Finance

What Is Store Credit

Published: January 13, 2024

Learn about store credit and how it can benefit your personal finances. Explore the advantages of using store credit for your purchases and managing your budget effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

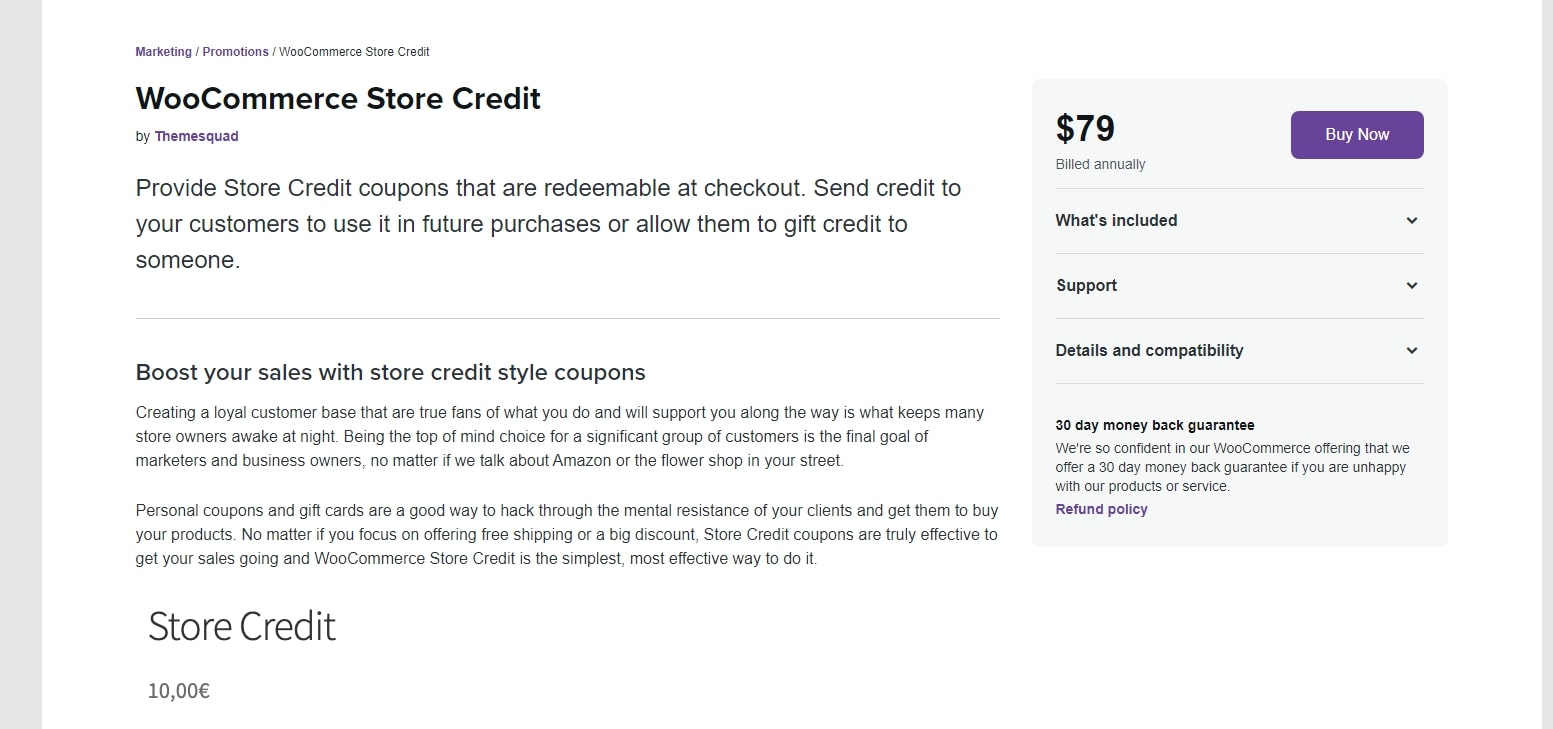

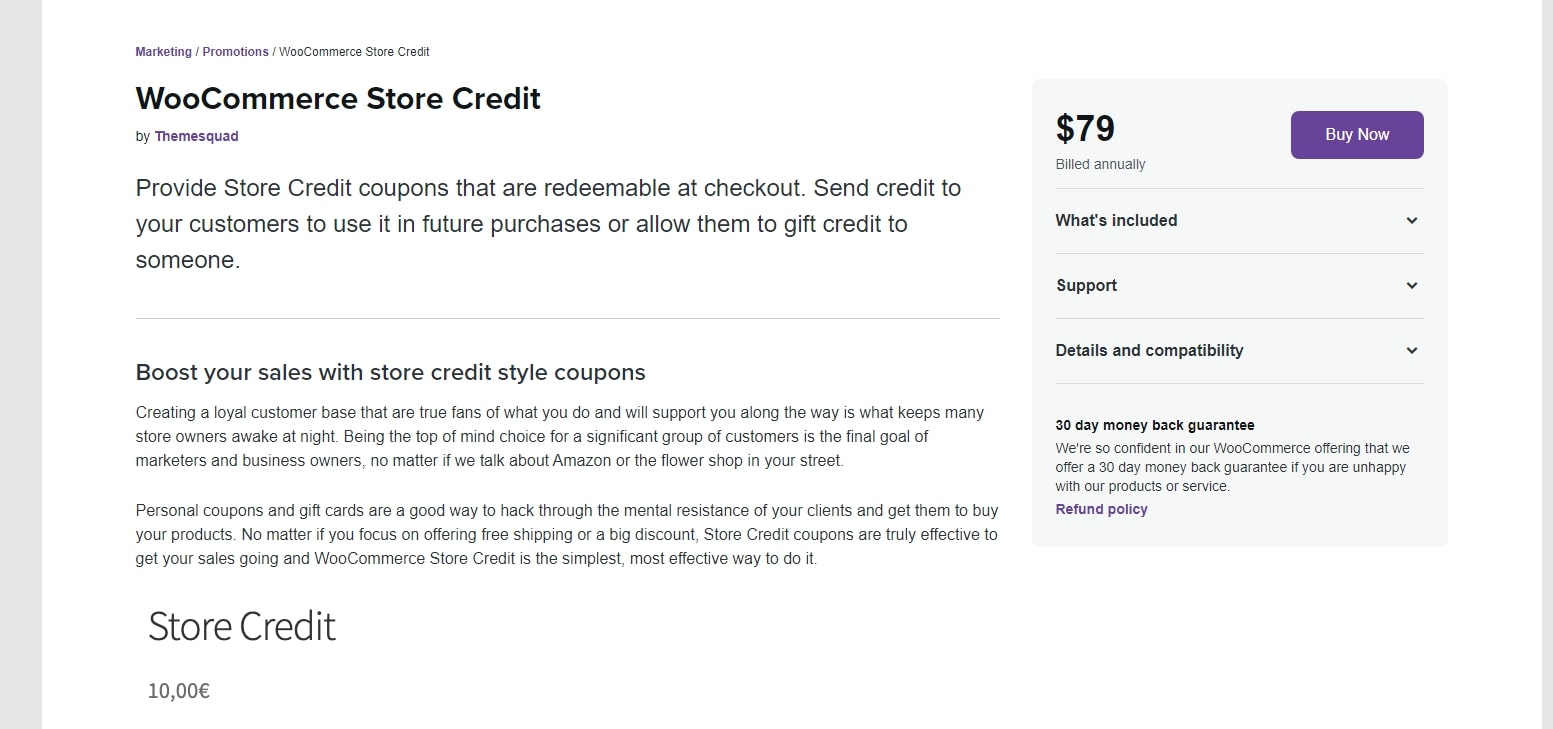

Store credit is a financial tool that has gained popularity in recent years, offering consumers a convenient and flexible alternative to traditional payment methods. It is essentially a form of credit issued by a specific retailer or business, allowing customers to make purchases within that establishment without using cash or a credit card.

Store credit can be compared to a virtual wallet that holds a predetermined amount of money that can only be used within the issuing store. It provides shoppers with the freedom to buy products or services on credit, without the need for an external credit card or loan. This form of credit is typically accessible to customers as a result of returns, exchanges, or special promotions offered by the store.

The concept of store credit is not new, as retailers have long utilized it as a means of building customer loyalty and encouraging repeat purchases. However, with the advent of online shopping and e-commerce, store credit has become more prevalent and accessible to a wider range of consumers.

Store credit offers several benefits for both customers and retailers. For customers, it provides a convenient and flexible payment option, allowing them to make purchases even if they don’t have immediate access to cash or a credit card. It also eliminates the worry of maxing out credit cards or incurring high-interest charges.

On the other hand, retailers benefit from issuing store credit by increasing customer retention and encouraging repeat business. It serves as a marketing tool, fostering brand loyalty and incentivizing customers to continue shopping within their store.

In the following sections, we will delve deeper into how store credit works, its advantages and disadvantages, how to obtain it, and how it differs from gift cards. By understanding these aspects, you will be better equipped to make informed decisions regarding the utilization of store credit.

Definition of Store Credit

Store credit is a form of currency issued by a specific retailer or business that can be used as a payment method for purchases within the same establishment. It represents the amount of money a customer has available to spend within that particular store, much like a virtual wallet.

Store credit is different from traditional forms of payment such as cash or credit cards because it can only be used within the issuing store. It is typically provided to customers as a result of returns, exchanges, or special promotions offered by the retailer.

When a customer returns an item that was originally purchased using cash or a credit card, they may choose to receive store credit instead of a refund in the form of cash. This store credit can then be used to make future purchases within the store.

In some cases, store credit may be issued as a form of compensation or an incentive to encourage customer loyalty. For example, a retailer might offer store credit to customers who sign up for a store loyalty program or as part of a promotional campaign.

Store credit is typically associated with a specific customer account, either in the form of a physical card or a digital account tied to the customer’s email address or phone number. Customers can usually check their available store credit balance either online or at the store’s customer service desk.

It’s important to note that store credit cannot be used to make purchases outside of the issuing store. It is non-transferable and can only be redeemed within the specified establishment where it was issued.

Overall, store credit provides consumers with a convenient and flexible payment option within a specific retailer or business, allowing them to make purchases without the need for cash or a credit card. For retailers, it serves as a valuable tool to foster customer loyalty and encourage repeat business.

How Store Credit Works

Store credit works as a form of virtual currency that can be used for purchases within the issuing store. Here is a breakdown of how store credit works:

1. Acquisition: Store credit is typically acquired through returns, exchanges, or special promotions offered by the retailer. When a customer returns an item, instead of receiving a cash refund, they may be given the option to receive the refunded amount in the form of store credit. Alternatively, store credit can be offered as part of a loyalty program, incentive, or promotional campaign.

2. Issuance: Once the store credit is acquired, it is usually credited to the customer’s account. This can be in the form of a physical card, a digital account, or a unique code associated with the customer’s details. The store credit amount is determined by the value of the returned item or the promotion offering.

3. Redemption: Customers can then redeem their store credit by presenting their account details or physical card at the point of purchase. The store credit amount is deducted from the total purchase price, and any remaining credit can be saved for future use.

4. Limitations: It’s important to note that store credit is typically non-transferable and can only be used within the issuing store. It cannot be redeemed for cash and may have an expiration date, so it’s important to use it before it expires.

5. Tracking and Balances: Most retailers provide customers with an option to track their store credit balance. This can be done through online portals, mobile apps, or by visiting the customer service desk at the store. Customers can keep track of their available store credit balance to know how much they have available for future purchases.

6. Combining with Other Payment Methods: In some cases, customers may have the option to combine store credit with other payment methods, such as cash or credit cards, to complete a purchase. This allows customers to use their store credit for part of the payment and pay the remaining balance using another method.

Store credit offers a convenient way for customers to make purchases without relying on cash or credit cards. It also benefits retailers by encouraging repeat purchases and driving customer loyalty. By understanding how store credit works, both customers and retailers can optimize its usage and enjoy the advantages it provides.

Advantages of Store Credit

Store credit offers several advantages to both customers and retailers. Here are some key benefits of using store credit:

1. Flexible Payment Option: Store credit provides customers with a flexible payment option, allowing them to make purchases without relying on cash or credit cards. This is especially beneficial for individuals who may not have immediate access to funds or prefer not to use credit cards.

2. Avoiding Interest Charges: By using store credit for purchases, customers can avoid accumulating interest charges that would typically be associated with credit card purchases. This can help keep expenses in check and prevent the burden of high-interest debts.

3. Keep Gift Returns Simple: In situations where customers receive gifts they wish to return, store credit offers a convenient solution. Instead of going through the hassle of returning the item and receiving a cash refund, customers can opt for store credit, making the process quicker and easier.

4. Encourages Repeat Purchases: Store credit acts as an incentive for customers to continue shopping at the same retailer. When customers have store credit available, they are more likely to return to the store to make additional purchases, boosting customer retention and increasing sales for the retailer.

5. Greater Purchasing Power: Store credit allows customers to access a specific amount of money designated for purchases within the store. This increases their purchasing power, enabling them to buy higher-value items or indulge in products or services they may not have been able to afford otherwise.

6. Convenient Tracking: Most retailers provide customers with the ability to track their store credit balances online or through mobile apps. This makes it easy for customers to stay updated on their available credit and plan their future purchases accordingly.

7. Marketing and Promotions: Store credit can be used by retailers as a marketing tool to attract customers. By offering store credit as part of promotional campaigns or loyalty programs, retailers can increase brand loyalty, entice customers to make additional purchases, and differentiate themselves from competitors.

Overall, store credit offers a range of advantages for both customers and retailers. It provides a convenient and flexible payment option, encourages repeat purchases, and enhances customer satisfaction. By leveraging these benefits, store credit can be a valuable tool for improving the shopping experience and driving business growth.

Disadvantages of Store Credit

While store credit offers various advantages, it is important to consider the potential disadvantages that come with using it. Here are some drawbacks to be aware of:

1. Limited Usability: The primary drawback of store credit is its limited usability. Unlike cash or a credit card, store credit can only be used within the issuing store. This can be restrictive, especially if customers prefer to have the flexibility to shop at different retailers or online platforms.

2. Expiration Dates: Store credit often comes with an expiration date, meaning it must be used within a specified timeframe. If customers fail to use their store credit before it expires, they may lose out on the value they were entitled to, resulting in wasted funds.

3. Non-Transferrable: Store credit is typically non-transferrable and cannot be given to someone else as a form of payment or gift. This limitation can be inconvenient for customers who may have preferred to transfer their store credit to another individual or use it to make purchases on behalf of someone else.

4. Store-Specific Usage: As mentioned earlier, store credit is only applicable for purchases within the issuing store. This can be problematic if the store does not offer a wide range of products or if customers prefer to shop at different retailers to get a better variety or price options.

5. Limited Return Options: When customers receive store credit for returned items, they may have limited options if they want a cash refund instead. This can pose an issue if customers find themselves needing the funds for other purposes or if they would rather have the flexibility to spend the money elsewhere.

6. Inefficient Refunds: In some cases, store credit is automatically issued instead of providing customers with a cash refund for returned items. This can be frustrating for customers who were expecting a cash refund and may lead to a more time-consuming and complicated process to receive the funds they are owed.

Despite these disadvantages, store credit can still offer value and convenience for certain customers, especially those who frequently shop at the issuing store and can utilize the credit within the given timeframe. It is essential for individuals to assess their personal shopping habits and preferences before deciding to use store credit.

How to Obtain Store Credit

Obtaining store credit is typically a straightforward process, and there are a few common ways to acquire it. Here are some ways to obtain store credit:

1. Returns and Exchanges: One of the most common ways to receive store credit is through returns and exchanges. When you return an item to a store, instead of receiving a cash refund, you may have the option to choose store credit as a form of reimbursement. This enables you to use the credit towards future purchases at that particular store.

2. Loyalty Programs: Many retailers offer store credit as a perk of their loyalty programs. By signing up for the program, you can earn points or credits based on your purchases. These accumulated points can then be redeemed for store credit, allowing you to make future purchases at the store at a discounted or even free price.

3. Special Promotions and Incentives: Retailers occasionally run special promotions or incentives that grant store credit to customers. For example, they may offer store credit for reaching a specific spending threshold, participating in a survey or contest, or referring new customers to their store. Keep an eye out for these opportunities to earn store credit.

4. Gift Returns: If you receive a gift that you wish to return, some stores may offer the option to receive store credit instead of a cash refund. This provides a convenient solution and allows you to choose something else from the same store.

5. Store Credit Cards: Some retailers offer store credit cards that are linked to their store’s credit system. These cards often come with incentives, such as rewards programs or special discounts. When you make purchases using the store credit card, you can earn store credit that can be used for future transactions.

To obtain store credit, it is important to familiarize yourself with the specific policies and procedures of the retailer. This includes understanding their return and exchange policies, signing up for loyalty programs if available, and taking advantage of any special promotions or offers that they may have.

Remember to keep track of your store credit balances and any expiration dates associated with the credit. This will ensure that you make timely and efficient use of the store credit that you have obtained.

By utilizing these methods, you can acquire store credit and enjoy the flexibility and benefits it provides for your future purchases within the store.

Using Store Credit

Using store credit is a simple and convenient process. Once you have obtained store credit, here’s how you can effectively use it:

1. Check the Balance: Before making a purchase, it is important to check the balance of your store credit. This can typically be done by logging into your online account, using a mobile app, or contacting customer service either in-store or via phone. Knowing your available store credit balance ensures that you can make informed purchasing decisions.

2. Select Your Items: Browse the store’s offerings and choose the items you wish to purchase. Keep in mind that store credit is often only valid for products or services within the issuing store. Be sure to select items that fall within your available store credit amount.

3. Present Store Credit: At the time of checkout, inform the cashier or provide your store credit details, such as a physical card or digital account information. The cashier will deduct the amount of your purchase from your store credit balance.

4. Cover Remaining Balance: If your store credit does not cover the entire purchase amount, you will need to pay the remaining balance using another payment method, such as cash, credit card, or debit card. This allows you to combine different payment methods to complete the transaction.

5. Keep Track of Changes: After using store credit, it is important to keep track of any changes to your remaining balance. If you have any unused store credit after the transaction, it will still be available for future purchases within the store.

6. Return and Exchange Policies: It’s important to understand the return and exchange policies specific to items purchased with store credit. Some retailers may have different policies for returns or exchanges involving store credit. Familiarize yourself with these policies to ensure a smooth process in case you need to make any changes to your purchase.

Remember to use your store credit before it expires, as most store credit has an expiration date. Utilizing your store credit ensures that you are maximizing its value and enjoying the benefits it provides.

Using store credit offers a convenient way to make purchases within a specific store without relying solely on cash or credit cards. By effectively managing your store credit and understanding the store’s policies, you can take full advantage of this payment option and make the most of your shopping experience.

Store Credit vs. Gift Cards

Store credit and gift cards are both forms of payment options that provide flexibility and convenience to shoppers. While they may seem similar, there are some key differences between the two. Here’s a comparison of store credit and gift cards:

1. Usage Restrictions: Store credit can only be used within the issuing store or retailer. It is non-transferable and cannot be used at other establishments. On the other hand, gift cards are often more versatile and can be used at multiple stores or even online, depending on the card’s network or brand.

2. Acquisition: Store credit is typically obtained through returns, exchanges, or as part of loyalty programs offered by the retailer. It is often specific to an individual’s account with that particular store. Gift cards, on the other hand, are usually purchased by the buyer and can be given as a gift or obtained as a promotional item.

3. Expiration and Fees: Store credit may have an expiration date, meaning it must be used within a certain timeframe. In contrast, gift cards often come with regulations regarding expiration dates, but regulations can vary by jurisdiction. Gift cards may also have fees associated with inactivity or maintenance, while store credit is typically fee-free.

4. Flexibility: Store credit is limited to the issuing store, which means the user can only make purchases within that specific retailer. Gift cards, on the other hand, offer users more flexibility as they can be used at multiple stores or online platforms, depending on the card’s acceptance.

5. Return and Refund Policies: When it comes to returning or refunding items purchased with store credit, policies may differ from regular cash or credit card purchases. Returns may result in store credit being issued rather than a cash refund. With gift cards, returns are often treated similarly to cash or credit card transactions, with refunds being issued back to the original payment method.

6. Personal vs. Gifting: Store credit is usually tied to an individual’s account and cannot be transferred to someone else. It is meant for personal use within the store. Gift cards, on the other hand, are designed primarily for gifting purposes and can be given to someone else to use as a form of payment.

Both store credit and gift cards have their advantages and are useful in different scenarios. Store credit is beneficial for those who frequently shop at a specific retailer and want to maximize their purchasing power within that store. Gift cards, on the other hand, provide more flexibility and can be a great option for gifts or when shopping across multiple stores.

Understanding the differences between store credit and gift cards can help consumers make informed decisions about which payment option best suits their needs and preferences.

Conclusion

Store credit serves as a convenient and flexible payment option within a specific retailer or business. It provides customers with the ability to make purchases without relying on cash or credit cards, offering various advantages such as increased purchasing power, avoiding interest charges, and simplifying gift returns. Store credit is also beneficial for retailers as it encourages repeat purchases, fosters customer loyalty, and can be used as a marketing tool.

However, it’s important to consider the disadvantages of store credit, such as its limited usability, expiration dates, and non-transferability. Customers should carefully evaluate their shopping habits, preferences, and the specific policies of the retailer before deciding to use store credit.

When using store credit, customers should be aware of their available balance, shop within the designated store, and understand the return and refund policies associated with store credit purchases. Keeping track of expiration dates and any remaining balances is essential to make the most of the store credit.

Store credit differs from gift cards, as it is specific to the issuing store and non-transferable, while gift cards offer more flexibility and can be used in multiple establishments. Customers should consider their gifting needs and shopping preferences when deciding between store credit and gift cards.

In conclusion, store credit provides a convenient and flexible payment option for customers and serves as an effective tool for retailers to increase customer retention and loyalty. By understanding how store credit works, its advantages and disadvantages, and adhering to proper usage, customers can maximize its benefits and enjoy a seamless and rewarding shopping experience.