Finance

When Do Biotech Buyouts Usually Occurr

Modified: December 30, 2023

Learn about the timing of biotech buyouts in the world of finance. Discover when these acquisitions typically take place and how they impact the industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Biotech buyouts have become a common occurrence in the finance industry, as companies look to capitalize on the advancements and innovations in the biotechnology sector. These buyouts involve one company acquiring another, often for strategic reasons such as gaining access to new technology, expanding product portfolios, or entering new markets.

The field of biotechnology encompasses a wide range of industries, including pharmaceuticals, healthcare, agriculture, and environmental sciences. With the potential for immense growth and profitability, it’s no wonder that biotech buyouts have become increasingly attractive to investors and companies looking for strategic partnerships.

However, biotech buyouts are not without their challenges. The complex nature of the biotech industry, including regulatory hurdles, long development timelines, and high failure rates, presents unique risks that both buyers and sellers must carefully consider.

In this article, we will explore the factors driving biotech buyouts, the key players involved, the timing of these transactions, and the challenges and risks associated with them. By gaining a deeper understanding of the dynamics behind biotech buyouts, investors and industry participants can make more informed decisions and navigate the intricate landscape of this rapidly evolving sector.

Factors Driving Biotech Buyouts

Biotech buyouts are driven by several key factors that make them appealing to both buyers and sellers in the industry. Understanding these factors can provide insights into the motivations behind these transactions. Here are some of the main drivers:

- Technological Advancements: The biotech industry is known for its rapid pace of innovation and technological advancements. Companies that have developed cutting-edge technologies or have promising drug candidates in their pipelines often become attractive targets for acquisition. Buyers seek to gain access to these innovative technologies to enhance their own research and development capabilities and stay ahead in the competitive market.

- Market Expansion: Biotech buyouts can also be driven by the desire to enter new markets or expand into existing ones. Acquiring a company with an established presence in a particular geographic region or therapeutic area allows buyers to gain immediate access to a wider customer base and distribution networks. This can help accelerate their growth and increase market share.

- Intellectual Property: Intellectual property rights and patents play a crucial role in the biotech industry. Companies with valuable patents or proprietary technology platforms can attract acquirers looking to gain exclusive rights to those assets. Acquiring intellectual property can provide a competitive advantage, preventing others from entering the market with similar products or technologies.

- Product Portfolio Diversification: Biotech buyouts can also be driven by the desire to diversify product portfolios. Companies may seek to acquire products that complement their existing offerings or target different therapeutic areas. This diversification strategy helps mitigate risks associated with a single product or market focus and can lead to increased profitability and market stability.

- Strategic Partnerships: Strategic partnerships and collaborations are common in the biotech industry. Buyouts can be a result of successful collaborations where the parties involved decide to deepen their relationship through an acquisition. This allows for further integration of resources and expertise, enhancing the chances of success in the development and commercialization of new products.

These factors, among others, contribute to the increasing number of biotech buyouts in the market. Buyers and sellers are motivated by a combination of strategic, financial, and competitive advantages, aiming to capitalize on the potential value and opportunities present in the biotechnology sector.

Key Players in Biotech Buyouts

Biotech buyouts involve various players in the finance industry, including pharmaceutical companies, venture capital firms, private equity firms, and even other biotech companies. These players have different motivations and strategies when it comes to participating in biotech buyouts. Here are some of the key players:

- Pharmaceutical Companies: Established pharmaceutical companies often engage in biotech buyouts to enhance their product pipelines and gain access to new technologies. These companies have the resources and expertise to develop and commercialize biotech products at a larger scale. Biotech buyouts allow them to expand their portfolios and enter new therapeutic areas, or acquire late-stage drug candidates that are closer to market approval.

- Venture Capital Firms: Venture capital firms play a crucial role in the biotech industry by providing early-stage funding to startups and emerging biotech companies. They often invest in promising companies with innovative technologies or potential breakthrough drugs. In some cases, venture capital firms may participate in biotech buyouts as part of their exit strategy, selling their stake in the company for a profit.

- Private Equity Firms: Private equity firms are another important player in biotech buyouts. They typically invest in more mature biotech companies that have demonstrated commercial potential. Private equity firms provide the necessary capital and resources to support the growth and expansion of these companies, often with the goal of taking them public or selling them to larger pharmaceutical companies at a later stage.

- Biotech Companies: Biotech buyouts can also involve one biotech company acquiring another. This often occurs when companies have complementary technologies, product pipelines, or research capabilities. By merging their resources, these companies can leverage synergies and create a stronger entity in the market. Biotech buyouts can also be a strategic move to eliminate competition or gain access to specific expertise or intellectual property.

- Investment Banks: Investment banks play a significant role as intermediaries in biotech buyouts. They provide financial advisory services, conduct due diligence, and facilitate the transaction process. Investment banks help identify potential acquirers or targets, negotiate deal terms, and ensure that the transaction is executed efficiently and in compliance with regulatory requirements.

The participation of these key players in biotech buyouts reflects the diverse landscape and interests within the industry. Each player brings its unique expertise, resources, and strategic objectives, contributing to the dynamic nature of biotech buyouts.

Timing of Biotech Buyouts

The timing of biotech buyouts can vary depending on various factors, including the stage of development of the target company, market conditions, and the strategic objectives of the acquiring company. Here are some key considerations when it comes to the timing of biotech buyouts:

- Early-Stage Buyouts: Some biotech buyouts occur at an early stage of a company’s development, often when it has promising technology or drug candidates but lacks the resources or expertise to bring them to market. Acquiring companies may see potential value in these early-stage companies and decide to invest and acquire them to capitalize on their future success.

- Mid-Stage Buyouts: Biotech buyouts can also happen at a mid-stage, when the target company has advanced its research and development efforts and is closer to achieving key milestones, such as clinical trial results or regulatory approvals. Acquiring companies may be interested in taking advantage of this progress and acquiring the target company to gain access to its developed compounds or validated technologies.

- Late-Stage Buyouts: Late-stage biotech buyouts typically involve acquiring companies that have achieved significant milestones, such as completed clinical trials or regulatory approvals. Acquiring companies may be attracted to late-stage buyouts as it reduces the risk associated with early-stage development and increases the likelihood of successful product commercialization. These buyouts often involve higher transaction values due to the advanced stage of the target company’s development.

- Market Conditions: The timing of biotech buyouts can also be influenced by market conditions, including investor sentiment, access to capital, and overall market trends. During favorable market conditions, where investor confidence is high and there is ample capital available, biotech buyouts tend to be more frequent. Conversely, in uncertain or volatile market conditions, buyout activities may slow down as companies become more cautious with their investment decisions.

- Strategic Objectives: The strategic objectives of the acquiring company also play a role in determining the timing of biotech buyouts. Companies may choose to acquire a target to fill a gap in their product pipeline, enter a new market, or gain a competitive edge. The timing for these acquisitions will depend on when the strategic need arises and when the target company aligns with the acquiring company’s objectives.

It’s worth noting that the timing of biotech buyouts can be unpredictable and influenced by various external factors. Regulatory developments, clinical trial outcomes, and market dynamics can all impact the timing and success of these transactions. It is essential for both buyers and sellers to carefully assess the market conditions and align their strategies accordingly to maximize the potential benefits of biotech buyouts.

Case Studies of Biotech Buyouts

Examining case studies of biotech buyouts provides valuable insights into the dynamics and outcomes of these transactions. Here are a few notable examples:

- Google’s Acquisition of Fitbit: In 2019, technology giant Google acquired fitness tracker company Fitbit for $2.1 billion. This buyout allowed Google to expand its presence in the wearable technology market and leverage Fitbit’s user data and expertise in health and fitness tracking. The acquisition aligned with Google’s strategic objective to enter the healthcare industry and compete with other tech companies in the growing digital health sector.

- Pfizer’s Acquisition of Anacor Pharmaceuticals: In 2016, pharmaceutical company Pfizer completed its acquisition of Anacor Pharmaceuticals for approximately $5.2 billion. Anacor Pharmaceuticals was known for its innovative topical treatments for fungal infections. Pfizer saw the acquisition as an opportunity to strengthen its dermatology portfolio and gain access to Anacor’s promising drug candidate, Crisaborole. Pfizer successfully launched Crisaborole under the brand name Eucrisa and expanded its presence in the dermatology market.

- Sanofi’s Acquisition of Genzyme: In 2011, French pharmaceutical company Sanofi acquired biotech company Genzyme for $20.1 billion. This buyout was motivated by Sanofi’s desire to diversify its product portfolio and strengthen its presence in the rare disease and orphan drug market. Genzyme had developed several successful therapies for rare genetic disorders, and the acquisition allowed Sanofi to tap into this niche market and benefit from the revenue generated by these specialized treatments.

- Juno Therapeutics’ Acquisition by Celgene: In 2018, biopharmaceutical company Celgene acquired Juno Therapeutics, a leader in the field of CAR-T cell therapies, for $9 billion. Celgene’s acquisition of Juno Therapeutics was driven by its goal of expanding into the emerging field of immunotherapy and strengthening its oncology product pipeline. The acquisition provided Celgene with access to Juno’s advanced cell therapy platforms and promising clinical-stage candidates for the treatment of various types of cancers.

- Johnson & Johnson’s Acquisition of Actelion: In 2017, pharmaceutical giant Johnson & Johnson completed its acquisition of Swiss biotech company Actelion for $30 billion. Actelion was known for its expertise in pulmonary arterial hypertension (PAH) and had developed several market-leading treatments for this rare disease. The acquisition allowed Johnson & Johnson to enter the PAH market and expand its cardiovascular disease portfolio, diversifying its offerings and positioning itself for long-term growth.

These case studies highlight the strategic and financial motivations behind biotech buyouts. Companies seek to acquire innovative technologies, product pipelines, and expertise that align with their strategic objectives. Successful biotech buyouts can lead to accelerated market entry, increased market share, and enhanced profitability for the acquiring companies.

Challenges and Risks in Biotech Buyouts

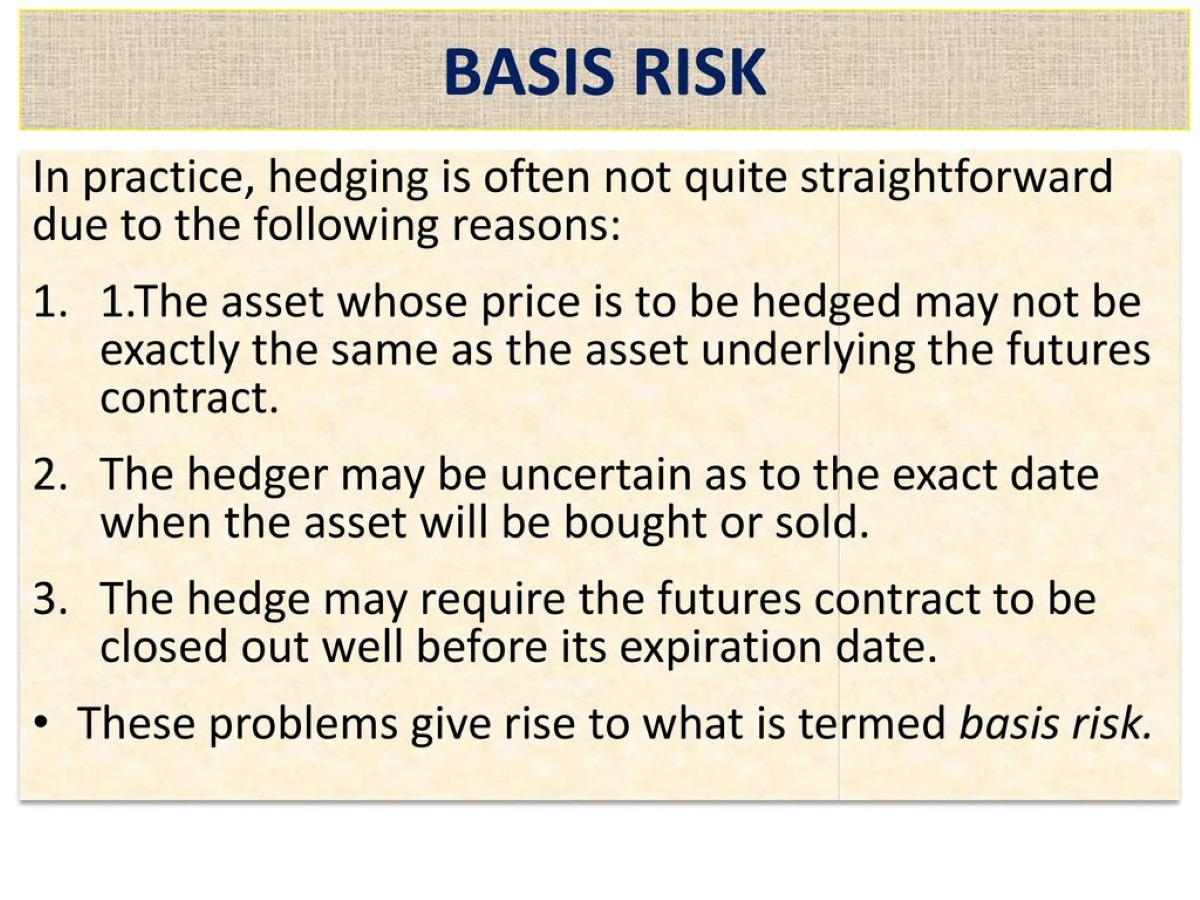

While biotech buyouts offer significant opportunities, they also come with their fair share of challenges and risks. It’s important for both buyers and sellers to be aware of these challenges and assess them carefully before engaging in such transactions. Here are some of the key challenges and risks involved in biotech buyouts:

- Regulatory Hurdles: The biotech industry is subject to stringent regulatory oversight, particularly when it comes to drug development and commercialization. Acquiring companies must navigate complex regulatory processes, including obtaining approvals from regulatory authorities, addressing potential safety concerns, and complying with post-market regulations. Failure to meet these regulatory requirements can result in delays, increased costs, or even the inability to bring a product to market.

- Development Risks: Biotech products often have long development timelines and high failure rates. Acquiring companies must carefully evaluate the target company’s product pipeline and assess the likelihood of successful commercialization. The failure of key drug candidates or unexpected safety issues can significantly impact the value of the acquisition. It is essential for buyers to perform thorough due diligence and understand the potential risks associated with the target company’s development portfolio.

- Intellectual Property Challenges: Intellectual property rights are crucial in the biotech industry, and disputes over patents and patent infringement can arise during and after biotech buyouts. Acquiring companies must conduct thorough intellectual property due diligence to ensure they are acquiring valid and enforceable patents. Failure to address intellectual property challenges can result in legal complications, loss of market exclusivity, or infringement claims from competitors.

- Integration Complexities: Integrating two companies with different cultures, processes, and operations can be a complex and challenging task. Achieving synergies and realizing the expected benefits of the acquisition requires careful planning and execution. Failure to effectively integrate the acquired company can result in disruptions, operational inefficiencies, and loss of key talent.

- Market and Competitive Risks: The biotech industry is highly competitive, with a constant influx of new entrants and evolving market dynamics. Acquiring companies must assess the target company’s competitive positioning, market size, and potential market share. Changes in market conditions, pricing pressures, or the emergence of new technology or therapies can impact the profitability of the acquisition.

It is crucial for both buyers and sellers to conduct thorough due diligence and seek advice from legal, financial, and regulatory experts to mitigate these challenges and risks. Assessing and managing these risks can help ensure the success and long-term viability of biotech buyouts.

Conclusion

Biotech buyouts have become increasingly prominent in the finance industry, driven by technological advancements, market expansion opportunities, intellectual property acquisitions, product portfolio diversification, and strategic partnerships. The timing of biotech buyouts can vary, ranging from early-stage acquisitions to late-stage buyouts, influenced by market conditions and the strategic objectives of acquiring companies.

Key players in biotech buyouts include pharmaceutical companies, venture capital firms, private equity firms, biotech companies themselves, and investment banks, each with their unique motivations and strategies. Case studies of biotech buyouts like Google’s acquisition of Fitbit, Pfizer’s acquisition of Anacor Pharmaceuticals, Sanofi’s acquisition of Genzyme, Juno Therapeutics’ acquisition by Celgene, and Johnson & Johnson’s acquisition of Actelion provide valuable insights into the dynamics and outcomes of these transactions.

However, biotech buyouts also come with challenges and risks. Regulatory hurdles, development risks, intellectual property challenges, integration complexities, and market and competitive risks pose potential obstacles to the success of these transactions. Careful due diligence, strategic planning, and expert advice are essential to navigate these challenges and mitigate risks.

In conclusion, biotech buyouts present tremendous opportunities for growth, innovation, and strategic advantage in the rapidly evolving biotechnology sector. By understanding the drivers, timing, key players, and associated challenges of biotech buyouts, investors and industry participants can make informed decisions and capitalize on the potential value and opportunities available in this dynamic industry.