Home>Finance>Why Is Making The Minimum Payment On Your Credit Card Account Each Month A Trap?

Finance

Why Is Making The Minimum Payment On Your Credit Card Account Each Month A Trap?

Published: February 26, 2024

Learn the dangers of making only the minimum payment on your credit card each month. Avoid the financial trap and take control of your finances with smart strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Minimum Payment Trap

Making the minimum payment on your credit card account each month may seem like a responsible financial move, but it can actually lead to a deceptive and costly cycle of debt. This article will delve into the reasons why the minimum payment can be a financial trap and provide insights into how to break free from its grip.

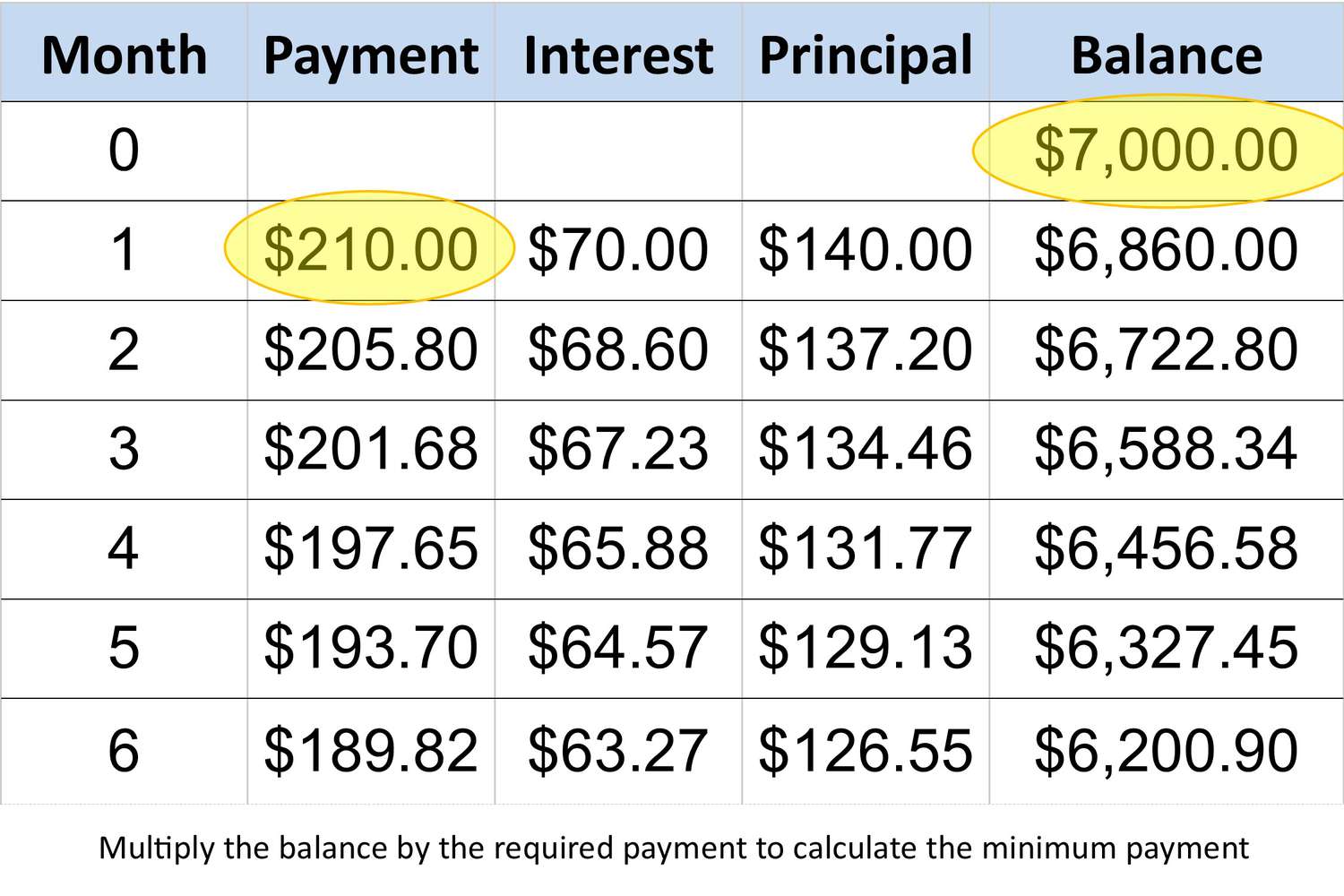

Credit card companies typically require cardholders to make a minimum payment each month, which is usually a small percentage of the total balance, often around 1-3%. While this may appear convenient, especially when finances are tight, it can have detrimental long-term consequences.

The allure of the minimum payment lies in its ability to provide temporary relief by allowing individuals to maintain their line of credit without fully paying off their balances. However, this temporary relief comes at a steep price, as the remaining balance accrues interest, leading to a cycle of debt that can be challenging to escape.

In the following sections, we will explore the true cost of making minimum payments, how this practice perpetuates a cycle of debt, and most importantly, how individuals can liberate themselves from the minimum payment trap to achieve financial freedom.

Understanding the Minimum Payment Trap

At first glance, the minimum payment on a credit card may seem like a manageable and convenient way to keep the account in good standing while dealing with other financial obligations. However, the reality is that the minimum payment is designed to benefit the credit card company rather than the cardholder. By only paying the minimum amount due each month, cardholders inadvertently fall into a financial trap that can be challenging to escape.

When individuals make only the minimum payment, they are essentially carrying a balance forward, subjecting themselves to exorbitant interest rates on the remaining amount. This means that a significant portion of the payment goes towards interest rather than reducing the principal balance. As a result, the overall debt continues to linger, and the interest compounds, leading to a cycle of increasing debt and financial strain.

Furthermore, the minimum payment trap often creates a false sense of financial security. Cardholders may feel that they are managing their debt responsibly by making regular payments, unaware that they are primarily servicing the interest rather than making meaningful progress towards reducing the principal balance. This can perpetuate a cycle of debt that becomes increasingly burdensome over time.

Understanding the minimum payment trap involves recognizing that it is a mechanism that keeps individuals in a cycle of indebtedness, ultimately benefiting the credit card company through the accrual of interest. By gaining insight into this deceptive financial practice, individuals can take proactive steps to break free from its grip and regain control of their financial well-being.

The Cost of Making Minimum Payments

While making the minimum payment on a credit card may offer temporary relief, the long-term financial implications can be staggering. By only paying the minimum amount due, cardholders subject themselves to substantial interest charges, significantly inflating the overall cost of their purchases. This is primarily due to the compounding nature of credit card interest, which can quickly spiral out of control when only minimum payments are made.

It’s essential to understand that credit card interest is calculated based on the remaining balance, and by carrying this balance forward through minimum payments, individuals find themselves trapped in a cycle of accruing interest on interest. This means that a substantial portion of each payment goes towards servicing the interest rather than reducing the principal balance, resulting in a prolonged repayment period and a significantly higher total cost.

Moreover, the true cost of making minimum payments becomes evident when considering the overall impact on one’s financial well-being. By perpetuating a cycle of debt, individuals may find themselves allocating a substantial portion of their income towards servicing interest, limiting their ability to save, invest, or address other essential financial goals. This can hinder long-term wealth accumulation and financial stability, ultimately compromising one’s financial future.

Furthermore, the cost of making minimum payments extends beyond the financial realm, impacting individuals’ emotional and mental well-being. The burden of persistent debt and the feeling of being trapped in a cycle of financial insecurity can lead to stress, anxiety, and a diminished quality of life. Recognizing these broader costs is crucial in understanding the detrimental impact of the minimum payment trap and the urgency of breaking free from its constraints.

How Minimum Payments Keep You in Debt

Minimum payments can perpetuate a cycle of debt by creating a false sense of financial stability while allowing interest to accumulate, ultimately hindering individuals from making meaningful progress in paying off their credit card balances. When individuals make only the minimum payment, they are essentially deferring a substantial portion of their debt to the future, prolonging the repayment period and significantly increasing the overall cost.

One of the primary mechanisms through which minimum payments keep individuals in debt is the compounding effect of interest. By carrying a balance forward and only paying the minimum amount due, individuals subject themselves to continuous interest charges on the remaining balance, leading to a cycle of increasing debt. This compounding interest can quickly escalate the total amount owed, making it increasingly challenging to break free from the burden of debt.

Moreover, the prolonged nature of debt resulting from minimum payments can impede individuals’ financial progress and limit their ability to achieve other essential financial goals. As interest continues to accrue, a significant portion of individuals’ financial resources goes towards servicing the interest rather than reducing the principal balance, perpetuating a cycle of indebtedness that becomes increasingly burdensome over time.

Additionally, the psychological impact of being trapped in a cycle of debt due to minimum payments cannot be overlooked. The constant pressure of managing persistent debt and the feeling of being unable to make meaningful headway in paying off balances can lead to stress, anxiety, and a sense of financial insecurity. This emotional toll further exacerbates the challenges associated with breaking free from the minimum payment trap.

Understanding how minimum payments keep individuals in debt is crucial in empowering individuals to take proactive steps towards financial liberation. By recognizing the detrimental impact of this practice and its long-term consequences, individuals can cultivate a strategic approach to managing their debt and work towards breaking free from the cycle of indebtedness perpetuated by minimum payments.

Breaking Free from the Minimum Payment Trap

Escaping the minimum payment trap requires a proactive and strategic approach to managing and eliminating credit card debt. By taking deliberate steps, individuals can liberate themselves from the cycle of indebtedness perpetuated by minimum payments and regain control of their financial well-being.

1. Pay More Than the Minimum: A crucial step in breaking free from the minimum payment trap is to pay more than the minimum amount due each month. By allocating additional funds towards reducing the principal balance, individuals can accelerate the repayment process and minimize the long-term impact of interest charges.

2. Create a Repayment Plan: Developing a structured repayment plan can provide clarity and direction in tackling credit card debt. This plan may involve prioritizing high-interest balances, consolidating debts where feasible, and setting achievable milestones to track progress towards debt freedom.

3. Avoid New Charges: To effectively break free from the minimum payment trap, it is essential to avoid adding new charges to credit cards. By refraining from increasing existing balances, individuals can focus on reducing their debt without being further entangled in the cycle of minimum payments and accruing interest.

4. Explore Balance Transfer Options: For individuals facing high-interest credit card debt, exploring balance transfer options to cards with lower or zero interest rates can provide temporary relief and facilitate more efficient debt repayment. However, it’s crucial to assess transfer fees and promotional periods to make informed decisions.

5. Seek Financial Guidance: Seeking guidance from financial advisors or credit counseling services can offer valuable insights and personalized strategies for overcoming credit card debt. These professionals can provide tailored recommendations and support individuals in navigating the path towards financial freedom.

6. Cultivate Financial Discipline: Breaking free from the minimum payment trap necessitates cultivating financial discipline and prudent spending habits. By adhering to a budget, prioritizing debt repayment, and making conscious financial decisions, individuals can gradually regain control of their financial well-being.

By implementing these proactive measures and adopting a strategic approach to managing credit card debt, individuals can break free from the minimum payment trap, alleviate the burden of persistent debt, and pave the way towards long-term financial stability and freedom.

Conclusion

The minimum payment trap poses a significant threat to individuals’ financial well-being, luring them into a cycle of indebtedness and impeding their path to financial freedom. By perpetuating the accumulation of interest and prolonging the repayment period, minimum payments can have far-reaching implications, both financially and emotionally. However, by understanding the true cost of making minimum payments and the mechanisms through which they keep individuals in debt, it becomes evident that breaking free from this cycle is not only feasible but imperative for long-term financial stability.

Empowerment lies in proactive financial management, including paying more than the minimum, creating structured repayment plans, and seeking guidance where necessary. By fostering financial discipline and prioritizing debt reduction, individuals can liberate themselves from the minimum payment trap and regain control of their financial destinies.

Breaking free from the minimum payment trap is not merely a financial endeavor; it is a transformative journey towards reclaiming financial autonomy and peace of mind. By taking deliberate steps to overcome the allure of minimum payments and the cycle of debt they perpetuate, individuals can pave the way towards a future characterized by financial resilience, empowerment, and the pursuit of their most meaningful aspirations.