Home>Finance>Where Do I Mail My Federal Tax Return In Virginia?

Finance

Where Do I Mail My Federal Tax Return In Virginia?

Published: October 29, 2023

Need to mail your federal tax return in Virginia? Find out the correct mailing address in Virginia for sending your finance-related documents.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to Virginia, where beautiful landscapes and historical landmarks blend seamlessly with a thriving economy and a diverse population. Whether you’re a resident or a non-resident, if you’re required to file a federal tax return, you may be wondering where to send it. While filing taxes can seem daunting, knowing where to mail your federal tax return in Virginia is a straightforward process.

Virginia, known for its low unemployment rate, has a significant presence of both individuals and businesses. As a result, there is a designated mailing address for taxpayers in Virginia and a separate address for those who reside outside of the state. In this article, we will explore the mailing addresses for both Virginia residents and non-residents and provide additional information and considerations to ensure a smooth tax filing experience.

So, whether you’re a proud Virginian or a taxpayer from elsewhere, let’s dive into the process of mailing your federal tax return in Virginia. Knowing where to send your return will help ensure that it reaches the appropriate IRS office and that your tax filing process is complete.

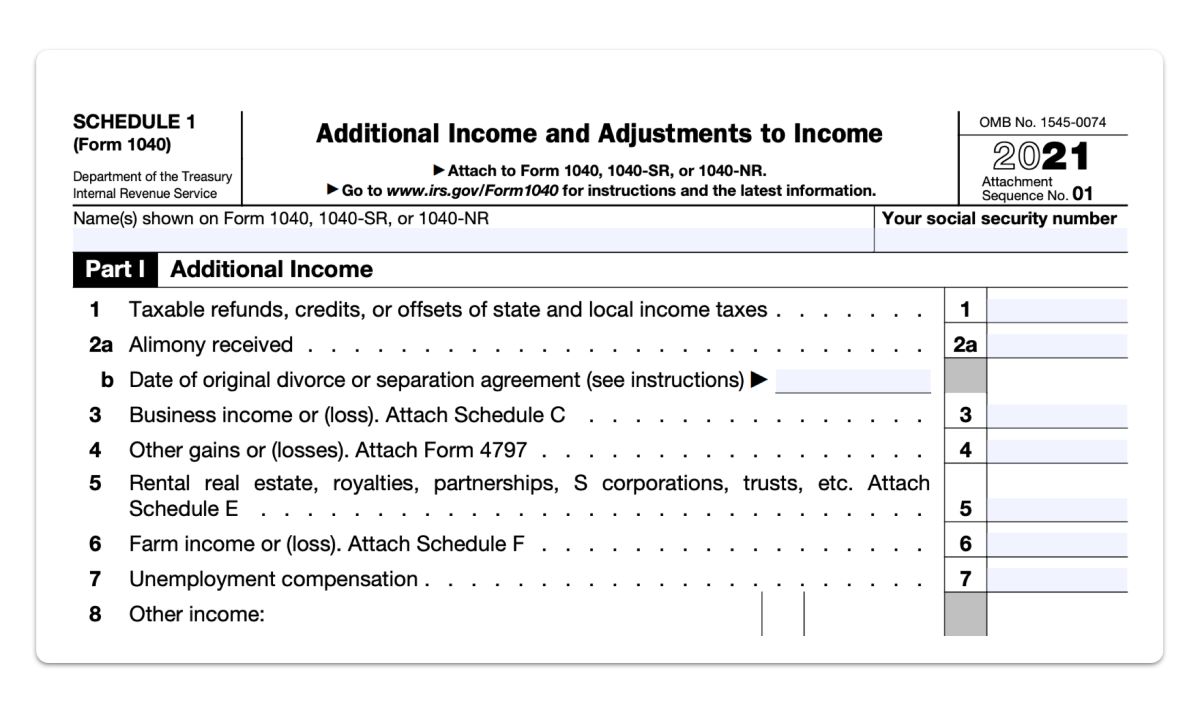

Mailing Federal Tax Returns in Virginia

When it comes to mailing your federal tax return in Virginia, it’s essential to follow the guidelines provided by the Internal Revenue Service (IRS). The IRS has specific addresses for Virginia residents and non-residents to ensure that returns are processed efficiently. It’s important to note that the address you send your tax return to may vary depending on the type of tax return form you are filing.

If you are a Virginia resident and filing a paper tax return, you will need to send your tax return to the IRS based on the location where you live. The IRS has designated specific addresses for each region within Virginia. To determine the correct address to send your tax return, you can refer to the IRS website or consult the instructions provided with your tax return form. It’s vital to send your tax return to the correct address to avoid any delays in processing.

On the other hand, if you are a non-resident of Virginia and need to mail your federal tax return, you will send it to a different address. The IRS has designated specific addresses for non-residents based on their location. To find the correct address for mailing your tax return, you can visit the IRS website or refer to the instructions provided with your tax return form.

Alternatively, if you prefer to file your tax return electronically, you can take advantage of the various e-filing options available. By e-filing, you can electronically transmit your tax return to the IRS, eliminating the need for paper forms and mailing. E-filing is not only convenient but also ensures faster processing of your tax return and quicker receipt of any refund you may be entitled to.

Remember, whether you choose to file a paper tax return or e-file, it’s crucial to carefully follow the instructions provided by the IRS. This will ensure that your tax return is properly filed and reaches the appropriate IRS office for processing. Failing to send your tax return to the correct address can result in delays or other complications in the tax filing process.

Address for Virginia Residents

If you are a Virginia resident and need to mail your federal tax return, the address you send it to will depend on the region in which you reside. The Internal Revenue Service (IRS) has designated specific addresses for each region within Virginia to ensure that tax returns are processed efficiently. Here are the addresses based on the region:

- Eastern Region: If you live in cities such as Richmond, Virginia Beach, Norfolk, or Newport News in eastern Virginia, you will send your tax return to the following address:

- Mid-Atlantic Region: For residents in areas such as Arlington, Alexandria, Fairfax, or Fredericksburg, which fall under the Mid-Atlantic region, the address for mailing your tax return is as follows:

- Southern Region: Residents in cities such as Roanoke, Lynchburg, Danville, or Bristol, which are part of the Southern region, will mail their tax return to the following address:

- Chesterfield/Charleston/Morgantown: If you reside in the areas of Chesterfield, Charleston, or Morgantown in Virginia, the address for sending your tax return is as follows:

[Eastern Region Address]

[Mid-Atlantic Region Address]

[Southern Region Address]

[Chesterfield/Charleston/Morgantown Address]

It is important to double-check the address on the official IRS website or consult the instructions provided with your tax return form. This will ensure that you have the correct and up-to-date address for sending your tax return as the addresses may be subject to change.

When mailing your tax return, it is also recommended to use certified mail or a reputable courier service to track and confirm the receipt of your documents by the IRS. This provides an additional layer of security and peace of mind in ensuring that your tax return is successfully delivered.

Address for Non-Virginia Residents

If you are a non-resident of Virginia and need to mail your federal tax return, the Internal Revenue Service (IRS) has specific addresses based on your location. The address you send your tax return to will depend on the region in which you reside. Here are the addresses for non-Virginia residents:

- Eastern Region: If you live outside of Virginia in the Eastern region, which includes states like New York, New Jersey, Pennsylvania, and Connecticut, you will send your tax return to the following address:

- Mid-Atlantic Region: For non-residents in the Mid-Atlantic region, which includes states such as Maryland, Delaware, Washington D.C., and West Virginia, the address for mailing your tax return is as follows:

- Southern Region: Residents in states like North Carolina, South Carolina, Georgia, and Florida, which fall under the IRS Southern region, will mail their tax return to the following address:

- Other States: If you reside in a state that is not included in the aforementioned regions, you will send your tax return to this address:

[Eastern Region Address]

[Mid-Atlantic Region Address]

[Southern Region Address]

[Other States Address]

It is important to note that these addresses are subject to change, so it is recommended to verify the correct mailing address on the official IRS website or refer to the instructions provided with your tax return form. Using the most up-to-date address will ensure that your tax return is sent to the appropriate IRS office for processing.

When mailing your tax return as a non-resident, consider using certified mail or a reliable courier service to track the delivery and confirm that the IRS receives your documents. This extra precaution provides peace of mind and helps ensure that your tax return reaches its intended destination.

Additional Information and Considerations

When mailing your federal tax return in Virginia, there are a few additional details and considerations to keep in mind to ensure a smooth and successful filing process:

- Postmark Deadline: It’s important to remember that your tax return must be postmarked by the IRS filing deadline, which is typically April 15th of each year. If the deadline falls on a weekend or a holiday, it is usually extended to the next business day. Be sure to check the IRS website or consult the instructions for your tax return form to confirm the exact filing deadline.

- Accurate Mailing Address: It is crucial to verify and use the correct mailing address based on your residential status and location. Sending your tax return to the wrong address may result in delays or complications in the processing of your return. Double-check the address on the official IRS website or refer to the instructions provided with your tax return form.

- Secure Packaging: When mailing your tax return, ensure that all the necessary documents, such as W-2 forms and additional schedules, are securely enclosed in the envelope. Avoid using regular letter envelopes and opt for larger envelopes or flat-rate boxes if needed, providing enough space to accommodate your tax return and supporting documents.

- Keep Copies: It’s a good practice to make copies of your completed tax return and all supporting documents before sending them. This helps in case of any future discrepancies or audits. Additionally, keeping electronic copies of your tax return files on a secure drive can provide easy access and backup.

- Consider E-Filing: While mailing your tax return is a traditional method, consider the benefits of e-filing. Electronic filing is secure, reduces the chance of errors, and allows for faster processing and potential faster receipt of any tax refunds. There are different options available, including using IRS Free File, commercial tax software, or certified tax professionals.

By keeping these additional details and considerations in mind, you can ensure a smooth and successful filing process when mailing your federal tax return in Virginia.

Conclusion

Filing your federal tax return in Virginia is a straightforward process, as long as you are aware of where to mail it. Whether you are a Virginia resident or a non-resident, the Internal Revenue Service (IRS) provides specific addresses based on your location to ensure efficient processing of your tax return.

For Virginia residents, it is important to send your tax return to the correct IRS address based on your region within the state. Double-check the address provided on the IRS website or consult the instructions that come with your tax return form. Using certified mail or a reputable courier service adds an extra layer of security to ensure successful delivery.

If you are a non-Virginia resident, the IRS has designated addresses based on your location. Make sure to verify the correct mailing address on the official IRS website or refer to the instructions provided with your tax return form.

Remember to send your tax return by the IRS filing deadline, which is typically April 15th. Accurately packaging your tax return, keeping copies for your records, and considering e-filing as an alternative are also important factors to keep in mind to ensure a smooth filing process.

Mailing your federal tax return may seem like a small step in the tax filing journey, but it is an essential one. By following the guidelines and using the correct mailing address, you can ensure that your tax return reaches the appropriate IRS office, leading to the timely processing of your return.

So, whether you’re a proud Virginian or a non-resident with tax obligations in Virginia, now you know the necessary information to confidently and accurately mail your federal tax return in the state. Remember, accurate filing and on-time submission are key to a hassle-free tax season.