Finance

When Do You Credit Accounts Receivable

Modified: February 21, 2024

Discover when to credit accounts receivable in the world of finance. Get expert insights and make informed decisions for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of accounts receivable! A vital component of any business’s financial operations, accounts receivable represents the money owed to a company by its customers or clients for goods or services provided. Managing accounts receivable is crucial for organizations of all sizes and industries, as it directly impacts the cash flow and overall financial health of the business.

As businesses grow and transactions multiply, it becomes essential to accurately record and track accounts receivable. This involves not only debiting the accounts receivable when an invoice is generated but also crediting it when payment is received. Crediting accounts receivable is a fundamental step that ensures accurate bookkeeping and maintains an up-to-date financial picture.

In this article, we will explore the concept of crediting accounts receivable, its importance, eligible transactions for crediting, how to record credited accounts receivable, factors to consider, and provide some examples to illustrate the process.

So, whether you are a business owner, accountant, or financial enthusiast seeking to expand your knowledge, let’s dive deep into the world of crediting accounts receivable!

Definition of Accounts Receivable

Before we delve into the process of crediting accounts receivable, let’s begin by understanding what exactly accounts receivable is.

Accounts receivable, often abbreviated as AR, refers to the amount of money that a business is owed by its customers or clients for goods or services provided on credit. When a customer purchases goods or services but does not pay immediately, the amount becomes a part of the accounts receivable for the business.

Essentially, accounts receivable represents the company’s uncollected revenues, and it is considered an asset in the balance sheet. It reflects the credit sales made by the business and represents its expectation of receiving cash in the future.

Typically, accounts receivable is created when a business extends credit terms to its customers, allowing them to make payments within a specified period. This is common in industries where services are provided on an ongoing basis or when goods are sold on credit rather than for immediate payment.

Accounts receivable is an important metric for assessing a company’s financial health and liquidity. It helps determine the amount of cash that will be flowing into the business in the future and aids in managing cash flow effectively.

Now that we have a clear understanding of accounts receivable, let’s explore the significance of crediting accounts receivable.

Importance of Crediting Accounts Receivable

Crediting accounts receivable is a critical step in the bookkeeping process that has several important implications for businesses. Let’s explore why crediting accounts receivable is important:

- Accurate Financial Reporting: Crediting accounts receivable ensures that the financial statements of a company accurately reflect the current status of outstanding customer debts. By recording the payments received, businesses can provide a true and up-to-date picture of their accounts receivable balances, which is essential for financial reporting and analysis.

- Cash Flow Management: Crediting accounts receivable allows businesses to track the cash inflows from their customers. By promptly recording and crediting the payments, businesses can monitor their cash flow and understand the timing and amount of cash they can expect to receive. This information is crucial for managing working capital effectively and making informed financial decisions.

- Customer Relationship Management: Crediting accounts receivable plays a pivotal role in maintaining positive customer relationships. By accurately recording payments and updating accounts, businesses can provide accurate payment histories to their customers. This helps in addressing any disputes or discrepancies promptly and ensures transparency in financial dealings, leading to stronger customer trust and satisfaction.

- Internal Control and Auditing: Crediting accounts receivable is an essential element of internal control processes. By maintaining an accurate record of payments received, businesses can monitor their financial transactions and identify any discrepancies or errors. This helps in internal auditing and ensures the integrity and reliability of financial data.

- Legal Compliance: Properly crediting accounts receivable is crucial for legal compliance. In some jurisdictions, businesses are required to maintain accurate records of payments received for tax purposes. By diligently crediting accounts receivable and maintaining records, businesses can ensure compliance with tax regulations and avoid legal penalties.

In summary, crediting accounts receivable is of utmost importance for accurate financial reporting, effective cash flow management, maintaining customer relationships, internal control, and legal compliance. It is a vital step in the financial operations of any business and contributes to its overall financial stability and success.

Eligible Transactions for Crediting Accounts Receivable

When it comes to crediting accounts receivable, there are specific transactions that are eligible for recording. Let’s explore the most common types of transactions that warrant crediting accounts receivable:

- Customer Payments: The most straightforward and common transaction for crediting accounts receivable is when a customer makes a payment towards their outstanding balance. Whether it’s a full payment or a partial payment, these transactions should be promptly recorded and credited to the respective customer’s accounts receivable.

- Accounts Receivable Write-Offs: There are instances when a business determines that it is unlikely to collect payment from a customer due to various reasons such as bankruptcy, liquidation, or other financial difficulties. In such cases, the business may decide to write off the accounts receivable as bad debt. This write-off transaction involves crediting the specific customer’s accounts receivable and debiting the bad debt expense account.

- Discounts and Allowances: In some cases, businesses offer discounts or allowances to customers as an incentive for early payment or to address any issues or discrepancies with the goods or services provided. When a discount or allowance is granted, it should be reflected by crediting the customer’s accounts receivable for the corresponding amount.

- Reversals: Occasionally, errors occur in the recording of customer payments or adjustments. When such errors are identified, they can be corrected by reversing the initial entry and subsequently recording the correct transaction. The reversal transaction involves crediting accounts receivable to cancel out the incorrect entry.

- Returned Merchandise: If a customer returns merchandise or disputes the quality or quantity of the goods received, it may result in a reduction of the accounts receivable balance. To reflect this adjustment, the accounts receivable should be credited by the appropriate amount.

It’s important to note that these are just a few examples of eligible transactions for crediting accounts receivable. The specific transactions can vary depending on the nature of the business, industry, and customer agreements. Businesses should establish clear policies and procedures to accurately identify and record eligible transactions for crediting accounts receivable.

Now that we understand the transactions that warrant crediting accounts receivable, let’s explore how to properly record credited accounts receivable.

Recording Credited Accounts Receivable

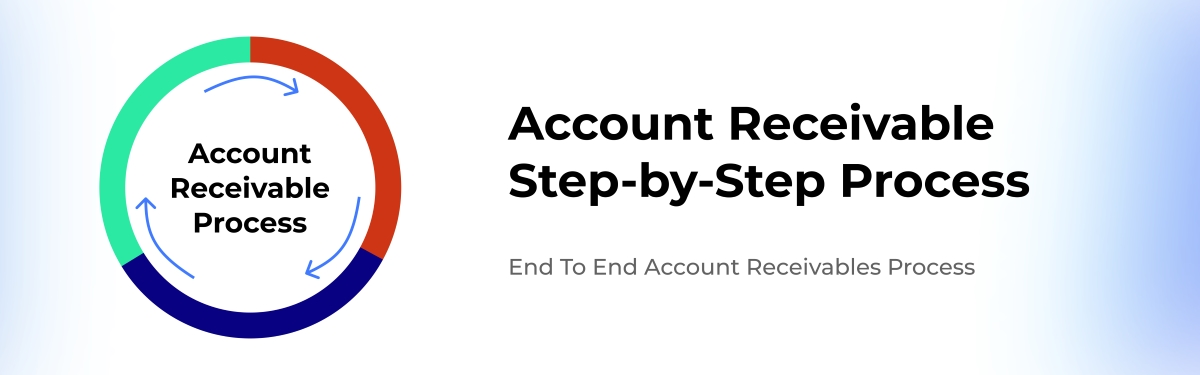

Properly recording credited accounts receivable is crucial for maintaining accurate financial records. Let’s walk through the steps involved in recording credited accounts receivable:

- Identify the Transaction: First, identify the specific transaction that requires crediting accounts receivable. This could be a customer payment, an allowance or discount granted, a write-off of bad debt, a reversal, or a return of merchandise.

- Choose the Correct Account: Depending on the nature of the transaction, select the appropriate account to credit. For customer payments, credit the specific customer’s accounts receivable. For discounts or allowances, credit the accounts receivable for the corresponding customer. For bad debt write-offs, credit the specific customer’s accounts receivable and debit the bad debt expense account. And for reversals or returns, credit the appropriate customer’s accounts receivable.

- Record the Transaction: Use your accounting software or manually prepare a journal entry to record the transaction. Enter the date of the transaction, the specific accounts involved, and the corresponding amounts. Ensure that the debit and credit amounts are equal to maintain the balance in the accounting equation.

- Update the Accounts Receivable Balance: Once the transaction is recorded, update the accounts receivable balance for the specific customer affected by the transaction. This ensures that the accounts receivable balance accurately reflects the current status of outstanding customer debts.

- Verify the Accuracy: Before finalizing the recording of credited accounts receivable, double-check the accuracy of the transaction details, account codes, and amounts. This step is crucial to maintain the integrity and reliability of financial records.

- Reconcile the Updated Accounts Receivable: Regularly reconcile the updated accounts receivable balances with customer statements and other supporting documents. This helps identify any discrepancies or errors and ensures the accuracy of the accounts receivable balance.

By following these steps, businesses can accurately record credited accounts receivable transactions and maintain reliable financial records. It’s important to establish clear processes and train employees involved in the bookkeeping function to ensure consistency and accuracy in recording credited accounts receivable.

Now that we know how to record credited accounts receivable, let’s explore some important factors to consider when crediting these accounts.

Factors to Consider when Crediting Accounts Receivable

When crediting accounts receivable, there are several factors that businesses should consider to ensure accurate and effective bookkeeping. Let’s explore these factors:

- Transaction Documentation: It is essential to maintain proper documentation for each transaction that results in crediting accounts receivable. This includes invoices, payment receipts, credit memos, return authorizations, and any other relevant documents. Proper documentation provides a clear audit trail and supports the credibility of the transaction.

- Timeliness: Crediting accounts receivable should be done promptly and in a timely manner. Recording customer payments or adjustments as soon as they occur ensures accurate financial reporting and provides a real-time view of the accounts receivable balance. Timely recording also allows for effective cash flow management.

- Accuracy: Accuracy is paramount when recording credited accounts receivable. Care must be taken to enter the correct transaction details, account codes, and amounts. Any errors can result in misreported financial information and discrepancies in accounts receivable balances. Regular reconciliations and reviews should be conducted to ensure accuracy.

- Verification: Verifying the authenticity and legitimacy of customer payments is crucial before crediting accounts receivable. This involves cross-checking payment amounts and methods, confirming that funds have been received, and validating against supporting documents. Proper verification helps mitigate the risk of fraud or incorrect recording.

- Consistency: Establishing consistent processes and procedures for crediting accounts receivable is vital. This helps ensure that all transactions are recorded in a uniform manner and allows for easier retrieval of information during audits or financial analysis. Consistency also facilitates the training of employees involved in the bookkeeping function.

- Understanding Accounting Standards: It’s important to have a solid understanding of accounting standards and principles to correctly credit accounts receivable. This includes knowledge of revenue recognition principles, allowance for doubtful accounts, and any industry-specific guidelines. Adhering to these standards ensures compliance and accurate financial reporting.

- Reconciliation: Regular reconciliation of the accounts receivable balance is crucial to maintain accuracy and identify discrepancies. Comparing the accounts receivable balance with customer statements and other supporting documents helps catch any errors or omissions. Reconciliations should be performed on a scheduled basis and any differences should be researched and resolved.

Considering these factors when crediting accounts receivable helps businesses maintain accurate financial records, improve internal controls, and ensure compliance with accounting principles and regulations.

Now, let’s explore some examples to better understand how crediting accounts receivable works in practice.

Examples of Crediting Accounts Receivable

To further illustrate the process of crediting accounts receivable, let’s explore a few examples:

- Customer Payment: Let’s say a customer, ABC Corporation, makes a payment of $1,000 towards their outstanding invoice. To credit their accounts receivable, you would record a journal entry by crediting ABC Corporation’s accounts receivable for $1,000 and debiting the cash account for $1,000. This transaction reduces the accounts receivable balance for ABC Corporation.

- Discount Granted: Suppose you offer a 10% early payment discount to a customer, XYZ Enterprises, for an invoice of $500. If the customer takes advantage of the discount and pays within the specified period, you would credit XYZ Enterprises’ accounts receivable for $50 (10% of $500) and debit the sales discount account for $50.

- Accounts Receivable Write-Off: If a customer, DEF Inc., files for bankruptcy and is unable to pay their outstanding invoice of $1,500, you may decide to write off their accounts receivable as a bad debt. This involves crediting DEF Inc.’s accounts receivable for $1,500 and debiting the bad debt expense account for $1,500. This transaction removes the non-collectible amount from the accounts receivable balance.

- Reversal: In the previous example, suppose you mistakenly credited DEF Inc.’s accounts receivable for $1,500 instead of debiting their accounts payable. To correct the error, you would reverse the initial entry by crediting DEF Inc.’s accounts receivable and debiting the accounts payable. Then, you can record the correct transaction by crediting DEF Inc.’s accounts payable and debiting the accounts receivable.

- Returned Merchandise: If a customer, GHI Company, returns $200 worth of goods they purchased on credit, you would credit GHI Company’s accounts receivable for $200. This transaction reflects the reduction in the accounts receivable balance due to the returned merchandise.

These examples provide a glimpse into how crediting accounts receivable works in various scenarios. It’s important to tailor the recording process to your specific business needs and ensure compliance with applicable accounting standards and regulations.

Now, let’s summarize what we have covered so far.

Conclusion

Crediting accounts receivable is an essential aspect of effective financial management for businesses. It ensures accurate financial reporting, improves cash flow management, maintains customer relationships, supports internal control processes, and facilitates legal compliance. By promptly and accurately recording transactions that warrant crediting accounts receivable, businesses can maintain reliable financial records and make informed business decisions.

In this article, we explored the definition of accounts receivable and its importance in the financial operations of a business. We discussed eligible transactions for crediting accounts receivable, such as customer payments, write-offs, discounts, reversals, and returns. Additionally, we examined the process of recording credited accounts receivable and highlighted important factors to consider, including transaction documentation, timeliness, accuracy, verification, consistency, understanding accounting standards, and reconciliation.

Throughout the examples provided, we demonstrated the practical application of crediting accounts receivable in various scenarios. These examples showcased how different transactions impact the accounts receivable balance and how they should be properly recorded.

By following the best practices outlined in this article, businesses can confidently manage their accounts receivable, maintain accurate financial records, and improve overall financial performance.

In conclusion, crediting accounts receivable is a fundamental process that helps businesses maintain financial stability, provide transparent reporting, and effectively manage customer debts. By understanding and implementing proper procedures, businesses can ensure accuracy, compliance, and improved decision-making in their financial processes.