Home>Finance>How Long After I Verify My Identity With The IRS

Finance

How Long After I Verify My Identity With The IRS

Published: October 31, 2023

Learn how long it takes after verifying your identity with the IRS for your financial matters to be resolved.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Identity verification is an essential process when it comes to dealing with the Internal Revenue Service (IRS). Whether you are filing your tax return, claiming a refund, or answering an IRS notice, verifying your identity may be required. The IRS has strict measures in place to ensure the accuracy and integrity of the tax system, and verifying your identity is one such measure.

Identity verification usually involves providing personal information such as your name, Social Security number, date of birth, and address. In certain situations, the IRS may request additional documents or ask you to confirm specific details about your tax return. The purpose of this verification process is to protect you from tax-related fraud and to ensure that your tax return is processed accurately.

Many taxpayers wonder how long it takes for the IRS to complete the identity verification process and what impact it may have on their tax return processing. In this article, we will explore the timeline for identity verification with the IRS and how it affects your tax-related matters.

It is important to note that the exact time it takes to verify your identity may vary depending on various factors, including the volume of verifications being processed and the complexity of your case. While we cannot provide an exact timeframe, we will discuss the general processing time and provide insights on what to expect during and after the verification process.

Identity Verification with the IRS

When the IRS needs to verify your identity, they will typically send you a letter or notice by mail. This letter will provide instructions on how to complete the verification process. In some cases, the IRS may require you to call a specific phone number or visit a local IRS office to verify your identity.

The letter or notice from the IRS will outline the necessary steps to verify your identity. These steps may include providing personal information over the phone, submitting supporting documents via mail or in-person, or completing the verification process online through the IRS website. It is important to follow the instructions precisely to ensure a smooth and efficient verification process.

During the identity verification process, you may be required to provide documents such as a valid driver’s license or passport, a copy of your previous year’s tax return, or other documents that establish your identity. It is important to gather all the necessary documents and submit them promptly to avoid delays in the verification process.

Once you have completed the required steps for identity verification, the IRS will review your information and documents. They will compare the information you provided with their records to ensure accuracy and authenticity. The verification process may take some time, especially during peak tax season when the IRS is handling a high volume of verifications.

In some cases, the IRS may request additional information or documents if they need further clarification or if there are discrepancies in the information provided. It is essential to respond promptly to any requests from the IRS to avoid any delays in the verification process.

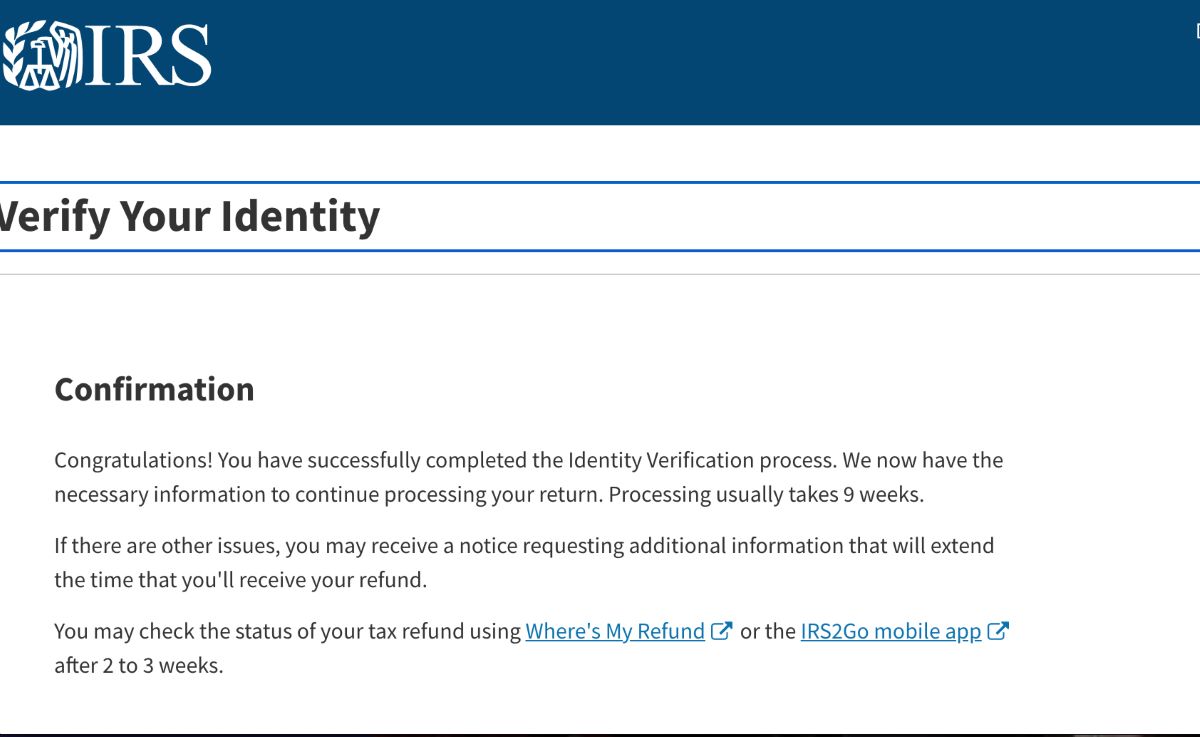

After the IRS has successfully verified your identity, they will update their records accordingly. This verification is crucial because it ensures that the IRS is interacting with the correct taxpayer and helps prevent fraudulent activity.

Next, we will discuss the typical processing time after identity verification and how it can impact your tax return processing.

Processing Time after Identity Verification

Once you have completed the identity verification process with the IRS, you may be wondering how long it will take for your tax return or other tax-related matters to be processed. The processing time can vary depending on various factors, including the complexity of your case, the volume of returns being processed by the IRS, and the time of year.

In general, the IRS aims to process tax returns and other tax-related matters within a reasonable timeframe. However, if your identity verification occurred during the peak tax season, which is typically between January and April, it may take longer for the IRS to process your documents and complete their review.

On average, the processing time after identity verification can range from a few weeks to several months. It is important to note that this timeframe is an estimate and may vary in individual cases. If the processing time extends beyond what is considered reasonable, you may consider contacting the IRS to inquire about the status of your case and seek further clarification.

It is also important to keep in mind that the processing time can be affected by any additional issues or inquiries that may arise during the verification process. For example, if the IRS identifies discrepancies or requires further information, it may result in a longer processing time as they investigate and resolve the matter.

During the processing period, it is advisable to regularly check the status of your tax return or other tax-related matters on the IRS’s official website or by using the IRS’s online tools. These tools can provide updates on the progress of your case and help you stay informed about any additional steps you may need to take.

In some cases, taxpayers may experience delays or complications with their tax return processing even after successfully completing the identity verification process. If you have concerns or specific questions about your case, it is recommended to contact the IRS directly or consult with a tax professional for guidance.

Next, we will explore the impact that identity verification and the subsequent processing time can have on your tax return processing.

Impact on Tax Return Processing

Identity verification with the IRS can have an impact on the processing of your tax return. While the verification itself may cause a temporary delay, the overall impact on your tax return processing will depend on various factors, including the nature of the verification and any additional issues identified during the process.

If your tax return is selected for identity verification, it is important to note that it will not be processed until the verification is complete. This means that any refunds or other actions related to your tax return will be put on hold during this time. The IRS will not issue refunds until they are confident in the accuracy of the return and have completed the verification process.

In general, the verification process does not affect the validity of your deductions, credits, or other tax benefits. However, if the verification process reveals discrepancies or inconsistencies in your tax return, the IRS may need to make adjustments or request additional information. This could result in changes to your tax liability or the timing of any refunds or payments owed.

It is important to review your tax return carefully to ensure the accuracy of the information before submitting it to the IRS. Double-checking your calculations, verifying the documentation you provide, and ensuring that all applicable forms and schedules are attached can help minimize the chances of further inquiries or delays during the verification process.

If the IRS identifies any issues during the verification process, they may reach out to you for further clarification or documentation. It is crucial to respond promptly and provide the requested information to avoid any unnecessary delays or complications. Failure to comply with the IRS’s requests may result in the denial of tax benefits or potential penalties.

While the verification process can be time-consuming and may cause some temporary disruptions, it serves an important purpose in ensuring the integrity of the tax system and preventing fraudulent activity. It is an essential step to protect both taxpayers and the IRS from identity theft and tax-related fraud.

Next, let’s explore how you can communicate with the IRS regarding your identity verification or any related concerns.

Communicating with the IRS

If you have completed the identity verification process with the IRS and have any questions or concerns regarding your case, it is important to know how to effectively communicate with the IRS. Here are some tips to help you navigate the process:

1. Use secure and official channels: When reaching out to the IRS, make sure to use secure and official channels of communication. Avoid sharing sensitive information through email or social media platforms. Use the official IRS website, phone numbers, or mail addresses provided in their correspondence to ensure your communication is secure.

2. Be prepared with relevant information: Before contacting the IRS, gather all relevant information related to your identity verification and have it on hand. This may include copies of letters or notices received, any documentation provided during the verification process, and your personal information such as name, Social Security number, and address.

3. Call the appropriate IRS phone number: If you need to speak with an IRS representative regarding your identity verification, refer to the phone number provided in the IRS letter or notice. Contacting the correct department or helpline will ensure that your inquiry is directed to the appropriate personnel who can assist you.

4. Be patient and persistent: Keep in mind that the IRS handles a significant volume of inquiries and requests. It may take some time to reach a representative or receive a response. Remain patient, but also be persistent in following up if necessary. Keep a record of your communication, including the date and names of the IRS representatives you speak with.

5. Seek assistance from a tax professional: If you find it challenging to communicate with the IRS or need expert guidance, consider seeking assistance from a tax professional. Tax professionals, such as enrolled agents or certified public accountants (CPAs), have experience in dealing with the IRS and can provide valuable insights and support during the identity verification process.

Remember to maintain a respectful and professional tone when communicating with the IRS. Clearly state your concerns or questions, and provide any necessary information or documentation requested by the IRS. By effectively communicating with the IRS, you can seek the clarity and assistance you need regarding your identity verification.

As we conclude this article, it is important to understand that each taxpayer’s situation may vary. The information provided here serves as general guidance, and it is always recommended to consult with a tax professional or directly contact the IRS for specific inquiries or issues related to your identity verification.

By following the proper procedures and cooperating with the IRS, you can ensure a smoother verification process and contribute to the overall security and integrity of the tax system.

Best of luck with your identity verification process!

Conclusion

Identity verification with the IRS is an important step in ensuring the accuracy and security of the tax system. While the exact timeframe for verification and processing can vary, understanding the general process and its impact can help you navigate the system more effectively.

During identity verification, it is crucial to follow the instructions provided by the IRS and promptly submit any requested documents or information. This will help ensure a smooth and timely verification process and minimize potential delays.

After completing the verification, it is important to be aware that the processing time for tax returns and other tax-related matters may be extended. The processing time can range from a few weeks to several months, with potential delays during peak tax season and if additional issues arise.

Remember to regularly check the status of your tax return or tax-related matters using the IRS’s online tools or official website. This will help you stay informed and take any necessary actions promptly.

If you have any questions or concerns regarding your identity verification or the processing of your tax return, use secure and official channels to communicate with the IRS. Be patient but persistent, and consider seeking assistance from a tax professional if needed.

By cooperating with the IRS and effectively managing the identity verification process, you contribute to the overall integrity and security of the tax system. Your compliance and cooperation help protect yourself and other taxpayers from tax-related fraud.

Remember, every taxpayer’s situation may be unique, so it is important to consult with a tax professional or directly contact the IRS for specific guidance related to your individual case.

Best of luck with your identity verification process, and may your tax-related matters be resolved in a timely and efficient manner.