Home>Finance>What Is My Credit Score If Ive Never Had A Credit Card

Finance

What Is My Credit Score If Ive Never Had A Credit Card

Modified: March 6, 2024

Discover your credit score and financial standing even if you've never had a credit card. Get insights into your finances and plan your future with confidence in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of a Credit Score

- Factors that Determine Credit Score

- How Credit Cards Impact your Credit Score

- Credit Score Options for Individuals with No Credit Card History

- Building Credit without a Credit Card

- Alternative Ways to Establish Credit History

- Monitoring and Improving your Credit Score

- Conclusion

Introduction

Having a good credit score is crucial for many financial activities, such as obtaining a loan, renting an apartment, or even opening a new credit card. However, if you’ve never had a credit card, you may be wondering what your credit score is and how it is determined. In this article, we will explore the topic of credit scores for individuals without a credit card history.

Credit scores play a significant role in financial decision-making processes. They are a numerical representation of your creditworthiness, indicating how likely you are to repay debt. Lenders use this score to assess the risk of extending credit to you. A higher credit score indicates a lower risk, making it easier for you to access favorable loan terms and interest rates.

But what if you’ve never had a credit card? Does that mean you don’t have a credit score at all? The truth is, everyone starts with a credit score of zero. This means that if you have never used credit cards, taken out loans, or engaged in any other form of credit-related activity, you won’t have a credit score because there is no credit history to evaluate.

While not having a credit score can be seen as a disadvantage when applying for credit, it also means that you don’t have any negative marks on your credit report. This can be an advantage in the long run if you manage your credit responsibly and build a positive credit history.

In the following sections, we will delve deeper into the factors that determine a credit score, as well as how credit cards impact your credit score. We will also explore the different credit score options for individuals without a credit card history and discuss alternative ways to establish credit without a credit card. Lastly, we will provide tips on how to monitor and improve your credit score. Understanding these concepts will equip you with the knowledge needed to make informed financial decisions and successfully navigate the world of credit.

Importance of a Credit Score

A credit score is a vital tool used by lenders, landlords, and even potential employers to evaluate your financial responsibility and trustworthiness. It is a numerical representation of your creditworthiness and is typically calculated based on your credit history, including payment history, credit utilization, length of credit history, types of credit, and new credit applications.

One of the primary reasons why your credit score is important is its significant impact on your ability to secure loans and credit. Lenders use your credit score to determine whether or not to approve your loan application and what interest rate to offer you. A higher credit score can result in more favorable loan terms, such as lower interest rates and higher borrowing limits.

Having a good credit score can also make it easier for you to rent an apartment. Landlords often check prospective tenants’ credit scores to assess their ability to pay rent on time and manage their financial obligations. A high credit score may increase your chances of being approved for a rental and even allow you to negotiate lower security deposits.

Furthermore, many insurance companies use credit scores to determine insurance premiums. Studies have shown a correlation between credit history and the likelihood of filing claims. Individuals with lower credit scores may be deemed higher risk and face higher insurance rates as a result.

Moreover, a good credit score can be beneficial when applying for certain jobs, particularly those in the financial industry. Employers may consider your credit score as an indication of your financial responsibility and trustworthiness, particularly for positions that involve handling financial transactions or sensitive information. A higher credit score can provide a competitive edge over other candidates.

Additionally, your credit score can also impact your ability to obtain utility services, such as electricity, water, or cable. Utility companies may check your credit score to determine whether you need to provide a security deposit or if you qualify for certain promotional rates.

Overall, a good credit score is essential for achieving financial goals and enjoying favorable terms and opportunities. By maintaining a positive credit history and managing your financial obligations responsibly, you can establish a solid credit score and reap the benefits it brings.

Factors that Determine Credit Score

Many factors contribute to the calculation of your credit score. Understanding these factors can help you better manage your credit and work towards improving your credit score. Here are the key factors that determine your credit score:

- Payment history: This is the most critical factor in determining your credit score. It accounts for about 35% of your score. Lenders want to see a history of on-time payments, so consistently paying your bills by their due dates is crucial.

- Credit utilization ratio: This factor accounts for about 30% of your credit score. It reflects the amount of credit you are currently using compared to your available credit limit. Keeping your credit utilization below 30% is generally recommended to maintain a good credit score.

- Length of credit history: The length of time you have had credit accounts for about 15% of your credit score. Generally, having a longer credit history can positively impact your score, as it provides more data for lenders to assess your creditworthiness.

- Types of credit: The mix of credit accounts you have, such as credit cards, loans, and mortgages, contributes to about 10% of your credit score. Having a diverse range of credit types can be beneficial, as it demonstrates your ability to manage different financial obligations.

- New credit applications: When you apply for new credit, such as a credit card or loan, it can temporarily lower your credit score. This factor accounts for about 10% of your credit score. Lenders may interpret frequent credit applications within a short period as a sign of financial instability.

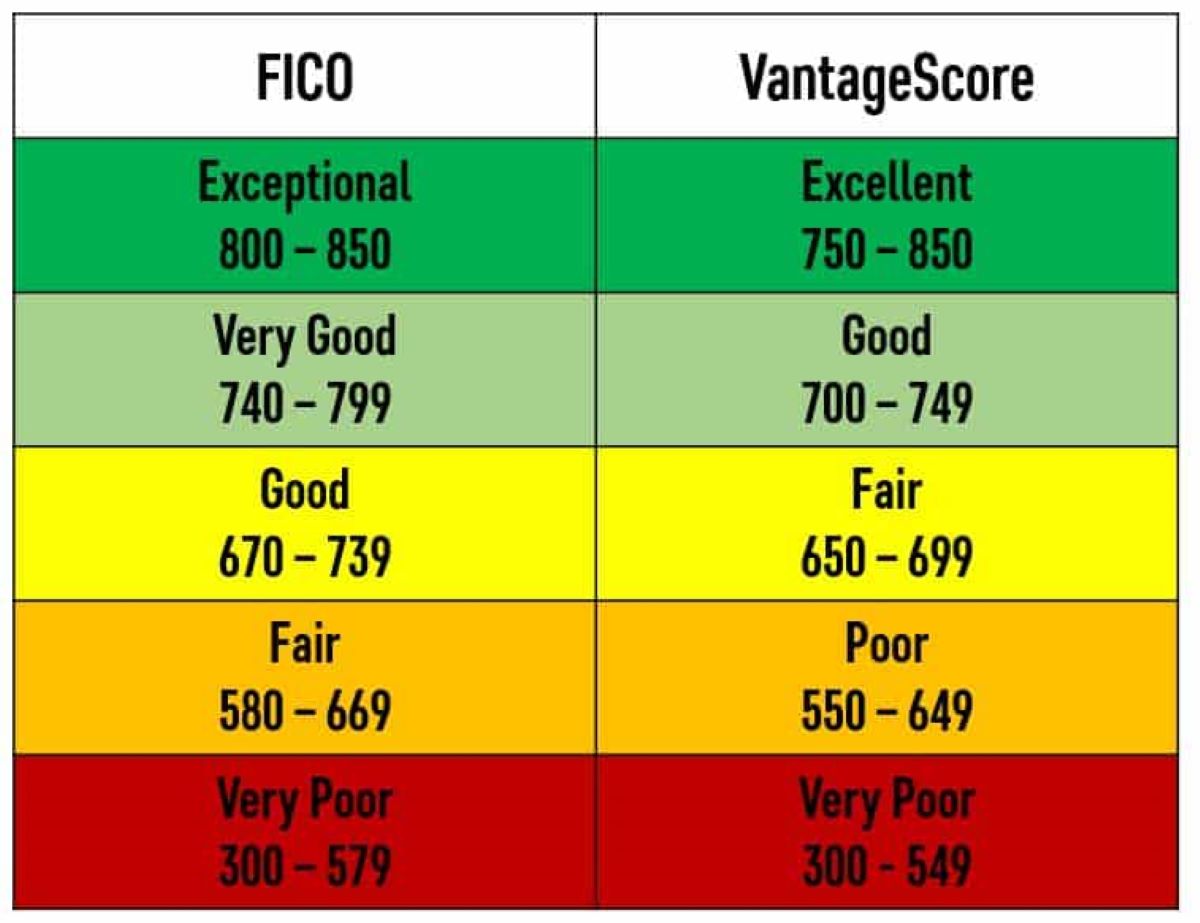

It is essential to note that while these factors are generally considered in credit score calculations, the exact weightings may vary depending on the credit scoring model used by different credit bureaus. For example, FICO scores and VantageScore use slightly different algorithms.

By understanding these factors, you can take proactive steps to improve your credit score. Paying bills on time, keeping credit card balances low, and maintaining a good mix of credit can all contribute to a healthier credit profile. It’s also important to monitor your credit report regularly for any errors or inconsistencies that could negatively impact your score.

Remember, building and maintaining a good credit score takes time and consistency. It’s a gradual process that requires responsible financial habits and a focus on long-term financial well-being.

How Credit Cards Impact your Credit Score

Credit cards play a significant role in shaping your credit score. Properly managing your credit card accounts can help you build a positive credit history and improve your credit score. Here’s how credit cards impact your credit score:

- Payment history: Your payment history is a crucial factor in determining your credit score. Making timely credit card payments demonstrates responsible financial behavior and positively impacts your credit score. On the other hand, consistently missing payments or making late payments can severely harm your credit score.

- Credit utilization ratio: This refers to the amount of credit you are currently using compared to your available credit limit. Keeping your credit card balances low in relation to your credit limits is essential for maintaining a good credit utilization ratio. High credit card balances can negatively impact your score, so it’s advisable to keep your utilization below 30%.

- Length of credit history: Credit cards can contribute positively to the length of your credit history. The longer you have a credit card account in good standing, the more it adds to the length of your credit history, which can improve your credit score over time.

- Types of credit: Maintaining a mix of credit accounts, including credit cards, can help diversify your credit profile. It shows lenders that you can responsibly handle different types of credit, which can positively impact your credit score.

- New credit applications: Each time you apply for a credit card, it triggers a hard inquiry on your credit report. Too many hard inquiries within a short period may negatively impact your credit score. It’s important to be mindful of the number of credit card applications you submit.

In addition to these factors, responsible credit card usage involves other aspects such as avoiding maxing out credit cards, consistently paying more than the minimum payment, and keeping accounts open as long as possible. Closing credit card accounts can negatively impact your credit score, especially if it shortens your credit history or reduces your overall credit limit.

Moreover, it’s crucial to review your credit card statements regularly and address any errors or discrepancies promptly. Reporting and resolving inaccuracies can help protect your credit score from any negative impact caused by fraudulent activity or billing errors.

Remember, credit cards can be a powerful tool for building credit and improving your credit score. However, it’s essential to use them responsibly, make timely payments, and keep your balances low to reap the benefits they offer.

Credit Score Options for Individuals with No Credit Card History

If you’ve never had a credit card before, you may be wondering how to establish your credit score. While not having a credit card history can make it more challenging to obtain a traditional credit score, there are still options available to build your creditworthiness. Here are a few credit score options for individuals with no credit card history:

- Secured Credit Cards: A secured credit card is a great option for those starting from scratch. With a secured card, you make a cash deposit upfront, which serves as collateral for the credit limit. As you make purchases and repay them on time, your positive payment history is reported to the credit bureaus, helping you establish credit history and improve your credit score.

- Credit Builder Loans: Credit builder loans are specifically designed to help individuals with no credit history build credit. These loans work by having the lender hold the loan amount in a separate account while you make monthly payments. Once you have repaid the loan in full, you gain access to the funds, and your payment history is reported to the credit bureaus, helping establish credit history.

- Authorized User: Consider becoming an authorized user on someone else’s credit card account, such as a family member or close friend. As an authorized user, their positive payment history and credit utilization will also be reported on your credit report, helping you establish credit history. However, it’s crucial to choose someone who responsibly manages their credit and ensures that they maintain good payment habits.

- Alternative Credit Scores: Some credit bureaus offer alternative credit scores that consider alternative data, such as rental payment history, utility bill payments, and even cell phone bill payments. These alternative scores can help bridge the gap for individuals with no credit card history and provide a more comprehensive view of their creditworthiness.

- Credit Builder Programs: Several financial institutions and organizations offer credit builder programs aimed at assisting individuals in building credit. These programs typically involve making small monthly payments, and as you make these payments, your positive payment history is reported to the credit bureaus, helping you establish a credit history over time.

While these options can help you establish credit history and eventually obtain a traditional credit score, it’s important to remember that building credit takes time and consistency. Make sure to use any credit options responsibly, make payments on time, and keep credit utilization low to maximize the positive impact on your credit score.

Additionally, it can also be helpful to monitor your progress by checking your credit report regularly. This way, you can ensure that your credit information is accurate and take any necessary steps to address any errors or discrepancies that may negatively affect your credit score.

By utilizing these credit score options and practicing responsible financial habits, you can build a positive credit history and improve your creditworthiness over time.

Building Credit without a Credit Card

While credit cards can be an effective tool for building credit, they are not the only option available. If you prefer to avoid using credit cards or don’t qualify for one, there are alternative ways to establish and build credit. Here are some strategies for building credit without a credit card:

- Personal Loans: Taking out a small personal loan from a reputable lender can help establish credit history. Make sure to repay the loan on time and in full to demonstrate responsible financial behavior and build a positive credit history.

- Credit Builder Loans: Credit builder loans, also known as secured loans, are specifically designed to help individuals build credit. With a credit builder loan, you borrow a certain amount of money and make fixed monthly payments. Once you’ve repaid the loan, including any interest, you’ll have established a positive payment history that can boost your credit score.

- Installment Plans: Some retailers and service providers offer installment plans for purchasing goods or services. These plans allow you to make equal monthly payments over a specified period. By making regular and on-time payments, you can demonstrate your ability to manage credit responsibly and establish a positive credit history.

- Alternative Credit Reporting: Some credit bureaus consider alternative data, such as rent payments, utility bills, and telecommunications accounts, when calculating credit scores. By ensuring that your positive payment history for these obligations is reported to the credit bureaus, you can build credit without a credit card.

- Authorized User: Similar to the previous section, becoming an authorized user on someone else’s credit card account can help you build credit. The primary account holder’s responsible credit management will reflect positively on your credit report. However, it’s important to choose a primary account holder who has good credit habits to avoid any negative impact on your credit.

- Secured Credit Cards: While technically a credit card, a secured credit card is worth mentioning here as it requires a security deposit upfront. This deposit serves as collateral and determines your credit limit. By using a secured credit card and making regular payments, you can establish credit history and eventually qualify for an unsecured credit card.

Remember, regardless of the method you choose to build credit, the key is to make payments on time and in full. Consistently demonstrating responsible financial behavior and maintaining low credit utilization (if applicable) will help you establish a positive credit history and improve your creditworthiness over time.

Lastly, it’s advisable to periodically review your credit report to ensure its accuracy and address any errors or discrepancies promptly. Monitoring your credit will give you a better understanding of your progress and allow you to make informed decisions about your financial future.

By utilizing these alternative methods of building credit, you can establish yourself as a reliable borrower and pave the way for future financial opportunities.

Alternative Ways to Establish Credit History

If you are looking to establish credit history without relying on credit cards or loans, there are alternative methods available. While these methods may not have the same impact as traditional credit accounts, they can still help demonstrate your creditworthiness. Here are some alternative ways to establish credit history:

- Utility Bills: Paying your utility bills, such as electricity, water, and internet, consistently and on time can help build a positive credit history. Some credit bureaus factor in utility payments when calculating credit scores, so be sure to inquire whether your utility company reports payment history to the credit agencies.

- Rent Payments: Rent payments can also contribute to your credit history. Certain services and platforms allow you to have your rent payments reported to credit bureaus, helping establish a credit history based on your rental payments. Make sure to confirm with your landlord or property management company if they report rent payments to credit bureaus.

- Alternative Credit Reporting Agencies: There are alternative credit reporting agencies that consider non-traditional data to generate credit reports and scores. These agencies analyze factors like rental history, phone bill payments, and even bank account activity to create a comprehensive credit profile. Companies like PRBC (Payment Reporting Builds Credit) and Experian Boost offer services that can help you build credit using this non-traditional data.

- Financial Account Reporting: Some financial institutions, such as credit unions or online banks, may report your account activities to credit bureaus. By consistently managing your checking or savings accounts, you can potentially establish positive credit behavior that will be reflected in your credit history.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect individuals looking to borrow money with individual lenders. These loans are often based on factors beyond traditional credit history, such as personal circumstances, employment, and repayment ability. Successfully repaying a peer-to-peer loan can help establish credit history and demonstrate your creditworthiness.

While these alternative methods can help establish credit history, it’s important to note that they may not be recognized by all lenders or have the same weight as traditional credit accounts. However, they can be useful in combination with other credit-building strategies.

Remember, regardless of which alternative method you choose, it’s crucial to make timely and consistent payments. Paying bills on time and in full shows responsible financial behavior and can positively impact your creditworthiness.

Continuously monitoring your credit reports from major credit bureaus will give you an insight into how these alternative methods are reflected in your credit history. This will also allow you to detect and rectify any errors or discrepancies that might affect your creditworthiness.

Through these alternative ways to establish credit history, you can start building a positive credit profile and work towards a solid credit foundation.

Monitoring and Improving your Credit Score

Monitoring and actively managing your credit score is vital for maintaining a healthy credit profile. By regularly checking your credit report and taking steps to improve your score, you can enhance your creditworthiness and qualify for better financial opportunities. Here are some strategies for monitoring and improving your credit score:

- Check your credit reports regularly: Monitoring your credit reports from the major credit bureaus (Equifax, Experian, and TransUnion) allows you to review your credit history, identify any errors or discrepancies, and detect signs of potential identity theft. You are entitled to one free credit report from each bureau annually through AnnualCreditReport.com.

- Review your credit utilization: Aim to keep your credit utilization ratio (the amount of credit you use compared to your total credit limit) below 30%. High credit card balances can negatively impact your credit score. Paying down debt and keeping balances low can help improve your credit utilization ratio.

- Make payments on time: Payment history is a significant factor in credit scoring models. Late payments can have a detrimental impact on your credit score. Always strive to make payments by their due dates and avoid collections, charge-offs, or other negative payment notations.

- Manage debt responsibly: If you have outstanding debts, work on reducing them over time. Focus on paying off high-interest debts first and consider creating a budget to allocate funds toward debt repayment. Responsible debt management can positively impact your credit score.

- Keep credit accounts open: Length of credit history plays a role in credit scoring. Closing older credit accounts can shorten your credit history and potentially lower your score. Unless there are compelling reasons, consider keeping your credit accounts open, even if you’re not actively using them.

- Avoid applying for unnecessary credit: Each time you apply for credit, it triggers a hard inquiry on your credit report. Too many inquiries might indicate a higher credit risk to lenders. Limiting credit applications can help minimize the impact on your credit score.

- Build a diverse credit mix: Having a mix of different types of credit accounts, such as credit cards, loans, and mortgages, can positively influence your credit score. However, it’s essential to manage all accounts responsibly and avoid taking on more credit than you can handle.

- Prioritize credit education: Continue to educate yourself on how credit scores work, credit management best practices, and financial responsibility. The more knowledge you have, the better equipped you’ll be to make informed decisions and effectively manage your credit.

Improving your credit score takes time and consistent effort. It’s crucial to be patient, as positive changes in your credit score won’t happen overnight. By implementing these strategies and maintaining good credit habits, you can gradually raise your credit score and enjoy the benefits of a higher creditworthiness.

Lastly, remember to regularly monitor your credit score using reputable credit monitoring services or through free credit score providers. Tracking your progress and being aware of any changes or fluctuations in your credit score will provide valuable insight into your financial health and allow you to take proactive steps to maintain or improve it further.

Building and maintaining a strong credit score is an ongoing process that requires commitment and responsible financial behavior. With dedication and attention to your credit profile, you can achieve a solid credit score and open doors to better borrowing opportunities.

Conclusion

Establishing and maintaining a good credit score is essential for financial success. While having a credit card can be a significant contributor to your creditworthiness, it is not the only way to build a credit history. By utilizing alternative methods and taking proactive steps, individuals without credit card history can still establish and improve their credit scores.

It’s important to remember that building credit takes time, consistency, and responsible financial behavior. By making timely payments, managing debt wisely, and diversifying your credit mix, you can build a positive credit history and improve your creditworthiness over time.

Monitoring your credit score regularly and reviewing your credit reports helps ensure accuracy and gives you an opportunity to address any errors or discrepancies. It also allows you to track your progress and make informed decisions about your financial future.

While credit cards can play a significant role in building credit, alternative methods such as secured credit cards, credit builder loans, authorized user arrangements, and reporting alternative credit data can all contribute to establishing credit history for individuals without a credit card history.

Remember, building credit is not just about obtaining credit but also responsibly managing it. Paying bills on time, maintaining low credit card balances, and using credit wisely are crucial habits to cultivate for long-term financial health.

Regardless of where you are in your credit-building journey, it’s important to stay informed and continue to educate yourself about credit scores, credit management, and personal finance. The more knowledge you acquire, the better equipped you’ll be to make informed decisions and establish a strong credit foundation.

In conclusion, while not having a credit card history may pose some challenges in building credit, it is not an insurmountable obstacle. By utilizing alternative methods, practicing responsible financial habits, and actively monitoring your credit, you can establish and improve your credit score, opening doors to better financial opportunities in the future.