Home>Finance>What Is The Difference Between Accounting Income And Cash Flow

Finance

What Is The Difference Between Accounting Income And Cash Flow

Modified: December 30, 2023

Learn the Difference between Accounting Income and Cash Flow in Finance. Discover how they differ in assessing a company's financial performance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to assessing the financial performance of a business, two key metrics come into play: accounting income and cash flow. Although these terms may sound similar, they represent distinct aspects of a company’s finances. Understanding the difference between accounting income and cash flow is crucial for investors, analysts, and business owners.

In simple terms, accounting income refers to the revenue and expenses reported in a company’s financial statements. It represents the amount of profit or loss generated by a business over a specific period. On the other hand, cash flow refers to the actual inflows and outflows of cash in a business. While accounting income focuses on revenues earned and expenses incurred during a given time frame, cash flow takes into account the movement of cash itself.

This article aims to provide a comprehensive understanding of the differences between accounting income and cash flow, highlighting their unique characteristics and significance in financial analysis. By delving into the concepts of timing of recognition, accrual basis vs. cash basis, and non-cash items, we will uncover the factors that set these two metrics apart. Additionally, we will discuss the importance of analyzing both accounting income and cash flow to gain a holistic perspective of a company’s financial health.

Whether you are an investor evaluating potential opportunities, an analyst deciphering financial statements, or a business owner making decisions based on financial data, grasping the distinction between accounting income and cash flow is essential. So, let’s dive in and explore the nuances of these crucial financial indicators.

Definition of Accounting Income

Accounting income, also known as net income or profit, refers to the amount of revenue generated by a business after deducting expenses and taxes. It is a measure of the company’s financial performance over a specific period, usually a fiscal year. Accounting income is reflected in a company’s financial statements, including the income statement, balance sheet, and cash flow statement.

To calculate accounting income, the revenue earned from the sale of goods or services is subtracted from the total expenses incurred during the period. Expenses include costs such as raw materials, employee salaries, rent, utilities, and other operating expenses. Once all expenses are deducted from the revenue, the resulting figure represents the net profit or loss.

Accounting income is typically measured on an accrual basis, meaning that revenues and expenses are recognized when they are incurred, regardless of whether cash has been received or paid. This adherence to the accrual method allows businesses to match revenues with the expenses incurred to generate those revenues, providing a more accurate representation of the company’s financial performance.

The accounting income figure provides valuable insights into a company’s profitability and helps investors and stakeholders evaluate the financial health of the business. It serves as a key performance indicator and is often used in financial ratios as a benchmark for financial analysis.

It is important to note that accounting income does not necessarily equate to cash on hand. While a business may have positive accounting income, it does not guarantee that the company has sufficient cash flow to fund its operations or meet its financial obligations.

Understanding the concept and calculation of accounting income is crucial for investors and financial analysts, as it allows them to assess a company’s profitability, track trends over time, and make informed investment decisions.

Definition of Cash Flow

Cash flow refers to the movement of cash into and out of a business during a specific period. It represents the actual cash inflows and outflows from operating activities, investing activities, and financing activities.

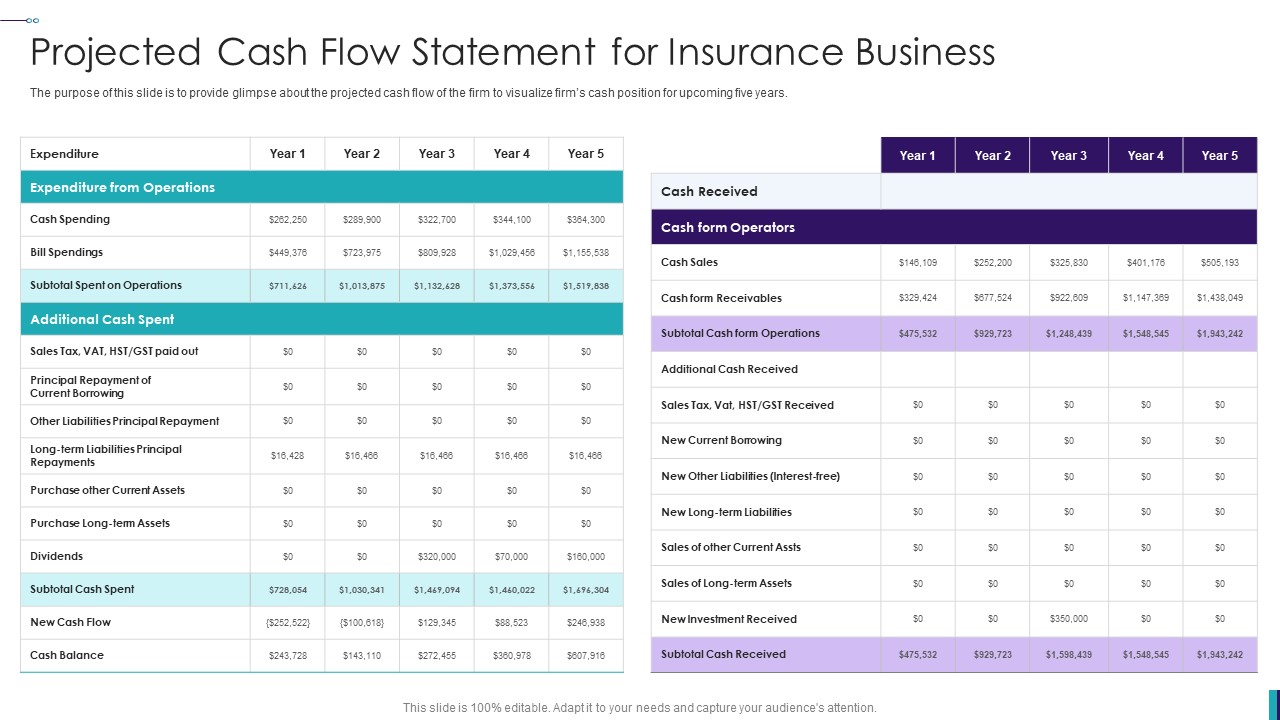

There are three main categories of cash flows:

- Operating Cash Flow: This includes cash generated from the company’s core business activities, such as customer payments, supplier payments, and employee salaries. It reflects the day-to-day cash flow resulting from the sale of goods or services.

- Investing Cash Flow: This category covers cash flow related to the acquisition or disposal of long-term assets, such as property, plant, and equipment, as well as investments in other companies or financial instruments. Investing cash flows can include cash inflows from the sale of assets and cash outflows from the purchase of assets.

- Financing Cash Flow: Financing activities involve cash flow related to the company’s financing structure, including the issuance or repayment of debt, equity financing, payment of dividends, and other capital transactions. Financing cash flows reflect the movement of cash resulting from the company’s capital structure decisions.

The calculation of cash flow involves adjusting the net income figure by adding back non-cash expenses and subtracting non-cash revenues. Non-cash expenses or revenues are items that affect the accounting income but do not involve an actual inflow or outflow of cash, such as depreciation and amortization.

The cash flow statement is a financial statement that provides a detailed breakdown of a company’s cash inflows and outflows during a particular period. It helps investors and stakeholders understand how a company manages its cash and assess its ability to generate positive cash flow.

In contrast to accounting income, which is based on the accrual method, cash flow is determined on a cash basis. This means that cash inflows and outflows are recognized when the actual cash is received or paid. Consequently, cash flow provides a more accurate representation of a company’s liquidity and its ability to meet short-term obligations.

Analysis of cash flow is essential for assessing a company’s solvency, its ability to generate cash, and its financial stability. It helps identify any potential cash flow issues and provides insights into a company’s cash management strategies.

By analyzing both accounting income and cash flow, investors and financial analysts can gain a comprehensive understanding of a company’s financial performance and make well-informed investment decisions.

Key Differences between Accounting Income and Cash Flow

While accounting income and cash flow are both important indicators of a company’s financial performance, there are several key differences between the two metrics:

- Timing of Recognition: Accounting income is recognized on an accrual basis, meaning that revenues and expenses are recorded when they are earned or incurred, regardless of the actual cash flow. In contrast, cash flow is recognized on a cash basis, where cash inflows and outflows are recorded when the cash is received or paid.

- Accrual Basis vs. Cash Basis: Accounting income is calculated using the accrual method, which allows for the matching of revenues and expenses. This provides a more accurate representation of a company’s performance over a given period. On the other hand, cash flow is determined on a cash basis, focusing solely on the movement of cash in and out of the business.

- Non-Cash Items: Accounting income may include non-cash items such as depreciation and amortization, which are expenses that do not involve an actual cash outflow. These items are accounted for in calculating accounting income but do not affect cash flow. Cash flow, on the other hand, only considers actual cash inflows and outflows.

- Focus on Profitability vs. Liquidity: Accounting income primarily focuses on measuring a company’s profitability and its ability to generate earnings. It helps assess the company’s performance, profitability ratios, and trends over time. Cash flow, on the other hand, provides insights into a company’s liquidity and its ability to generate and manage cash. It helps assess the company’s ability to meet short-term obligations and fund its operations.

- Importance in Financial Analysis: Accounting income is a crucial metric for financial analysis as it helps investors and stakeholders evaluate a company’s profitability and overall financial performance. It serves as a basis for analyzing financial ratios and assessing the company’s ability to generate returns. Cash flow, on the other hand, is vital for assessing a company’s cash position and its ability to meet its financial obligations. It helps evaluate the company’s liquidity, solvency, and cash management strategies.

Understanding the differences between accounting income and cash flow is essential for a comprehensive analysis of a company’s financial health. While accounting income provides insights into a company’s profitability, cash flow helps assess its liquidity. Both metrics play a crucial role in evaluating a company’s financial performance and making informed investment decisions.

Timing of Recognition

One of the key differences between accounting income and cash flow is the timing of recognition. Accounting income follows the accrual basis of accounting, which means that revenues and expenses are recognized when they are earned or incurred, regardless of when the cash is received or paid. On the other hand, cash flow is recognized on a cash basis, where cash inflows and outflows are recorded when the actual cash is received or paid.

Let’s consider an example to understand this difference. Suppose a company provides consulting services to a client in December but does not receive the payment until the following January. From an accounting perspective, the revenue from the services rendered in December would be recognized in the income statement for that month, even though the cash is not received until January. This is known as accounts receivable, where the revenue is recognized when it is earned, regardless of the actual cash flow.

Similarly, expenses are recognized on the accrual basis as well. Let’s say a business purchases supplies on credit in November and pays for them in December. The expense for the supplies would be recognized in the income statement for November, even though the cash is not paid until the following month. This is known as accounts payable, where the expense is recognized when it is incurred, regardless of the actual cash flow.

In contrast, cash flow focuses on the actual movement of cash. Using the same examples, the cash flow from the consulting services would be recorded in January when the payment is received, and the cash flow from the supplies would be recorded in December when the payment is made.

This difference in timing of recognition can have significant implications for assessing a company’s financial health. While accounting income provides insights into the company’s profitability over a given period, cash flow reflects the actual cash inflow and outflow, which is crucial for evaluating a company’s liquidity and cash management.

It is important to consider both accounting income and cash flow in financial analysis to have a comprehensive understanding of a company’s financial position. By analyzing the timing of recognition, investors and financial analysts can assess the impact of non-cash items, such as accounts receivable and accounts payable, on a company’s cash flow and overall financial performance.

Accrual Basis vs. Cash Basis

A key distinction between accounting income and cash flow lies in the method of recognition: accrual basis versus cash basis. Accrual basis accounting recognizes transactions when they are incurred or earned, regardless of when the cash is received or paid. In contrast, the cash basis of accounting recognizes transactions only when the cash is actually received or paid.

Under the accrual basis, revenues are recognized when they are earned, which may occur before or after the cash is received. This means that even if a company has not yet received payment for goods or services, it can still recognize revenue if the products have been delivered or the services have been rendered. Similarly, expenses are recognized when they are incurred, which may be before or after the cash is paid.

On the other hand, the cash basis recognizes revenues only when the cash is received, and expenses are recognized only when the cash is paid. This method focuses solely on the movement of cash, disregarding when the revenue was earned or the expenses were incurred.

For example, let’s consider a scenario where a customer purchases goods from a company in November but does not make the payment until December. Using the accrual basis, the company would recognize the revenue in November when the goods were delivered, even though the cash is received in December. In contrast, the cash basis of accounting would recognize the revenue only in December when the cash is received.

The same principle applies to expenses. If a company receives an invoice for services rendered in January but pays the bill in February, the accrual basis would recognize the expense in January when the services were provided, while the cash basis would recognize the expense in February when the cash was actually paid.

The choice between accrual basis and cash basis accounting depends on various factors, including the size and complexity of the business, reporting requirements, and regulatory guidelines. Accrual basis accounting provides a more accurate representation of a company’s financial performance over a specific period, as it matches revenues with the expenses incurred to generate those revenues. Cash basis accounting, on the other hand, focuses solely on the movement of cash and may be more suitable for small businesses with straightforward transactions.

When analyzing financial statements, it is important to be aware of the basis of accounting used, as it can affect the interpretation of financial data. While accounting income is typically calculated using the accrual basis, cash flow statements provide information on the actual cash inflows and outflows of a business, following the cash basis of accounting.

By understanding the differences between accrual basis and cash basis accounting, investors and financial analysts can assess the impact of timing and gain a better understanding of a company’s financial position and performance.

Non-Cash Items

Non-cash items are another important distinction between accounting income and cash flow. Non-cash items are expenses or revenues that affect the calculation of accounting income but do not involve an actual inflow or outflow of cash. These items are accounted for in calculating accounting income but are excluded from cash flow analysis.

Examples of non-cash items include depreciation, amortization, and non-cash expenses such as stock-based compensation or impairment charges. These items are important because they can have a significant impact on a company’s accounting income but do not directly affect the cash position of the business.

Depreciation and amortization are accounting methods used to allocate the cost of an asset over its useful life. They represent the reduction in value of assets such as buildings, machinery, or intangible assets like patents or copyrights. Although depreciation and amortization are recorded as expenses in the income statement, they do not involve an actual cash outflow. Therefore, they are considered non-cash items in the context of cash flow analysis.

Non-cash expenses such as stock-based compensation also fall into the category of non-cash items. In cases where companies compensate employees or executives with stock options or stock grants, the value of these awards is recognized as an expense in the income statement, even though no cash is involved in the transaction.

Non-cash items can have a significant impact on a company’s financial statements. For example, a company may report a net loss due to the inclusion of large non-cash expenses, even if the business is generating positive cash flow. Conversely, a company may report higher accounting income due to non-cash revenues, such as the revaluation of assets, even if actual cash inflows are not present.

When analyzing a company’s financial position and performance, it is important to consider both accounting income and cash flow. Cash flow analysis provides a clearer picture of a company’s ability to generate and manage cash, while accounting income reflects profitability. Understanding the impact of non-cash items allows investors and financial analysts to better interpret and evaluate a company’s financial statements.

By excluding non-cash items from cash flow analysis, analysts can focus on the actual movement of cash and gain insights into a company’s liquidity, cash management strategies, and ability to meet short-term obligations. Moreover, by understanding the impact of non-cash items on accounting income, investors can determine the true economic performance and the cash-generating potential of a company.

Importance of Accounting Income and Cash Flow Analysis

Accounting income and cash flow analysis both play crucial roles in evaluating a company’s financial health and making informed decisions. By assessing both metrics, investors and stakeholders can gain a comprehensive understanding of a company’s performance, profitability, liquidity, and cash management.

Here are some key reasons why accounting income and cash flow analysis are important:

- Evaluating Profitability: Accounting income provides insights into a company’s profitability and financial performance. It helps investors and stakeholders assess the ability of a business to generate earnings and measure its overall success. By analyzing accounting income, investors can track trends over time, compare performance against industry benchmarks, and make informed investment decisions.

- Assessing Liquidity: Cash flow analysis is essential for evaluating a company’s liquidity and its ability to meet short-term obligations. Positive cash flow indicates that a business has sufficient cash on hand to cover its operating expenses, debt obligations, and capital expenditures. It helps highlight any potential liquidity issues and provides insights into a company’s cash management strategies.

- Identifying Cash Flow Patterns: Analyzing cash flow over time reveals patterns and trends in a company’s cash generation and usage. It helps assess the stability and predictability of cash flows, which is essential for financial planning and forecasting. Cash flow analysis can identify cycles of cash inflows and outflows, helping businesses optimize cash management and make informed decisions regarding investments, expansion, and financing.

- Evaluating Solvency and Financial Stability: Both accounting income and cash flow analysis contribute to assessing a company’s solvency and financial stability. Accounting income indicates the profitability and earning power of a business, while cash flow analysis reflects its ability to generate and manage cash. Combined, these metrics provide a holistic view of a company’s financial position, enabling investors and stakeholders to evaluate its long-term sustainability.

- Identifying Non-Cash Items: Understanding non-cash items in accounting income provides insights into the true economic performance of a company. By removing non-cash expenses or revenues, analysts can determine the cash-generating potential and profitability of the business. This helps paint a more accurate picture of a company’s financial performance, especially when comparing it to other companies or benchmarking against industry standards.

Overall, accounting income and cash flow analysis are important tools for assessing the financial health and performance of a company. By analyzing both metrics, investors, financial analysts, and business owners gain a holistic understanding of a company’s profitability, liquidity, and cash management strategies. This information is crucial for making informed investment decisions, evaluating financial stability, and planning for future growth and success.

Conclusion

Understanding the differences between accounting income and cash flow is essential for anyone involved in evaluating a company’s financial performance or making investment decisions. While accounting income focuses on the revenue and expenses recognized in financial statements, cash flow assesses the actual movement of cash in and out of a business.

Accounting income, often referred to as net income or profit, provides insights into a company’s profitability and financial performance over a specific period. It is calculated using the accrual basis, which allows for the matching of revenues and expenses to provide a more accurate representation of a company’s financial health.

On the other hand, cash flow analysis focuses on the actual cash inflows and outflows from operating activities, investing activities, and financing activities. It is determined on a cash basis, recognizing transactions when the cash is actually received or paid.

The differences between accounting income and cash flow lie in the timing of recognition, the basis of accounting used, and the inclusion of non-cash items. Accounting income reflects revenue and expenses on an accrual basis, even if the cash has not been received or paid. Cash flow, on the other hand, considers the movement of actual cash and provides insights into a company’s liquidity and cash management.

Both accounting income and cash flow analysis are crucial for assessing a company’s financial health. By analyzing accounting income, investors can evaluate profitability, track trends, and make informed investment decisions. Cash flow analysis, on the other hand, helps assess a company’s liquidity, capital management, and ability to meet financial obligations.

It is important to understand the impact of non-cash items on accounting income and the difference in timing of recognition between the two metrics. Non-cash items, such as depreciation and non-cash expenses, can significantly affect accounting income without directly affecting cash flow.

In conclusion, both accounting income and cash flow analysis provide valuable insights into a company’s financial performance. By considering both metrics, investors, financial analysts, and business owners can gain a comprehensive understanding of a company’s profitability, liquidity, and financial stability. This knowledge is essential for making informed investment decisions, assessing financial health, and planning for future growth and success in the dynamic world of finance.