Finance

What Percent Of Pension Funds Have Failed?

Published: January 23, 2024

Discover the finance industry's statistics on pension fund failures and the impact on retirement planning. Learn about the percentage of pension funds that have failed.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Pension funds play a vital role in securing the financial future of millions of individuals worldwide. These funds are designed to provide a steady income stream during retirement, offering a sense of security and stability. However, the possibility of pension fund failures has become a growing concern, raising questions about the long-term viability of these essential financial instruments.

The stability and reliability of pension funds are critical to retirees, as they rely on these funds to support their livelihood during their non-working years. Understanding the factors that contribute to pension fund failures, the potential impacts of such failures, and the measures to prevent them is crucial for both current and future retirees, as well as for the financial industry as a whole.

In this article, we will delve into the intricate world of pension fund failures, exploring the underlying causes, real-life case studies, and the broader implications of such occurrences. By examining these aspects, we aim to shed light on the significance of safeguarding pension funds and highlight the proactive steps that can be taken to mitigate the risks associated with pension fund failures. Through this exploration, readers will gain a comprehensive understanding of the complexities surrounding pension funds and the potential ramifications of their failure.

As we embark on this journey, it is essential to recognize the profound impact that pension fund failures can have on individuals, families, and society at large. With this in mind, we will navigate through the multifaceted landscape of pension fund failures, aiming to provide valuable insights and actionable knowledge to empower readers in making informed decisions regarding their financial well-being.

Understanding Pension Fund Failure

Before delving into the complexities of pension fund failures, it is imperative to grasp the fundamental mechanisms of these financial instruments. Pension funds are designed to accumulate and invest funds over an individual’s working years, with the objective of providing a reliable source of income during retirement. These funds are typically managed by financial institutions, investment firms, or government entities, and are governed by stringent regulations to ensure their stability and sustainability.

Pension fund failures occur when these funds are unable to meet their financial obligations to retirees, either partially or in full. This failure can stem from various underlying issues, including inadequate fund management, economic downturns, demographic shifts, and regulatory challenges. Understanding the intricate web of factors that contribute to pension fund failures is crucial in addressing and mitigating these risks.

At the core of pension fund failure lies the challenge of ensuring consistent and sufficient returns on investments to meet the long-term financial commitments to retirees. Inadequate investment strategies, market volatilities, and unforeseen economic crises can significantly impact the performance of pension funds, leading to potential shortfalls in meeting future payment obligations.

Furthermore, demographic shifts, such as aging populations and declining birth rates, can exert pressure on pension funds, as the ratio of retirees to active contributors becomes imbalanced. This demographic imbalance can strain the financial resources of pension funds, potentially leading to insolvency if not effectively managed.

Regulatory challenges and policy changes also play a pivotal role in the stability of pension funds. Evolving regulatory landscapes, shifts in retirement age requirements, and alterations in tax laws can introduce complexities and uncertainties, influencing the overall health of pension funds.

By comprehensively understanding the intricate dynamics of pension fund failures, individuals, financial institutions, and policymakers can proactively address these challenges and work towards ensuring the long-term sustainability of pension funds. In the subsequent sections, we will explore the specific factors contributing to pension fund failures, analyze real-life case studies, and discuss proactive measures to prevent and mitigate the impacts of such failures.

Factors Contributing to Pension Fund Failure

The stability and viability of pension funds can be influenced by a myriad of factors, each playing a distinct role in shaping the financial health of these essential instruments. Understanding the specific contributors to pension fund failures is instrumental in formulating proactive strategies to mitigate these risks and safeguard the interests of retirees and active contributors.

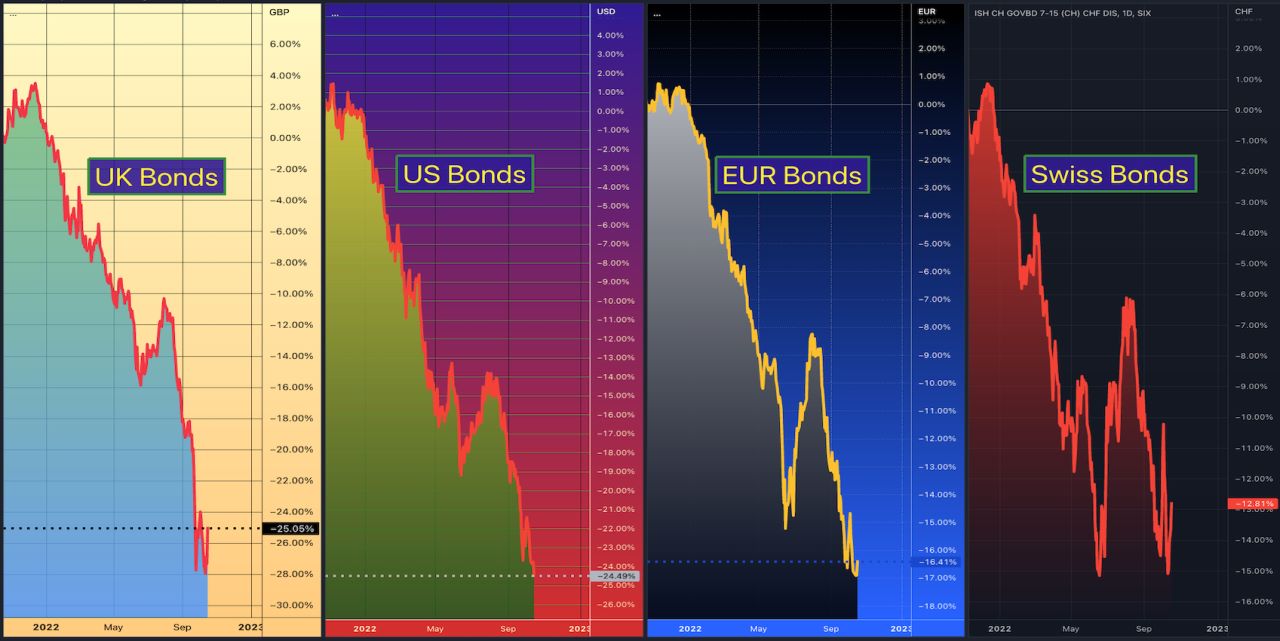

One of the primary factors contributing to pension fund failure is inadequate investment returns. Pension funds rely on the prudent investment of contributions to generate returns that can fulfill future payment obligations. However, economic downturns, market volatilities, and suboptimal investment strategies can impede the ability of pension funds to achieve the necessary returns, potentially leading to shortfalls in meeting future financial commitments.

Demographic shifts also significantly impact pension fund stability. As populations age and birth rates decline, the ratio of retirees to active contributors can become imbalanced, placing strain on pension funds. The resultant financial pressure may lead to difficulties in meeting pension obligations, particularly if proactive measures to address demographic changes are not implemented.

Regulatory challenges and policy changes represent another critical factor contributing to pension fund failures. Evolving regulatory landscapes, alterations in retirement age requirements, and shifts in tax laws can introduce complexities and uncertainties, influencing the financial soundness of pension funds. Adapting to these regulatory changes while maintaining the long-term sustainability of pension funds poses a substantial challenge to fund managers and policymakers.

Inadequate risk management practices can also exacerbate the vulnerability of pension funds. Failure to effectively assess and mitigate investment risks, interest rate fluctuations, and longevity risks can compromise the ability of pension funds to meet their financial obligations, leading to potential failures.

Moreover, external economic and geopolitical factors, such as recessionary trends, geopolitical instability, and currency fluctuations, can pose significant challenges to pension fund stability. These external forces can impact investment performance, asset valuations, and overall fund solvency, thereby contributing to the risk of pension fund failures.

By comprehensively understanding these contributing factors, stakeholders can actively address and mitigate the risks associated with pension fund failures. In the subsequent sections, we will delve into real-life case studies of pension fund failures, examine their broader impacts, and discuss measures to prevent and mitigate the ramifications of such occurrences.

Case Studies of Pension Fund Failures

Examining real-life instances of pension fund failures provides valuable insights into the multifaceted nature of these occurrences and their far-reaching impacts. These case studies offer tangible examples of the challenges and complexities faced by pension funds, shedding light on the underlying factors that can lead to their failure.

One notable case of pension fund failure is the collapse of the St. Louis Police Retirement System in the early 2000s. Mismanagement, risky investments, and inadequate oversight contributed to the fund’s insolvency, leaving retirees uncertain about their future financial security. This case underscores the critical importance of effective fund management and robust oversight mechanisms in ensuring the stability of pension funds.

In a similar vein, the failure of the Teamsters Central States Pension Fund serves as a poignant example of the repercussions of demographic shifts and economic challenges. The fund, which faced significant financial strain due to an aging workforce and declining union membership, struggled to meet its obligations to retirees, prompting widespread concerns about the sustainability of pension benefits. This case underscores the impact of demographic changes on pension fund viability and the need for proactive measures to address such shifts.

Furthermore, the global financial crisis of 2008 exposed numerous pension funds to substantial losses, eroding their asset values and jeopardizing their ability to fulfill future payment commitments. The unprecedented market turmoil and investment downturns highlighted the vulnerability of pension funds to external economic shocks, emphasizing the importance of robust risk management practices and diversified investment strategies.

These case studies illustrate the intricate interplay of factors that can lead to pension fund failures, encompassing investment risks, demographic challenges, regulatory dynamics, and external economic pressures. By examining these real-life examples, stakeholders can gain a deeper understanding of the complexities inherent in pension fund management and the imperative need for proactive measures to safeguard the long-term financial security of retirees.

As we delve deeper into the impacts of pension fund failures in the subsequent section, it is essential to recognize the profound implications of these occurrences on retirees, active contributors, and the broader financial landscape. By analyzing these impacts, we can elucidate the urgency of implementing measures to prevent and mitigate the ramifications of pension fund failures.

Impacts of Pension Fund Failures

The ramifications of pension fund failures extend far beyond the financial realm, profoundly impacting retirees, active contributors, and the broader socioeconomic landscape. Understanding the multifaceted impacts of these failures is essential in comprehending the urgency of implementing measures to prevent and mitigate their far-reaching consequences.

One of the most immediate and poignant impacts of pension fund failures is the erosion of retirees’ financial security. When pension funds fail to meet their obligations, retirees may face a sudden and drastic reduction in their expected income, jeopardizing their ability to cover essential living expenses and maintain their standard of living during retirement. This financial strain can lead to heightened stress, anxiety, and uncertainty among retirees, undermining their overall well-being.

Furthermore, the repercussions of pension fund failures extend to active contributors, who may witness a loss of confidence in the pension system and a heightened apprehension about their own retirement prospects. This loss of confidence can manifest in reduced participation in pension programs, exacerbating the challenges faced by existing pension funds and contributing to broader societal concerns about retirement security.

From a macroeconomic perspective, pension fund failures can exert significant pressure on government resources and social safety nets. In instances where pension funds become insolvent, governments may be compelled to intervene through financial assistance programs or other support measures to mitigate the impact on retirees. This can strain public finances and divert resources that could have been allocated to other critical areas of societal development.

Moreover, the broader financial industry can experience ripple effects from pension fund failures, as investor confidence may wane, and regulatory scrutiny of pension management practices intensifies. These dynamics can influence investment behaviors, market stability, and the overall perception of retirement planning, underscoring the interconnectedness of pension fund failures with the broader financial ecosystem.

By comprehensively understanding these impacts, stakeholders can recognize the urgency of implementing proactive measures to prevent and mitigate the ramifications of pension fund failures. In the subsequent section, we will explore actionable steps and strategies to bolster the resilience of pension funds and safeguard the financial security of retirees and active contributors.

Measures to Prevent Pension Fund Failures

Proactively addressing the factors that contribute to pension fund failures is paramount in safeguarding the long-term financial security of retirees and active contributors. By implementing robust measures and strategies, stakeholders can mitigate the risks associated with pension fund failures and bolster the resilience of these essential financial instruments.

One fundamental measure to prevent pension fund failures is the implementation of prudent and diversified investment strategies. By diversifying investment portfolios across various asset classes and regions, pension funds can mitigate the impact of market volatilities and reduce the vulnerability to economic downturns. Additionally, rigorous risk assessment and management practices can help identify and mitigate potential investment risks, enhancing the overall stability of pension funds.

Addressing demographic shifts is also crucial in preventing pension fund failures. Proactive measures, such as periodic assessments of demographic trends, adjusting contribution rates, and implementing innovative retirement planning solutions, can help pension funds adapt to changing population dynamics and ensure the sustainability of future payment obligations. Moreover, fostering initiatives to encourage active participation in pension programs and promoting financial literacy can contribute to a more robust and resilient pension system.

Enhanced regulatory oversight and governance mechanisms play a pivotal role in preventing pension fund failures. Strengthening regulatory frameworks, instituting transparent reporting standards, and fostering effective governance structures can enhance the accountability and transparency of pension fund management, reducing the likelihood of mismanagement and malpractice. Furthermore, engaging in regular stress testing and scenario analysis can provide valuable insights into the resilience of pension funds under varying economic conditions.

Collaborative efforts between governments, financial institutions, and industry stakeholders are essential in preventing pension fund failures. By fostering dialogue and cooperation, stakeholders can collectively address systemic challenges, share best practices, and develop innovative solutions to fortify the stability of pension funds. Additionally, promoting public awareness and understanding of pension planning and retirement security can empower individuals to make informed decisions regarding their financial future.

By proactively implementing these measures, stakeholders can work towards mitigating the risks associated with pension fund failures and fortifying the long-term sustainability of pension funds. In doing so, the financial security of retirees and the confidence of active contributors in the pension system can be upheld, contributing to a more resilient and robust retirement landscape.

As we reflect on the significance of these preventive measures, it becomes evident that proactive action is imperative in securing the future well-being of retirees and fostering a sustainable pension ecosystem. In the concluding section, we will encapsulate the key insights gleaned from our exploration of pension fund failures and the measures to address them, reaffirming the critical importance of safeguarding the financial security of individuals in their retirement years.

Conclusion

The intricate landscape of pension fund failures underscores the critical importance of safeguarding the financial security of retirees and active contributors. Our exploration of the factors contributing to pension fund failures, real-life case studies, impacts, and preventive measures has illuminated the multifaceted nature of these occurrences and their far-reaching implications. It is evident that proactive action is imperative in fortifying the resilience of pension funds and ensuring the long-term sustainability of retirement planning.

By comprehensively understanding the contributing factors, such as inadequate investment returns, demographic shifts, regulatory challenges, and inadequate risk management, stakeholders can proactively address these challenges and work towards mitigating the risks associated with pension fund failures. Real-life case studies have provided tangible examples of the challenges faced by pension funds, emphasizing the imperative need for effective fund management, robust oversight, and proactive measures to address demographic shifts and economic challenges.

The impacts of pension fund failures extend beyond the financial realm, profoundly affecting retirees, active contributors, government resources, and the broader financial industry. The erosion of retirees’ financial security, loss of confidence in the pension system, and macroeconomic pressures underscore the urgency of implementing measures to prevent and mitigate the ramifications of pension fund failures.

Measures to prevent pension fund failures, including diversified investment strategies, addressing demographic shifts, enhanced regulatory oversight, and collaborative efforts, offer a pathway towards fortifying the stability of pension funds. By implementing these measures, stakeholders can work towards mitigating the risks associated with pension fund failures and upholding the financial security of retirees and active contributors.

As we conclude this exploration, it becomes evident that the proactive safeguarding of pension funds is pivotal in shaping a resilient and sustainable retirement landscape. By fostering dialogue, implementing best practices, and promoting public awareness, stakeholders can collectively contribute to a more robust and secure pension ecosystem, ensuring the long-term financial well-being of individuals in their retirement years.

Ultimately, the significance of addressing and mitigating the risks associated with pension fund failures cannot be overstated. By embracing proactive measures and fortifying the resilience of pension funds, we can uphold the promise of financial security and stability for current and future retirees, fostering a landscape where individuals can embark on their retirement years with confidence and peace of mind.