Home>Finance>When Does A Life Insurance Contract Become Effective If The Initial Premium Is Not Collected?

Finance

When Does A Life Insurance Contract Become Effective If The Initial Premium Is Not Collected?

Published: October 16, 2023

Find out when a life insurance contract becomes effective in finance, even if the initial premium is not collected. Discover the key details here.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on life insurance contracts and the important aspect of when they become effective. Life insurance is an essential financial tool that provides financial protection for loved ones in the event of the policyholder’s death. Understanding the key components of a life insurance contract is crucial for individuals seeking to secure their family’s financial future.

In this article, we will delve into the intricacies of life insurance contracts and specifically focus on when a life insurance contract becomes effective if the initial premium is not collected. We will explore the initial premium collection process, scenarios where the initial premium is not collected, consequences of non-payment, and alternative options for premium payment.

Whether you are considering purchasing a life insurance policy or simply curious about the workings of life insurance contracts, this guide will provide you with valuable insights and knowledge.

So, let’s begin our journey into the world of life insurance contracts and the important matter of when they become effective.

Understanding Life Insurance Contracts

Before we delve into the specific topic of when a life insurance contract becomes effective, let’s first gain a clear understanding of what a life insurance contract entails.

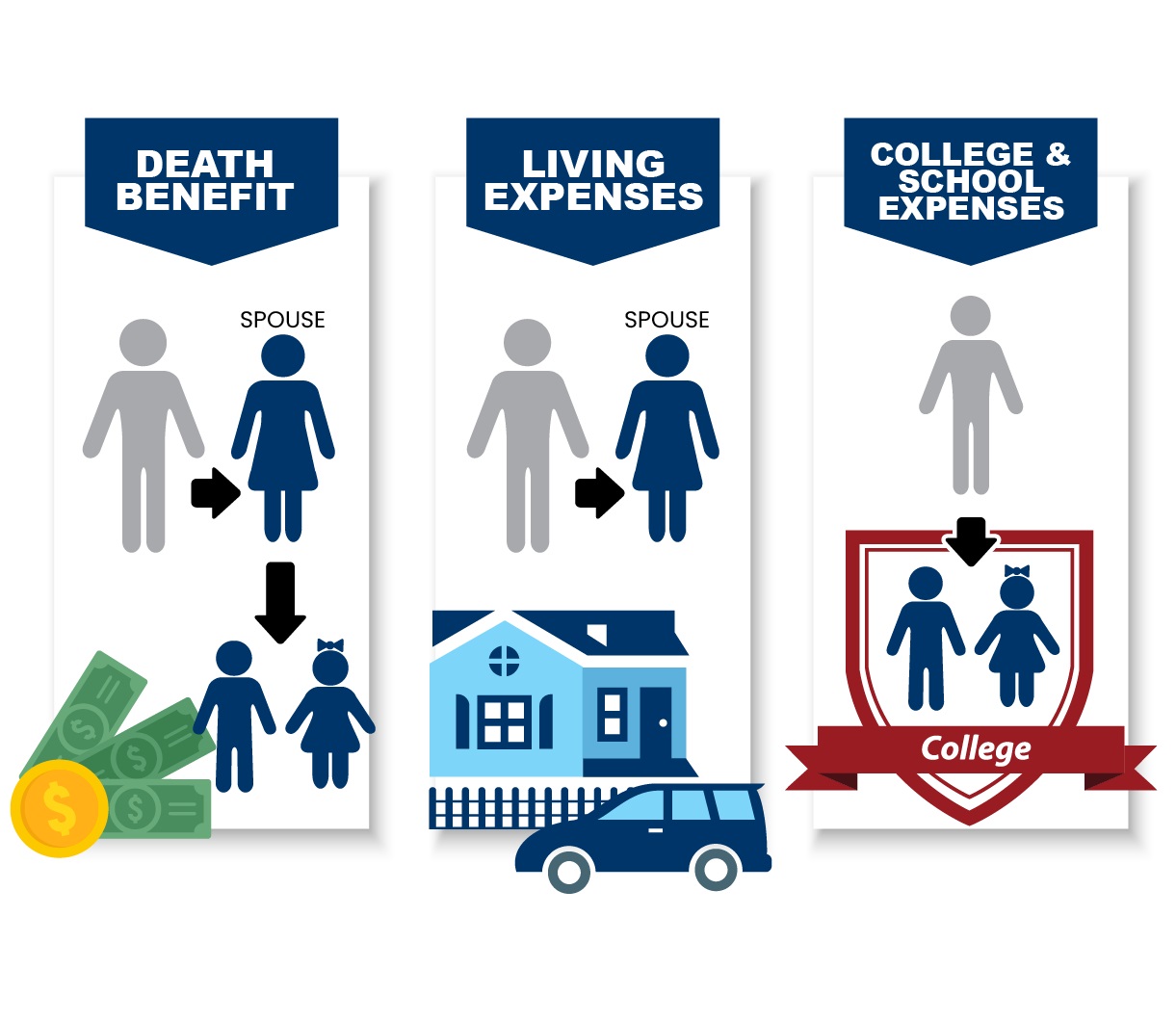

A life insurance contract is a legal agreement between an individual (the policyholder) and an insurance company. The purpose of this contract is to provide a predetermined death benefit to the designated beneficiaries upon the policyholder’s death in exchange for the payment of premiums.

Life insurance contracts offer different types of policies, such as term life insurance and whole life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. Whole life insurance, on the other hand, offers coverage for the entirety of the policyholder’s life.

Life insurance contracts also contain various components, including the policy terms, premium amount and frequency, death benefit amount, policy exclusions, and any optional riders or additional coverage.

Understanding these components is vital for policyholders to make informed decisions when acquiring life insurance coverage. It is crucial to carefully review the contract’s terms and conditions, as well as any limitations or exclusions that may apply.

Now that we have a solid understanding of life insurance contracts, let’s explore the specific circumstances under which a life insurance policy becomes effective if the initial premium is not collected.

When Does a Life Insurance Contract Become Effective?

A life insurance contract becomes effective once all necessary requirements are fulfilled, including the payment of the initial premium. The initial premium is the first payment made by the policyholder to the insurance company to initiate the policy.

Typically, the insurance contract specifies that coverage will begin once the initial premium is received and processed by the insurance company. This is a standard practice in the life insurance industry and ensures that the policyholder has actively demonstrated their commitment to the policy.

In most cases, the initial premium is required to be paid at the time of application or shortly thereafter. This payment serves as a confirmation of the policyholder’s intention to secure coverage and willingness to fulfill their financial obligations under the contract.

Once the insurance company receives and confirms the payment of the initial premium, the policyholder will receive a policy document outlining the coverage details and terms. At this point, the life insurance contract becomes fully effective, and the policyholder is entitled to the benefits and protections outlined in the policy.

It is important to note that without the payment of the initial premium, the life insurance contract does not become effective. The insurance company has no obligation to provide coverage or process any claims until the premium is collected.

However, there are some scenarios where the initial premium may not be collected immediately, which we will explore in the following section.

The Initial Premium Collection Process

The initial premium collection process is a crucial step in establishing a life insurance contract. It involves the payment of the first premium by the policyholder to the insurance company, signifying their intent to secure coverage.

Typically, the initial premium is due at the time of application or shortly thereafter. The policyholder can choose to pay the initial premium in various ways, including a lump sum payment or through installment payments, depending on the policy terms and the insurance company’s policy.

The insurance company will provide the policyholder with instructions on how to make the premium payment. This can be done through various methods, such as online payment portals, bank transfers, or by mailing a check or money order to the designated address.

Once the initial premium payment is made, the insurance company will process the payment and validate it against the policyholder’s application. This includes confirming the accuracy of the payment amount, verifying the policyholder’s identity, and cross-referencing the payment with the policy details.

If any discrepancies or issues arise during the payment processing, the insurance company will contact the policyholder to resolve them. It is essential for the policyholder to provide accurate and up-to-date information during the application process to ensure a smooth premium collection process.

Upon successful verification and processing of the initial premium, the insurance company will generate a receipt or confirmation of payment. This serves as proof that the initial premium has been collected and aids in tracking the policyholder’s payment history.

Once the payment is confirmed, the insurance company will proceed to activate the life insurance contract, and the policyholder will receive the policy documents outlining the coverage details and contractual terms.

It is important for policyholders to keep a copy of the payment receipt and all correspondence related to the initial premium collection. This documentation can be useful for reference purposes and in case of any disputes or inquiries regarding premium payments.

Now that we understand the initial premium collection process, let’s explore some scenarios where the initial premium is not collected.

Scenarios Where Initial Premium is Not Collected

While it is typically expected for the initial premium to be collected at the time of application or shortly thereafter, there are certain situations where the initial premium may not be collected immediately. Here are a few common scenarios:

- Underwriting review: After submitting the application, the insurance company may need additional time to review the policyholder’s application and assess their risk profile. In such cases, the initial premium collection may be delayed until the underwriting process is complete.

- Pending policyholder requirements: Sometimes, the insurance company may request additional information or documentation from the policyholder before finalizing the policy. This could include medical reports, financial statements, or other relevant documents. In such cases, the initial premium collection may be put on hold until all requirements are fulfilled.

- Policyholder request: In certain situations, the policyholder may request a delayed payment of the initial premium due to personal circumstances. This could be due to financial constraints or other factors. The insurance company may allow for a grace period or a specific timeframe within which the initial premium must be paid.

- Conditional coverage: In certain cases, the insurance company may provide conditional coverage without the initial premium being collected. This is usually done when there is a time-sensitive need for coverage, such as during the application process for a mortgage. However, the finalization of the policy and the activation of the coverage will still be contingent upon the payment of the initial premium.

- Premium financing: In some instances, the policyholder may opt for premium financing, where a third-party lender pays the initial premium on their behalf. The policyholder then repays the lender over time. In this scenario, the initial premium is not directly collected by the insurance company, but by the lender.

It is important to note that the specific policies and practices regarding the collection of the initial premium may vary between insurance companies. It is advisable for policyholders to clarify any doubts or questions about the initial premium collection process with their insurance company or insurance agent.

Now that we are familiar with scenarios where the initial premium is not collected immediately, let’s explore the consequences of not collecting the initial premium in a timely manner.

Consequences of Not Collecting the Initial Premium

Not collecting the initial premium within the specified timeframe can have several consequences for both the policyholder and the insurance company. Here are some potential outcomes:

- Lack of coverage: The most significant consequence of not collecting the initial premium is that the life insurance contract will not become effective. Without the payment of the initial premium, the insurance company has no obligation to provide coverage or process any claims. This leaves the policyholder and their beneficiaries exposed to financial risk in the event of the policyholder’s death.

- Cancellation of the application: In many cases, if the initial premium is not collected within the specified timeframe, the insurance company may cancel the policyholder’s application. This means that the policyholder will need to reapply for coverage if they still wish to obtain a life insurance policy. This can result in delays and potential changes in premium rates or policy terms.

- Loss of favorable rates: If there was an initial premium quote provided to the policyholder based on their current age, health, and other factors, not collecting the initial premium in a timely manner could result in an increase in premium rates. This is because the policyholder’s circumstances may have changed during the delay, and the insurance company may need to reassess the risk factors.

- Missed coverage opportunity: In certain situations, the policyholder may have had a specific need for life insurance coverage within a certain timeframe. Failure to collect the initial premium within that timeframe can result in a missed opportunity to secure the desired coverage. This can be particularly concerning if the policyholder’s health or circumstances deteriorate, making it more difficult to obtain affordable coverage in the future.

- Negative impact on insurability: Delaying or not collecting the initial premium can also have a negative impact on the policyholder’s insurability. Any delays or complications in the initial premium payment process may raise red flags for other insurance companies in the future, potentially resulting in higher premiums or difficulty in obtaining coverage from other insurers.

It is crucial for policyholders to understand the importance of timely premium payment to ensure the activation of their life insurance policy and the availability of coverage in the event of their death. Clear communication with the insurance company and adhering to the specified payment timelines can help mitigate the risk of facing these consequences.

Now, let’s explore alternative options available for premium payment in the event that the initial premium cannot be paid immediately.

Alternative Options for Premium Payment

In cases where the payment of the initial premium cannot be made immediately, there are alternative options available for policyholders to consider. These options may provide flexibility in premium payment and ensure that the life insurance policy remains effective.

Grace Period: Some insurance companies offer a grace period, which is a specified timeframe after the due date of the initial premium. During this period, the policyholder can still make the payment without any negative consequences or lapse in coverage. It is important to note that the grace period varies between insurance companies, so it is crucial to check the policy terms and conditions.

Premium Financing: Policyholders who are facing financial constraints but still wish to obtain coverage can explore premium financing options. With premium financing, a third-party lender pays the initial premium on behalf of the policyholder. The policyholder then repays the lender over time, usually with interest. This allows the policyholder to spread out the cost of the premium payment while maintaining the life insurance coverage.

Payment Plans: In certain situations, the insurance company may offer flexible payment plans to accommodate the policyholder’s financial situation. This can include monthly or quarterly premium payments instead of a lump sum payment. It is important to discuss payment plan options with the insurance company or insurance agent to determine the feasibility and suitability for the specific policy.

Policy Amendments: In some cases, the policyholder may request changes to the policy terms to accommodate their financial situation. This could involve adjusting the premium amount, changing the premium payment frequency, or modifying the death benefit amount. However, it is important to understand that any amendments to the policy will be subject to the approval of the insurance company.

Policy Replacement or Conversion: If the policyholder is unable to pay the initial premium on their existing policy, they may explore options for policy replacement or conversion. This involves terminating the current policy and acquiring a new policy with modified terms or converting the existing policy into a different type of policy, such as converting a term life insurance policy into a permanent life insurance policy.

It is important for policyholders to communicate openly with their insurance company or insurance agent about their financial situation and explore the available options for premium payment. This can help identify the best solution to ensure the continuity of life insurance coverage.

Now that we have discussed alternative options for premium payment, let’s conclude our discussion on when a life insurance contract becomes effective.

Conclusion

Understanding when a life insurance contract becomes effective is crucial for individuals seeking financial protection for their loved ones. The initial premium payment plays a key role in activating the policy and ensuring coverage. While the typical practice is to collect the initial premium at the time of application or shortly thereafter, there are scenarios where it may be delayed due to underwriting, pending requirements, or policyholder requests.

However, it is important to note that without the payment of the initial premium, the life insurance contract does not become effective, leaving the policyholder and their beneficiaries exposed to financial risk. Not collecting the initial premium in a timely manner can result in the cancellation of the policy application, loss of coverage, and potential negative implications for insurability.

Fortunately, there are alternative options available for policyholders facing challenges in making the initial premium payment. Grace periods, premium financing, payment plans, and policy amendments can provide flexibility and ensure the continuity of coverage.

If you find yourself unable to pay the initial premium immediately, it is crucial to communicate openly with your insurance company or insurance agent. They can provide guidance on available options and help you find a solution that suits your financial situation.

In conclusion, the payment of the initial premium is a vital step in activating a life insurance contract. It is essential to adhere to the specified payment timelines to secure coverage and protect your loved ones in the event of your death. By being proactive, transparent, and exploring alternative payment options if needed, you can ensure that your life insurance policy remains effective and provides the financial security you desire.