Finance

What Is Spouse Voluntary Life Insurance?

Modified: February 16, 2024

Discover how spouse voluntary life insurance can provide financial security for your loved ones. Learn more about this essential finance option today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Spouse Voluntary Life Insurance?

- Benefits of Spouse Voluntary Life Insurance

- Eligibility for Spouse Voluntary Life Insurance

- Coverage Options for Spouse Voluntary Life Insurance

- How Does Spouse Voluntary Life Insurance Work?

- How to Enroll for Spouse Voluntary Life Insurance

- Premiums and Costs of Spouse Voluntary Life Insurance

- Claiming Benefits from Spouse Voluntary Life Insurance

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

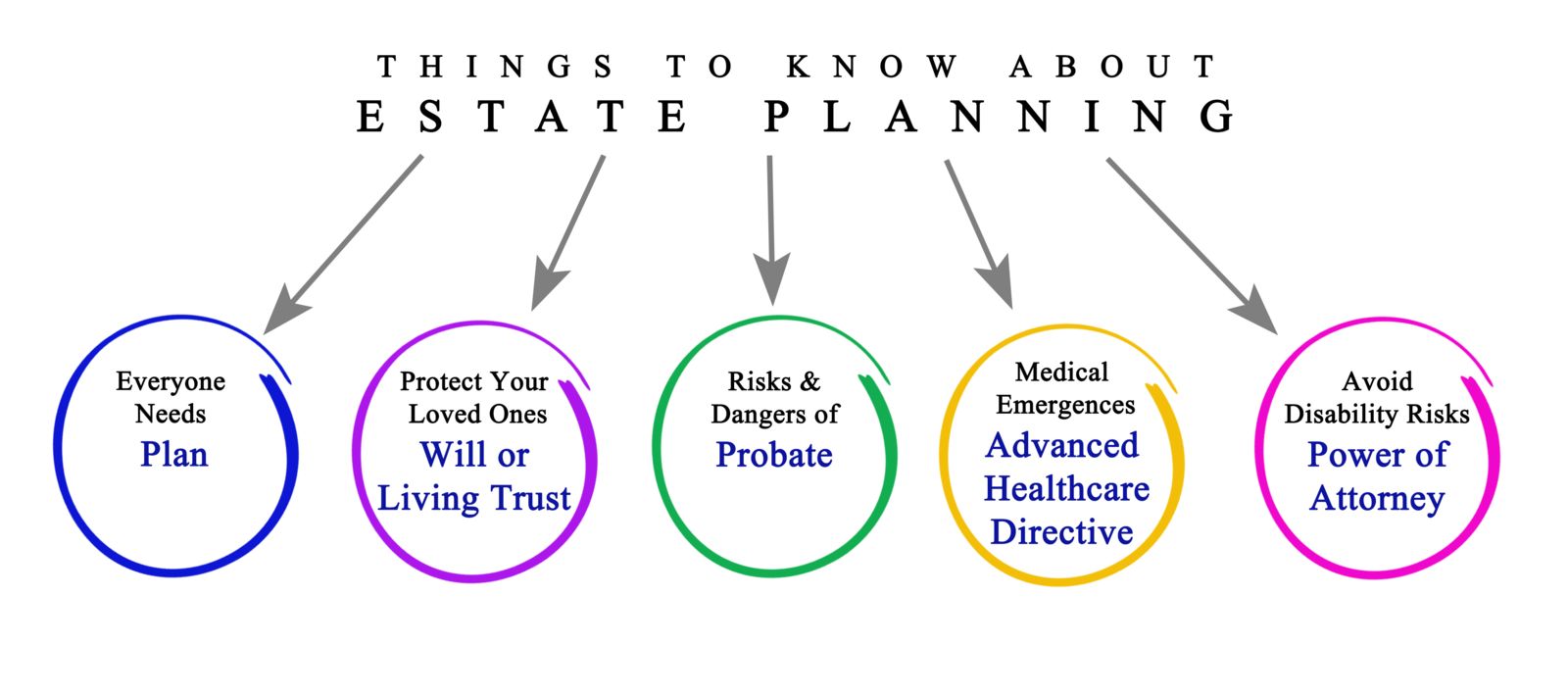

When it comes to protecting your loved ones financially, life insurance is a crucial consideration. It provides a financial safety net that ensures your family is taken care of in the event of your passing. While most people are familiar with individual life insurance policies, there is another option that offers additional coverage for spouses – spouse voluntary life insurance.

Spouse voluntary life insurance is a type of life insurance policy that allows you to extend coverage to your spouse or partner. It is an add-on to your own life insurance policy, providing an extra layer of protection for your loved one. This insurance can help alleviate the financial burden that may arise upon the unexpected death of your spouse.

In this article, we will explore what spouse voluntary life insurance is all about, its benefits, eligibility requirements, coverage options, how it works, and how to enroll for it. We will also shed light on the premiums and costs associated with this insurance, as well as how to file a claim to receive the benefits.

If you are considering adding additional coverage for your spouse to your life insurance policy, or if you are seeking information on how to protect your loved ones financially, this article will provide you with a comprehensive understanding of spouse voluntary life insurance and its importance in securing your family’s future.

What is Spouse Voluntary Life Insurance?

Spouse voluntary life insurance is a type of life insurance policy that extends coverage to your spouse or partner. It is an optional add-on to your own life insurance policy, allowing you to provide an added level of financial protection for your loved one. This type of insurance is designed to help relieve the financial strain that may occur if your spouse were to pass away unexpectedly.

The coverage provided by spouse voluntary life insurance is similar to that of an individual life insurance policy. In the event of your spouse’s death, the policy pays out a death benefit to the designated beneficiary. This benefit can be used by your spouse for various purposes, such as covering funeral expenses, paying off outstanding debts, or maintaining their standard of living.

One key aspect of spouse voluntary life insurance is that it is separate from your employer-provided life insurance. While many employers offer basic life insurance coverage for employees, spouse voluntary life insurance allows you to choose additional coverage specifically for your spouse. This means that you have more control over the amount of coverage and the specific terms of the policy.

It is important to note that spouse voluntary life insurance typically has its own set of premiums and coverage options. The cost of the insurance will depend on factors such as your spouse’s age, health status, and the desired coverage amount. Additionally, the coverage amount can vary depending on the policy you select, ranging from a certain percentage of your own life insurance coverage to a fixed dollar amount.

Overall, spouse voluntary life insurance offers an important level of financial protection for your spouse or partner. It provides peace of mind knowing that your loved one will be taken care of financially in the event of your spouse’s unexpected passing. By considering spouse voluntary life insurance, you are taking a proactive step in securing the financial future of your family.

Benefits of Spouse Voluntary Life Insurance

Spouse voluntary life insurance provides several benefits that can bring peace of mind to you and your loved ones. Let’s explore some of the key advantages of having this type of coverage:

- Financial Protection for Your Spouse: The primary benefit of spouse voluntary life insurance is the financial protection it offers to your spouse. In the event of your spouse’s untimely death, the policy will provide a death benefit that can be used to cover immediate expenses, such as funeral costs, as well as long-term financial needs, such as paying off debts or replacing lost income.

- Added Security: By extending coverage to your spouse, you are providing an added layer of security for your family’s financial future. This insurance can help ensure that your spouse can continue to maintain their lifestyle and meet their financial obligations, even if you are no longer there to provide for them.

- Flexibility in Coverage Amount: Spouse voluntary life insurance allows you to choose the appropriate coverage amount for your spouse. This flexibility enables you to tailor the policy to your specific needs and budget. You can select a coverage amount that aligns with your spouse’s financial needs and future goals.

- Portability: Unlike employer-provided life insurance, spouse voluntary life insurance is typically portable. This means that even if you change jobs or leave your current employer, you can usually take the policy with you. This portability ensures that your spouse’s coverage remains intact, providing continued protection irrespective of your employment status.

- Supplement to Other Policies: If you and your spouse already have individual life insurance policies, spouse voluntary life insurance can act as a supplement to those policies. It provides an additional safety net, addressing any gaps or limitations in the individual coverage. This can provide your spouse with even more financial security in the unfortunate event of your passing.

Overall, spouse voluntary life insurance offers valuable benefits that help safeguard the financial well-being of your spouse. It provides peace of mind and ensures that your loved one will be taken care of financially when they need it the most. Consider adding this coverage option to your life insurance policy to enhance the protection for your entire family.

Eligibility for Spouse Voluntary Life Insurance

In order to be eligible for spouse voluntary life insurance, certain criteria must be met. While requirements may vary depending on the insurance provider, the following are common eligibility factors to consider:

- Marital Status: As the name suggests, spouse voluntary life insurance is specifically designed for married couples or partners in a civil union. Generally, you need to be legally married or in a recognized domestic partnership to qualify for this type of coverage.

- Employment Status: Most spouse voluntary life insurance policies are offered through employers as part of their employee benefits package. Therefore, you and your spouse typically need to be employed by the same company or organization that offers the insurance. Some employers may also require a minimum number of hours worked or a minimum length of employment to be eligible.

- Age Limitations: Insurance providers usually have age restrictions for coverage. Both you and your spouse will likely need to be within a certain age range to qualify for spouse voluntary life insurance. The specific age limits can vary, but it is common for coverage to be available for spouses between the ages of 18 and 70.

- Health Evaluation: Depending on the insurance provider, a health evaluation may be required for your spouse to qualify for coverage. This can involve completing a health questionnaire or undergoing a medical examination. The purpose of this evaluation is to assess the overall health and determine the level of risk associated with insuring your spouse.

It is important to note that eligibility requirements can differ between insurance providers and specific policy options. Some providers may have additional criteria or restrictions in place, so it is essential to review the terms and conditions of the insurance policy and consult with an insurance agent or representative for accurate and up-to-date information.

Overall, meeting the eligibility criteria ensures that both you and your spouse can access the benefits of spouse voluntary life insurance. It is advisable to carefully review the requirements and consider the coverage options available to determine the best fit for your specific needs and circumstances.

Coverage Options for Spouse Voluntary Life Insurance

Spouse voluntary life insurance offers a range of coverage options to suit your specific needs and circumstances. These options allow you to customize the policy to provide the right level of financial protection for your spouse. Here are some common coverage options available:

- Percentage of Primary Policy: One popular coverage option is to provide a percentage of the primary policy’s coverage amount for your spouse. For example, if your primary life insurance policy has a death benefit of $500,000, you can choose to offer your spouse 50% or any other designated percentage of that coverage amount as their spouse voluntary life insurance policy.

- Fixed Dollar Amount: Alternatively, you can select a specific dollar amount as the coverage for your spouse. This option allows you to decide the exact value of the policy, regardless of the coverage amount of your primary policy. It enables you to tailor the coverage to the financial needs of your spouse, and you can adjust the amount as necessary over time.

- Incremental Coverage: Some insurance providers offer incremental coverage options where you can choose to increase the coverage amount for your spouse at specific intervals or life events. This flexibility allows you to adjust the policy as your spouse’s needs change over time, such as with the birth of a child or a significant increase in financial responsibilities.

- Guaranteed Issue: In some cases, spouse voluntary life insurance may be offered on a guaranteed issue basis. This means that your spouse can obtain coverage without having to undergo a medical examination or provide detailed health information. This can be particularly beneficial if your spouse has pre-existing health conditions that could impact their eligibility for coverage.

It is important to carefully consider the coverage options available to ensure that your spouse’s insurance aligns with their financial needs and goals. Take into account factors such as your spouse’s age, current financial obligations, and any future financial plans. Additionally, reviewing the terms and conditions of the policy and consulting with an insurance professional can help you make an informed decision.

By choosing the right coverage option for your spouse voluntary life insurance, you are providing the necessary financial protection that will help ensure your spouse’s well-being and financial security in the event of your passing.

How Does Spouse Voluntary Life Insurance Work?

Spouse voluntary life insurance works similarly to individual life insurance policies but with the added coverage specifically for your spouse. Here is an overview of how this type of insurance works:

Policyholder and Beneficiary: As the policyholder, you are the individual who owns the spouse voluntary life insurance policy. You have the responsibility of paying the premiums and managing the coverage. Your spouse is the designated beneficiary of the policy, which means they will receive the death benefit in the event of your spouse’s passing.

Premium Payments: Just like with individual life insurance, spouse voluntary life insurance requires premium payments. You will need to make regular payments to maintain the coverage for your spouse. The premium amount is typically based on factors such as your spouse’s age, health, and the chosen coverage amount.

Death Benefit: If your spouse passes away while the policy is in effect, the insurance provider will pay out a death benefit to the designated beneficiary, which is your spouse. This benefit can be a lump sum payment or provided in installments, depending on the terms of the policy. Your spouse can use this benefit to cover various expenses and financial obligations.

Coverage Limitations: It is important to be aware of any limitations or exclusions that may apply to spouse voluntary life insurance. Some policies may have a waiting period before the full death benefit is payable. Additionally, there may be specific circumstances or causes of death that are not covered by the policy. It is crucial to thoroughly review the terms and conditions of the policy to understand the coverage limitations.

Duration of Coverage: Spouse voluntary life insurance can have different durations, depending on the policy you choose. Some policies provide coverage for a specific term, such as 10 or 20 years. Others offer coverage for the entire lifespan of the insured individual, as long as the premiums are paid. Be sure to understand the duration of coverage when selecting the policy.

It is important to note that spouse voluntary life insurance is typically separate from your own life insurance policy. While they may be linked as add-ons, they function as two distinct policies with separate coverage and beneficiaries.

By having spouse voluntary life insurance, you are taking an important step in securing the financial future of your spouse or partner. It provides the necessary funds to help your spouse navigate the financial challenges that may arise upon your passing, ensuring their financial well-being during a difficult time.

How to Enroll for Spouse Voluntary Life Insurance

If you are interested in enrolling for spouse voluntary life insurance, the process typically involves the following steps:

- Evaluate Available Options: Start by researching and evaluating the spouse voluntary life insurance options available to you. Check with your employer or consult with an insurance agent to understand the policies offered, coverage limits, and premium costs. Compare different plans to find the one that best suits your needs and budget.

- Review Eligibility Requirements: Familiarize yourself with the eligibility requirements for spouse voluntary life insurance. Ensure you and your spouse meet the criteria, such as being legally married or in a recognized domestic partnership and being employed by an organization that offers the insurance.

- Collect Documentation: Gather any necessary documentation required for enrollment. This may include proof of marriage or partnership, employment information, and identification documents for both you and your spouse. Make sure to have all the necessary paperwork ready to streamline the enrollment process.

- Enrollment Period: Typically, spouse voluntary life insurance enrollment is done during a specified enrollment period. This is often tied to your employer’s open enrollment period or upon eligibility for new employees. Be mindful of the enrollment period and ensure you submit your application within the designated timeframe.

- Complete the Application: Fill out the application form for spouse voluntary life insurance accurately and thoroughly. Provide all required information, including personal details for both you and your spouse, desired coverage amount, and beneficiary designation. Review the application carefully before submission to ensure accuracy.

- Medical Examination (if applicable): Depending on the insurance provider and policy, a medical examination or health evaluation may be required for your spouse. If this is the case, schedule the necessary appointments and complete any required medical tests. Ensure all health information is accurately reported on the application form.

- Submit the Application: After completing the application and any required medical evaluations, submit it to the insurance provider or your employer’s benefits administrator. Follow the provided instructions for submission, including any additional documents or signatures that are necessary.

Once your application is submitted, it will be reviewed by the insurance provider or benefits administrator. If approved, you will receive confirmation of coverage and information regarding premium payments. Keep a copy of all documentation related to your spouse voluntary life insurance for future reference.

Remember, it is crucial to understand the specific process and requirements set by your insurance provider or employer’s benefits program. If you have any questions, reach out to the insurance provider’s customer service or consult with an insurance professional for guidance.

By following the enrollment process, you can secure spouse voluntary life insurance coverage to provide additional financial protection for your spouse or partner.

Premiums and Costs of Spouse Voluntary Life Insurance

Understanding the premiums and costs associated with spouse voluntary life insurance is crucial when considering this type of coverage. Here are some key points to consider:

Premium Calculation: The premium for spouse voluntary life insurance is typically calculated based on several factors, including your spouse’s age, health status, and the coverage amount you choose. Generally, younger and healthier individuals will have lower premiums compared to older or less healthy individuals.

Group Insurance Rates: Spouse voluntary life insurance is often offered as part of a group insurance plan through employers. Group insurance plans tend to offer more affordable rates compared to individual policies, as the risk is spread among a larger pool of insured individuals. This can result in lower premiums for spouse voluntary life insurance.

Dependent Coverage Costs: The cost of spouse voluntary life insurance is separate from the premium for your own life insurance policy. The premium for the dependent coverage is typically an additional expense beyond what you pay for your own coverage. The exact cost will depend on the coverage amount, age, and health of your spouse.

Additional Riders: Some insurance providers offer optional riders that can be added to the spouse voluntary life insurance policy. These riders provide extra coverage or benefits, such as accidental death coverage or accelerated death benefits. The inclusion of riders can impact the overall cost of the policy, so it’s essential to consider the potential additional costs and benefits they provide.

Premium Payment Frequency: Premiums for spouse voluntary life insurance are usually paid on a regular basis, such as monthly or annually, depending on the insurance provider’s policies. Consider your budget and choose a premium payment frequency that works best for you. Keep in mind that selecting a different premium payment frequency may have a minor impact on the total cost of the policy.

Policy Renewal: Spouse voluntary life insurance policies are typically renewable, meaning they can be extended beyond the initial coverage term. However, when renewing the policy, the premium costs may change based on various factors, such as changes in your spouse’s age or health status. It’s essential to review the renewal process and potential premium adjustments before committing to the policy.

It is important to review and compare the premiums and costs of different spouse voluntary life insurance policies. Consider obtaining quotes from multiple insurance providers to assess the competitiveness of the pricing and coverage options available. Additionally, consult with an insurance professional who can provide guidance and help you navigate the cost considerations.

By understanding the premiums and costs associated with spouse voluntary life insurance, you can make an informed decision that aligns with your budget and provides the necessary protection for your spouse or partner.

Claiming Benefits from Spouse Voluntary Life Insurance

When the unfortunate event of your spouse’s passing occurs, it is essential to understand how to claim the benefits from the spouse voluntary life insurance policy. Here’s a general overview of the process:

- Notify the Insurance Provider: As soon as possible after your spouse’s passing, contact the insurance provider to inform them of the death. They will guide you through the claims process and provide the necessary forms and documentation.

- Gather Required Documents: The insurance provider will typically require specific documents to process the claim. These may include a death certificate, proof of identification, the policyholder’s information, and any other supporting documents requested by the insurance provider.

- Complete the Claims Form: Fill out the claims form provided by the insurance provider. Include all necessary details, such as policy information, your spouse’s information, and any additional requested information. Ensure that the form is accurately completed to avoid delays in the claims process.

- Submit the Claims Form: Once the claims form is completed, submit it to the insurance provider according to their specified method. It can usually be done through mail or online submission. Include any required supporting documents along with the form.

- Review of the Claim: The insurance provider will review the submitted claim form and documentation. They may request additional information or clarification if needed. It is essential to promptly respond to any requests to avoid delays in the claims process.

- Benefit Disbursement: After the claim is reviewed and approved, the insurance provider will disburse the death benefit to the designated beneficiary, which is typically you as the surviving spouse. The benefit can be provided as a lump sum payment or in installments, depending on the terms of the policy.

- Use of the Death Benefit: The death benefit received from the spouse voluntary life insurance policy can be used at your discretion. It can cover immediate expenses, such as funeral costs or outstanding debts, as well as provide long-term financial support for you and your family.

It is important to note that the claims process may vary slightly depending on the insurance provider’s policies and any specific requirements outlined in the spouse voluntary life insurance policy. It is advisable to carefully review the terms and conditions of the policy and reach out to the insurance provider’s customer service or claims department for any necessary guidance.

By understanding the process and promptly filing the necessary claims forms and documentation, you can ensure a smooth and efficient claims process during a difficult time. The benefits received from the spouse voluntary life insurance policy can help provide the financial support needed to navigate the aftermath of your spouse’s passing.

Frequently Asked Questions (FAQs)

Here are some commonly asked questions about spouse voluntary life insurance:

- Is spouse voluntary life insurance the same as dependent life insurance?

Spouse voluntary life insurance is a type of dependent life insurance that specifically covers your spouse or partner. It provides additional financial protection for your spouse in the event of your passing. - Can I have spouse voluntary life insurance if my spouse doesn’t work?

Yes, you can still have spouse voluntary life insurance even if your spouse doesn’t work. As long as you meet the eligibility criteria set by the insurance provider or employer, you can extend coverage to your non-working spouse. - Can I change the coverage amount for my spouse voluntary life insurance?

In many cases, you can change the coverage amount for your spouse voluntary life insurance during certain life events or within specific policy limitations. Speak to your insurance provider or benefits administrator to understand the options available for adjusting the coverage amount. - Can I cancel spouse voluntary life insurance at any time?

Generally, you can cancel spouse voluntary life insurance at any time. However, it is advisable to review the terms of the policy and consult with your insurance provider or benefits administrator to understand any potential penalties or consequences of canceling the coverage. - Is spouse voluntary life insurance portable if I change jobs?

In many cases, spouse voluntary life insurance is portable, meaning you can take it with you if you change jobs. However, it is essential to review the policy details and consult with the insurance provider to understand the portability options and any necessary steps to maintain the coverage. - Can I have spouse voluntary life insurance if I already have an individual life insurance policy?

Yes, you can typically have spouse voluntary life insurance even if you have an individual life insurance policy. Spouse voluntary life insurance can act as an additional layer of coverage, providing extra financial protection for your spouse or partner.

If you have more specific questions regarding spouse voluntary life insurance, it is advisable to consult with an insurance professional or reach out to your insurance provider for accurate and detailed information tailored to your specific situation.

Conclusion

Spouse voluntary life insurance is a valuable option to consider when it comes to protecting the financial well-being of your spouse or partner. By extending coverage beyond your own life insurance policy, you provide an added layer of protection that can help alleviate the financial burden that your loved one may face in the event of your passing.

In this article, we discussed the importance of spouse voluntary life insurance and its benefits. We explored eligibility requirements, coverage options, and the process of enrolling for this type of insurance. Additionally, we provided an overview of premiums and costs associated with spouse voluntary life insurance, as well as the process of claiming the benefits and responding to frequently asked questions.

When considering spouse voluntary life insurance, it is important to assess your specific needs, budget, and the coverage options available to you. Research different insurance providers, review the terms and conditions of the policies, and consult with an insurance professional for guidance. By doing so, you can make an informed decision that provides the necessary financial protection for your spouse or partner.

Remember, spouse voluntary life insurance not only offers peace of mind but also ensures that your loved one will be supported in the face of unforeseen circumstances. By taking the proactive step of securing this additional coverage, you prioritize the financial stability and well-being of your family.

Take the time to evaluate your options, gather the necessary information, and make an informed choice. By choosing spouse voluntary life insurance, you are investing in the future security and peace of mind for both yourself and your spouse.