Finance

What Is Cash Flow Per Share

Published: December 20, 2023

Learn about cash flow per share in finance and how it affects company valuation and investment decisions. Explore its importance and calculation methods.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance where understanding key financial metrics is essential for making informed investment decisions. One such metric that investors often rely on is Cash Flow Per Share. In this article, we will explore the meaning, calculation, importance, and limitations of Cash Flow Per Share.

Cash Flow Per Share is a financial ratio that provides valuable insights into the cash generating capacity of a company on a per share basis. It measures the amount of cash generated by a company’s operations that is available to be distributed to its shareholders, after accounting for expenses and taxes. Investors use this metric to assess the overall financial health of a company, its ability to generate consistent cash flows, and to compare it against its competitors.

Understanding Cash Flow Per Share is crucial because it reveals a company’s ability to fund its operations, invest in growth opportunities, pay dividends, and service its debt. Companies with positive and increasing Cash Flow Per Share are generally considered healthier and more attractive to investors than those with negative or declining values.

As an investor, it’s essential to analyze a company’s cash flow trends over time to ensure stability and sustainability. A company reporting strong cash flow numbers indicates that it has sufficient liquidity and financial strength to withstand economic downturns and invest in future growth. On the flip side, consistently negative cash flow or declining cash flow could be a red flag, indicating potential financial distress or operational inefficiencies.

Now that we have a basic understanding of Cash Flow Per Share and its importance, let’s dive into how it is calculated and explore some real-world examples to illustrate its significance in financial analysis.

Definition of Cash Flow Per Share

Cash Flow Per Share is a financial ratio that measures the amount of cash generated by a company per share of its outstanding common stock. It is calculated by dividing the company’s cash flow from operations by the weighted average number of shares outstanding during a specific period.

Cash flow from operations represents the cash inflows and outflows resulting from a company’s core operations, such as revenue from sales, payments to suppliers, salaries and wages, and interest paid. It is a more accurate measure of a company’s financial performance than net income, as it excludes non-cash expenses and considers the timing of cash flows.

Weighted average number of shares outstanding is used to calculate Cash Flow Per Share to account for any changes in the number of shares over the reporting period. This is important because if the number of outstanding shares changes, it can affect the overall cash flow earned per share.

Cash Flow Per Share provides a per-share perspective on a company’s cash flow, enabling investors to assess the amount of cash generated by the company per unit of ownership. This helps in comparing companies of different sizes or with varying numbers of outstanding shares.

It is important to note that Cash Flow Per Share is an indicator of a company’s cash-generating ability and not its profitability. A company can have positive Cash Flow Per Share while reporting a net loss due to non-cash expenses or investments in long-term assets.

This measure is commonly used by investors, analysts, and financial professionals as it provides valuable insights into a company’s ability to generate cash and distribute it among its shareholders. By comparing the Cash Flow Per Share of different companies within the same industry, investors can gain a better understanding of which company is generating more cash and potentially make more informed investment decisions.

Importance of Cash Flow Per Share

Cash Flow Per Share is a vital metric for investors and financial analysts, as it provides valuable information about the financial health and performance of a company. Here are some key reasons why Cash Flow Per Share is important:

- Indication of Cash Generating Capacity: Cash Flow Per Share helps investors assess a company’s ability to generate cash from its operations. Companies with consistently positive and increasing Cash Flow Per Share are generally considered financially stable and capable of funding their operations, paying dividends, and servicing their debt.

- Comparison among Companies: Cash Flow Per Share allows for easy comparison of companies within the same industry. By comparing the cash flow generated per share, investors can identify companies that are more efficient in generating cash and potentially identify investment opportunities.

- Insight into Financial Sustainability: By analyzing the trend of Cash Flow Per Share over time, investors can evaluate the financial sustainability of a company. Consistently positive Cash Flow Per Share indicates a company’s ability to generate cash flows even during challenging economic conditions, while negative or declining values may signal potential financial distress.

- Indicator of Value Creation: Cash Flow Per Share is a key metric used to evaluate a company’s ability to create value for its shareholders. Companies with higher cash flows per share have the potential to issue dividends, repurchase shares, or reinvest in growth opportunities, ultimately benefiting shareholders in the long run.

- Assessment of Dividend Sustainability: Cash Flow Per Share is used to assess a company’s ability to sustain dividend payments. Companies with a healthy and growing Cash Flow Per Share are more likely to have the financial capacity to continue paying dividends to their shareholders.

It is important to note that while Cash Flow Per Share is a valuable metric, it should not be the sole determinant of investment decisions. It should be used in conjunction with other financial indicators and analysis to have a comprehensive view of a company’s overall financial performance and prospects.

Now that we understand the importance of Cash Flow Per Share, let’s move on to the next section to explore how it is calculated.

Calculation of Cash Flow Per Share

The calculation of Cash Flow Per Share involves two primary components: cash flow from operations and the weighted average number of shares outstanding. Here’s how the calculation is done:

- Cash Flow from Operations: Start by obtaining the cash flow from operations from the company’s cash flow statement. This figure represents the cash generated or used in the company’s core business activities.

- Weighted Average Number of Shares Outstanding: Determine the weighted average number of shares outstanding during the reporting period. This can be obtained from the company’s financial statements or annual report. The weighted average takes into account any changes in the number of shares outstanding, such as stock splits or issuances.

- Calculate Cash Flow Per Share: Divide the cash flow from operations by the weighted average number of shares outstanding. The formula for calculating Cash Flow Per Share is as follows:

Cash Flow Per Share = Cash Flow from Operations / Weighted Average Number of Shares Outstanding

For example, let’s say Company XYZ reported a cash flow from operations of $10 million for the year and had a weighted average of 5 million shares outstanding. The calculation would be as follows:

Cash Flow Per Share = $10,000,000 / 5,000,000 = $2.00 per share

In this example, the Cash Flow Per Share for Company XYZ would be $2.00.

It’s important to note that the calculation of Cash Flow Per Share provides a per-share perspective, allowing for easy comparison among companies with different numbers of outstanding shares. This metric gives investors a clearer understanding of how much cash is being generated for each share they own.

Now that we know how to calculate Cash Flow Per Share, let’s move on to the next section to explore some real-world examples to further illustrate its significance in financial analysis.

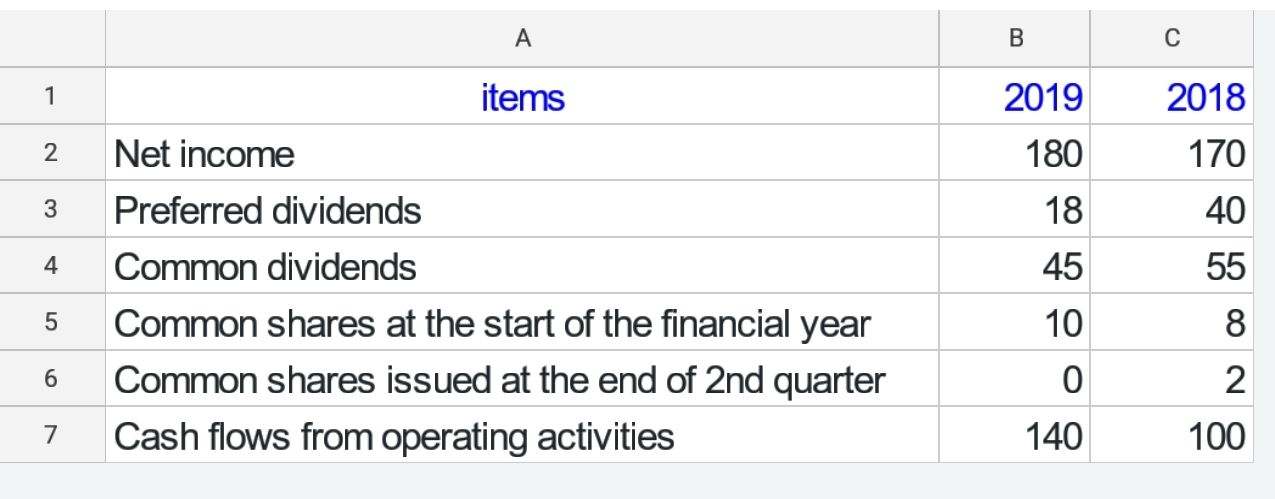

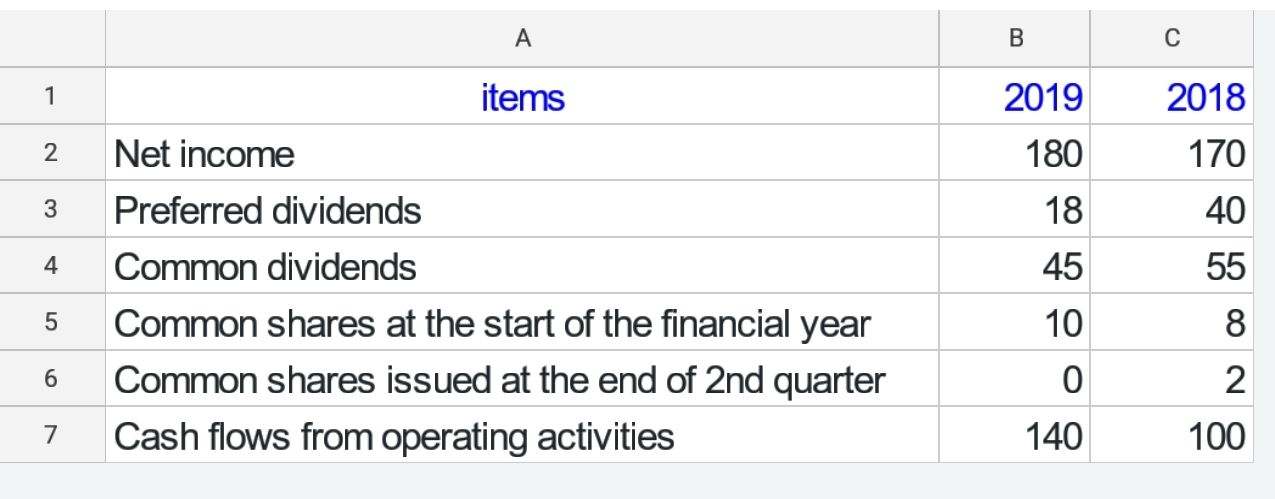

Examples of Cash Flow Per Share

To better understand the significance of Cash Flow Per Share, let’s explore a couple of real-world examples:

Example 1: Company ABC

Company ABC reported a cash flow from operations of $50 million for the year. The weighted average number of shares outstanding during the same period was 10 million. To calculate the Cash Flow Per Share for Company ABC:

Cash Flow Per Share = $50,000,000 / 10,000,000 = $5.00 per share

In this example, Company ABC has a Cash Flow Per Share of $5.00. This indicates that for each outstanding share, the company generated $5.00 in cash flow from its operations.

Example 2: Company XYZ

Company XYZ reported a cash flow from operations of $20 million for the year. However, during the reporting period, the company had a stock split, which increased the number of outstanding shares from 4 million to 8 million. To calculate the Cash Flow Per Share for Company XYZ:

Cash Flow Per Share = $20,000,000 / 6,000,000 = $3.33 per share

In this example, Company XYZ has a Cash Flow Per Share of $3.33, taking into account the weighted average number of shares after the stock split. This adjustment ensures a more accurate comparison of cash flow generated per share.

By comparing the Cash Flow Per Share of different companies within the same industry, investors can gain insights into which companies are generating more cash flow per share and potentially identifying investment opportunities. It allows for a fair comparison, regardless of the company’s size or the number of outstanding shares.

It’s important to note that these examples are simplified for illustration purposes. In reality, companies’ financial statements may have more complex cash flow structures and varying numbers of outstanding shares.

Now that we have seen some examples of Cash Flow Per Share, let’s analyze and interpret this metric in the next section to understand its implications for investors and financial analysis.

Analysis and Interpretation of Cash Flow Per Share

Cash Flow Per Share is a valuable metric for investors and analysts to analyze a company’s financial health. Here are some key points to consider when interpreting and analyzing Cash Flow Per Share:

- Positive Cash Flow Per Share: A positive Cash Flow Per Share indicates that a company is generating cash from its operations and has the potential to distribute it to shareholders. This is generally seen as a positive sign, as it suggests the company has a healthy cash flow position.

- Negative Cash Flow Per Share: A negative Cash Flow Per Share means that a company’s operations are not generating enough cash flow to cover its expenses and obligations. This could be a concerning sign, as it may indicate financial difficulties or inefficiencies in managing the business. Investors should investigate further to understand the reasons behind the negative cash flow and assess the company’s ability to improve its financial position.

- Comparison to Industry Peers: Comparing a company’s Cash Flow Per Share to its industry peers can provide insights into its relative performance. A higher Cash Flow Per Share compared to competitors indicates better cash generation efficiency and potential for value creation. Conversely, a lower Cash Flow Per Share may raise questions about the company’s operational performance and ability to generate cash flows.

- Historical Analysis: Tracking a company’s Cash Flow Per Share over multiple periods allows for trend analysis. A consistent increase in Cash Flow Per Share indicates a healthy and growing business that is effectively generating cash over time. On the other hand, a declining trend in Cash Flow Per Share may indicate deteriorating financial performance or ineffective cash management.

- Contextual Factors: It’s important to consider the industry and business cycle when interpreting Cash Flow Per Share. Industries with high capital expenditure requirements, such as manufacturing or technology, may have lower Cash Flow Per Share compared to service-based industries with lower capital requirements. Additionally, economic downturns or specific market conditions can impact a company’s cash flow generation, so it should be considered in the overall assessment.

Overall, Cash Flow Per Share provides valuable insights into a company’s ability to generate cash flows and distribute them to shareholders. However, it should be used in conjunction with other financial metrics and analysis to have a comprehensive understanding of a company’s financial position and prospects.

Next, let’s explore the limitations of Cash Flow Per Share to understand its potential shortcomings in financial analysis.

Limitations of Cash Flow Per Share

While Cash Flow Per Share is a valuable metric, there are some limitations that investors and analysts should be aware of when using it for financial analysis. Here are some important limitations to consider:

- Exclusion of Financing and Investing Activities: Cash Flow Per Share focuses solely on cash flows from operations. It does not include cash flows from financing activities (such as raising capital through debt or equity) or investing activities (such as buying or selling assets). This omission may result in an incomplete picture of a company’s overall cash flow situation.

- Non-Cash Expenses and Income: Cash Flow Per Share does not consider non-cash expenses, such as depreciation and amortization, which can significantly impact a company’s net income. These expenses reduce net income but do not have a direct impact on cash flow, potentially leading to a discrepancy between net income and Cash Flow Per Share.

- Quality of Earnings: Cash Flow Per Share does not assess the quality of a company’s earnings. A company with high Cash Flow Per Share may still have poor quality earnings due to aggressive accounting practices or unsustainable revenue sources. It’s essential to analyze other financial metrics and conduct a thorough examination of the company’s financial statements to ensure the earnings are of high quality.

- Timing of Cash Flows: Cash Flow Per Share does not take into account the timing of cash flows. Companies may experience fluctuations in cash flows due to seasonality, delayed payments, or changes in customer behavior. It is important to consider the consistency and predictability of cash flows when evaluating a company’s financial health.

- Industry Comparability: Cash Flow Per Share may not be directly comparable across different industries. Industries with different capital requirements or business models may have varying levels of Cash Flow Per Share. When comparing companies, it is crucial to consider industry norms and take industry-specific factors into account.

Despite its limitations, Cash Flow Per Share remains a valuable metric for assessing a company’s cash-generating capacity. To gain a comprehensive understanding of a company’s financial health, it is recommended to use Cash Flow Per Share in conjunction with other financial ratios and analysis.

Now that we have discussed the limitations of Cash Flow Per Share, let’s conclude this article.

Conclusion

Cash Flow Per Share is a crucial financial metric that provides insights into a company’s cash generating capacity on a per share basis. It allows investors and analysts to evaluate the company’s ability to generate consistent cash flows, fund its operations, pay dividends, and service its debt. By comparing Cash Flow Per Share among companies within the same industry, investors can identify companies that are more efficient in generating cash and potentially make more informed investment decisions.

While Cash Flow Per Share is valuable, it is essential to consider its limitations. It excludes cash flows from financing and investing activities, does not account for non-cash expenses, and may not be directly comparable across industries. Additionally, it does not assess the quality of earnings or consider the timing of cash flows. It is crucial to use Cash Flow Per Share in conjunction with other financial metrics and analysis to gain a comprehensive understanding of a company’s financial health and prospects.

Overall, Cash Flow Per Share provides a per-share perspective to evaluate a company’s cash flow generation and distribution to shareholders. It helps investors assess financial sustainability, compare companies, and evaluate dividend sustainability. However, it should not be the sole determinant of investment decisions. Investors should conduct thorough financial analysis, consider industry-specific factors, and assess other key performance indicators to make well-informed investment choices.

By understanding and utilizing Cash Flow Per Share effectively, investors can strengthen their financial analysis and make more informed investment decisions in the dynamic world of finance.

References

Here are some references that were used in the creation of this article:

- Brigham, E. F., & Houston, J. F. (2019). Fundamentals of Financial Management. Cengage Learning.

- Gitman, L. J., & Zutter, C. J. (2018). Principles of Managerial Finance. Pearson Education.

- Investopedia. (n.d.). Cash Flow Per Share. Retrieved from https://www.investopedia.com/terms/c/cashflowpershare.asp

- Khan, M. Y., & Jain, P. K. (2017). Financial Management: Text, Problems, and Cases. Tata McGraw-Hill Education.

- Penman, S. H. (2017). Financial Statement Analysis and Security Valuation. McGraw-Hill.

These references provide further insights into the concept of Cash Flow Per Share, its calculation, interpretation, and its role in financial analysis. They can be valuable resources for investors, analysts, and financial professionals seeking a deeper understanding of this important financial metric.

Please note that the references listed above are for informational purposes only and do not constitute an endorsement of any specific publication or source.