Finance

What Is Secured Business Loan

Modified: December 30, 2023

Get the finance you need for your business with a secured business loan. Discover how this type of loan can provide the financial security you're looking for.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Secured Business Loan

- How Secured Business Loans Work

- Types of Collateral Accepted for Secured Business Loans

- Pros and Cons of Secured Business Loans

- Eligibility Criteria for Secured Business Loans

- Application Process for Secured Business Loans

- Secured Business Loan vs. Unsecured Business Loan

- Conclusion

Introduction

Welcome to the world of secured business loans, an important financing option for businesses looking to grow, expand, or sustain their operations. Whether you’re a small startup or an established enterprise, securing the necessary funds to achieve your business goals is crucial. However, obtaining a loan can be a daunting task due to the multitude of options available. One popular choice among business owners is a secured business loan.

A secured business loan is a type of financing that requires borrowers to provide collateral, such as property, equipment, or inventory, to secure the loan. This collateral serves as a guarantee or security for the lender, reducing their risk and enabling them to offer more favorable loan terms and interest rates to borrowers.

Secured business loans are a reliable solution for businesses that may not qualify for unsecured loans or need larger loan amounts. By pledging collateral, borrowers can access greater funding opportunities and enjoy longer repayment terms, making it easier to manage their financial obligations.

In this article, we will explore the ins and outs of secured business loans, including how they work, the types of collateral accepted, the pros and cons, the eligibility criteria, the application process, and how they compare to unsecured business loans. By understanding the fundamentals of secured business loans, you will be well-equipped to make informed financial decisions and choose the right financing option for your business needs.

Definition of Secured Business Loan

A secured business loan is a type of financing arrangement in which a business owner pledges collateral, such as assets or property they own, to secure the loan. This collateral serves as a guarantee or security for the lender, reducing their risk if the borrower defaults on the loan.

The collateral provided by the borrower acts as a form of protection for the lender. In the event that the borrower is unable to repay the loan, the lender has the right to seize and sell the collateral to recover their losses. This provides assurance to the lender and allows them to offer more favorable loan terms, such as lower interest rates and longer repayment periods.

Unlike unsecured loans, where no collateral is required, secured business loans offer a higher level of security for the lender, making them more willing to lend larger loan amounts and provide more flexible repayment options. However, it is essential for the borrower to carefully consider the risks involved, as failure to repay the loan could result in the loss of the pledged collateral.

The amount that can be borrowed through a secured business loan is typically determined by the value of the collateral provided. Lenders will evaluate the collateral and assess its market value to determine the loan amount. Generally, the higher the value of the collateral, the higher the loan amount that can be obtained.

Secured business loans can be used for a variety of purposes, including purchasing equipment, funding expansion projects, managing cash flow, refinancing existing debt, or investing in inventory. The borrower has the freedom to allocate the loan funds as per their business requirements, giving them the flexibility to pursue growth opportunities.

Overall, a secured business loan is a financial tool that provides businesses with access to the capital they need while giving lenders the necessary assurance to mitigate their risk. By understanding the definition and mechanics of secured business loans, entrepreneurs can make informed decisions about utilizing this financing option to achieve their business objectives.

How Secured Business Loans Work

Secured business loans operate on the principle of providing collateral as security for the loan amount. Here’s a breakdown of how these loans work:

- Application Process: The business owner applies for a secured business loan with a lender, providing necessary documentation, such as financial statements, business plans, and details of the collateral to be pledged.

- Evaluation of Collateral: The lender assesses the value and quality of the collateral provided. This evaluation helps determine the loan amount that can be extended to the borrower.

- Loan Approval: If the lender is satisfied with the collateral and the borrower’s creditworthiness, they approve the loan application. The terms of the loan, such as interest rate, repayment schedule, and loan duration, are finalized at this stage.

- Pledging Collateral: The borrower formally pledges the agreed-upon collateral to the lender. This may involve signing legal documents, such as a security agreement, and transferring ownership or providing a lien on the collateral.

- Disbursement of Funds: Once the collateral is secured, the lender disburses the loan funds to the borrower. The funds can be used for various business purposes, as agreed upon during the loan application process.

- Repayment: The borrower is responsible for making regular loan repayments as per the agreed-upon terms. These repayments typically include both principal and interest portions, which are calculated based on the loan amount and the agreed-upon interest rate.

- Collateral Protection: As long as the borrower fulfills their repayment obligations, the collateral remains unaffected. However, if the borrower defaults on the loan, the lender has the legal right to seize and sell the collateral to recover their losses.

- End of Loan Term: Once the borrower completes all loan repayments, including any interest accrued, the loan term ends, and the collateral is released back to the borrower.

It is important for borrowers to understand the terms and conditions of the loan, including any fees or penalties for early repayment or late payments. Regular communication with the lender throughout the loan term is crucial to maintaining a healthy borrower-lender relationship and ensuring a smooth loan process.

Secured business loans provide a reliable financing option for businesses, allowing them to obtain essential capital while offering lenders the security they need. By understanding how secured business loans work, entrepreneurs can make informed decisions, choose the right loan terms, and effectively manage their loan obligations.

Types of Collateral Accepted for Secured Business Loans

When applying for a secured business loan, the collateral you provide plays a crucial role in determining the loan amount and terms. Here are some common types of collateral accepted by lenders:

- Real Estate: Property, including commercial buildings, land, or residential real estate, is a commonly accepted form of collateral. The lender will assess the value of the property to determine the loan amount that can be extended.

- Equipment: Machinery, vehicles, and other equipment used in the business can be pledged as collateral. Lenders consider the condition, age, and market value of the equipment to determine its value in securing the loan.

- Inventory: Businesses that have stock or inventory can use it as collateral. The value of the inventory, along with considerations such as perishability or seasonality, affects the loan value.

- Accounts Receivable: If your business has outstanding invoices or receivables from customers, lenders may allow you to pledge these as collateral. This type of collateral is known as accounts receivable financing.

- Cash or Savings: In some cases, if you have substantial cash reserves or savings, you can use these as collateral. This option is more common in secured loans provided by banks or credit unions.

- Securities and Investments: Marketable securities such as stocks, bonds, mutual funds, or other investments can also be used as collateral. The value of these assets and their liquidity are considered when determining the loan amount.

- Personal Guarantees: In addition to physical assets, lenders may require a personal guarantee from the business owner or other affiliated parties. This guarantee serves as an additional form of collateral, assuring the lender that they can recoup their losses if the business defaults on the loan.

It’s important to note that the specific types of collateral accepted may vary depending on the lender and the nature of the business. Some lenders may specialize in certain industries and have specific collateral requirements related to that industry.

When choosing collateral for your secured business loan, it’s crucial to consider the value, marketability, and risk associated with the assets you are pledging. Additionally, maintaining proper documentation and ownership records for the collateral is essential.

By understanding the types of collateral accepted for secured business loans, you can assess your available assets and determine which ones are most suitable to secure the financing you need to support your business growth.

Pros and Cons of Secured Business Loans

Secured business loans offer several advantages and disadvantages for business owners. It’s important to weigh these pros and cons before deciding if this type of financing is suitable for your business. Here are some key considerations:

Pros:

- Higher Borrowing Capacity: Secured business loans allow borrowers to access larger loan amounts compared to unsecured loans. The collateral provided mitigates the lender’s risk, making them more willing to offer higher funding limits.

- Lower Interest Rates: In general, secured loans come with lower interest rates compared to unsecured loans. Lenders have the collateral as security, reducing the risk involved and allowing them to offer more competitive loan terms.

- Flexible Repayment Terms: Secured loans often come with longer repayment periods, making it easier for businesses to manage their cash flow. The extended repayment terms help reduce the strain on monthly finances and allow more time for the business to generate revenue.

- Improved Credit Profile: Successfully repaying a secured business loan can have a positive impact on the borrower’s credit profile. Timely payments and responsible financial management can help improve the business’s creditworthiness, making it easier to secure future financing.

- Varied Use of Funds: Secured loans provide borrowers with flexibility in using the funds. Whether it’s for business expansion, purchasing equipment, or managing working capital, businesses have the freedom to allocate the funds as per their specific needs.

Cons:

- Risk of Collateral Loss: The primary risk associated with secured business loans is the potential loss of the pledged collateral. If the borrower defaults on the loan, the lender has the right to seize and sell the collateral to recover their losses. This risk should be carefully assessed and considered before opting for a secured loan.

- Lengthy Application Process: Secured business loans often involve a more elaborate application process compared to unsecured loans. This can include detailed collateral evaluations, legal documentation, and additional paperwork, which may prolong the loan approval process.

- Asset Valuation Challenges: Determining the value of certain collateral, such as inventory or equipment, can be subjective and challenging. This can impact the loan amount offered, potentially limiting the funds available to the borrower.

- Limited Collateral Options: Not all businesses may have tangible assets that can be used as collateral. Lack of suitable collateral can make it difficult for some businesses to qualify for secured loans, limiting their financing options.

- Potential Impact on Cash Flow: Taking on debt through a secured loan means committing to regular repayments. While the repayment terms are typically more favorable, it’s important to carefully evaluate the impact on cash flow and ensure the business can comfortably meet the repayment obligations.

Assessing the pros and cons of secured business loans is essential in making an informed decision that aligns with your business’s financial goals and risk tolerance. Consider your business’s specific needs, available collateral, and ability to manage loan repayments before proceeding with this type of financing.

Eligibility Criteria for Secured Business Loans

Secured business loans come with specific eligibility criteria that borrowers need to meet in order to qualify for financing. While the criteria may vary among lenders, here are some common factors considered:

- Creditworthiness: Lenders assess the creditworthiness of the borrower and their business. They typically consider factors such as credit score, credit history, and the business’s financial track record. A strong credit profile increases the chances of loan approval and may result in more favorable loan terms.

- Business Viability: Lenders want to ensure that the business seeking financing is viable and has the potential to generate sufficient cash flow to repay the loan. They may review the business’s financial statements, sales figures, and projections to assess its financial health and ability to service the debt.

- Collateral Value: The value, condition, and marketability of the collateral being offered play a significant role in determining loan eligibility. Lenders evaluate the collateral to assess its suitability as security and to determine the loan amount that can be extended to the borrower.

- Industry and Business Type: Some lenders specialize in specific industries or business types. They may have specific eligibility requirements tailored to those industries. For example, lenders may have different criteria for manufacturing businesses compared to professional service providers.

- Business Experience: Lenders often consider the experience of the business owner or the management team in the industry. A track record of successful business management or industry expertise can enhance the borrower’s credibility and improve loan eligibility.

- Debt-to-Income Ratio: Lenders evaluate the business’s debt-to-income ratio to assess its ability to handle additional debt. A lower debt-to-income ratio indicates a healthier financial position and increases the likelihood of loan approval.

It’s important to note that meeting the eligibility criteria does not guarantee loan approval. Each lender has their own set of criteria and risk assessment methods. Factors such as the loan amount, interest rate, and repayment terms will also depend on the specific financial institution and the borrower’s financial situation.

Before applying for a secured business loan, it is advisable to research and compare different lenders to find the one that best aligns with your business’s needs and eligibility criteria. Taking the time to assess your eligibility and prepare the necessary documentation will improve your chances of securing the financing your business requires.

Application Process for Secured Business Loans

The application process for secured business loans typically involves several steps. While the specific process may vary depending on the lender, here’s a general outline of what you can expect:

- Gather Necessary Documentation: Start by compiling the necessary documentation to support your loan application. This may include financial statements, business plans, cash flow projections, tax returns, and any documents related to the collateral you plan to pledge as security for the loan.

- Research and Choose a Lender: Do your research to find lenders that specialize in secured business loans and have favorable terms. Compare their interest rates, loan terms, and customer reviews to choose the lender that best suits your business’s needs.

- Submit Loan Application: Prepare and submit your loan application to the chosen lender. Include all required information and documentation, ensuring accuracy and completeness. The application form may be available online or require an in-person visit to the lender’s office.

- Collateral Evaluation: The lender will assess the collateral you plan to pledge. They may conduct an evaluation to determine its value and verify its ownership. This step helps the lender determine the loan amount they can offer based on the collateral’s market value.

- Credit and Financial Review: The lender will review your business’s creditworthiness by analyzing your credit history and financial statements. They will assess your ability to repay the loan based on your business’s revenue, profitability, and debt-to-income ratio.

- Loan Approval and Terms: If the lender is satisfied with your application and the collateral evaluation, they will approve your loan. They will provide you with the loan terms, including the interest rate, repayment schedule, and any fees associated with the loan.

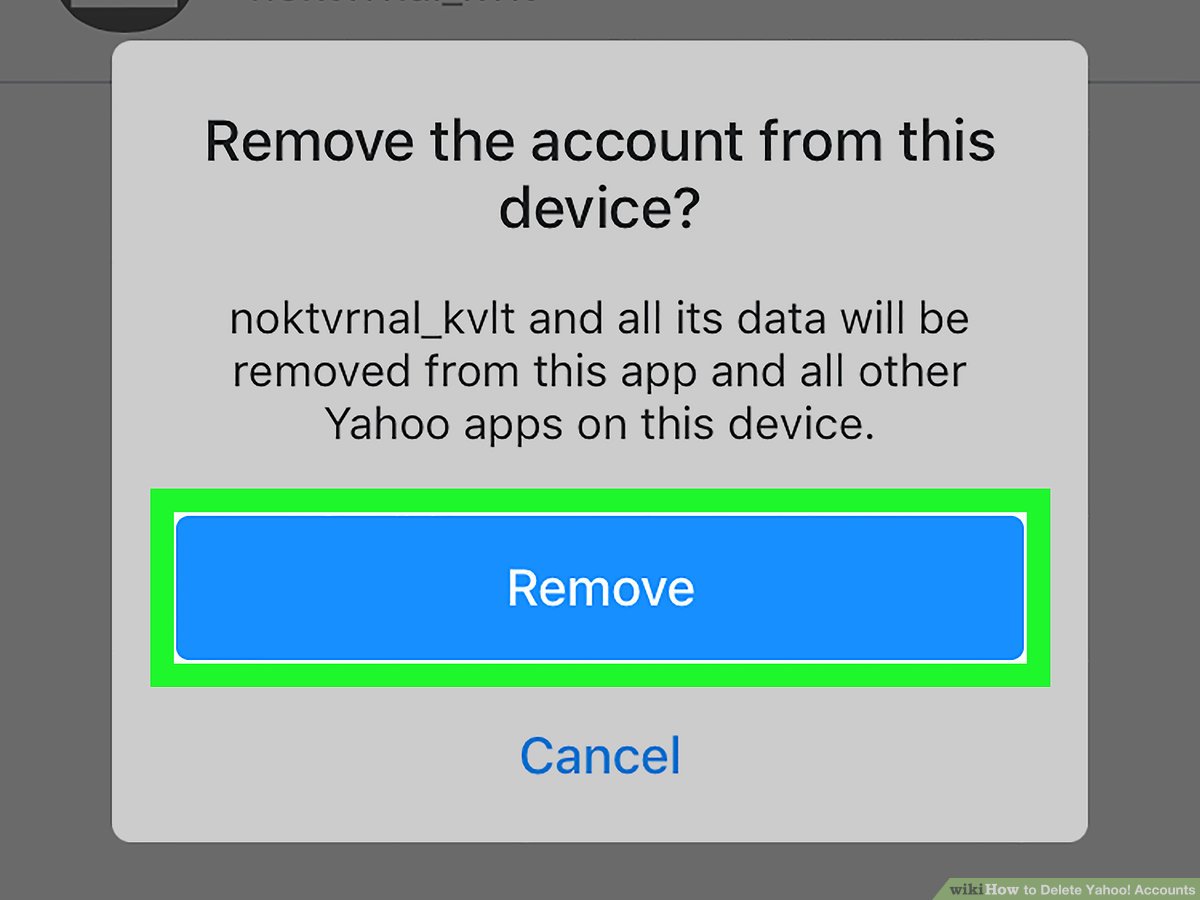

- Collateral Documentation: Once your loan is approved, you will proceed to provide the necessary collateral documentation. This may involve signing legal agreements, such as a security agreement, and transferring ownership or providing a lien on the collateral.

- Loan Disbursement: After the collateral documentation is completed, the lender will disburse the loan funds to your business. The funds can be used for the purposes outlined in your loan application and agreed upon terms.

- Loan Repayment: You are responsible for making regular loan payments as per the agreed-upon terms. This includes both principal and interest payments. Maintaining timely payments will ensure a positive credit history and protect the pledged collateral.

It’s crucial to communicate regularly with your lender throughout the application process and loan term. They can provide guidance, answer any questions, and assist you in managing the loan effectively.

By understanding the application process for secured business loans, you can be prepared and organized when seeking financing for your business needs. The process may require time and effort, but securing a well-suited loan will contribute to your business’s growth and success.

Secured Business Loan vs. Unsecured Business Loan

When exploring business loan options, two common types you’ll encounter are secured business loans and unsecured business loans. Understanding the differences between these two financing options is essential in choosing the right one for your business. Here’s a comparison:

Secured Business Loan:

A secured business loan requires the borrower to provide collateral, such as property, equipment, or inventory, to secure the loan. The collateral serves as security for the lender, reducing their risk and enabling them to offer more favorable loan terms, such as lower interest rates and higher loan amounts. In the event of default, the lender has the right to seize and sell the collateral to recover their losses.

Pros of Secured Business Loans:

- Higher borrowing capacity

- Lower interest rates

- Longer repayment terms

- Greater flexibility in loan use

- Potential to build credit history

Cons of Secured Business Loans:

- Risk of collateral loss

- Lengthy application process

- Collateral valuation challenges

- Limited collateral options

- Potential impact on cash flow

Unsecured Business Loan:

An unsecured business loan does not require collateral. Instead, it relies on the borrower’s creditworthiness, financial track record, and business revenue to assess the repayment ability. Due to the higher risk for the lender, unsecured loans often come with higher interest rates and lower loan amounts. In the event of default, the lender does not have collateral to seize.

Pros of Unsecured Business Loans:

- No risk of collateral loss

- Simplified application process

- No collateral valuation required

- Flexibility in loan use

Cons of Unsecured Business Loans:

- Higher interest rates

- Lower borrowing capacity

- Shorter repayment terms

- Strict eligibility criteria

- Impact on personal credit score

Choosing between a secured and unsecured business loan depends on your specific business needs and circumstances. If you have valuable collateral and need larger loan amounts, a secured loan may be a better option. However, if you have a strong credit history and don’t have or want to risk collateral, an unsecured loan could be more suitable.

It’s important to carefully weigh the advantages, disadvantages, and risks associated with each type of loan before making a decision. Consider the financial health of your business, your creditworthiness, the loan amount required, and the impact on your cash flow when evaluating which loan option aligns best with your business goals.

Conclusion

Secured business loans are a valuable financing tool for businesses looking to grow, expand, or manage their operations. By providing collateral as security, borrowers can access larger loan amounts, benefit from lower interest rates, and enjoy more flexible repayment terms. This type of loan offers advantages such as increased borrowing capacity and longer repayment periods, allowing businesses to meet their financial needs and pursue growth opportunities.

However, secured business loans also come with risks, primarily the potential loss of the pledged collateral if the borrower defaults on the loan. It’s crucial for business owners to carefully evaluate their ability to repay the loan and assess the risks associated with putting up assets as collateral.

When deciding between secured and unsecured business loans, understanding your business’s specific needs, financial health, and risk tolerance is paramount. Unsecured loans may be more appropriate for businesses without collateral or those seeking smaller loan amounts. However, for businesses looking to secure larger funding or benefit from lower interest rates, a secured loan may be the preferred option.

Ultimately, the choice of a secured or unsecured business loan depends on factors such as the loan amount, interest rates, repayment terms, available collateral, and your creditworthiness. It’s essential to gather all the necessary information, compare lenders, and carefully consider the pros and cons before making a decision.

By being well-informed about the mechanics, eligibility criteria, application process, and differences between secured and unsecured business loans, business owners can effectively leverage financing options to support their growth and success.

Remember, securing the right loan can provide the financial fuel your business needs to thrive, but it’s equally important to weigh the risks and ensure that repaying the loan aligns with your long-term business goals. With a well-executed loan strategy, you can navigate the path to business growth and achieve your desired outcomes.