Home>Finance>Why Can Commodity Futures Contracts Be Bought And Sold On The Open Market?

Finance

Why Can Commodity Futures Contracts Be Bought And Sold On The Open Market?

Published: December 24, 2023

Discover the reasons why commodity futures contracts can be freely traded on the open market and how it impacts the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Commodity Futures Contracts

- Overview of the Open Market

- Reasons for Buying and Selling Commodity Futures Contracts on the Open Market

- Benefits and Opportunities for Market Participants

- Factors Affecting the Price of Commodity Futures Contracts on the Open Market

- Risks and Challenges in the Open Market Trading of Commodity Futures Contracts

- Role of Market Regulations and Oversight

- Conclusion

Introduction

Commodity futures contracts play a vital role in the global financial markets, offering investors and traders the opportunity to buy and sell a wide range of commodities, from agricultural products such as wheat and corn, to energy resources like crude oil and natural gas. But what exactly does it mean to buy and sell commodity futures contracts on the open market?

A commodity futures contract is a legal agreement between two parties, typically a buyer and a seller, to buy or sell a specified quantity of a commodity at a predetermined price at a future date. These contracts are standardized and traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX).

The open market, also known as the exchange-traded market, refers to the marketplace where these commodity futures contracts are bought and sold. It is an open and transparent platform that allows multiple participants, including individual investors, institutional traders, and even speculators, to enter into transactions with each other.

The open market for commodity futures contracts provides several benefits and opportunities for market participants. It allows them to hedge against price volatility, speculate on price movements, and gain exposure to various commodities without physically owning the underlying assets. It also promotes price discovery and liquidity, as the trading activity in the open market determines the fair value of these contracts based on supply and demand.

However, trading commodity futures contracts on the open market is not without risks and challenges. Market participants need to be aware of the potential for substantial losses, as prices can be highly volatile and unpredictable. They also need to consider factors such as market trends, economic indicators, and geopolitical events that can influence commodity prices.

Market regulations and oversight play a crucial role in ensuring fair and orderly trading in the open market. Regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) in the United States, set rules and monitor market activity to prevent manipulation, fraud, and other illegal practices. This helps maintain the integrity of the market and protects the interests of all participants.

In this article, we will delve deeper into the reasons why commodity futures contracts can be bought and sold on the open market. We will explore the benefits and opportunities that the open market provides, the factors influencing commodity prices, and the risks involved in trading in the open market. We will also examine the role of market regulations in ensuring a fair and transparent trading environment.

So, if you’ve ever wondered why commodity futures contracts are traded on the open market, read on to discover the fascinating world of commodity trading and the open market.

Definition of Commodity Futures Contracts

Commodity futures contracts are financial instruments that allow market participants to buy or sell a specific commodity at a future date and at a predetermined price. These contracts are legally binding agreements that standardize the terms and conditions of the transaction, including the quantity of the commodity and the delivery date.

These contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the London Metal Exchange (LME). They serve as a crucial tool for managing price risk and providing liquidity to market participants.

One key characteristic of commodity futures contracts is that they are standardized. This means that the terms of the contract, including the product grade, quantity, and delivery location, are predetermined and set by the exchange. This standardization ensures transparency and facilitates the trading process.

For example, let’s consider a corn futures contract traded on the CME. The contract may specify the delivery of 5,000 bushels of corn of a particular grade, with a delivery month of December. The contract also includes the price at which the corn will be bought or sold, known as the futures price.

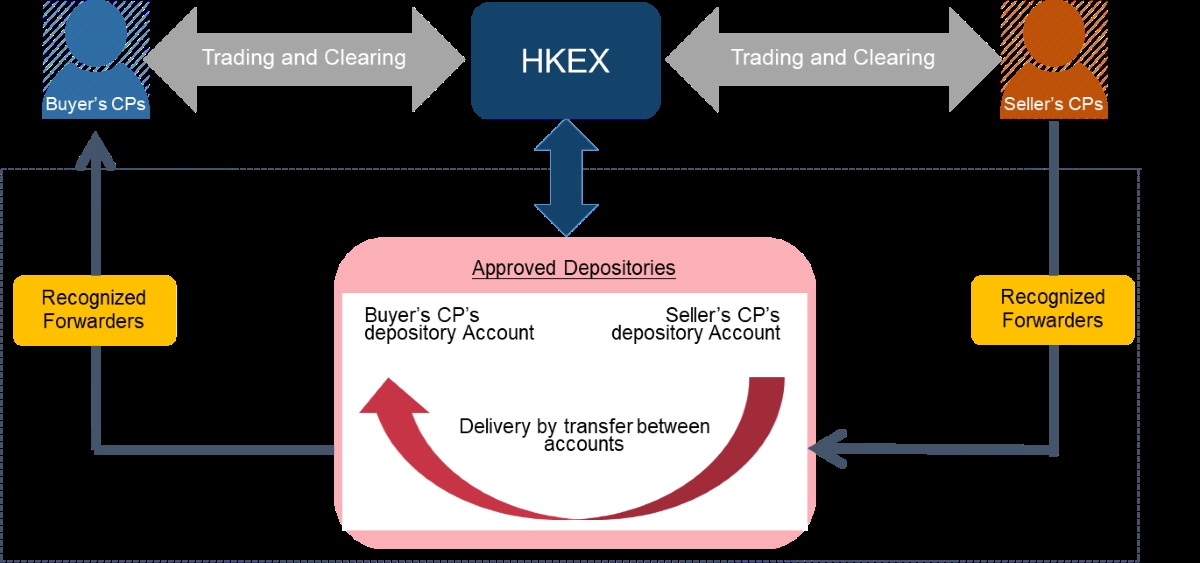

Commodity futures contracts are typically settled through cash settlement or physical delivery. In cash settlement, the profit or loss is settled in cash based on the difference between the futures price and the market price at the time of contract expiration. Physical delivery involves the actual transfer of the underlying commodity between the buyer and the seller.

These contracts serve different purposes for market participants. Producers, such as farmers and mining companies, can use futures contracts to lock in prices for their commodities, ensuring a predictable revenue stream and protecting against price volatility. On the other hand, consumers and end-users, such as manufacturers and energy companies, can use futures contracts to secure future supply at a fixed price.

Speculators, who are not producers or consumers of the commodity, participate in the futures market to profit from price fluctuations. They enter into futures contracts with the expectation of buying low and selling high or vice versa. Their buying and selling activities contribute to market liquidity and price discovery.

Overall, commodity futures contracts provide a mechanism for market participants to manage price risk, gain exposure to commodities, and facilitate efficient price discovery. By standardizing the terms and conditions, these contracts promote transparency and facilitate trading on the open market.

In the next section, we will explore the open market and why commodity futures contracts are bought and sold in this market.

Overview of the Open Market

The open market, also known as the exchange-traded market, is where commodity futures contracts are actively bought and sold. It serves as a central hub where market participants can engage in trading activities, including buying contracts to take on long positions or selling contracts to take on short positions.

The open market provides a transparent and efficient platform for trading commodity futures contracts. Market participants can access the open market through electronic trading platforms, which allow for real-time price quotes, order placement, and execution. These platforms provide equal access to all participants, whether they are individual investors, institutional traders, or market makers.

One key advantage of the open market is the ability to execute trades quickly and easily. Market participants can enter orders at any time during trading hours, which typically span multiple hours a day, depending on the exchange. This flexibility enables participants to actively react to market movements, news events, and economic indicators.

Market liquidity is another crucial aspect of the open market. Liquidity refers to the ease with which an asset or security can be bought or sold without causing a significant change in its price. In a liquid market, there are ample buyers and sellers, allowing participants to execute trades at competitive prices.

The open market provides high liquidity for commodity futures contracts due to the participation of various market players. These participants include hedgers, speculators, market makers, and arbitrageurs, each with their own objectives and strategies.

Hedgers use the open market to manage price risk by taking opposite positions in the futures market compared to their positions in the physical commodity. For example, a wheat farmer might sell wheat futures contracts to hedge against a potential decline in wheat prices, while a bread manufacturer might buy wheat futures contracts to hedge against a potential increase in wheat prices. Hedging in the open market allows these market participants to lock in prices and reduce their exposure to price fluctuations.

Speculators, on the other hand, take positions in the open market to profit from price movements. They buy or sell futures contracts based on their expectations of future price changes, aiming to benefit from these price fluctuations. Speculators provide liquidity to the market as they are willing to take on the opposite side of trades from hedgers.

Market makers play a vital role in maintaining a liquid market. They continuously provide buy and sell quotes for commodity futures contracts, offering traders the ability to enter or exit their positions at competitive prices. Market makers earn a profit from the bid-ask spread, which is the difference between the buying price and the selling price.

Arbitrageurs take advantage of price discrepancies between different markets or related instruments. They buy at a lower price in one market and sell at a higher price in another, profiting from the price differential. Arbitrage activities in the open market help align prices across different markets and promote market efficiency.

To ensure fair and orderly trading, the open market operates under the supervision of regulatory bodies. These bodies set rules and guidelines to prevent market manipulation, fraud, and other illegal activities. They also monitor market activity and enforce compliance with trading regulations.

In the following sections, we will explore the reasons why market participants buy and sell commodity futures contracts on the open market, the benefits and opportunities it offers, and the factors influencing commodity prices.

Reasons for Buying and Selling Commodity Futures Contracts on the Open Market

Market participants buy and sell commodity futures contracts on the open market for various reasons, driven by their specific objectives and strategies. Let’s explore some of the key reasons why individuals and institutions engage in these trading activities.

Price Hedging: One of the primary reasons for buying and selling commodity futures contracts is to mitigate price risk. Hedgers, such as farmers, manufacturers, and energy producers, use futures contracts to protect themselves against adverse price movements in the physical commodity market. By taking equal and opposite positions in the futures market, hedgers can offset potential losses in the cash market with gains in their futures positions. This enables them to lock in prices and ensure more predictable revenue streams.

Speculation: Speculators, including individual investors and financial institutions, actively participate in the open market to profit from price fluctuations. They buy or sell futures contracts based on their expectations of future price movements. Speculation adds liquidity to the market and promotes efficient price discovery. While speculators assume higher risks, they also have the potential for greater profits if their price predictions are accurate.

Arbitrage Opportunities: Arbitrageurs take advantage of price discrepancies between different markets or related instruments. They identify situations where the same commodity is trading at different prices in different markets or where the futures price deviates significantly from the expected spot price. Arbitrage activities help align prices across markets and provide opportunities for risk-free profits by buying low in one market and selling high in another.

Portfolio Diversification: Commodity futures contracts offer diversification benefits for investors seeking to spread their risk. Adding commodities to a portfolio that already includes stocks, bonds, and other asset classes can potentially reduce overall portfolio volatility. Commodity futures contracts have historically exhibited low correlation with traditional asset classes, making them a valuable tool to hedge against inflation and diversify investment portfolios.

Access to Physical Commodities: Investing in commodity futures contracts allows market participants to gain exposure to physical commodities without the need for direct ownership. This is particularly valuable for individuals and institutions who are interested in commodities but do not have the means or infrastructure to handle the physical delivery and storage of these assets. Trading futures contracts provides a convenient and efficient way to participate in the commodity market.

Profit Potential and Leverage: Commodity futures contracts offer the potential for substantial profits, especially when leverage is considered. Leverage allows investors to control a larger position in the market with a smaller initial investment. While leverage amplifies potential gains, it also increases the risk of losses. Therefore, it is crucial for market participants to carefully manage their risk and use leverage responsibly.

The open market for commodity futures contracts provides a level playing field for all participants, enabling them to pursue their individual strategies and goals. Whether it’s hedging against price risk, speculating on price movements, seeking arbitrage opportunities, diversifying portfolios, or gaining exposure to physical commodities, the open market offers a wide range of opportunities for market participants to manage risk and potentially profit from the commodities market.

In the next section, we will explore the specific benefits and opportunities that the open market provides for market participants.

Benefits and Opportunities for Market Participants

The open market for commodity futures contracts offers a multitude of benefits and opportunities for market participants, catering to their diverse objectives and strategies. Let’s delve into some of the key advantages that trading in the open market provides.

Price Discovery: The open market plays a crucial role in determining the fair value of commodities based on supply and demand dynamics. Through the continuous buying and selling of futures contracts, market participants contribute to the process of price discovery. This transparent and efficient price discovery mechanism benefits both buyers and sellers, allowing them to make informed decisions based on market conditions.

Liquidity: The open market is characterized by high liquidity, meaning there is a significant volume of buyers and sellers actively trading commodity futures contracts. This liquidity provides market participants with the ability to enter and exit positions quickly and at competitive prices. The ample liquidity also reduces the risk of being unable to find a counterparty for a trade, ensuring efficient market functioning.

Hedging Against Price Volatility: For producers and consumers of commodities, the open market offers a valuable tool for managing price risk. By taking opposite positions in the futures market compared to their positions in the physical commodity market, hedgers can protect themselves from adverse price movements. This allows them to stabilize cash flows, plan production and consumption, and reduce uncertainty in their operations.

Speculation: Speculators play a critical role in providing liquidity to the open market. They take positions based on their expectations of future price movements, contributing to market liquidity and efficiency. For speculators, the open market offers numerous trading opportunities and the potential for profit if their price predictions are accurate. However, it is important to note that speculative trading carries inherent risks and requires careful analysis and risk management.

Portfolio Diversification: Commodity futures contracts offer an additional asset class for diversifying investment portfolios. Commodities often have a low correlation with traditional asset classes, such as stocks and bonds, making them valuable for reducing overall portfolio volatility. By including commodity futures contracts in a diversified portfolio, investors can potentially achieve better risk-adjusted returns and protect against inflation.

Flexibility and Accessibility: The open market provides market participants with flexibility and accessibility. Traders can engage in trading activities during designated trading hours, allowing for timely responses to market developments. Additionally, electronic trading platforms offer ease of access, enabling participants to execute trades from anywhere, thereby removing geographical barriers and increasing market accessibility.

Leverage: Market participants can take advantage of leverage when trading commodity futures contracts. This means they can control a larger position in the market with a smaller initial capital outlay. Leverage amplifies potential profits, but it also magnifies losses. Traders must exercise caution and employ risk management strategies to mitigate the inherent risks associated with leverage.

Opportunities for Arbitrage: The open market provides opportunities for arbitrage, where market participants can exploit price discrepancies between different markets or related instruments. By quickly buying and selling contracts at different prices, arbitrageurs can capture risk-free profits and help align prices across markets, promoting market efficiency.

These benefits and opportunities make the open market for commodity futures contracts a vibrant and attractive arena for market participants. It offers a range of tools and avenues for managing risk, generating returns, and participating in the global commodities market. However, it is essential for participants to develop a thorough understanding of market dynamics, formulate well-informed strategies, and manage risks effectively to navigate the open market successfully.

In the following sections, we will explore the factors that influence the price of commodity futures contracts on the open market, the risks and challenges associated with open market trading, and the role of regulations in ensuring a fair and transparent trading environment.

Factors Affecting the Price of Commodity Futures Contracts on the Open Market

Understanding the factors that influence the price of commodity futures contracts on the open market is crucial for market participants to make informed trading decisions. Several key factors have a significant impact on commodity prices, driving the movements of futures contracts. Let’s explore some of the major factors that affect the price of commodity futures contracts.

Supply and Demand: The fundamental principle of supply and demand plays a central role in determining commodity prices. If the supply of a particular commodity increases or the demand decreases, it can lead to downward pressure on prices. Conversely, if the supply decreases or the demand increases, it can result in upward price movement. Factors such as weather conditions, geopolitical tensions, and changes in consumption patterns can affect the supply and demand dynamics of commodities.

Inventory Levels: The level of inventories for a specific commodity can impact its price. Higher inventories may indicate an abundance of supply, putting downward pressure on prices. On the other hand, lower inventories can signal a potential shortage, driving prices higher. Inventory reports and storage data are closely monitored by market participants to gain insights into the supply-demand balance and potential price movements.

Macroeconomic Factors: Macroeconomic factors, such as economic growth, inflation, and interest rates, can influence commodity prices. Strong economic growth tends to increase demand for commodities, pushing prices higher. Inflation erodes the purchasing power of currency, making commodities relatively more attractive as a store of value, which can drive their prices up. Changes in interest rates can also impact commodity prices by influencing borrowing costs and affecting investor sentiment.

Currency Exchange Rates: Commodity prices are denominated in a specific currency, typically the U.S. dollar. Therefore, fluctuations in currency exchange rates can impact the prices of commodities. If the value of the currency depreciates, it can make commodities more expensive for investors using other currencies, potentially leading to a decrease in demand and lower prices. Conversely, a strengthening currency can make commodities more affordable, driving up demand and prices.

Weather Conditions: Weather plays a vital role in the production and supply of many commodities, particularly agricultural products. Droughts, floods, hurricanes, and other natural disasters can significantly impact crop yields and production. Adverse weather conditions can lead to reduced supply, which can drive commodity prices higher. On the other hand, favorable weather conditions can result in increased production and potentially lower prices.

Geopolitical Factors: Geopolitical events and geopolitical tensions can have a substantial impact on commodity prices. Political instability, trade disputes, sanctions, and conflicts in major commodity-producing regions can disrupt supply chains and create uncertainty in the market. These events can result in price volatility as market participants adjust their positions based on the changing geopolitical landscape.

Technological Advancements: Technological advancements can also influence commodity prices. Innovations in extraction techniques, energy efficiency, and agricultural practices can impact the production costs and supply of commodities. For example, advancements in hydraulic fracturing technology have significantly increased the supply of natural gas, leading to lower prices. Similarly, advancements in agricultural technology can increase crop yields and affect the supply of agricultural commodities.

Market Sentiment and Speculation: Market sentiment and speculative trading can influence commodity prices in the short term. Investor perceptions, expectations, and attitudes toward the market can drive buying or selling activities, impacting prices. The sentiment can be influenced by factors such as economic indicators, market rumors, and financial news. Speculators, who trade based on their expectations of price movements, can also contribute to price volatility in the open market.

It is important to note that the influence of these factors can vary depending on the specific commodity being traded and the market conditions. Market participants need to stay informed about these factors and conduct thorough analysis to assess their potential impact on commodity prices and make informed trading decisions.

In the next section, we will explore the risks and challenges that market participants face when trading commodity futures contracts on the open market.

Risks and Challenges in the Open Market Trading of Commodity Futures Contracts

While the open market for commodity futures contracts offers attractive opportunities, it also comes with inherent risks and challenges that market participants need to be aware of. Understanding and effectively managing these risks is crucial for successful trading. Let’s explore some of the key risks and challenges associated with open market trading of commodity futures contracts.

Price Volatility: Commodity prices can be highly volatile, driven by various factors such as supply and demand dynamics, geopolitical events, weather conditions, and economic indicators. The rapid and unpredictable price fluctuations in the open market pose both risks and opportunities. Traders need to carefully monitor market conditions and employ risk management strategies, such as stop-loss orders or position limits, to protect against adverse price movements.

Leverage and Margin Calls: Trading commodity futures contracts often involves the use of leverage, allowing market participants to control larger positions with a smaller initial investment. While leverage can amplify profits, it also amplifies losses. If the market moves against a trader’s position, it can result in margin calls, which require the trader to provide additional funds to cover potential losses. Failure to meet margin requirements can lead to forced liquidation of positions.

Limited Control over Supply and Demand Factors: Market participants in the open market have limited control over the supply and demand factors that influence commodity prices. External factors such as weather conditions, government policies, and global events can have significant impacts on supply and demand. Traders need to consider these external factors and closely monitor market news and events to anticipate potential price movements.

Market Liquidity: While the open market provides high liquidity, there could be instances where market liquidity temporarily dries up. During periods of low liquidity, it can be challenging to execute trades at desired prices, and bid-ask spreads may widen. Illiquid markets can increase transaction costs and make it more difficult to enter or exit positions, which can affect trading strategies and outcomes.

Counterparty Risk: Trading commodity futures contracts involves entering into contractual agreements with other market participants. There is always the risk that a counterparty might default on their contractual obligations. Market participants need to be vigilant in assessing counterparty creditworthiness and selecting reputable brokers or clearinghouses to minimize counterparty risk.

Regulatory and Legal Risks: Commodity futures trading is subject to regulatory oversight and compliance with trading rules and regulations. Failure to adhere to these regulations can result in penalties and legal consequences. Market participants need to stay updated and ensure compliance with applicable laws and regulations to mitigate regulatory and legal risks.

Commodity-Specific Risks: Different commodities can have unique risks associated with their production, storage, transportation, and geopolitical factors. Agricultural commodities, for example, are susceptible to weather conditions, pests, and diseases. Energy commodities face risks related to geopolitics, supply disruptions, and environmental regulations. Market participants need to understand the specific risks associated with the commodities they trade and develop strategies to manage those risks.

Psychological and Emotional Challenges: Trading in the open market can be psychologically demanding, especially during periods of market volatility. Emotional biases and impulsive decision-making can lead to poor trading outcomes. Traders need to cultivate discipline, patience, and emotional resilience to make rational decisions and stick to their trading strategies amidst market fluctuations.

Managing these risks and challenges requires careful planning, risk assessment, and risk management strategies. Market participants should establish a comprehensive risk management plan, including setting risk tolerance levels, diversifying their portfolios, using stop-loss orders, and continuously monitoring market conditions.

In the following section, we will explore the role of market regulations and oversight in ensuring a fair and transparent trading environment for commodity futures contracts.

Role of Market Regulations and Oversight

Market regulations and oversight play a critical role in ensuring a fair and transparent trading environment for commodity futures contracts. Regulatory bodies and exchanges implement rules and guidelines to maintain market integrity, protect market participants, and promote efficient and orderly trading. Let’s explore the key aspects of market regulations and oversight in the trading of commodity futures contracts.

Regulatory Bodies: Regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) in the United States, oversee and regulate commodity futures trading. These bodies are responsible for developing and enforcing regulations that promote fair practices, prevent fraud and market manipulation, and safeguard the interests of market participants. They ensure compliance with trading rules, investigate potential violations, and take enforcement actions when necessary.

Market Surveillance: Regulatory bodies, along with exchanges and clearinghouses, conduct market surveillance to monitor trading activities and detect any suspicious or manipulative behavior. Through advanced surveillance technology and data analysis, they identify irregularities, abnormal trading patterns, and signs of potential market abuse. Market surveillance helps maintain market integrity and ensures a level playing field for all participants.

Clearinghouses: Clearinghouses act as intermediaries between buyers and sellers in the open market. They guarantee the fulfillment of futures contracts and reduce counterparty risk. Clearinghouses ensure the financial integrity of the market by collecting margin deposits from market participants and overseeing the settlement process. They also enforce trading rules, conduct risk assessments, and manage default procedures to maintain market stability.

Position Limits: Position limits set by regulatory bodies restrict the maximum number of contracts an individual or entity can hold for a specific commodity. These limits aim to prevent excessive speculation, market manipulation, and disruptions in the market. Position limits help maintain a fair and orderly trading environment and promote market integrity.

Reporting and Transparency: Regulatory bodies require market participants to report their positions, transactions, and other relevant information. Reporting requirements help regulators gather data and monitor market activities for potential market abuse and systemic risks. Transparency in the reporting of positions and trading activities promotes market efficiency and integrity.

Market Participant Eligibility: Regulatory bodies set eligibility criteria and registration requirements for market participants, including brokers, traders, and investment firms. Market participants must meet certain standards, such as financial stability, professional qualifications, and compliance with ethical and conduct standards. These eligibility requirements help safeguard the market and protect the interests of all participants.

Market Surveillance Technology: The advancements in technology have enabled regulators to enhance their market surveillance capabilities. Utilizing sophisticated algorithms and data analysis tools, regulators can detect potential market misconduct, such as spoofing, front-running, or insider trading. Market surveillance technology helps in proactive detection, investigation, and prevention of market manipulation.

Overall, market regulations and oversight play a vital role in maintaining market integrity, ensuring fair and transparent trading, and protecting the interests of market participants. They prevent fraud and manipulation, promote efficient price discovery, and create a level playing field for participants. Market participants should stay updated on the regulatory requirements, adhere to trading rules, and cooperate with regulatory bodies to foster a well-regulated and trustworthy market environment.

In the concluding section, we will summarize the key points discussed and emphasize the importance of understanding the dynamics of open market trading in commodity futures contracts.

Conclusion

Trading commodity futures contracts on the open market offers a wide range of opportunities and benefits for market participants. These contracts provide a mechanism for managing price risk, gaining exposure to commodities, and facilitating efficient price discovery. Market participants, including hedgers, speculators, and arbitrageurs, can take advantage of the open market to achieve their objectives and implement their trading strategies.

However, open market trading of commodity futures contracts also comes with inherent risks and challenges. Price volatility, leverage, counterparty risk, and regulatory compliance are factors that market participants need to carefully consider and manage. Sound risk management practices, including diversification, setting risk tolerance levels, and continuous monitoring of market conditions, are essential for successful trading.

Regulatory bodies and market oversight play a crucial role in ensuring a fair and transparent trading environment. They establish and enforce regulations, monitor market activity, conduct surveillance, and promote market integrity. Compliance with regulatory requirements and cooperation with regulatory bodies are essential for maintaining market stability and protecting the interests of all participants.

Understanding the factors that influence commodity prices, such as supply and demand dynamics, macroeconomic factors, and geopolitical events, is crucial for making informed trading decisions. Market participants should conduct thorough analysis, stay updated on market news, and develop strategies based on reliable market information.

The open market for commodity futures contracts is a dynamic and ever-evolving arena. It offers opportunities for price discovery, liquidity, and diverse trading strategies. Market participants should continuously adapt to changing market conditions, remain disciplined, and utilize risk management tools to navigate the market effectively.

In conclusion, open market trading of commodity futures contracts provides an avenue for market participants to manage risk, gain exposure to commodities, and potentially profit from price movements. However, it requires a deep understanding of market dynamics, adherence to regulations, and diligent risk management practices. With the right knowledge, skills, and strategies, market participants can harness the opportunities offered by the open market and navigate the world of commodity futures trading successfully.