Home>Finance>What Is My Credit Score If I’ve Never Had A Credit Card

Finance

What Is My Credit Score If I’ve Never Had A Credit Card

Published: October 23, 2023

Discover what your credit score is if you've never had a credit card. Get insights on your financial standing with this comprehensive guide on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Score

- Importance of Credit Score

- Factors Affecting Credit Score

- Credit Score for Individuals with No Credit Card

- Alternative Ways to Build Credit History

- Secured Credit Cards for Establishing Credit Score

- Credit Builder Loans

- Authorized User on Someone Else’s Credit Card

- Rent Reporting Services

- Final Thoughts

Introduction

Welcome to the world of personal finance! Whether you’re just starting your financial journey or looking to improve your creditworthiness, understanding your credit score is essential. Your credit score is a three-digit number that represents your creditworthiness and plays a crucial role in your financial life. It determines your eligibility for loans, credit cards, and even housing rentals.

But what if you’ve never had a credit card? How does that impact your credit score? In this article, we will explore the credit scoring system, its importance, the factors that affect your credit score, and how you can build credit history without a credit card.

Having a good credit score opens doors to favorable interest rates, better loan terms, and access to financial opportunities. It showcases your ability to manage credit responsibly and gives lenders confidence in your ability to repay debts. This is why it’s crucial to understand the ins and outs of your credit score and take steps to build and maintain a healthy credit history.

Now let’s dive deeper into the world of credit scores and explore how you can navigate the system, even if you’ve never had a credit card.

Understanding Credit Score

Before we delve into the impact of not having a credit card on your credit score, let’s first understand what a credit score is. A credit score is a numerical representation of your creditworthiness, indicating the likelihood that you will repay borrowed money. It helps lenders assess the risk associated with lending you money and plays a significant role in determining whether you qualify for loans, credit cards, or other forms of credit.

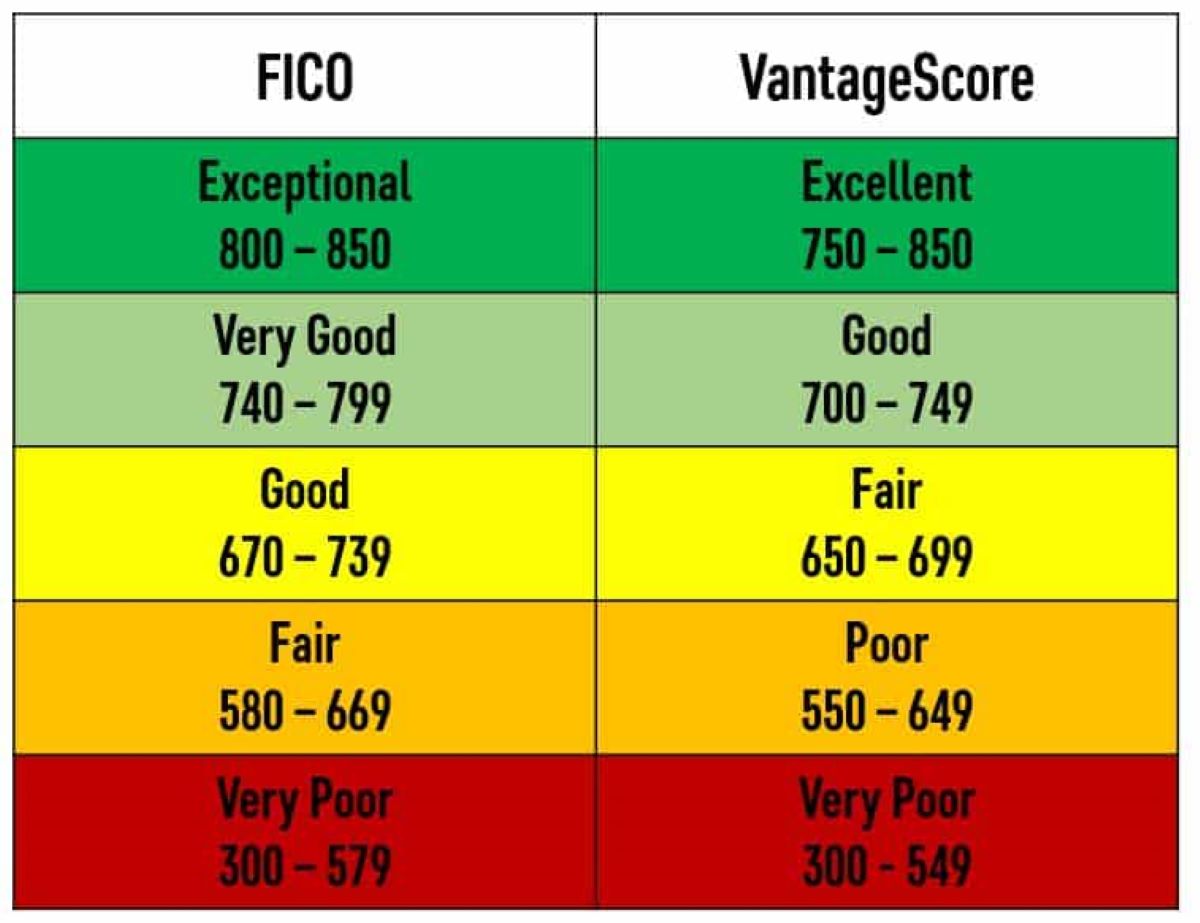

The most commonly used credit scoring model is the FICO score, developed by the Fair Isaac Corporation. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Other credit scoring models, such as VantageScore, may also be used by lenders. These scoring models take into account various factors to calculate your credit score.

The factors that influence your credit score typically include:

- Payment History: This is the most crucial factor, accounting for approximately 35% of your credit score. It evaluates whether you make payments on time and if you have any past delinquencies or defaults.

- Credit Utilization: This factor measures the amount of available credit you’re using. Keeping your credit utilization below 30% is generally recommended.

- Length of Credit History: The longer your credit history, the better, as it demonstrates your ability to manage credit over an extended period.

- Mix of Credit: Lenders prefer to see a diverse mix of credit, including credit cards, loans, and mortgages, as it showcases your ability to handle different types of credit responsibly.

- New Credit Inquiries: Opening multiple new credit accounts within a short period can negatively impact your credit score, as it can be seen as a sign of financial instability.

While having a credit card can be one way to establish a credit history, it’s important to note that it is not the only determining factor in calculating your credit score. You can still build credit and have a good credit score without ever having a credit card. In the next section, we will explore the importance of credit scores and the impact of not having a credit card on your creditworthiness.

Importance of Credit Score

Your credit score holds significant importance when it comes to your financial well-being. It serves as a measure of your creditworthiness and can have a direct impact on your ability to access credit, secure favorable interest rates, and even land certain job opportunities or rental agreements.

Here are some key reasons why your credit score is important:

Lending Approval: Your credit score is a vital factor that lenders consider when deciding whether to approve your loan or credit card application. A higher credit score increases your chances of getting approved and may also qualify you for more favorable terms, such as lower interest rates and higher credit limits.

Interest Rates: A good credit score can help you secure lower interest rates on loans and credit cards. This can save you a significant amount of money over time, as you’ll pay less in interest charges. On the other hand, a lower credit score may result in higher interest rates, making borrowing more expensive.

Housing Rentals: Many landlords and property management companies use credit scores as part of their tenant screening process. A good credit score can give you an advantage when applying for rental properties, as it demonstrates your financial responsibility and reliability as a tenant.

Employment Opportunities: Some employers may conduct credit checks as part of the hiring process, especially for positions that involve financial responsibility. While your credit score is not the sole determinant of your employability, a poor credit history may raise concerns about your financial management skills.

Insurance Premiums: In some cases, insurance companies may use credit scores to determine premiums for auto or home insurance. A good credit score can help you secure lower insurance rates, while a lower credit score may result in higher premiums.

Understanding the importance of your credit score emphasizes the need to build and maintain a positive credit history, even if you’ve never had a credit card. In the next section, we will explore the factors that can affect your credit score and discuss the impact of not having a credit card on your creditworthiness.

Factors Affecting Credit Score

Several factors play a significant role in determining your credit score. Understanding these factors can help you make informed decisions to maintain or improve your creditworthiness. Here are the key factors that can affect your credit score:

Payment History: Your payment history is one of the most crucial factors influencing your credit score. Lenders want to see that you consistently make your payments on time. Late payments, defaults, or collections can have a negative impact on your credit score.

Credit Utilization Ratio: This ratio compares the amount of credit you’re using to the total amount available to you. It’s recommended to keep your credit utilization below 30%. Higher utilization ratios can indicate a higher risk of default and may negatively impact your credit score.

Credit History Length: The length of your credit history is a factor that lenders consider. It takes into account the age of your oldest account, the average age of all your accounts, and how long it has been since you used certain accounts. A longer credit history can positively impact your credit score, as it provides more data for lenders to assess your creditworthiness.

Types of Credit: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can contribute positively to your credit score. It shows lenders that you can handle various forms of credit responsibly.

New Credit Applications: When you apply for new credit, the lender will typically make an inquiry into your credit history. Multiple credit inquiries within a short period can indicate financial instability and may lower your credit score. However, if you’re rate shopping for a loan, such as a mortgage or auto loan, inquiries made within a certain time frame (usually 14-45 days) are usually counted as a single inquiry.

Public Records: Negative public records, such as bankruptcies, tax liens, or civil judgments, can significantly impact your credit score and stay on your credit report for several years.

Understanding these factors can help you make responsible financial decisions and prioritize actions that can positively impact your credit score. In the next section, we will explore how individuals with no credit card can still establish and build their credit history.

Credit Score for Individuals with No Credit Card

If you’ve never had a credit card, you might be wondering how not having one impacts your credit score. While having a credit card and managing it responsibly can be one way to build credit history, it’s not the only method. There are alternative ways for individuals without a credit card to establish and build their credit score.

Here are a few options for individuals with no credit card:

- Secured Credit Cards: A secured credit card is a credit card that requires a cash deposit as collateral. This deposit acts as your credit limit, and your payment history is reported to the credit bureaus. By using a secured credit card responsibly, making timely payments, and maintaining a low credit utilization ratio, you can establish a positive credit history.

- Credit Builder Loans: Credit builder loans, also known as secured installment loans, are designed specifically to help individuals build credit. With these loans, you borrow a certain amount of money and make fixed monthly payments. The lender holds the borrowed amount in a locked savings account, which you can access once the loan is repaid. Credit builder loans provide an opportunity to demonstrate your ability to make consistent payments and establish a positive credit history.

- Authorized User on Someone Else’s Credit Card: If you have a trusted friend or family member with a credit card, you can ask them to add you as an authorized user. As an authorized user, their credit card activity will be reported on your credit report, helping you build credit history. However, it’s important to ensure that the primary cardholder has good credit practices, as their actions can impact your credit score as well.

- Rent Reporting Services: Rent payments are typically not reported to credit bureaus, but there are rent reporting services available that can help you establish credit. These services report your rental payment history to the credit bureaus, allowing you to build credit through consistent, on-time rent payments.

While these alternative methods can help you build credit without a credit card, it’s important to note that they require responsible financial management and consistent on-time payments. Over time, demonstrating creditworthy behavior through these strategies can result in a positive credit score.

Now that we’ve explored options for building credit history without a credit card, you can choose the method that aligns best with your financial situation and goals. In the next section, we will delve deeper into some of the alternative approaches mentioned above.

Alternative Ways to Build Credit History

Building credit history is essential for establishing a good credit score, even if you’ve never had a credit card. Fortunately, there are alternative methods available that can help you build creditworthiness and demonstrate your ability to manage credit responsibly. Here are some effective alternatives to consider:

- Secured Credit Cards: Secured credit cards are a popular option for individuals looking to build credit. These cards require a cash deposit as collateral, which sets your credit limit. By using the card regularly and making timely payments, you can establish a positive credit history. Look for secured credit cards that report to all three major credit bureaus to ensure that your efforts are reflected in your credit report.

- Credit Builder Loans: Credit builder loans are specifically designed to help individuals establish credit. Essentially, you borrow a certain amount of money and make monthly payments towards the loan. However, unlike traditional loans, the borrowed money is held in a locked savings account or certificate of deposit as collateral. By consistently making your payments on time, you build credit history and show lenders that you are a responsible borrower.

- Authorized User on Someone Else’s Credit Card: Consider becoming an authorized user on a trusted friend or family member’s credit card. As an authorized user, their credit card activity will be reported on your credit report, helping you establish credit history. It’s important to choose someone who has good credit habits and maintains a low credit utilization ratio to maximize the benefit to your credit score.

- Rent Reporting Services: While rental payments typically do not appear on credit reports, utilizing rent reporting services can help you build credit history through your rent payments. These services verify your rental payments and report them to the credit bureaus. By consistently making on-time rent payments, you can showcase your creditworthiness and improve your credit score over time.

Regardless of the method you choose, it’s crucial to practice responsible financial habits. Make all your payments on time, keep your credit utilization low, and avoid taking on more debt than you can comfortably handle. Building credit history takes time, but with patience and diligence, you can establish a solid credit foundation without relying on a traditional credit card.

Remember, credit building is a lifelong journey. Establishing positive credit habits and maintaining a good credit score opens up doors to better financial opportunities and favorable interest rates in the future. Stay persistent and committed to building your credit history, and you’ll reap the benefits in the long run.

In the next section, we will delve deeper into the concept of secured credit cards as an effective tool for establishing credit history.

Secured Credit Cards for Establishing Credit Score

Secured credit cards are an excellent tool for individuals looking to establish or rebuild their credit history. These cards require a cash deposit as collateral, which serves as your credit limit. Secured credit cards work similarly to traditional credit cards, allowing you to make purchases and build credit history. Here’s how secured credit cards can help you establish a credit score:

Build Credit History: Secured credit cards provide an opportunity to demonstrate responsible credit management. By making regular purchases and paying off the balance in full or making timely minimum payments, you establish a positive payment history, which is a crucial factor in calculating your credit score. As you continue to use the secured credit card responsibly, your creditworthiness improves over time.

Report to Credit Bureaus: To ensure that your efforts are recognized, choose a secured credit card that reports to all three major credit bureaus (Experian, TransUnion, and Equifax). Reporting your payment history to the credit bureaus is essential for building your credit score. Keep in mind that not all secured credit cards report to all three bureaus, so do your research to find one that does.

Graduation to Unsecured Credit Card: One of the significant benefits of a secured credit card is the potential for graduation to an unsecured credit card. Graduation typically occurs when you’ve demonstrated responsible credit management for a specific period, such as six months to a year. Once you graduate, you’ll receive your deposit back, and your secured credit card may be converted into an unsecured credit card. This transition provides you with even more credit-building opportunities and benefits.

Lower Risk: Secured credit cards are less risky for lenders since they have the security of the cash deposit. This makes them more accessible to individuals with limited or no credit history. By using a secured credit card, you can start building your creditworthiness without the risk of overspending or accumulating excessive debt. It’s essential to keep your credit utilization ratio low (below 30%) and make timely payments to maximize the benefits of your secured credit card.

Remember, building credit with a secured credit card requires responsibility and discipline. Be mindful of your spending habits and always pay your bill on time. Avoid carrying a high balance or utilizing the entire credit limit, as this may negatively impact your credit score. As you establish a positive credit history with a secured credit card, you increase your chances of qualifying for unsecured credit cards, loans, and other credit opportunities.

In the next section, we will explore another method for building credit history, known as credit builder loans.

Credit Builder Loans

Credit builder loans, also known as secured installment loans, are specifically designed to help individuals build or rebuild their credit history. These loans are an excellent option for those who have limited or no credit history, including individuals who have never had a credit card. Credit builder loans work differently from traditional loans, as the borrowed amount is held in a locked savings account or certificate of deposit (CD) as collateral. Here’s how credit builder loans can help you establish credit history:

Building Credit History: Credit builder loans provide an opportunity to demonstrate your ability to make consistent, on-time payments. As you borrow a certain amount of money, usually deposited into a locked savings account or CD, you make fixed monthly payments towards the loan. Each payment you make is reported to the credit bureaus, helping you establish a positive payment history and build credit over time.

Locked Savings Account or CD: Unlike traditional loans, credit builder loans require you to deposit the borrowed amount into a locked savings account or CD. This account acts as collateral for the loan, ensuring that the lender has security in the event of default. Once you have made all the payments on the loan, you can access the funds in the savings account or CD.

No Risk of Overspending: With a credit builder loan, you are borrowing your own money, which eliminates the risk of overspending or falling into debt. As you make payments towards the loan, you gradually build credit history and demonstrate responsible financial behavior without the temptation to accumulate excessive debt.

Establish Positive Payment History: One of the significant benefits of credit builder loans is that they help you establish a positive payment history. Timely payments are crucial for building credit, and credit builder loans provide you with the opportunity to consistently make on-time payments. This demonstrates your creditworthiness to lenders and can improve your credit score over time.

Increase Credit Score: As you make regular payments on your credit builder loan, you are establishing a positive credit history. This can result in an increase in your credit score, allowing you to qualify for better loan terms, credit cards, and other financial opportunities in the future.

Credit builder loans are an effective tool for building credit history, especially for individuals without a credit card. Before taking out a credit builder loan, make sure to explore different lenders and compare their terms and conditions. Look for reputable lenders who report your payment history to all three major credit bureaus to ensure that your efforts are reflected in your credit report. By responsibly managing a credit builder loan, you can establish a solid credit foundation and pave the way for a healthier financial future.

In the next section, we will discuss another approach for building credit history, which is becoming an authorized user on someone else’s credit card.

Authorized User on Someone Else’s Credit Card

If you don’t have a credit card of your own and are looking for alternative ways to build credit history, becoming an authorized user on someone else’s credit card can be a viable option. Being an authorized user means you are granted permission to use someone else’s credit card while their payment activity is reported on your credit history. Here’s how being an authorized user can help you establish credit:

Building Credit History: As an authorized user, the credit card activity of the primary cardholder is reported on your credit report, helping you establish a credit history. This includes their payment history, credit limit, and length of credit card usage. If the primary cardholder has a positive credit history, it can significantly benefit your credit score.

Credit Card Utilization: By being an authorized user on a credit card with a low credit utilization ratio, you can indirectly benefit from it. Credit utilization, which is the percentage of available credit that is being used, plays a crucial role in calculating your credit score. Being associated with a credit card that has a low utilization ratio can have a positive impact on your own credit utilization, improving your creditworthiness.

Length of Credit History: The length of credit history is an important factor considered by lenders. By becoming an authorized user on an established credit card, you can benefit from the primary cardholder’s credit history. The longer the history of the credit card, the more positive impact it will have on your credit score.

Responsible Credit Card Usage: It’s important to choose a primary cardholder who practices responsible credit card usage. Late payments or high credit utilization by the primary cardholder could negatively affect your credit score as an authorized user.

Although being an authorized user on someone else’s credit card can be advantageous for building credit, it’s important to establish clear communication and trust with the primary cardholder. Ensure that they understand and adhere to responsible credit practices, such as making timely payments and maintaining a low credit utilization ratio.

Remember, being an authorized user does not make you legally responsible for the credit card debt. However, any negative activity on the credit card can impact both the primary cardholder’s credit and your credit as an authorized user. Therefore, it’s essential to maintain open communication and regularly review your credit reports to ensure accuracy.

In the next section, we will explore an alternative method for building credit history: using rent reporting services.

Rent Reporting Services

For individuals who don’t have a credit card and are looking for alternative ways to build credit history, utilizing rent reporting services can be an effective strategy. Rent reporting services allow you to have your rental payment history reported to credit bureaus, helping you establish and strengthen your creditworthiness based on your consistent and on-time rent payments. Here’s how rent reporting services can help you build credit history:

Documenting Rental Payments: Rent reporting services work by verifying your rental payment history and reporting it to the credit bureaus. Typically, your landlord or property management company needs to be affiliated with the particular rent reporting service in order to participate. This process provides documented evidence of your on-time rent payments.

Building Credit History: By reporting your rental payment history to the credit bureaus, you can establish a positive credit history. Timely rent payments demonstrate responsible financial behavior and can positively impact your creditworthiness. Building a solid credit history through rent payments can help you qualify for loans, credit cards, and other financial opportunities in the future.

Improving Credit Score: If you consistently make your rent payments on time, having them reported to the credit bureaus can improve your credit score. A positive payment history is a crucial factor in calculating your credit score, and reporting your rent payments can strengthen this aspect of your credit profile.

Supplementing Credit History: Rent reporting services can be especially beneficial for individuals with limited or no credit history. If you don’t have a credit card or other forms of credit, reporting your rent payments can help supplement your credit history and provide lenders with additional data to assess your creditworthiness.

When exploring rent reporting services, it’s important to choose a reputable provider that reports to all three major credit bureaus. This ensures that your efforts are reflected in your credit report and can be considered by lenders when evaluating your creditworthiness.

Keep in mind that not all landlords or property management companies participate in rent reporting services. Before signing a lease agreement, it may be worth inquiring with potential landlords about their participation in such programs.

Remember, to maximize the benefits of rent reporting services, it’s crucial to make timely and consistent rent payments. Regularly monitoring your credit report and verifying the accuracy of the reported rent payments is also important. By utilizing rent reporting services, you can proactively build credit history and increase your financial opportunities.

In the next section, we will conclude our discussion and provide some final thoughts on building credit history without a credit card.

Final Thoughts

Building credit history without a credit card is entirely possible with alternative methods available to individuals. While having a credit card can be a convenient tool for establishing credit, it is not the only path to building a solid credit foundation. By exploring options such as secured credit cards, credit builder loans, becoming an authorized user, or utilizing rent reporting services, you can still establish and strengthen your creditworthiness.

Regardless of the method you choose, it’s important to practice responsible financial habits. Make all your payments on time, keep your credit utilization low, and avoid taking on more debt than you can comfortably handle. Building credit history takes time and patience, but with consistent efforts, you can gradually improve your credit score and open doors to better financial opportunities.

As you embark on your credit-building journey, it’s also helpful to regularly monitor your credit reports. This allows you to check for inaccuracies or errors and ensure that your efforts are properly reflected in your credit history. Staying proactive and vigilant in managing your credit will help safeguard your financial well-being.

Lastly, remember that building and maintaining good credit is an ongoing process. It involves responsible credit management, making timely payments, and consistently practicing healthy financial habits. By demonstrating creditworthy behavior over time, you’ll not only establish a strong credit score but also pave the way for future financial success.

Now that you have a better understanding of how to establish credit history without a credit card, it’s time to choose the approach that aligns with your financial goals and circumstances. Whether it’s through secured credit cards, credit builder loans, authorized user arrangements, or rent reporting services, take the necessary steps to build and maintain a positive credit history.

Remember, everyone’s credit journey is unique, and patience is key. As you build your credit history, you’ll increase your financial opportunities and set yourself up for a brighter financial future.