Finance

What Is The Surrender Value Of Life Insurance?

Modified: February 21, 2024

Learn about the surrender value of life insurance and how it plays a key role in your financial planning. Find out how it works and its importance in your overall financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Surrender Value

- Components of Surrender Value

- Calculation of Surrender Value

- Importance of Surrender Value

- Factors Affecting Surrender Value

- Surrender Value vs. Cash Value

- Surrender Value and Policyholder Benefits

- Surrender Value Examples

- Surrender Value and Tax Implications

- Surrender Value and Surrender Charges

- Surrender Value in Different Types of Life Insurance Policies

- Conclusion

Introduction

Welcome to the world of life insurance and its intricacies! Life insurance is a valuable financial tool that offers protection to individuals and their families by providing a lump sum payment in the event of the policyholder’s death. However, life insurance policies are not only about death benefits. They often come with additional features, such as the surrender value.

Understanding the surrender value of a life insurance policy is essential for policyholders to make informed decisions about their financial future. The surrender value represents the amount of money an individual is eligible to receive upon surrendering or canceling their life insurance policy before the end of its term.

Like many other financial concepts, the surrender value can be complex and vary depending on the type of policy and the number of years it has been in force. In this article, we will delve into the intricacies of surrender value and help demystify its significance in the world of life insurance.

In the following sections, we will define the surrender value, explore its components, discuss how it is calculated, and examine its importance for policyholders. Additionally, we will explore factors that can affect the surrender value, compare it to cash value, and highlight tax implications and surrender charges. We will conclude with a look at how surrender value is influenced by different types of life insurance policies.

So, whether you are a policyholder trying to make sense of your life insurance policy or a curious individual wanting to understand the inner workings of life insurance, keep reading to discover the ins and outs of the surrender value and its implications.

Definition of Surrender Value

The surrender value of a life insurance policy refers to the amount of money that a policyholder is entitled to receive when they voluntarily terminate or surrender their policy before its maturity or the completion of the full term. Essentially, it is the cash value that the insurance company will pay to the policyholder upon surrendering the policy.

Life insurance policies are typically long-term commitments, and circumstances may arise where the insured individual no longer wishes to continue paying premiums or feels that the policy no longer serves their needs. In such cases, surrendering the policy allows the policyholder to exit the contract prematurely and receive the surrender value as a cash payout.

The surrender value is determined by the insurance company and is influenced by various factors, including the type of policy, the duration of the policy, the amount of premiums paid, and any applicable surrender charges or penalties.

It’s important to note that the surrender value is distinct from the death benefit of a life insurance policy. The death benefit is the amount that the insurance company pays out to the designated beneficiaries upon the death of the insured individual. The surrender value, on the other hand, is payable to the policyholder during their lifetime if they choose to terminate the policy.

The surrender value can vary significantly depending on the type of policy. Whole life insurance policies, for example, typically accumulate a cash value over time, which forms the basis of the surrender value. Term life insurance policies, on the other hand, generally do not accumulate cash value, so the surrender value may be minimal or non-existent.

It’s important to carefully consider the surrender value before making any decisions. While it can provide policyholders with a cash payout, it also means relinquishing the insurance coverage and any future benefits associated with the policy.

Next, let’s explore the components that make up the surrender value of a life insurance policy.

Components of Surrender Value

The surrender value of a life insurance policy is composed of several key components that determine the amount of money a policyholder will receive upon surrendering their policy. Understanding these components is crucial for policyholders to grasp how the surrender value is calculated and to make informed decisions.

1. Cash Value: The cash value is the portion of the surrender value that represents the accumulated savings or investment component of a permanent life insurance policy, such as whole life or universal life insurance. Over time, as policyholders pay premiums, a portion of those premiums is allocated towards the cash value, which grows on a tax-deferred basis. The cash value serves as a source of funds that can be accessed during the policyholder’s lifetime, either through policy loans or surrendering the policy.

2. Premiums Paid: The surrender value is also impacted by the total amount of premiums paid by the policyholder. Generally, the more premiums paid, the higher the surrender value. However, it’s important to note that surrendering a policy early in its term may result in a lower surrender value as the accumulated cash value may not have had sufficient time to grow.

3. Policy Expenses: Insurance companies deduct various costs and fees associated with administering the policy from the surrender value. These expenses include administrative fees, mortality charges, and other fees related to insurance coverage. The deduction of these policy expenses reduces the overall surrender value.

4. Surrender Charges: Some life insurance policies, particularly those with an investment component, may have surrender charges or penalties for terminating the policy before a specified period. These charges are designed to discourage policyholders from surrendering the policy early and aim to recover the costs incurred by the insurance company in underwriting and administering the policy. Surrender charges can significantly impact the surrender value, and their percentage may vary depending on the policy’s terms and conditions.

5. Policy Loans: If a policyholder has taken out a loan against the cash value of their policy, the outstanding loan balance is deducted from the surrender value. It is important to repay any outstanding policy loans before surrendering the policy to maximize the surrender value.

By considering these components, policyholders can get a better understanding of how the surrender value is derived and what factors can affect its calculation. Next, let’s dive into the actual calculation of the surrender value.

Calculation of Surrender Value

The calculation of the surrender value of a life insurance policy can be complex and vary depending on the policy type and terms. Insurance companies use different formulas and methods to determine the surrender value, but there are some common approaches used in the industry. Here, we will explore a few basic methods of calculating the surrender value.

1. Cash Value Method: This method is applicable to permanent life insurance policies that accumulate a cash value. The surrender value is typically equal to the policy’s cash value at the time of surrender, minus any applicable surrender charges or outstanding policy loans. The cash value represents the accumulated premiums, minus policy expenses and charges, plus any interest or investment gains.

2. Net Reserve Method: This method is commonly used for traditional whole life insurance policies and takes into account the net amount at risk for the insurance company. The net amount at risk is calculated by subtracting the policy’s accumulated cash value from the death benefit amount. The surrender value is then determined by applying a surrender value factor to the net amount at risk.

3. Paid-Up Insurance Method: Certain policies allow policyholders to convert a portion of their existing policy into a paid-up policy with a reduced face amount. The surrender value is determined by calculating the amount of paid-up insurance that can be obtained based on the policy’s cash value and the premiums paid.

It’s important to note that each insurance company may have its own specific formula and methodology for calculating the surrender value. Policyholders should refer to their policy documents and consult with their insurance agent or company to understand the exact calculation method used for their specific policy.

Additionally, it’s crucial to consider any surrender charges, outstanding policy loans, or other deductions that may reduce the final surrender value. These factors can vary from policy to policy and should be carefully evaluated before making a decision to surrender the policy.

Now that we have explored the calculation process, let’s move on to discuss the importance of surrender value for policyholders.

Importance of Surrender Value

The surrender value of a life insurance policy holds significant importance for policyholders. It serves as a financial safeguard and provides individuals with flexibility and options in managing their insurance policies. Here are some key reasons why understanding and considering the surrender value is important:

1. Financial Flexibility: The surrender value gives policyholders the option to access cash when needed. Life circumstances can change, and individuals may require funds for various reasons, such as paying off debts, covering medical expenses, or investing in other opportunities. Surrendering a policy and receiving the surrender value provides policyholders with a lump sum payout that can be used to address their financial needs.

2. Policy Adaptability: Life insurance needs may change over time. The surrender value offers policyholders the flexibility to adjust their coverage based on their evolving circumstances. If the current policy no longer aligns with their financial goals, surrendering the policy and receiving the surrender value enables them to explore other insurance options that better suit their needs.

3. Financial Hardship: In times of financial hardship, one may find it challenging to keep up with premium payments. Surrendering the policy and receiving the surrender value can provide much-needed financial relief during challenging times. However, it’s essential to carefully evaluate the impact of surrendering the policy on the long-term financial protection and consider alternative solutions, such as requesting a policy loan or adjusting the coverage amount.

4. Evaluating Policy Performance: Monitoring the surrender value over time can serve as a gauge for evaluating the policy’s performance. If the surrender value accumulation is lower than anticipated or expected, it may be an indication that the policy is not delivering the desired results. Policyholders can use this information to review their policy, consider potential modifications, or explore alternative insurance options that may better align with their financial objectives.

5. Estate Planning: Surrender value can play a role in estate planning. If policyholders anticipate no longer needing life insurance coverage or have other financial resources to rely on for their beneficiaries, surrendering the policy and receiving the surrender value may be a viable option. It allows policyholders to effectively distribute their assets based on their wishes and priorities.

It’s important to remember that while the surrender value provides financial flexibility, surrendering a life insurance policy means forfeiting the death benefit and any associated riders or benefits. Careful consideration should be given to the long-term implications, including the impact on financial protection and potential tax consequences.

Next, let’s explore the factors that can influence the surrender value of a life insurance policy.

Factors Affecting Surrender Value

The surrender value of a life insurance policy is influenced by several factors that can vary depending on the policy type and the insurance company’s terms and conditions. Understanding these factors is crucial in assessing the potential surrender value and making informed decisions. Here are some key factors that can affect the surrender value:

1. Policy Type: Different types of life insurance policies have varying surrender value structures. Permanent life insurance policies, such as whole life or universal life, typically accumulate a cash value over time, which forms the basis for the surrender value. In contrast, term life insurance policies do not accumulate cash value and may have minimal or no surrender value.

2. Policy Duration: The surrender value of a life insurance policy increases over time as the policyholder pays premiums and the cash value accumulates. Typically, surrendering a policy in the early years may result in a lower surrender value as the cash value may not have had sufficient time to grow. As the policy matures, the surrender value tends to increase.

3. Premium Payments: The amount of premiums paid towards a life insurance policy can affect the surrender value. Generally, the higher the premiums paid, the higher the surrender value. Policyholders who have consistently paid premiums for a longer duration may have a higher surrender value compared to those who have paid premiums for a shorter period.

4. Surrender Charges: Some life insurance policies may have surrender charges or penalties for terminating the policy before a specified period. These charges are designed to discourage policyholders from surrendering the policy early and aim to recover the costs incurred by the insurance company in underwriting and administering the policy. Surrender charges can significantly reduce the surrender value.

5. Policy Loans: If a policyholder has taken out a loan against the cash value of their policy, the outstanding loan balance will be deducted from the surrender value. It is important to repay any outstanding policy loans before surrendering the policy to maximize the surrender value.

6. Policy Expenses: Insurance companies deduct various costs and fees associated with administering the policy from the surrender value. These expenses include administrative fees, mortality charges, and other fees related to insurance coverage. The deduction of these policy expenses reduces the overall surrender value.

7. Policy Riders and Benefits: Additional riders or benefits added to a life insurance policy can impact the surrender value. Some riders may increase the cash value accumulation, while others may have separate surrender values. It’s important to understand how these riders or benefits affect the surrender value before making any decisions.

It’s crucial to carefully review the policy terms and conditions to understand how these factors will impact the surrender value. Consulting with an insurance professional can provide clarity about the specific factors influencing the surrender value of a particular policy.

Next, let’s explore the difference between surrender value and cash value in a life insurance policy.

Surrender Value vs. Cash Value

The surrender value and cash value are two important components of a life insurance policy, but they serve different purposes and have distinct characteristics. Understanding the difference between these two values is crucial in evaluating the financial implications of a life insurance policy. Let’s explore the disparities between surrender value and cash value:

Surrender Value: The surrender value represents the amount of money a policyholder is entitled to receive if they decide to surrender or cancel their life insurance policy before its maturity or the completion of the full term. It is the cash payout that the insurance company provides to the policyholder upon surrendering the policy. The surrender value takes into consideration factors such as the policy type, duration, premiums paid, surrender charges, and outstanding policy loans. Surrendering the policy means forfeiting the death benefit and any associated riders or benefits.

Cash Value: The cash value is the savings or investment component of a permanent life insurance policy, such as whole life or universal life insurance. It represents the portion of premiums that is allocated towards investments and grows on a tax-deferred basis. The cash value accumulates over time and can be accessed by the policyholder during their lifetime through policy loans or partial surrenders. Unlike the surrender value, the cash value is not the total amount available upon surrendering the policy. Surrendering a policy may result in receiving the cash value minus any applicable surrender charges and outstanding policy loans.

In summary, while both the surrender value and cash value have monetary value within a life insurance policy, they have distinct purposes and implications. The surrender value is the amount received upon surrendering the policy before its maturity, taking into consideration various factors. The cash value, on the other hand, is the accumulated savings or investment portion of a permanent policy that policyholders can access while the policy is in force.

It’s important for policyholders to carefully consider both the surrender value and cash value when making decisions about their life insurance policies. Evaluating the long-term financial objectives, needs, and potential tax implications will help policyholders determine the best course of action regarding their life insurance coverage.

Next, let’s explore the benefits that policyholders can receive in addition to the surrender value.

Surrender Value and Policyholder Benefits

The surrender value of a life insurance policy is just one aspect of the benefits that policyholders can receive. In addition to the surrender value, there are other potential advantages and options that policyholders should be aware of. Let’s explore some of the key benefits that policyholders can enjoy:

1. Flexibility: The surrender value provides policyholders with financial flexibility. If circumstances change and policyholders find themselves unable to continue paying premiums or if they require a lump sum of cash, they have the option to surrender the policy and receive the surrender value. This flexibility allows individuals to adapt their insurance coverage based on their evolving needs and financial goals.

2. Access to Cash Value: Permanent life insurance policies, such as whole life or universal life insurance, often accumulate a cash value component over time. Policyholders can access this cash value through policy loans, where they borrow against the cash value and repay it with interest. These loans provide a source of funds that can be used for various purposes, such as supplementing retirement income, paying for educational expenses, or covering unexpected financial emergencies.

3. Income Generation: The cash value component of permanent life insurance policies has the potential to generate income. Policyholders can choose to use the cash value to purchase additional paid-up insurance, which can provide a lifetime income stream. This option allows policyholders to create a source of income in retirement or other stages of life, offering financial stability and security.

4. Wealth Accumulation: The cash value accumulation in permanent life insurance policies can serve as a wealth-building tool. As the cash value grows over time, policyholders can benefit from potential tax-deferred growth and leverage the cash value for future financial planning needs, such as estate planning, funding education expenses, or leaving a financial legacy for their loved ones.

5. Financial Protection: While surrendering a policy means giving up the death benefit, it’s important to recognize that life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. Although the surrender value may not be relevant in this scenario, the death benefit can offer invaluable support to loved ones by providing a tax-free lump sum payment to cover ongoing living expenses, pay off debts, or secure a financially stable future.

Understanding the various benefits associated with life insurance policies, including the surrender value and the other advantages mentioned above, allows policyholders to make informed decisions about their coverage. It is advisable to consult with a financial advisor or insurance professional to assess individual circumstances, goals, and needs to determine the best strategy for maximizing the benefits of a life insurance policy.

Now, let’s move on to provide examples of how the surrender value is calculated in different scenarios.

Surrender Value Examples

Understanding how surrender value is calculated is essential for policyholders to comprehend the potential payouts they may receive when surrendering a life insurance policy. Let’s consider a few examples to illustrate the calculation of surrender value in different scenarios:

Example 1: Whole Life Insurance Policy

John has a whole life insurance policy that he has held for 15 years. The policy has a cash value of $50,000, and the surrender charges for surrendering the policy before 20 years are 10% of the cash value. In this scenario, the surrender value would be $45,000 ($50,000 cash value minus 10% surrender charge).

Example 2: Universal Life Insurance Policy

Sarah has a universal life insurance policy with a cash value of $100,000. She has paid premiums for 10 years and has taken out a policy loan of $20,000. If Sarah decides to surrender the policy, she will need to repay the outstanding loan balance of $20,000. In this case, the surrender value would be $80,000 ($100,000 cash value minus $20,000 outstanding loan).

Example 3: Term Life Insurance Policy

Michael has a term life insurance policy that he has held for 5 years. Term policies generally do not accumulate cash value, so the surrender value is typically minimal or non-existent. In this example, the surrender value may be zero, meaning that Michael would not receive any payout if he chooses to surrender the policy.

Example 4: Reduced Paid-Up Option

Anna has a whole life insurance policy with a cash value of $75,000. She has decided not to surrender the policy but instead wants to exercise the reduced paid-up option. This option allows Anna to convert her policy into a paid-up policy with a reduced face amount. Based on the policy’s terms, Anna can receive a paid-up policy with a face amount of $50,000. In this case, the surrender value would be the difference between the cash value and the reduced face amount, which is $25,000 ($75,000 cash value minus $50,000 reduced face amount).

These examples illustrate how the surrender value can vary based on factors such as policy type, cash value, surrender charges, and outstanding policy loans. It’s important to note that each insurance company may have its own specific calculation method, and policyholders should refer to their policy documents and consult with their insurance agent or company to understand the exact surrender value in their particular case.

Now, let’s explore the potential tax implications associated with surrendering a life insurance policy.

Surrender Value and Tax Implications

When considering surrendering a life insurance policy, it is important to be aware of the potential tax implications associated with the surrender value. The surrender value can have tax consequences depending on various factors, including the policy type, the amount of premiums paid, and the reason for surrendering. Let’s explore the common tax considerations related to surrendering a life insurance policy:

1. Income Tax: In general, the surrender value is treated as taxable income to the policyholder to the extent that it exceeds the total premiums paid into the policy. The amount that exceeds the premiums is considered a gain and subject to income tax. It is essential to consult with a tax professional to understand the specific tax implications based on individual circumstances.

2. Capital Gains Tax: If the policy has accumulated a significant cash value and the surrender value exceeds the policyholder’s basis (premiums paid), the gain may be subject to capital gains tax. The capital gains tax rate will depend on the policyholder’s tax bracket and the length of time the policy has been in force.

3. Surrender Charges: Surrender charges, which are common in permanent life insurance policies, may be tax-deductible in certain circumstances. If the surrender charges are considered an expense related to the termination of the policy, they may be eligible for a tax deduction. Policyholders should consult with a tax advisor to determine if the surrender charges qualify for a deduction.

4. Policy Loans: If the policyholder has taken out a loan against the cash value of the policy, surrendering the policy may trigger a taxable event. Any outstanding loan balance that is not repaid prior to surrender is considered a distribution and may be subject to income tax. It is important to carefully evaluate the tax implications and repayment options for policy loans.

It’s crucial to note that tax laws and regulations are subject to change and can vary from one jurisdiction to another. Policyholders should consult with a qualified tax professional or financial advisor to fully understand the tax implications specific to their situation before making any decisions regarding surrendering a life insurance policy.

Next, let’s explore the concept of surrender charges and their significance in relation to the surrender value.

Surrender Value and Surrender Charges

When considering surrendering a life insurance policy, it is important to understand the concept of surrender charges and their impact on the surrender value. Surrender charges are fees or penalties imposed by insurance companies for terminating a policy before a specified period. Here, we will explore the relationship between surrender value and surrender charges:

1. Purpose of Surrender Charges: Insurance companies implement surrender charges to encourage policyholders to maintain their policies for a certain duration. These charges help offset the administrative and underwriting expenses incurred by the insurance company upfront. Surrender charges are typically specified in the policy contract and vary depending on the policy type, duration, and sometimes the amount of premiums paid.

2. Effect on Surrender Value: Surrender charges have a direct impact on the surrender value. When a policyholder decides to surrender their policy, the surrender value is reduced by the applicable surrender charges. The surrender value is calculated by subtracting the surrender charges from the accumulated cash value or other relevant factors, such as outstanding policy loans or unpaid premiums.

3. Surrender Charge Periods: Surrender charges typically apply during the early years of a life insurance policy. The surrender charge period is specified in the policy contract and can range from a few years to more than a decade. Once the surrender charge period ends, policyholders may be able to surrender their policies without incurring any charges, or the charges may decrease significantly. It is crucial to review and understand the surrender charge period outlined in the policy contract.

4. Impact on Decision-Making: Surrender charges can significantly affect policyholders’ decisions to surrender a policy. Policyholders should consider the impact of surrender charges on the surrender value before making any decisions. If the surrender value is minimal due to high surrender charges, it may be more beneficial to keep the policy in force until the surrender charge period expires or explore alternative options, such as converting the policy or taking a policy loan, if available.

5. Exceptions to Surrender Charges: Some policies may offer exceptions or waivers for surrender charges under certain circumstances. These exceptions can include situations such as disability, terminal illness, or change of ownership. It’s essential to review the policy contract and consult with the insurance company or agent to understand any potential exceptions or alternatives to minimize surrender charges.

Understanding the relationship between surrender value and surrender charges is crucial in evaluating the financial implications of surrendering a life insurance policy. Policyholders should carefully review their policy contracts, assess the surrender charges, and consider how they align with their financial goals before making any decisions.

Next, let’s explore how surrender value is impacted by different types of life insurance policies.

Surrender Value in Different Types of Life Insurance Policies

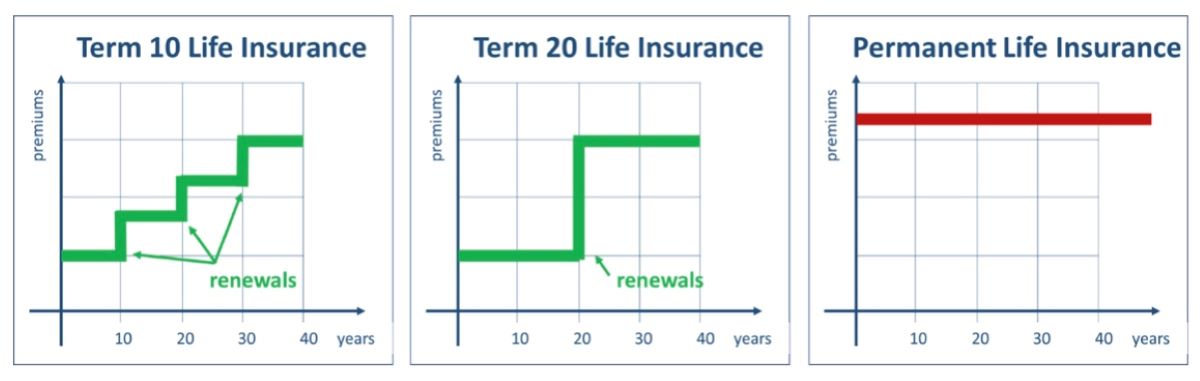

The surrender value of a life insurance policy can vary depending on the type of policy. Different types of life insurance offer distinct features and cash value accumulation, which in turn impact the surrender value. Let’s explore how surrender value is influenced by different types of life insurance policies:

1. Whole Life Insurance: Whole life insurance policies offer a guaranteed death benefit and a cash value component. The cash value accumulates over time, and policyholders can access it through policy loans or surrendering the policy. The surrender value of a whole life insurance policy is typically derived from the accumulated cash value minus any applicable surrender charges or outstanding policy loans.

2. Universal Life Insurance: Universal life insurance policies also accumulate cash value, but they provide more flexibility in premium payments and death benefit options compared to whole life insurance. The surrender value of a universal life insurance policy is affected by factors such as the cash value accumulation, surrender charges, outstanding policy loans, and the performance of the underlying investment options.

3. Term Life Insurance: Term life insurance policies provide coverage for a specified term without a cash value component. As a result, term life policies typically have minimal or no surrender value. When the policyholder surrenders a term life insurance policy, there is generally no cash payout. However, term life insurance remains valuable for its primary benefit of providing financial protection to beneficiaries in the event of the policyholder’s death.

4. Variable Life Insurance: Variable life insurance policies allow policyholders to invest the cash value component in various investment options, such as stocks or bonds. The surrender value of a variable life insurance policy depends on the performance of the underlying investments. If the investments have performed well, the surrender value may be higher. Conversely, poor investment performance may result in a lower surrender value.

5. Indexed Universal Life Insurance: Indexed universal life insurance policies offer the potential for cash value growth linked to a specific market index. The surrender value of an indexed universal life insurance policy is influenced by the performance of the underlying index and any applicable surrender charges or outstanding policy loans.

It’s important to note that surrender values can differ significantly between policyholders due to factors such as age, health, premiums paid, and policy duration. Policyholders should review their specific policy documents, consult with their insurance agent or company, and consider their financial goals to understand the surrender value unique to their individual circumstances.

Now, let’s conclude our discussion on the significance of surrender value and its impact on life insurance policies.

Conclusion

The surrender value is an important aspect of life insurance policies that policyholders should consider when evaluating their financial strategies. It represents the cash value a policyholder is entitled to receive upon surrendering or canceling their policy before its maturity. Understanding the surrender value allows policyholders to make informed decisions about their life insurance coverage, based on their evolving needs and goals.

Throughout this article, we explored the definition of surrender value and its components. We also discussed how surrender value is calculated, the importance of surrender value, and factors that can affect its calculation. Additionally, we examined the difference between surrender value and cash value, and the potential benefits that policyholders can receive in addition to the surrender value.

We also highlighted potential tax implications associated with surrendering a life insurance policy, such as income tax, capital gains tax, and the deductibility of surrender charges. Understanding these tax considerations is crucial in making well-informed decisions that align with individual financial circumstances.

Furthermore, we discussed surrender charges and their impact on the surrender value. Surrender charges discourage policyholders from terminating their policies early and vary depending on the policy type and duration. By considering surrender charges, policyholders can evaluate the financial implications of surrendering their policies and determine the best course of action.

We also explored how surrender value can differ across different types of life insurance policies such as whole life, universal life, term life, variable life, and indexed universal life. Each policy type has unique characteristics that affect the surrender value, and policyholders should carefully review their specific policy contracts and consult with insurance professionals to understand the surrender value specific to their circumstances.

In conclusion, the surrender value of a life insurance policy provides policyholders with financial flexibility and options to adapt their coverage based on changing needs. While surrendering a policy may result in a cash payout, it’s important to weigh the surrender value against the potential loss of the death benefit and other associated benefits. Policyholders should carefully evaluate their financial goals, tax implications, and long-term insurance needs before making any decisions regarding their life insurance policies.

Remember, it is always recommended to consult with a financial advisor or insurance professional who can provide personalized guidance based on individual circumstances. By understanding the surrender value and its implications, policyholders can make informed decisions that align with their overall financial well-being.