Home>Finance>What Is The Status Of Central States Pension Fund

Finance

What Is The Status Of Central States Pension Fund

Published: November 27, 2023

Learn about the current status of the Central States Pension Fund and how it affects finance. Find out the latest updates and potential implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Background of Central States Pension Fund

- Current Financial Situation of Central States Pension Fund

- Factors Contributing to the Financial Challenges

- Efforts to Address the Pension Fund’s Status

- Impact on Pensioners and Retirees

- Legal and Legislative Developments

- Potential Solutions and Future Outlook

- Conclusion

Introduction

The Central States Pension Fund, one of the largest multi-employer pension funds in the United States, has been facing significant financial challenges in recent years. The fund, which was created to provide retirement benefits for trucking industry workers and their families, has been grappling with a growing funding shortfall that threatens the security of pensions for thousands of retirees.

The Central States Pension Fund was established in 1955 and has been a lifeline for many truck drivers and other workers in the industry. However, over the years, several factors have contributed to its current financial predicament. This has led to concerns and uncertainty among pensioners and has prompted calls for action to ensure the long-term viability of the fund.

In this article, we will delve into the background of the Central States Pension Fund, examine its current financial situation, explore the factors that have contributed to its challenges, and discuss the efforts being made to address its status. We will also explore the impact of the pension fund’s situation on retirees and pensioners, examine any legal and legislative developments related to the fund, and consider potential solutions for its future.

It is important to understand the complexities of the Central States Pension Fund issue, as it not only affects the retirees and pensioners relying on their pensions but also has broader implications for the stability of the multi-employer pension system in the United States. By examining the various facets of this issue, we can gain a comprehensive understanding of the current state of the Central States Pension Fund and the potential paths forward.

Join us as we explore the challenges facing the Central States Pension Fund and the implications for its pensioners and the wider financial landscape.

Background of Central States Pension Fund

The Central States Pension Fund was established in 1955 as a multi-employer pension plan to provide retirement benefits for employees in the trucking industry. The fund covers a diverse range of workers, including truck drivers, dock workers, mechanics, and administrative staff.

Initially, the Central States Pension Fund enjoyed a stable financial position, with enough assets to cover its obligations to retirees and pensioners. However, over the years, various factors have contributed to the fund’s current challenges.

One significant factor is the changing dynamics within the trucking industry. As the industry underwent significant transformations, including deregulation and increased competition, many companies struggled to remain profitable. This led to a decline in the number of active workers contributing to the pension fund, while the number of retirees continued to grow. The shrinking contributor base, combined with the increasing number of beneficiaries, strained the fund’s financial resources.

In addition, the Central States Pension Fund faced financial difficulties due to external factors. For example, the economic downturns in the early 2000s and the Great Recession of 2008 significantly impacted the fund’s investment portfolio. The fund experienced significant investment losses, which further exacerbated its financial challenges.

Furthermore, the Central States Pension Fund faced challenges regarding the structural design of its pension plan. The fund utilized a defined benefit plan, which guarantees a specific monthly benefit to eligible retirees based on factors such as years of service and earnings history. This type of plan places the responsibility of funding pension benefits on the employer and the pension fund, rather than individual employees. While this provides stable and predictable income for pensioners, it also poses financial risks for the fund if contributions and investments are not sufficient to cover the promised benefits.

As a result of these combined factors, the Central States Pension Fund found itself in a precarious financial position. It became clear that without significant intervention, the fund would be unable to meet its obligations to pensioners in the long term. This sparked concerns and discussions around the future sustainability of the fund and the need for action to preserve the retirement benefits of its participants.

In the following sections, we will delve into the current financial situation of the Central States Pension Fund and explore the factors that have contributed to its challenges. By understanding the background of the fund, we can gain insights into the complexities of its current status and the efforts being made to address its financial stability.

Current Financial Situation of Central States Pension Fund

The Central States Pension Fund is currently facing a severe financial crisis, with a significant funding shortfall that jeopardizes the future pension payments to its beneficiaries. The fund’s assets are not sufficient to meet its long-term pension obligations, leading to concerns regarding its solvency.

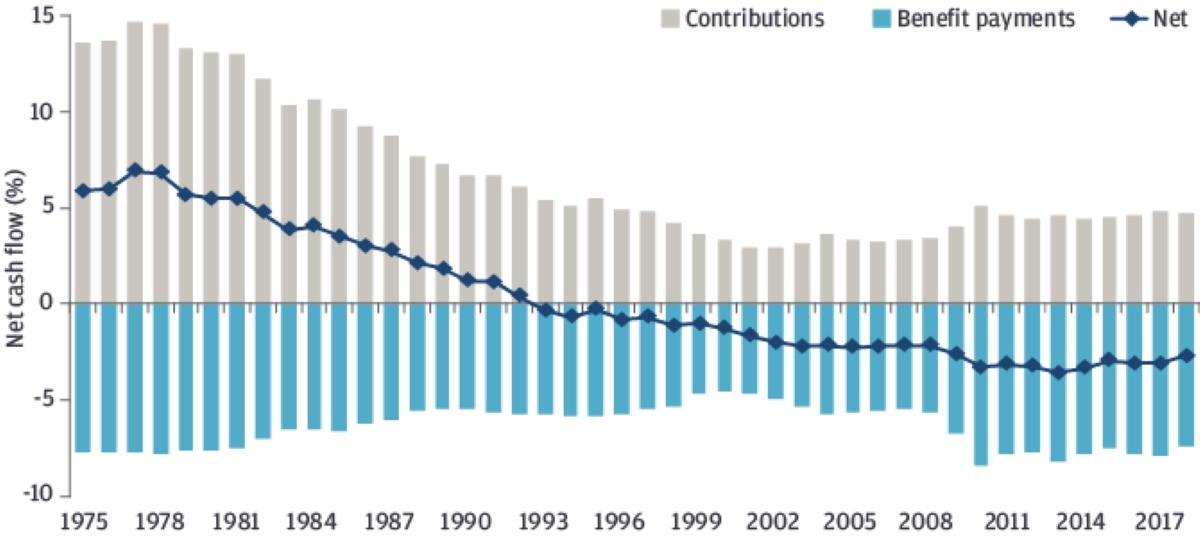

The most recent actuarial report revealed that the Central States Pension Fund had only 48% of the assets needed to cover its liabilities. This means that for every dollar of required pension benefits, the fund has less than 50 cents in assets. This significant deficit has raised alarm bells among retirees, as it casts doubt on the fund’s ability to sustain pension payments in the years to come.

The fund’s financial challenges stem from a combination of factors, including investment losses, a decline in employer contributions, and demographic shifts in the participant population.

Investment losses have played a significant role in the fund’s current financial situation. Like many pension funds, the Central States Pension Fund faced substantial investment losses during market downturns and economic crises. These losses put a strain on the fund’s assets, making it difficult to recover and achieve the necessary returns to meet its pension obligations.

In addition, the decline in employer contributions has contributed to the fund’s financial woes. With the consolidation and bankruptcy of several trucking companies, the number of employers participating in the fund has decreased. This reduction in active contributors has resulted in a decrease in the amount of money flowing into the fund, further exacerbating the funding shortfall.

An additional factor influencing the fund’s financial situation is the demographic shifts in the participant population. The number of retirees receiving pension benefits has been steadily increasing, while the number of active workers contributing to the fund has decreased. This demographic mismatch has put additional strain on the fund’s resources, as it must support a growing number of pensioners with a diminishing number of contributors.

To address the financial challenges, the Central States Pension Fund has taken measures to preserve its assets and ensure the continuity of pension payments. These measures include reducing benefits, suspending cost-of-living adjustments, and implementing changes to the funding rules to manage the fund’s resources more effectively.

However, these actions have not been sufficient to fully resolve the fund’s financial crisis. Additional solutions are needed to ensure the long-term viability and sustainability of the Central States Pension Fund.

In the following sections, we will explore the factors contributing to the fund’s financial challenges and the efforts being made to address its status. Understanding the current financial situation of the Central States Pension Fund is crucial to comprehending the impact on pensioners and retirees and exploring potential solutions for its future.

Factors Contributing to the Financial Challenges

The Central States Pension Fund’s current financial challenges can be attributed to a combination of factors that have emerged over the years. These factors have contributed to the fund’s funding shortfall and pose significant obstacles to its long-term financial health.

One key factor is the decline in the number of active workers contributing to the fund. This decline can be attributed to several reasons, including the consolidation and bankruptcy of many trucking companies. As companies merge or go out of business, the number of employers participating in the fund decreases, affecting the flow of employer contributions into the pension fund. With fewer companies actively contributing to the fund, the ability to generate sufficient revenue to meet pension obligations becomes increasingly difficult.

Another contributing factor is the changing demographics of the participant population. As the trucking industry has evolved, there has been an aging workforce with a growing number of retirees. The increasing number of retirees drawing pension benefits places additional strain on the fund’s resources, as there are fewer active workers contributing to support the growing retiree population. This demographic shift creates a mismatch between the number of contributors and the number of beneficiaries, further exacerbating the fund’s funding shortfall.

The impact of market volatility and investment losses cannot be ignored when considering the financial challenges faced by the Central States Pension Fund. Like many pension funds, the fund invests its assets to generate returns and maintain the long-term sustainability of the pension system. However, economic downturns and market fluctuations can lead to investment losses, eroding the fund’s assets and hindering its ability to meet pension obligations. The fund’s exposure to these market risks, combined with the impact of the 2008 financial crisis, has significantly strained its financial resources.

The design of the pension plan itself also contributes to the fund’s financial challenges. The Central States Pension Fund utilizes a defined benefit plan, which guarantees a specific monthly benefit to eligible retirees based on factors such as years of service and earnings history. While this type of plan provides stable and predictable income for retirees, it places the responsibility of funding pension benefits primarily on the employer and the pension fund. Unlike defined contribution plans, where employees contribute a portion of their income to their retirement accounts, the burden of funding benefits in a defined benefit plan falls on the collective pool of assets held by the pension fund. If the contributions and investments are not sufficient to cover the promised benefits, it can strain the fund’s financial resources and contribute to its funding shortfall.

These various factors, including the decline in active contributors, demographic shifts, investment losses, and the structure of the pension plan, have all played a significant role in the Central States Pension Fund’s financial challenges. Addressing these factors will be crucial in finding sustainable solutions to ensure the fund’s long-term viability and the security of pension benefits for its participants.

In the following sections, we will explore the efforts being made to address the financial challenges of the Central States Pension Fund and the impact on pensioners and retirees. It is essential to understand these factors to formulate potential solutions and pave the way for a more stable future for the fund.

Efforts to Address the Pension Fund’s Status

The financial challenges faced by the Central States Pension Fund have prompted various efforts to address its precarious status and ensure the long-term sustainability of the fund. Recognizing the importance of finding solutions to protect the pension benefits of its participants, several stakeholders have been actively engaged in exploring potential avenues for improvement.

One significant effort is the Comprehensive Plan Improvement Committee (CPIC), established by the Central States Pension Fund trustees. The CPIC consists of a diverse group of stakeholders, including pension trustees, participants, employers, and government representatives. The committee’s primary objective is to develop a comprehensive plan to improve the financial health of the fund while preserving the pension benefits of its participants.

The CPIC has explored various strategies to address the fund’s funding shortfall. One strategy has been to advocate for legislative reforms and changes in regulations that would provide additional financial support to the fund. This includes proposals to secure government assistance or financial resources to help stabilize the fund and alleviate the burden on pensioners and retirees.

Furthermore, the CPIC has been actively engaged in exploring potential benefit adjustments to ensure the long-term sustainability of the fund. This includes evaluating options such as reducing future benefit accruals, implementing temporary or permanent benefit reductions, or adjusting cost-of-living adjustments (COLA) for pensioners.

While these potential benefit adjustments are sensitive and challenging decisions, they are necessary to address the financial challenges faced by the fund. The goal is to strike a balance between ensuring the pension fund’s long-term viability and minimizing the impact on pensioners and retirees who rely on these benefits for their livelihoods.

In addition to the CPIC’s efforts, there has been ongoing engagement with lawmakers and policymakers to address the Central States Pension Fund’s status. The fund’s trustees and various advocacy groups have been actively lobbying for legislative changes that would provide relief and stabilize the fund’s financial situation. This includes exploring possibilities for government-backed loans or guarantees to ease the burden on the pension fund and protect the retirement benefits of its participants.

While progress has been made in terms of raising awareness and advocating for support, finding a comprehensive and sustainable solution remains a complex task. Balancing the needs of the pension fund, its participants, and the broader financial landscape requires collaboration and cooperation between various stakeholders.

It is important to note that the efforts to address the pension fund’s status are ongoing, and it will require strong and sustained commitment from all parties involved. Exploring innovative solutions, engaging with policymakers, and valuing the voices of pensioners and retirees are crucial steps towards finding sustainable pathways for the Central States Pension Fund.

In the following sections, we will delve into the impact of the fund’s status on pensioners and retirees and examine any legal and legislative developments that have taken place. By understanding these aspects, we can gain a comprehensive understanding of the challenges faced by the fund and the potential paths forward.

Impact on Pensioners and Retirees

The financial challenges faced by the Central States Pension Fund have had a significant impact on the pensioners and retirees who rely on their pensions for their livelihoods. The uncertainty surrounding the fund’s financial health has created a sense of insecurity and concern among pensioners, as they worry about the sustainability of their pension payments in the long term.

One of the main concerns for pensioners is the potential reduction in their pension benefits. As the fund seeks to address its funding shortfall, there have been discussions about implementing benefit adjustments to ensure the long-term viability of the fund. This can include reducing future benefit accruals, implementing temporary or permanent benefit reductions, or adjusting cost-of-living adjustments (COLA) for pensioners. These potential adjustments can have a direct impact on the income and standard of living for retirees, causing financial strain and uncertainty.

Pensioners also face the possibility of an erosion of their purchasing power due to inflation. With the potential limitations or adjustments to COLA, pension payments may not keep pace with the rising cost of living. This can have a profound impact on the ability of retirees to meet their expenses and maintain their quality of life.

Furthermore, the financial challenges faced by the Central States Pension Fund have led to fears of benefit cuts or even the risk of pension fund insolvency. If the fund is unable to meet its pension obligations, there is a possibility that pensioners could see severe reductions in their benefits or even a complete loss of their pensions. This raises concerns about the long-term financial security and well-being of retirees who rely on their pensions as their primary source of income.

Aside from the financial implications, the uncertainty and instability surrounding the Central States Pension Fund can take a toll on the mental and emotional well-being of pensioners. The stress and anxiety caused by the uncertain future of their pensions can significantly impact retirees’ overall quality of life and their ability to enjoy their retirement years.

It is important to recognize the significant contributions that pensioners and retirees have made to the trucking industry and the workforce as a whole. These individuals dedicated their careers to supporting the economy and creating opportunities for others. Ensuring the security and stability of their pension benefits is not only a matter of financial responsibility but also a matter of honoring their years of service and the sacrifices they have made.

Efforts are being made by the Central States Pension Fund, the Comprehensive Plan Improvement Committee, and various advocacy groups to mitigate the impact on pensioners and retirees. It is essential to find solutions that strike a balance between addressing the financial challenges faced by the fund and ensuring that pensioners’ benefits are protected and preserved.

In the following sections, we will examine any legal and legislative developments related to the Central States Pension Fund and explore potential solutions and the future outlook for the fund. By understanding these aspects, we can gain insights into the path forward and the efforts being made to support pensioners and retirees who rely on their Central States Pension Fund benefits.

Legal and Legislative Developments

The financial challenges faced by the Central States Pension Fund have prompted significant legal and legislative developments aimed at addressing the fund’s status and ensuring the security of pension benefits for its participants. These developments involve both federal legislation and legal proceedings.

One notable piece of federal legislation that has had an impact on the Central States Pension Fund is the Multiemployer Pension Reform Act (MPRA), which was enacted in 2014. The MPRA was designed to provide troubled multiemployer pension plans, like the Central States Pension Fund, with options to address their funding shortfalls and avoid insolvency. Under the MPRA, pension plans can apply for approval to reduce benefits in order to improve the fund’s financial situation. However, any benefit reductions must be deemed necessary to avoid plan insolvency and must be subject to approval by the Department of the Treasury.

The Central States Pension Fund submitted a proposed rescue plan under the MPRA, seeking to reduce pension benefits to improve the fund’s solvency. However, the proposed benefit reductions faced significant opposition from pensioners and retirees, leading to legal challenges and further developments.

In 2020, a federal district court judge ruled against the proposed benefit cuts, finding that the Treasury Department violated federal law by approving the reduction plan without considering all relevant factors. This ruling provided relief for pensioners and retirees who were at risk of facing significant benefit reductions.

Following the court’s decision, there have been efforts to explore alternative legislative solutions to address the Central States Pension Fund’s funding shortfall. Legislation such as the Butch Lewis Act has been introduced to provide federal financial assistance to troubled multiemployer pension plans and protect the benefits of pensioners and retirees. This legislation aims to provide low-interest loans to struggling pension plans, helping them maintain their pension payments and easing the financial burden they face.

Furthermore, discussions have been ongoing at the federal level to explore potential legislative reforms that could support the long-term stability of multiemployer pension plans. These reforms might include changes to funding rules, increased federal oversight, and additional financial assistance programs to address the systemic issues faced by these pension plans.

While there have been legal and legislative developments surrounding the Central States Pension Fund, addressing the fund’s status continues to be a complex and evolving issue. It requires careful consideration of the financial health of the fund, the rights and expectations of pensioners and retirees, and the broader implications for the multiemployer pension system in the United States.

In the following sections, we will explore potential solutions and the future outlook for the Central States Pension Fund. By considering these aspects, we can gain a comprehensive understanding of the path forward and the potential opportunities to secure the pension benefits of its participants.

Potential Solutions and Future Outlook

The Central States Pension Fund’s financial challenges require innovative and sustainable solutions to ensure the long-term viability of the fund and the security of pension benefits for its participants. While the task ahead is complex, there are potential strategies being explored to address the fund’s status and pave the way for a more stable future.

One potential solution is exploring legislative reforms and changes in regulations that would provide additional financial support to the fund. This includes advocating for government assistance or financial resources to stabilize the fund and alleviate the burden on pensioners and retirees. The Butch Lewis Act, for example, aims to provide federal financial assistance in the form of low-interest loans to troubled multiemployer pension plans, such as the Central States Pension Fund.

Another potential solution is to explore innovative funding options. This could involve expanding the fund’s investment strategies to generate higher returns, provided that appropriate risk management measures are in place. Additionally, exploring partnerships or collaboration with other pension funds or institutions could help leverage resources and expertise to strengthen the Central States Pension Fund’s financial position.

Efforts to improve the fund’s financial health may also involve exploring potential benefit adjustments. While these adjustments can be sensitive and challenging decisions, they may be necessary to ensure the fund’s long-term sustainability. Implementing reasonable benefit reductions or modifying cost-of-living adjustments (COLA) may help alleviate the strain on the fund’s resources while minimizing the impact on pensioners and retirees.

It is crucial to engage all stakeholders in the decision-making process to find solutions that strike a balance between the interests of the fund, its participants, and the broader financial landscape. This includes ongoing collaboration between the Central States Pension Fund trustees, the Comprehensive Plan Improvement Committee (CPIC), pensioners, retirees, employers, congressional representatives, and other relevant parties.

The future outlook for the Central States Pension Fund and its participants depends on the successful implementation of sustainable solutions and ongoing monitoring of the fund’s financial health. It requires a comprehensive and collaborative approach to address the funding shortfall, manage investment risks, and ensure the long-term stability of the fund.

While there are challenges ahead, there is an opportunity to protect the retirement benefits of pensioners and retirees who have dedicated their careers to the trucking industry. By finding viable solutions and taking proactive measures, it is possible to secure the financial well-being of those who rely on the Central States Pension Fund for their livelihoods.

As the discussions and efforts continue, it is important to prioritize transparency, open communication, and an inclusive decision-making process. This will help foster trust and ensure that the interests of all stakeholders are effectively considered in shaping the future of the Central States Pension Fund.

By working together and exploring diverse solutions, we can strive towards a future where pensioners and retirees can have confidence in the security and stability of their pension benefits, ensuring a dignified and well-deserved retirement for those who have contributed to the industry for so many years.

Conclusion

The Central States Pension Fund’s financial challenges have placed the retirement benefits of its participants in jeopardy. The fund’s funding shortfall, declining contributions, and changing demographics have created a complex and urgent situation that requires attention and action.

Efforts are underway to address the fund’s status and find sustainable solutions that ensure the long-term viability of the Central States Pension Fund. The Comprehensive Plan Improvement Committee (CPIC), alongside various stakeholders, is exploring legislative reforms, benefit adjustments, and innovative funding options to stabilize the fund and protect the pension benefits of retirees.

The impact on pensioners and retirees cannot be overlooked. The uncertainty surrounding the fund’s financial health, potential benefit reductions, and erosion of purchasing power due to inflation creates anxiety and stress for those relying on their pensions for income. It is vital that solutions prioritize the security and well-being of these individuals, who have dedicated their careers to the trucking industry.

The legal and legislative developments surrounding the Central States Pension Fund have provided hope for pensioners and retirees. Proposals, such as the Butch Lewis Act, seek to provide financial assistance and protect the benefits of those relying on troubled multiemployer pension plans.

The future outlook for the Central States Pension Fund depends on collaborative efforts, stakeholder engagement, and ongoing monitoring of the fund’s financial health. Balancing the needs of the fund, its participants, and the broader financial landscape is crucial in finding sustainable solutions.

By advocating for legislative changes, exploring innovative funding options, and engaging all stakeholders, there is an opportunity to secure the retirement benefits of pensioners and retirees who have contributed significantly to the industry.

In conclusion, the plight of the Central States Pension Fund calls for urgent attention and collaborative action. The fairness and security of pension benefits for retirees depend on the collective efforts of trustees, government entities, employers, pensioners, and retirees themselves. By working together, we can strive towards a future where the Central States Pension Fund remains a pillar of support for those who have dedicated their lives to the trucking industry.