Finance

What Is The Surrender Value Of Life Insurance?

Published: November 28, 2023

Discover the financial benefits of the surrender value in life insurance policies. Learn how it can provide cash value and options for policyholders at various stages of life.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Life insurance is a financial product that provides protection and financial security to individuals and their families. It offers a death benefit to the beneficiaries upon the policyholder’s passing, ensuring that loved ones have the means to cover expenses, pay off debts, and maintain their quality of life.

However, there are instances when a policyholder may no longer want or need their life insurance policy. In such cases, surrendering the policy becomes an option. Surrendering a life insurance policy involves terminating the contract with the insurance company and receiving the surrender value.

Surrender value, also known as cash surrender value, is the amount of money the policyholder receives upon surrendering a life insurance policy before its maturity or end date. This value is determined by several factors, such as the length of time the policy has been active, the paid premiums, and the type of policy.

In this article, we will explore what surrender value is, how it is calculated, the factors that affect it, and the pros and cons of surrendering a life insurance policy. We will also provide guidance on how to go about surrendering a policy. By understanding these aspects, individuals can make an informed decision regarding their life insurance coverage.

What is Surrender Value?

Surrender value is the cash value that a policyholder receives when they choose to surrender or cancel their life insurance policy before its maturity or end date. When a policy is surrendered, the insurance company terminates the contract and provides the policyholder with a sum of money based on the accumulated cash value of the policy.

It’s important to note that surrendering a life insurance policy is a permanent decision. Once the policy is surrendered, the coverage and any associated benefits, including the death benefit, are forfeited. This means that the policyholder will no longer have life insurance protection and their beneficiaries will not receive a payout upon their death.

The surrender value is typically lower than the total premiums paid by the policyholder. This is because life insurance policies often have administrative fees, mortality charges, and other costs associated with maintaining the policy. These costs are deducted from the premiums, which reduces the cash value and subsequently the surrender value.

The surrender value can be calculated as the accumulated cash value plus any applicable surrender charges and minus any outstanding loans or policy debts. The surrender value will vary depending on the type of life insurance policy, the length of time the policy has been active, the premium payments made, and the insurance company’s policies and provisions.

Surrender value is an important consideration for policyholders who are thinking of surrendering their life insurance policy. It represents the monetary value that can be recovered from the policy, which can be used for various purposes such as paying off debts, covering medical expenses, or investing in other financial assets.

Understanding the surrender value is essential for individuals who are reassessing their insurance needs and evaluating the financial implications of surrendering their life insurance policy. It is advisable to consult with a financial advisor or insurance professional to carefully weigh the pros and cons before making a decision.

How is Surrender Value Calculated?

The calculation of surrender value varies depending on the type of life insurance policy and the insurance company’s specific terms and conditions. However, there are common elements that are typically taken into account when determining the surrender value.

One of the primary factors is the accumulated cash value of the policy. Cash value is the portion of the premiums that have accumulated over time, typically through investment gains and the allocation of funds in a policy’s cash value account. The longer the policy has been in force, the higher the cash value is likely to be, which in turn increases the surrender value.

Surrender charges or surrender fees are another component that affects the calculation of surrender value. These charges are incurred by the policyholder when surrendering the policy before the specified surrender period ends. The surrender charges are deducted from the accumulated cash value, thereby reducing the overall surrender value.

Outstanding loans against the policy can also impact the surrender value. If the policyholder has taken out loans from the cash value of the policy, these loans are typically deducted from the surrender value. Outstanding interest on these loans can also be a factor in the calculation.

Other deductions or costs may apply, such as outstanding premiums or administrative fees. Additionally, tax implications may need to be considered when calculating the surrender value. Surrendering a policy may have tax consequences, and it is recommended to consult with a tax professional to understand the potential tax implications.

It is important to note that the surrender value is usually less than the total premiums paid. This is due to the deductions and charges associated with the policy, as mentioned above. The surrender value represents the amount that the insurance company is willing to pay to cancel the policy and terminate the contractual obligations.

Ultimately, the surrender value is calculated by the insurance company based on the specific provisions outlined in the policy contract. To obtain an accurate calculation, policyholders should reach out to their insurance company or agent to request the surrender value quote.

By understanding how surrender value is calculated, policyholders can make an informed decision when considering surrendering their life insurance policy. It is recommended to weigh the surrender value against the potential benefits and drawbacks to determine if surrendering the policy aligns with their financial goals and circumstances.

Factors Affecting Surrender Value

The surrender value of a life insurance policy is influenced by several factors that impact the policy’s cash value. These factors may vary depending on the type of policy and the insurance company’s specific provisions. Understanding these factors can help policyholders better evaluate their surrender value and make informed decisions about their life insurance policy.

1. Policy Duration: The length of time the policy has been active significantly affects the surrender value. Generally, the longer the policy has been in force, the higher the cash value and subsequently the surrender value will be. Policies that have been in force for a shorter period of time may have lower surrender values.

2. Premium Payments: Surrender value is influenced by the amount of premiums paid into the policy. Policyholders who have consistently made higher premium payments may accumulate more cash value, resulting in a higher surrender value. Similarly, missed or late premium payments may reduce the cash value and surrender value.

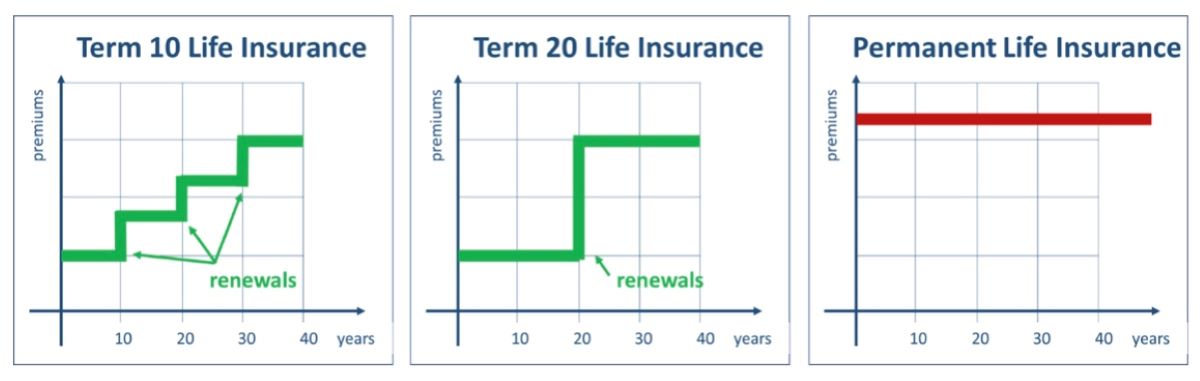

3. Policy Type: Different types of life insurance policies have varying surrender value calculations. For example, whole life insurance policies typically have more stable cash value accumulation, resulting in higher surrender values. On the other hand, term life insurance policies generally do not have a cash value component, and surrendering the policy may not yield any surrender value.

4. Surrender Charges: Many life insurance policies have a surrender charge or fee for surrendering the policy before a specified surrender period ends. This charge is assessed as a percentage of the cash value and reduces the surrender value. The surrender charge gradually decreases over time until it is eliminated once the surrender period has passed.

5. Outstanding Loans: If a policyholder has taken out loans against the cash value of the policy, the outstanding loan balance is deducted from the surrender value. Any accrued interest on these loans may also be included in the calculation, further reducing the surrender value.

6. Policy Provisions: The specific provisions outlined in the policy contract can affect the surrender value. These provisions may include administrative fees, mortality charges, and other costs associated with maintaining the policy. These costs are deducted from the cash value, resulting in a lower surrender value.

7. Dividends: Certain types of life insurance policies, such as participating whole life insurance, may offer dividends to policyholders. Dividends can contribute to the cash value and potentially increase the surrender value. However, dividends are not guaranteed and depend on the insurance company’s performance.

It is crucial for policyholders to familiarize themselves with these factors and consult with their insurance company or agent to understand how they specifically apply to their life insurance policy. By considering these factors, policyholders can make more informed decisions regarding surrendering their life insurance policy and weigh the potential surrender value against their financial needs and goals.

Surrender Value vs. Cash Value

Understanding the difference between surrender value and cash value is essential when evaluating a life insurance policy. While these terms are related, they represent distinct aspects of the policy’s financial components.

Cash value refers to the portion of the premium payments that accumulate over time in a life insurance policy. It is similar to a savings account within the policy, and this value grows tax-deferred and can potentially earn interest or investment returns. The cash value can be accessed during the policyholder’s lifetime through policy loans or withdrawals, providing a source of funds for various financial needs or emergencies.

Surrender value, on the other hand, is the amount of money that a policyholder receives if they choose to surrender or cancel their life insurance policy before its maturity date. It represents the cash value available to the policyholder after deducting any applicable surrender charges, outstanding loans, and fees.

While these values are related, it’s important to understand that surrender value is typically lower than the cash value. This is due to the deductions and charges associated with surrendering the policy, including surrender fees and outstanding loans. Surrender charges are often higher in the early years of the policy and gradually decrease over time.

The surrender value represents the amount that the insurance company is willing to pay to terminate the policy and release the policyholder from their obligations. It provides policyholders with an option to access their accumulated cash value if they decide that the life insurance coverage is no longer needed or if they require immediate funds for other purposes.

Both the cash value and surrender value are affected by factors such as premium payments, policy duration, policy type, and any outstanding loans. Additionally, the surrender value and cash value may have tax implications, and it is advisable to consult with a tax professional to understand the potential tax consequences.

It’s important to note that surrendering a life insurance policy and receiving the surrender value means forfeiting the death benefit associated with the policy. If the policyholder still requires life insurance coverage or wants to ensure financial protection for their loved ones, surrendering the policy may not be the most suitable option.

Policyholders need to carefully weigh the pros and cons of surrendering a life insurance policy, considering factors such as financial needs, long-term goals, and the availability of alternative financial resources. Consulting with a financial advisor or insurance professional can help individuals make an informed decision about whether surrendering their life insurance policy aligns with their unique circumstances.

Benefits of Surrendering a Life Insurance Policy

Surrendering a life insurance policy is a significant decision that can have both advantages and implications for policyholders. While surrendering a policy means foregoing the death benefit and terminating the coverage, there are several potential benefits that individuals may consider:

1. Access to Cash: Surrendering a life insurance policy allows policyholders to access the cash value that has accumulated over time. The surrender value can provide a lump sum of money that can be used for various purposes such as paying off debts, funding educational expenses, covering medical bills, or investing in other financial assets.

2. Financial Flexibility: Surrendering a life insurance policy can provide individuals with greater financial flexibility. If the policyholder no longer needs the coverage or has sufficient alternative means of financial security, surrendering the policy can free up resources and eliminate ongoing premium payments.

3. No Premium Obligations: Surrendering a life insurance policy relieves the policyholder from future premium payments. This can be beneficial for those who are facing financial constraints or have alternative means of obtaining insurance coverage.

4. Changing Insurance Needs: Over time, individuals’ life insurance needs may change. Surrendering a policy allows policyholders to reassess their coverage requirements and explore other insurance options that better align with their current circumstances and financial goals.

5. Transition to Other Investments: The surrender value received from a life insurance policy can be used to invest in potentially higher-yielding financial assets or investment opportunities. These investments may offer better returns or more suitable options for financial growth.

It is important to note that the benefits of surrendering a life insurance policy should be carefully weighed against the potential drawbacks and long-term financial implications. Surrendering a policy means forfeiting the death benefit, which can leave loved ones without the financial protection that life insurance provides.

Before making a decision, individuals should evaluate their overall financial situation, consider alternative options such as policy loans or partial withdrawals, and consult with a financial advisor or insurance professional. They can provide personalized guidance based on the specific circumstances and help individuals make an informed decision that aligns with their financial goals and priorities.

Drawbacks of Surrendering a Life Insurance Policy

While surrendering a life insurance policy may offer immediate financial benefits, it is crucial to consider the potential drawbacks before making a decision. Here are some of the key disadvantages to keep in mind:

1. Loss of Death Benefit: Surrendering a life insurance policy means forfeiting the death benefit associated with the policy. This can leave loved ones without the financial protection that life insurance provides in the event of the policyholder’s death. If the policyholder has dependents or outstanding financial obligations, surrendering the policy may not be in their best interest.

2. Irreversible Decision: Surrendering a life insurance policy is typically a permanent decision. Once the policy is surrendered, it cannot be reinstated, and the benefits of the coverage are lost forever. It is crucial to evaluate future insurance needs and consider alternative options before surrendering the policy.

3. Lower Surrender Value: The surrender value of a life insurance policy is usually less than the total premiums paid. This is due to the deduction of various fees, charges, and outstanding loans. Surrendering the policy early in its term may result in a significantly lower surrender value, reducing the financial benefit gained from termination.

4. Tax Implications: Surrendering a life insurance policy may have tax consequences. Depending on the policy type, the surrender value may be subject to income tax. It is advisable to consult with a tax professional to fully understand the potential tax implications before making a decision.

5. Loss of Cash Value Growth: Surrendering a policy means giving up the potential growth of the cash value over time. If the policy has been active for a considerable period, the cash value may have significantly increased, providing a substantial asset that could continue to grow and be utilized in the future.

6. Alternatives May Have Higher Costs: If a policyholder decides to surrender their life insurance policy due to financial constraints, they may later find it challenging or more expensive to obtain a new policy. Insurance rates are generally based on age and health, and securing coverage at a later stage may come at a higher cost or with more restrictive terms.

It is important to weigh these drawbacks against the potential benefits of surrendering a life insurance policy. Policyholders should carefully assess their current and future financial needs, consider alternative options like policy loans or partial withdrawals, and consult with a financial advisor or insurance professional.

Ultimately, the decision to surrender a life insurance policy should be made with a clear understanding of the potential drawbacks and careful consideration of the individual’s unique circumstances and goals.

How to Surrender a Life Insurance Policy

If you have decided to surrender your life insurance policy, it is essential to follow the proper process to ensure a smooth and effective termination. The steps to surrender a life insurance policy may vary depending on the insurance company and the specific policy’s terms and conditions. Here is a general guide on how to surrender a life insurance policy:

1. Review Policy Documents: Start by thoroughly reviewing your life insurance policy documents to understand the surrender provisions, requirements, and any potential fees or charges applicable to surrendering the policy. Familiarize yourself with the surrender value calculation and any necessary documentation needed for the surrender process.

2. Contact Your Insurance Company or Agent: Reach out to your insurance company or agent directly to initiate the surrender process. They will guide you through the necessary steps and provide you with the specific requirements and documentation needed for the surrender.

3. Gather Required Documentation: Prepare the necessary documentation as instructed by the insurance company. This may include a surrender form, policy documents, identification, and any additional paperwork specific to your policy or insurance company’s requirements.

4. Complete Surrender Form: Fill out the surrender form accurately and provide all requested information. This may include personal details, policy information, and reasons for surrendering the policy. Ensure that the form is signed and dated as per the instructions provided.

5. Submit Documentation: Submit the completed surrender form and any additional required documents to the insurance company. Make sure to keep copies of all documents for your records.

6. Review Surrender Value and Terms: Once the insurance company processes your surrender request, they will provide you with the surrender value calculation. Review the calculation to ensure it aligns with your expectations and the terms outlined in your policy documents.

7. Receive Surrender Value: Upon approval of your surrender request, the insurance company will issue the surrender value payment. The payment may be provided as a check or transferred electronically to your designated bank account, depending on the insurer’s practices.

8. Confirm Policy Termination: Verify with the insurance company that your policy has been successfully terminated and that you are no longer obligated to make any further premium payments.

It is important to note that surrendering a life insurance policy should be carefully considered, as it means forfeiting the death benefit and potential future coverage. Before proceeding with the surrender, evaluate your long-term financial goals, insurance needs, and consider alternative options such as policy loans or partial withdrawals.

While this general guide provides an overview of the surrender process, it is recommended to contact your insurance company or agent directly for specific instructions and requirements based on your policy. Seeking guidance from a financial advisor or insurance professional can also provide valuable insights and help you navigate the decision-making process.

Conclusion

Surrendering a life insurance policy is a significant decision that should be carefully considered and evaluated in the context of your unique financial situation and goals. Understanding the surrender value, as well as the potential benefits and drawbacks, is crucial in making an informed decision.

While surrendering a policy allows access to the accumulated cash value and provides immediate financial flexibility, it also means forfeiting the death benefit and potential future coverage for your loved ones. Additionally, surrendering a policy may result in a lower surrender value due to surrender charges, outstanding loans, and other deductions.

Before deciding to surrender a life insurance policy, thoroughly review the policy provisions, consult with your insurance company or agent, and consider alternative options such as policy loans or partial withdrawals. A financial advisor or insurance professional can provide personalized guidance based on your specific circumstances.

Ultimately, the decision to surrender a life insurance policy should align with your current financial needs, long-term goals, and the availability of alternative financial resources. It is crucial to weigh the potential benefits against the implications and ensure that surrendering the policy is the most suitable option for your individual situation.

Remember, life insurance serves as a crucial tool for providing financial protection to your loved ones and can play a significant role in your overall financial plan. Make sure to assess your insurance needs periodically and review your options with the help of professionals to ensure that you are adequately protected.