Home>Finance>What Is Economic Collapse? Definition And How It Can Occur

Finance

What Is Economic Collapse? Definition And How It Can Occur

Published: November 16, 2023

Learn about economic collapse and how it can occur in the finance industry. Understand the definition and potential impacts of financial downturns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Economic Collapse: Definition and Causes

Welcome to our finance blog! Today, we are going to delve into a critical topic that has the potential to shape our lives in unimaginable ways – economic collapse. What exactly is economic collapse, and how can it occur? We are here to provide you with a comprehensive understanding of this phenomenon, its definition, and the various factors that can lead to its occurrence.

Key Takeaways:

- Economic collapse refers to a severe and sudden decline in the economic activities, resulting in a significant downturn of a country’s financial system.

- It can be caused by various factors, including financial crises, political instability, natural disasters, and global economic imbalances.

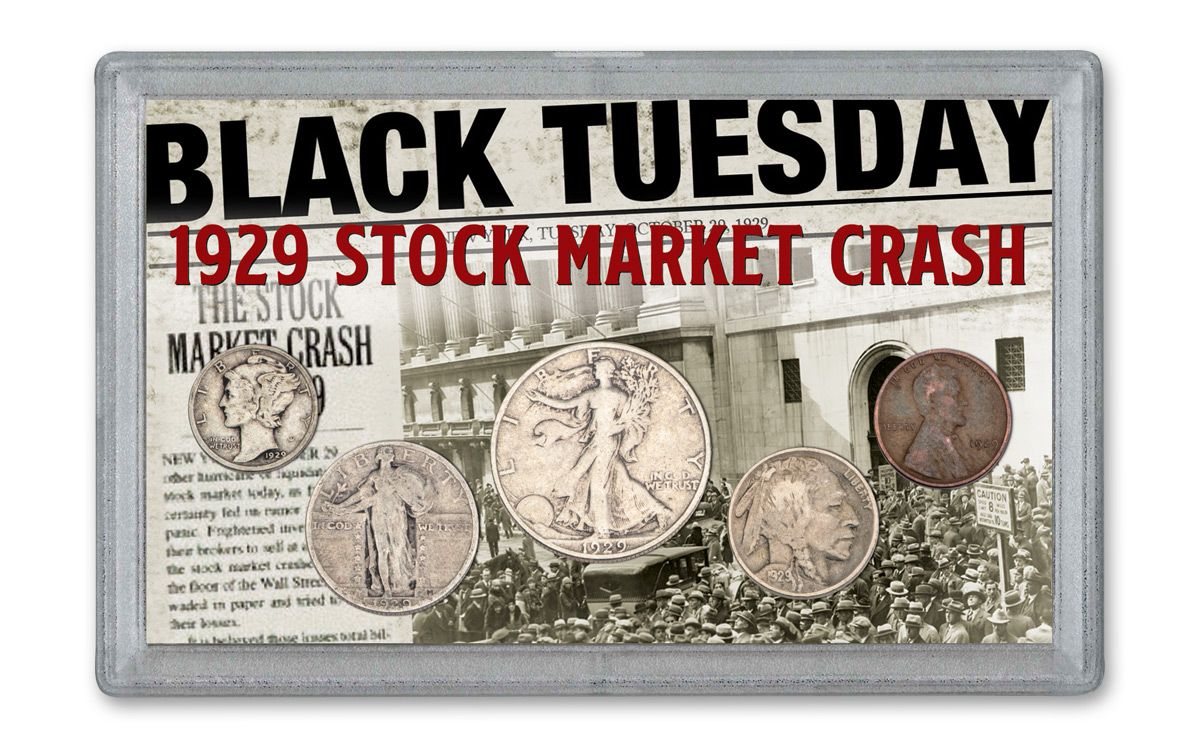

Imagine a scenario where the stock market crashes, businesses shut down, unemployment rates skyrocket, and the value of currency plunges. This devastating situation is known as economic collapse. It is a state where a country’s economic system experiences a rapid and dramatic decline, leaving its citizens struggling to meet their basic needs and causing widespread societal upheaval.

When we talk about economic collapse, we are not referring to a mere recession or slowdown in economic growth. Instead, we are addressing a catastrophic event that can have long-lasting and far-reaching consequences. Let’s explore some of the key factors that can trigger an economic collapse:

The Factors Behind Economic Collapse

- Financial Crises: One of the most common causes of economic collapse is a financial crisis. This often occurs when the banking or financial sector faces severe instability, leading to bank failures, credit freezes, and a loss of consumer and investor confidence. The 2008 global financial crisis serves as a stark reminder of the devastating impact a financial downturn can have on the overall economy.

- Political Instability: Political instability can greatly contribute to economic collapse. When a country undergoes excessive political turmoil, such as coup attempts, civil unrest, or government corruption, it can create an environment of uncertainty and discourage foreign investments. This, in turn, can hinder economic growth and potentially lead to a collapse.

- Natural Disasters: Natural disasters, such as earthquakes, hurricanes, or pandemics, can have severe economic consequences. These events can disrupt supply chains, destroy infrastructure, and result in massive job losses. The financial burden of rebuilding and recovery can strain a country’s resources to the point of collapse.

- Global Economic Imbalances: Economic interdependence between countries means that global imbalances can have a domino effect. When economic powerhouses suffer a downturn, it can send shockwaves throughout the global financial system. For example, a significant economic collapse in one country can lead to a decline in export demand for other nations, eventually affecting their domestic economies as well.

Economic collapse is a complex phenomenon influenced by a multitude of factors. It is essential to note that these causes are often interrelated, exacerbating the potential for a collapse. Moreover, the consequences of an economic collapse can be far-reaching, impacting not only a nation’s economic stability but also its social fabric.

In Conclusion

While economic collapse may seem like a distant and unlikely event, history has shown us that it can happen. Understanding the definition and causes of economic collapse is crucial, as it enables us to recognize warning signs and take necessary precautions to minimize its impact.

By staying informed and actively participating in economic discussions, we can work together to build a resilient and robust financial system that is more adaptive to potential crises. Remember, knowledge is power, and being aware of the risks is the first step toward mitigating them.

Thank you for reading our blog post on economic collapse! We hope you found this information valuable and insightful. If you have any further questions or would like to explore other finance-related topics, be sure to check out the other articles in our FINANCE category. Stay tuned for more informative content!