Home>Finance>What Will Be My Minimum Payment For A Credit Card?

Finance

What Will Be My Minimum Payment For A Credit Card?

Published: February 26, 2024

Find out how to calculate your minimum credit card payment and manage your finances effectively. Learn about the factors that determine your minimum payment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding Your Minimum Credit Card Payment

Introduction

Credit cards are convenient financial tools that offer flexibility and purchasing power. However, it's crucial to understand the responsibilities that come with using them, including making timely payments. One of the most important aspects of credit card management is the minimum payment requirement. Understanding the concept of minimum payments is essential for maintaining a healthy financial standing and avoiding unnecessary debt accumulation.

When you receive your credit card statement, you'll notice a section detailing the minimum payment due. This represents the smallest amount you must pay by a specific date to keep your account in good standing. While paying the minimum may seem like a manageable option, it's important to recognize the potential long-term consequences of doing so. By delving into the factors influencing minimum payments and learning how they are calculated, you can gain valuable insights into managing your credit card obligations more effectively.

In this article, we'll explore the intricacies of minimum credit card payments, shedding light on the various factors that affect them and providing practical tips for handling them responsibly. By the end of this discussion, you'll have a comprehensive understanding of minimum payments, empowering you to make informed decisions regarding your credit card usage and payment strategies.

Understanding Minimum Payments

Minimum payments represent the lowest amount that credit card holders must pay each month to keep their accounts in good standing. While this may seem like a convenient option, it’s essential to recognize that making only the minimum payment can lead to long-term financial challenges. When you pay only the minimum, you accrue interest on the remaining balance, potentially resulting in a significant increase in the total amount owed over time.

It’s important to understand that credit card companies calculate minimum payments based on various factors, including the outstanding balance, interest rates, and a percentage of the total balance. By comprehending these elements, cardholders can make more informed decisions regarding their payment strategies and overall credit card usage.

Moreover, gaining insight into the implications of minimum payments can help individuals develop responsible financial habits. By understanding the potential pitfalls of paying only the minimum, cardholders can strive to pay more than the minimum amount due whenever possible, thereby reducing the overall interest accrued and working towards debt reduction.

Furthermore, understanding minimum payments involves recognizing their impact on credit scores. Consistently paying only the minimum amount due can reflect negatively on credit reports, potentially affecting credit scores and future borrowing opportunities. By delving into the significance of minimum payments, individuals can proactively manage their credit card obligations, ultimately contributing to improved financial well-being.

Factors Affecting Minimum Payments

Several factors influence the calculation of minimum credit card payments, each playing a significant role in determining the amount due each month. Understanding these factors is crucial for cardholders seeking to manage their finances effectively and make informed decisions regarding their payment obligations.

- Outstanding Balance: The outstanding balance on a credit card directly impacts the minimum payment. Generally, the higher the balance, the higher the minimum payment due. This factor underscores the importance of managing credit card spending and striving to keep balances at manageable levels.

- Interest Rates: The interest rate on a credit card significantly influences the minimum payment. Higher interest rates result in larger minimum payments, making it more challenging to pay off the balance. By comprehending the impact of interest rates, cardholders can assess the long-term costs of carrying a balance and consider strategies for minimizing interest accrual.

- Percentage of Total Balance: Credit card companies often calculate minimum payments as a percentage of the total balance. This percentage can vary among issuers and may change based on specific terms and conditions. Understanding this aspect allows cardholders to anticipate their minimum payment amounts and plan their finances accordingly.

- Additional Fees and Charges: Certain fees and charges, such as late payment fees or over-limit fees, can also affect the minimum payment. These additional costs can lead to higher minimum payments, emphasizing the importance of adhering to payment deadlines and staying within credit limits to avoid unnecessary financial burdens.

By considering these factors, credit card users can gain valuable insights into the dynamics of minimum payments and develop proactive strategies for managing their credit card obligations. Awareness of these influences can empower individuals to make sound financial decisions, ultimately contributing to a more secure and stable financial future.

Calculating Minimum Payments

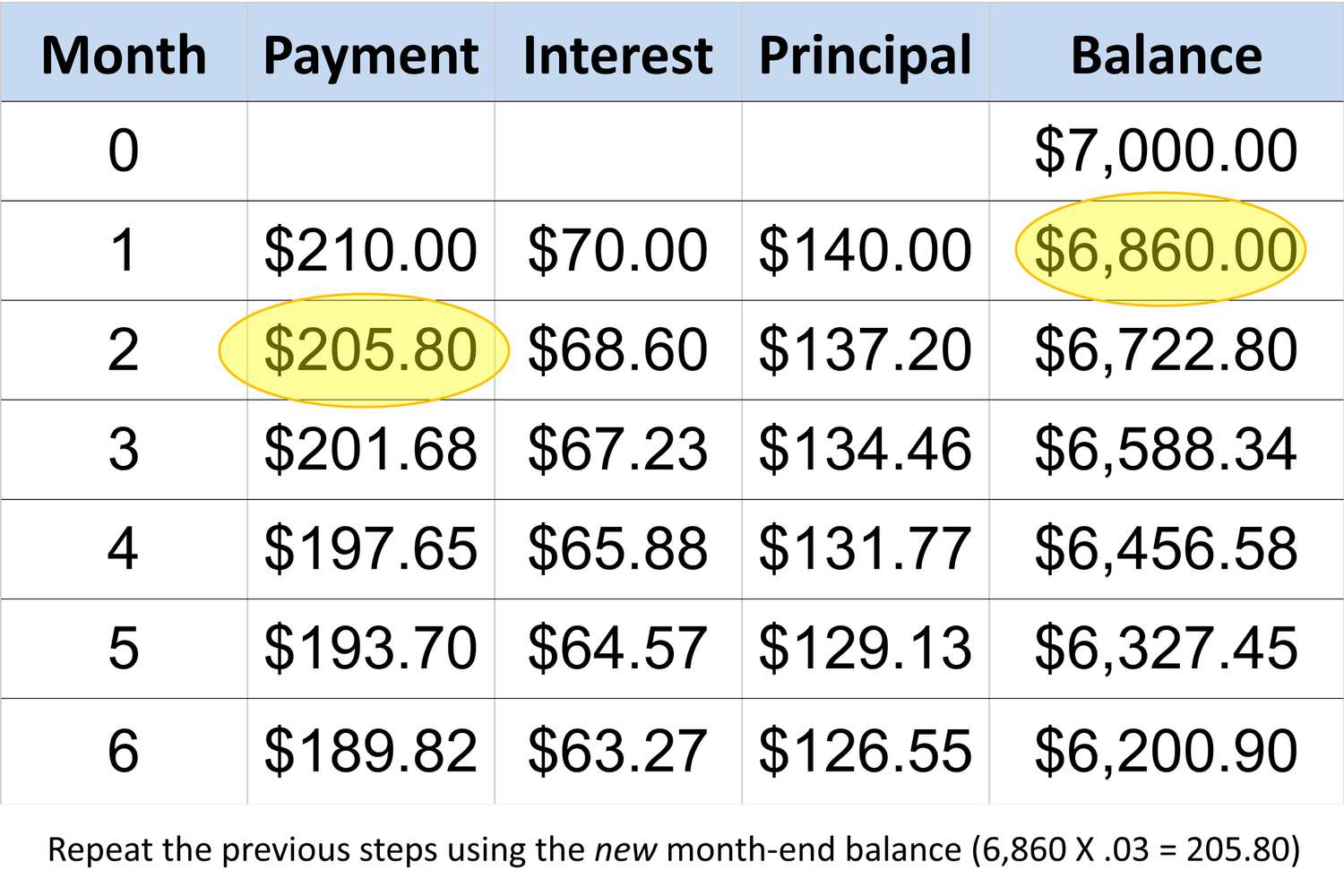

Understanding how credit card companies calculate minimum payments is essential for cardholders aiming to manage their financial responsibilities effectively. While specific calculation methods may vary among issuers, certain common principles underpin the determination of minimum payment amounts.

One prevalent approach involves setting the minimum payment as a percentage of the total balance, typically ranging from 1% to 3% of the outstanding amount. Additionally, the issuer may incorporate the interest accrued during the billing cycle and any applicable fees into the minimum payment calculation. This comprehensive approach aims to ensure that cardholders address both the principal balance and the associated interest and fees, albeit at the minimum required level.

It’s important to note that minimum payments are structured to cover the interest and fees while making a modest contribution towards reducing the principal balance. As a result, consistently paying only the minimum amount due can prolong the repayment period and significantly increase the overall interest paid over time.

Furthermore, some credit card companies set a minimum payment floor, ensuring that the minimum amount due does not fall below a specified threshold. This practice safeguards against excessively low payments that may impede the reduction of the outstanding balance and lead to prolonged debt accumulation.

By gaining insights into the methodology behind minimum payment calculations, cardholders can make informed decisions regarding their payment strategies. Understanding the components that factor into minimum payments empowers individuals to assess the long-term implications of their repayment approach and consider alternatives that align with their financial goals.

Ultimately, comprehending the calculation of minimum payments enables cardholders to navigate their credit card obligations more effectively, fostering responsible financial management and contributing to a more secure financial future.

Tips for Managing Minimum Payments

Effectively managing minimum credit card payments is essential for maintaining financial stability and working towards debt reduction. By implementing strategic approaches and cultivating responsible financial habits, cardholders can navigate their minimum payment obligations more effectively. The following tips offer valuable guidance for managing minimum payments and promoting sound financial management:

- Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum amount due. By allocating additional funds towards your credit card payments, you can expedite the reduction of your outstanding balance and minimize the interest accrued over time.

- Create a Payment Schedule: Establish a consistent payment schedule to ensure timely and regular credit card payments. Setting reminders or automating payments can help you stay organized and avoid missed or late payments, thereby mitigating the risk of incurring additional fees.

- Monitor Your Spending: Keep a close eye on your credit card expenditures to maintain control over your balances. Responsible spending habits can contribute to manageable balances, making it easier to meet minimum payment requirements and avoid excessive interest charges.

- Consider Balance Transfer Options: If feasible, explore balance transfer opportunities to consolidate high-interest balances onto a card with more favorable terms. This can help reduce interest costs and streamline your repayment efforts.

- Seek Financial Assistance if Needed: In cases of financial hardship or difficulty meeting minimum payments, don’t hesitate to reach out to your credit card issuer or a financial advisor for guidance. Exploring available assistance programs or restructuring options can provide relief and support your efforts to manage your credit card obligations effectively.

By implementing these tips, credit card users can proactively manage their minimum payments, reduce their overall debt burden, and cultivate healthy financial practices. Taking a proactive and informed approach to managing minimum payments contributes to improved financial well-being and positions individuals to achieve their long-term financial goals.

Conclusion

Understanding the dynamics of minimum credit card payments is a crucial aspect of responsible financial management. By delving into the intricacies of minimum payments, individuals can gain valuable insights into the factors influencing their calculation, the implications of paying only the minimum, and effective strategies for managing their credit card obligations.

Recognizing the impact of factors such as outstanding balances, interest rates, and payment calculation methods empowers cardholders to make informed decisions regarding their repayment strategies. Moreover, implementing proactive measures, such as paying more than the minimum and monitoring spending habits, can contribute to reducing overall debt and fostering a healthier financial outlook.

It’s essential for credit card users to approach minimum payments with a comprehensive understanding of their implications and actively work towards managing their credit card obligations responsibly. By leveraging the tips and insights provided in this article, individuals can navigate their minimum payment requirements more effectively, ultimately contributing to improved financial well-being and a more secure financial future.

In conclusion, a proactive and informed approach to managing minimum credit card payments is instrumental in achieving financial stability and working towards long-term financial goals. By integrating responsible financial habits and leveraging available strategies, individuals can effectively manage their credit card obligations, minimize interest costs, and pave the way for a more secure financial future.