Home>Finance>What Is Pure Risk? Definition, 2 Potential Outcomes, And Types

Finance

What Is Pure Risk? Definition, 2 Potential Outcomes, And Types

Published: January 14, 2024

Learn the definition of pure risk in finance, its two potential outcomes, and different types. Understand the risks and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is Pure Risk? Definition, 2 Potential Outcomes, and Types

When it comes to managing finances, understanding the different types of risks is essential. One such risk is pure risk. In this blog post, we will explore the definition of pure risk, its two potential outcomes, and the different types it can take. So let’s dive in and gain a deeper understanding of this critical aspect of finance.

Key Takeaways:

- Pure risk is a type of risk that involves the possibility of loss or no loss at all.

- The potential outcomes of pure risk are either an adverse event occurring or no event occurring at all.

Defining Pure Risk

Pure risk refers to a type of risk where there is no opportunity for gain, only a chance of loss. Unlike speculative risk where there is a possibility of gain, pure risk involves situations where the only outcome is typically negative. These risks are generally beyond our control and occur due to factors like natural disasters, accidents, or unforeseen events.

Pure risks are characterized by their uncontrollable nature and the absence of any potential for profit. While we cannot eliminate pure risks entirely, it is possible to manage them effectively through various risk management strategies, such as insurance, diversification, or risk transfer.

Potential Outcomes of Pure Risk

When it comes to pure risk, there are two potential outcomes that can occur:

- An adverse event occurs: In this scenario, the risk materializes, and an unfortunate event takes place. For example, a natural disaster strikes, causing significant damage or loss.

- No event occurs: In this case, the risk does not materialize, and there is no loss or negative impact. While this outcome is favorable, it does not eliminate the potential for future risks.

Types of Pure Risk

Pure risks can manifest in various forms. Here are some common types of pure risk:

- Personal Risks: These risks pertain to individual well-being and include risks such as illness, disability, or loss of life.

- Property Risks: Property risks involve potential damage, destruction, or loss of physical assets, such as buildings, homes, or vehicles.

- Liability Risks: Liability risks arise from potential legal obligations and include risks such as lawsuits or claims against individuals or organizations.

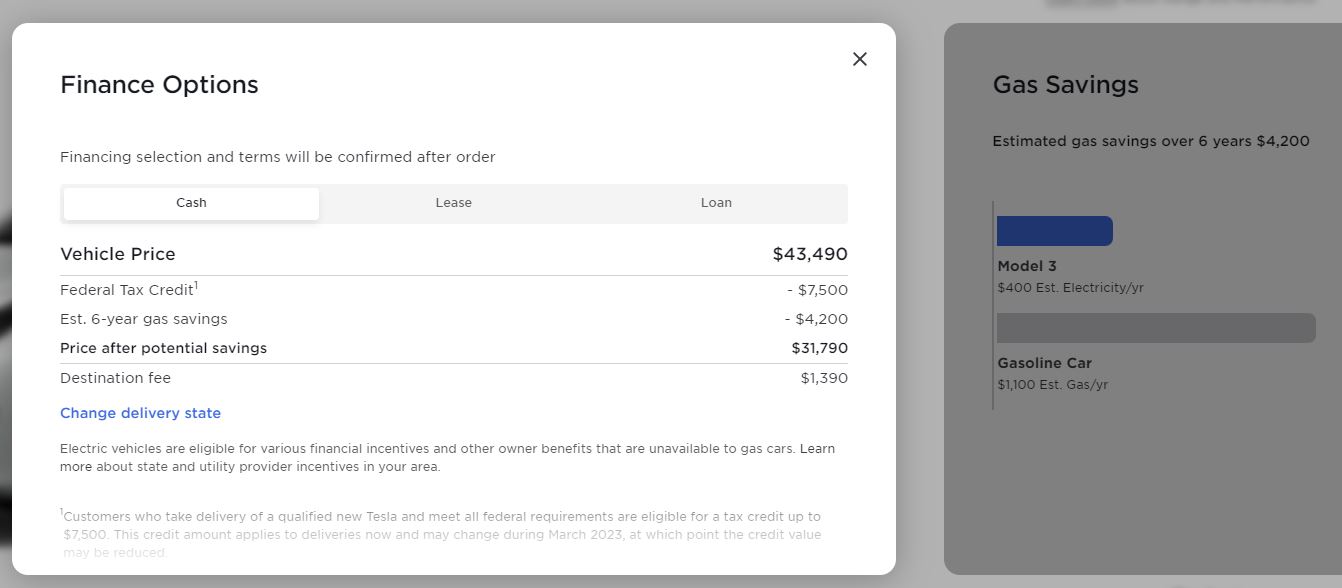

- Financial Risks: Financial risks involve potential losses in the financial markets or economic downturns.

- Operational Risks: Operational risks relate to internal business processes and systems, including risks associated with technology, management, or human error.

- Strategic Risks: Strategic risks involve potential threats to an organization’s long-term objectives and strategies, such as changes in market dynamics or regulatory landscape.

Given the diverse nature of pure risks, it is essential for individuals and businesses to assess, mitigate, and manage them accordingly. By understanding the different types of pure risks and implementing relevant risk management strategies, one can protect themselves and their financial interests.

In conclusion, pure risk is a type of risk characterized by the absence of any potential for gain, only a chance of loss. These risks can lead to adverse events or no events at all. By understanding the various types of pure risks and implementing appropriate risk management measures, individuals and businesses can safeguard their financial well-being in an uncertain world.