Finance

Adjusted Underwriting Profit Definition

Published: October 1, 2023

Enhance your understanding of finance with our comprehensive guide on the adjusted underwriting profit definition, providing insights and clarity on this important financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

A Comprehensive Guide to Adjusted Underwriting Profit Definition in Finance

Welcome to our FINANCE blog category! In this post, we are going to delve into the world of adjusted underwriting profit and explain its definition, importance, and how it impacts the finance industry. So, if you’re curious about what adjusted underwriting profit is and how it affects your financial endeavors, you’ve come to the right place!

Key Takeaways:

- Adjusted underwriting profit is a crucial measure in the finance industry that determines the profitability of insurance companies and their underwriting activities.

- Insurance companies aim to achieve a positive adjusted underwriting profit by carefully assessing risks, setting appropriate premiums, and managing claim payouts efficiently.

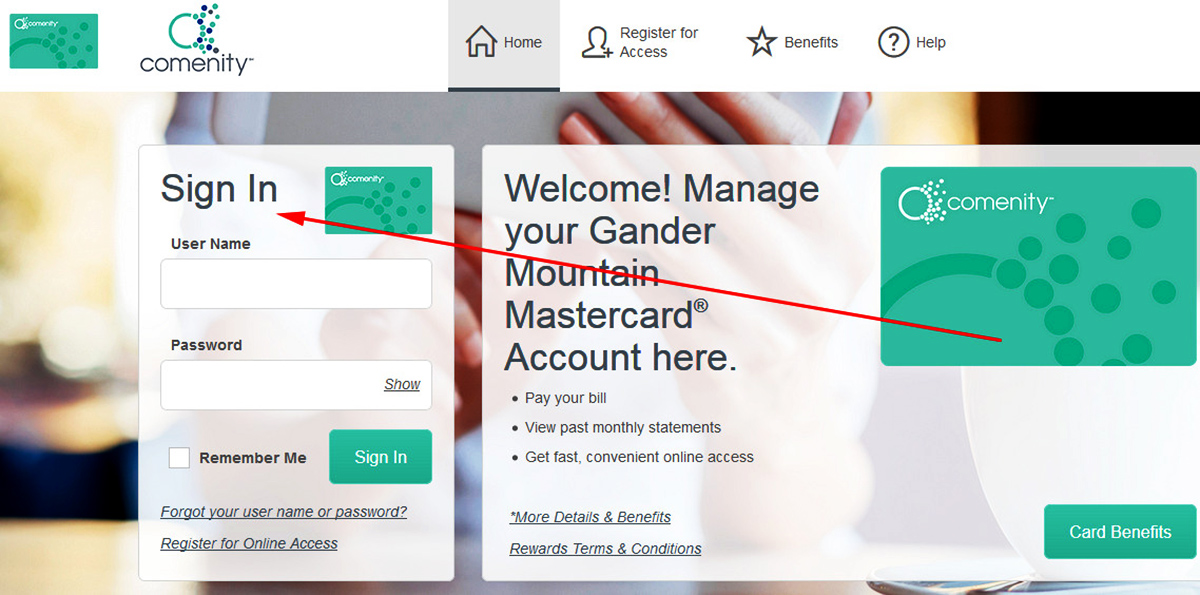

What is Adjusted Underwriting Profit?

Adjusted underwriting profit is a financial metric used to evaluate the profitability of insurance companies based on their underwriting activities. Underwriting refers to the process of assessing risks, determining premium rates, and assuming the responsibility of covering potential losses from policyholders’ claims.

When examining financial statements, underwriters need to consider both underwriting profit and investment income for a comprehensive assessment. Adjusted underwriting profit adjusts the financial results of underwriting activities by excluding investment income and other non-underwriting factors, focusing solely on the core profitability of insurance operations.

The Importance of Adjusted Underwriting Profit

Adjusting underwriting profit provides insurance companies with a clear view of their core business performance without the influence of investment returns. This metric enables companies to identify areas where they can improve their underwriting practices, pricing strategies, and risk management capabilities.

Here are two key takeaways on the importance of adjusted underwriting profit:

- It helps insurance companies assess the adequacy of their premium rates. By analyzing the adjusted underwriting profit, insurers can determine whether their premiums are enough to cover potential losses and operating expenses.

- Adjusted underwriting profit evaluation is essential for insurers to identify underperforming business lines and take corrective measures. It ensures that insurance companies focus on writing profitable policies.

The Impact on the Finance Industry

Adjusted underwriting profit plays a significant role in the financial performance of insurance companies, which, in turn, affects the broader finance industry. Here’s how:

- Financial Stability: A positive adjusted underwriting profit indicates that insurance companies are effectively managing their risks, ensuring stability and financial security for both policyholders and investors.

- Market Competition: Adjusted underwriting profit analysis helps insurance companies understand their competitive positioning and determine if they need to adjust their strategies to stay competitive. It promotes healthy competition, benefiting consumers and the industry as a whole.

- Investment Decisions: Investors and stakeholders rely on adjusted underwriting profit as a key financial indicator to assess the attractiveness of insurance companies for potential investments, influencing capital allocation decisions within the finance sector.

In Conclusion

Adjusted underwriting profit is a vital metric in the finance industry that evaluates the profitability of insurance companies’ underwriting activities. By analyzing this measure, insurers can gain insights into their core business performance, assess premium adequacy, and identify areas for improvement. The impact of adjusted underwriting profit extends beyond insurance companies, affecting the overall stability of the finance industry and guiding investment decisions. Understanding and evaluating adjusted underwriting profit is crucial for insurance professionals, investors, and anyone interested in the financial health of insurance companies.