Finance

What Stores Accept Mobile Payments?

Published: February 28, 2024

Discover which stores accept mobile payments and streamline your finances with ease. Find out where you can use your mobile wallet for convenient transactions. Explore the top retailers that embrace this modern payment method.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- The Rise of Mobile Payments: Revolutionizing the Shopping Experience

- Embracing Innovation: Leading Retailers at the Forefront of Mobile Payments

- Empowering Small Businesses: Embracing Mobile Payments for Enhanced Customer Experience

- Seamless Transactions in the Digital Realm: Mobile Payments Transforming Online Shopping

- Empowering Consumers and Businesses: Unlocking the Advantages of Mobile Payments

- Navigating the Complexities: Understanding the Potential Drawbacks of Mobile Payments

- Embracing Innovation: Navigating the Future of Mobile Payments

Introduction

The Rise of Mobile Payments: Revolutionizing the Shopping Experience

Welcome to the era of convenience and seamless transactions, where the simple act of making a purchase has been transformed by the power of mobile technology. With the widespread adoption of smartphones and the evolution of digital payment systems, consumers now have the option to complete transactions using their mobile devices, eliminating the need for physical wallets and traditional payment methods.

In recent years, the retail landscape has witnessed a significant shift towards embracing mobile payments, with major retailers, smaller businesses, and online stores recognizing the value of offering this convenient payment option to their customers. This shift not only caters to the preferences of tech-savvy consumers but also aligns with the growing demand for efficient and secure payment solutions.

This article delves into the world of mobile payments, shedding light on the major retailers, smaller businesses, and online stores that have embraced this innovative payment method. Additionally, we will explore the benefits of using mobile payments, as well as the potential risks and concerns associated with this technology. By the end of this journey, you will have a comprehensive understanding of the mobile payment landscape and the impact it has on the modern shopping experience.

Major Retailers Accepting Mobile Payments

Embracing Innovation: Leading Retailers at the Forefront of Mobile Payments

As the demand for seamless and efficient payment methods continues to rise, major retailers have been quick to adopt mobile payment technologies, catering to the preferences of their tech-savvy customer base. These industry giants understand the importance of staying ahead of the curve, offering a convenient and secure payment option that aligns with the modern consumer’s lifestyle.

One of the prominent players in the mobile payment arena is Apple Pay, which has gained widespread acceptance across various major retailers. With its seamless integration with iOS devices, Apple Pay has become a favored choice for customers at renowned establishments such as Starbucks, McDonald’s, and Walgreens. The simplicity and security offered by Apple Pay have positioned it as a go-to payment method for countless individuals seeking a frictionless transaction experience.

Similarly, Google Pay has made significant inroads into the retail space, forging partnerships with leading retailers to provide a seamless payment experience for Android users. Retail giants such as Target, Best Buy, and Walmart have embraced Google Pay, empowering their customers to make purchases with a simple tap of their smartphones. This widespread acceptance underscores the growing influence of mobile payments in shaping the future of retail transactions.

Beyond Apple Pay and Google Pay, major retailers like Costco, Whole Foods, and CVS Pharmacy have also integrated mobile payment options into their checkout process, recognizing the value of accommodating customers who prefer the convenience and security of digital wallets.

These major retailers’ embrace of mobile payments not only reflects the evolving consumer preferences but also underscores the industry’s commitment to leveraging technology to enhance the overall shopping experience. With the seamless integration of mobile payment solutions, these retailers are at the forefront of revolutionizing the way transactions are conducted, setting the stage for a more streamlined and customer-centric approach to retail.

Smaller Retailers Accepting Mobile Payments

Empowering Small Businesses: Embracing Mobile Payments for Enhanced Customer Experience

While major retailers have spearheaded the adoption of mobile payments, smaller businesses and local establishments have also recognized the transformative potential of this technology in catering to their customer base. By embracing mobile payments, these smaller retailers are not only keeping pace with the evolving consumer preferences but also differentiating themselves through a commitment to convenience and innovation.

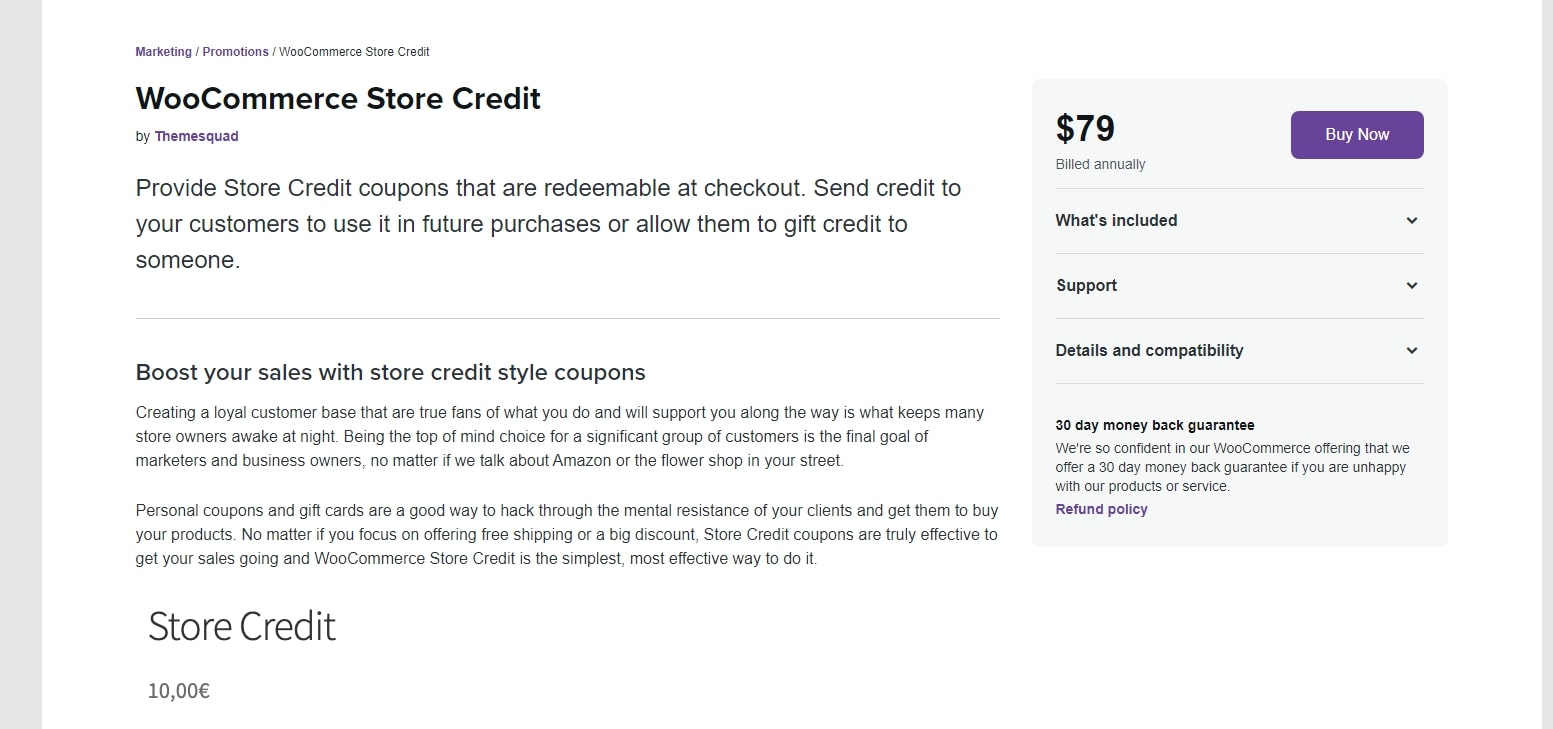

One notable player in the mobile payment space is Square, a versatile payment solution that has gained popularity among small businesses, independent retailers, and local vendors. With its user-friendly interface and seamless integration with smartphones and tablets, Square has empowered small retailers to accept various forms of digital payments, including contactless transactions and mobile wallet payments.

Additionally, PayPal Here has emerged as a valuable tool for small businesses, enabling them to accept mobile payments through a compact card reader that connects to smartphones. This flexibility allows small retailers to expand their payment options, catering to customers who prefer the convenience of mobile transactions.

Furthermore, the adoption of mobile payment technologies by smaller retailers extends beyond physical storefronts to encompass mobile and pop-up businesses. Whether at local markets, community events, or temporary retail setups, these businesses leverage mobile payments to offer a seamless and efficient transaction experience, enhancing customer satisfaction and loyalty.

By embracing mobile payments, smaller retailers demonstrate their commitment to staying abreast of technological advancements and meeting the diverse needs of their customer base. This proactive approach not only elevates the overall shopping experience for consumers but also positions these businesses as forward-thinking and customer-centric establishments in the competitive retail landscape.

Online Stores Accepting Mobile Payments

Seamless Transactions in the Digital Realm: Mobile Payments Transforming Online Shopping

In the realm of e-commerce, the integration of mobile payment options has redefined the way consumers engage in online shopping, offering a convenient and secure avenue for completing transactions. Online retailers have recognized the significance of accommodating mobile payments, catering to the increasing number of shoppers who prefer the flexibility of making purchases through their smartphones and tablets.

Leading the charge in mobile payment acceptance, e-commerce giant Amazon has seamlessly incorporated mobile wallet options such as Apple Pay and Amazon Pay into its platform, providing customers with a hassle-free payment experience. This integration allows shoppers to expedite the checkout process, streamlining their online shopping journey and enhancing overall satisfaction.

Similarly, other prominent online retailers, including eBay and Etsy, have embraced mobile payments, acknowledging the pivotal role of this technology in meeting the evolving needs of their diverse customer base. By offering a range of mobile payment options, these platforms empower users to complete transactions with ease, whether they are purchasing handmade crafts on Etsy or exploring a vast array of products on eBay.

Moreover, the seamless integration of mobile payment solutions has extended to subscription-based services and digital content providers. Platforms such as Netflix and Spotify have leveraged mobile payments to facilitate recurring transactions, allowing subscribers to manage their accounts and enjoy uninterrupted access to premium content through the convenience of their mobile devices.

By embracing mobile payments, online stores are not only enhancing the convenience of the shopping experience but also instilling confidence in consumers regarding the security and efficiency of digital transactions. This proactive approach underscores the commitment of online retailers to adapt to the changing landscape of consumer behavior, ensuring that they remain at the forefront of providing a seamless and customer-centric online shopping environment.

Benefits of Using Mobile Payments

Empowering Consumers and Businesses: Unlocking the Advantages of Mobile Payments

Mobile payments offer a myriad of benefits for both consumers and businesses, revolutionizing the way transactions are conducted and redefining the overall shopping experience. From unparalleled convenience to enhanced security, the advantages of embracing mobile payments extend across various facets of modern commerce.

- Convenience: One of the primary benefits of mobile payments is the unparalleled convenience they offer. With the ability to complete transactions using smartphones or wearable devices, consumers can forgo the need to carry physical wallets or rummage through cards, streamlining the checkout process and expediting their shopping journey.

- Efficiency: Mobile payments enable swift and efficient transactions, reducing the time spent at checkout counters. This efficiency is particularly valuable during peak shopping periods or when making quick purchases, enhancing the overall customer experience.

- Security: The robust security features embedded in mobile payment technologies, such as tokenization and biometric authentication, provide consumers with enhanced protection against fraud and unauthorized transactions. This instills a sense of confidence and trust in the safety of digital payments.

- Rewards and Loyalty Programs: Many mobile payment platforms integrate seamlessly with rewards and loyalty programs, allowing consumers to accrue points, discounts, and exclusive offers with each transaction. This incentivizes customer loyalty and engagement, fostering long-term relationships between businesses and their clientele.

- Tracking and Organization: Mobile payments facilitate efficient tracking of transactions, enabling consumers to maintain detailed records of their purchases. This level of organization contributes to better financial management and budgeting, empowering individuals to monitor their expenditure effectively.

- Accessibility: Mobile payments cater to the diverse needs of consumers, including individuals with disabilities or those who may encounter challenges with traditional payment methods. The accessibility of mobile payment technologies ensures inclusivity and equal access to seamless transaction experiences.

For businesses, the adoption of mobile payments presents additional advantages, including streamlined operations, reduced reliance on cash transactions, and the ability to cater to a broader customer base. By leveraging the benefits of mobile payments, both consumers and businesses contribute to shaping a modern, efficient, and secure commerce ecosystem that prioritizes convenience and customer satisfaction.

Risks and Concerns with Mobile Payments

Navigating the Complexities: Understanding the Potential Drawbacks of Mobile Payments

While mobile payments offer a host of benefits, it is essential to acknowledge and address the potential risks and concerns associated with this innovative payment method. As with any technological advancement, the adoption of mobile payments introduces certain complexities and vulnerabilities that warrant careful consideration by both consumers and businesses.

- Security Vulnerabilities: Despite the robust security measures implemented in mobile payment systems, there is a persistent concern regarding potential security breaches, including unauthorized access to payment credentials and sensitive financial information. This necessitates continuous vigilance and adherence to best practices for safeguarding personal data.

- Privacy Issues: The collection of consumer data through mobile payment transactions raises privacy concerns, as individuals may be apprehensive about the extent to which their purchasing behavior and personal information are monitored and utilized by payment service providers and affiliated entities.

- Technical Glitches and Connectivity Issues: The reliance on network connectivity and digital infrastructure renders mobile payments susceptible to technical glitches, network outages, and compatibility issues with different devices. These challenges can disrupt the seamless nature of transactions, leading to frustration for both consumers and businesses.

- Fraud and Unauthorized Transactions: Despite the implementation of security protocols, the potential for fraudulent activities and unauthorized transactions persists in the mobile payment ecosystem. Consumers and businesses must remain vigilant against phishing attempts, identity theft, and other fraudulent schemes that target mobile payment users.

- Dependency on Technology: The increasing reliance on mobile payments may raise concerns about the overreliance on technology for financial transactions. This dependency underscores the importance of maintaining alternative payment methods and ensuring preparedness for unforeseen technological disruptions.

- Regulatory and Compliance Challenges: The evolving landscape of mobile payments necessitates adherence to stringent regulatory frameworks and compliance standards. Businesses offering mobile payment services must navigate the complexities of regulatory requirements, ensuring adherence to data protection laws and financial regulations.

Addressing these risks and concerns requires collaborative efforts from technology providers, regulatory bodies, businesses, and consumers to establish robust security protocols, enhance privacy safeguards, and foster greater transparency in the mobile payment ecosystem. By acknowledging and mitigating these challenges, the industry can cultivate a more resilient and trustworthy environment for mobile payments, ensuring that the benefits of this innovative technology are maximized while minimizing potential drawbacks.

Conclusion

Embracing Innovation: Navigating the Future of Mobile Payments

The evolution of mobile payments has ushered in a new era of convenience, efficiency, and security in the realm of commerce, fundamentally transforming the way consumers engage in transactions and interact with businesses. From major retailers to smaller establishments and online stores, the widespread acceptance of mobile payments underscores the industry’s commitment to meeting the evolving needs of the modern consumer.

As consumers increasingly seek seamless and secure payment methods, the integration of mobile payments into the retail landscape has become a pivotal differentiator, offering unparalleled convenience and empowering individuals to navigate the shopping experience with ease. The benefits of mobile payments, including enhanced convenience, robust security measures, and seamless integration with loyalty programs, have reshaped the dynamics of consumer transactions, fostering a more engaging and personalized interaction between businesses and their clientele.

However, alongside the remarkable advantages of mobile payments, it is crucial to acknowledge and address the inherent risks and concerns associated with this innovative technology. By navigating the complexities of security vulnerabilities, privacy considerations, and regulatory challenges, stakeholders in the mobile payment ecosystem can collaboratively mitigate potential drawbacks and fortify the foundation of trust and reliability for digital transactions.

Looking ahead, the future of mobile payments holds immense promise, driven by ongoing advancements in technology, user experience enhancements, and the continuous evolution of security protocols. As businesses and consumers embrace the transformative potential of mobile payments, a concerted focus on innovation, collaboration, and responsible utilization will pave the way for a robust, inclusive, and resilient mobile payment landscape.

Ultimately, the journey of mobile payments represents a testament to the industry’s adaptability and commitment to enhancing the consumer experience. By navigating the opportunities and challenges inherent in this digital frontier, the realm of mobile payments continues to shape a dynamic and interconnected commerce ecosystem, poised to deliver unparalleled value and convenience for individuals and businesses alike.