Home>Finance>What’s A Synthetic Credit Default Obligation (Synthetic CDO)?

Finance

What’s A Synthetic Credit Default Obligation (Synthetic CDO)?

Published: March 4, 2024

Learn about synthetic credit default obligations (synthetic CDOs) in finance, including how they work and their impact on the financial markets. Understand the complexities of synthetic CDOs and their role in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of finance, complex instruments known as Synthetic Credit Default Obligations (Synthetic CDOs) have garnered attention for their intricate nature and potential impact on the financial markets. Understanding these instruments is crucial, especially in the wake of the 2008 financial crisis, which brought them into the spotlight.

Synthetic CDOs are a type of derivative financial instrument that allows investors to speculate or hedge against credit events without owning the underlying assets. These instruments played a significant role in the financial crisis, making it essential to comprehend their mechanics, risks, and regulations.

Exploring the depths of Synthetic CDOs involves delving into the broader concept of Credit Default Obligations (CDOs) and the unique characteristics that set Synthetic CDOs apart. Furthermore, it is vital to examine the functioning of Synthetic CDOs, the various types available, the associated risks, and the regulatory measures in place to oversee them.

As we navigate through the intricacies of Synthetic CDOs, we will gain insight into their role in the financial landscape, their impact on the economy, and the measures implemented to prevent a recurrence of the turmoil experienced during the 2008 financial crisis. Let's embark on a journey to unravel the complexities of Synthetic CDOs and gain a comprehensive understanding of their significance in the world of finance.

Understanding Credit Default Obligations

To comprehend Synthetic Credit Default Obligations (Synthetic CDOs), it is essential to first grasp the concept of Credit Default Obligations (CDOs). CDOs are financial instruments that allow investors to gain exposure to a diversified pool of debt obligations, such as bonds, loans, or other credit products. These instruments are structured to segregate the credit risk associated with the underlying assets and create tranches with varying levels of risk and return.

Within a traditional CDO, the cash flow is derived from the interest and principal payments made by the underlying debtors. If the debtors default, the cash flow to the investors diminishes, impacting the returns on their investment. This fundamental understanding of CDOs forms the basis for comprehending Synthetic CDOs.

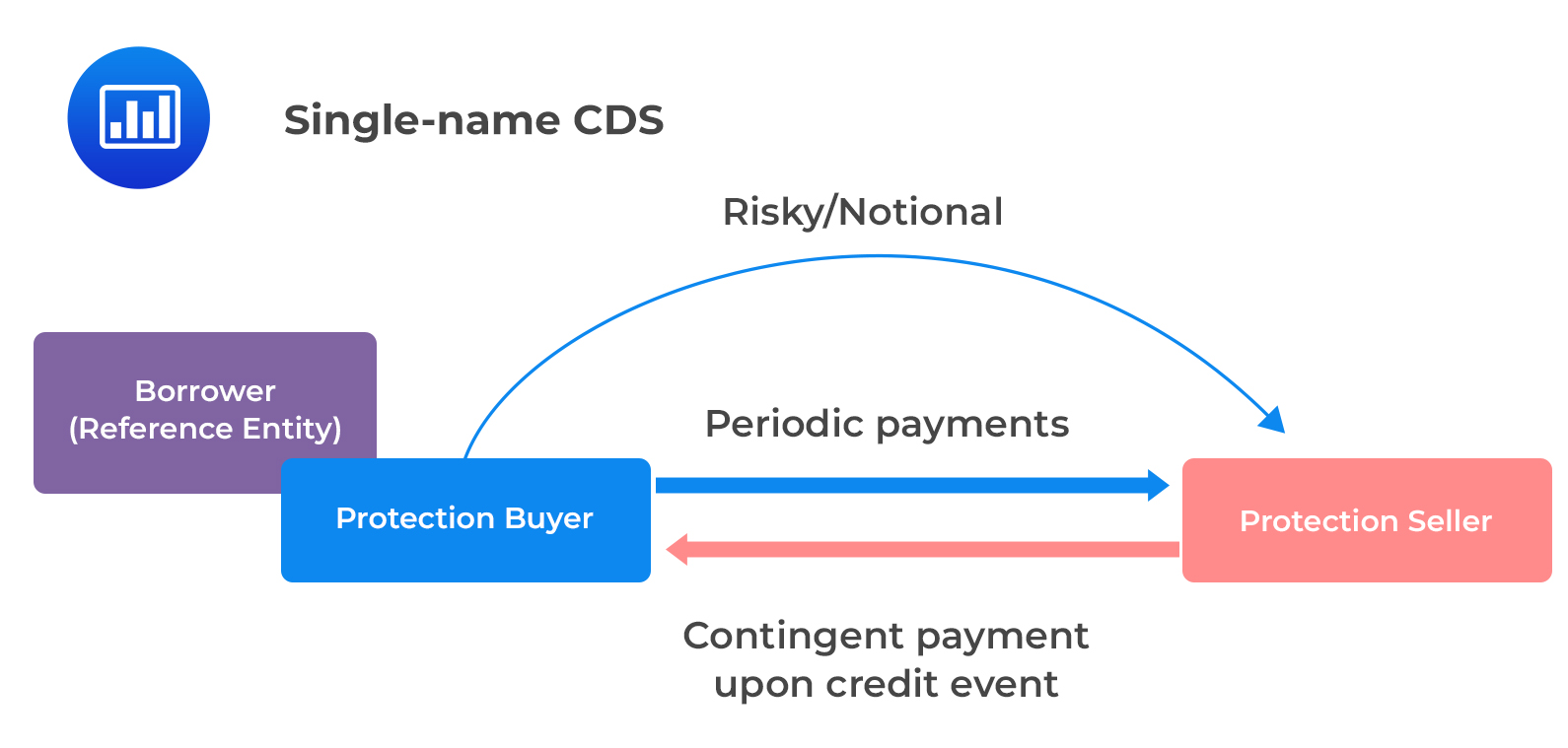

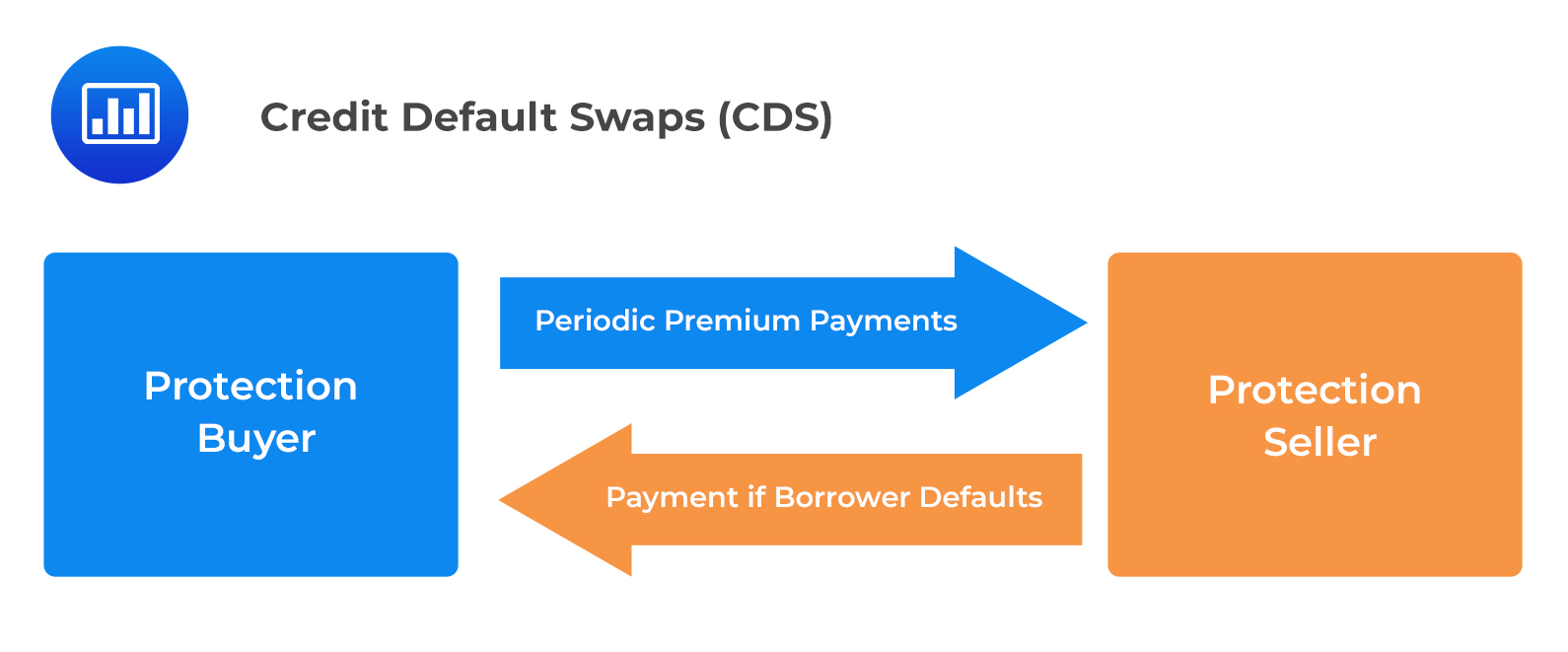

When it comes to Synthetic CDOs, the key distinction lies in the method of exposure. Unlike traditional CDOs, where investors have direct exposure to the underlying debt instruments, Synthetic CDOs offer exposure through the use of credit default swaps (CDS). These swaps act as insurance against the default of the underlying assets, allowing investors to speculate on the creditworthiness of the referenced debt without owning it.

Understanding the structure and function of CDOs provides a solid foundation for exploring Synthetic CDOs. The evolution of CDOs into more complex and diverse forms, including Synthetic CDOs, has significantly impacted the financial landscape and investor behavior. As we delve deeper into Synthetic CDOs, it is crucial to recognize the pivotal role that CDOs play in shaping the financial markets and influencing investment strategies.

What Is a Synthetic CDO?

A Synthetic Credit Default Obligation (Synthetic CDO) is a complex financial instrument that allows investors to gain exposure to the credit risk of a portfolio of reference entities without owning the underlying assets. Unlike traditional CDOs, which are backed by a pool of actual debt instruments, Synthetic CDOs use credit derivatives, such as credit default swaps (CDS), to create exposure to the credit risk of the referenced assets.

Within a Synthetic CDO, the reference entities typically comprise a diversified portfolio of corporate bonds, loans, or other debt obligations. The performance of the Synthetic CDO is contingent on the credit events related to these reference entities, such as defaults, rating downgrades, or other specified credit events.

Investors in Synthetic CDOs can take different roles, including protection buyers and protection sellers. Protection buyers pay periodic premiums to the protection sellers in exchange for protection against credit events affecting the reference entities. In the event of a credit event, the protection seller compensates the protection buyer for the losses incurred, mirroring the payout structure of traditional CDOs.

One of the defining features of Synthetic CDOs is the ability to create customized exposures to credit risk without the need to hold the actual underlying assets. This flexibility allows investors to tailor their risk and return profiles based on their market outlook and investment objectives. However, the complexity and opacity of Synthetic CDOs have raised concerns about their potential impact on systemic risk and market stability.

As we unravel the intricacies of Synthetic CDOs, it is crucial to recognize their role in shaping the financial landscape and influencing investor behavior. The unique characteristics of Synthetic CDOs set them apart from traditional CDOs and other financial instruments, making them a subject of interest and scrutiny within the realm of finance.

How Synthetic CDOs Work

Synthetic Credit Default Obligations (Synthetic CDOs) operate through the use of credit derivatives, primarily credit default swaps (CDS), to create exposure to the credit risk of a portfolio of reference entities. These reference entities typically consist of corporate bonds, loans, or other debt obligations, and the performance of the Synthetic CDO is tied to the credit events affecting these entities.

Investors in Synthetic CDOs can take on different roles, shaping the dynamics of these complex instruments. Protection buyers pay periodic premiums to protection sellers in exchange for protection against credit events impacting the reference entities. In return, protection sellers receive premiums and assume the risk of having to make payouts in the event of credit events.

The structure of Synthetic CDOs allows for the segmentation of credit risk into tranches with varying levels of seniority and risk exposure. Senior tranches have priority in receiving payments and bear lower risk, while junior tranches are more exposed to losses but offer higher potential returns. This tranching mechanism enables investors to customize their risk and return profiles based on their risk appetite and investment objectives.

One of the key mechanisms in Synthetic CDOs is the concept of notional value, which represents the hypothetical value of the reference entities. This notional value serves as the basis for determining the cash flows and potential payouts in the event of credit events. The notional value does not involve the actual exchange of the underlying assets but serves as a reference point for calculating the exposure and potential obligations of the parties involved.

Understanding the mechanics of Synthetic CDOs provides insight into the intricate nature of these instruments and the complexities involved in their valuation and risk assessment. The utilization of credit derivatives and the segmentation of credit risk through tranching mechanisms are fundamental aspects of how Synthetic CDOs operate, shaping their role in the financial markets and investor strategies.

Types of Synthetic CDOs

Synthetic Credit Default Obligations (Synthetic CDOs) encompass various types that cater to different investor preferences and risk profiles. Understanding the distinctions between these types is crucial for navigating the complexities of Synthetic CDOs and their implications in the financial landscape.

One prominent type of Synthetic CDO is the “Cash Flow” CDO, which generates income from the premiums paid by protection buyers and distributes it to protection sellers and investors in the form of periodic payments. This type of Synthetic CDO mirrors the cash flow structure of traditional CDOs, albeit without direct ownership of the underlying assets.

Another type is the “Market Value” CDO, where the cash flows are determined by the market value of the reference portfolio and the potential payouts in the event of credit events. The valuation of the reference entities plays a pivotal role in shaping the cash flows and payouts within this type of Synthetic CDO.

Furthermore, “Hybrid” Synthetic CDOs combine elements of both cash flow and market value structures, offering a blend of income generation and valuation-based cash flows. This hybrid approach provides flexibility and diversification in the cash flow dynamics of Synthetic CDOs, catering to a broader range of investor preferences.

Within each type, Synthetic CDOs can be further categorized based on the nature of the reference entities, such as corporate bonds, sovereign debt, or structured finance products. These variations allow investors to tailor their exposure to specific sectors or asset classes, reflecting their market outlook and risk management strategies.

Understanding the nuances of the different types of Synthetic CDOs is essential for investors, regulators, and market participants to grasp the diverse structures and risk profiles inherent in these instruments. The classification of Synthetic CDOs based on cash flow, market value, and hybrid structures, along with the underlying reference entities, underscores the complexity and diversity of these instruments within the realm of structured finance.

Risks Associated with Synthetic CDOs

Synthetic Credit Default Obligations (Synthetic CDOs) are inherently associated with a range of risks that stem from their complex structure and the dynamics of credit derivatives. Understanding these risks is crucial for investors, financial institutions, and regulators to assess the potential impact of Synthetic CDOs on the financial system and the broader economy.

One of the primary risks is counterparty risk, which arises from the reliance on credit default swaps (CDS) and the creditworthiness of the protection sellers. In the event of a credit event affecting the reference entities, the ability of the protection seller to honor their obligations becomes a critical factor in the payout structure of Synthetic CDOs.

Liquidity risk is another significant concern, particularly in times of market stress or turmoil. The trading of Synthetic CDOs and credit derivatives may face challenges in finding willing buyers or sellers, leading to potential liquidity constraints that impact the ability to unwind positions or manage exposures effectively.

Furthermore, the opacity and complexity of Synthetic CDOs contribute to valuation risk, making it challenging to ascertain the true market value and risk exposure of these instruments. The reliance on models and assumptions in valuing Synthetic CDOs introduces uncertainty and potential discrepancies in risk assessment.

Systemic risk is a broader concern associated with Synthetic CDOs, especially in the context of their interconnectedness with financial institutions and the potential for contagion effects. The concentration of risk within the financial system due to the widespread use of Synthetic CDOs can amplify the impact of credit events and market disruptions.

Credit risk, market risk, and legal risk are additional factors that contribute to the overall risk profile of Synthetic CDOs, reflecting the multifaceted nature of these instruments and the challenges in managing and mitigating their inherent risks.

As we navigate the landscape of Synthetic CDOs, it is essential to recognize the complex interplay of risks and their potential implications for investors and the stability of the financial markets. The evolving nature of risk management and regulatory oversight underscores the ongoing efforts to address the challenges posed by Synthetic CDOs and their impact on the broader financial ecosystem.

Synthetic CDOs and the 2008 Financial Crisis

The 2008 financial crisis cast a spotlight on Synthetic Credit Default Obligations (Synthetic CDOs) as they played a pivotal role in the turmoil that engulfed the global financial system. These complex financial instruments, along with other structured products, became emblematic of the excessive risk-taking and opacity that characterized the prelude to the crisis.

One of the key factors contributing to the crisis was the proliferation of mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), including Synthetic CDOs, linked to subprime mortgages. The securitization of these high-risk mortgages, coupled with the use of complex derivatives such as credit default swaps (CDS), amplified the interconnectedness of financial institutions and magnified the impact of mortgage defaults and foreclosures.

Synthetic CDOs, in particular, were instrumental in spreading and amplifying the risks associated with subprime mortgages across the financial system. The opacity and lack of transparency in these instruments obscured the true extent of exposure and risk concentrations, leading to a systemic underestimation of the potential fallout from the subprime mortgage crisis.

The interconnectedness of financial institutions through Synthetic CDOs and related derivatives contributed to the contagion effect, wherein the distress in one segment of the financial markets spilled over to others, triggering widespread panic and a crisis of confidence. The inability to accurately assess and manage the risks embedded in Synthetic CDOs exacerbated the severity of the crisis and its far-reaching repercussions.

The aftermath of the 2008 financial crisis prompted a reassessment of risk management practices, regulatory oversight, and the role of complex financial instruments in the stability of the financial system. The lessons learned from the crisis underscored the need for greater transparency, enhanced risk assessment, and improved governance of structured products, including Synthetic CDOs.

As we reflect on the 2008 financial crisis and its impact on the financial landscape, the role of Synthetic CDOs serves as a cautionary tale, highlighting the imperative of robust risk management, transparency, and regulatory vigilance in mitigating the potential destabilizing effects of complex financial instruments.

Regulation and Oversight of Synthetic CDOs

The complex and intricate nature of Synthetic Credit Default Obligations (Synthetic CDOs) has prompted regulatory scrutiny and oversight aimed at mitigating the potential risks associated with these instruments and safeguarding the stability of the financial system. Regulatory frameworks and oversight mechanisms play a crucial role in addressing the challenges posed by Synthetic CDOs and ensuring transparency, risk management, and investor protection.

One of the key regulatory initiatives targeting Synthetic CDOs is the implementation of enhanced disclosure requirements. Regulators seek to promote transparency by mandating comprehensive disclosures regarding the structure, underlying assets, risk factors, and potential conflicts of interest associated with Synthetic CDOs. These disclosures enable investors and market participants to make informed decisions and assess the risk exposures inherent in these complex instruments.

Furthermore, regulatory authorities have focused on strengthening risk management practices related to Synthetic CDOs. This includes the assessment and mitigation of counterparty risk, liquidity risk, and valuation risk, which are inherent in the utilization of credit derivatives and the tranching mechanisms within Synthetic CDO structures. Robust risk management frameworks are essential for financial institutions and investors to navigate the complexities of Synthetic CDOs and manage their exposure effectively.

The oversight of Synthetic CDOs also extends to the evaluation of market practices and conduct to prevent abusive or manipulative activities that could undermine the integrity of these instruments. Regulatory authorities closely monitor the trading, pricing, and structuring of Synthetic CDOs to identify potential misconduct and ensure compliance with market integrity standards.

In addition to disclosure and risk management requirements, regulatory authorities have emphasized the importance of stress testing and scenario analysis to assess the resilience of financial institutions and the broader financial system to potential shocks stemming from Synthetic CDOs. These exercises provide insights into the potential impact of adverse market conditions and credit events on the stability and solvency of institutions exposed to Synthetic CDOs.

The evolving regulatory landscape continues to address the challenges posed by Synthetic CDOs, with a focus on enhancing transparency, risk management, and market integrity. The collaboration between regulatory authorities, market participants, and industry stakeholders is instrumental in fostering a robust and resilient framework for the issuance and trading of Synthetic CDOs, ensuring their role within the financial ecosystem is aligned with the broader objectives of financial stability and investor protection.

Conclusion

The intricate world of Synthetic Credit Default Obligations (Synthetic CDOs) encompasses a complex interplay of financial instruments, risk dynamics, regulatory oversight, and historical implications. Understanding the significance of Synthetic CDOs in the realm of structured finance is essential for investors, financial institutions, and regulatory authorities as they navigate the challenges and opportunities presented by these instruments.

From their roots in the broader concept of Credit Default Obligations (CDOs) to the pivotal role they played in the 2008 financial crisis, Synthetic CDOs have left an indelible mark on the financial landscape. The evolution of regulatory frameworks and oversight mechanisms reflects the ongoing efforts to address the risks associated with Synthetic CDOs and ensure the integrity and stability of the financial system.

As we reflect on the lessons learned from the 2008 financial crisis, it becomes evident that the transparency, risk management, and regulatory vigilance surrounding Synthetic CDOs are instrumental in mitigating the potential destabilizing effects of these complex instruments. The implementation of enhanced disclosure requirements, robust risk management practices, and market conduct oversight underscores the commitment to promoting transparency and investor protection in the issuance and trading of Synthetic CDOs.

Looking ahead, the continued evolution of Synthetic CDOs and the regulatory landscape necessitates a collaborative approach among regulatory authorities, market participants, and industry stakeholders. The ongoing dialogue and cooperation are vital in shaping a resilient framework that aligns the role of Synthetic CDOs with the broader objectives of financial stability, market integrity, and investor confidence.

In conclusion, the journey through the intricacies of Synthetic CDOs offers a deeper understanding of the complexities and challenges inherent in these instruments. By embracing transparency, robust risk management, and regulatory oversight, Synthetic CDOs can contribute to the efficient allocation of capital and risk in the financial markets, fostering a more resilient and sustainable financial ecosystem for investors and market participants.