Home>Finance>Verifying Insurance Is Part Of Which Revenue Cycle Step?

Finance

Verifying Insurance Is Part Of Which Revenue Cycle Step?

Modified: February 21, 2024

Verifying insurance is a crucial step in the finance revenue cycle to ensure accurate documentation and reimbursement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on verifying insurance as part of the revenue cycle. In today’s complex healthcare landscape, medical institutions face numerous challenges when it comes to managing their finances effectively. Among these challenges is the need to verify insurance coverage for patients. Verifying insurance is a vital step in the revenue cycle process that ensures accurate reimbursement for the services provided.

Insurance verification involves confirming the details of a patient’s insurance coverage, such as coverage type, policy number, and network participation. This step allows healthcare providers to determine the extent of coverage for specific procedures or treatments and prepare accurate billing information.

With the rising costs of healthcare and the increasing number of insurance plans on the market, it is crucial for healthcare organizations to streamline their insurance verification processes. Failure to do so can result in delayed payments, denied claims, and financial burdens for both the provider and the patient.

In this guide, we will delve into the various aspects of insurance verification in the revenue cycle and explore its significance, benefits, challenges, and best practices. Whether you are a healthcare professional, administrator, or revenue cycle manager, understanding the role and importance of insurance verification is key to optimizing your organization’s financial performance.

Join us as we navigate the world of insurance verification and equip you with the knowledge and tools to effectively manage this critical component of the revenue cycle.

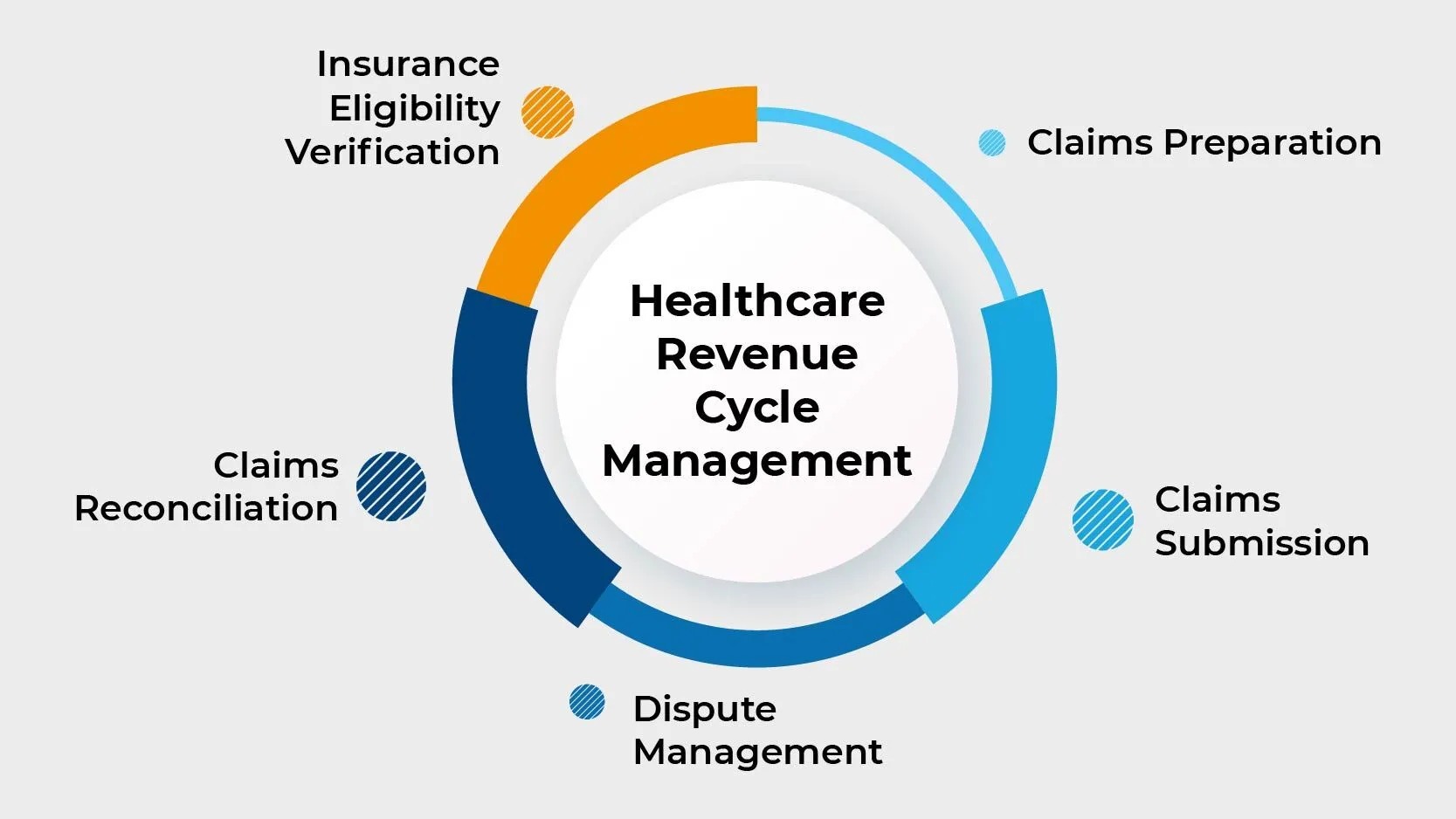

Overview of Revenue Cycle

The revenue cycle in healthcare refers to the process of managing and optimizing the financial aspect of providing medical services. It encompasses all the steps involved in generating revenue, from scheduling an appointment to receiving payment for services rendered.

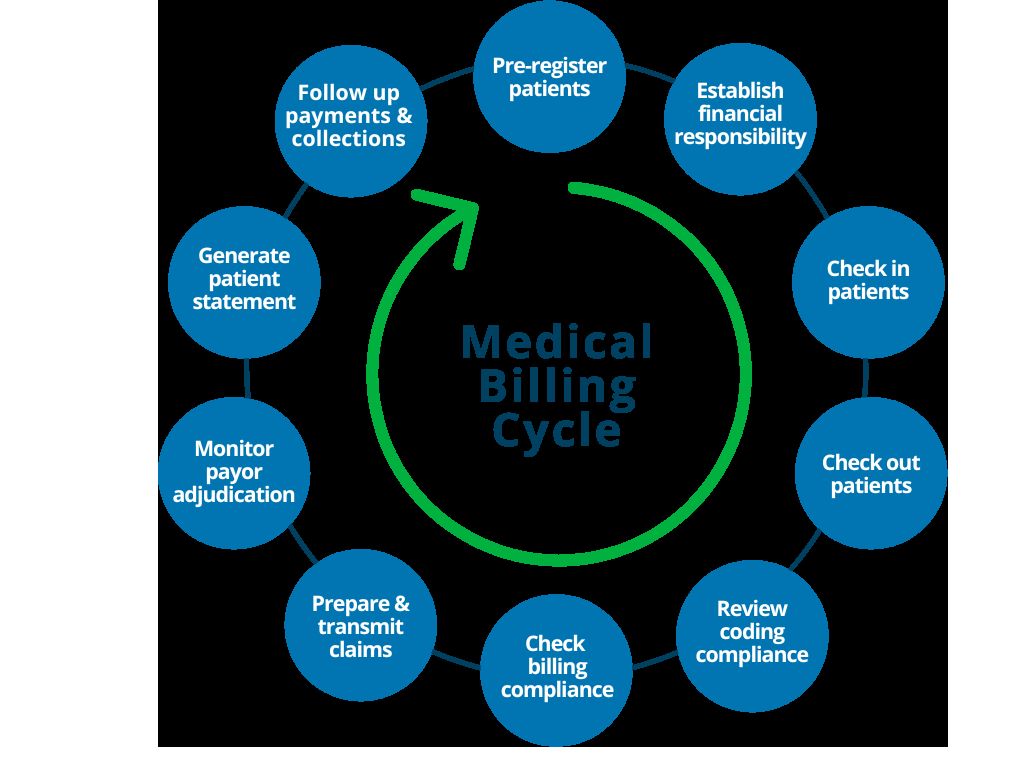

The revenue cycle begins with the patient’s initial contact and continues through the various stages, including pre-registration, registration, eligibility verification, charge capture, coding, claims submission, payment posting, and denial management.

Each stage in the revenue cycle is interconnected, and any gaps or inefficiencies can have a significant impact on the financial health of a healthcare organization. Maximizing revenue requires a well-coordinated and streamlined process that minimizes errors, reduces reimbursement delays, and ensures accurate billing and coding practices.

The revenue cycle also involves interactions with multiple stakeholders, including patients, healthcare providers, insurance companies, and government entities. Effective communication and collaboration among these stakeholders are essential to navigate the complex web of insurance policies, reimbursement policies, and regulatory requirements.

Key performance indicators (KPIs) play a crucial role in monitoring and evaluating the performance of the revenue cycle. Metrics such as days in accounts receivable, clean claim rate, denial rate, and net collection rate provide insights into the efficiency and effectiveness of revenue cycle operations.

Optimizing the revenue cycle is a continuous process that requires regular assessment and improvement. It involves implementing technology solutions, streamlining workflows, training staff, and staying up-to-date with changing regulations and industry trends.

By effectively managing the revenue cycle, healthcare organizations can enhance financial stability, improve cash flow, minimize claim denials, and ultimately provide better patient care. One crucial step in the revenue cycle process is verifying insurance coverage for patients, which ensures accurate reimbursement and avoids potential billing issues.

In the next section, we will explore the importance of verifying insurance and its role in the revenue cycle.

Importance of Verifying Insurance

Verifying insurance is a critical step in the revenue cycle process for healthcare organizations. It involves confirming the details of a patient’s insurance coverage, ensuring that the services provided are eligible for reimbursement. Proper insurance verification is essential for several reasons:

1. Accuracy in Billing: Verifying insurance coverage allows healthcare providers to accurately bill the insurance company for services rendered. By ensuring that the patient’s insurance information is correct and up-to-date, healthcare organizations can avoid billing errors and reduce the risk of claim denials or delayed payments.

2. Proper Reimbursement: Verifying insurance coverage helps healthcare providers determine the extent of coverage for specific procedures or treatments. This information allows them to estimate the patient’s financial responsibility accurately and submit accurate claims to the insurance company. It ensures that healthcare organizations receive proper reimbursement for the services provided, improving their financial stability.

3. Avoiding Financial Burdens: Verifying insurance coverage helps patients understand their financial responsibility before receiving medical services. It allows them to plan for potential out-of-pocket expenses, such as deductibles, co-pays, and co-insurance. By providing transparency in the billing process, healthcare organizations can help patients avoid unexpected financial burdens and maintain a positive patient experience.

4. Preventing Claim Denials: Verifying insurance coverage minimizes the risk of claim denials. By ensuring that the services provided are covered by the patient’s insurance plan, healthcare organizations can submit clean claims that are more likely to be accepted. This reduces the need for time-consuming and costly claim appeals and increases the chances of timely and accurate payment.

5. Compliance with Regulations: Verifying insurance coverage is essential for complying with regulatory requirements. Healthcare organizations must adhere to guidelines set by federal and state agencies, as well as insurance companies. By verifying insurance, providers can ensure that they meet the necessary criteria for reimbursement and avoid potential penalties or legal issues.

6. Building Trust and Credibility: Proper insurance verification demonstrates professionalism and reliability to patients. It assures them that the healthcare organization is committed to delivering high-quality care and managing their financial transactions accurately. This builds trust and credibility, fostering positive relationships between patients and healthcare providers.

Overall, insurance verification is a crucial component of the revenue cycle process for healthcare organizations. It plays a vital role in ensuring accurate billing, proper reimbursement, and financial stability. In the next section, we will delve into the specific steps involved in the revenue cycle and how insurance verification fits into this process.

Steps in the Revenue Cycle

The revenue cycle in healthcare consists of several interconnected steps that span from scheduling an appointment to receiving payment. While the specific processes may vary slightly among healthcare organizations, the core stages involved in the revenue cycle typically include:

- Pre-Registration: This initial step involves collecting basic patient information, such as demographics and insurance details, before the appointment. It allows healthcare organizations to gather essential data for insurance verification and streamline the registration process.

- Registration: During this stage, patients provide more comprehensive information, including personal details, insurance coverage, and consent forms. This data is crucial for accurately billing the services provided and communicating with insurance companies.

- Eligibility Verification: Verification of insurance coverage is a key aspect of the revenue cycle. It involves confirming the patient’s eligibility and benefits under their insurance plan, including policy details, coverage limits, and network participation. This step ensures accurate reimbursement and helps estimate the patient’s financial responsibility.

- Charge Capture: Charge capture involves recording the services provided to the patient, including procedures, treatments, and supplies. Accurate and timely documentation is crucial for proper billing and capturing the revenue associated with patient encounters.

- Coding: Medical coding assigns standardized codes to the services rendered, using specific classification systems such as ICD-10-CM and CPT. Proper coding ensures accurate and consistent documentation, facilitating claims processing and reimbursement.

- Claims Submission: Once the services are coded, healthcare organizations submit claims to insurance companies for reimbursement. Claims include the necessary documentation, such as the patient’s medical records, coding information, and any supporting documentation required by the payer.

- Payment Posting: This step involves recording and reconciling payments received from insurance companies and patients. Accurate payment posting is crucial for maintaining proper accounting records and tracking outstanding balances.

- Denial Management: In the event of claim denials, healthcare organizations engage in denial management to understand the reasons for denial and take appropriate actions to rectify the situation. This may involve appealing denied claims, resolving coding issues, or re-submitting corrected claims.

- Accounts Receivable Follow-Up: Following up on unpaid claims and outstanding balances is crucial for maximizing revenue and reducing accounts receivable. Timely and efficient follow-up helps identify and resolve claim issues, improve cash flow, and minimize aged accounts.

- Financial Reporting and Analysis: Regular financial reporting and analysis provide insights into the organization’s revenue cycle performance. Key performance indicators (KPIs) are measured and analyzed to identify areas for improvement, monitor cash flow, and enhance revenue cycle efficiency.

While these steps provide a general overview of the revenue cycle, it’s important to note that each organization’s process may differ based on their size, specialties, and operational workflows. Effective management and coordination throughout the revenue cycle are crucial for maximizing revenue, minimizing billing errors, and ensuring optimal financial outcomes.

In the next section, we will explore the specific role of insurance verification within the revenue cycle process.

Verifying Insurance in the Revenue Cycle

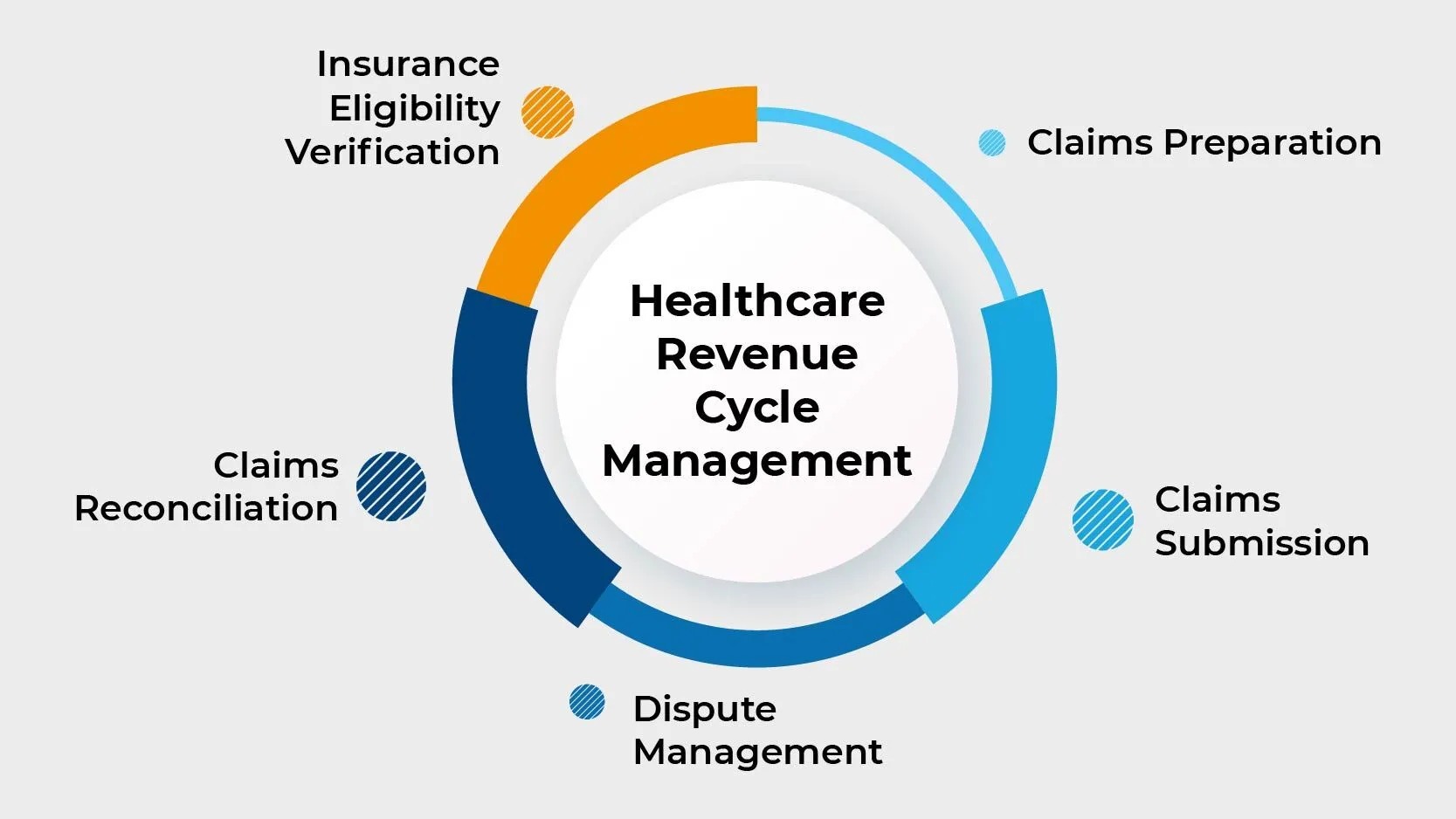

Verifying insurance is a vital step within the revenue cycle process that ensures accurate reimbursement for healthcare services provided. This crucial process involves confirming the details of a patient’s insurance coverage, such as coverage type, policy number, and network participation.

Insurance verification typically takes place after the registration stage but before the services are rendered. It involves contacting the patient’s insurance provider or using electronic tools to verify the patient’s coverage and eligibility. The information obtained during this process is crucial for determining the extent of coverage and estimating the patient’s financial responsibility.

During the insurance verification process, healthcare organizations gather essential information, including:

- Patient Information: Verify the patient’s demographic details, such as name, date of birth, and address, to ensure accuracy in insurance claims submissions.

- Insurance Coverage: Confirm the patient’s insurance plan details, such as the insurance company, policy number, group number, and coverage dates.

- Plan Details: Verify the specific benefits, limitations, and exclusions of the patient’s insurance plan, ensuring that the services provided align with the coverage.

- Network Participation: Determine if the healthcare provider is in-network or out-of-network for the patient’s insurance plan, as this can impact reimbursement rates and patient financial responsibility.

- Prior Authorization: Check if prior authorization is required for specific procedures or treatments, ensuring that the necessary approvals are obtained before providing services.

Verifying insurance information is crucial for accurate billing and successful claims submission. By obtaining accurate and up-to-date insurance details, healthcare organizations can avoid billing errors, reduce claim denials, and optimize the revenue cycle. Providers can estimate the patient’s financial responsibility based on the verified insurance information, enabling them to discuss any potential out-of-pocket costs with the patient beforehand.

Integration of technology and automated tools can significantly streamline the insurance verification process. Electronic eligibility verification systems can retrieve insurance information from various payers in real-time, saving time and reducing the chances of errors. These tools can also provide alerts for prior authorization requirements or other coverage restrictions, ensuring compliance and avoiding claim denials.

Verifying insurance in the revenue cycle is essential for maintaining financial stability and optimizing revenue. It facilitates accurate billing, minimizes claim denials, prevents financial burdens for patients, and ensures compliance with insurance company requirements and regulations.

In the next section, we will explore the benefits of effectively verifying insurance in the revenue cycle.

Benefits of Verifying Insurance

Verifying insurance coverage in the revenue cycle process offers several important benefits for healthcare organizations. By ensuring accurate and up-to-date insurance information, healthcare providers can optimize their operations and improve financial outcomes. The key benefits of effectively verifying insurance include:

1. Accurate Billing and Reimbursement: Insurance verification ensures that healthcare services are billed accurately to the patient’s insurance company. By confirming coverage details, such as policy numbers and coverage dates, providers can submit claims with the correct information. This reduces the risk of billing errors and increases the likelihood of timely and accurate reimbursement, improving revenue cycle efficiency and financial stability.

2. Minimized Claim Denials: Verifying insurance coverage helps reduce the chances of claim denials. By confirming the extent of coverage and ensuring compliance with insurance company requirements, healthcare organizations can submit clean claims that meet the necessary criteria. This reduces the need for claim appeals and rework, saving time and resources while increasing the chances of successful reimbursement.

3. Enhanced Financial Performance: Effective insurance verification leads to improved financial performance. By optimizing the revenue cycle process, healthcare organizations can increase the speed of reimbursement, reduce accounts receivable days, and minimize the number of unpaid claims. These improvements contribute to better cash flow, increased revenue, and overall financial health.

4. Transparent Financial Communication with Patients: Verifying insurance coverage allows healthcare providers to communicate patient financial responsibilities more accurately. By informing patients about their insurance benefits, potential out-of-pocket costs, and coverage limitations, providers can promote transparency in financial discussions. This helps patients make informed decisions about their healthcare and prevents unexpected financial burdens, improving patient satisfaction and overall experience.

5. Compliance with Payer Requirements: Insurance companies have specific requirements for claims submission and reimbursement. Verifying insurance ensures that healthcare organizations meet these requirements, such as obtaining prior authorizations if necessary or seeking referrals as mandated. Compliance with payer guidelines minimizes the risk of claim rejections, denials, or penalties, allowing providers to maintain positive relationships with insurance companies.

6. Streamlined Workflow Efficiency: Integrating insurance verification into the revenue cycle process streamlines workflow efficiency. By automating the verification process and leveraging technology solutions, healthcare organizations can reduce manual tasks, eliminate paperwork, and minimize errors. This saves time for administrative staff and allows them to focus on higher-value activities, leading to increased productivity and operational efficiency.

7. Prevention of Fraud and Billing Abuse: Verifying insurance coverage helps protect against fraud and billing abuse. By confirming the patient’s eligibility and coverage details, healthcare organizations can identify any inconsistencies or potential fraudulent activities. This proactive approach reduces the risk of improper billing and helps maintain the integrity of the healthcare system.

Overall, the benefits of verifying insurance coverage in the revenue cycle are far-reaching. From accurate billing and improved reimbursement to enhanced financial performance and patient satisfaction, effective insurance verification plays a crucial role in optimizing operations and ensuring the financial stability of healthcare organizations.

In the next section, we will discuss the challenges that healthcare organizations may face when it comes to verifying insurance.

Challenges in Verifying Insurance

While verifying insurance coverage is essential, healthcare organizations face several challenges in the process. These challenges can impact the efficiency of the revenue cycle and create obstacles to accurate billing and reimbursement. The key challenges in verifying insurance include:

1. Complex Insurance Landscape: The healthcare insurance landscape is vast and continuously evolving. There are numerous insurance providers, each with their own plans, coverage details, and requirements. Verifying insurance becomes challenging when healthcare organizations need to navigate this complex landscape to determine the patient’s coverage, network participation, and other relevant information.

2. Diverse Patient Insurance Plans: Patients have a variety of insurance plans, each with different coverage levels, benefits, and limitations. Verifying insurance requires healthcare organizations to gather accurate and up-to-date information about the patient’s plan, taking into account variables such as deductibles, co-pays, and co-insurance. Managing this diversity of plans can be time-consuming and complex.

3. Lack of Standardization: Insurance verification processes are not standardized across insurance providers, leading to inconsistency and challenges in verifying coverage. Each insurance company has its own procedures and systems for verifying insurance information, making it difficult for healthcare organizations to ensure a consistent and efficient verification process.

4. Limited Access to Real-Time Information: Some insurance companies do not provide real-time access to insurance information. This delays the verification process, as healthcare organizations must rely on manual methods or third-party systems to obtain the necessary coverage details. The lack of immediate access to information can result in delayed claims submission and reimbursement.

5. Eligibility Errors and Changes: Insurance coverage can change over time due to various factors, such as policy updates, employment changes, or life events. Ensuring that the patient’s insurance information is accurate and up-to-date is crucial for successful verification. However, eligibility errors or delays in updating insurance information can lead to erroneous billing and claim denials.

6. Lack of Clear Communication: Communication gaps between insurance companies and healthcare providers can hinder the verification process. Incomplete or delayed information from insurance companies can result in confusion and errors in the verification process. Clear and timely communication is necessary to obtain accurate insurance details and ensure seamless billing and reimbursement.

7. Time and Resource Constraints: Verifying insurance coverage requires time, resources, and skilled staff. Healthcare organizations may face resource constraints, such as limited staffing or insufficient technology solutions, which can impact the efficiency and accuracy of the verification process. These constraints can lead to delays in verification and potential errors in billing and reimbursement.

Despite these challenges, healthcare organizations can overcome them by implementing best practices and leveraging technology solutions for insurance verification. The next section will explore these best practices in detail to enhance the verification process within the revenue cycle.

Best Practices for Verifying Insurance

To ensure the efficiency and accuracy of the insurance verification process, healthcare organizations can adopt several best practices. Implementing these practices can enhance the revenue cycle, streamline workflows, and optimize billing and reimbursement. The key best practices for verifying insurance coverage include:

1. Implement Electronic Eligibility Verification: Leveraging technology solutions, such as electronic eligibility verification systems, can streamline the insurance verification process. These systems automate the retrieval of insurance information from various payers in real-time, providing accurate and up-to-date coverage details. Electronic verification reduces manual efforts, minimizes errors, and speeds up the verification process.

2. Maintain Accurate Patient Information: Ensuring that patient information is accurate and up-to-date is crucial for insurance verification. Healthcare organizations should implement procedures to verify and update patient information regularly. This includes confirming demographic details, contact information, and insurance coverage during each patient encounter or periodically during the patient’s care journey.

3. Standardize Insurance Verification Processes: Establishing standardized procedures for verifying insurance coverage improves consistency and efficiency. Healthcare organizations should develop clear protocols and guidelines for staff to follow during the verification process. Standardization can help reduce errors, ensure compliance, and streamline the workflow across different insurance companies and plans.

4. Train Staff Effectively: Proper training for staff involved in insurance verification is essential. Healthcare organizations should provide comprehensive training on insurance verification processes, coverage guidelines, and the proper use of technology tools. This ensures that staff members have the necessary knowledge and skills to perform accurate and efficient insurance verification.

5. Establish Communication Channels with Insurance Companies: Building strong relationships and establishing clear communication channels with insurance companies is crucial. It allows healthcare organizations to obtain timely and accurate insurance information, resolve any eligibility or coverage issues, and ensure smooth billing and reimbursement processes. Regular communication enhances collaboration and facilitates problem-solving between providers and payers.

6. Regularly Monitor and Update Insurance Coverage: It is important to monitor and update insurance coverage information regularly. Healthcare organizations should have processes in place to verify coverage at various touchpoints, including during pre-registration, registration, and subsequent visits. Regularly monitoring coverage changes, such as policy updates or terminations, helps avoid billing errors and claim denials.

7. Perform Pre-Service Financial Counseling: Engaging in pre-service financial counseling with patients is crucial for managing expectations and fostering financial transparency. This counseling involves discussing the patient’s insurance coverage, estimated costs, and any potential out-of-pocket expenses. It helps patients understand their financial responsibility and plan accordingly, enhancing their satisfaction and reducing billing surprises.

8. Continuously Improve and Adapt: The healthcare industry is constantly evolving, with changes in insurance policies, regulations, and technology. Healthcare organizations should stay up-to-date with industry trends, regulatory requirements, and best practices for insurance verification. Continuous improvement and adaptation to changing circumstances will optimize the insurance verification process and help maximize revenue.

By incorporating these best practices into their operations, healthcare organizations can streamline insurance verification, minimize billing errors, reduce claim denials, and enhance overall revenue cycle performance. These practices contribute to financial stability, improved patient satisfaction, and operational efficiency.

In the next section, we will conclude our guide on verifying insurance in the revenue cycle.

Conclusion

Verifying insurance coverage is a crucial step within the revenue cycle process for healthcare organizations. By confirming the details of a patient’s insurance coverage, healthcare providers can ensure accurate billing, proper reimbursement, and financial stability. Effective insurance verification improves the efficiency of the revenue cycle, minimizes claim denials, and enhances the overall financial performance of healthcare organizations.

Throughout this guide, we have explored the significance of verifying insurance and its role within the revenue cycle. We learned about the steps involved in the revenue cycle, with a specific focus on insurance verification. From pre-registration to payment posting, each stage is interconnected and vital for optimizing financial outcomes.

Verifying insurance offers numerous benefits, including accurate billing and reimbursement, minimized claim denials, transparent financial communication with patients, and compliance with payer requirements. By adopting best practices, such as implementing electronic eligibility verification, maintaining accurate patient information, standardizing processes, and training staff effectively, healthcare organizations can enhance their insurance verification processes and maximize revenue.

However, challenges like the complex insurance landscape, diverse patient insurance plans, lack of standardization, and time/resource constraints can impact the efficiency of insurance verification. Overcoming these challenges requires clear communication, regular monitoring, and technological solutions to streamline workflows.

In conclusion, insurance verification is an essential component of the revenue cycle that contributes to the financial stability and success of healthcare organizations. By efficiently verifying insurance coverage, healthcare providers can optimize their operations, deliver accurate billing, and provide optimal patient care. Embracing best practices and staying adaptable to industry changes will ensure healthcare organizations can navigate the complexities of insurance verification and achieve positive financial outcomes.

Thank you for joining us on this comprehensive journey through verifying insurance in the revenue cycle. We hope this guide has provided valuable insights and practical strategies to enhance your understanding and implementation of insurance verification within your organization.