Finance

When Does USAA Start To Charge A Late Fee

Published: February 21, 2024

Learn when USAA starts to charge a late fee and how it impacts your finances. Understand the consequences and manage your payments effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of personal finance, where managing your accounts and payments is crucial for maintaining a healthy financial standing. In this article, we’ll delve into the late fee policy of USAA, a prominent financial institution known for its commitment to serving military members and their families. Understanding when USAA begins to charge late fees and how to avoid them can empower you to take control of your financial responsibilities.

Managing your finances involves more than just making timely payments; it’s about understanding the terms and conditions set forth by your financial institution. USAA, with its dedication to providing financial services tailored to the unique needs of military members, has specific policies regarding late fees. By gaining insight into these policies, you can navigate your financial obligations with confidence and avoid unnecessary charges.

Let’s embark on a journey through the intricacies of USAA’s late fee policy, uncovering the details of when late fees come into play and exploring proactive strategies to sidestep them. By the end of this article, you’ll be equipped with the knowledge to navigate your financial responsibilities with USAA effectively, ensuring that you can maintain a positive financial standing while avoiding unnecessary fees.

USAA Late Fee Policy

USAA, known for its unwavering commitment to serving military members and their families, maintains a transparent and customer-centric approach to its late fee policy. Understanding the specifics of this policy is essential for ensuring that you remain informed and in control of your financial obligations.

USAA’s late fee policy is designed to encourage timely payments while providing a grace period for unexpected circumstances. The institution outlines clear terms regarding the assessment of late fees, empowering customers to make informed decisions and take proactive measures to avoid such charges.

It’s important to note that USAA’s late fee policy is in place to incentivize timely payments, thereby promoting responsible financial management among its members. By familiarizing yourself with the details of this policy, you can navigate your financial responsibilities with confidence and mitigate the risk of incurring unnecessary fees.

USAA’s commitment to transparency and customer empowerment is evident in its approach to late fees, ensuring that members have access to the information needed to make informed financial decisions. By upholding these principles, USAA fosters a sense of trust and reliability, further solidifying its position as a leading financial institution dedicated to serving the military community.

When USAA Starts to Charge a Late Fee

USAA’s late fee policy specifies the timeline for the assessment of late fees, providing clarity on when customers can expect to incur such charges. Understanding these timelines is crucial for managing your financial responsibilities and avoiding unnecessary fees.

Typically, USAA starts to charge a late fee when a payment is not received by the due date. The specific due date is outlined in the terms of your account, and it’s essential to familiarize yourself with this information to ensure timely payments. Upon missing the due date, USAA may initiate the late fee assessment process, which can result in additional charges being applied to your account.

It’s important to note that USAA often provides a grace period after the due date, allowing customers additional time to submit their payments without incurring late fees. This grace period serves as a buffer for unforeseen circumstances, offering a reasonable window for making payments before late fees are imposed.

By understanding when USAA begins to charge late fees, you can proactively manage your payments and avoid the consequences of missed deadlines. Staying informed about the due dates for your accounts and leveraging the grace period provided by USAA can help you navigate your financial obligations with confidence, minimizing the risk of incurring late fees.

Furthermore, maintaining open communication with USAA and staying updated on any changes to your account terms can contribute to a proactive approach in managing your financial responsibilities. By remaining vigilant and informed, you can uphold a strong financial standing while mitigating the impact of late fees on your accounts.

How to Avoid Late Fees with USAA

Effectively managing your payments and avoiding late fees with USAA involves proactive strategies and a thorough understanding of your financial obligations. By implementing the following practices, you can navigate your accounts with confidence and minimize the risk of incurring unnecessary fees.

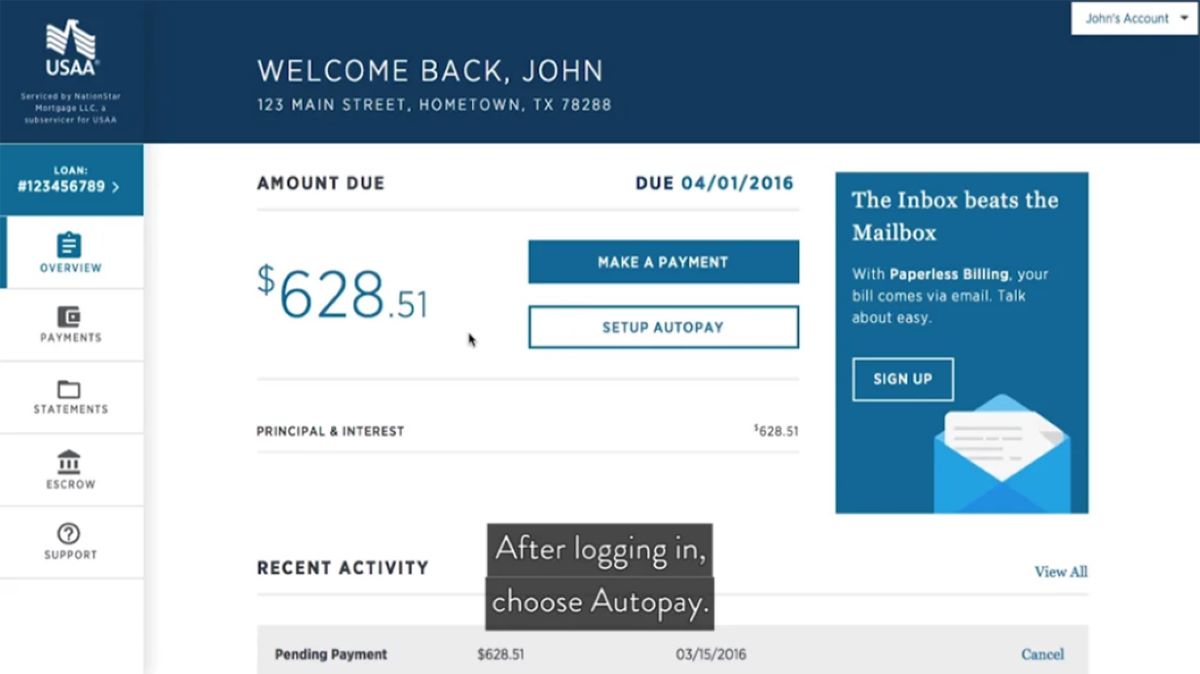

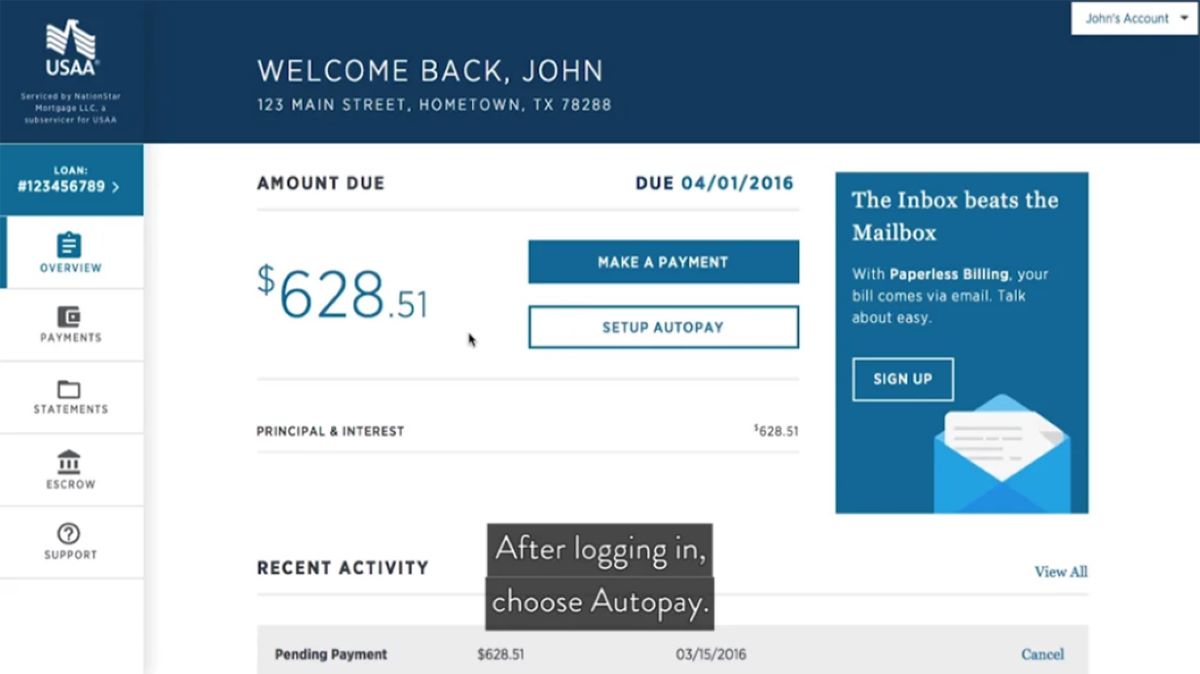

- Set Up Automated Payments: Utilize USAA’s automated payment options to schedule recurring payments for your accounts. By automating your payments, you can ensure that your obligations are met on time, reducing the likelihood of late fees.

- Stay Informed About Due Dates: Regularly review the due dates for your USAA accounts and set reminders to submit payments ahead of time. Staying informed about these deadlines empowers you to plan and execute timely payments.

- Utilize Electronic Alerts: Take advantage of USAA’s electronic alert features to receive notifications about upcoming due dates and payment reminders. Leveraging these alerts can help you stay on top of your financial commitments.

- Monitor Account Activity: Routinely monitor your USAA accounts to track payment statuses and ensure that all obligations are fulfilled. This proactive approach allows you to identify and address any potential issues promptly.

- Communicate with USAA: In the event of unforeseen circumstances that may impact your payments, consider reaching out to USAA to discuss alternative arrangements or seek guidance. Maintaining open communication can contribute to finding viable solutions and mitigating the impact of late fees.

By incorporating these practices into your financial management approach, you can proactively safeguard against late fees and maintain a positive standing with USAA. Empowering yourself with the knowledge of proactive strategies and leveraging the resources offered by USAA can contribute to a seamless and responsible approach to managing your financial obligations.

Conclusion

Navigating the realm of financial responsibilities with USAA requires a combination of awareness, proactive measures, and a clear understanding of the institution’s late fee policy. By familiarizing yourself with the specifics of USAA’s late fee policy and implementing proactive strategies, you can effectively manage your accounts and minimize the risk of incurring unnecessary fees.

USAA’s commitment to serving military members and their families is evident in its transparent and customer-centric approach to late fees. The institution provides grace periods and resources to empower customers to fulfill their financial obligations responsibly. Understanding when USAA begins to charge late fees and leveraging the available tools and features can contribute to a seamless and proactive approach to managing your accounts.

By setting up automated payments, staying informed about due dates, utilizing electronic alerts, monitoring account activity, and maintaining open communication with USAA, you can proactively avoid late fees and maintain a positive financial standing. These practices not only empower you to navigate your financial responsibilities effectively but also contribute to a sense of financial security and control.

As you continue your journey of financial management with USAA, remember that staying informed, proactive, and communicative are key components of a successful and responsible approach. By upholding these principles and leveraging the resources provided by USAA, you can navigate your accounts with confidence and minimize the impact of late fees on your financial well-being.

Empower yourself with knowledge, stay vigilant about your financial obligations, and embrace the proactive strategies outlined in this article to safeguard against late fees and maintain a positive relationship with USAA. Your commitment to responsible financial management sets the stage for a secure and stable financial future, ensuring that you can navigate your accounts with confidence and peace of mind.