Home>Finance>When Does Central States Deposit Pension Funds?

Finance

When Does Central States Deposit Pension Funds?

Published: January 23, 2024

Learn about the deposit schedule for Central States Pension Funds and manage your finances effectively. Find out when your funds will be available.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the intricate world of pension funds, where the timing of deposits holds significant importance for both the fund managers and the beneficiaries. In this article, we will delve into the timing of pension fund deposits, with a specific focus on Central States Pension Funds. Understanding the timing of these deposits is crucial for gaining insight into the financial operations of pension funds and the impact on the individuals who rely on them for their retirement security.

Pension funds play a vital role in providing financial stability to retirees, ensuring that they have a reliable source of income during their post-employment years. The timing of pension fund deposits directly influences the fund's ability to generate returns, meet its financial obligations, and ultimately, fulfill its primary purpose of providing retirement benefits to employees. Therefore, exploring when Central States Pension Funds make their deposits is essential for comprehending the dynamics of pension fund management and its broader implications.

Throughout this article, we will unravel the factors that influence the timing of pension fund deposits, the significance of timely deposits, and the broader context of how these deposits impact the financial well-being of retirees. By shedding light on these aspects, we aim to provide a comprehensive understanding of the intricacies surrounding the timing of pension fund deposits, particularly within the realm of Central States Pension Funds. So, let's embark on this enlightening journey to uncover the temporal dynamics of pension fund deposits and their profound implications.

Overview of Central States Pension Funds

Central States Pension Funds represent a crucial pillar of financial security for countless workers across various industries. Established to provide retirement benefits to employees, these funds are designed to ensure that individuals have a reliable source of income after they conclude their careers. The Central States Pension Fund, in particular, caters to a diverse array of workers, encompassing sectors such as trucking, warehouse, and related industries.

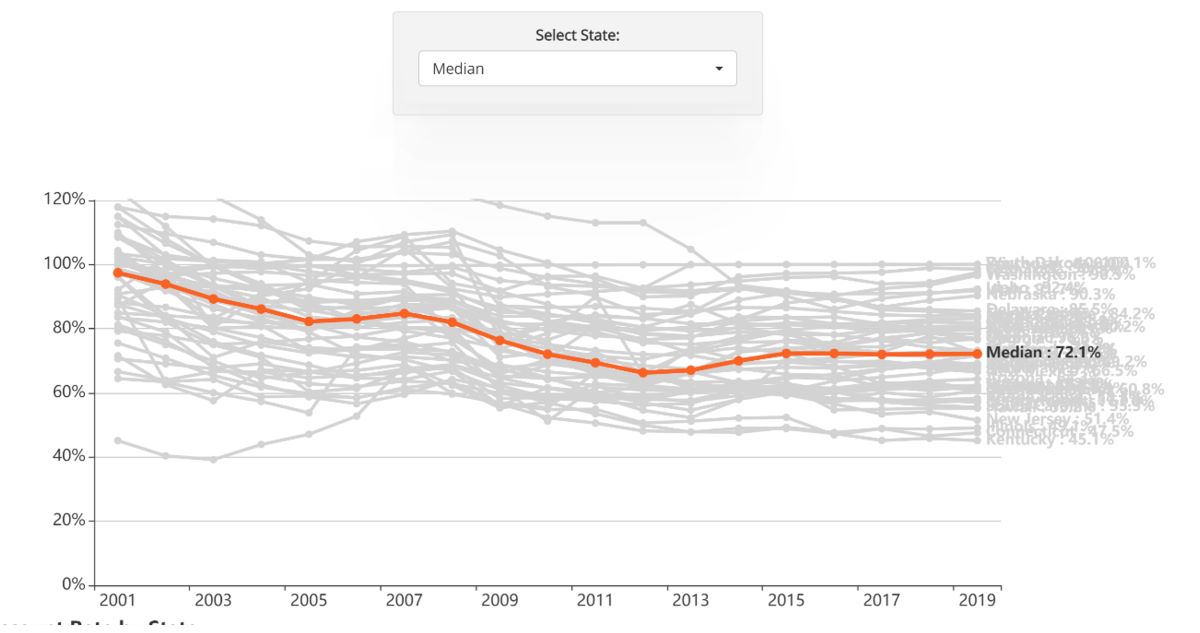

Managed by a dedicated team of financial experts, the Central States Pension Fund operates with the primary objective of safeguarding the financial futures of its members. Through prudent investment strategies and diligent fund management, the Central States Pension Fund endeavors to generate sustainable returns, thereby securing the retirement benefits of its participants.

Central States Pension Funds are structured to accumulate contributions from employers, which are then diligently managed and invested to ensure the long-term solvency of the fund. These contributions, often made through regular payroll deductions, form the financial bedrock of the pension fund, enabling it to fulfill its commitment to retirees.

Amidst the ever-evolving landscape of retirement planning and pension fund management, the Central States Pension Fund remains steadfast in its mission to provide reliable and sustainable retirement benefits to its members. As we navigate through the intricacies of pension fund deposits, understanding the fundamental framework and operational dynamics of Central States Pension Funds is essential in comprehending the broader context of deposit timing and its impact on retirees and the overall fund performance.

Timing of Pension Fund Deposits

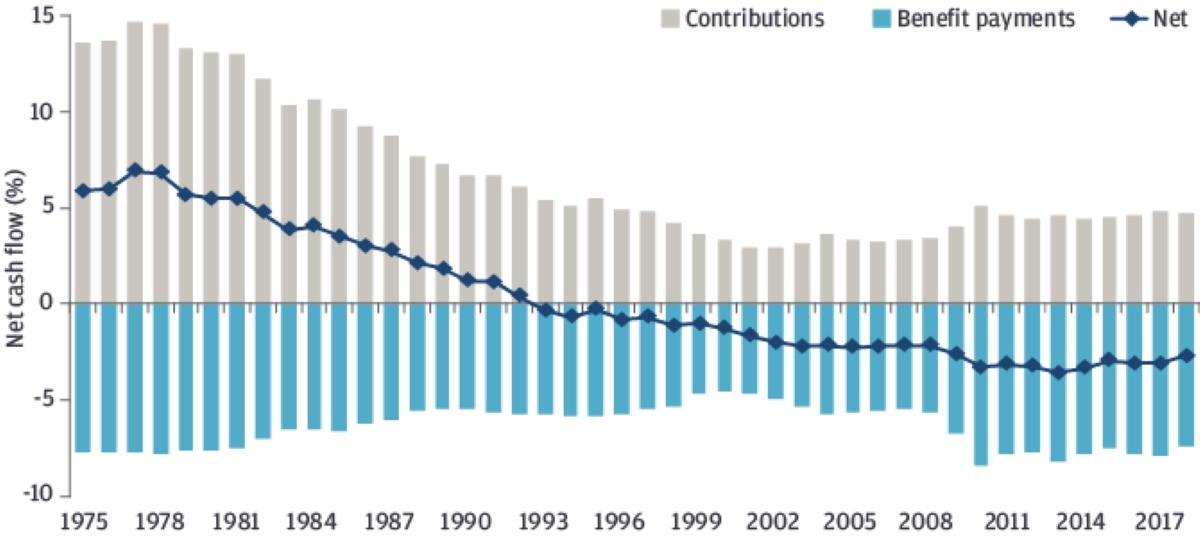

The timing of pension fund deposits is a critical element that underpins the operational and financial dynamics of retirement funds such as the Central States Pension Fund. It refers to the specific intervals at which contributions from employers or other funding sources are deposited into the pension fund. These deposits form the lifeblood of the fund, enabling it to fulfill its core purpose of providing retirement benefits to employees.

For Central States Pension Funds, the timing of deposits is meticulously planned and executed to ensure the seamless inflow of contributions. This process involves adherence to predefined schedules and financial regulations, with a keen focus on maintaining the fund’s liquidity and investment capabilities. The frequency of deposits can vary, with some funds opting for monthly, quarterly, or even annual contribution cycles.

Understanding the timing of pension fund deposits is crucial for both the fund administrators and the beneficiaries. It allows the fund managers to effectively plan and manage the fund’s investment portfolio, ensuring that the deposited funds are strategically utilized to generate returns while meeting the fund’s financial obligations. Simultaneously, for the retirees and beneficiaries, the timing of these deposits directly influences the availability and stability of their pension benefits, thereby impacting their financial security during retirement.

Moreover, the timing of pension fund deposits also plays a pivotal role in shaping the fund’s overall financial performance. Timely and consistent deposits contribute to the fund’s ability to capitalize on investment opportunities, maintain liquidity, and honor its commitments to retirees. Conversely, irregular or delayed deposits can impede the fund’s operational efficiency and potentially affect the sustainability of retirement benefits.

As we explore the nuances of pension fund deposits, it becomes evident that the timing of these contributions holds profound implications for the financial well-being of retirees and the overall stability of pension funds. By delving into the factors that influence deposit timing and the significance of adherence to predefined schedules, we can gain valuable insights into the intricacies of pension fund management and its impact on retirement security.

Factors Affecting Deposit Timing

The timing of pension fund deposits is influenced by a myriad of factors that collectively shape the operational and financial landscape of retirement funds such as the Central States Pension Fund. Understanding these factors is essential for comprehending the intricacies surrounding deposit timing and its implications for both the fund administrators and the beneficiaries.

1. Payroll Cycles: The structure of employers’ payroll cycles significantly impacts the timing of pension fund deposits. Funds reliant on employer contributions often align their deposit schedules with the frequency of payroll cycles, ensuring a steady influx of funds into the pension account.

2. Regulatory Requirements: Pension funds operate within a regulatory framework that stipulates guidelines for depositing contributions. Compliance with these regulations, which may specify deposit frequency and timelines, is a key determinant of deposit timing.

3. Investment Strategy: The investment approach employed by the pension fund managers can influence deposit timing. Funds with a focus on long-term investment strategies may opt for less frequent but substantial deposits, while those emphasizing short-term gains may prefer more frequent contributions to capitalize on immediate investment opportunities.

4. Cash Flow Management: Efficient cash flow management within the pension fund plays a pivotal role in determining deposit timing. Fund administrators must balance the timing of deposits with the fund’s financial obligations, ensuring that there is adequate liquidity to meet retirees’ benefit payments and operational expenses.

5. Economic Conditions: Economic fluctuations and market dynamics can impact deposit timing, especially for funds with investment portfolios sensitive to market performance. Volatility in financial markets may prompt fund managers to adjust the timing of deposits to optimize investment outcomes and mitigate risks.

6. Administrative Processes: The internal administrative processes of the pension fund, including the reconciliation of contributions and verification procedures, can influence deposit timing. Streamlining these processes is crucial for ensuring efficient and timely fund deposits.

By examining these factors, we gain a comprehensive understanding of the intricate variables that shape the timing of pension fund deposits. The interplay of these factors underscores the complexity of pension fund management and highlights the multifaceted considerations involved in ensuring the consistent and timely inflow of contributions, ultimately safeguarding the retirement benefits of workers.

Importance of Timely Pension Fund Deposits

The timely deposit of contributions into pension funds holds immense significance, exerting a far-reaching impact on the fund’s operational efficiency, investment capabilities, and, most importantly, the financial security of retirees. Understanding the importance of adhering to predefined deposit schedules is pivotal in recognizing the broader implications for both pension fund administrators and beneficiaries.

1. Ensuring Retirement Security: Timely deposits are paramount in safeguarding the retirement security of employees who rely on pension benefits. Consistent and predictable inflows of contributions enable pension funds to honor their commitments to retirees, providing them with a reliable source of income during their post-employment years.

2. Optimizing Investment Opportunities: Timely deposits empower pension fund managers to capitalize on investment opportunities. By maintaining a steady influx of funds, the fund can strategically deploy resources, diversify its investment portfolio, and potentially enhance long-term returns, thereby bolstering the sustainability of retirement benefits.

3. Mitigating Liquidity Risks: Regular and timely deposits contribute to the fund’s liquidity management, ensuring that there are adequate resources to meet benefit payments and operational expenses. This mitigates liquidity risks and reduces the likelihood of financial strain on the fund, thereby fostering its long-term stability.

4. Regulatory Compliance and Fiduciary Responsibility: Adhering to predefined deposit schedules is essential for ensuring compliance with regulatory requirements and upholding the fiduciary responsibility of pension fund administrators. It reflects a commitment to transparent and responsible fund management, instilling confidence in both beneficiaries and regulatory authorities.

5. Enhancing Predictability for Beneficiaries: Timely deposits provide beneficiaries with a predictable and stable flow of pension benefits, offering them assurance and peace of mind regarding their financial well-being during retirement. This predictability fosters a sense of security and stability, alleviating concerns about the availability of pension benefits.

6. Upholding Fund Integrity: The consistent and timely deposit of contributions upholds the integrity and credibility of the pension fund. It reflects a commitment to honoring obligations, maintaining financial prudence, and preserving the trust placed in the fund by both current and future retirees.

By recognizing the importance of timely pension fund deposits, we acknowledge the pivotal role that deposit schedules play in sustaining the financial security of retirees and ensuring the operational resilience of pension funds. The adherence to predefined deposit timelines serves as a cornerstone of responsible fund management, underpinning the overarching goal of providing sustainable and dependable retirement benefits to employees across diverse industries.

Conclusion

Delving into the temporal dynamics of pension fund deposits, particularly within the realm of Central States Pension Funds, has provided valuable insights into the intricate interplay of factors that influence deposit timing and the profound importance of adhering to predefined schedules. The timing of pension fund deposits stands as a linchpin in the operational and financial framework of retirement funds, exerting a tangible impact on the fund’s investment prowess, liquidity management, and, ultimately, the retirement security of beneficiaries.

Central States Pension Funds, like their counterparts in the pension fund landscape, operate within a multifaceted ecosystem shaped by regulatory requirements, economic dynamics, and prudent investment strategies. The meticulous timing of deposits aligns with the fund’s overarching mission of providing sustainable and reliable retirement benefits to workers across diverse industries, thereby underscoring the fundamental role of deposit schedules in fulfilling this commitment.

Recognizing the significance of timely pension fund deposits unveils a narrative that transcends financial mechanics, delving into the realm of social responsibility and fiduciary stewardship. It underscores the assurance and stability that timely deposits offer to retirees, fostering a sense of confidence and security as they transition into the post-employment phase of their lives.

As we conclude this exploration, it becomes evident that the timing of pension fund deposits is not merely a procedural aspect of fund management; rather, it embodies a commitment to honoring obligations, optimizing financial resources, and safeguarding the retirement aspirations of individuals who have dedicated their careers to various industries. The importance of adhering to predefined deposit schedules resonates as a testament to the integrity and resilience of pension funds, encapsulating their pivotal role in fortifying the financial well-being of retirees.

By shedding light on the temporal intricacies of pension fund deposits and their broader implications, we gain a deeper appreciation for the conscientious stewardship that underpins the pension fund landscape. The commitment to timely deposits serves as a cornerstone of responsible fund management, epitomizing the enduring pledge to uphold the financial security and dignity of individuals as they embark on the next chapter of their lives.