Home>Finance>When Does A Life Insurance Contract Become Effective?

Finance

When Does A Life Insurance Contract Become Effective?

Modified: February 21, 2024

Learn about the effective date of life insurance contracts and how they impact your finances. Understand when your coverage begins and plan accordingly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Life Insurance Contracts

- Contractual Effective Date Explained

- Factors Affecting the Effective Date of a Life Insurance Contract

- Application Date vs Policy Effective Date

- Graded Death Benefit Period

- Waiting Period for Certain Conditions

- Policy Delivery and Acceptance

- Grace Period and Retroactive Coverage

- Exceptions and Special Circumstances

- Conclusion

Introduction

Life insurance is a financial tool that provides protection and peace of mind for individuals and their loved ones. When considering purchasing a life insurance policy, it is crucial to understand when the contract becomes effective. The effective date plays a significant role in determining when the coverage begins and what events are covered under the policy.

In this article, we will explore the ins and outs of life insurance contracts and delve into the factors that affect their effective date. We will discuss the difference between the application date and the policy effective date, as well as explore special circumstances that may impact the policy’s effectiveness. By understanding these concepts, you will be better informed when choosing a life insurance policy that best fits your needs.

Life insurance contracts are legal agreements between the policyholder and the insurance company. A life insurance policy provides a death benefit to the policyholder’s beneficiaries upon the insured’s death. However, the effective date determines when the policyholder’s coverage begins and the scope of the coverage provided.

The effective date is the point in time when the life insurance contract becomes legally enforceable, and the insurer assumes the risk associated with providing coverage. It is essential to establish this date to ensure clarity and avoid any disputes or confusion regarding the policy’s activation.

Several factors influence the effective date of a life insurance contract. These factors include the completion of the application process, any applicable waiting periods, the delivery and acceptance of the policy, and any special circumstances outlined in the contract.

Understanding the nuances of the contract’s effective date is crucial for policyholders. It delineates when their coverage begins and when they are eligible to claim the death benefit in the event of the insured’s passing. By comprehending these factors, policyholders can make informed decisions regarding their life insurance coverage and ensure that their loved ones are protected financially.

Understanding Life Insurance Contracts

Life insurance contracts are legal agreements between the policyholder and the insurance company, outlining the terms and conditions of the coverage. These contracts provide financial protection for the policyholder’s beneficiaries in the event of their death. Understanding the key components of a life insurance contract is essential to make an informed decision and ensure that the coverage meets your needs.

Life insurance contracts typically include details such as the policyholder’s personal information, premium amount and payment frequency, death benefit amount, policy term, and any additional riders or endorsements. It is crucial to carefully review and understand these components before entering into a life insurance contract.

The contract also includes provisions that define the rights and responsibilities of both the policyholder and the insurance company. These provisions typically cover topics such as premium payments, policy cancellation or surrender, beneficiary designations, and policy renewal or conversion options. Understanding these provisions is essential to ensure that you are aware of your obligations and rights as a policyholder.

Life insurance contracts also specify the exclusions and limitations of coverage. These are situations or circumstances in which the insurance company may deny a claim or reduce the death benefit. Common exclusions can include death resulting from suicide within a specified period after the policy’s effective date, death due to participating in hazardous activities, or death resulting from war or acts of terrorism.

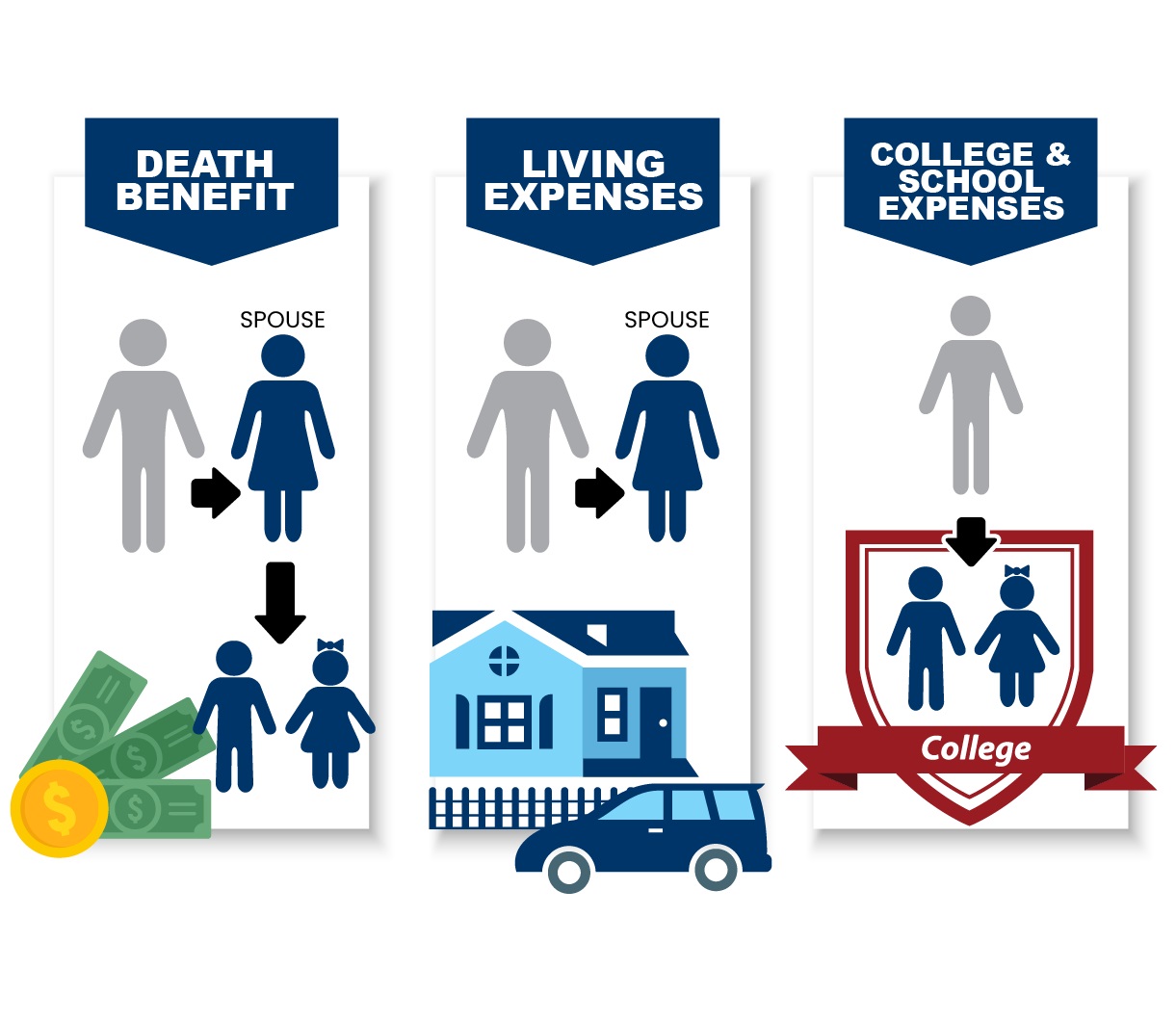

In addition to the contract provisions, it is essential to understand the different types of life insurance policies. The two main categories are term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and pays a death benefit if the policyholder passes away during the term. Permanent life insurance, on the other hand, provides coverage for the entire lifetime of the insured and includes a cash value component that builds over time.

Understanding the components and provisions of a life insurance contract is crucial for both the policyholder and their beneficiaries. It ensures that the coverage meets the policyholder’s needs and financial goals, and provides clarity on the terms and conditions to avoid any potential issues during the claims process. Before signing a life insurance contract, it is advisable to consult with a financial advisor or insurance professional who can help guide you through the process and answer any questions you may have.

Contractual Effective Date Explained

The contractual effective date of a life insurance policy is the date specified in the contract when the coverage officially begins. It is crucial to understand the contractual effective date as it determines when the policyholder’s coverage and benefits commence. This date is typically agreed upon and stated in the policy documents, and it is essential to adhere to the terms to ensure the policy’s enforceability.

The contractual effective date is significant because it establishes the starting point for the policyholder’s insurance coverage. It is the date from which the policyholder becomes eligible to receive the death benefit if the insured were to pass away. While the effective date may differ depending on the insurance company and policy type, it is generally set either on the date the application is approved or the date the first premium payment is made.

The effectiveness of the policy from its contractual effective date is crucial because it determines the coverage for specific events. For example, if the insured were to pass away due to an accident or illness that occurred after the effective date, the beneficiaries would typically be eligible to receive the death benefit. However, if the insured were to pass away before the effective date, the policy would not provide coverage, and the beneficiaries would not be entitled to the death benefit.

It is important to note that the contractual effective date does not necessarily coincide with the date the insurance company issues and delivers the policy documents to the policyholder. The effective date is established when both parties agree to the terms and conditions and is usually a separate date from the policy delivery. Therefore, even if there is a delay in the policy’s physical delivery, as long as the contractual effective date has been reached, the coverage is considered in force.

To ensure clarity and avoid any misunderstandings, it is crucial for both the policyholder and the insurance company to clearly state and agree upon the contractual effective date. This date should be documented in the policy and communicated to the policyholder to set expectations for coverage and benefits. It is advisable for policyholders to review their policy documents thoroughly and seek clarification from their insurance agent or company if they have any questions or concerns regarding the contractual effective date.

Understanding the significance of the contractual effective date is fundamental to obtaining the intended protection from a life insurance policy. By knowing when the coverage begins, policyholders can make informed decisions regarding their insurance needs and ensure that their loved ones are financially protected in the event of their passing.

Factors Affecting the Effective Date of a Life Insurance Contract

The effective date of a life insurance contract is influenced by various factors that determine when the coverage begins. It is crucial to understand these factors as they play a significant role in determining the start of the policy’s enforceability and the eligibility for benefits. Here are some key factors that affect the effective date of a life insurance contract:

- Application Process: The effective date can be influenced by the time it takes to complete the application process. This includes submitting the application, providing the necessary documentation, and undergoing any required medical exams or underwriting procedures. The effective date is typically set once the insurance company approves the application and the policyholder meets all the requirements.

- Payment of Premium: The effective date may also depend on when the policyholder makes the first premium payment. In some cases, the policy may become effective upon receipt of the premium payment or the initiation of automatic premium deductions from the policyholder’s bank account.

- Underwriting and Approval: If the insurance company requires underwriting, which involves assessing the applicant’s health and risk factors, the effective date may be determined after the underwriting process is completed and the policy is approved by the insurer.

- Policy Delivery and Acceptance: The effective date may be contingent upon the policyholder’s acceptance of the policy. Once the insurance company issues and delivers the policy documents to the policyholder, they are typically given a certain period to review the policy and accept its terms. The effective date is usually set upon the policyholder’s acceptance.

- Graded Death Benefit Period: Some life insurance policies have a graded death benefit period, especially for policies with significant health risks or older applicants. This means that the full death benefit may not be paid out immediately upon the policy’s effective date. Instead, the policy may have a waiting period during which a reduced death benefit is provided. The full death benefit is typically paid out after the graded period expires.

- Waiting Period for Certain Conditions: Certain conditions, such as pre-existing medical conditions or high-risk activities, may require a waiting period before coverage for those specific conditions becomes effective. The waiting period is often outlined in the policy and must be satisfied before the coverage is fully in force.

Understanding these factors is vital to grasp when the life insurance policy becomes effective and when its benefits can be claimed. Policyholders should carefully review their policy documents and seek clarification from their insurance agent or company regarding the specific factors that may impact the effective date. By being aware of these factors, policyholders can ensure that their coverage begins when expected and that they and their beneficiaries receive the intended protection and benefits from the life insurance policy.

Application Date vs Policy Effective Date

When applying for a life insurance policy, it is essential to understand the difference between the application date and the policy effective date. These two dates play distinct roles in the life insurance process and can impact the timing of coverage and benefits for the policyholder. Let’s explore the differences between the application date and the policy effective date:

The application date is the day on which the policyholder completes and submits the application for life insurance coverage. It is the starting point of the underwriting process, where the insurance company assesses the applicant’s risk profile and determines their eligibility for coverage. The application date is crucial as it initiates the evaluation of the policyholder’s health history, lifestyle habits, and other factors that may affect the insurance company’s decision to approve or decline the application.

On the other hand, the policy effective date is the date when the life insurance policy officially comes into force, and the coverage begins. It is the point from which the policyholder becomes eligible for the death benefit and other benefits specified in the policy. The policy effective date is determined by the insurance company based on various factors, including the completion of the underwriting process, payment of the first premium, and the policyholder’s acceptance of the policy terms.

It is important to note that the policy effective date may not necessarily coincide with the application date. Depending on the insurance company’s processes and the time it takes to complete the underwriting requirements, there may be a delay between the application date and the policy effective date. Therefore, it is crucial for policyholders to review their policy documents carefully and understand the timeframe within which the coverage will become effective.

During this period between the application date and the policy effective date, it is important for applicants to maintain their insurability by refraining from engaging in hazardous activities or developing any adverse health conditions. Any changes in health or lifestyle habits that occur during this time may affect the underwriting decision and, in turn, the policy effective date.

Understanding the distinction between the application date and the policy effective date can help policyholders manage their expectations regarding coverage and benefits. It is important to work closely with the insurance company and provide all requested information promptly to expedite the underwriting process. By doing so, policyholders can ensure a smooth transition from the application date to the policy effective date and secure the desired life insurance coverage in a timely manner.

Graded Death Benefit Period

In certain cases, a life insurance policy may include a graded death benefit period. This provision is commonly found in policies that cover individuals with higher health risks or older applicants. The graded death benefit period is a specific timeframe during which the full death benefit is not payable immediately upon the policy’s effective date. Instead, the policy provides a reduced death benefit during this period, and the full death benefit becomes payable after the graded period expires.

The purpose of implementing a graded death benefit period is to mitigate the risks associated with insuring individuals who may have pre-existing health conditions or higher mortality rates. During the graded period, the insurance company assesses the policyholder’s health status and gathers additional information to determine the level of risk they present.

Typically, the graded death benefit period is structured in years, ranging from one to three years, although the specific duration may vary depending on the policy. For example, in the first year of the graded period, the death benefit may be limited to a percentage of the full benefit, such as 25% or 50%. The percentage increases gradually each year until the full death benefit becomes payable at the end of the graded period.

It is important to note that during the graded death benefit period, if the insured were to pass away, the beneficiaries would only receive the reduced death benefit amount as specified in the policy. The reduced benefit amount may be based on factors such as the cause of death, with some policies excluding certain types of deaths from payout during the graded period, such as suicides.

The purpose of the graded death benefit period is to protect the insurance company from adverse selection, which is the phenomenon where high-risk individuals are more likely to apply for coverage. By providing a graded death benefit, the insurance company can accurately assess the policyholder’s risk profile and adjust the payout accordingly to manage their financial exposure.

It is crucial for policyholders to understand the presence of a graded death benefit period in their policy and the specific terms and conditions outlined within. It is advisable to review the policy documents carefully and ask for clarification from the insurance company or agent if any doubts arise.

Once the graded period expires, the policyholder becomes eligible for the full death benefit if the insured were to pass away. The expiration of the graded death benefit period signifies the policyholder’s successful completion of the higher-risk period and the insurance company’s assumption of the full coverage and benefits as specified in the policy.

Overall, the graded death benefit period plays a significant role in providing coverage for individuals who may present higher health risks. By understanding this provision and its impact on the death benefit, policyholders can make informed decisions when selecting a life insurance policy and ensure that their coverage aligns with their financial needs and goals.

Waiting Period for Certain Conditions

In some life insurance policies, there may be a waiting period for certain conditions before the coverage becomes effective. A waiting period is a specific timeframe that policyholders must adhere to before coverage is provided for particular circumstances. This provision is commonly included to mitigate the risk of insuring individuals with pre-existing health conditions or engaging in high-risk activities.

During the waiting period, the policyholder is still covered by the policy, but there may be limitations or exclusions for certain conditions or events. It is crucial for policyholders to understand the terms and conditions regarding the waiting period in their policy, as it can vary depending on the insurance company and the specific policy terms.

The waiting period is established to ensure that policyholders are not taking advantage of the policy by purchasing coverage after developing a known medical condition or after engaging in hazardous activities. It allows the insurance company to assess the policyholder’s level of risk and determine the appropriate premium and coverage based on their health status and lifestyle habits.

Common examples of conditions that may have a waiting period include pre-existing medical conditions, such as heart disease, cancer, or diabetes, or other high-risk conditions. The waiting period typically ranges from several months to a few years, depending on the policy. During this time, if the policyholder were to pass away due to the specified condition, the death benefit may be limited or excluded altogether.

It’s important to note that not all life insurance policies have a waiting period for certain conditions. Policies without waiting periods may be more expensive or have stringent underwriting requirements to account for the potential risks. Therefore, understanding the policy terms and provisions is crucial in determining whether a waiting period exists and how it may impact the coverage and benefits.

It is advisable for policyholders to disclose any pre-existing conditions or high-risk activities during the application process to ensure that all relevant information is considered by the insurance company. Failure to disclose such information can lead to policy rescission or denial of a claim.

Once the waiting period has passed, the policyholder becomes eligible for full coverage and benefits for all conditions specified in the policy. It is important to review the policy documents carefully and consult with the insurance company or agent to understand when the waiting period expires and to seek clarification on any questions or concerns regarding coverage during this period.

By understanding the waiting period for certain conditions, policyholders can make informed decisions regarding their life insurance coverage and ensure that they are aware of any limitations or exclusions that may apply. It is essential to carefully review the policy documents and work closely with the insurance company to fully understand the waiting period’s implications and the coverage it provides during this time.

Policy Delivery and Acceptance

Once a life insurance policy has been approved and issued by the insurance company, it is typically delivered to the policyholder for review and acceptance. The policy delivery and acceptance process is a critical step in finalizing the insurance coverage and establishing the policy’s effective date.

Policy delivery refers to the insurance company issuing and physically delivering the policy documents to the policyholder. This can be done through various methods, including mail, email, or online portals. Upon receiving the policy, it is important for the policyholder to carefully review the documents to ensure accuracy and understanding of the coverage and terms.

During the review process, the policyholder should pay close attention to important details such as the policy effective date, premium payment frequency and amount, death benefit amount, policy duration, and any additional riders or endorsements included. It is essential to ensure that the policy matches the original terms agreed upon during the application process.

After reviewing the policy, the policyholder is required to accept and acknowledge its terms and conditions. Policy acceptance can be done by signing and returning a physical acceptance form or electronically accepting the policy through an online platform provided by the insurance company. Acceptance of the policy indicates the policyholder’s agreement to the terms and signifies their intent to move forward with the coverage as outlined in the policy.

It is important to note that the effective date of the policy may not necessarily align with the date the policy is physically delivered or accepted. The effective date is typically set based on the terms specified in the policy or upon completion of certain requirements, such as payment of the first premium or completion of any necessary underwriting processes. Policyholders should refer to their policy documents to determine the specific effective date of their coverage.

In some cases, the policy may include a grace period that allows the policyholder additional time to review the policy and make a decision. During the grace period, the policy remains in force, and coverage is provided even if the acceptance process is not completed within the designated time frame. However, it is advisable to promptly review and accept the policy to ensure that coverage begins as intended.

It is crucial for policyholders to keep copies of all signed documents, including the acceptance form, for their records. This can be helpful in case of any future disputes or to provide documentation if the insurance company requests it.

By carefully reviewing and accepting the policy, policyholders can ensure that they are fully aware of their coverage and understand their rights and responsibilities as outlined in the contract. It is recommended to consult with an insurance professional or representative if there are any questions or concerns regarding the policy terms or the acceptance process.

Understanding the policy delivery and acceptance process is crucial for policyholders to ensure that their coverage begins as intended and that they have the necessary documentation to support their insurance claims. By reviewing the policy and accepting it promptly, policyholders can have peace of mind knowing their insurance coverage is in effect and that their loved ones are protected financially.

Grace Period and Retroactive Coverage

A grace period is a specified time frame in a life insurance policy that allows the policyholder additional time to make premium payments without the risk of coverage lapsing. This provision is designed to provide a safety net for policyholders who may have difficulties making timely premium payments. Understanding the grace period is essential for policyholders to maintain continuous coverage and avoid any potential gaps in protection.

The grace period typically ranges from 30 to 60 days after the premium due date. During this period, the policy remains in force, and coverage continues to be provided, even if the premium payment is not received by the due date. This allows policyholders some flexibility in making their premium payments without immediate consequences.

It is important to note that the grace period does not extend the policy’s effective date. The policy begins on the policy’s effective date stated in the contract and remains active as long as the premium payments are made within the grace period. Missing the premium payment within the grace period may result in the policy lapsing, and the coverage being terminated.

In some cases, if the premium payment is not made within the grace period, the policyholder has the option to reinstate the policy. Reinstatement involves paying the overdue premium along with any applicable fees or interest. The insurance company may also require the policyholder to provide evidence of insurability to ensure that there have been no changes in health or other factors that might impact the policy’s coverage.

Retroactive coverage refers to the provision of coverage for a specified period before the policy’s effective date. This provision is typically found in group life insurance policies offered by employers. When a policyholder is newly eligible for group insurance, there may be a retroactive coverage provision that provides coverage for a period of time before the policy’s effective date. This ensures that the policyholder is protected for any relevant events or incidents during that retroactive period.

It is important to read the policy documents carefully to determine if there is a retroactive coverage provision and the specific terms and conditions associated with it. The retroactive coverage period may vary depending on the policy and can range from a few days to several months.

Understanding the duration and conditions of the retroactive coverage is crucial. Policyholders should ensure they meet any requirements, such as being actively at work or completing a waiting period, to qualify for retroactive coverage during that period. It is also important to note that retroactive coverage typically does not apply to pre-existing medical conditions or events that occurred before the retroactive period.

By being aware of the grace period and retroactive coverage provisions in a life insurance policy, policyholders can ensure that they maintain continuous coverage and understand the parameters of their policy in the event of missed premium payments or eligibility for retroactive coverage. It is essential to consult with the insurance company or agent if there are any questions or concerns regarding these provisions to ensure clarity and peace of mind regarding the policy’s terms and coverage.

Exceptions and Special Circumstances

While life insurance contracts generally follow standard guidelines and provisions, there can be exceptions and special circumstances that may impact the effective date, coverage, or benefits. It is important for policyholders to be aware of these exceptions and special circumstances to ensure that they fully understand their policy and the situations that may affect their coverage. Let’s explore some common exceptions and special circumstances in life insurance:

- Missed Premium Payments: If a policyholder fails to make a premium payment within the grace period, the policy may lapse, resulting in a loss of coverage. It is crucial to promptly make premium payments to maintain continuous coverage and avoid any interruption in benefits.

- Policy Loans: Some types of permanent life insurance policies, such as whole life or universal life, may offer the option to borrow against the policy’s cash value. However, taking a policy loan can have implications on the coverage and death benefit, depending on the terms of the policy. It is essential to understand the impact of policy loans on the policy and consult with the insurance company or an advisor before taking such action.

- Policy Riders and Endorsements: Policyholders may have the option to add riders or endorsements to their life insurance policy, which provide additional coverage for specific events or circumstances. It is important to review the terms and conditions of these riders carefully, as they may have their own exceptions or limitations. Examples of riders include disability income riders, accelerated death benefit riders, or accidental death benefit riders.

- Travel or Residency Restrictions: Some life insurance policies may have limitations or exclusions related to travel or residency. Policyholders who plan to travel or reside in certain high-risk areas may need to disclose this information and ensure that it does not affect their coverage.

- Occupational Hazard Exclusions: Certain occupations or hobbies that involve higher risks, such as aircraft piloting, deep-sea diving, or professional sports, may be excluded or limited in coverage. Policyholders engaged in such occupations or activities should disclose this information and be aware of any implications on their coverage.

- Term Conversion Options: For term life insurance policies, there may be a provision that allows policyholders to convert the policy into a permanent life insurance policy without undergoing additional underwriting. This option usually has a specified timeframe within which it is available, and it is important to be aware of the conversion window to take advantage of this option if desired.

These are just a few examples of exceptions and special circumstances that may exist in life insurance policies. It is crucial for policyholders to carefully read the policy documents, ask questions, and seek clarification from the insurance company or agent regarding any exceptions or special circumstances that may apply to their specific policy. By understanding these exceptions and special circumstances, policyholders can ensure that they have a comprehensive understanding of their coverage and can make informed decisions regarding their life insurance needs.

Conclusion

Understanding the effective date and various factors that influence a life insurance contract is essential for policyholders. The effective date determines when the coverage begins and when the policyholder becomes eligible for the death benefit and other policy benefits. By grasping the nuances of the contractual effective date, policyholders can ensure that their coverage aligns with their financial objectives and that their loved ones are protected financially.

Throughout this article, we have explored the key components of life insurance contracts, including the application date, policy effective date, grace period, and waiting periods. We have also discussed exceptional circumstances such as graded death benefit periods, retroactive coverage, and exceptions that may impact the coverage and benefits of the policy.

Policyholders are encouraged to thoroughly review their policy documents and consult with an insurance professional or agent to fully understand the terms and provisions of their life insurance contract. By doing so, policyholders can make informed decisions, ensure accurate premium payments, and maintain continuous coverage to protect their loved ones in times of need.

Life insurance provides financial security and peace of mind by safeguarding the future of policyholders and their families. It serves as a crucial tool to provide financial protection, cover liabilities, and ensure the well-being of beneficiaries.

Remember to keep track of premium payment due dates, review your policy regularly, and inform your insurance company of any changes in your circumstances that may affect your coverage. By staying proactive and informed, you can make the most out of your life insurance policy and ensure that it meets your evolving needs over time.

In conclusion, comprehending the effective date, contractual terms, and special circumstances of a life insurance contract is crucial for policyholders. This knowledge empowers individuals to make informed decisions, effectively manage their coverage, and provide financial security for their loved ones. By understanding the provisions and implications of their life insurance policy, policyholders can navigate the complexities and obtain the intended benefits that will protect their financial well-being for years to come.