Finance

What Is Spouse Life Insurance?

Published: October 14, 2023

Explore how spouse life insurance can provide financial protection for your loved ones. Secure your family's future with this essential financial tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of spouse life insurance! In this article, we will explore the ins and outs of spouse life insurance, its benefits, different types of policies available, factors to consider when selecting a policy, and how to apply for one. Whether you are newly married or have been together for years, spouse life insurance is a crucial aspect of financial planning for your family’s future.

Life is unpredictable, and in the unfortunate event of the loss of a spouse, the emotional and financial burden can be overwhelming. Spouse life insurance provides a safety net by providing a financial payout to help the surviving spouse cope with the financial responsibilities that may arise.

While it’s essential to have a comprehensive life insurance policy for oneself, adding a spouse life insurance policy further secures your family’s financial stability. It offers peace of mind, knowing that your loved one will be taken care of financially in case of your untimely demise. Spouse life insurance is a thoughtful and prudent decision that demonstrates your commitment to your partner’s well-being and future.

Spouse life insurance provides financial protection for the surviving spouse by offering a lump sum payment, which can be used to cover various expenses such as mortgage payments, childcare, education costs, and daily living expenses. This financial assistance can alleviate the stress and financial strain that comes with the loss of a loved one, allowing the surviving spouse and children to maintain their quality of life.

Additionally, spouse life insurance can be an essential tool for estate planning purposes. It can help cover estate taxes, funeral expenses, and other financial obligations that arise upon the death of a spouse. It ensures that your family’s financial goals can still be met, even in your absence.

Now that we’ve explored the importance and benefits of spouse life insurance, let’s delve into the details of understanding spouse life insurance and the various options available.

Understanding Spouse Life Insurance

Spouse life insurance is a type of life insurance policy that provides financial protection for the surviving spouse in the event of the insured partner’s death. It is designed to offer a financial safety net, ensuring that the surviving spouse can maintain their standard of living and meet their financial obligations.

One key difference between individual life insurance and spouse life insurance is that the policy is taken out on the life of the spouse, rather than the individual themselves. This means that the insured person is the policyholder’s partner, and in the event of their death, the benefits are paid out to the surviving spouse.

The payout from a spouse life insurance policy can be used in various ways. It can be used to cover immediate expenses such as funeral costs and medical bills. It can also help replace the lost income of the deceased spouse, allowing the surviving spouse to continue covering ongoing expenses like mortgage payments, utilities, and other household bills.

It’s important to note that spouse life insurance is not limited to married couples. It can also be obtained by domestic partners or couples in a recognized civil partnership. The key requirement is that the policyholders have a legal and financial connection.

When considering spouse life insurance, it’s essential to assess the financial needs of your family. Factors to consider include the current income and expenses of both spouses, outstanding debts, future financial goals, and the number of dependents. Evaluating these factors will help determine the appropriate coverage amount needed to ensure the surviving spouse is adequately protected.

It’s worth noting that obtaining spouse life insurance is easier when both partners are relatively young and in good health. Insurance companies typically require medical underwriting, including a health questionnaire and, in some cases, a medical examination. The healthier the insured partner, the more favorable the insurance rates are likely to be.

Stay tuned as we explore the various benefits of spouse life insurance in the next section.

Benefits of Spouse Life Insurance

Spouse life insurance offers several key benefits that can provide peace of mind and financial security for both partners. Let’s take a closer look at the advantages of having a spouse life insurance policy:

- Financial Protection: The primary benefit of spouse life insurance is the financial protection it provides to the surviving spouse. In the event of the insured partner’s death, the policy pays out a lump-sum amount to the surviving spouse. This payout can help cover immediate expenses, outstanding debts, and ongoing financial obligations.

- Maintaining Lifestyle: Losing a spouse can be emotionally devastating, and the last thing a surviving spouse should have to worry about is a sudden financial burden. Spouse life insurance ensures that the surviving spouse can continue to maintain their lifestyle and cover everyday expenses, such as mortgage or rent payments, utility bills, and childcare costs. It gives the surviving spouse the time and flexibility to adjust to their new financial circumstances without sacrificing their quality of life.

- Income Replacement: When a spouse passes away, they may leave behind lost income, especially if they were the primary breadwinner. Spouse life insurance can provide a source of income replacement, allowing the surviving spouse to continue meeting their financial commitments and providing for dependent children. This can be particularly beneficial if there are significant financial responsibilities, such as mortgage payments or college tuition.

- Debt Repayment: Many couples have joint debts, such as mortgages, car loans, or credit card balances. If one spouse dies, the surviving spouse may be responsible for repaying these debts on their own. Spouse life insurance can provide the necessary funds to pay off outstanding debts, easing the financial burden and allowing the surviving spouse to start anew without the weight of debt.

- Estate Planning: Spouse life insurance can play a crucial role in estate planning. It can help cover estate taxes or other obligations that arise upon the death of a spouse. By having a life insurance policy in place, it ensures that your family’s financial goals and legacies can still be fulfilled even in your absence.

Having a spouse life insurance policy offers invaluable financial protection and peace of mind for both partners. It provides reassurance that if the unexpected happens, the surviving spouse will have the necessary resources to navigate the financial challenges that may arise.

Now that we understand the benefits of spouse life insurance, let’s explore the different types of policies available to suit varying needs and circumstances.

Different Types of Spouse Life Insurance Policies

When it comes to spouse life insurance, there are several types of policies available to choose from. The right policy for you and your spouse will depend on your specific needs, budget, and long-term financial goals. Let’s explore some of the most common types of spouse life insurance policies:

- Term Life Insurance: Term life insurance is a popular option because it provides coverage for a specified period, typically ranging from 10 to 30 years. It offers a death benefit to the surviving spouse if the insured partner passes away during the term of the policy. Term life insurance policies are typically more affordable and straightforward, making them an attractive option for many couples.

- Whole Life Insurance: Whole life insurance is a permanent life insurance policy that provides coverage for the entire lifetime of the insured spouse. It offers a death benefit as well as a cash value component that grows over time. Whole life insurance policies tend to have higher premiums compared to term life insurance, but they provide lifelong coverage and the added benefit of building cash value that can be accessed or borrowed against if needed.

- Universal Life Insurance: Universal life insurance is another type of permanent life insurance that combines a death benefit with a cash value component. Unlike whole life insurance, universal life insurance policies offer more flexibility in premium payments and death benefit amounts. They allow you to adjust the policy’s coverage and premiums to adapt to your changing financial needs and goals.

- Joint Life Insurance: Joint life insurance policies are designed specifically for couples. These policies cover both spouses under a single policy and pay out the death benefit upon the first spouse’s passing. Joint life insurance can be beneficial if both partners contribute financially and share similar goals and responsibilities.

- Survivorship Life Insurance: Survivorship life insurance, also known as second-to-die insurance, is a policy that covers two individuals, typically spouses. The death benefit is paid out after both insured individuals pass away. Survivorship life insurance can be a useful tool for estate planning purposes, as it can help cover estate taxes and other financial obligations that arise upon the death of both spouses.

Each type of spouse life insurance policy has its own unique features and benefits. It’s essential to carefully consider your and your spouse’s financial situation, long-term goals, and budget when selecting the right policy. Consulting with a reputable insurance professional can help guide you in choosing the most suitable option for your specific needs.

Now that we have explored the different types of policies, let’s move on to the factors that you should consider when choosing a spouse life insurance policy.

Factors to Consider when Choosing Spouse Life Insurance

Choosing the right spouse life insurance policy is a crucial decision that requires careful consideration. To make an informed choice, it’s important to evaluate various factors that can impact the suitability and effectiveness of the policy for you and your spouse. Let’s delve into the key factors to consider when selecting a spouse life insurance policy:

- Coverage Amount: Determine how much coverage you need to adequately protect your spouse. Consider factors such as income replacement, outstanding debts, mortgage payments, future expenses, and the number of dependents. Your coverage amount should be sufficient to cover these financial obligations and provide for your spouse’s needs in the event of your death.

- Premium Affordability: Evaluate your budget and financial resources to determine the premium you can comfortably afford. Remember that life insurance is a long-term commitment, so choose a policy with premiums that fit within your budget without causing financial strain for you and your spouse.

- Policy Term: Consider the length of the policy term. If you have short-term financial obligations or expect your financial responsibilities to change in the near future, a term life insurance policy with a shorter term may be appropriate. For long-term needs or estate planning purposes, a permanent life insurance policy with lifelong coverage may be more suitable.

- Medical Underwriting: Take into account your and your spouse’s health conditions. Some insurance policies require medical underwriting, which involves a health questionnaire or even a medical examination. Your health status can affect your premium rates or eligibility for certain types of insurance policies.

- Add-On Riders: Explore optional riders that can enhance your policy’s coverage. Riders such as accidental death benefit, disability benefit, or critical illness benefit can provide additional financial protection and peace of mind.

- Policy Conversion: If you opt for a term life insurance policy, check if it offers a conversion option. This allows you to convert the policy into a permanent life insurance policy without the need for further medical underwriting. Having the flexibility to convert your policy can be valuable if your circumstances change in the future.

- Reputation and Financial Stability: Research and choose a reputable insurance company with a strong financial stability rating. Look for insurers with a good track record of paying claims promptly and providing excellent customer service. A reliable insurance provider ensures that your spouse will receive the financial support they need when the time comes.

By considering these factors, you can make an informed decision and choose a spouse life insurance policy that aligns with your financial goals and provides the necessary protection for your spouse in the event of your passing.

Next, in our exploration of spouse life insurance, we will discuss the application process and what you can expect when applying for a policy.

How to Apply for Spouse Life Insurance

Applying for spouse life insurance involves a straightforward process that typically begins with gathering the necessary information and understanding your specific needs. Here are the general steps to follow when applying for spouse life insurance:

- Evaluate Your Needs: Determine the coverage amount and type of policy that best suits your spouse’s financial needs and your long-term goals. Consider factors such as income replacement, outstanding debts, and future expenses to ascertain the appropriate level of coverage.

- Research Insurance Providers: Take the time to research and compare reputable insurance providers that offer spouse life insurance policies. Look for companies with a strong financial stability rating, positive customer reviews, and a history of reliable claim payments.

- Request Quotes: Reach out to the insurance providers you have identified and request quotes for spouse life insurance policies that align with your coverage requirements. Provide accurate information about your spouse’s age, health condition, and any other relevant details to obtain accurate quotes.

- Review Policies and Coverage: Carefully review the policies offered, paying close attention to the coverage terms, premium amounts, riders, and any other policy details. Compare the policies side by side to determine which one offers the best value and fits your specific needs.

- Complete the Application: Once you have selected an insurance provider and policy, complete the application form provided by the insurer. Be prepared to provide personal information about both you and your spouse, including contact details, date of birth, occupation, and health history. Be honest and thorough in your responses to ensure a smooth underwriting process.

- Underwriting Process: The insurance company will initiate the underwriting process, which may involve further health information gathering, such as a medical questionnaire or medical examination. The insurer will assess the risk associated with providing coverage for your spouse based on the information provided. This stage is crucial in determining premium rates and policy approval.

- Premium Payment: If your application is approved, the insurance provider will generate the policy documents. Pay the initial premium indicated in the policy offer to activate the coverage. You will receive a policy contract that outlines the terms and conditions of the spouse life insurance policy.

- Review and Update: Periodically review your spouse life insurance policy to ensure it aligns with your evolving needs, such as changes in income, family size, or financial goals. Update the policy as necessary to maintain adequate coverage for your spouse.

Remember, it’s essential to provide accurate and truthful information throughout the application process. Failure to disclose relevant information may result in the denial of a claim in the future.

Consulting with an insurance professional can help guide you through the application process and ensure you select the right spouse life insurance policy for your specific needs and budget.

In the next section, we will address some commonly asked questions about spouse life insurance to further clarify any doubts or concerns you may have.

Common Questions and Answers about Spouse Life Insurance

Spouse life insurance is an important aspect of financial planning, and it’s natural to have questions about how it works and what it entails. Here are answers to some commonly asked questions about spouse life insurance:

- Can I get spouse life insurance if we have pre-existing health conditions?

While having pre-existing health conditions can affect your premium rates, it does not necessarily disqualify you from obtaining spouse life insurance. The insurance company will evaluate the health risks associated with the conditions and may charge higher premiums or impose coverage limitations as a result. - Can I have multiple spouse life insurance policies?

Yes, you can have multiple spouse life insurance policies as long as you meet the underwriting requirements and financial justification for the coverage. However, it’s important to consider the financial implications and whether multiple policies are necessary to adequately protect your spouse. - What happens if we get divorced?

When a couple gets divorced, the spouse life insurance policy typically terminates. It’s important to review and update your life insurance policies during major life events, including divorce, to ensure they reflect your current circumstances and beneficiaries. - Can I change the beneficiary on my spouse life insurance policy?

Yes, you can generally change the beneficiary on your spouse life insurance policy at any time, as long as you follow the procedures specified by the insurance company. It’s a good practice to review and update your beneficiary designations periodically, especially after significant life events like marriage, divorce, or the birth of children. - Can I borrow against the cash value of a permanent spouse life insurance policy?

If you have a whole life insurance or universal life insurance policy with a cash value component, you may be able to borrow against the accrued cash value. Borrowing from the cash value is typically considered a loan and may have interest charges associated with it. It’s essential to carefully review the terms and conditions of your specific policy. - What happens if I stop paying premiums?

If you stop paying premiums on your spouse life insurance policy, the coverage will typically lapse or terminate after a grace period. It’s important to understand the consequences of premium non-payment and evaluate alternative options, such as converting to a reduced coverage policy, to maintain some level of coverage if needed. - Can I add riders to my spouse life insurance policy?

Yes, many spouse life insurance policies offer optional riders that can enhance the coverage. These riders provide additional benefits such as accidental death benefit, critical illness coverage, or disability coverage. Adding riders can increase the premium, so it’s crucial to consider whether the added benefits align with your needs and budget.

It’s important to note that the answers provided are general guidelines, and the specific terms and conditions of your spouse life insurance policy may vary depending on the insurance company and the policy you choose. Reviewing the policy contract and consulting with an insurance professional can provide more precise information tailored to your situation.

Now that we have addressed some common questions, let’s conclude our exploration of spouse life insurance.

Conclusion

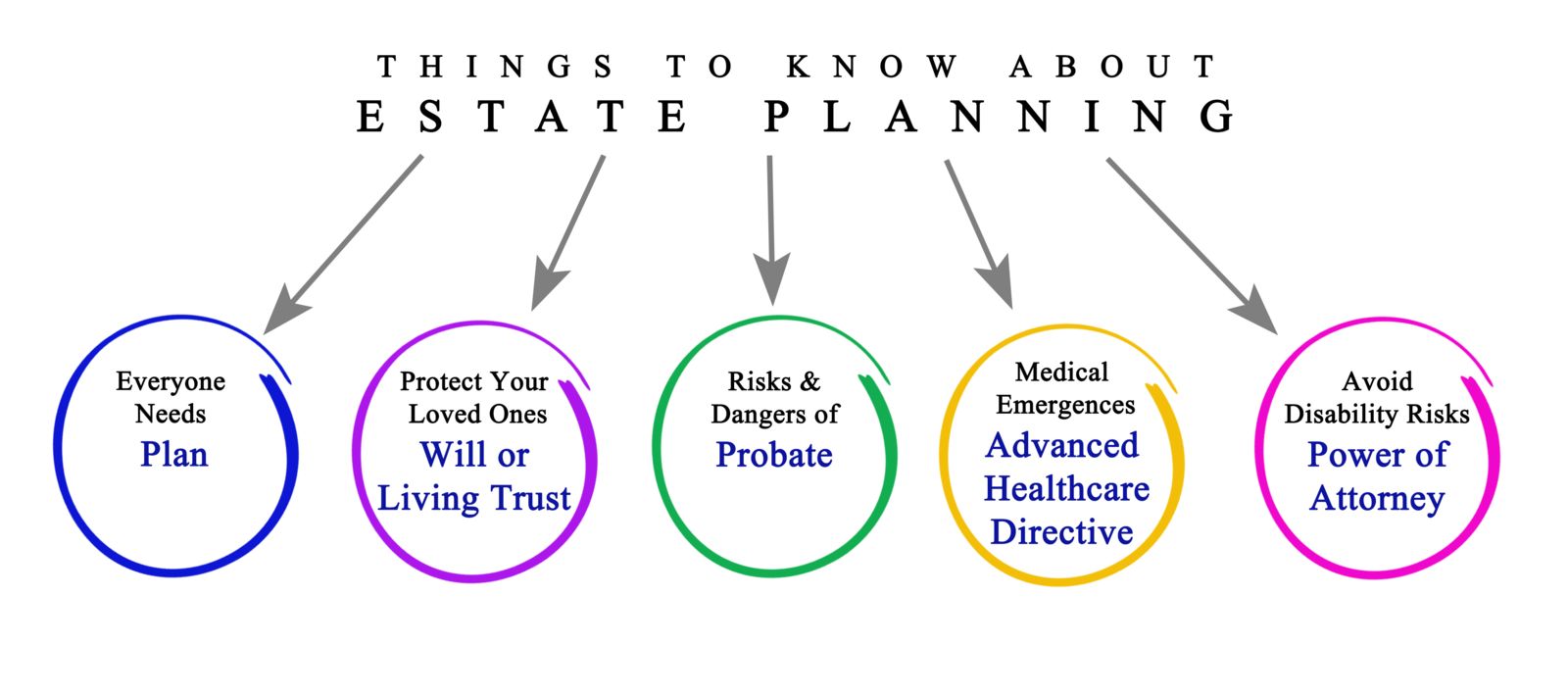

Spouse life insurance is a crucial component of financial planning that provides peace of mind and financial security for couples in the face of life’s uncertainties. By understanding the concept of spouse life insurance and exploring the various types of policies available, you can make informed decisions that align with your specific needs and long-term goals.

Having a spouse life insurance policy ensures that if the unexpected happens and one partner passes away, the surviving spouse is provided with a financial safety net. It offers a means to maintain their lifestyle, cover immediate expenses, replace lost income, and manage ongoing financial obligations. Spouse life insurance also plays a vital role in estate planning, helping to safeguard the financial legacy of both partners.

When choosing a spouse life insurance policy, it is crucial to consider factors such as coverage amount, premium affordability, policy term, and any additional riders that can enhance the coverage. Working with a reputable insurance provider and seeking expert advice can help navigate the selection process and ensure that the chosen policy meets your specific needs.

Applying for spouse life insurance involves a straightforward process of evaluating your needs, researching insurance providers, completing the application, and undergoing the underwriting process. It’s important to provide accurate information and review the policy details before finalizing the application.

Throughout this article, we have addressed common questions about spouse life insurance to clarify any doubts or concerns that you may have had. Remember that the specific terms and conditions of your policy may vary, so it’s crucial to review the policy contract and seek professional guidance for personalized advice.

By prioritizing spouse life insurance, you are taking an essential step towards protecting your loved one’s financial well-being in the event of your untimely demise. It is a testament to your commitment to their future and provides the necessary support to navigate the financial challenges that may arise.

Now that you have a better understanding of spouse life insurance, its benefits, types of policies, and the application process, you can confidently make decisions that provide financial security for you and your spouse. Take the time to assess your needs, explore the options available, and take the necessary steps to protect your loved ones today and in the years to come.