Finance

What Is A Credit Default Swap

Published: March 4, 2024

Learn about credit default swaps in the finance industry. Understand how they work and their impact on financial markets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

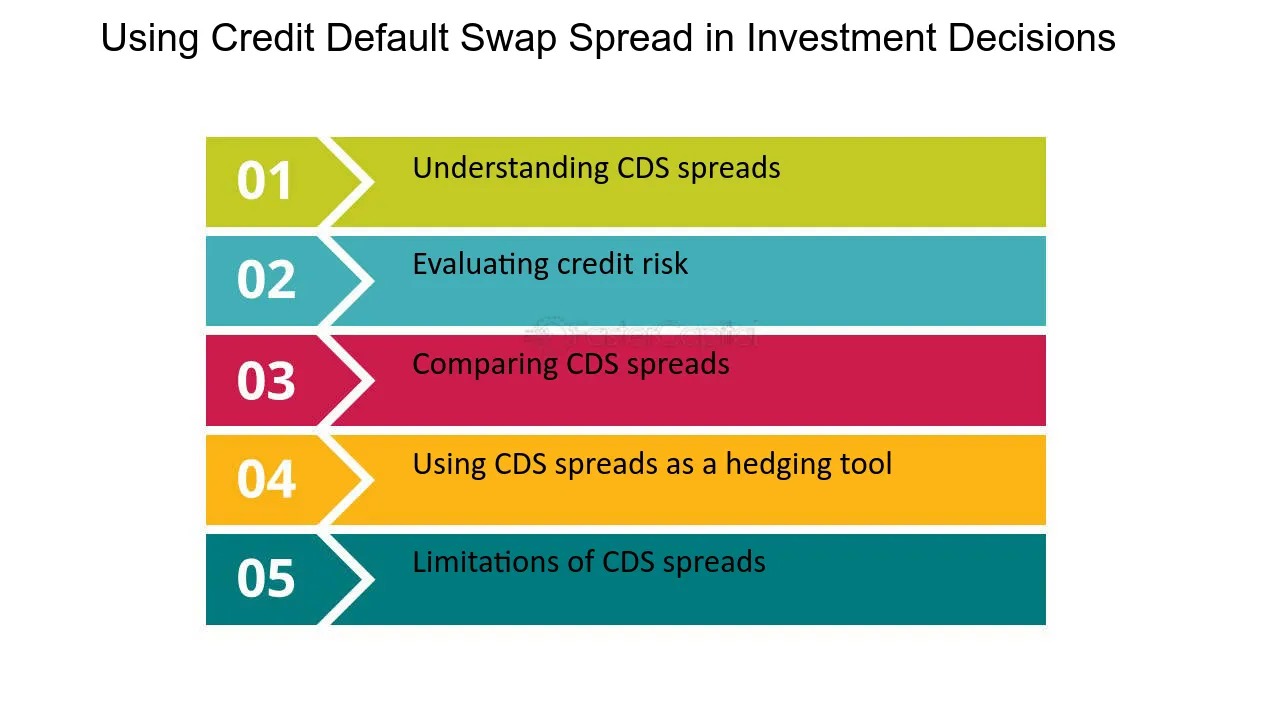

Understanding Credit Default Swaps

Credit default swaps (CDS) are financial instruments that played a significant role in the 2008 global financial crisis. These complex derivatives are essentially insurance contracts that allow investors to hedge against the risk of a borrower defaulting on their debt obligations. While they can serve as valuable risk management tools, credit default swaps have also been heavily criticized for their role in amplifying the impact of the financial crisis.

In this article, we will delve into the intricacies of credit default swaps, exploring how they function, their benefits and risks, and the regulatory framework that governs these financial instruments. By gaining a deeper understanding of credit default swaps, readers will be better equipped to comprehend their impact on the financial markets and the broader economy.

Credit default swaps are a type of derivative, meaning their value is derived from the performance of an underlying asset—in this case, a bond or loan. These instruments provide a way for investors to protect themselves against the risk of default by the issuer of the underlying debt. In essence, a credit default swap is a contract between two parties, where the buyer makes periodic payments to the seller in exchange for protection against potential default on the underlying debt.

As we unravel the intricacies of credit default swaps, we will explore the mechanisms that underpin these financial instruments, the potential benefits they offer to market participants, and the inherent risks associated with their utilization. Furthermore, we will examine the regulatory landscape surrounding credit default swaps, shedding light on the measures put in place to mitigate the potential negative impacts of these complex financial instruments.

Understanding Credit Default Swaps

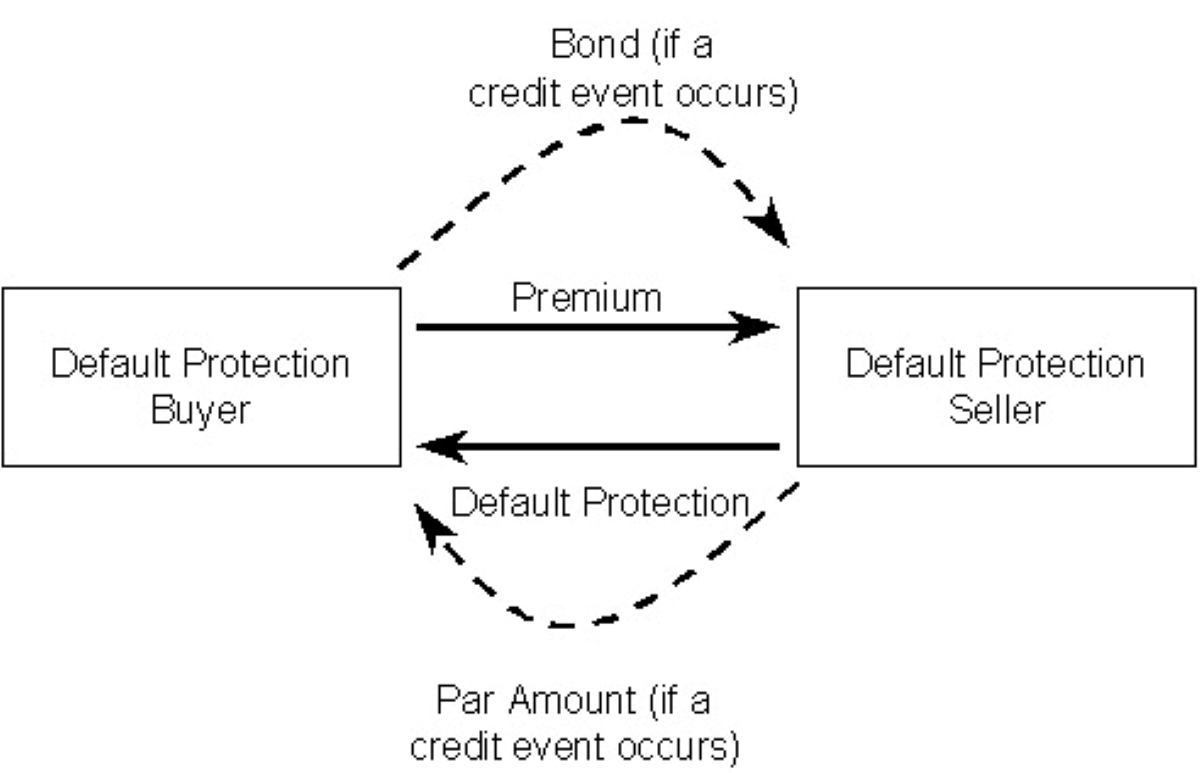

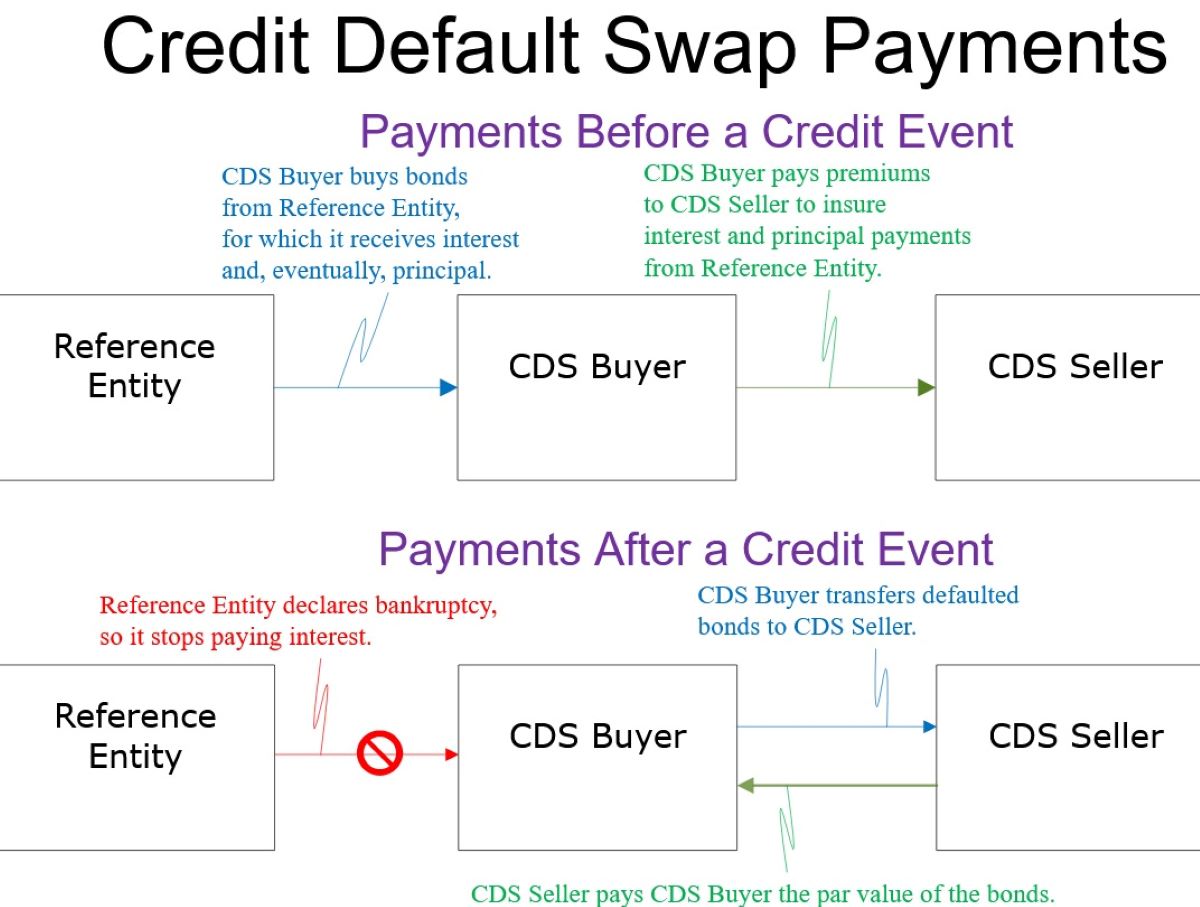

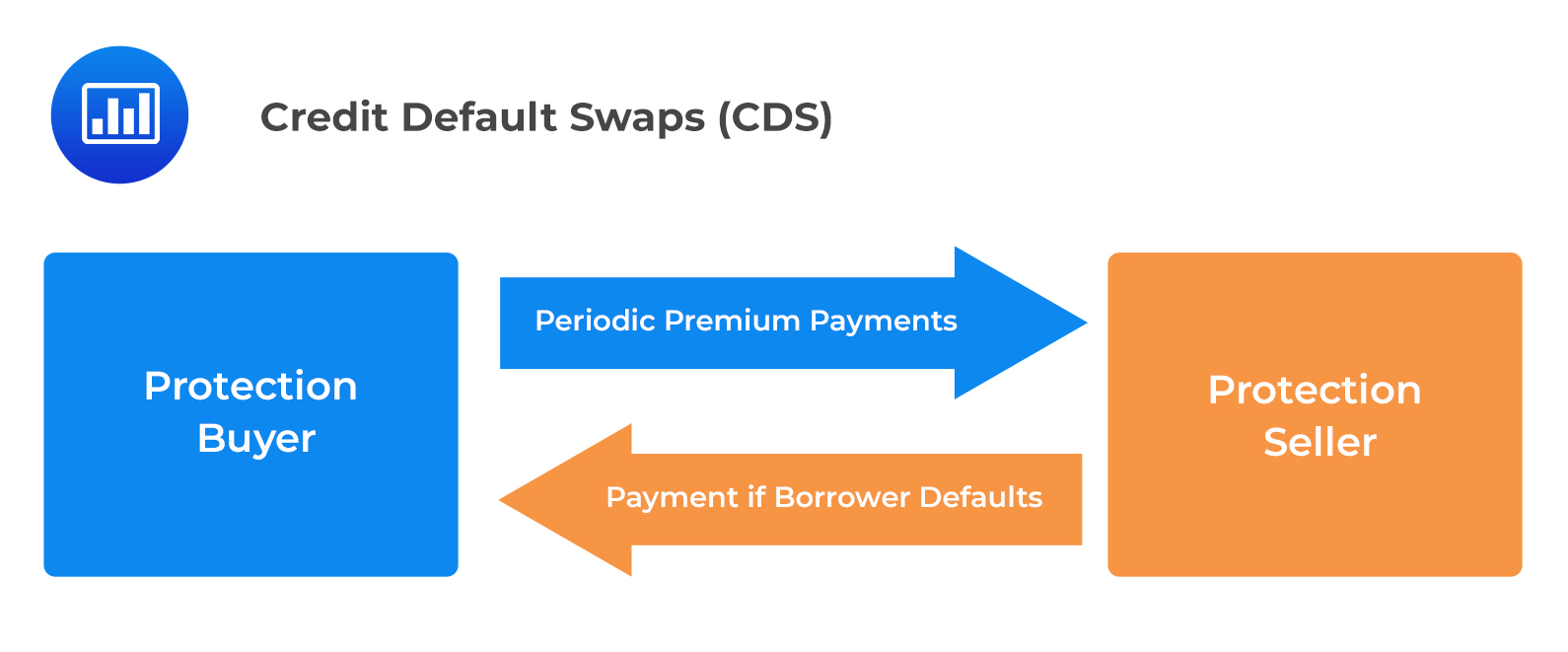

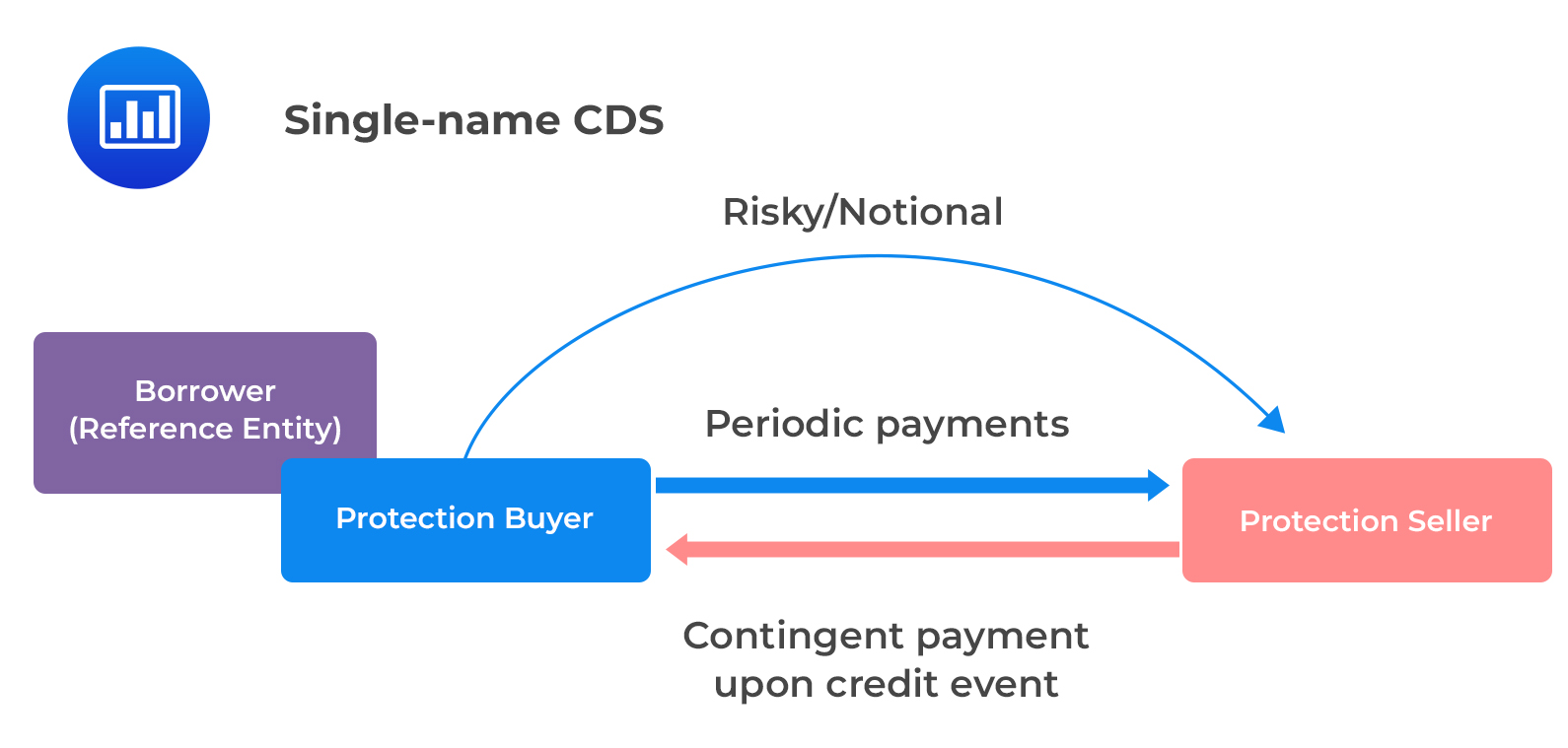

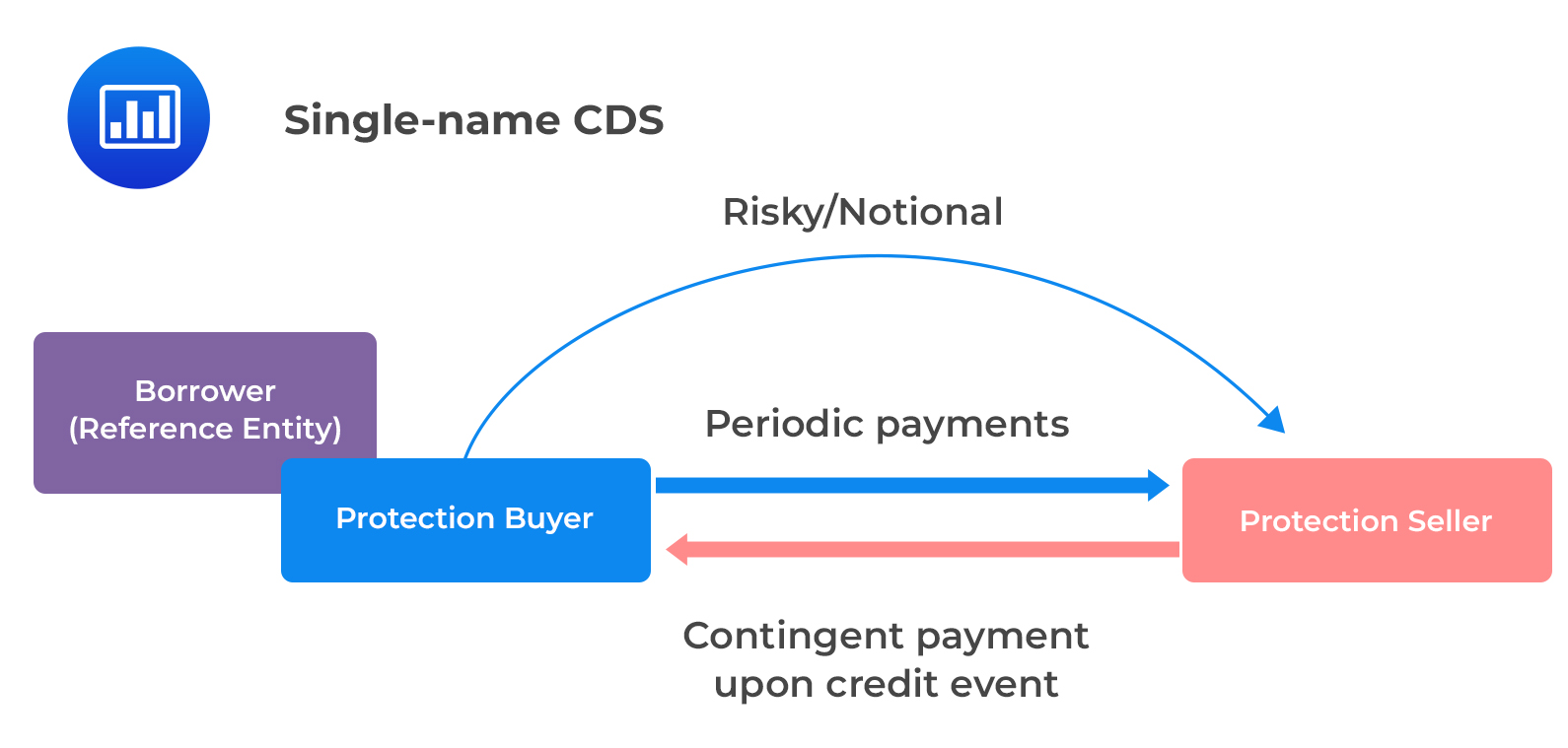

To comprehend credit default swaps, it’s essential to grasp their fundamental purpose and mechanics. At its core, a credit default swap is a financial contract between two parties, where one party acts as the protection buyer and the other as the protection seller. The protection buyer makes periodic payments to the protection seller, often referred to as the premium, in exchange for protection against the risk of default on a specific debt obligation.

These instruments are commonly used as a form of hedging against credit risk. For instance, if an investor holds a bond issued by a company but is concerned about the issuer’s ability to meet its debt obligations, they can enter into a credit default swap to mitigate the risk of potential default. In this scenario, the protection buyer would receive compensation from the protection seller in the event of a default, effectively transferring the credit risk to the seller.

Furthermore, credit default swaps are not limited to corporate bonds; they can also be based on other forms of debt, such as mortgage-backed securities or sovereign debt. This versatility allows market participants to manage a wide range of credit risks across various asset classes.

One crucial aspect of credit default swaps is that they are traded over-the-counter (OTC), meaning they are not transacted on formal exchanges. This OTC nature gives rise to a level of customization, as the terms of the contracts can be tailored to suit the specific needs of the parties involved. However, this lack of transparency and standardization has also contributed to concerns about the opacity and complexity of these instruments.

As we delve deeper into the realm of credit default swaps, it becomes evident that these financial instruments are not without controversy. While they offer a means for market participants to manage credit risk, their intricate nature and potential for speculative use have raised questions about their overall impact on financial stability. As we continue our exploration, we will uncover the benefits and risks associated with credit default swaps, shedding light on their broader implications for the financial markets and the economy at large.

How Credit Default Swaps Work

Understanding the mechanics of credit default swaps is essential for grasping their functionality in the financial landscape. When a protection buyer acquires a credit default swap, they are essentially seeking insurance against the possibility of a specific debt issuer defaulting on its obligations. In return for this protection, the buyer makes periodic payments, known as premiums, to the protection seller.

If the issuer of the underlying debt fails to meet its obligations, the protection buyer can claim a payout from the protection seller. This payout typically corresponds to the shortfall incurred due to the default, effectively compensating the buyer for the loss suffered. The amount of the payout is determined by the terms of the credit default swap contract, including the notional value of the underlying debt and the recovery rate applied in the event of default.

It’s important to note that credit default swaps can also be utilized for speculative purposes. Investors who do not hold the underlying debt can still purchase credit default swaps, effectively taking a position on the creditworthiness of the issuer. In this scenario, the investor stands to benefit if the issuer defaults, as they would receive a payout without holding the actual debt.

One of the key features of credit default swaps is their tradability. Once a credit default swap has been initiated, it can be traded between parties in the secondary market. This tradability provides flexibility for market participants to manage their exposure to credit risk. However, it also introduces liquidity and valuation challenges, especially during periods of market stress when the pricing and availability of credit default swaps may fluctuate significantly.

Moreover, the interconnected nature of credit default swaps has implications for systemic risk. Since these instruments allow for the transfer of credit risk between parties, the widespread use of credit default swaps can potentially amplify the impact of a large-scale credit event, such as a wave of corporate defaults or a sovereign debt crisis. As we navigate through the intricacies of credit default swaps, we will further explore the potential benefits and risks associated with these financial instruments, shedding light on their broader implications for the financial markets and the economy at large.

Benefits and Risks of Credit Default Swaps

Credit default swaps offer several potential benefits to market participants, but they also carry inherent risks that warrant careful consideration. On the positive side, these financial instruments provide a means for investors to hedge against credit risk and manage their exposure to potential defaults. By entering into credit default swaps, market participants can transfer the risk of default to willing protection sellers, thereby reducing their overall credit risk exposure.

Additionally, credit default swaps can enhance market liquidity and price discovery for debt securities. The ability to trade these instruments allows investors to express their views on credit risk and adjust their portfolios accordingly. This liquidity can contribute to more efficient pricing of credit risk in the broader financial markets, ultimately benefiting market participants seeking to manage their risk exposure.

However, the utilization of credit default swaps also poses significant risks. One notable concern is the potential for speculative use and market manipulation. Since investors can purchase credit default swaps without holding the underlying debt, there is a risk that these instruments may be used for speculative purposes, potentially impacting the stability of the financial system.

Moreover, the interconnectedness of credit default swaps has implications for systemic risk. In the event of a widespread credit crisis, the extensive use of these instruments could exacerbate the impact of defaults, leading to broader market turmoil. The opacity and lack of transparency in the credit default swap market further contribute to these systemic risk concerns, as the true extent of exposure across market participants may not be readily apparent.

Another risk associated with credit default swaps is the potential for counterparty risk. Since these instruments are traded over-the-counter, the creditworthiness of the protection seller becomes a critical consideration. In the event of a default by the protection seller, the protection buyer may face challenges in receiving the intended payouts, leading to financial losses and disruptions in the market.

As we navigate through the landscape of credit default swaps, it becomes evident that while these instruments offer valuable risk management tools, they also present complex challenges and potential risks that require ongoing vigilance and regulatory oversight. By understanding the interplay of benefits and risks associated with credit default swaps, market participants and regulators can work towards fostering a more resilient and transparent financial system.

The Role of Credit Default Swaps in the Financial Crisis

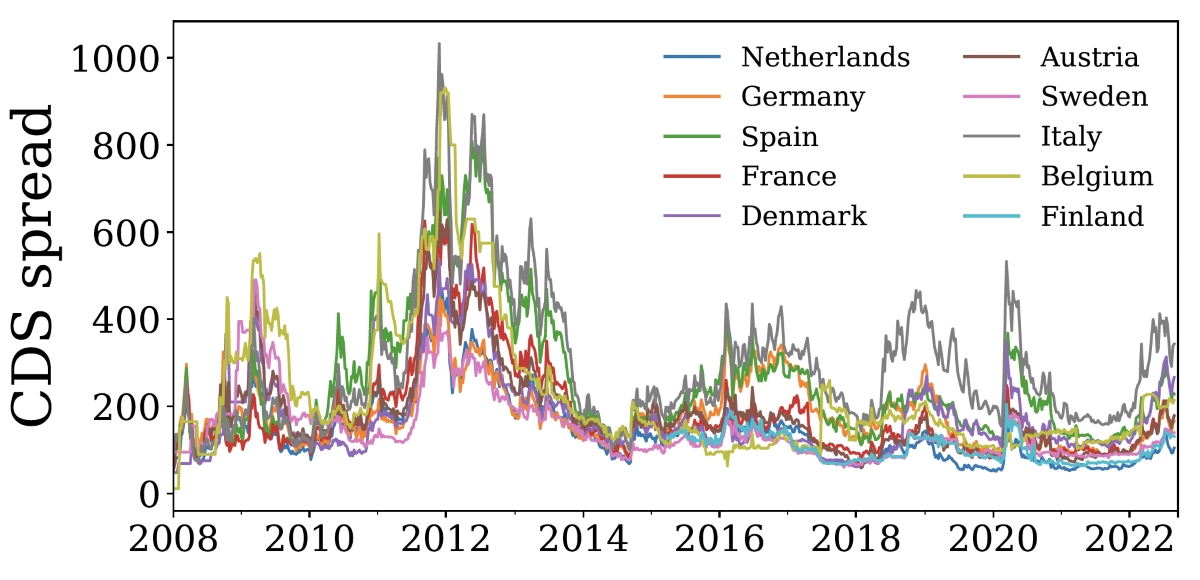

The 2008 global financial crisis brought the role of credit default swaps into sharp focus, highlighting both their impact on the crisis and the challenges they posed to financial stability. Leading up to the crisis, the widespread use of credit default swaps amplified the fallout from the subprime mortgage market collapse, contributing to a broader systemic meltdown.

One key aspect of the crisis was the extensive exposure of financial institutions to mortgage-backed securities and other complex debt instruments. As these securities faced mounting defaults, the interconnected nature of credit default swaps magnified the losses, leading to a ripple effect across the financial system. The lack of transparency and oversight in the credit default swap market further exacerbated the crisis, as the true extent of exposure and counterparty risk became increasingly uncertain.

Moreover, the speculative use of credit default swaps added fuel to the fire. Investors, including hedge funds and other market participants, had accumulated significant positions in credit default swaps without holding the underlying debt, effectively betting on the likelihood of defaults. This speculative activity intensified the market turmoil, contributing to heightened volatility and widespread distress.

The aftermath of the financial crisis prompted a reevaluation of the role of credit default swaps in the financial system. Regulators and policymakers sought to address the opacity and risks associated with these instruments, implementing reforms aimed at enhancing transparency, mitigating systemic risk, and strengthening oversight of the derivatives market.

While credit default swaps were not the sole cause of the financial crisis, their intricate interplay with complex debt securities and the amplification of risk underscored the need for comprehensive regulatory measures and risk management practices. By understanding the lessons learned from the crisis, market participants and regulators can strive to foster a more resilient and transparent financial system, where the benefits of credit default swaps can be realized without unduly jeopardizing financial stability.

Regulation of Credit Default Swaps

The regulatory landscape governing credit default swaps has undergone significant changes in response to the lessons learned from the 2008 financial crisis. The inherent risks and complexities associated with these instruments prompted policymakers to implement measures aimed at enhancing transparency, mitigating systemic risk, and strengthening oversight of the derivatives market.

One pivotal development in the regulation of credit default swaps was the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States. This landmark legislation introduced comprehensive reforms targeting the over-the-counter derivatives market, including credit default swaps. The Act mandated the central clearing of standardized derivatives contracts through clearinghouses, aimed at reducing counterparty risk and enhancing market transparency.

Furthermore, regulatory authorities, such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), were granted expanded oversight and enforcement powers to monitor and regulate the derivatives market. These measures aimed to address concerns related to market manipulation, speculative trading, and the potential for destabilizing activities involving credit default swaps.

Internationally, efforts to harmonize the regulation of derivatives, including credit default swaps, have been pursued through forums such as the G20 and the Financial Stability Board (FSB). The goal has been to establish consistent standards and regulatory frameworks across jurisdictions, reducing regulatory arbitrage and promoting a more coordinated approach to overseeing the derivatives market.

Central to the regulation of credit default swaps is the push for greater transparency. Requirements for reporting trades to swap data repositories and the dissemination of pricing and transaction information aim to enhance market visibility and facilitate better risk assessment. These transparency measures also seek to address concerns about the opacity of the credit default swap market, providing regulators and market participants with improved insights into the extent of exposure and potential risks.

While regulatory reforms have made significant strides in addressing the challenges posed by credit default swaps, ongoing vigilance and adaptation to evolving market dynamics remain essential. By fostering a robust regulatory framework that promotes transparency, risk mitigation, and market integrity, regulators aim to strike a balance where the benefits of credit default swaps can be realized while safeguarding against potential systemic risks and market abuse.

Conclusion

Credit default swaps have left an indelible mark on the financial landscape, serving as both valuable risk management tools and sources of systemic concern. These complex derivatives, born out of the need to hedge against credit risk, have played a pivotal role in shaping market dynamics and influencing the broader economy. As we reflect on the intricacies of credit default swaps, it becomes evident that they embody a duality—a duality characterized by the potential for risk mitigation and the challenges of opacity and systemic impact.

While credit default swaps offer market participants a means to hedge against credit risk and manage their exposure to potential defaults, their utilization also poses significant risks. The speculative nature of these instruments, coupled with their interconnectedness and potential for amplifying systemic risk, has prompted regulators to implement reforms aimed at enhancing transparency, mitigating risk, and strengthening oversight.

The aftermath of the 2008 financial crisis served as a catalyst for regulatory changes, leading to the implementation of measures designed to address the challenges posed by credit default swaps. From central clearing requirements to enhanced reporting and transparency mandates, the regulatory landscape governing these instruments has evolved to foster a more resilient and transparent derivatives market.

Looking ahead, the regulation of credit default swaps will continue to be a focal point for policymakers and market participants. Striking a balance between reaping the benefits of these instruments and safeguarding against potential risks remains a paramount objective. By fostering a robust regulatory framework that promotes transparency, risk mitigation, and market integrity, stakeholders aim to navigate the complexities of credit default swaps while upholding financial stability.

As we navigate the evolving terrain of financial markets, the lessons learned from the role of credit default swaps in the 2008 crisis serve as a guiding light. By embracing transparency, prudent risk management, and coordinated regulatory efforts, market participants and regulators can work towards a future where the potential benefits of credit default swaps are realized within a framework that prioritizes resilience and stability.