Home>Finance>What Is The Difference Between Internet Banking And Mobile Banking

Finance

What Is The Difference Between Internet Banking And Mobile Banking

Modified: December 30, 2023

Discover the distinction between internet banking and mobile banking in the realm of finance and learn how these convenient digital platforms can revolutionize your financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Banking has evolved significantly over the years, with advancements in technology transforming the way we manage our finances. Two popular methods that have gained widespread popularity are internet banking and mobile banking. Both these forms of banking provide convenient and accessible ways to conduct financial transactions and manage accounts. However, there are distinct differences between the two that are worth exploring.

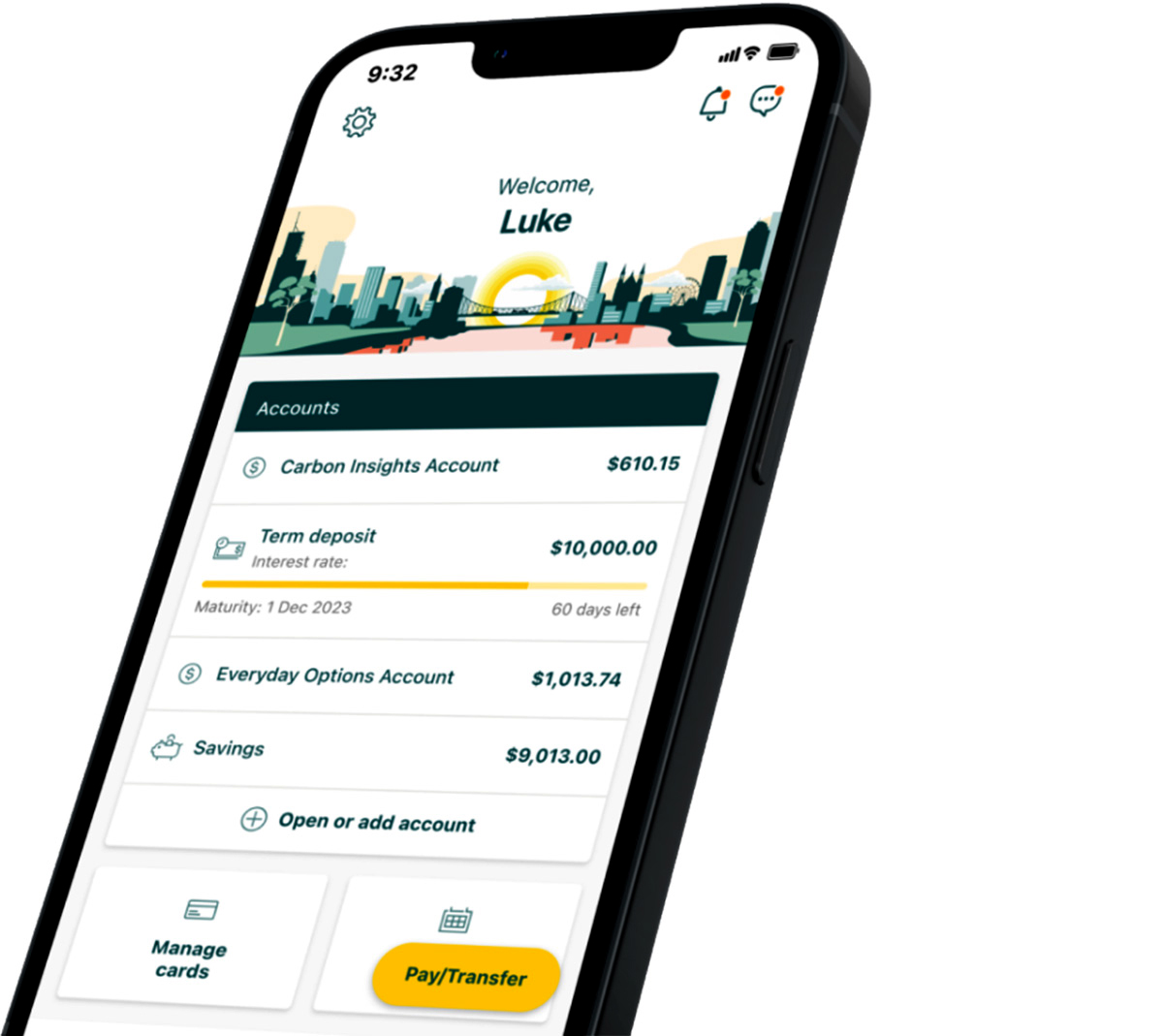

Internet banking, also known as online banking, refers to the use of a website or web-based platform provided by a bank to facilitate banking activities. It allows customers to access and manage their accounts through a computer or laptop with an active internet connection. On the other hand, mobile banking involves the use of a mobile application provided by a bank, which enables customers to access banking services through their smartphones or tablets.

In this article, we will delve into the key differences between internet banking and mobile banking, looking at factors such as accessibility and convenience, range of services, security measures, user experience, and cost. It is essential to understand these differences to determine which form of banking best suits your individual needs and preferences.

Definition of Internet Banking

Internet banking, or online banking, is a service provided by financial institutions that allows customers to access and manage their accounts through the internet. It provides a secure and convenient way for individuals to conduct various banking transactions from the comfort of their homes or offices.

With internet banking, customers can perform a wide range of activities such as checking account balances, transferring funds between accounts, paying bills, initiating loan applications, and downloading account statements. The banking platform is typically accessed through a dedicated website provided by the bank, which requires customers to log in with their unique username and password.

The primary advantage of internet banking is the 24/7 accessibility it offers. Customers can conduct banking transactions at any time, without having to visit a physical bank branch. This flexibility is particularly beneficial for individuals with busy schedules or those who have difficulty accessing physical bank branches.

Due to the online nature of this banking method, it eliminates the need for paper-based transactions and provides a digital medium for financial management. Customers can review their transaction history, set up automated payments, and even receive notifications or alerts for various account activities.

Furthermore, internet banking provides a level of convenience that traditional banking cannot match. Customers can access their accounts from any location with an internet connection, giving them the freedom to manage their finances while traveling or away from home. It also eliminates the need for physical paperwork, saving time and reducing the risk of errors.

Security is a critical aspect of internet banking. Banks implement robust security measures to protect customer information and prevent unauthorized access. Measures such as encrypted connections, multi-factor authentication, and secure login protocols ensure that customer data remains confidential and secure.

Definition of Mobile Banking

Mobile banking refers to the use of mobile devices, such as smartphones or tablets, to access and manage banking services and accounts. It provides customers with a convenient and portable way to perform various financial transactions on the go.

Mobile banking is typically facilitated through dedicated mobile applications provided by banks. These applications are downloaded and installed on the customer’s mobile device, allowing them to access their accounts securely. Alternatively, some banks offer mobile banking services through text messaging (SMS) or mobile web browsers.

This form of banking offers a wide range of services similar to internet banking, including checking account balances, transferring funds, paying bills, and managing credit card accounts. Mobile banking may also include additional features like mobile check deposits, account alerts, and even person-to-person payment options.

One of the main advantages of mobile banking is its portability and accessibility. With a mobile device in hand, customers can manage their accounts and conduct transactions from anywhere, anytime. This is especially useful for individuals who are constantly on the move or have limited access to computers and internet connectivity.

Another key feature of mobile banking is the ability to simplify and expedite certain financial tasks. For example, mobile check deposits allow customers to deposit checks by simply taking a photo with their mobile device. This eliminates the need to visit a physical branch or ATM, saving time and effort.

Security is a top priority in mobile banking as well. Banks implement various security measures to protect customer information and secure mobile transactions. These measures include data encryption, biometric authentication, and secure app frameworks to ensure that customer data is kept confidential and transactions are conducted safely.

Furthermore, mobile banking apps are designed to provide a user-friendly experience, with intuitive navigation and streamlined interfaces. This makes it easier for customers to manage their finances and perform transactions with minimal hassle.

In summary, mobile banking offers a convenient and portable way for customers to access and manage their accounts using their mobile devices. It provides a wide range of services, simplifies certain financial tasks, and ensures the security of customer information and transactions.

Comparison of Internet Banking and Mobile Banking

While both internet banking and mobile banking share the common goal of providing convenient and accessible banking services, there are several key differences between the two. Let’s compare them in terms of accessibility and convenience, range of services, security measures, user experience, and cost.

- Accessibility and Convenience: Internet banking can be accessed through a computer or laptop with an internet connection, allowing customers to manage their accounts from anywhere. Mobile banking, on the other hand, offers even greater convenience by enabling customers to access their accounts through their smartphones or tablets, providing the flexibility to bank on the go.

- Range of Services: Both internet banking and mobile banking offer a wide range of services, including checking account balances, transferring funds, and paying bills. However, mobile banking often provides additional features such as mobile deposits, person-to-person payments, and cardless ATM withdrawals, making it more versatile compared to internet banking.

- Security Measures: Both forms of banking prioritize security. However, mobile banking typically incorporates additional security measures such as biometric authentication (fingerprint or facial recognition) and device-level security features, offering an extra layer of protection compared to internet banking.

- User Experience: Mobile banking apps are specifically designed to optimize the user experience on smaller screens, with intuitive interfaces and touch-friendly navigation. Internet banking platforms, while still functional, may not offer the same level of user-friendliness on mobile devices.

- Cost: In terms of cost, both internet banking and mobile banking are typically free services provided by banks. However, data usage charges may apply when using mobile banking services, depending on the customer’s mobile data plan.

Ultimately, the choice between internet banking and mobile banking depends on the individual’s preferences and lifestyle. If accessibility and convenience are a priority, mobile banking offers the flexibility to manage finances on the go. However, for users who prefer a wider range of services and a more robust online banking experience, internet banking may be the preferred option.

It’s worth noting that many banks offer a combination of both internet banking and mobile banking, allowing customers to utilize both platforms interchangeably. This enables individuals to enjoy the benefits of both methods and choose the most convenient option for their specific banking needs.

Accessibility and Convenience

When it comes to banking, accessibility and convenience play a vital role in determining the preferred method for managing finances. Both internet banking and mobile banking offer unique advantages in terms of accessibility and convenience.

Internet banking provides customers with the flexibility to access their accounts and conduct various transactions from anywhere with an internet connection. This means individuals can manage their finances conveniently from the comfort of their homes, offices, or even while traveling. The 24/7 availability of internet banking allows customers to handle their banking needs at any time, without having to adhere to the limited operating hours of physical bank branches.

On the other hand, mobile banking takes convenience to a whole new level. With mobile banking apps installed on their smartphones or tablets, customers can access their accounts and perform banking tasks while on the go. The portability of mobile devices ensures that customers can manage their finances anytime and anywhere, whether they’re in a coffee shop, waiting in line, or commuting.

Mobile banking apps are specifically designed to optimize the user experience on smaller screens, making it easy for customers to navigate through the application and perform transactions with just a few taps. The intuitive interfaces and touch-friendly controls enhance the convenience factor, allowing users to quickly check account balances, transfer funds, or pay bills from their mobile devices.

Furthermore, mobile banking offers additional features that enhance accessibility and convenience. These features may include mobile check deposit, where users can simply take a photo of a check and deposit it electronically, eliminating the need to visit a physical bank branch or ATM. Additionally, features like person-to-person payments and cardless ATM withdrawals provide users with more options and flexibility in managing their finances.

In summary, both internet banking and mobile banking provide convenient access to banking services. Internet banking offers the flexibility of managing accounts from any computer with an internet connection, while mobile banking takes convenience to the next level by enabling customers to access their accounts and perform transactions on the go using their smartphones or tablets. The availability of these services ensures that customers can conveniently manage their finances, saving time and effort in the process.

Range of Services

Both internet banking and mobile banking offer a wide range of services to cater to the diverse needs of customers. While there may be some overlap in the services provided, each method has its unique offerings.

Internet banking platforms provide customers with essential banking services such as checking account balances, viewing transaction history, transferring funds between accounts, and initiating bill payments. Customers can also set up recurring payments and schedule future transactions according to their preferences. In addition to these core services, many internet banking platforms offer features like online account opening, loan applications, and access to additional financial products such as insurance or investment options.

Mobile banking, on the other hand, offers a similar range of services but often includes additional features that are specifically tailored for mobile devices. In addition to the essential services mentioned above, mobile banking apps may offer mobile check deposits, allowing customers to deposit checks by simply taking a photo of the check using their smartphone’s camera. Person-to-person payment options are another common feature, enabling users to transfer funds to friends or family members instantly. Some mobile banking apps also provide the ability to locate nearby ATMs and branches or to make cardless ATM withdrawals.

Both internet banking and mobile banking platforms may also provide access to credit card accounts, allowing customers to view credit card transactions, make payments, and manage rewards programs.

As technology continues to advance, the range of services offered by both internet banking and mobile banking is expanding. For example, some banks are now introducing contactless payment options, allowing customers to make purchases using their mobile devices through online wallets or mobile payment apps.

In summary, both internet banking and mobile banking offer a comprehensive set of services to customers. Internet banking platforms provide essential banking functions along with additional financial products and services, while mobile banking apps offer similar services with added convenience features that are optimized for mobile devices. The specific range of services may vary from bank to bank, so it is advisable to check with your bank to understand the full range of services available to you.

Security Measures

Security is a critical aspect of banking, and both internet banking and mobile banking employ various measures to ensure the safety and confidentiality of customer information and transactions.

Internet banking platforms use robust security protocols to protect customer data. One of the primary security measures is encryption, which encodes data transmitted between the customer’s device and the bank’s servers. This encryption ensures that sensitive information such as login credentials, account details, and transaction data are securely transmitted and cannot be intercepted by unauthorized individuals.

Additionally, most internet banking platforms require customers to set up secure login credentials, typically a unique username and password combination. Some platforms may also employ multi-factor authentication, which adds an extra layer of security by requiring users to provide additional verification, such as a one-time password sent via text message or generated by an authentication app. This helps protect against unauthorized access to customer accounts.

Mobile banking apps also prioritize security by implementing encryption and secure transmission protocols to safeguard user data. In addition to traditional login credentials, many mobile banking apps offer biometric authentication options such as fingerprint recognition or facial recognition, adding an extra layer of security. These biometric authentication methods ensure that only authorized individuals can access the mobile banking app on the device.

Banks also employ security measures to protect against fraud and unauthorized transactions. This may include monitoring customer accounts for suspicious activity or implementing transaction alerts, where customers receive notifications for specific account activities such as large withdrawals or online purchases.

Moreover, both internet banking and mobile banking platforms adhere to industry-standard security best practices and undergo regular security audits and assessments to identify and address potential vulnerabilities. Financial institutions employ dedicated cybersecurity teams that continually update security protocols to protect against emerging threats.

It is important for customers to play their part in ensuring security as well. This includes keeping login credentials secure, regularly updating passwords, avoiding using public Wi-Fi networks for banking transactions, and promptly reporting any suspicious activity or unauthorized transactions to their bank.

In summary, both internet banking and mobile banking prioritize the security of customer information and transactions. They employ a range of security measures, including encryption, secure login credentials, multi-factor authentication, and biometric authentication. It is crucial for customers to follow recommended security practices and stay vigilant to protect their personal and financial information.

User Experience

User experience plays a significant role in determining the level of satisfaction and convenience customers experience while using internet banking and mobile banking platforms. Both methods strive to provide a seamless and user-friendly interface for customers to manage their finances effectively.

Internet banking platforms typically offer a comprehensive and feature-rich user experience. They provide a user-friendly interface that allows customers to navigate through various banking functions easily. Customers can access their account information, view transaction history, transfer funds, pay bills, and manage financial products all within a few clicks. The layout and design of internet banking platforms are typically optimized for desktop or laptop screens, providing a comfortable and familiar environment for users.

On the other hand, mobile banking apps are designed specifically for smartphones and tablets, focusing on optimizing the user experience on smaller screens. The interfaces are sleek, intuitive, and touch-friendly, allowing customers to perform banking activities with ease. Mobile banking apps often utilize icons, intuitive gestures, and simplified navigation menus to enhance the overall user experience.

Both internet banking and mobile banking platforms offer personalized experiences by allowing customers to customize their dashboard, set preferences, and access frequently used features easily. This level of personalization enhances the user experience and improves efficiency in managing finances.

In terms of transaction speed, mobile banking often offers a quicker experience. Mobile banking apps are designed to facilitate quick transactions with minimal steps. Features like mobile check deposits, which allow customers to deposit checks by simply taking a photo, eliminate the need for manual data entry and reduce the time taken for traditional banking tasks.

Another aspect of user experience is the availability of support and assistance. Both internet banking and mobile banking platforms typically provide customer support channels such as helplines, chat support, and frequently asked questions. Users can reach out to customer support for assistance with account-related queries or technical issues.

In summary, user experience is a key consideration in both internet banking and mobile banking. Internet banking platforms offer comprehensive functionality and feature-rich experiences optimized for desktop or laptop screens. Mobile banking apps, on the other hand, prioritize intuitive touch-friendly interfaces and streamlined navigation for smartphones and tablets. Both methods aim to provide convenient and user-friendly experiences that enable customers to manage their finances efficiently.

Cost

One of the significant advantages of both internet banking and mobile banking is that they are typically free services provided by banks to their customers. Banks offer these services as an added convenience to enhance the banking experience without charging any fees for access or usage.

With internet banking, customers can access their accounts, perform transactions, and utilize various banking services through the bank’s website or online platform at no additional cost. This means that customers can check their account balances, transfer funds, pay bills, and perform other banking activities without incurring any charges beyond their regular banking fees such as maintenance fees or transaction fees.

In the case of mobile banking, customers can download and install the dedicated mobile banking application provided by their bank onto their smartphones or tablets for free. The mobile banking app allows customers to access their accounts and perform various banking transactions without any additional charges.

However, it is essential to note that while mobile banking itself is free, using mobile banking services may consume data from the customer’s mobile data plan. Depending on the individual’s mobile data plan and usage, this may result in additional data charges billed by the mobile service provider. It is advisable for customers to check with their mobile service provider to ensure they have an appropriate data plan or consider using Wi-Fi networks when conducting mobile banking activities to avoid incurring excess data charges.

It is also worth mentioning that certain advanced features or specific services offered through internet banking or mobile banking, such as expedited payments or international transfers, may come with associated fees. These fees vary across banks and depend on the specific service being utilized. It is important for customers to review their bank’s fee schedule or contact their bank directly to understand any potential costs associated with specific services.

Overall, both internet banking and mobile banking are typically free services provided by banks to their customers, allowing individuals to access and manage their accounts without incurring additional charges. However, it is important to consider any potential data charges for mobile banking activities and be aware of potential fees for specific advanced services offered by the banks.

Future Developments

The world of banking is constantly evolving, driven by technological advancements and changing consumer preferences. As such, both internet banking and mobile banking are expected to continue evolving and adapting to meet the needs of customers in the future.

One notable development in the future of banking is the integration of artificial intelligence (AI) and machine learning technologies. Banks are increasingly utilizing AI-powered chatbots and virtual assistants to provide personalized and efficient customer support. These AI-driven assistants can handle customer queries, provide account information, and even make recommendations based on individual financial patterns.

Moreover, biometric authentication is likely to become even more prevalent in the future. While fingerprint recognition and facial recognition are already used in many mobile banking apps, advancements in technology may bring new biometric identification methods such as iris scanning or voice recognition to enhance security and simplify authentication processes.

The emergence of open banking regulations and APIs (Application Programming Interfaces) is another development that will shape the future of banking. Open banking allows customers to securely share their financial data with authorized third-party providers, enabling them to access a broader range of financial services and products. This could lead to the integration of various banking services, such as budgeting tools and investment platforms, within internet banking and mobile banking applications.

The rise of mobile wallets and contactless payments is also expected to continue. Mobile banking apps may incorporate features that allow users to make payments directly from their devices using near-field communication (NFC) technology, eliminating the need to carry physical cards or cash. This trend aligns with the increasing adoption of digital payments and the decline of traditional cash transactions.

Furthermore, the adoption of blockchain technology and cryptocurrencies in the banking industry may impact both internet banking and mobile banking. Banks may explore using blockchain for secure and instant cross-border transactions, while some mobile banking apps might integrate support for cryptocurrencies, enabling customers to manage their digital assets alongside traditional banking functionalities.

Overall, the future of banking holds exciting possibilities for both internet banking and mobile banking. Advances in technologies like AI, biometrics, open banking, mobile wallets, and blockchain will likely shape the way customers access and manage their finances. As these developments unfold, banks will continue to innovate to provide seamless, secure, and convenient banking experiences for their customers.

Conclusion

Internet banking and mobile banking have revolutionized the way individuals manage their finances, providing convenient and accessible solutions for everyday banking needs. While both methods offer similar core functionalities, they have their distinct advantages and nuances.

Internet banking provides customers with 24/7 accessibility, enabling them to manage their accounts and conduct transactions from any computer with an internet connection. It offers an extensive range of services, personalized experiences, and robust security measures. On the other hand, mobile banking takes convenience a step further, allowing customers to access their accounts and perform transactions using their smartphones or tablets. Mobile banking offers features specifically designed for mobile devices, such as mobile check deposits and person-to-person payments.

Both internet banking and mobile banking prioritize the security of customer information and employ encryption, secure login credentials, and other security measures to protect against unauthorized access. They continuously adapt to emerging technologies and customer preferences, incorporating features such as AI-powered virtual assistants and biometric authentication.

As technology continues to advance, the future of banking holds even more exciting possibilities. Developments such as open banking, contactless payments, and the integration of blockchain and cryptocurrencies are poised to shape the banking landscape. Banks will continue to innovate and enhance their internet banking and mobile banking offerings to provide seamless, secure, and user-friendly experiences.

Ultimately, the choice between internet banking and mobile banking comes down to personal preferences and lifestyle. Some individuals may prefer the convenience of mobile banking for its portability and quick access, while others may prefer the comprehensive functionality of internet banking on larger screens. It is also worth noting that many banks offer both platforms, allowing customers to enjoy the advantages of both methods.

Regardless of the preferred method, internet banking and mobile banking have undoubtedly transformed how individuals manage their finances, offering a new level of convenience, accessibility, and control. As technology continues to advance, it will be exciting to see how these banking methods evolve further to meet the changing needs of customers and provide innovative solutions for managing their financial lives.