Finance

When Does The IRS Levy Bank Accounts?

Published: November 1, 2023

Find out when the IRS can legally seize bank accounts for unpaid taxes and learn how to navigate the finance system to protect your assets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding IRS Levy

- Circumstances Leading to an IRS Bank Account Levy

- Notice of Intent to Levy

- Timeline for IRS Bank Account Levy

- Protecting Your Bank Account from IRS Levy

- Releasing an IRS Levy on a Bank Account

- Consequences of an IRS Bank Account Levy

- Seeking Professional Help for IRS Levy Issues

- Conclusion

Introduction

Dealing with the Internal Revenue Service (IRS) can be a daunting task, especially when it comes to financial matters. One of the most alarming situations taxpayers may face is the IRS levy on their bank accounts. An IRS bank account levy occurs when the IRS seizes funds from your bank account to satisfy unpaid taxes, penalties, or other outstanding debts.

Understanding how and when the IRS can levy your bank account is crucial for every taxpayer. This article will shed light on the circumstances that can lead to an IRS levy, the timeline for a bank account levy, steps to protect your bank account, how to release an IRS levy, and the consequences of a bank account levy.

It is important to note that this article is for informational purposes only and should not be considered professional tax advice. If you are currently facing an IRS levy or have any concerns about your tax situation, it is advisable to seek guidance from a qualified tax professional.

Understanding IRS Levy

An IRS levy is a legal action taken by the Internal Revenue Service to collect unpaid taxes. It gives the IRS the authority to seize assets, including funds from bank accounts, to satisfy the outstanding tax debt. The IRS has the power to initiate a bank account levy when all other attempts to collect the tax debt have failed.

It is important to recognize that an IRS bank account levy is different from a bank garnishment initiated by a creditor. While a creditor requires a court order to garnish your bank account, the IRS can levy your account without obtaining a court order. However, this does not mean that the IRS can levy your bank account without proper notice and due process.

Before the IRS can levy your bank account, they are required to provide you with a Notice of Intent to Levy. This notice serves as a final warning, giving you the opportunity to resolve your tax debt or appeal the proposed levy action. It is crucial to respond to this notice promptly to avoid the levy on your bank account.

It is worth mentioning that the IRS has the power to levy other types of assets as well, such as wages, vehicles, real estate, and retirement accounts. However, the focus of this article will be specifically on bank account levies.

Circumstances Leading to an IRS Bank Account Levy

There are specific circumstances that can lead to the IRS deciding to levy your bank account. Understanding these circumstances can help you better navigate your tax obligations and prevent a bank account levy. Here are some common situations that can result in an IRS bank account levy:

-

Unpaid Tax Debt: The most common reason for an IRS bank account levy is unresolved tax debt. If you have outstanding taxes, penalties, or interest that you have not paid, the IRS may take action to collect the unpaid amount by levying your bank account.

-

Ignored IRS Notices: Ignoring or disregarding notices from the IRS can have serious consequences. Failure to respond to notices related to your tax debt can ultimately lead to an IRS bank account levy. It is important to address any communication from the IRS promptly and seek professional guidance if needed.

-

Failed Payment Arrangements: If you have entered into a payment arrangement with the IRS, such as an installment agreement, it is crucial to make your payments as agreed. Defaulting on your payment plan can trigger the IRS to proceed with a bank account levy.

-

Tax Liens: When the IRS files a tax lien against you, it becomes a public record that alerts creditors, including banks. If you have a tax lien, it increases the likelihood of the IRS pursuing a bank account levy to satisfy the outstanding debt.

It is important to note that the IRS is required to provide notice and an opportunity to resolve the tax debt before levying your bank account. You will receive a Notice of Intent to Levy, which gives you the chance to address the outstanding tax debt and prevent the levy action. Therefore, it is essential to take any communication from the IRS seriously and take appropriate steps to resolve your tax issues.

Notice of Intent to Levy

Before the IRS can levy your bank account, they are legally obligated to provide you with a Notice of Intent to Levy. This notice serves as a final warning and gives you an opportunity to address your tax debt or appeal the proposed levy action.

The Notice of Intent to Levy will typically be sent to you via certified mail, allowing the IRS to obtain proof of delivery. It will outline the amount of the unpaid tax debt, any penalties or interest accrued, and the deadline by which you must take action to prevent the levy.

Upon receiving the Notice of Intent to Levy, it is crucial to review it carefully and understand the options available to you. Here are some important points to keep in mind:

-

Responding in a Timely Manner: The notice will specify a deadline by which you must respond to prevent the bank account levy. It is essential to take action within this timeframe to avoid the levy. Ignoring the notice or failing to respond can result in the IRS moving forward with the levy action.

-

Paying the Tax Debt: If you have the means to pay the tax debt in full, doing so before the specified deadline will prevent the bank account levy. You can make the payment online, mail a check, or explore other payment options available to you.

-

Setting Up a Payment Arrangement: If paying the full amount is not feasible, you may have the option to set up a payment arrangement with the IRS. This could be an installment agreement, wherein you agree to make monthly payments over an extended period of time. It is important to follow the terms of the agreement to prevent the levy.

-

Filing an Appeal: If you believe the IRS has made an error or you have a valid reason to dispute the tax debt, you may consider filing an appeal. This involves providing supporting documentation and presenting your case to the IRS to seek a resolution without the need for a bank account levy.

It is crucial to consult with a tax professional or seek legal advice if you receive a Notice of Intent to Levy. They can guide you through the options available and the appropriate steps to take to resolve your tax debt and prevent the bank account levy.

Timeline for IRS Bank Account Levy

The timeline for an IRS bank account levy can vary depending on various factors, including the taxpayer’s response and actions taken by the IRS. Understanding the general timeline can help you better navigate the situation and take appropriate steps to protect your bank account. Here is a breakdown of the typical timeline:

-

Notice of Intent to Levy: The first step in the process is the issuance of a Notice of Intent to Levy. This notice serves as a final warning and typically provides the taxpayer with a deadline by which they must respond to prevent the bank account levy. The taxpayer usually has around 30 days to take action.

-

Taxpayer’s Response: Upon receiving the Notice of Intent to Levy, the taxpayer has several options to prevent the bank account levy. They can pay the tax debt in full, set up a payment arrangement, file an appeal, or explore other resolution options. It is crucial to respond within the specified timeframe.

-

IRS Review and Decision: After the taxpayer responds to the Notice of Intent to Levy, the IRS will review the information provided and make a decision. They will consider the taxpayer’s payment proposal, appeal, or any other resolution options presented. The IRS may accept, reject, or modify the proposed resolution.

-

Bank Account Levy: If the taxpayer does not respond to the Notice of Intent to Levy or the proposed resolution is not accepted by the IRS, they will proceed with the bank account levy. Typically, this occurs after the specified deadline mentioned in the notice. The bank will freeze the account, and the IRS will seize the funds to satisfy the outstanding tax debt.

It is important to note that the timeline can vary depending on the complexity of the case, the taxpayer’s responsiveness, and any ongoing negotiations or appeals. It is crucial to address the Notice of Intent to Levy promptly and seek professional guidance to ensure the best possible outcome and protect your bank account.

Protecting Your Bank Account from IRS Levy

While dealing with an IRS bank account levy can be stressful, there are steps you can take to protect your bank account from being seized. It is important to be proactive and address your tax issues before the situation escalates. Here are some strategies to consider:

-

Stay in Communication: Always open and respond to any communication from the IRS promptly. Ignoring notices or failing to communicate can increase the likelihood of an IRS bank account levy. Stay in regular contact and provide requested information or documentation as needed.

-

Resolve Tax Debt: The best way to prevent an IRS bank account levy is to resolve your tax debt. If you have the means, pay the amount owed in full. If that is not feasible, explore payment options such as installment agreements or an offer in compromise. Working out a payment plan with the IRS can prevent levies and provide a structured approach to resolving your tax debt.

-

Seek Professional Guidance: Dealing with the IRS can be complex and overwhelming on your own. Consider seeking the assistance of a tax professional, such as a certified public accountant or tax attorney. They can provide expert advice, guide you through the process, and help negotiate with the IRS on your behalf.

-

Request a Collection Due Process Hearing: If you receive a Notice of Intent to Levy, you have the right to request a Collection Due Process (CDP) hearing. This gives you an opportunity to present your case and explore alternative resolution options. It can temporarily halt collection efforts, including an IRS bank account levy.

-

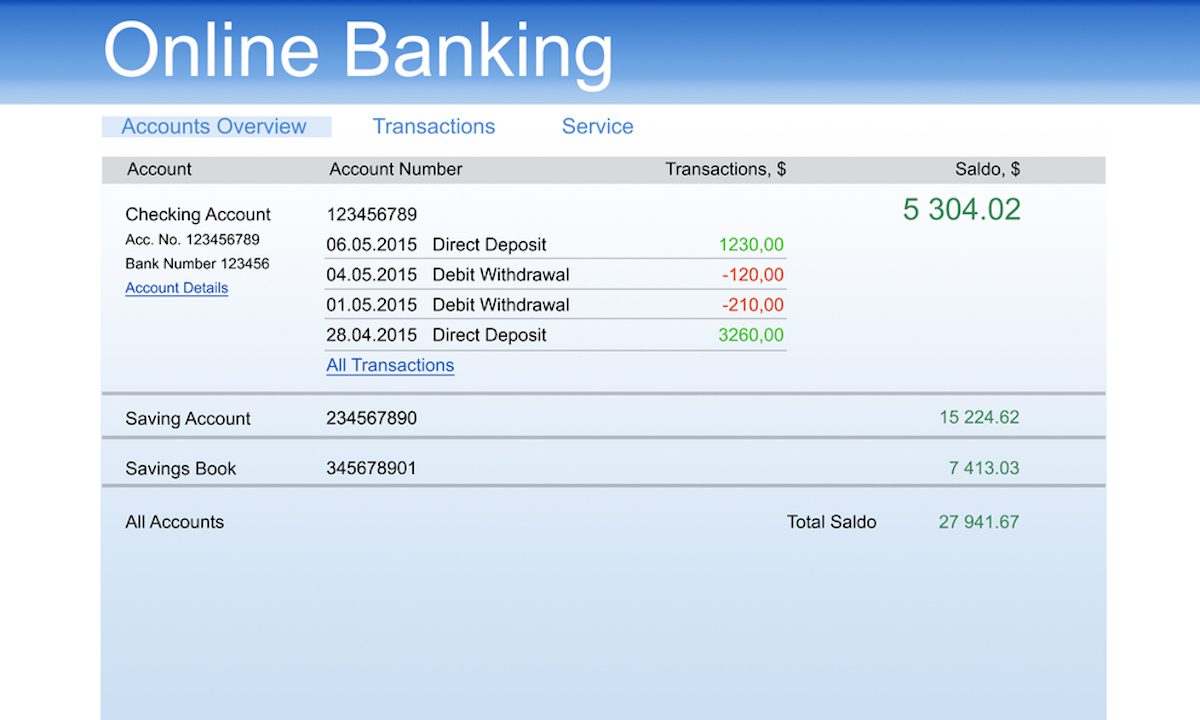

Place Funds in Exempt Accounts: The IRS can only levy funds in accounts that are accessible to you. Consider moving funds to accounts that are exempt from levy, such as certain retirement accounts or accounts protected by state law. However, be cautious not to engage in fraudulent activity or attempt to hide assets.

Remember, preventing an IRS bank account levy requires proactive measures and timely action. Take your tax obligations seriously, seek professional guidance if needed, and stay in communication with the IRS to resolve your tax issues and protect your bank account.

Releasing an IRS Levy on a Bank Account

If your bank account has been levied by the IRS, it is essential to take immediate action to release the levy and regain access to your funds. Here are the steps you can take to potentially release an IRS levy on your bank account:

-

Contact the IRS: Start by contacting the IRS to discuss the levy on your bank account. The IRS may require certain information or documentation from you to facilitate the release process. Be prepared to provide necessary identification, tax return information, and any supporting documentation relevant to your case.

-

Payment in Full: If you can pay the full amount due, including any penalties and interest, the IRS will release the levy on your bank account. You can make the payment online, via check, or explore other payment options recommended by the IRS.

-

Negotiate a Payment Plan: If paying the full amount upfront is not possible, you can negotiate a payment plan with the IRS. This could be in the form of an installment agreement where you agree to make regular monthly payments to satisfy the tax debt. Once the payment plan is established and adhered to, the IRS may release the bank account levy.

-

Offer in Compromise: In certain situations, you may qualify for an Offer in Compromise (OIC) with the IRS. It is a settlement option where the IRS agrees to accept a reduced amount to satisfy the tax debt. If your OIC is accepted, the bank account levy will be released upon payment of the agreed-upon amount.

-

Prove Financial Hardship: You can submit documentation to the IRS to demonstrate that releasing the levy will cause you significant financial hardship. If approved, the IRS may release the levy to alleviate the economic impact on you and your family. Providing accurate and comprehensive financial information is crucial for this option.

-

Collection Due Process Hearing: If you have not had the opportunity to request a Collection Due Process (CDP) hearing prior to the bank account levy, you can still request one after the levy. The CDP hearing allows you to present your case to an independent appeals officer who can potentially release the levy or suggest alternative solutions.

It is important to remember that the process of releasing an IRS bank account levy can take time. Patience, persistence, and timely communication with the IRS are key factors in achieving a successful resolution. Consulting with a tax professional can also provide valuable guidance throughout the process.

Consequences of an IRS Bank Account Levy

An IRS bank account levy can have significant consequences on your financial well-being. Understanding these consequences can help you better navigate the situation and take appropriate steps to minimize the impact. Here are some of the key consequences of an IRS bank account levy:

-

Frozen Bank Account: When the IRS levies your bank account, the funds in the account will be frozen. This means you will not have access to the money until the levy is released or resolved. It can disrupt your day-to-day financial activities, making it difficult to pay bills, cover expenses, or make necessary purchases.

-

Additional Financial Hardships: The frozen bank account can lead to other financial difficulties. You may face bounced checks, overdraft fees, or missed payments on loans or bills. The financial strain can escalate if you were relying on the funds in the bank account for critical expenses.

-

Difficulty Meeting Financial Obligations: With a frozen bank account, meeting your financial obligations can become challenging. It could hinder your ability to pay rent, mortgage, utilities, or other essential expenses. It is important to communicate with your creditors and explain the situation to seek temporary relief or alternative payment arrangements.

-

Damage to Credit Score: If you are unable to meet financial obligations and default on your payments due to the bank account levy, it can negatively impact your credit score. Late payments or defaults can be reported to credit bureaus, making it difficult for you to obtain credit in the future or increasing the cost of borrowing.

-

Potential Loss of Assets: If the bank account levy does not satisfy the entire tax debt, the IRS may pursue other assets to recover the remaining amount. This can include wages, real estate, vehicles, or other valuable possessions. The loss of assets can have lasting financial consequences and impact your overall financial stability.

-

Increased Interest and Penalties: In addition to the original tax debt, the IRS may impose additional interest and penalties on the amount owed. The longer the levy remains in place, the more the debt can accumulate, making it even more challenging to resolve the outstanding tax liability.

It is important to address the IRS bank account levy promptly to mitigate these consequences. Seeking professional guidance, exploring resolution options, and being proactive in communicating with the IRS are essential steps to resolve the levy and minimize its impact on your financial situation.

Seeking Professional Help for IRS Levy Issues

Dealing with an IRS bank account levy can be overwhelming and complex. Given the potential consequences and the intricate nature of tax matters, seeking professional help is highly advisable. Here are the reasons why you should consider seeking assistance from a qualified tax professional:

-

Expertise and Knowledge: Tax professionals, such as enrolled agents, certified public accountants (CPAs), or tax attorneys, have deep knowledge and expertise in tax laws and regulations. They understand the complexities of IRS procedures and can guide you through the process, ensuring compliance and exploring the most favorable solutions for your situation.

-

Personalized Guidance: Every taxpayer’s situation is unique. A tax professional can provide personalized guidance based on your specific circumstances. They can analyze your financial situation, review your tax history, and recommend the best course of action to resolve the IRS bank account levy effectively.

-

Negotiation and Representation: If you choose to negotiate with the IRS to release the bank account levy, a tax professional can represent you during discussions and negotiations. They have experience dealing with the IRS and can present your case effectively, increasing the likelihood of a favorable outcome.

-

Navigating Tax Laws and Procedures: Tax laws and procedures can be complex and constantly changing. Keeping up with all the regulations and requirements can be overwhelming for the average taxpayer. A tax professional can stay updated on the latest developments and ensure that you are in compliance with all necessary tax laws.

-

Minimizing Financial Consequences: A tax professional can help you navigate the potential financial consequences of an IRS bank account levy. They can advise you on methods to protect your assets, explore resolution options that minimize the financial impact, and guide you towards a path of financial recovery.

-

Peace of Mind: Dealing with the IRS can be stressful and emotionally draining. Engaging a tax professional takes the burden off your shoulders and provides you with peace of mind. You can trust that you have an experienced advocate working on your behalf to resolve the bank account levy and protect your financial interests.

It is important to choose a reputable and qualified tax professional to assist you with your IRS levy issues. Research and seek recommendations to find someone with a proven track record and experience in handling similar cases. Their expertise and guidance can make a significant difference in resolving your IRS bank account levy effectively and ensuring a favorable outcome.

Conclusion

Dealing with an IRS bank account levy can be a challenging and stressful experience. Understanding the circumstances that can lead to an IRS levy, the timeline for the levy process, and the consequences it can have on your financial well-being is essential. Taking proactive measures to protect your bank account and seeking assistance from a qualified tax professional can significantly impact your ability to navigate through this situation successfully.

When facing an IRS bank account levy, it is crucial to respond promptly to the Notice of Intent to Levy and explore resolution options such as paying the tax debt in full, setting up a payment arrangement, or filing an appeal. Seeking professional help can provide you with expert guidance, personalized advice, and representation during negotiations with the IRS. They can ensure compliance with tax laws, minimize financial consequences, and help you regain control over your financial situation.

Remember, every taxpayer’s situation is unique, and seeking professional assistance tailored to your specific circumstances is highly recommended. By being proactive, staying informed, and taking appropriate steps, you can navigate the IRS bank account levy process more effectively and protect your financial well-being.

Disclaimer: This article is for informational purposes only and should not be considered professional tax advice. If you are currently facing an IRS levy or have any concerns about your tax situation, it is advisable to seek guidance from a qualified tax professional.