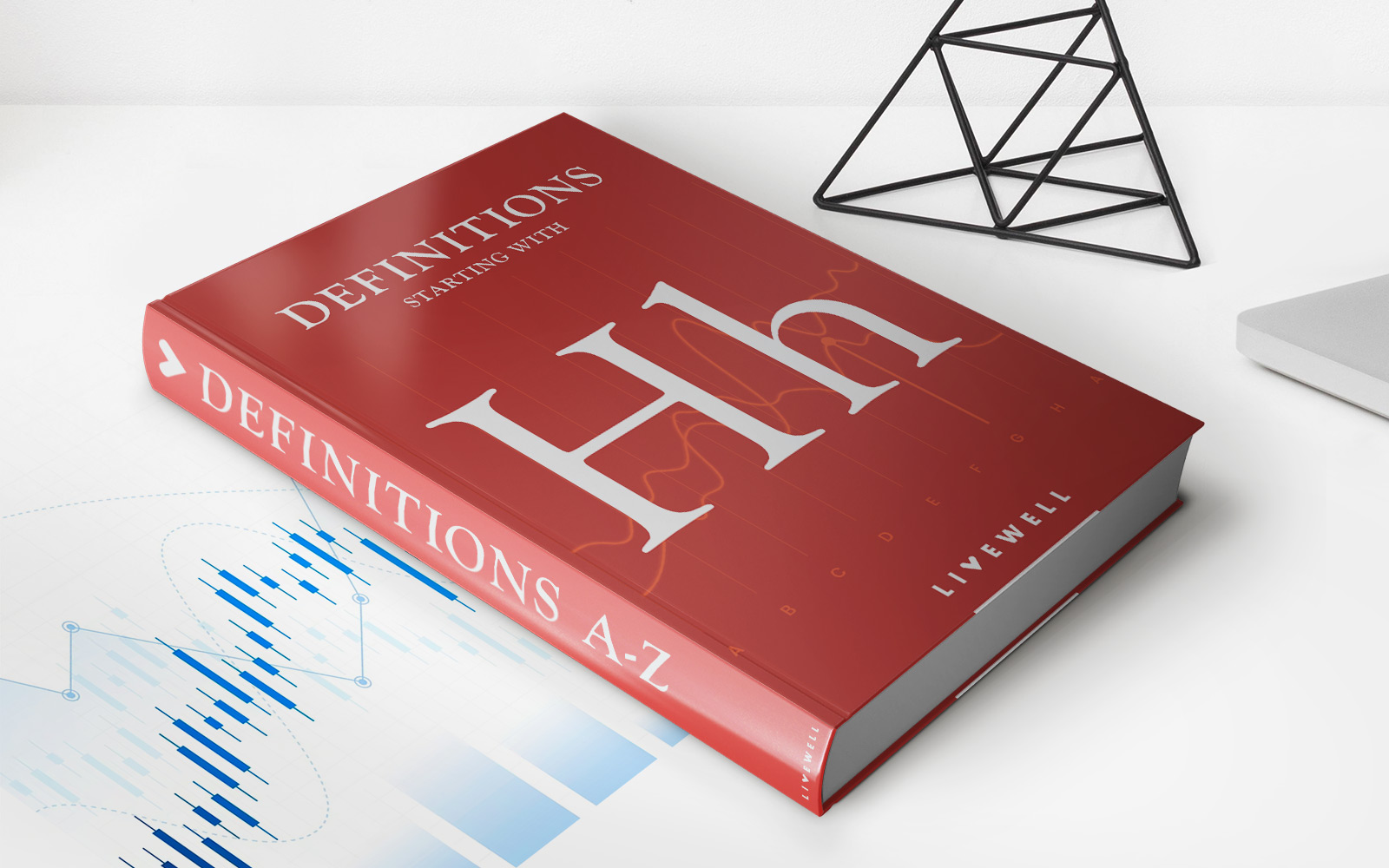

Finance

What Is Shared Savings In Healthcare

Published: January 15, 2024

Learn about shared savings in healthcare and how it impacts finance. Discover the benefits and challenges of this financial model in the healthcare industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Shared savings in healthcare is a concept that has gained significant attention in recent years as a way to improve the quality and efficiency of healthcare delivery. The traditional fee-for-service model of healthcare has often been criticized for promoting unnecessary tests and procedures, leading to higher costs and potentially lower quality of care. Shared savings programs aim to address these issues by incentivizing healthcare providers to focus on value-based care, rather than simply providing more services.

At its core, shared savings in healthcare involves a payment structure that rewards healthcare providers for achieving specified cost savings while maintaining or improving patient outcomes. These savings are typically shared between the healthcare organization and the payer, such as a health insurance company or the government. The idea is that by aligning incentives and encouraging collaboration, shared savings programs can drive down costs and improve the overall health of the population.

The concept of shared savings in healthcare is closely tied to the shift towards value-based care, where the emphasis is on providing high-quality care at a lower cost. This approach contrasts with the traditional fee-for-service model, where providers are reimbursed based on the volume of services they deliver, rather than the value or outcomes of those services.

Shared savings programs come in various forms, with different payment models and eligibility criteria. They can be implemented at the national level, such as the Medicare Shared Savings Program, or at a smaller scale within specific healthcare organizations or accountable care organizations (ACOs).

In the following sections, we will explore the definition and workings of shared savings programs in more detail, highlighting their benefits and challenges, and providing examples of successful implementations.

Definition of Shared Savings in Healthcare

Shared savings in healthcare is a payment model that incentivizes healthcare providers to reduce costs while maintaining or improving patient outcomes. It involves a financial arrangement between the healthcare organization and the payer, where any cost savings achieved are shared between the two parties.

Under a shared savings program, healthcare providers are encouraged to adopt more efficient and effective practices that can lead to reduced spending. These practices can range from implementing care coordination initiatives to improving preventive care measures to reducing unnecessary hospital readmissions. By focusing on value-based care and cost containment, shared savings programs aim to create a more sustainable and efficient healthcare system.

The payment structure of shared savings programs typically involves a baseline cost target, against which the actual costs incurred by the healthcare provider are compared. If the provider manages to achieve cost savings below the baseline target, a portion of those savings is shared with the payer. This can be done through various mechanisms, such as shared savings contracts, bundled payments, or accountable care organizations (ACOs).

Shared savings programs are often a part of broader healthcare reform initiatives aimed at transitioning from the fee-for-service model to value-based care. These programs align financial incentives with the delivery of high-quality care and encourage providers to focus on outcomes rather than volume. By rewarding cost savings, shared savings programs create a win-win situation for both the healthcare organization and the payer, leading to better care coordination, improved patient outcomes, and lower healthcare costs.

It’s important to note that shared savings in healthcare is just one component of the broader shift towards value-based care. Other payment models, such as bundled payments, pay-for-performance, and capitation, also play a role in aligning incentives and promoting value in healthcare delivery.

Next, we will delve into how shared savings programs work and the mechanisms through which cost savings are achieved and shared between healthcare providers and payers.

How Shared Savings Programs Work

Shared savings programs operate on the principle of incentivizing healthcare providers to deliver high-quality care while reducing costs. These programs encourage collaboration between providers, payers, and patients to achieve better health outcomes and lower healthcare spending.

Here is a general overview of how shared savings programs work:

- Identification of participating providers: Healthcare organizations, such as hospitals, physician groups, or accountable care organizations, voluntarily participate in shared savings programs. They enter into agreements with payers to implement these programs and share in the savings achieved.

- Establishment of cost targets: A baseline cost target is set, representing the expected cost of providing healthcare services. This target may be determined based on historical data, regional benchmarks, or other relevant factors. The goal is to create a benchmark against which cost savings can be measured.

- Implementation of care coordination: Shared savings programs often emphasize the importance of care coordination. Providers work together to ensure seamless transitions of care, reduce duplicated services, and improve communication among healthcare professionals. This helps to enhance the overall efficiency and quality of care delivered to patients.

- Monitoring of performance: Healthcare organizations participating in shared savings programs are required to track and report various performance metrics, such as quality measures, patient outcomes, and healthcare costs. By monitoring their performance, providers can identify areas for improvement and make necessary changes to enhance efficiency and value.

- Calculation and sharing of savings: A key aspect of shared savings programs is the calculation and sharing of cost savings. This is typically based on the actual costs incurred by the healthcare organization compared to the baseline target. If the provider achieves cost savings below the target, a portion of those savings is shared with the payer, according to the agreed-upon sharing arrangement.

- Reinvestment of savings: Shared savings programs often incentivize providers to reinvest a portion of the shared savings in initiatives aimed at further improving the quality of care. This can include investments in technology, care coordination programs, or patient engagement initiatives.

It is important to note that the specific details and requirements of shared savings programs can vary depending on the program’s design and the participating organizations. Programs may also incorporate other elements, such as quality improvement initiatives, patient satisfaction measures, or risk-sharing provisions.

Overall, shared savings programs create a framework that aligns financial incentives with the delivery of high-value care. By rewarding providers for achieving cost savings and improving patient outcomes, these programs foster collaboration and promote the delivery of efficient, patient-centered healthcare.

Benefits of Shared Savings in Healthcare

Shared savings programs in healthcare offer several benefits that can positively impact the overall healthcare system, providers, payers, and patients. These benefits include:

- Cost savings: One of the primary benefits of shared savings programs is the potential for reducing healthcare costs. By incentivizing providers to focus on value-based care and implement cost-effective practices, unnecessary tests, procedures, and hospitalizations can be minimized. This leads to lower healthcare spending for both the healthcare organization and the payer, which can have a positive ripple effect on healthcare affordability.

- Improved care coordination: Shared savings programs encourage collaboration and care coordination among healthcare professionals. This ensures that patients receive more streamlined and efficient care, reducing the likelihood of medical errors, unnecessary hospital readmissions, and fragmented care. Better care coordination leads to improved patient outcomes, increased patient satisfaction, and a higher quality of care.

- Enhanced focus on preventive care: Shared savings programs incentivize providers to prioritize preventive care measures, such as regular screenings, vaccinations, and wellness programs. By emphasizing prevention, healthcare organizations can help identify and address health issues earlier, ultimately reducing the need for costly interventions or treatments at later stages of illness.

- Promotion of value-based care: Shared savings programs contribute to the shift towards value-based care, where providers are rewarded based on the quality and outcomes of care rather than the quantity of services rendered. This incentivizes healthcare organizations to prioritize patient-centered care, evidence-based practices, and population health management. By focusing on value, shared savings programs promote the delivery of more efficient and effective healthcare services.

- Increased provider engagement and accountability: Shared savings programs encourage healthcare organizations to take an active role in managing costs while maintaining high-quality care. Providers become more engaged in outcomes and cost-reduction efforts, leading to a culture of accountability and continuous improvement. This can result in more efficient utilization of resources and better overall healthcare management.

- Potential for innovation: Shared savings programs provide a platform for healthcare organizations to innovate and experiment with new care delivery models that prioritize value. By incentivizing cost savings and quality improvement, providers are motivated to seek innovative solutions, such as telemedicine, data analytics, and care coordination technologies. These innovations have the potential to improve patient care, increase efficiency, and drive healthcare system transformation.

It is important to note that while shared savings programs offer numerous benefits, they also come with challenges and considerations that need to be addressed for successful implementation. We will delve into these challenges in the next section.

Challenges of Implementing Shared Savings Programs

While shared savings programs in healthcare offer several benefits, their implementation can pose several challenges and considerations. These challenges include:

- Data integration and interoperability: One of the key challenges in implementing shared savings programs is the need for seamless data integration and interoperability among different healthcare systems and providers. Integrating data from various sources, such as electronic health records, claims data, and quality measures, is crucial for accurate performance measurement and shared savings calculations.

- Complexity of attribution: Determining the appropriate assignment of patients to specific providers or accountable care organizations (ACOs) within shared savings programs can be complex. Patient attribution methodologies must account for various factors, such as primary care provider selection, care utilization patterns, and patient preferences. Ensuring accurate attribution is essential for fair distribution of shared savings and accountability.

- Financial risks and uncertainty: Shared savings programs involve financial risks for providers, especially in cases where cost savings targets are not achieved. Providers may need to invest in care coordination infrastructure, technological advancements, and quality improvement initiatives upfront. If savings are not realized, providers may face financial losses, which can hinder participation and adoption of shared savings programs.

- Changes in practice patterns and culture: Implementing shared savings programs often requires significant changes in practice patterns and organizational culture. Providers must shift from a volume-based mindset to one focused on value and cost containment. This requires buy-in from healthcare professionals and may require investments in training, education, and care coordination efforts to support the necessary practice transformations.

- Data privacy and security: The sharing and integration of patient health information across different organizations and systems raise concerns about data privacy and security. Healthcare organizations need robust safeguards and secure infrastructure to protect patient data and comply with regulations such as the Health Insurance Portability and Accountability Act (HIPAA).

- Patient engagement and education: Engaging and educating patients about shared savings programs and their benefits can be challenging. Patients may not be aware of their healthcare provider’s participation in such programs or understand the potential impact on their care. Clear and effective communication is necessary to ensure patients understand the goals, benefits, and potential cost implications of shared savings programs.

Addressing these challenges requires collaboration among healthcare stakeholders, ongoing monitoring and adjustment, and a commitment to innovation and continuous improvement. Despite these challenges, shared savings programs offer a promising approach to improving the value and efficiency of healthcare delivery.

In the following section, we will explore examples of successful shared savings initiatives that have yielded positive results.

Examples of Shared Savings Initiatives

Several successful shared savings initiatives and programs have been implemented in healthcare, showcasing the potential benefits and outcomes of this payment model. Here are a few notable examples:

- Medicare Shared Savings Program (MSSP): MSSP is one of the largest and most well-known shared savings programs in the United States. It is administered by the Centers for Medicare & Medicaid Services (CMS) and encourages healthcare organizations to form accountable care organizations (ACOs) to deliver coordinated, high-quality care while reducing costs. Through MSSP, ACOs are eligible to share in the savings they generate for Medicare. The program has shown promising results, with participating ACOs achieving cost savings and improved patient outcomes.

- Commercial payer collaborations: Many private insurance companies have established shared savings collaborations with healthcare organizations. For example, Anthem’s Enhanced Personal Health Care program partners with primary care practices to improve care coordination and achieve cost savings. Similarly, UnitedHealthcare’s Accountable Care Rewards program provides financial incentives to healthcare organizations that meet quality and cost targets, resulting in both improved care and reduced costs.

- State Medicaid shared savings programs: Several states in the U.S. have implemented shared savings programs within their Medicaid systems. For instance, Oregon’s Coordinated Care Organizations (CCOs) focus on population health, care coordination, and cost containment to achieve shared savings. These programs have demonstrated improved health outcomes and reduced healthcare costs for Medicaid beneficiaries.

- Commercial bundled payment initiatives: Bundled payment programs, where a fixed payment is made for a predefined set of services, can also incorporate shared savings components. The Comprehensive Care for Joint Replacement (CJR) model implemented by CMS is an example of a successful bundled payment initiative that includes shared savings. Participating hospitals can share in cost savings if they provide high-quality care while keeping costs below a target price.

- Regional health systems and collaborative networks: Some regional health systems and collaborative networks have implemented shared savings programs to improve care coordination and reduce costs. For instance, Advocate Health Care in Illinois has partnered with Blue Cross and Blue Shield to create an accountable care organization (ACO). This ACO has achieved significant cost savings while delivering high-quality care, demonstrating the impact of regional collaborations in shared savings programs.

These are just a few examples of shared savings initiatives that have shown promising results in terms of cost savings, improved care coordination, and enhanced patient outcomes. Each program has unique characteristics, partnerships, and approaches to achieving shared savings. These initiatives serve as valuable models for healthcare organizations and payers looking to implement or participate in shared savings programs.

In the next section, we will summarize the key points discussed and conclude the article.

Conclusion

Shared savings programs in healthcare have emerged as a innovative payment model that incentivizes providers to deliver high-quality care while reducing costs. These programs foster collaboration, care coordination, and a focus on value-based care, ultimately benefiting healthcare organizations, payers, and patients.

Shared savings programs offer numerous benefits, including cost savings, improved care coordination, enhanced focus on preventive care, promotion of value-based care, increased provider engagement and accountability, and potential for innovation. By aligning financial incentives and encouraging cost-effective practices, shared savings programs contribute to the transformation of the healthcare system towards higher value and improved patient outcomes.

However, implementing shared savings programs does come with challenges. These challenges include data integration and interoperability, complexity of attribution, financial risks and uncertainty, changes in practice patterns and culture, data privacy and security, and patient engagement and education. Healthcare organizations and stakeholders must address these challenges to successfully implement and optimize shared savings programs.

Successful shared savings initiatives, such as the Medicare Shared Savings Program (MSSP), commercial collaborations, state Medicaid programs, bundled payment initiatives, and regional health systems, demonstrate the potential of shared savings programs to achieve cost savings and improved care outcomes. These programs serve as valuable models for others looking to adopt shared savings payment models.

In conclusion, shared savings in healthcare offers promising opportunities to enhance the delivery of care, reduce costs, and improve patient outcomes. By incentivizing value-based care and collaboration among healthcare stakeholders, shared savings programs can contribute to a more sustainable and patient-centered healthcare system.