Finance

Where Can I Use Revvi Credit Card

Published: October 26, 2023

Discover where you can use the Revvi credit card to finance your purchases. Find out the wide range of merchants and shops that accept this convenient payment method.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Revvi credit cards! With a Revvi credit card in your wallet, you gain access to a wide array of benefits and rewards. Whether you’re an avid online shopper, a frequent traveler, or simply someone looking to make everyday purchases more convenient, Revvi credit cards have got you covered.

Revvi credit cards are designed to provide users with a seamless and secure payment experience. Accepted at a variety of businesses, these cards offer flexibility and convenience, making them an excellent addition to your financial arsenal.

Furthermore, Revvi credit cards often come with bonus rewards and cashback offers, allowing you to earn as you spend. You can enjoy exclusive perks, discounts, and access to special promotions that can help you save money and make the most of your purchases.

Whether you’re a seasoned credit card user or new to the world of plastic money, Revvi credit cards offer a gateway to a world of possibilities. In this article, we will explore the various ways you can utilize your Revvi credit card, from online shopping to dining out, and everything in between. So, without further ado, let’s dive into the exciting opportunities that await you!

Online Shopping

Revvi credit cards are a perfect companion for online shopping enthusiasts. Whether you’re buying clothes, electronics, groceries, or even booking travel accommodations online, your Revvi credit card can be used on a wide range of e-commerce platforms.

When making online purchases with your Revvi credit card, you can enjoy increased security measures such as two-factor authentication and fraud protection. This ensures that your transactions are safe and your personal information is kept secure.

Additionally, many Revvi credit cards offer reward programs tailored specifically for online shopping. With every purchase you make, you can earn points or cashback rewards, which can be redeemed for discounts, gift cards, or future purchases. This means you not only benefit from the convenience of online shopping, but you also get rewarded for it!

Revvi credit cards also offer added convenience through digital wallet integration. You can securely link your card to popular digital payment platforms such as Apple Pay or Google Pay, allowing for quick and easy checkout experiences.

So whether you’re buying a new set of headphones, ordering your weekly groceries, or booking a weekend getaway, rest assured that your Revvi credit card will provide you with a seamless and rewarding online shopping experience.

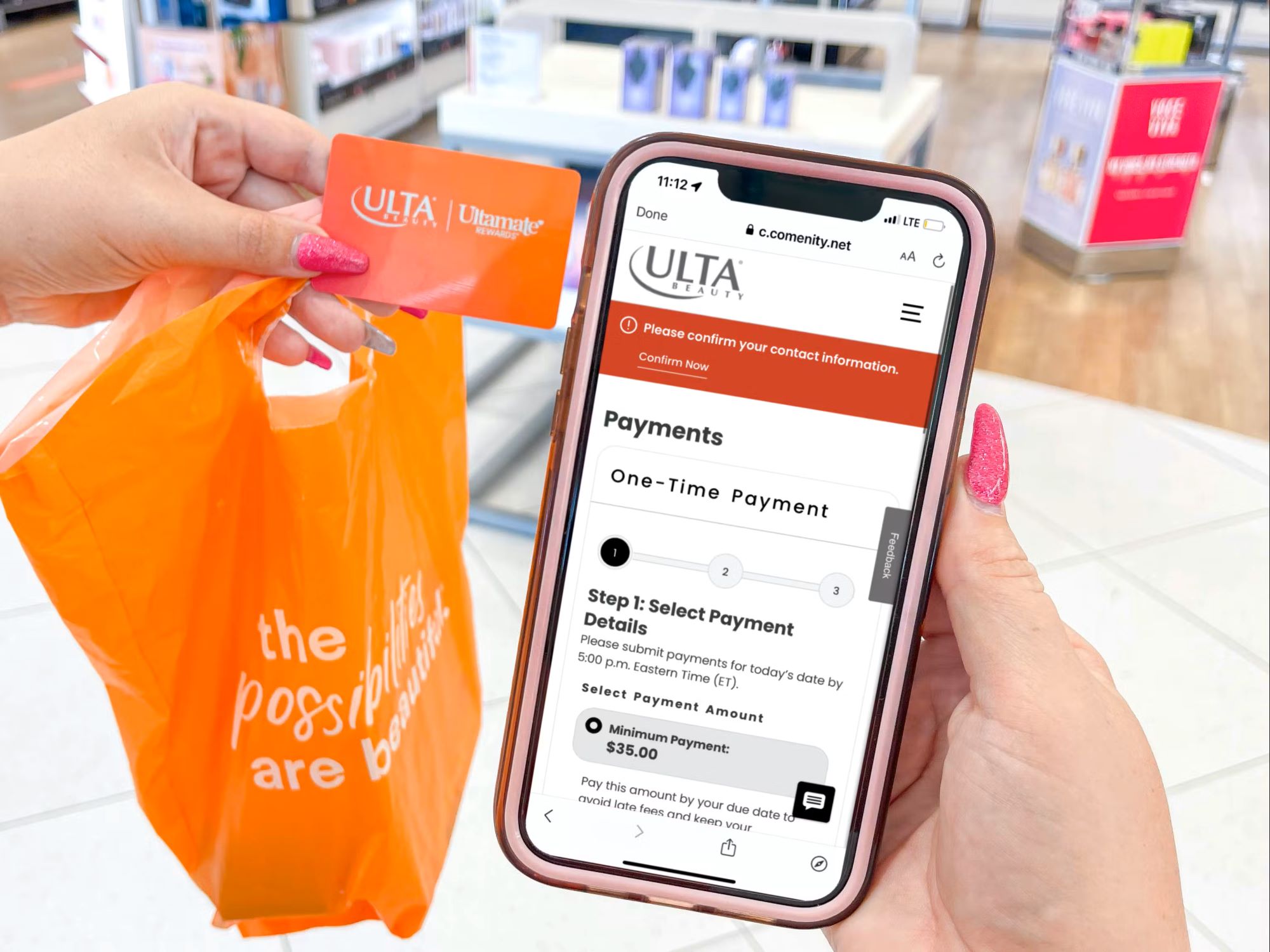

In-store Retail

Revvi credit cards aren’t just for online shopping; they can also be used for in-store retail purchases. Whether you’re browsing your favorite clothing store, shopping for household items, or indulging in a little retail therapy, your Revvi credit card can be your go-to payment method.

Using your Revvi credit card for in-store retail purchases offers several advantages. Firstly, it eliminates the need to carry cash or multiple physical cards, streamlining your wallet and making transactions more convenient. Simply swipe or insert your card, enter your PIN or sign, and you’re good to go!

Many Revvi credit cards also offer exclusive deals and discounts at partner retailers. These promotions can range from instant discounts to bonus rewards for certain purchases, giving you the opportunity to save money and maximize your shopping experience.

Furthermore, Revvi credit cards often come with purchase protection policies. This means that if you encounter any issues with your purchases, such as damaged goods or incorrect orders, you may be eligible for refunds or exchanges, providing you with peace of mind.

Revvi credit cards can also help you build your credit history. By responsibly using your card for in-store retail purchases and making timely payments, you can establish a positive credit history, which can be beneficial for future loans, mortgages, or credit applications.

So, the next time you’re out and about, don’t forget to bring along your Revvi credit card. It’s not only a convenient payment method, but it also opens up a world of opportunities for discounts, rewards, and enjoyable retail experiences.

Dining and Restaurants

When it comes to dining out, your Revvi credit card can be your best companion. Whether you’re enjoying a romantic dinner at a fine dining restaurant or grabbing a quick bite at your favorite fast-food joint, using your Revvi credit card offers a range of benefits and conveniences.

One of the advantages of using a Revvi credit card for dining is the potential to earn cashback or reward points. Many credit cards offer higher reward rates for restaurant purchases, allowing you to accumulate points or cashback that can be redeemed for future dining experiences or other rewards.

Some Revvi credit cards also provide exclusive dining offers, such as discounts at partner restaurants or access to special events and experiences. This can enhance your dining experience by introducing you to new culinary destinations or allowing you to try out restaurants that may have been out of reach due to budget constraints.

Furthermore, certain Revvi credit cards offer dining-related perks such as complimentary food and beverage vouchers, priority reservations, or even access to exclusive dining clubs. These additional benefits can make your dining experiences even more memorable and enjoyable.

Using your Revvi credit card for dining expenses also offers added security and convenience. You don’t need to worry about carrying cash or fumbling for exact change when it’s time to settle the bill. Simply present your card and make the payment, ensuring a smooth and hassle-free transaction.

So, whether you’re planning a special celebration or just looking for a convenient way to pay for your daily meals, don’t forget to bring along your Revvi credit card. It not only simplifies the payment process but also opens up a world of rewards, discounts, and exclusive experiences in the world of dining and restaurants.

Travel and Accommodation

When it comes to booking travel and accommodation, your Revvi credit card can be the key to unlocking a world of convenience and benefits. Whether you’re planning a dream vacation or a quick business trip, using your Revvi credit card offers numerous advantages throughout the travel process.

One of the main benefits of using a Revvi credit card for travel expenses is the opportunity to earn travel rewards. Many credit cards offer bonus points or miles for hotel stays, flights, car rentals, and other travel-related expenses. These rewards can be redeemed for discounted or even free travel in the future, allowing you to save money and make the most of your trips.

In addition to earning travel rewards, some Revvi credit cards provide travel-related perks and benefits. These can include access to airport lounges, complimentary or discounted travel insurance, priority boarding, or even concierge services to assist with travel arrangements and reservations.

Revvi credit cards also offer increased security measures for travel transactions. With features such as chip technology and fraud protection, you can have peace of mind knowing that your travel expenses are guarded against unauthorized use.

Furthermore, using your Revvi credit card for travel expenses can help you track and manage your spending. Most credit card statements provide detailed transaction information, making it easier to keep track of your travel expenses and maintain an organized record for reimbursement or budgeting purposes.

Whether you’re booking flights, reserving hotel rooms, or renting a car, be sure to utilize your Revvi credit card. Not only will you benefit from convenient and secure payments, but you’ll also have the opportunity to earn rewards and enjoy travel-related perks that will enhance your overall travel experience.

Entertainment and Events

When it comes to enjoying entertainment and attending events, your Revvi credit card can be your ticket to a world of fun and excitement. Whether you’re catching a movie, attending a live concert, or enjoying a sporting event, using your Revvi credit card offers a range of benefits and conveniences.

One of the advantages of using a Revvi credit card for entertainment and event purchases is the potential to earn special rewards or cashback. Many credit cards offer higher reward rates for entertainment expenses, allowing you to accumulate points or cashback that can be redeemed for future entertainment experiences or other rewards.

Furthermore, some Revvi credit cards provide exclusive offers and discounts on entertainment and event tickets. These promotions can include early access to ticket sales, discounted ticket prices, or even VIP experiences, enhancing your overall enjoyment while saving you money.

Using your Revvi credit card for entertainment expenses also offers added security and convenience. You can avoid the need to carry cash or worry about keeping track of multiple tickets by using your card for digital ticket purchases or electronic payments at venues.

Additionally, certain Revvi credit cards offer special benefits such as access to exclusive lounges, priority seating, or even pre-sale opportunities for popular events. These additional perks can elevate your entertainment experiences, making them even more memorable and enjoyable.

So, the next time you’re planning to attend a concert, movie, or any other entertainment event, remember to bring along your Revvi credit card. Not only will it simplify the payment process, but it may also unlock fantastic rewards, discounts, and exclusive perks that will enhance your overall entertainment experience.

Subscription Services

In today’s digital age, subscription services have become increasingly popular for accessing a wide range of products and content. Whether you’re subscribed to streaming platforms, online fitness classes, beauty boxes, or meal delivery services, your Revvi credit card can make managing these subscriptions a breeze.

Using your Revvi credit card for subscription services offers several advantages. Firstly, it provides a convenient and secure payment method for recurring charges. Instead of manually making payments each month or worrying about missed payments, your credit card can ensure that your subscriptions are automatically renewed without any hassle.

Many Revvi credit cards also offer features that allow you to track and manage your subscriptions. With transaction notifications and detailed statements, you can easily keep track of your subscription expenses, making it easier to budget and monitor your spending.

Furthermore, some Revvi credit cards offer additional benefits and rewards for subscription services. This can include cashback or bonus rewards for certain subscription categories, such as streaming services or online shopping subscriptions, allowing you to earn even more as you enjoy your favorite subscriptions.

If you ever decide to cancel a subscription, your Revvi credit card can provide added protection. Some credit cards offer purchase protection policies that may allow you to dispute charges or receive refunds in case of subscription issues or unauthorized charges.

So, whether you’re into binge-watching your favorite shows, staying fit with online workouts, or discovering new products through subscription boxes, don’t forget to use your Revvi credit card. It not only simplifies the payment process for your subscription services but may also offer rewards and benefits that enhance your overall subscription experience.

Utilities and Bills

Paying your utility bills and other monthly expenses is a necessary part of life, and your Revvi credit card can make the process more convenient and rewarding. Whether it’s your electricity bill, internet bill, or even your monthly grocery expenses, using your Revvi credit card for utility bills offers a range of benefits.

One of the advantages of using a Revvi credit card for utility bill payments is the ability to earn cashback or rewards. Many credit cards offer cashback or reward points for every dollar spent, including utility bill payments. This means that you can accumulate rewards as you take care of your essential expenses.

Using your Revvi credit card for bill payments also offers added convenience and flexibility. Instead of writing checks or visiting multiple bill payment centers, you can simply set up recurring payments with your credit card. This saves you time and effort by ensuring that your bills are paid automatically each month.

Furthermore, paying your bills with a Revvi credit card allows you to consolidate your expenses onto a single platform. With digital statements and transaction records, you can easily keep track of your bills, making it easier to create budgets and manage your finances.

In addition, some Revvi credit cards offer additional perks and benefits, such as purchase protection and extended warranties. This can provide peace of mind, especially when it comes to expensive utility purchases or repairs.

When it’s time to handle your utility bills and monthly expenses, don’t forget to use your Revvi credit card. It’s not just a convenient payment method, but it also offers the potential to earn rewards and streamline your bill-paying process, making your financial management a breeze.

Charity Donations

Giving back to the community and supporting charitable causes is a noble endeavor, and your Revvi credit card can make it easier and more impactful. Whether you’re passionate about environmental conservation, animal welfare, or humanitarian causes, using your Revvi credit card for charity donations offers several advantages.

One of the benefits of using a Revvi credit card for charitable contributions is the potential to earn rewards or cashback. Some credit cards offer bonus rewards for donations made to eligible charitable organizations. This means that every time you make a donation, you’re not only helping those in need but also earning rewards that can be redeemed for other purchases or charitable contributions.

Using your Revvi credit card for charity donations also provides a convenient and secure payment method. Instead of writing checks or carrying cash, you can simply input your credit card information and make the donation online or over the phone. This not only saves you time and effort but also ensures that your donation is processed quickly and efficiently.

Many Revvi credit cards also partner with charitable organizations to offer exclusive benefits. These can include discounts on event tickets, access to exclusive charity events, or even opportunities to volunteer and engage directly with the cause you care about.

In addition, using your Revvi credit card to make charitable donations allows you to easily track your contributions. Most credit card statements provide detailed transaction information, making it easier to keep a record of your donations for tax purposes or personal reference.

So, whether you’re making a one-time donation or setting up recurring contributions, consider using your Revvi credit card. By doing so, you can support your favorite causes while potentially earning rewards and enjoying the convenience and security that comes with using a credit card.

Conclusion

In conclusion, having a Revvi credit card opens up a world of possibilities and benefits across various aspects of your financial life. From online shopping to in-store retail, dining out to traveling, and enjoying entertainment to supporting charitable organizations, your Revvi credit card can enhance your experiences, offer convenience, and even provide rewards.

When it comes to online shopping, your Revvi credit card allows you to make secure and convenient purchases while potentially earning cashback and rewards. In-store retail transactions become effortless, with added perks such as exclusive discounts and purchase protection.

Dining out becomes more enjoyable as your Revvi credit card offers rewards, discounts, and exclusive experiences. When it’s time to travel and book accommodations, your card can help you earn travel rewards and provide additional travel-related benefits and protections.

For entertainment and events, your Revvi credit card can unlock exclusive offers, discounts, and rewards, enriching your experiences and making them even more memorable.

Managing your subscription services becomes hassle-free with automatic payments and the potential to earn rewards. Even paying utility bills and making charity donations can be simplified, allowing you to earn rewards or cashback as you take care of your financial responsibilities.

In the end, having a Revvi credit card not only offers convenience and rewards but also enables you to build a positive credit history and enjoy added security measures. So, whether you’re a seasoned credit card user or new to the world of plastic money, consider the various ways you can use your Revvi credit card to enhance your financial journey and make the most of your everyday transactions and interests.