responsible financial behavior and establishing a payment history, you can gradually improve your creditworthiness and increase your chances of qualifying for better financing options in the future.

In the next section, we’ll delve deeper into how Credit Strong works and the various benefits it offers to consumers.

How Does Credit Strong Work?

Credit Strong operates on a simple yet effective principle: by combining installment loans or savings accounts with credit reporting, it helps individuals establish and improve their credit scores over time. Let’s take a closer look at how Credit Strong works:

1. Choose your credit-building product: Credit Strong offers two primary options – the Credit Strong Installment Loan or the Credit Strong Savings Account. Select the product that best suits your financial goals and needs.

2. Apply and get approved: Once you’ve chosen your desired credit-building product, you’ll need to apply and get approved. The application process is straightforward and typically requires basic personal and financial information.

3. Set up your account: After approval, you’ll need to set up your Credit Strong account. This involves creating a username and password, as well as linking your bank account for automatic monthly payments.

4. Make monthly payments: If you opt for the Credit Strong Installment Loan, you’ll need to make monthly payments towards your loan. These payments are reported to the credit bureaus, demonstrating your ability to manage credit responsibly. If you choose the Credit Strong Savings Account, you’ll make regular deposits into the account, which will also be reported to the credit bureaus.

5. Check your progress: Credit Strong provides you with access to credit monitoring tools and resources to track the progress of your credit-building journey. This allows you to stay updated on any changes to your credit report and monitor the improvement of your credit score.

6. Build credit over time: As you make on-time payments and establish a positive payment history, your credit score gradually improves. With consistent and responsible credit building practices, you can enhance your creditworthiness and expand your access to better financing options.

Credit Strong’s approach to credit building is unique in that it focuses on creating positive credit history rather than simply removing negative items from your credit report. By demonstrating responsible financial behavior and building a solid payment history, you are more likely to be viewed as a reliable borrower by lenders.

Now that we understand how Credit Strong works, let’s explore the numerous benefits it offers to individuals looking to build or repair their credit in the next section.

Benefits of Credit Strong

Credit Strong offers a range of benefits to individuals seeking to build or improve their credit scores. Let’s explore some of the key advantages of using Credit Strong:

- Establishes Positive Credit History: By making on-time payments on your Credit Strong installment loan or regular deposits into your Credit Strong savings account, you can establish a positive payment history. This positive credit history is reported to the major credit bureaus, helping to improve your credit score over time.

- Builds Creditworthiness: Building credit can be challenging, especially if you have a limited credit history or past credit issues. Credit Strong provides a structured and reliable program that helps individuals build creditworthiness by demonstrating responsible financial behavior.

- Variety of Credit-Building Options: Credit Strong offers both installment loans and savings accounts as credit-building options. This allows you to choose the product that aligns with your financial goals and preferences. Whether you prefer to simulate the experience of repaying a loan or want to focus on saving while building credit, Credit Strong has a solution for you.

- Access to Credit Monitoring Tools: With Credit Strong, you’ll have access to credit monitoring tools and resources. These tools allow you to keep track of your progress, monitor changes in your credit report, and stay informed about your credit score improvement.

- Opportunities for Financial Growth: Building a strong credit score opens doors to better financial opportunities. With an improved credit score, you may qualify for lower interest rates on loans, credit cards with better rewards, and more favorable financing options for major purchases like a home or car.

- Educational Resources: Credit Strong understands that financial literacy is important for long-term success. They provide educational resources and tools to help you learn about credit management, budgeting, and responsible financial practices.

- Customer Support: Credit Strong prides itself on its high-quality customer support. If you have any questions or concerns, their knowledgeable and friendly team is available to assist you every step of the way.

Credit Strong’s commitment to helping individuals build credit is evident in the numerous benefits it offers. By leveraging these benefits, you can take control of your credit journey and work towards achieving your financial goals.

Next, let’s dive into the steps involved in getting started with Credit Strong.

Steps to Get Started with Credit Strong

If you’re ready to start building your credit with Credit Strong, here are the steps to get started:

- Research and Choose: Begin by researching Credit Strong and understanding the credit-building products they offer. Evaluate which option – the Credit Strong Installment Loan or the Credit Strong Savings Account – aligns best with your financial goals and needs.

- Apply Online: Once you’ve selected the credit-building product, visit the Credit Strong website and complete the online application process. You will need to provide personal and financial information to determine your eligibility.

- Approval and Required Documents: After submitting your application, Credit Strong will review your information and determine whether you are eligible for their credit-building product. If approved, they may request additional documents, such as proof of identity or income verification.

- Set Up Your Account: Once approved, you will need to set up your Credit Strong account. This involves creating a username and password to access your account portal. You may also need to link your bank account for automatic monthly payments.

- Review Terms and Conditions: Take the time to carefully review the terms and conditions of your Credit Strong agreement. Familiarize yourself with the payment schedule, interest rates (if applicable), and any other details that pertain to your credit-building product.

- Make Payments or Deposits: Depending on the credit-building product you chose, you will need to make monthly payments towards your Credit Strong Installment Loan or regular deposits into your Credit Strong Savings Account. It is crucial to make your payments on time to build a positive credit history.

- Monitor Your Progress: Credit Strong provides access to credit monitoring tools and resources. Be sure to regularly check your progress, monitor changes in your credit report, and keep track of your improving credit score.

- Stay Consistent: Building credit takes time and consistency. Maintain responsible financial practices, make on-time payments or deposits, and stay committed to your credit-building journey with Credit Strong.

By following these steps, you can begin your credit-building journey with Credit Strong and start working towards achieving your financial goals.

While Credit Strong is a fantastic option for many individuals, it’s important to explore alternative credit-building solutions as well. Let’s explore some alternatives to Credit Strong in the next section.

Alternatives to Credit Strong

While Credit Strong offers an excellent credit-building solution, it’s always beneficial to explore alternative options to find the best fit for your financial needs. Here are a few alternatives to Credit Strong:

- Secured Credit Cards: Secured credit cards are a popular alternative for individuals looking to build or repair their credit. These cards require a security deposit, which becomes your credit limit. By using the card responsibly and making timely payments, you can demonstrate positive credit behavior and improve your credit score.

- Credit Builder Loans: Similar to Credit Strong’s installment loan, credit builder loans are specifically designed to help individuals establish or rebuild credit. These loans are often offered by credit unions or community banks and require regular monthly payments. As you make on-time payments, the lender reports your activity to the credit bureaus, helping to improve your credit history.

- Authorized User Status: If you have a trusted family member or friend with good credit, you may consider becoming an authorized user on one of their credit card accounts. The positive payment history and credit utilization ratio of the primary cardholder can have a positive impact on your credit score.

- Self Lender: Self Lender is another credit-building platform that offers credit builder loans. It works similarly to Credit Strong, allowing you to make monthly payments that are reported to the credit bureaus, helping you establish or improve your creditworthiness.

- Rent Reporting Services: Services like RentTrack and RentReporters allow you to have your rental payment history reported to the credit bureaus. This can be beneficial for individuals who have a limited credit history or are unable to qualify for traditional credit-building tools.

When considering these alternatives, it’s crucial to research and compare the features, requirements, and costs associated with each option. Look for reputable providers that report to the major credit bureaus, as this is essential in building and improving your credit score.

Remember, regardless of the credit-building solution you choose, the key is to be consistent in practicing responsible financial habits, making on-time payments, and managing your credit responsibly.

Now let’s wrap up and summarize the key points we’ve covered in this article.

Conclusion

Building credit is an essential step towards financial stability and achieving your life goals. With Credit Strong and its unique credit-building products, you have access to a reliable and effective solution. By simulating the experience of borrowing and repaying a loan or saving while building credit, Credit Strong helps individuals establish a positive credit history and improve their creditworthiness.

Throughout this article, we’ve explored what Credit Strong is and how it works. We’ve discussed the benefits it offers, such as the ability to establish positive credit history, build creditworthiness, and access to credit monitoring tools. We’ve also outlined the steps to get started with Credit Strong, as well as provided alternative credit-building options to consider.

Remember, building credit takes time and consistency. It’s important to choose a credit-building solution that aligns with your financial goals and personal preferences. Whether you opt for Credit Strong or explore alternative options, the key is to make on-time payments or deposits, practice responsible financial habits, and monitor your progress.

As you embark on your credit-building journey, take advantage of the educational resources and support provided by Credit Strong and other credit-building platforms. Understand the factors that impact your credit score, develop good financial habits, and stay committed to improving your creditworthiness.

Building and maintaining good credit opens doors to better financial opportunities, from securing lower interest rates on loans to qualifying for premium credit cards and favorable financing options.

So, take charge of your credit journey and start building a solid foundation with Credit Strong or the alternative option that suits your needs. With dedication, discipline, and the right credit-building tools, you can pave the way to a brighter financial future.

Remember, everyone’s credit-building journey is unique, so it’s essential to find the approach that works best for you. Explore your options, take proactive steps towards building credit, and watch as your creditworthiness grows over time.

Here’s to your success in building a strong credit history and achieving your financial goals!