Finance

When Is It A Late Fee On Car Insurance

Published: February 22, 2024

Learn about late fees on car insurance and how they can impact your finances. Understand the consequences of missing payments and how to avoid additional charges.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Car insurance is a vital aspect of responsible vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. While it's crucial to secure the right coverage for your vehicle, it's equally important to understand the implications of late payments on your car insurance. Late fees on car insurance can have significant financial repercussions and may even impact your coverage. Therefore, gaining insight into the factors that contribute to late fees, the potential consequences, and effective strategies to avoid them is essential for all car owners.

Understanding the nuances of late fees on car insurance can empower individuals to make informed decisions, manage their finances effectively, and maintain continuous coverage for their vehicles. In the following sections, we will delve into the intricacies of late fees on car insurance, explore the potential repercussions of delayed payments, and provide actionable tips to prevent late fees. By gaining a comprehensive understanding of this topic, car owners can navigate the realm of car insurance with confidence and ensure that their coverage remains uninterrupted.

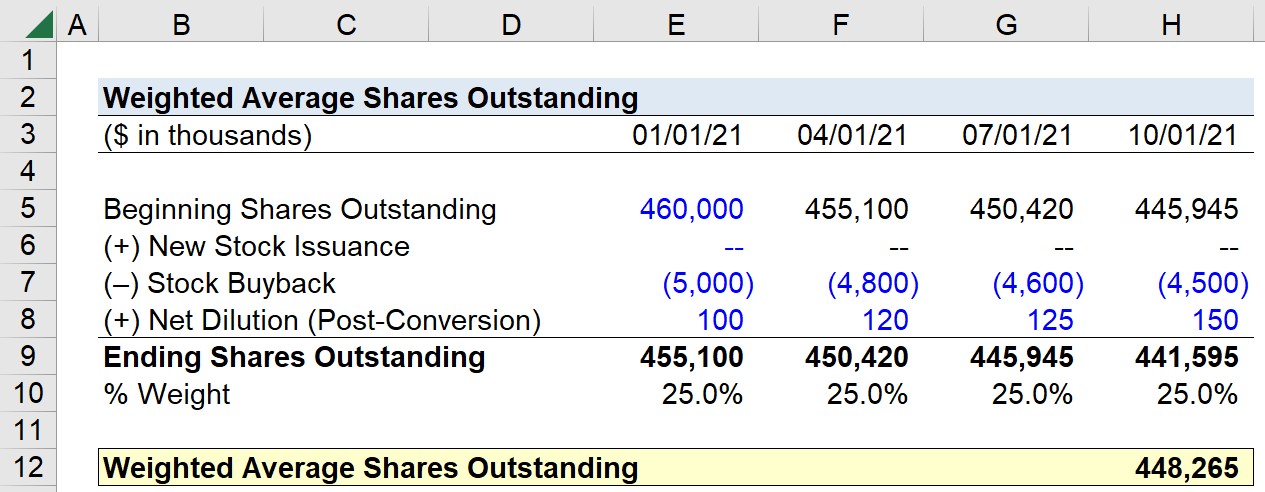

Understanding Late Fees on Car Insurance

Late fees on car insurance typically come into play when policyholders fail to make their premium payments by the specified due date. The grace period for making these payments varies among insurance providers, but it’s essential for policyholders to be aware of this timeframe to avoid incurring late fees. When a payment is not received within the grace period, the insurance company may impose a late fee, which is an additional charge on top of the regular premium.

It’s important to note that late fees can vary depending on the insurance provider and the terms outlined in the policy. Some insurers may implement a flat late fee, while others might calculate it as a percentage of the overdue amount. Understanding the specific late fee structure outlined in your policy is crucial for managing your payments effectively and avoiding unnecessary financial strain.

Policyholders should also be mindful of any potential repercussions associated with late payments, such as the risk of policy cancellation or a lapse in coverage. In some cases, repeated late payments may lead to non-renewal of the policy, making it challenging to secure affordable coverage in the future. Therefore, staying informed about the late fee policies and potential ramifications outlined in your car insurance policy is paramount.

Moreover, being proactive in addressing any financial challenges that may hinder timely premium payments can help prevent the accumulation of late fees. Communicating with the insurance provider to explore potential payment arrangements or seeking guidance on available options can be instrumental in avoiding late fees and maintaining continuous coverage for your vehicle.

Consequences of Late Payment

Late payment of car insurance premiums can lead to a range of adverse consequences that may significantly impact policyholders. One of the immediate repercussions is the imposition of late fees, which can result in additional financial burden on top of the regular premium amount. These late fees, whether fixed or calculated as a percentage of the overdue amount, can accumulate over time, amplifying the overall cost of the policy.

Beyond the financial implications, repeated late payments can jeopardize the continuity of coverage. Insurance providers may view consistent delinquency in premium payments as a risk factor, potentially leading to policy cancellation or non-renewal. This can leave policyholders without the essential protection that car insurance offers, exposing them to potential financial liabilities in the event of accidents or other covered incidents.

Furthermore, the impact of late payments extends beyond the individual policyholder. In cases where multiple vehicles or drivers are covered under the same policy, late payments can affect the entire coverage, impacting the vehicles and individuals included in the policy.

Additionally, a history of late payments and the associated repercussions can have long-term effects on a policyholder’s financial well-being. It can influence credit scores and financial credibility, potentially leading to challenges in securing favorable insurance rates in the future. Therefore, the consequences of late payments extend beyond the immediate financial penalties, encompassing broader implications for the policyholder’s overall financial stability and access to affordable coverage.

Understanding the multifaceted consequences of late payment underscores the importance of prioritizing timely premium payments and actively seeking solutions to mitigate the risk of incurring late fees. By proactively addressing payment challenges and staying informed about the potential ramifications of late payments, policyholders can safeguard their financial well-being and ensure continuous access to essential car insurance coverage.

Avoiding Late Fees

Effectively managing car insurance payments is essential for avoiding late fees and maintaining continuous coverage. To prevent the accumulation of late fees, policyholders can implement proactive strategies and leverage available resources offered by insurance providers. Here are key measures to avoid late fees on car insurance:

- Stay Informed: Familiarize yourself with the payment due dates and grace periods specified in your car insurance policy. Understanding these timelines is crucial for ensuring timely payments and avoiding late fees.

- Set Reminders: Utilize digital calendars, mobile apps, or other reminder tools to set alerts for upcoming premium due dates. Proactive reminders can help you stay on top of payment deadlines and prevent oversights that may lead to late fees.

- Explore Payment Options: Many insurance providers offer flexible payment options, including automatic bank withdrawals, online payment portals, and installment plans. Exploring these options can streamline the payment process and reduce the likelihood of missed or delayed payments.

- Communicate with Your Insurer: In cases where financial challenges may impact your ability to make timely payments, communicate with your insurance provider proactively. They may offer assistance or alternative payment arrangements to help you avoid late fees and maintain coverage.

- Monitor Your Finances: Regularly review your financial situation to ensure that funds are allocated for car insurance premiums. Budgeting for insurance payments as a recurring expense can help prioritize timely payments and prevent late fees.

- Seek Financial Guidance: If you encounter financial difficulties that hinder your ability to make premium payments, consider seeking financial guidance from reputable sources. Understanding your options and potential solutions can help prevent late fees and mitigate the risk of coverage lapses.

By proactively implementing these measures and staying informed about the available resources and support offered by insurance providers, policyholders can effectively avoid late fees and maintain uninterrupted coverage for their vehicles. Prioritizing timely payments and leveraging available payment options can contribute to a seamless and financially responsible car insurance experience.

Conclusion

Understanding the implications of late fees on car insurance is essential for all policyholders. Late payments can lead to additional financial burdens, potential coverage interruptions, and long-term repercussions that extend beyond the immediate policy term. By familiarizing themselves with the late fee policies outlined in their car insurance contracts and implementing proactive strategies to avoid late fees, policyholders can safeguard their financial well-being and ensure continuous access to essential coverage.

Effective measures such as setting reminders, exploring flexible payment options, and maintaining open communication with insurance providers can significantly reduce the risk of incurring late fees. Furthermore, staying informed about payment due dates and grace periods, as well as actively monitoring personal finances, can contribute to a seamless and responsible approach to managing car insurance payments.

By prioritizing timely premium payments and actively seeking solutions to address potential financial challenges, policyholders can navigate the realm of car insurance with confidence and mitigate the risk of late fees. Proactive financial management not only helps avoid late fees but also contributes to overall financial stability and access to affordable coverage in the long run.

In conclusion, a comprehensive understanding of late fees on car insurance, coupled with proactive payment management, empowers policyholders to uphold their financial commitments, maintain continuous coverage, and mitigate the risk of incurring unnecessary late fees. By prioritizing timely payments and leveraging available resources, individuals can navigate the complexities of car insurance with confidence and ensure that their vehicles remain protected under continuous coverage.