Finance

When Does Late Fee Apply To FPL

Published: February 23, 2024

Learn about the application of late fees to FPL and ensure timely payments to avoid financial penalties. Get insights on finance-related late fee policies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding Late Fees for Florida Power & Light (FPL) Bills

Introduction

Florida Power & Light (FPL) is a major electricity provider serving millions of customers across the state of Florida. As with any utility service, timely payment of bills is crucial to maintaining uninterrupted access to electricity. FPL, like many other service providers, has a policy regarding late payments, which includes the application of late fees under specific circumstances.

Understanding the implications of late fees is essential for FPL customers to manage their finances effectively and avoid unnecessary penalties. In this article, we will delve into the details of late fees for FPL bills, including when they apply, potential exceptions, and strategies to prevent incurring these additional charges.

Late fees can significantly impact a household's budget, and being aware of the conditions under which they are applied is crucial for responsible bill management. By gaining a comprehensive understanding of FPL's late fee policy, customers can take proactive measures to ensure timely payments and minimize financial strain.

Next, we will explore the specifics of late fees for FPL bills, shedding light on the circumstances that trigger these charges and providing insights into how customers can navigate this aspect of their utility payments. Understanding late fees for FPL bills is not only about avoiding penalties; it is also a step towards financial empowerment and responsible utility management.

Understanding FPL Late Fees

Late fees are additional charges applied to a customer’s bill when payment is not received by the due date. For FPL, late fees are incurred when the full payment for the current billing cycle is not received by the specified due date. It’s important to note that late fees are not punitive measures but rather serve as a means for the utility company to recoup the costs associated with managing overdue accounts and to encourage timely payments.

When an FPL customer fails to submit the full payment by the due date, a late fee is typically added to the following month’s bill. The amount of the late fee is outlined in the terms and conditions of the service agreement and may vary based on the outstanding balance and the duration of the late payment.

Understanding the implications of late fees is crucial for FPL customers as these charges can impact their monthly budgets. Being aware of the specific conditions that trigger late fees empowers customers to take proactive measures to avoid incurring these additional expenses.

Customers should familiarize themselves with the terms and conditions of their FPL service agreement to gain clarity on the late fee policy. This includes reviewing the specified due date, the amount of the late fee, and any additional repercussions of late payments. By understanding these details, customers can effectively manage their bill payments and mitigate the risk of incurring late fees.

Moreover, comprehending the rationale behind late fees can help customers appreciate the importance of timely bill payments. By recognizing that late fees are designed to ensure the efficient operation of the utility company and to encourage responsible payment behavior, customers can approach their bill management with a sense of accountability and financial prudence.

Next, we will explore the specific circumstances under which late fees apply to FPL bills, providing customers with a clear understanding of when these charges are incurred and how they can be avoided.

When Late Fees Apply

Late fees for Florida Power & Light (FPL) bills are applied when the full payment for the current billing cycle is not received by the specified due date. The due date is clearly indicated on the bill, providing customers with a deadline by which the payment must be made to avoid incurring late fees. It’s important for FPL customers to take note of this date and ensure that their payments are submitted on time to prevent additional charges.

When a customer fails to submit the full payment by the due date, FPL applies a late fee to the following month’s bill. The specific amount of the late fee is outlined in the terms and conditions of the service agreement and is typically calculated based on the outstanding balance and the duration of the late payment. Understanding the factors that contribute to the late fee amount can provide customers with insights into the potential financial impact of delayed payments.

It’s essential for FPL customers to be mindful of the due date and to plan their bill payments accordingly to avoid late fees. By prioritizing timely payments and adhering to the specified deadlines, customers can prevent the accumulation of additional charges and maintain a positive payment record with the utility company.

Additionally, customers should be aware that late fees can compound over time if payments continue to be delayed. This can lead to a cycle of increasing financial burden, making it even more challenging to settle outstanding balances. Therefore, prompt payment is not only crucial for avoiding immediate late fees but also for preventing the escalation of financial strain in the long run.

Understanding when late fees apply to FPL bills empowers customers to take proactive measures to manage their payments effectively. By staying informed about the due date, the potential late fee amount, and the consequences of delayed payments, customers can make informed decisions regarding their bill management and strive to maintain a favorable financial standing with the utility company.

Next, we will explore potential exceptions to late fees for FPL bills, shedding light on circumstances where customers may be granted leniency in specific situations.

Exceptions to Late Fees

While timely payment is crucial to avoid late fees for Florida Power & Light (FPL) bills, there are certain circumstances in which customers may be granted exceptions or leniency regarding late payments. FPL understands that unexpected situations or financial hardships may arise, impacting a customer’s ability to submit payments on time. In such cases, customers are encouraged to communicate with FPL’s customer service to explore potential options for managing their bills.

One common exception to late fees is the occurrence of extenuating circumstances, such as natural disasters, severe weather events, or other emergencies that disrupt normal payment routines. In these situations, FPL may offer flexibility and understanding to affected customers, providing them with the opportunity to make alternative payment arrangements without incurring late fees.

Additionally, customers facing financial hardships or unexpected challenges that hinder their ability to meet payment deadlines can reach out to FPL to discuss their circumstances. The utility company may have support programs or payment assistance options available to eligible customers, offering them the opportunity to address their bills without being burdened by late fees.

It’s important for customers to be proactive in seeking assistance and communicating openly with FPL regarding their individual situations. By engaging with the utility company and expressing their challenges, customers may discover available resources or solutions that can alleviate the pressure of impending late fees.

Furthermore, FPL may consider exceptions to late fees on a case-by-case basis, taking into account the specific circumstances of the customer and their payment history. Customers who demonstrate a commitment to resolving outstanding balances and maintaining open communication with the utility company may be more likely to receive understanding and support in managing their bills.

Understanding the potential exceptions to late fees for FPL bills empowers customers to navigate challenging situations with greater confidence. By being aware of the avenues for seeking assistance and the circumstances under which leniency may be granted, customers can approach their bill management with a sense of assurance, knowing that there are options available to address unforeseen challenges.

Next, we will explore effective strategies for avoiding late fees on FPL bills, providing customers with actionable tips to maintain timely payments and financial stability.

How to Avoid Late Fees

Effectively managing bill payments is essential for avoiding late fees on Florida Power & Light (FPL) bills. By implementing proactive strategies and staying organized, customers can minimize the risk of incurring additional charges and maintain financial stability. Here are some actionable tips to help FPL customers avoid late fees:

- Set Reminders: Utilize calendars, mobile apps, or digital reminders to mark the FPL bill’s due date. Setting up alerts well in advance can help ensure that the payment deadline is not overlooked.

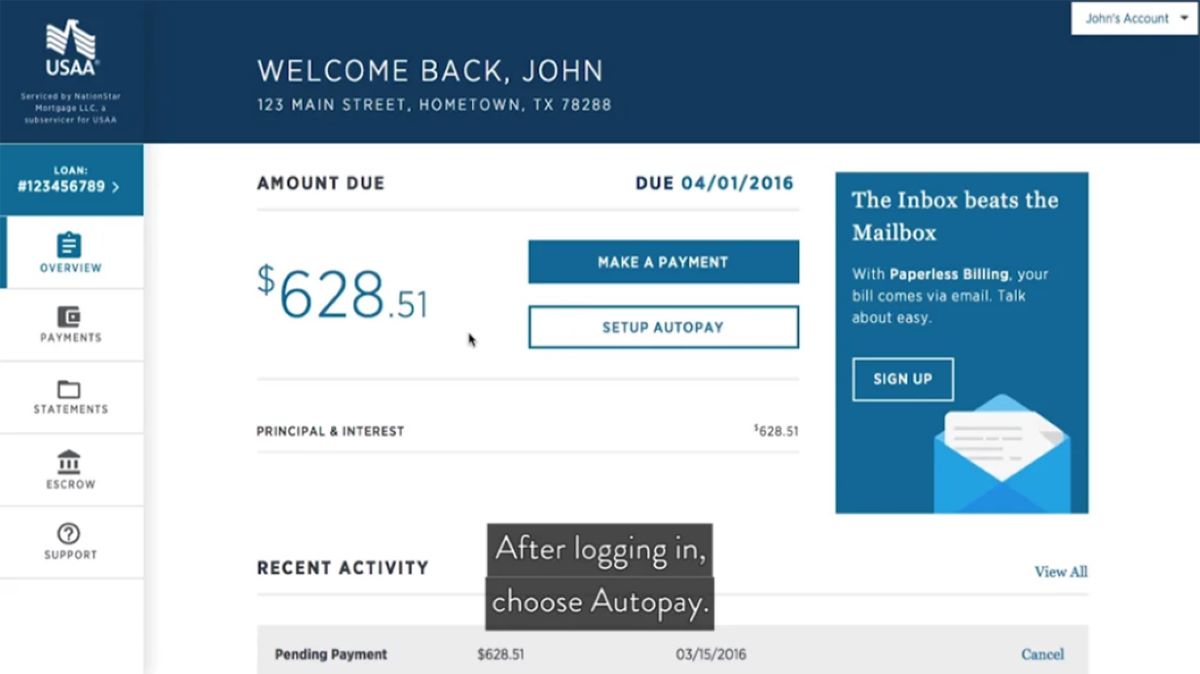

- Automate Payments: Consider enrolling in FPL’s automatic payment program, where the bill amount is automatically deducted from a designated bank account on the due date. This can streamline the payment process and reduce the likelihood of missing deadlines.

- Monitor Consumption: Stay informed about energy usage to anticipate the upcoming bill amount. By being aware of potential fluctuations in the bill, customers can plan their finances and allocate funds for timely payments.

- Review Billing Statements: Regularly review FPL billing statements to confirm the due date and verify the accuracy of the charges. Address any discrepancies or concerns promptly to avoid delays in payment.

- Explore Payment Assistance: In cases of financial hardship, customers should reach out to FPL’s customer service to inquire about available payment assistance programs or flexible payment arrangements.

- Communicate Proactively: If unexpected challenges arise that may impact bill payments, communicate with FPL in advance. Open dialogue with the utility company can lead to potential solutions and prevent the accumulation of late fees.

By implementing these proactive measures and staying attentive to bill management, FPL customers can navigate their payment responsibilities with greater ease and reduce the likelihood of incurring late fees. Timely bill payments not only help avoid additional charges but also contribute to a positive financial standing with the utility company.

Empowering customers with the knowledge and tools to avoid late fees is instrumental in promoting financial responsibility and stability. By taking a proactive approach to bill management and leveraging available resources, customers can navigate their FPL payments with confidence and minimize the impact of late fees on their budgets.

Next, we will summarize the key insights regarding late fees for FPL bills and conclude the article with a recap of the importance of timely payments and responsible bill management.

Conclusion

Understanding the implications of late fees for Florida Power & Light (FPL) bills is essential for customers to navigate their payment responsibilities effectively. By gaining insights into the circumstances that trigger late fees, potential exceptions, and strategies to avoid these additional charges, FPL customers can take proactive steps to maintain financial stability and responsible bill management.

Timely payment of FPL bills is not only about avoiding late fees but also contributes to uninterrupted access to essential electricity services. By prioritizing on-time payments and staying informed about the due dates and potential assistance options, customers can mitigate the risk of incurring additional charges and maintain a positive relationship with the utility company.

Furthermore, being aware of potential exceptions to late fees, such as extenuating circumstances and available support programs, empowers customers to address unexpected challenges with confidence. Open communication with FPL’s customer service and proactive engagement with bill management can lead to favorable outcomes, even in the face of financial hardships.

Empowering customers with actionable tips to avoid late fees, such as setting reminders, automating payments, and monitoring consumption, fosters a proactive and responsible approach to bill management. By leveraging these strategies, customers can streamline their payment processes and minimize the risk of incurring additional charges.

In conclusion, understanding late fees for FPL bills goes beyond financial considerations; it is a reflection of responsible utility management and proactive financial planning. By staying informed, communicating openly, and taking proactive steps to manage bill payments, FPL customers can navigate their financial responsibilities with confidence and minimize the impact of late fees on their budgets and overall financial well-being.