Finance

What Is Face Value In Bonds

Published: October 14, 2023

Learn about the concept of face value in bonds and its significance in finance. Understand how it affects bond pricing and investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to understanding bonds and their features, one important term that often comes up is the face value. The face value of a bond plays a significant role in determining its worth and is a crucial component in bond investing. Whether you are a seasoned investor or just starting to explore the world of finance, it is essential to grasp the concept of face value in bonds.

The face value, also known as par value or nominal value, refers to the initial value assigned to a bond when it is issued by the issuing entity. It represents the amount that the bondholder will receive back from the issuer upon maturity. In simpler terms, it is the principal amount that investors lend to the bond issuer when they purchase the bond.

Understanding the face value of a bond is crucial because it helps determine the interest payments, maturity value, and overall return on investment. It forms the basis for various calculations and provides investors with an idea of the bond’s fundamental worth. Let’s delve deeper into the concept of face value in bonds and explore its importance.

Definition of Face Value

The face value of a bond refers to the nominal or par value assigned to the bond when it is initially issued. It is a fixed amount that the bondholder will receive upon maturity, regardless of the market value or fluctuations in interest rates. The face value is typically stated on the face of the bond certificate and is expressed as a specific dollar amount per bond.

For example, if a bond has a face value of $1,000, it means that the investor will receive $1,000 from the issuer when the bond matures. The face value is often used to calculate the coupon payments, which are the periodic interest payments made by the issuer to the bondholder based on a percentage of the face value. These coupon payments can be fixed or variable, depending on the terms of the bond.

It is important to note that the face value is different from the market value of a bond. The market value is determined by supply and demand factors in the bond market and can fluctuate over time. In contrast, the face value remains constant and serves as a reference point for determining the bond’s worth.

The face value also plays a role in determining the maturity value of a bond. The maturity value is the total amount that the bondholder receives at the end of the bond’s term. In most cases, the maturity value is equal to the face value, assuming that the bond is held until maturity and no default or early redemption occurs.

Importance of Face Value in Bonds

The face value of a bond holds significant importance for both issuers and investors. Here are some key reasons why the face value is crucial in the world of bonds:

- Determining Interest Payments: The face value is used to calculate the interest payments, also known as coupon payments, that bondholders receive periodically. The interest rate is usually expressed as a percentage of the face value. For example, if a bond has a 5% coupon rate and a face value of $1,000, the bondholder will receive $50 in annual interest payments ($1,000 x 5%). Understanding the face value allows investors to estimate their income from the bond.

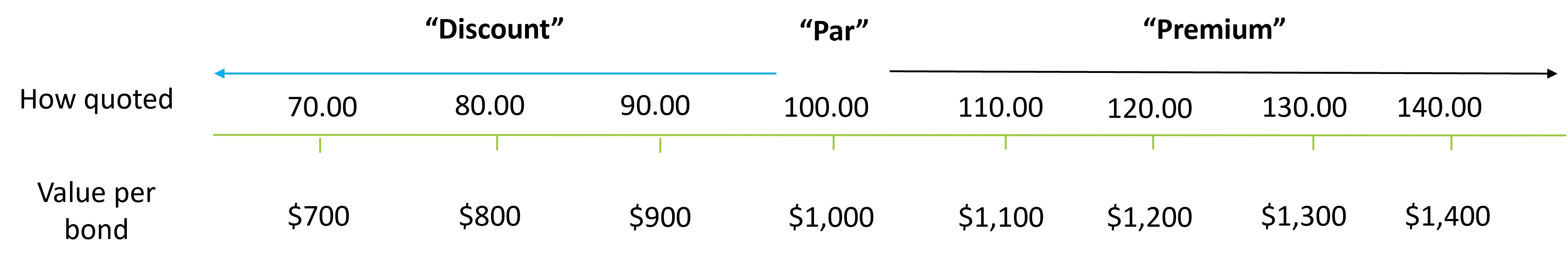

- Evaluating Bond Returns: The face value provides a benchmark for evaluating the return on investment of a bond. By comparing the face value to the price at which the bond is trading in the secondary market, investors can determine whether they are buying the bond at a discount (below face value), at par (equal to face value), or at a premium (above face value). This analysis helps investors assess the potential gain or loss on their investment.

- Assessing Bond Risk: The face value is an essential factor in assessing the risk associated with a bond. Bonds with higher face values typically entail larger principal amounts, implying a potentially higher default risk if the issuer experiences financial difficulties. Investors should consider the face value alongside other factors, such as the creditworthiness of the issuer, the bond’s maturity date, and prevailing market conditions, to evaluate the risk-reward trade-off.

- Understanding Maturity Value: The face value represents the amount that the bondholder will receive upon maturity. This helps investors understand the total amount they will receive at the end of the bond’s term. It is important to note that the market value of a bond may differ from its face value over time, but upon maturity, the bondholder is entitled to the face value.

Overall, the face value serves as a fundamental reference point for understanding the financial aspects of a bond, including interest payments, returns, risk assessment, and maturity value. It plays a crucial role in making informed investment decisions and managing the income and potential risks associated with investing in bonds.

Calculation of Face Value

The calculation of the face value of a bond is relatively straightforward. It is typically determined at the time of bond issuance and remains constant throughout the bond’s life. The face value is expressed as a specific dollar amount per bond.

To calculate the face value, you need to know the coupon rate and the maturity value of the bond. The coupon rate is the percentage of the face value that the issuer pays in annual interest to the bondholder, while the maturity value is the total amount the bondholder will receive at the end of the bond’s term.

The face value can be derived using the following formula:

Face Value = (Coupon Rate * Maturity Value) / 100

For example, let’s consider a bond with a coupon rate of 6% and a maturity value of $1,000. Applying the formula, we can calculate the face value as:

Face Value = (6% * $1,000) / 100

Face Value = $60

Therefore, the face value of this bond would be $60.

It is important to note that in most cases, the face value is a round number, such as $1,000 or $10,000, which makes it easier for investors to work with.

Calculating the face value allows investors to have a clear understanding of the principal amount they will receive upon maturity. This information is essential for evaluating the bond’s potential returns, assessing risks, and determining the appropriate investment strategy.

Variations of Face Value

Although the face value of a bond is typically fixed, there are certain variations and aspects to consider when it comes to understanding different types of bonds. Here are a few variations of face value:

- Zero-Coupon Bonds: Zero-coupon bonds, also known as discount bonds, are a type of bond that does not make regular interest payments. Instead, they are issued at a discount to their face value and are redeemed at face value upon maturity. The face value of a zero-coupon bond represents the amount the investor will receive at maturity, which makes up for the lack of periodic interest payments.

- Variable-Rate Bonds: In contrast to fixed-rate bonds, variable-rate bonds have a face value that can change over time based on a predetermined formula. These bonds are often linked to an underlying benchmark interest rate, such as the LIBOR or Treasury rates, and the coupon payments adjust periodically according to changes in the benchmark rate.

- Amortizing Bonds: Amortizing bonds are structured in a way that the face value gradually decreases over time. These bonds are designed to repay a portion of the principal along with the interest payments over the life of the bond. As a result, the face value declines until it reaches zero at the end of the bond’s term.

- Stripped Bonds: Also known as zero-coupon bonds, stripped bonds are created by separating the interest payments and the principal of a bond into separate securities. These securities, known as coupon strips and residue strips, have their face values that, when combined, make up the original face value of the bond. The coupon strips represent the future interest payments, while the residue strip represents the maturity value.

These variations in face value provide investors with different options and strategies to meet their specific investment objectives. It is essential to understand the specific terms and characteristics of each bond type to make informed investment decisions.

Relationship between Face Value and Market Value

The relationship between the face value and market value of a bond is an important consideration for both investors and issuers. While the face value represents the predetermined value assigned at the time of issuance, the market value is determined by supply and demand factors in the secondary market.

Here are a few key points regarding the relationship between the face value and market value:

- At Par Value: When a bond is trading at par, it means that the market value is equal to the face value. In this scenario, investors are buying the bond at its original intended value, and there is no premium or discount involved. Bonds are typically issued at par value, and their market prices may fluctuate above or below the face value depending on various factors.

- Premium or Above Par Value: A bond is said to be trading at a premium when the market value is higher than the face value. This situation occurs when the bond offers a more attractive interest rate compared to prevailing market rates. Investors are willing to pay a premium to secure a higher interest income. For example, if a bond has a face value of $1,000 but is trading at $1,050, it is considered to be trading at a premium.

- Discount or Below Par Value: A bond is considered to be trading at a discount when the market value is lower than the face value. This situation occurs when the bond offers a lower interest rate compared to prevailing market rates or if the issuer’s creditworthiness is in question. Investors may be reluctant to purchase the bond at its full face value and will demand a lower price. For example, if a bond has a face value of $1,000 but is trading at $950, it is considered to be trading at a discount.

- Factors Affecting Market Value: The market value of a bond is influenced by a range of factors, including prevailing interest rates, creditworthiness of the issuer, maturity date, overall market conditions, and investor sentiment. Changes in these factors can cause fluctuations in the market value and can lead to premiums or discounts relative to the face value.

It is important for investors to understand that while the face value remains constant, the market value can change throughout the life of the bond. The market value represents the perceived worth of the bond based on prevailing market conditions, investor demand, and other factors. Investors should consider both the face value and market value when making investment decisions, as they provide insight into the potential returns and risks associated with the bond.

Conclusion

The face value of a bond is a critical concept in the world of finance. It represents the nominal value assigned to a bond when it is issued and serves as the principal amount that investors lend to the issuer. Understanding the face value is essential for bond investors as it helps determine the interest payments, maturity value, and overall return on investment.

Throughout this article, we have discussed the definition of face value, its calculation, and its importance in bond investing. The face value provides a benchmark for evaluating the bond’s worth and helps investors assess the potential gain or loss on their investment. It is crucial for determining the interest payments, evaluating returns, assessing risks, and understanding the maturity value of the bond.

Furthermore, variations in face value, such as zero-coupon bonds, variable-rate bonds, amortizing bonds, and stripped bonds, offer different opportunities and strategies for investors to consider.

It is important to note that while the face value remains constant, the market value of a bond can fluctuate based on factors such as interest rates, creditworthiness, and market conditions. Investors should take into account both the face value and market value when making investment decisions.

In conclusion, understanding the face value of a bond is crucial for investors to make informed decisions and manage their investment portfolios effectively. By grasping the concept of face value and its relationship to market value, investors can navigate the bond market with confidence and maximize their potential returns.