Finance

How Do You Value Bonds

Modified: February 21, 2024

Learn how to value bonds in the world of finance. Understand the principles and calculations used to determine bond values.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the world of finance, bonds have long been regarded as one of the most popular investment options. From individual investors to large corporations, bonds are sought after for their relative stability and guaranteed returns. However, understanding how bonds are valued is crucial for making informed investment decisions.

In this article, we will delve into the intricacies of bond valuation and explore the factors that play a crucial role in determining the value of a bond. Whether you are a seasoned investor looking to expand your knowledge or a novice seeking to enter the world of fixed-income investments, this article will provide you with a comprehensive understanding of bond valuation.

Before we dive into the complexities of bond valuation, let’s take a brief look at what a bond actually is. In essence, a bond is a debt instrument issued by a government or a corporation to raise capital. When an entity issues a bond, they are essentially borrowing money from investors who purchase the bonds. The issuer promises to repay the principal amount, or face value, of the bond to the investor at a future date, known as the maturity date. In return for lending their money, investors receive periodic interest payments, known as coupon payments, throughout the life of the bond.

Now that we have a basic understanding of what bonds are, let’s explore how they are valued. Bond valuation is the process of determining the fair price of a bond in the market. The value of a bond is influenced by a variety of factors, including interest rates, the creditworthiness of the issuer, and the time remaining until the bond matures.

Understanding bond valuation is essential for investors, as it allows them to assess the attractiveness of a bond and make informed investment decisions. By understanding the key factors that contribute to a bond’s value, investors can determine whether a particular bond is overvalued, undervalued, or fairly priced.

In the following sections, we will delve deeper into the process of bond valuation and explore the key factors that affect the pricing of bonds.

Background on Bonds

Bonds have been a fundamental part of the financial market for centuries. They are essentially debt instruments that allow governments, municipalities, and corporations to raise capital by borrowing money from investors. Bonds are considered fixed-income securities because they provide investors with a predetermined stream of income in the form of periodic interest payments. These interest payments are referred to as coupon payments.

When an investor purchases a bond, they are essentially lending money to the issuer for a specified period of time. In return, the issuer promises to repay the principal amount, or face value, of the bond to the investor at a future date, known as the maturity date. In addition to the principal repayment, the issuer also pays periodic interest payments to the investor.

Bonds offer investors a more stable and predictable income compared to other investments, such as stocks. This is because bond issuers are legally obligated to make interest payments to bondholders, regardless of the financial performance of the issuer. Additionally, bonds typically have a fixed interest rate, which mitigates the risk of fluctuating returns.

There are various types of bonds available in the market, each with its own unique features and characteristics. Some common types of bonds include:

- Government Bonds: These bonds are issued by national governments to fund public projects and government expenditures.

- Corporate Bonds: These bonds are issued by corporations to raise capital for business operations, expansion, or mergers and acquisitions.

- Municipal Bonds: These bonds are issued by municipalities and local governments to finance infrastructure projects, such as schools, roads, and hospitals.

- Treasury Bonds: These bonds are issued by the government and are considered to be among the safest investments, as they are backed by the full faith and credit of the issuing government.

- Convertible Bonds: These bonds give the bondholder the option to convert the bond into a predetermined number of the issuer’s common shares.

The price of a bond in the secondary market, where previously issued bonds are traded, is influenced by a variety of factors such as interest rates, creditworthiness of the issuer, and the remaining time until the bond matures. Understanding these influences is crucial for valuing bonds and making informed investment decisions.

Now that we have a basic understanding of what bonds are and the different types available, let’s explore the process of bond valuation and understand how these factors affect the pricing of bonds.

Understanding Bond Valuation

Bond valuation is the process of determining the fair price of a bond in the market. It involves calculating the present value of future cash flows that the bond is expected to generate, including both the periodic interest payments and the principal repayment at maturity. The valuation of a bond takes into consideration several key factors, including the interest rate environment, the creditworthiness of the issuer, and the time remaining until the bond matures.

One of the most crucial concepts in bond valuation is the time value of money. This concept recognizes that a dollar received in the future is worth less than a dollar received today, due to factors such as inflation and the opportunity cost of tying up capital. Therefore, in order to accurately value a bond, the future cash flows need to be discounted back to their present value.

The discounting process involves using an appropriate discount rate, which is typically a measure of the current interest rate environment. When interest rates rise, the present value of bond cash flows decreases, resulting in a lower bond price. Conversely, when interest rates fall, the present value of bond cash flows increases, leading to a higher bond price.

In addition to interest rates, the creditworthiness of the bond issuer plays a significant role in bond valuation. Bond issuers are assigned credit ratings by independent rating agencies, such as Standard & Poor’s, Moody’s, and Fitch. These ratings reflect the perceived credit risk associated with the issuer and can range from “AAA” for the highest-rated issuers to “D” for issuers in default. The higher the credit rating, the lower the perceived risk, and the higher the bond price.

Furthermore, the time remaining until the bond matures also affects the valuation of a bond. Generally, bonds with longer remaining maturities are more sensitive to changes in interest rates and thus have greater price volatility. This is because the future cash flows of a longer-term bond are discounted back over a longer period, making them more sensitive to changes in interest rates.

Understanding bond valuation enables investors to assess whether a bond is trading at a fair price or is overvalued or undervalued in the market. By comparing the current market price to the calculated intrinsic value, investors can make informed decisions regarding their bond investments.

In the next section, we will explore the key factors that influence the pricing of bonds and further delve into the concept of yield-to-maturity.

Key Factors in Valuing Bonds

Valuing bonds involves considering a range of factors that play a crucial role in determining their fair market price. These factors include interest rates, creditworthiness of the issuer, and the bond’s characteristics such as maturity, coupon rate, and callability.

First and foremost, interest rates have a significant impact on bond valuation. When interest rates rise, the value of existing bonds with lower interest rates decreases, making them less attractive compared to newly issued bonds with higher coupon rates. Conversely, when interest rates decline, existing bonds with higher coupon rates become more valuable, as they provide a higher return compared to new bonds. This inverse relationship between bond prices and interest rates is known as interest rate risk.

Next, the creditworthiness of the issuer is an essential factor in bond valuation. The creditworthiness is typically assessed by credit ratings assigned by rating agencies. Bonds issued by entities with higher credit ratings are considered less risky and, therefore, tend to have higher prices. On the other hand, bonds with lower ratings or those issued by entities facing financial difficulties will have lower prices due to heightened credit risk.

The maturity of a bond is another important factor in valuation. Bonds with longer maturities generally have higher price volatility because they are exposed to interest rate changes for a longer period. This means that a small change in interest rates will have a greater impact on the present value of future cash flows, making longer-term bonds more sensitive to interest rate fluctuations.

The coupon rate, or the fixed interest rate paid by the issuer to the bondholders, also affects bond valuation. A bond with a higher coupon rate is more valuable because it provides a higher income stream to the investor. Conversely, a bond with a lower coupon rate will have a lower value since its coupon payments are relatively lower.

Another factor to consider is a bond’s callability. Callable bonds give the issuer the right to redeem the bond before its maturity date, which can lead to decreased value for the bondholder. This is because when interest rates decline, issuers may decide to call the bond and issue new bonds at lower rates, leaving the bondholder with lower returns than anticipated.

Overall, valuing bonds requires a careful analysis of the key factors mentioned above. By considering interest rates, creditworthiness, maturity, coupon rate, and callability, investors can accurately assess the fair market price of a bond and make informed investment decisions.

In the next section, we will explore the process of pricing bonds and delve into the concept of yield-to-maturity.

Pricing Bonds

The process of pricing bonds involves determining the specific market value at which a bond can be bought or sold. Bond prices are influenced by factors such as interest rates, creditworthiness, and the bond’s characteristics. Understanding how bonds are priced is essential for investors to make informed decisions and accurately assess the potential returns from their investments.

One commonly used method for pricing bonds is the present value approach. This approach calculates the present value of the bond’s future cash flows, which include both the periodic interest payments and the principal repayment at maturity.

To calculate the present value of the bond’s future cash flows, an investor needs to discount these cash flows back to their current value using an appropriate discount rate. The discount rate is typically determined by the prevailing interest rates in the market and reflects the opportunity cost of investing in the bond.

The discount rate used in bond pricing is often the yield-to-maturity (YTM). YTM is the total return anticipated by an investor if the bond is held until maturity. It takes into consideration not only the coupon payments received during the life of the bond but also any capital gains or losses upon maturity.

When interest rates rise, the present value of future cash flows decreases, resulting in a lower bond price. Conversely, when interest rates fall, the present value of future cash flows increases, leading to a higher bond price. This inverse relationship between bond prices and interest rates is known as interest rate risk.

In addition to interest rates, the creditworthiness of the bond issuer also plays a role in pricing. Bonds issued by entities with higher credit ratings are considered less risky and, therefore, tend to have higher prices. Conversely, bonds with lower ratings or those issued by entities facing financial difficulties will have lower prices due to increased credit risk.

The bond’s characteristics, such as its maturity, coupon rate, and callability, also impact its price. Longer-term bonds generally have higher price volatility, making them more sensitive to interest rate changes. Bonds with higher coupon rates offer greater income potential and may command higher prices. Callable bonds, on the other hand, may have lower prices due to the risk of early redemption by the issuer.

Market supply and demand dynamics also play a role in determining bond prices. If there is high demand for a particular bond, its price may be bid up, resulting in a higher market price. Conversely, if there is low demand, the bond price may be lower.

Overall, the pricing of bonds is a multifaceted process that takes into account multiple factors, including interest rates, creditworthiness, bond characteristics, and market dynamics. By understanding these factors, investors can effectively assess the fair market price of a bond and make informed investment decisions.

In the next section, we will explore the concept of yield-to-maturity (YTM) in more detail and its significance in bond investing.

Yield-to-Maturity

Yield-to-maturity (YTM) is a crucial concept in bond investing as it provides investors with a comprehensive measure of the bond’s potential return. YTM represents the total return anticipated by an investor if the bond is held until its maturity date.

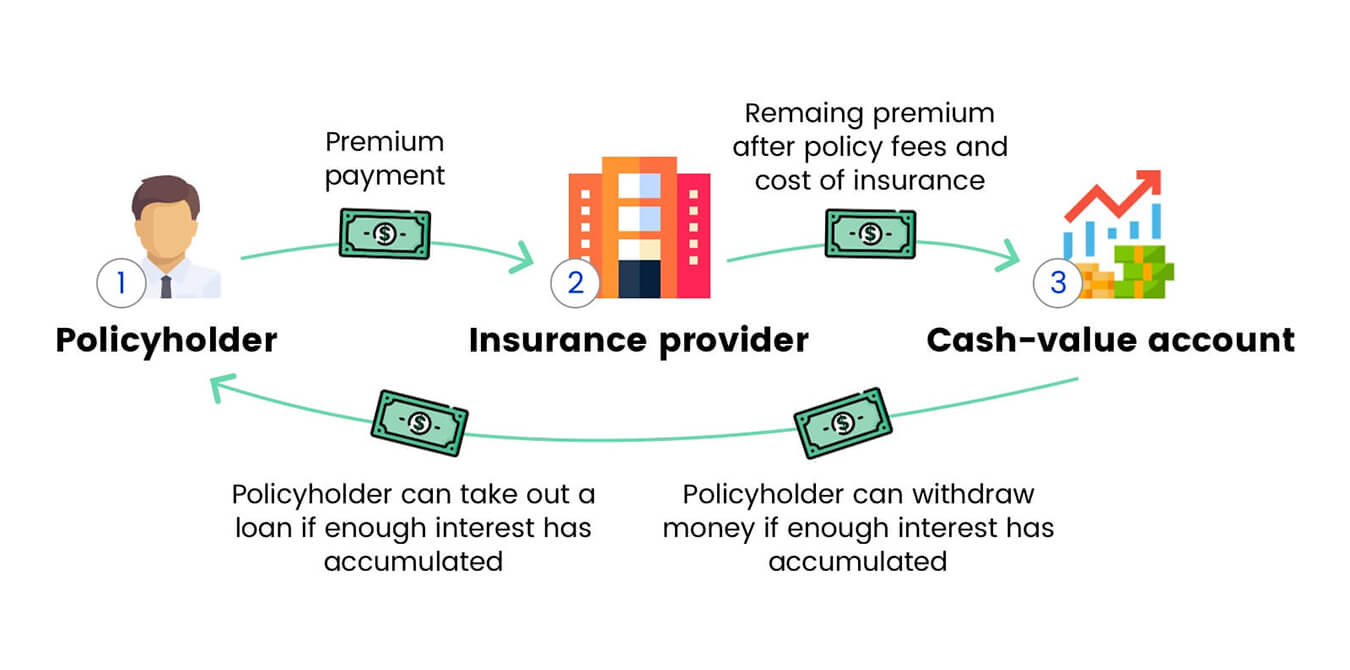

The YTM takes into account three key components of a bond’s return: the coupon payments received throughout the life of the bond, any capital gains or losses realized upon maturity, and the time value of money.

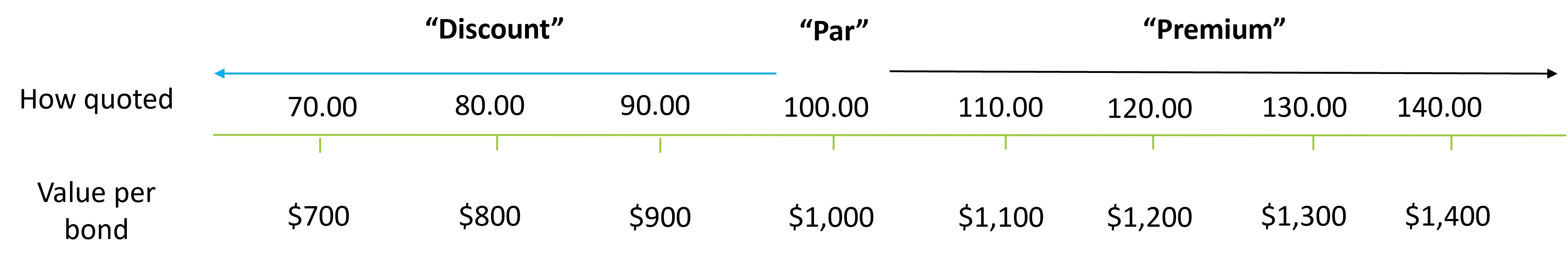

When a bond is purchased, it is typically bought at a price other than its face value. If the bond is trading at a premium, meaning its market price is higher than its face value, the investor will receive lower coupon payments in proportion to the premium paid. If the bond is trading at a discount, meaning its market price is lower than its face value, the investor will receive higher coupon payments in proportion to the discount received.

As the bond approaches maturity, its price tends to converge towards its face value. Therefore, at the bond’s maturity, the investor will not only receive the last coupon payment but also the return of the principal investment, which is the face value of the bond.

The time value of money is also factored into YTM. A dollar received in the future is worth less than a dollar received today due to factors such as inflation and the opportunity cost of tying up capital. The YTM discounts all future cash flows to their present value, taking into consideration the time value of money.

The YTM assumes that all coupon payments will be reinvested at the same rate until the bond matures. This is known as the reinvestment assumption. In practice, it can be difficult to reinvest coupon payments at the same rate due to varying market conditions, but the YTM serves as a useful approximation of the bond’s total return.

YTM is expressed as an annualized percentage and can be compared to other investment options to assess the relative attractiveness of a bond. A higher YTM indicates a potentially higher return, while a lower YTM indicates a lower return.

It is important to note that the YTM assumes the investor holds the bond until maturity and receives all coupon payments and the principal back. If the bond is sold prior to maturity, the actual return may differ from the YTM.

YTM is a useful tool for bond investors to evaluate the potential return on their investment. It provides a comprehensive measure that incorporates coupon payments, capital gains or losses, and the time value of money. By comparing the YTM of different bonds, investors can make informed decisions about which bonds may offer the most attractive returns given their risk tolerance and investment objectives.

In the next section, we will explore the significance of bond ratings and their impact on bond valuation.

Bond Ratings

Bond ratings are an essential tool for investors to assess the creditworthiness of bond issuers and evaluate the risk associated with investing in a particular bond. They are assigned by independent rating agencies such as Standard & Poor’s (S&P), Moody’s, and Fitch Ratings, among others.

Bond ratings are represented by a combination of letters and symbols, which indicate the credit quality and default risk of the issuer. The highest rating given to a bond is typically “AAA” or “Aaa,” indicating a low credit risk. As the creditworthiness of the issuer declines, the rating decreases, and the default risk increases.

Investors often rely on bond ratings to assess the likelihood of receiving timely interest payments and the return of their principal investment. Higher-rated bonds are considered safer investments because they are issued by entities with a strong credit profile, characterized by stable financials, a track record of meeting financial obligations, and a reduced risk of default.

Bond ratings are based on a comprehensive analysis of various factors, including the issuer’s financial health, cash flow generation, industry and market conditions, competitive position, and management quality. Rating agencies conduct thorough reviews and assign ratings based on their assessment of the issuer’s ability to meet its financial obligations.

While bond ratings are crucial indicators of creditworthiness, investors should understand that they are not foolproof. Rating agencies can occasionally make errors or fail to predict financial difficulties accurately. Therefore, it is important for investors to conduct their due diligence and consider other factors in addition to bond ratings when making investment decisions.

The bond market typically has a broad range of ratings, ranging from “investment grade” to “speculative grade” or “junk bonds.” Investment-grade bonds are issued by entities with a low risk of default and are considered safer investments. These bonds have higher credit ratings, typically ranging from “AAA” to “BBB” or “Aaa” to “Baa.” In contrast, speculative-grade or junk bonds have higher default risk and lower credit ratings, often below “BBB” or “Baa.”

Bond ratings not only provide guidance for investors but also have a direct impact on bond valuation. Higher-rated bonds tend to have higher prices and lower yields due to their perceived lower default risk. On the other hand, lower-rated bonds have lower prices and higher yields to compensate for the higher default risk associated with the issuer.

It is important to note that bond ratings can change over time as the issuer’s financial profile evolves or market conditions change. Therefore, investors should regularly monitor the ratings of their bond holdings to ensure they align with their risk tolerance and investment goals.

While bond ratings are valuable tools for investors, it is essential to complement them with thorough analysis and consideration of other factors before making investment decisions. By looking beyond the ratings and understanding the underlying creditworthiness of bond issuers, investors can make well-informed choices that align with their investment objectives.

In the next section, we will explore the risks associated with bond valuation and the importance of risk management in bond investing.

Risks Associated with Bond Valuation

While bonds are often considered less risky than other types of investments, they still carry certain risks that investors should be aware of when valuing bonds. Understanding these risks is essential for making sound investment decisions and effectively managing a bond portfolio.

1. Interest Rate Risk: Bonds are sensitive to changes in interest rates. When interest rates rise, bond prices generally decrease, and vice versa. This is because newly issued bonds with higher coupon rates become more attractive, making existing lower-coupon bonds less desirable. The longer the bond’s maturity, the greater its sensitivity to interest rate changes.

2. Credit Risk: Credit risk refers to the risk of default by the bond issuer. Bonds issued by entities with lower credit ratings or unstable financial conditions have a higher likelihood of defaulting on interest or principal payments. Credit risk is a significant consideration when valuing bonds, as it directly impacts the bond’s price and yield.

3. Liquidity Risk: Liquidity risk arises when it becomes challenging to buy or sell a bond without significantly impacting its price. Less liquid bonds may be subject to wider bid-ask spreads, resulting in higher transaction costs for investors. Additionally, in times of market stress, liquidity can dry up, making it difficult to exit positions quickly and at favorable prices.

4. Call Risk: Callable bonds have a risk of early redemption by the issuer, typically when interest rates decline. This can result in the bondholder receiving the principal back earlier than expected and having to reinvest it at potentially lower interest rates. Investors should consider the potential impact of call risk on the bond’s valuation and overall return.

5. Reinvestment Risk: Reinvestment risk refers to the risk that periodic coupon payments or principal repayments may need to be reinvested at lower interest rates. If interest rates decline after the bond is purchased, future reinvestments may yield lower returns, impacting the overall profitability of the bond investment.

6. Inflation Risk: Inflation erodes the purchasing power of fixed income investments, including bonds. If the interest rate or coupon payments of a bond do not adjust in line with inflation, the investor may experience a decrease in real return. Inflation risk is particularly relevant for long-term bonds as their purchasing power is exposed to inflation over an extended period.

7. Market Risk: Broad market conditions and economic factors can impact the valuation of all bond investments. Factors such as changes in macroeconomic conditions, geopolitical events, or shifts in investor sentiment can lead to price fluctuations and impact the overall value of a bond portfolio.

By understanding and assessing these risks, investors can make more informed decisions when valuing bonds and constructing their portfolios. Diversification, regular monitoring of market conditions, and staying up-to-date with the creditworthiness of bond issuers can help mitigate these risks and enhance the overall risk-adjusted return of the bond portfolio.

In the concluding section, we will summarize the key points covered in this article and emphasize the importance of bond valuation in successful investment strategies.

Conclusion

Understanding bond valuation is crucial for investors seeking to navigate the world of fixed-income investments. By grasping the key factors that contribute to a bond’s value, investors can make informed decisions and effectively manage their bond portfolios.

Bonds provide investors with a predictable income stream in the form of periodic coupon payments, making them a popular choice for those seeking stability and reliable returns. The valuation of bonds considers various factors, including interest rates, creditworthiness, and bond characteristics such as maturity, coupon rate, and callability.

Interest rates play a significant role in bond valuation, as changes in interest rates can impact the present value of future cash flows, resulting in price fluctuations. The creditworthiness of bond issuers is also crucial, with higher-rated bonds considered less risky and demanding higher prices in the market.

Furthermore, bond characteristics such as maturity, coupon rate, and callability influence pricing and potential returns. Longer-term bonds tend to be more sensitive to interest rate changes, while higher coupon rates increase the attractiveness of a bond. The potential callability of a bond can also affect its value, as investors may face early redemption and the need to reinvest at potentially lower rates.

Bond ratings provide investors with insights into the creditworthiness of issuers and facilitate risk assessment. Higher-rated bonds are generally considered safer investments, while lower-rated or speculative-grade bonds carry higher default risk and are priced accordingly.

It is important for investors to be aware of the risks associated with bond valuation, including interest rate risk, credit risk, liquidity risk, call risk, reinvestment risk, inflation risk, and market risk. Managing these risks through diversification, ongoing monitoring, and sound risk management strategies can help investors protect their capital and enhance their returns in bond investments.

In summary, bond valuation is a complex process that considers multiple factors and requires careful analysis. By understanding bond valuation, evaluating risks, and staying informed about market conditions, investors can make informed decisions and build successful bond portfolios that align with their investment objectives and risk tolerance.