Finance

What Is Memo Credit

Modified: February 21, 2024

Learn what memo credit is and how it impacts your finances. Discover how this financial concept can affect your spending and budgeting habits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, there are numerous terms and concepts that can be confusing to individuals who are not well-versed in the field. One such concept is memo credit. If you’ve come across this term and find yourself wondering what it means, you’ve come to the right place.

Memo credit, also known as memo posting, is a financial transaction that involves the temporary crediting of funds to an account. While it may sound similar to a traditional credit, it is important to note that memo credit does not result in an actual deposit of funds. Rather, it serves as a temporary placeholder or notification of pending funds. This mechanism allows businesses, financial institutions, and individuals to track and monitor pending transactions before they are fully processed.

Understanding how memo credits work and their various uses can be beneficial for both businesses and individuals. In this article, we will delve into the details of memo credit, exploring its functions, advantages, disadvantages, and key considerations for users.

Definition of Memo Credit

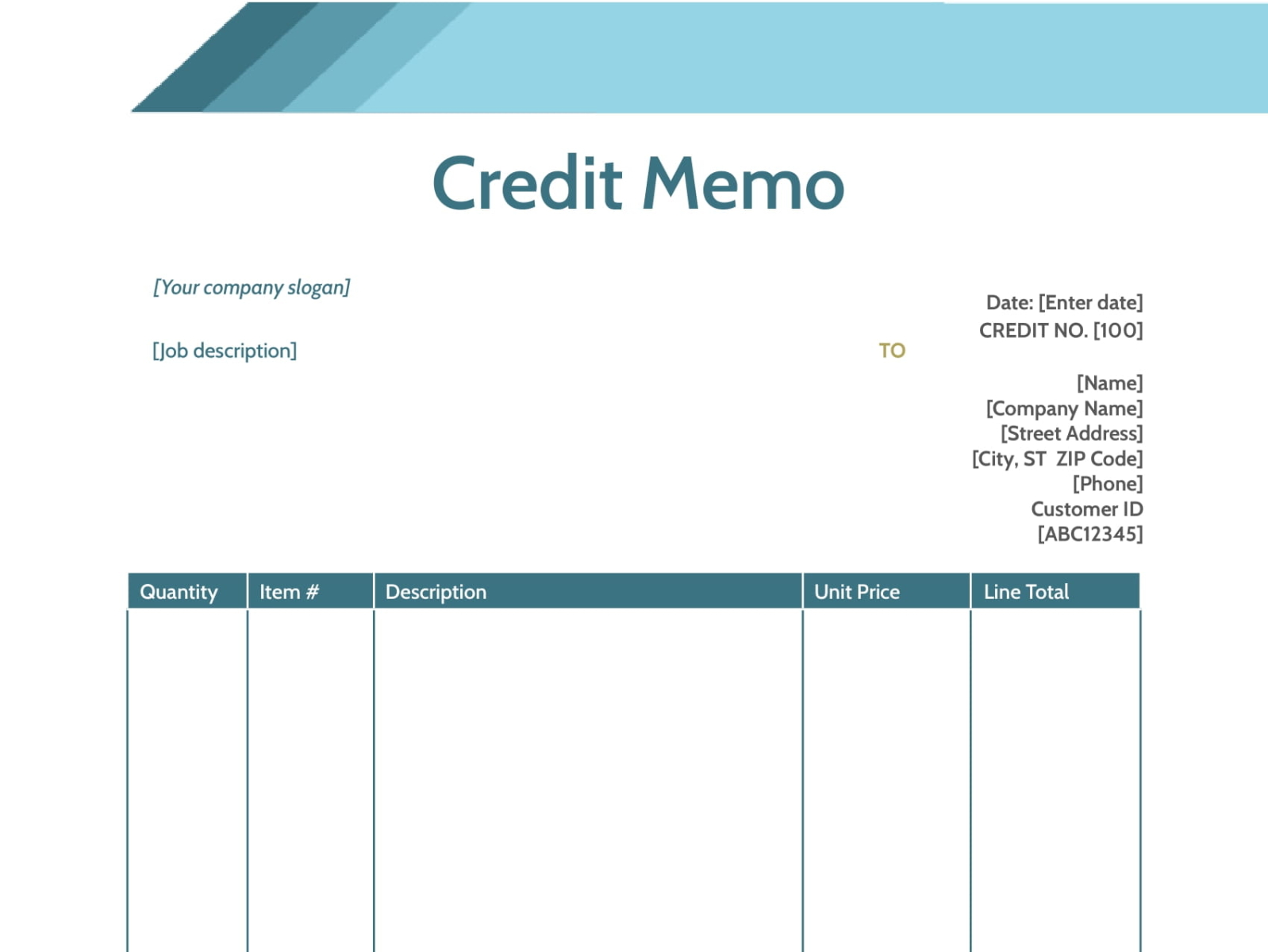

Memo credit, also known as memo posting, is a term used in the field of finance to describe a temporary credit entry in an account. It is a notification or placeholder that represents funds being credited to an account before the transaction is fully processed. It is important to note that memo credits do not result in an actual deposit of funds into the account, but rather serve as a record of pending transactions.

When a memo credit is applied to an account, it indicates that funds have been credited, but they have not yet been fully processed and made available for withdrawal or use. This is commonly seen in situations where businesses or financial institutions need to reconcile pending transactions or verify the availability of funds before completing the transaction.

Memo credits are typically used in banking systems and are particularly helpful in tracking and managing incoming funds. For example, when a customer deposits a check into their bank account, the bank may apply a memo credit to the account to reflect the pending funds. This allows the bank and the customer to have a record of the deposit and to monitor when the funds become fully available for withdrawal.

It is important to note that memo credits are temporary and can be reversed if the transaction is not completed or if there are insufficient funds to cover the credit. Once the transaction is processed and cleared, the memo credit is replaced with an actual deposit or transaction entry in the account.

In summary, memo credit is a temporary credit entry in an account that signifies the pending funds from a transaction. It provides a way for businesses, financial institutions, and individuals to track and manage incoming funds before they are fully processed.

How Memo Credits Work

Memo credits are a fundamental part of the financial transaction process, allowing businesses and financial institutions to effectively manage and track pending transactions. Understanding how memo credits work can provide valuable insights into the inner workings of the financial system.

When a memo credit is applied to an account, it serves as a temporary placeholder or notification of pending funds. This can occur in various scenarios, such as when a customer deposits a check, initiates a wire transfer, or receives a direct deposit. The memo credit represents the amount being credited to the account but does not immediately make the funds available for withdrawal or use.

Once the memo credit is applied, the accounting system records the pending transaction, reflecting an increase in the account balance. It is important to note that the funds represented by the memo credit are still in the process of being verified and processed. Therefore, they are considered as “on hold” or in a limbo state until the transaction is fully cleared.

During this period, the memo credit allows businesses and financial institutions to monitor and reconcile pending transactions without disrupting the customer’s access to their account. It provides them with visibility into the funds that are expected to be deposited, enabling more accurate financial planning and management.

Once the transaction is fully processed and cleared, the memo credit is replaced with an actual deposit or transaction entry in the account. At this point, the funds become available for withdrawal or use. In the case of insufficient funds to cover the credit, the memo credit may be reversed, resulting in a negative balance or a deduction from the account.

Memo credits can also be used in reverse scenarios, such as when a customer initiates a withdrawal or a payment is made from their account. In these situations, a memo debit may be applied to reflect the pending deduction from the account balance until the transaction is fully processed.

Overall, memo credits play a crucial role in the financial system by allowing businesses, financial institutions, and individuals to track and manage pending transactions. They provide a temporary record of pending funds and help ensure accurate accounting and financial management.

Uses of Memo Credit

Memo credit serves various purposes across different financial scenarios and industries. Its versatility makes it a valuable tool for businesses, financial institutions, and individuals alike. Let’s explore some of the key uses of memo credit.

- Banking and Deposit Transactions: When a customer deposits a check, initiates a wire transfer, or receives a direct deposit, memo credits are used to reflect the pending funds in their account. This allows the bank and the customer to track and monitor the incoming funds before they are fully processed. It provides a level of transparency and helps prevent any confusion regarding the availability of funds.

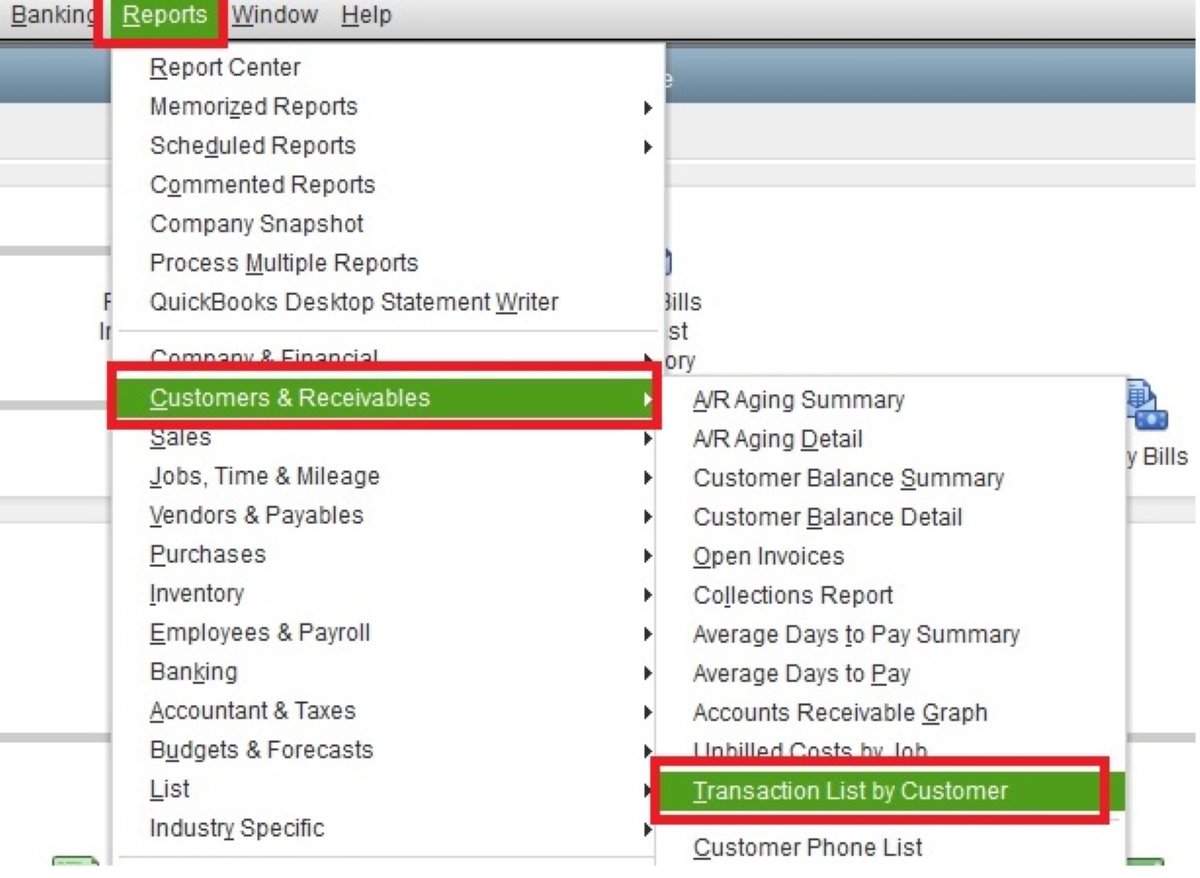

- Account Reconciliation: Memo credits are instrumental in reconciling accounts and verifying the accuracy of financial statements. Businesses and financial institutions utilize memo credits to record expected income, deposits, or pending transactions. By comparing the memo credit entries with the corresponding cleared transactions, they can identify any discrepancies and ensure accurate financial reporting.

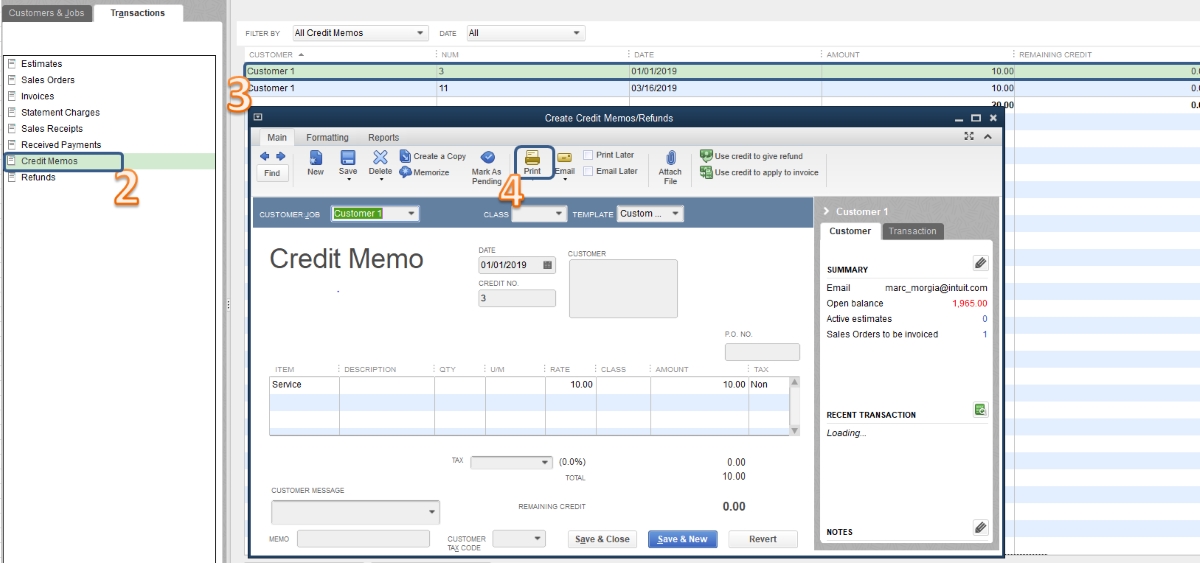

- Payment Processing: In certain situations, memo credits are used to facilitate payment processing. For example, when an individual makes a payment using a credit card, a memo credit may be applied to their account to reflect the pending deduction before the transaction is fully processed. This helps update the available credit limit and provides a real-time view of the account balance.

- Fund Transfers: When transferring funds between accounts or financial institutions, memo credits are crucial for tracking and managing the transaction. The memo credit serves as a temporary record of the funds being transferred, allowing both the sender and the recipient to monitor the progress of the transaction until it is completed.

- Merchant Transactions: Memo credits play a role in merchant transactions as well. In cases where a customer makes a purchase using a debit or credit card, a memo credit may be applied to the merchant’s account to represent the pending funds. This allows the merchant to have visibility into the expected payment and helps with inventory management and cash flow projections.

These are just a few examples of the many uses of memo credit in the financial realm. Its flexibility and functionality make it an essential tool for tracking, monitoring, and managing pending transactions in various scenarios.

Advantages of Memo Credit

Memo credit offers several advantages for businesses, financial institutions, and individuals alike. Let’s explore some of the key benefits:

- Transaction Visibility: Memo credit provides real-time visibility into pending transactions, allowing businesses and individuals to track the progress and status of their funds. This visibility helps prevent confusion and allows for more accurate financial planning and decision-making.

- Account Reconciliation: Memo credits are valuable for reconciling accounts and verifying the accuracy of financial statements. They provide a way to match pending transactions with corresponding cleared transactions, helping identify any discrepancies or errors in the accounting process.

- Improved Financial Planning: By having access to memo credits, businesses and individuals can better plan their financial activities. They can anticipate incoming funds and make informed decisions regarding budgeting, spending, and investment strategies.

- Reduced Risk of Overdrafts: Memo credits help mitigate the risk of overdrawing from an account. By providing a temporary record of pending funds, individuals and businesses can avoid spending money they do not have and prevent costly overdraft fees.

- Convenient Payment Processing: Memo credits streamline the payment processing experience. By applying a memo credit for pending transactions, individuals can see an updated account balance in real-time, allowing for better financial management.

- Enhanced Customer Service: Memo credits play a role in improving customer service. By providing customers with visibility into their pending transactions, financial institutions can offer better support and address any queries or concerns regarding fund availability.

Overall, memo credit offers numerous advantages, including transaction visibility, improved financial planning, reduced risk of overdrafts, and enhanced customer service. It is a valuable tool in the financial world, helping individuals and businesses better manage their funds and make informed financial decisions.

Disadvantages of Memo Credit

While memo credit serves various purposes and offers benefits, there are also some potential disadvantages to consider. It’s important to be aware of these drawbacks to make informed decisions regarding the use of memo credit. Let’s explore some of the key disadvantages:

- Temporary and Conditional: Memo credits are temporary and conditional, meaning that the funds represented by the memo credit are not immediately available for use or withdrawal. This can be frustrating for individuals who are expecting immediate access to the credited funds.

- Potential Reversal: Memo credits can be reversed if the transaction is not completed or if there are insufficient funds to cover the credit. This can lead to complications, especially if individuals have already made plans or commitments based on the assumption of the pending funds.

- Accounting Complexity: The use of memo credits can add complexity to financial accounting and reconciliation processes. Keeping track of pending transactions and ensuring accurate reporting requires attention to detail and the ability to match memo credits with cleared transactions.

- Potential for Confusion: Memo credits can sometimes cause confusion, particularly for individuals who are not familiar with the concept. The distinction between memo credits and actual deposits may be unclear, leading to misunderstandings or misinterpretation of available funds.

- Dependency on Financial Institution: The availability and processing of memo credits depend on the policies and procedures of the financial institution. Delays in processing or clearing transactions can result in extended periods of time where funds remain in a limbo state, potentially causing inconvenience or financial strain.

It’s important to be aware of these potential disadvantages of memo credit. While it can be a useful tool for tracking and managing pending transactions, individuals and businesses should carefully consider their specific circumstances and needs before relying on memo credits for financial planning and decision-making.

Key Considerations for Memo Credit Users

When utilizing memo credit in financial transactions, there are several important factors to keep in mind. By considering these key aspects, users can navigate the process more effectively and make informed decisions. Here are some key considerations for memo credit users:

- Understanding Memo Credit: It is essential to have a clear understanding of what memo credit is and how it works. Familiarize yourself with the concept, its limitations, and its implications for your financial transactions. This will help you make better-informed decisions and avoid any potential confusion or misunderstandings.

- Clearing Periods and Processing Times: Different financial institutions have varying clearing periods and processing times for transactions. Familiarize yourself with your institution’s policies to have a realistic expectation of when memo credits will be fully processed and funds will become available for use or withdrawal.

- Budgeting and Financial Planning: Use memo credits as a tool for better budgeting and financial planning. Take into account the pending transactions and use this information to make informed decisions regarding your spending and saving habits. Be mindful that memo credits are not guaranteed funds until they are fully processed and cleared.

- Monitoring Transactions: Keep a close eye on your account activity, especially when memo credits are involved. Regularly review your statements and track the progress of pending transactions. This will help you identify any discrepancies, reconcile your accounts, and address any issues promptly.

- Communication with Financial Institutions: If you have any questions or concerns regarding memo credits, don’t hesitate to reach out to your financial institution. Their customer service representatives can provide clarification, offer guidance, and assist with any issues or discrepancies that may arise during the process.

- Backup Funding Options: Consider maintaining alternative funding options or emergency funds to mitigate any potential risks associated with memo credits. This can help provide a financial safety net in case of any delays, reversals, or complications in the processing of your pending transactions.

By keeping these key considerations in mind, memo credit users can navigate the process more effectively and harness the benefits of memo credit while mitigating any associated risks or challenges.

Conclusion

Memo credit plays a crucial role in the world of finance, offering a temporary record of pending transactions and providing visibility into the status of funds. While memo credits have their advantages and disadvantages, they are a valuable tool for businesses, financial institutions, and individuals.

Understanding the definition and workings of memo credit is essential in navigating the financial landscape. Memo credit serves as a temporary placeholder, reflecting pending funds that have not yet been fully processed. It aids in account reconciliation, financial planning, and payment processing.

When utilizing memo credit, it is important to consider key factors such as understanding the concept, being aware of clearing periods and processing times, and monitoring transactions closely. Effective communication with financial institutions and maintaining backup funding options can help mitigate potential risks and ensure smoother financial transactions.

In conclusion, memo credit provides a convenient means of managing pending transactions, improving financial planning, and enhancing transparency. By being knowledgeable about memo credit and considering the relevant factors, individuals and businesses can effectively utilize this tool and make informed financial decisions.