Finance

What Is Financial Education?

Published: January 4, 2024

Enhance your understanding of finance with comprehensive financial education. Learn the essentials of managing money, investments, and personal finances for a secure financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Financial Education

- Importance of Financial Education

- Benefits of Financial Education

- Components of Financial Education

- Methods of Financial Education Delivery

- Challenges in Financial Education

- Government Initiatives in Financial Education

- Role of Schools in Financial Education

- Role of Parents in Financial Education

- Role of Financial Institutions in Financial Education

- Conclusion

Introduction

Financial education plays a crucial role in empowering individuals with the knowledge and skills necessary to make informed financial decisions. It encompasses the understanding of various financial concepts, strategies, and tools that can help individuals achieve their financial goals and navigate the complex world of personal finance. In today’s fast-paced and ever-changing economic landscape, financial education has become more important than ever.

Financial education equips individuals with the ability to manage their money effectively, make wise investments, and plan for their future. It provides them with the skills to budget, save, invest, and protect their financial well-being. Whether it’s understanding how to create a budget, manage debt, save for retirement, or make informed investment decisions, financial education provides the foundation for making sound financial choices.

Unfortunately, many individuals lack the necessary financial knowledge and skills to make informed decisions about their money. The consequences of this knowledge gap can be detrimental, leading to financial stress, debt, and missed opportunities for wealth creation. Increasing financial literacy is essential in addressing these challenges and promoting financial well-being for individuals, families, and communities.

In this article, we will explore the concept of financial education, its importance, benefits, components, and the various methods of delivery. We will also discuss the challenges involved in promoting financial education and the role of different stakeholders, such as governments, schools, parents, and financial institutions, in facilitating financial education initiatives. By understanding the significance of financial education, we can empower individuals to take control of their financial futures and achieve lifelong financial well-being.

Definition of Financial Education

Financial education refers to the process of acquiring knowledge and skills related to personal finance. It involves understanding various financial concepts, principles, and strategies that enable individuals to effectively manage their money, make informed financial decisions, and build a strong financial foundation. Financial education encompasses a wide range of topics, including budgeting, saving, investing, debt management, retirement planning, insurance, and more.

At its core, financial education aims to improve financial literacy, which is the ability to understand and use financial knowledge to make informed decisions. It equips individuals with the necessary tools to navigate the complex world of personal finance, empowering them to achieve their short-term and long-term financial goals.

Financial education goes beyond simply teaching individuals how to balance a checkbook or create a budget. It is about providing them with the knowledge and skills to make sound financial decisions throughout their lives. This includes understanding the risks and rewards of different financial products, evaluating investment opportunities, assessing the impact of financial decisions on their overall financial well-being, and developing a financial plan to achieve their goals.

Moreover, financial education fosters the development of critical thinking skills, enabling individuals to assess financial information, identify potential scams or fraudulent schemes, and make informed judgments about the best course of action. It also promotes financial responsibility, helping individuals understand the consequences of their financial actions and encouraging them to make responsible choices to secure their financial future.

Financial education is not a one-time event but a lifelong journey. It is an ongoing process that adapts to the changing financial landscape and individual circumstances. It requires continuous learning, staying updated with the latest financial trends and strategies, and seeking guidance from financial professionals when needed.

In summary, financial education is the acquisition of knowledge and skills related to personal finance, empowering individuals to make informed financial decisions, manage their money effectively, and build a strong financial future.

Importance of Financial Education

Financial education plays a pivotal role in today’s society, and its importance cannot be overstated. Here are some key reasons why financial education is crucial:

1. Empowers Individuals: Financial education empowers individuals with the knowledge and skills to take control of their financial lives. It provides them with the tools to set financial goals, create budgets, manage debt effectively, and make informed investment decisions. This empowerment leads to greater financial confidence and independence.

2. Promotes Financial Stability: A lack of financial education can contribute to financial instability. By understanding personal finance concepts and strategies, individuals are better equipped to manage their money, avoid excessive debt, and build an emergency fund. This promotes financial stability and reduces financial stress.

3. Enhances Financial Decision-making: Financial education equips individuals with the knowledge to make informed financial decisions. It enables them to evaluate financial products, compare investment options, and assess risks and potential returns. This helps individuals make decisions that align with their financial goals and values.

4. Prevents Financial Fraud and Scams: Financial education helps individuals recognize and avoid financial fraud and scams. It teaches them to be skeptical of unrealistic promises, ask critical questions, and conduct thorough research before making financial decisions. This knowledge is crucial in protecting individuals from falling victim to fraudulent schemes.

5. Prepares for Financial Emergencies: Financial education emphasizes the importance of saving for emergencies. It encourages individuals to establish an emergency fund to handle unexpected expenses, such as medical bills or job loss. This preparation mitigates the financial impact of emergencies and provides a safety net.

6. Supports Long-term Financial Goals: Financial education helps individuals plan for their long-term financial goals, such as buying a home, funding higher education, or retiring comfortably. It provides them with the knowledge of different investment options, retirement accounts, and wealth-building strategies. This enables individuals to make informed choices that align with their aspirations.

7. Fosters Financial Well-being: Ultimately, financial education fosters financial well-being. It equips individuals with the knowledge and skills to attain financial security, reduce financial stress, and achieve their financial goals. This, in turn, contributes to overall well-being and quality of life.

By recognizing the importance of financial education and investing in it, individuals can enhance their financial literacy, make informed decisions, and achieve long-term financial success. Moreover, the benefits extend beyond individuals to families, communities, and the broader economy, creating a stronger and more financially resilient society.

Benefits of Financial Education

Financial education offers numerous benefits, empowering individuals to improve their financial well-being and make informed decisions. Here are some key benefits of financial education:

1. Improved Financial Literacy: Financial education enhances individuals’ financial literacy, allowing them to understand complex financial concepts, terms, and strategies. This knowledge equips individuals to make informed financial decisions and navigate the ever-changing financial landscape.

2. Enhanced Money Management Skills: Financial education equips individuals with practical money management skills, such as budgeting, saving, and tracking expenses. It helps individuals develop a financial plan that aligns with their goals and allows them to achieve greater financial stability and control.

3. Increased Confidence and Empowerment: Financial education boosts individuals’ confidence in managing their finances. It empowers them to take control of their financial lives and make decisions that align with their goals and values. This sense of empowerment can positively impact other aspects of their lives as well.

4. Debt Management: Financial education provides individuals with strategies and tools to effectively manage debt. It helps them understand the consequences of high-interest debt and provides strategies to pay it off or avoid it altogether. This knowledge can prevent individuals from falling into a cycle of debt and financial stress.

5. Improved Saving and Investing Habits: Financial education emphasizes the importance of saving and investing for long-term goals, such as retirement or education. It educates individuals on different investment options, the power of compounding, and the benefits of starting early. This knowledge encourages individuals to develop good saving and investing habits for a secure financial future.

6. Responsible Borrowing: Financial education teaches individuals about responsible borrowing practices. It emphasizes the importance of understanding loan terms, interest rates, and repayment plans. This knowledge enables individuals to make informed decisions when taking on debt, minimizing the risk of financial instability or default.

7. Protection against Financial Scams: Financial education equips individuals with the knowledge to identify and protect themselves against financial scams and fraud. It educates individuals on the warning signs of fraudulent schemes and provides guidance on safeguarding personal and financial information. This knowledge empowers individuals to make informed decisions and avoid falling victim to scams.

8. Improved Financial Planning: Financial education helps individuals develop effective financial plans. It encourages them to set specific financial goals, create budgets, and establish saving strategies to achieve those goals. This structured approach to financial planning enhances financial management skills and promotes long-term financial success.

9. Financial Well-being: Ultimately, financial education contributes to overall financial well-being. It reduces financial stress, improves financial security, and allows individuals to achieve their financial goals. This, in turn, positively impacts other areas of their lives, including physical and mental well-being.

By recognizing and embracing the benefits of financial education, individuals can improve their financial knowledge, skills, and overall financial health. Financial education is an investment in oneself that pays dividends in the form of increased financial stability, confidence, and a brighter financial future.

Components of Financial Education

Financial education comprises various components that collectively contribute to building a comprehensive understanding of personal finance. These components cover a range of topics and skills necessary for individuals to make informed financial decisions. Here are some key components of financial education:

1. Basic Financial Concepts: Financial education begins with imparting fundamental financial concepts such as income, expenses, budgeting, and savings. Understanding these concepts lays the foundation for more advanced financial topics.

2. Budgeting and Money Management: A crucial component of financial education is teaching individuals how to budget effectively and manage their money. This includes creating a budget, tracking expenses, and making informed spending decisions based on income and financial goals.

3. Saving and Investing: Financial education covers the importance of saving and investing for both short-term and long-term goals. It teaches individuals how to save money, identify suitable investment options, and understand risk and return relationships. This component also includes introducing concepts like compound interest and diversification.

4. Debt Management: Understanding debt is a critical component of financial education. It encompasses teaching individuals about different types of debt, interest rates, payment schedules, and strategies for effective debt management. This includes educating individuals about responsible borrowing, loan terms, and the potential impacts of excessive debt.

5. Financial Planning: Financial education includes teaching individuals how to develop a financial plan tailored to their goals and circumstances. This involves setting specific objectives, identifying strategies to achieve those objectives, and regularly reviewing and adjusting the financial plan as needed.

6. Risk Management and Insurance: Financial education also covers the importance of risk management and the role of insurance. It educates individuals on different types of insurance coverage, how to assess their insurance needs, and the factors to consider when purchasing insurance products.

7. Retirement Planning: As part of financial education, individuals are introduced to the concept of retirement planning. This includes understanding retirement accounts, estimating retirement needs, and exploring strategies to build a retirement nest egg.

8. Consumer Awareness and Protection: Financial education teaches individuals about their rights and responsibilities as consumers. It covers topics such as understanding financial products, reading and interpreting financial statements, and recognizing and addressing fraudulent schemes.

9. Financial Technology: Given the increasing role of technology in personal finance, financial education incorporates knowledge about financial technology (FinTech) and its impact on financial services. This includes understanding online banking, mobile payment apps, and digital investing platforms.

10. Continuous Learning: Finally, financial education emphasizes the importance of continuous learning and staying updated with the latest financial trends, regulations, and strategies. It encourages individuals to seek ongoing education and engage with resources such as books, articles, and workshops.

By covering these components, financial education equips individuals with a holistic understanding of personal finance. It empowers them to navigate the complex financial landscape, make informed decisions, and ultimately achieve their financial goals.

Methods of Financial Education Delivery

Financial education can be delivered through various methods, utilizing different mediums and platforms to reach a wide audience. Here are some common methods of financial education delivery:

1. Formal Education: Financial education can be integrated into school curricula at different levels, from elementary to higher education. Schools can incorporate personal finance courses or include financial education modules within existing subjects like mathematics or social studies. This ensures that young individuals receive a solid foundation in financial literacy from an early age.

2. Workshops and Seminars: Financial literacy workshops and seminars are a popular method of delivering financial education to adults. These sessions can cover a range of topics, from budgeting and debt management to retirement planning and investment strategies. Workplaces, community centers, and financial institutions often organize these events to educate employees or community members.

3. Online Resources: The internet opens up a world of financial education resources that can be accessed anytime and anywhere. Online platforms offer a wealth of educational content, including articles, videos, interactive tools, and online courses. Individuals can explore topics at their own pace, making online resources a convenient and accessible option for self-paced learning.

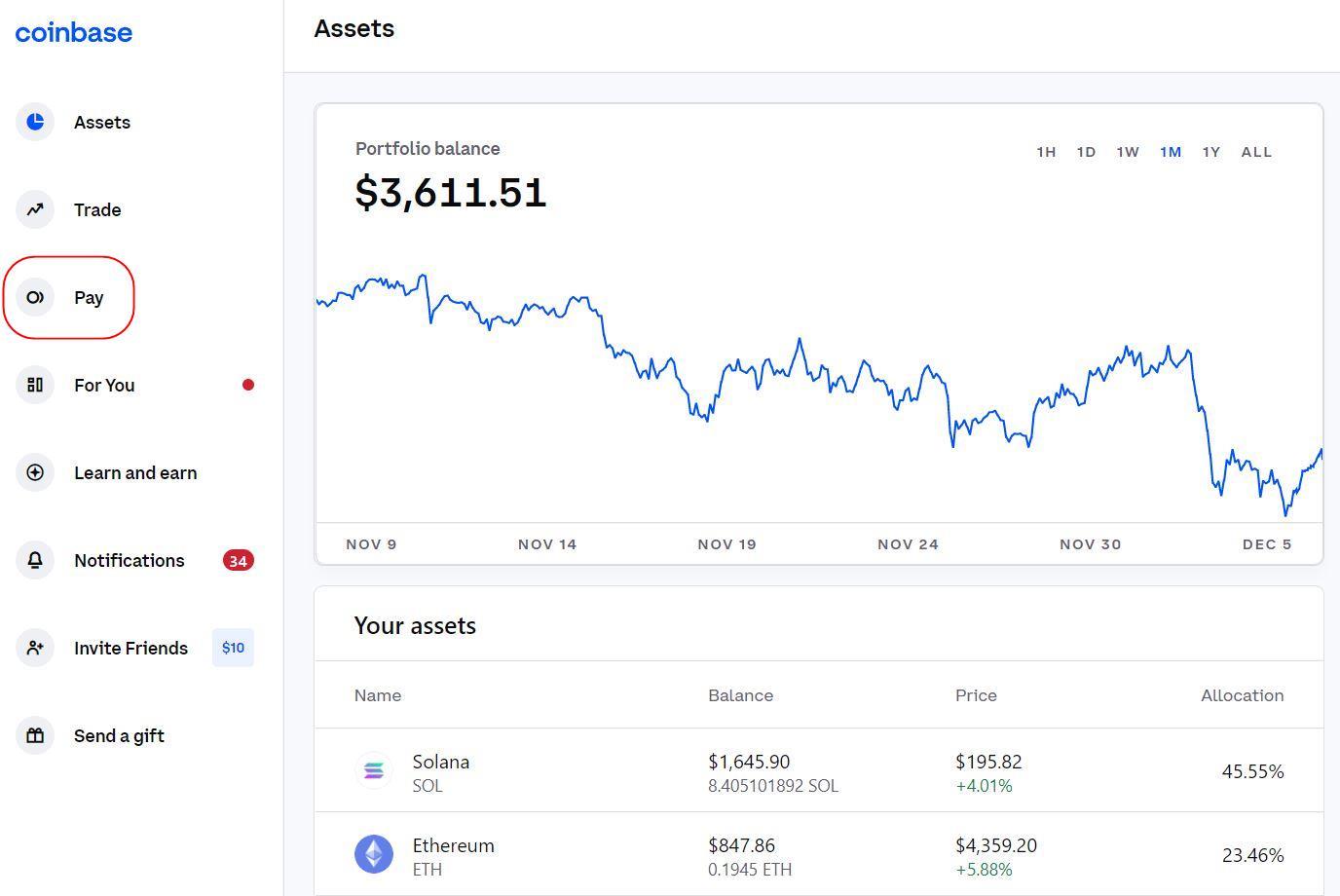

4. Mobile Applications: Mobile applications specifically designed for financial education have gained popularity. These apps provide users with tools to budget, track expenses, learn about investments, and access financial calculators. They offer a hands-on and interactive approach to financial education, making it easy for individuals to manage their finances on the go.

5. Financial Literacy Campaigns: Financial literacy campaigns are organized by government agencies, nonprofits, and financial institutions to raise awareness and promote financial education. These campaigns often involve public events, media campaigns, and partnerships with schools or community organizations to reach a wide audience. The goal is to engage and educate individuals about the importance of financial literacy and empower them to take control of their financial futures.

6. Peer Learning and Mentoring: Peer learning programs and mentorship initiatives can be effective methods of financial education delivery. Individuals learn from their peers who have already gained financial knowledge or from mentors who guide them in making informed financial decisions. These programs create a supportive environment for individuals to learn from real-life experiences and perspectives.

7. Financial Counseling and Coaching: Financial counseling and coaching provide personalized guidance to individuals seeking to improve their financial literacy. Certified financial counselors or coaches work one-on-one with individuals, assessing their financial situations, providing education and resources, and helping them develop personalized financial plans.

8. Community-Based Programs: Community-based programs, such as those organized by nonprofit organizations or local financial institutions, offer financial education tailored to specific groups or communities. These programs address the specific needs and challenges of the target audience, making the education more relatable and practical.

9. Collaboration with Employers: Employers can play a role in promoting financial education by offering workplace financial wellness programs. These programs provide employees with resources, tools, and educational materials to improve their financial literacy and well-being. Employers may also partner with financial institutions or experts to provide educational sessions or access to financial planning services.

By utilizing various methods of financial education delivery, we can reach a wide range of individuals and empower them with the knowledge and skills needed to make informed financial decisions. The key is to tailor the delivery method to the specific audience, making financial education accessible, engaging, and relevant to their needs and circumstances.

Challenges in Financial Education

While financial education is essential, there are several challenges that need to be addressed to ensure its effectiveness and impact. Here are some common challenges in financial education:

1. Lack of Access to Quality Education: Not everyone has equal access to quality financial education. In some communities, schools may not have the resources or curriculum to provide comprehensive financial education. This lack of access can perpetuate financial disparities and hinder individuals from acquiring the knowledge and skills necessary for financial well-being.

2. Complex Financial Landscape: The financial landscape is constantly evolving, with new products, services, and technologies emerging. Keeping up with these changes and understanding complex financial concepts can be challenging for individuals. Financial education needs to adapt and stay current to provide relevant information that helps individuals navigate this complexity.

3. Lack of Financial Inclusion: Financial education should be inclusive and reach individuals from all backgrounds, including those from low-income communities, marginalized groups, and individuals with limited English proficiency. Lack of financial inclusion can restrict access to resources and hinder individuals from participating fully in the economy and making informed financial decisions.

4. Limited Time and Resources: Incorporating financial education into already packed curricula can be challenging for schools. Teachers may have limited time, resources, or specialized knowledge to effectively teach personal finance topics. It requires prioritization and collaboration among educators, policymakers, and stakeholders to ensure that financial education is adequately integrated into school curricula.

5. Behavioral and Psychological Factors: Financial decision-making is influenced by behavioral and psychological factors such as cognitive biases, emotions, and peer pressure. Overcoming these biases and making rational financial choices is not always easy. Financial education needs to address these factors, provide strategies to overcome biases, and promote responsible financial behavior.

6. Lack of Engagement and Relevance: Financial education programs may fail to engage individuals if they are not presented in an interactive or relatable manner. Knowledge that is not relevant to individuals’ immediate financial needs and goals may be quickly forgotten. Effective financial education should be tailored to the audience, incorporate real-life examples, and demonstrate the benefits of applying the knowledge to everyday financial decisions.

7. Limited Evaluation and Assessment: It can be challenging to measure the impact and effectiveness of financial education programs. Traditional evaluation methods, such as test scores, may not capture individuals’ actual financial behaviors and outcomes. Ongoing assessment and research are required to understand the long-term effects of financial education and make improvements based on evidence and data.

8. Constantly Evolving Financial Scams: Financial scams and fraudulent schemes are constantly evolving, making it difficult for financial education programs to keep up. Individuals need to be educated on the latest tactics used by scammers and equipped with knowledge to protect themselves in an increasingly digital and connected world.

Addressing these challenges requires a collaborative effort between educators, policymakers, financial institutions, and communities. It involves improving access to quality financial education, tailoring programs to diverse audiences, keeping up with the changing financial landscape, and continuously evaluating and improving financial education initiatives. By addressing these challenges, we can promote effective financial education that equips individuals with the knowledge and skills to make informed financial decisions throughout their lives.

Government Initiatives in Financial Education

Governments around the world recognize the importance of financial education in promoting economic stability and individual well-being. As a result, many governments have implemented initiatives to enhance financial literacy among their populations. Here are some key ways in which governments have been involved in promoting financial education:

1. National Strategies and Frameworks: Governments often develop national strategies and frameworks for financial education. These strategies outline the vision, goals, and action plans for improving financial literacy levels across the country. They provide a roadmap for implementing financial education programs in various sectors and collaborating with stakeholders to achieve desired outcomes.

2. Curriculum Integration: Many governments prioritize integrating financial education into school curricula. They work with education ministries to develop age-appropriate financial literacy content and ensure that it is effectively taught in schools. This integration ensures that financial education reaches students from a young age, building a strong foundation for responsible financial management.

3. Financial Education Campaigns: Governments often run financial education campaigns to raise awareness and promote financial literacy among the general public. These campaigns use various media channels, such as television, radio, and social media, to disseminate information about personal finance topics, highlight the benefits of financial literacy, and provide resources for self-education.

4. Collaboration and Partnerships: Governments collaborate with various organizations, including financial institutions, nonprofit organizations, and community groups, to enhance the reach and impact of financial education initiatives. By leveraging the expertise and resources of these partners, governments can deliver comprehensive and effective financial education programs.

5. Financial Counseling and Assistance Programs: Governments may provide free or subsidized financial counseling services to individuals who need guidance in managing their finances. These programs offer personalized support, budgeting advice, debt management strategies, and information on financial products and services. They help individuals make informed financial decisions and improve their financial well-being.

6. Regulation and Consumer Protection: Governments enact regulations to protect consumers and promote transparency in the financial industry. This includes regulations on financial products, consumer rights, and the disclosure of terms and conditions. By creating a strong regulatory framework, governments aim to empower individuals to make informed decisions and safeguard them from fraudulent practices.

7. Research and Evaluation: Governments invest in research and evaluation studies to assess the effectiveness of financial education programs and identify areas for improvement. By collecting data on financial literacy levels, financial behaviors, and program outcomes, governments can make informed decisions and allocate resources more effectively to address specific needs and gaps.

8. Support for Low-Income and Vulnerable Groups: Governments recognize the importance of reaching marginalized and vulnerable populations with financial education initiatives. They may design targeted programs to address the specific financial challenges faced by low-income individuals, immigrants, seniors, and other underserved groups. These programs provide tailored support and resources to improve financial literacy and empower individuals to achieve financial stability.

Government initiatives in financial education demonstrate a commitment to equipping individuals with the knowledge and skills necessary to make informed financial decisions. By implementing these initiatives, governments can empower their populations, promote economic well-being, and create a more financially resilient society.

Role of Schools in Financial Education

Schools play a crucial role in promoting financial education and equipping students with the necessary knowledge and skills to make informed financial decisions. Here are some key roles schools have in financial education:

1. Curriculum Integration: Schools have the opportunity to integrate financial education into their curricula, incorporating it as a core subject or as part of existing subjects like mathematics, social studies, or economics. By embedding financial education into the curriculum, schools ensure that students receive consistent and systematic instruction in personal finance throughout their educational journey.

2. Foundation of Financial Literacy: Schools provide a foundation for financial literacy by introducing basic financial concepts and skills. Students learn about budgeting, saving, spending wisely, and basic financial calculations. Understanding these fundamental principles sets the stage for more advanced financial topics and lifelong financial well-being.

3. Skill-building Opportunities: Schools offer students the opportunity to develop critical financial skills that are applicable in real-life situations. Students can learn practical skills like managing money, creating budgets, understanding credit and debt, and making informed consumer choices. These skills empower students to navigate the financial landscape with confidence.

4. Experiential Learning: Schools can provide experiential learning opportunities where students apply financial concepts in real-world scenarios. Simulations, financial literacy games, business ventures, or investment simulations allow students to understand the consequences of their financial decisions and learn valuable lessons in a hands-on and engaging manner.

5. Promoting Financial Responsibility: Schools can instill values of financial responsibility and ethics in students. By emphasizing the importance of honesty, integrity, and fair financial practices, schools foster a sense of responsibility among students to handle money ethically and make wise financial decisions.

6. Encouraging Saving and Investing: Schools can promote the habit of saving and investing early on. They can introduce students to the concept of saving, teach them about different savings options like bank accounts or investment accounts, and emphasize the benefits of long-term investing. This early exposure to saving and investing helps students understand the advantages of long-term financial planning.

7. Consumer Awareness: Schools can educate students about their rights and responsibilities as consumers. This includes teaching them about reading and interpreting financial statements, understanding contracts, and recognizing deceptive advertising. By promoting consumer awareness, schools empower students to make informed choices and protect themselves from financial scams and fraudulent practices.

8. Career Readiness: Financial education in schools can also prepare students for the financial aspects of adulthood, including managing income, understanding taxes, evaluating employee benefits, and planning for retirement. By equipping students with these skills, schools enhance their overall career readiness and financial success in the future.

9. Collaboration with Community: Schools can collaborate with community stakeholders, such as financial institutions, local businesses, and nonprofit organizations, to enhance financial education offerings. Partnerships with these organizations can provide students with access to resources, guest speakers, mentorship opportunities, and real-world financial experiences, strengthening the impact of financial education.

By embracing their roles in financial education, schools can help students build a strong foundation of financial knowledge and skills. This prepares them to navigate the complex financial landscape, make informed decisions, and achieve financial well-being both during their academic journey and throughout their lives.

Role of Parents in Financial Education

Parents play a vital role in shaping the financial knowledge, attitudes, and behaviors of their children. As the first educators in a child’s life, parents have a unique opportunity to instill valuable financial lessons and habits. Here are some key roles parents have in financial education:

1. Setting a Financial Example: Parents serve as role models for their children, and their own financial attitudes and behaviors greatly influence their children’s perceptions about money. By practicing sound financial habits and demonstrating responsible money management, parents can impart invaluable lifelong financial lessons to their children.

2. Open Communication: Parents should engage in open conversations about money matters with their children. This involves discussing family finances, explaining financial decisions, and involving children in age-appropriate discussions about budgeting, saving, and spending. Regular communication about money helps children understand its importance and develop healthy financial values.

3. Allowances and Financial Responsibility: Providing children with allowances can teach them about earning, budgeting, and saving. Parents can encourage children to allocate their allowance into different categories, such as spending, saving, and giving. This hands-on experience helps children make decisions about money and develop a sense of financial responsibility at an early age.

4. Teaching Money Management Skills: Parents play a crucial role in teaching their children basic money management skills. This includes helping children understand the concept of money, how to count and handle cash, and the importance of saving for short- and long-term goals. Parents can involve children in everyday financial tasks like grocery shopping, comparing prices, and making simple financial decisions.

5. Encouraging Savings Habits: Parents can encourage their children to develop a habit of saving by providing piggy banks or opening savings accounts. They can set savings goals with their children and reward their achievements, reinforcing the value of saving for future needs and goals. By instilling saving habits early on, parents help their children develop long-term financial planning skills.

6. Financial Decision Involvement: Parents should involve their children in financial decisions that are appropriate for their age and understanding. This can include choices about family vacations, major purchases, or prioritizing spending. By involving children, parents help them understand the trade-offs involved in financial decision-making and foster their critical thinking skills.

7. Teaching Value and Delayed Gratification: Parents can educate children about the value of money and the importance of delayed gratification. By teaching children to distinguish between needs and wants, parents help them prioritize their expenses and make responsible spending decisions. This fosters self-discipline and helps children develop a balanced approach to managing their resources.

8. Encouraging Entrepreneurship and Work Ethic: Parents can foster an entrepreneurial spirit and work ethic in their children. They can encourage children to pursue opportunities to earn money, such as starting a small business or taking on age-appropriate jobs. By doing so, parents instill the values of hard work, determination, and financial independence in their children.

9. Utilizing Personal Financial Experiences: Parents can share their personal financial experiences, successes, and challenges with their children. By sharing real-life stories, parents help their children understand the consequences of financial decisions and build their financial resilience. These stories provide valuable lessons and guidance for children as they navigate their own financial journeys.

By actively engaging in their children’s financial education, parents can shape their children’s financial attitudes, behaviors, and future financial success. The impact of parental involvement in financial education extends beyond childhood, as it equips children with skills and knowledge that will benefit them throughout their lives.

Role of Financial Institutions in Financial Education

Financial institutions, such as banks, credit unions, and investment firms, have a significant role to play in promoting financial education. As trusted financial service providers, these institutions have the opportunity to educate and empower their customers to make informed financial decisions. Here are some key roles financial institutions have in financial education:

1. Providing Educational Resources: Financial institutions can develop and provide a range of educational resources, including articles, guides, tutorials, and webinars. These resources cover various financial topics such as budgeting, saving, investing, debt management, and retirement planning. By making these resources easily accessible to their customers, financial institutions empower individuals to increase their financial literacy.

2. Offering Financial Workshops and Seminars: Financial institutions can organize workshops and seminars focused on financial education in partnership with community organizations. These events can cover a variety of topics, such as basic money management, understanding credit scores, or investment strategies. By providing these educational opportunities, financial institutions help individuals develop the knowledge and skills necessary for financial success.

3. Financial Counseling and Guidance: Financial institutions can offer personalized financial counseling and guidance services to their customers. Certified financial professionals can provide one-on-one sessions to assist individuals in setting financial goals, creating budgets, managing debt, and planning for major life events. This personalized approach helps individuals address their specific financial needs and challenges.

4. Promoting Responsible Financial Products and Services: Financial institutions play a crucial role in promoting responsible financial products and services. This involves offering transparent and fair financial products, ensuring that customers understand the terms and conditions, and providing tools to help individuals make informed choices. By promoting responsible financial products and services, financial institutions prioritize the best interests of their customers.

5. Financial Literacy Partnerships: Financial institutions can collaborate with educational institutions, community organizations, and government agencies to develop and deliver financial literacy programs. By pooling resources and expertise, financial institutions contribute to comprehensive financial education initiatives that reach a broader audience. These partnerships can also involve offering scholarships, conducting financial literacy competitions, or sponsoring financial education events.

6. Innovating Financial Technology: Financial institutions can leverage technology to promote financial education. They can develop interactive mobile applications or online platforms that provide personalized financial education, budgeting tools, or investment simulators. By incorporating gamification and user-friendly interfaces, financial institutions create engaging experiences that facilitate learning and encourage individuals to take control of their finances.

7. Assisting Vulnerable Populations: Financial institutions have a responsibility to assist vulnerable populations in accessing financial education. This includes providing resources and support to individuals with lower income, seniors, immigrants, or individuals with limited financial literacy. Financial institutions can partner with community organizations to offer targeted financial education programs that address the specific needs of these populations.

8. Supporting Financial Literacy Advocacy: Financial institutions can support and participate in financial literacy advocacy efforts. They can contribute to public awareness campaigns, promote financial literacy initiatives, and collaborate with policymakers on enhancing financial education policies. By actively engaging in advocacy, financial institutions help foster a culture of financial responsibility and build a more financially empowered society.

By fulfilling these roles, financial institutions become key drivers of financial education, empowering individuals to make informed decisions, improve their financial well-being, and achieve their financial goals.

Conclusion

Financial education is a critical component of empowering individuals and promoting financial well-being. It equips individuals with the knowledge and skills necessary to make informed financial decisions, manage their money effectively, and plan for their future.

In this article, we explored the definition of financial education and its importance in today’s complex economic landscape. We discussed the benefits of financial education, including improved financial literacy, enhanced money management skills, and increased financial confidence and empowerment.

We also examined the various components of financial education, such as basic financial concepts, budgeting, saving and investing, debt management, and retirement planning. These components provide individuals with a comprehensive understanding of personal finance and the tools to navigate the financial landscape.

Furthermore, we explored the different methods of delivering financial education, including formal education, workshops and seminars, online resources, mobile applications, and community-based programs. These methods enable individuals to access financial education in a way that suits their learning preferences and lifestyles.

However, financial education does face challenges, such as limited access to quality education, a complex financial landscape, and behavioral biases that can influence financial decision-making. It is crucial for governments, schools, parents, financial institutions, and communities to address these challenges collectively to ensure the effectiveness and impact of financial education initiatives.

We also highlighted the roles of different stakeholders in financial education. Schools play a crucial role in integrating financial education into curricula and providing a strong foundation in financial literacy. Parents have a significant influence on shaping their children’s financial habits and attitudes through open communication and setting a positive financial example.

Financial institutions, as trusted providers of financial services, can contribute to financial education through educational resources, workshops and seminars, financial guidance, and promoting responsible financial products and services.

In conclusion, by recognizing the importance of financial education and actively engaging in its promotion and delivery, we can empower individuals to take control of their financial futures, improve their financial well-being, and build a more financially resilient society. Through collaboration and ongoing efforts, we can create a future where everyone has the knowledge and skills to make informed financial choices and achieve lifelong financial success.