Finance

Which Credit Bureau Does T-Mobile Use

Published: March 3, 2024

Find out which credit bureau T-Mobile uses to check your credit score. Understanding the credit bureau can help you manage your finances more effectively. Get the information you need to stay on top of your financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of personal finance, credit scores play a pivotal role in shaping our financial journey. Whether it's securing a loan, applying for a credit card, or even setting up a new phone plan, our creditworthiness is frequently evaluated. One such company that assesses creditworthiness is T-Mobile, a prominent player in the telecommunications industry. When individuals apply for T-Mobile services, their credit profiles are scrutinized to determine their eligibility and the terms of their agreement. However, understanding which credit bureau T-Mobile uses to assess credit scores is essential for individuals seeking their services.

The process of credit evaluation involves the collaboration of various entities, including credit bureaus. These bureaus gather and maintain individuals' credit information, which is then utilized by companies like T-Mobile to make informed decisions. As such, comprehending the dynamics of credit bureaus and their significance in credit evaluations is crucial for consumers aiming to navigate the financial landscape effectively.

In this article, we will delve into the intricacies of credit bureaus, elucidate the importance of credit scores, and explore the specific credit bureau utilized by T-Mobile. By the end of this comprehensive exploration, readers will have a clearer understanding of how credit bureaus influence financial transactions and the role they play in T-Mobile's credit assessment process.

Understanding Credit Bureaus

Credit bureaus, also known as credit reporting agencies, are entities that collect and maintain individuals’ credit information. These agencies compile data from various sources, including lenders, creditors, and public records, to create comprehensive credit reports for consumers. The primary role of credit bureaus is to assess individuals’ creditworthiness based on their financial history and behavior.

There are three major credit bureaus in the United States: Equifax, Experian, and TransUnion. Each of these bureaus gathers and analyzes financial data to generate credit reports, which are then utilized by lenders, landlords, employers, and service providers to evaluate an individual’s creditworthiness. These reports encompass a range of information, including credit accounts, payment history, outstanding debts, and public records such as bankruptcies or tax liens.

Consumers can access their credit reports from each of the three major bureaus annually for free through AnnualCreditReport.com. Reviewing these reports regularly is crucial for identifying any inaccuracies or potential signs of identity theft.

Furthermore, credit bureaus play a pivotal role in calculating credit scores, which are numerical representations of individuals’ creditworthiness. These scores are generated using complex algorithms that consider various factors, such as payment history, credit utilization, length of credit history, new credit accounts, and the types of credit used. The resulting credit scores provide a quick snapshot of an individual’s credit risk and are used by lenders to assess the likelihood of timely repayment.

Understanding the functions and significance of credit bureaus is essential for consumers as it empowers them to monitor their credit profiles, rectify any discrepancies, and comprehend how their financial behavior impacts their creditworthiness. This knowledge is particularly valuable when engaging in financial transactions with companies like T-Mobile, where credit evaluations are integral to the decision-making process.

Importance of Credit Scores

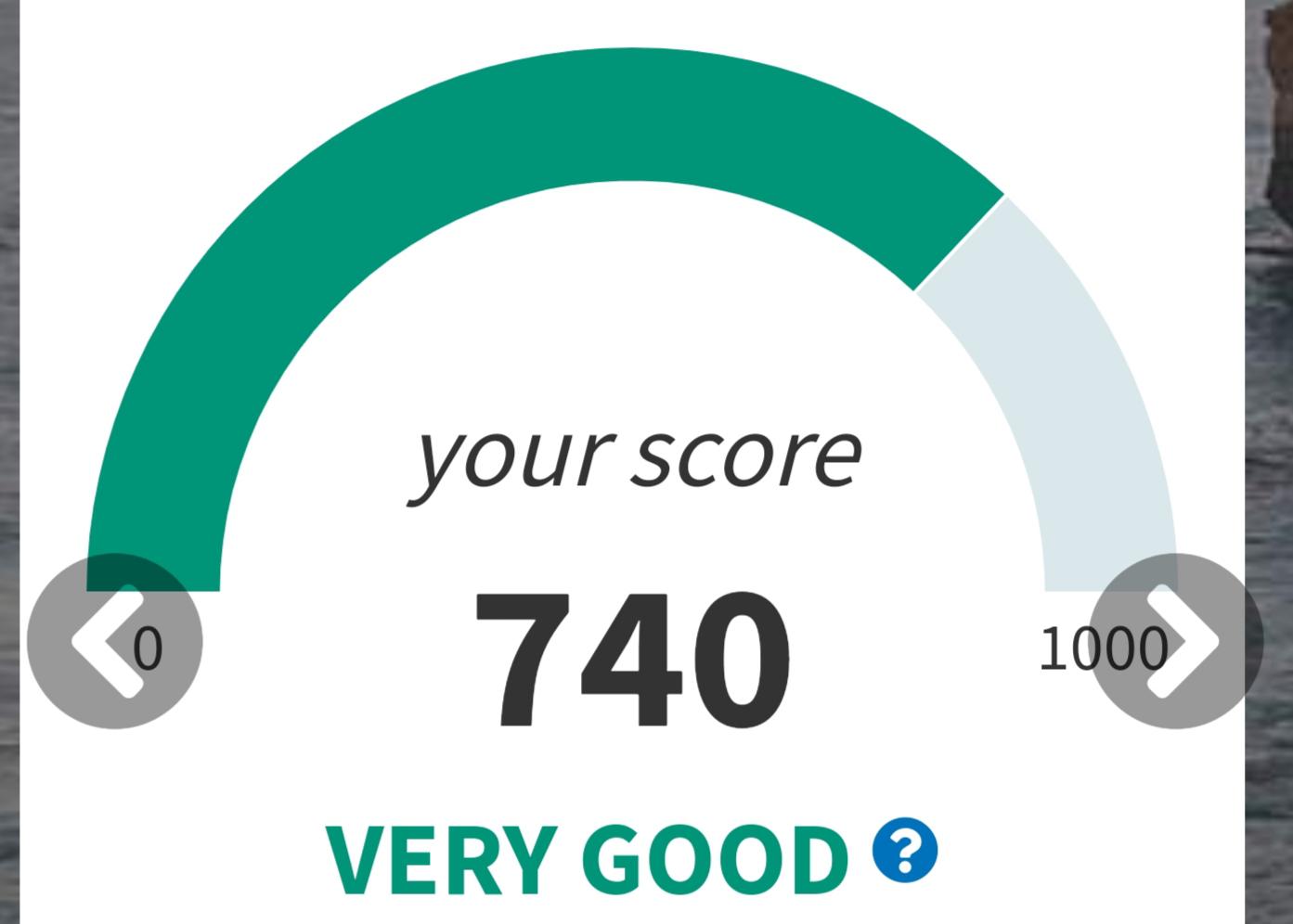

Credit scores wield significant influence over individuals’ financial endeavors, shaping their access to credit, interest rates, and favorable terms. These numerical representations of creditworthiness serve as a crucial determinant in various aspects of personal finance, underscoring the importance of maintaining a healthy credit profile.

When individuals apply for loans, mortgages, or credit cards, lenders scrutinize their credit scores to assess the level of risk associated with extending credit. Higher credit scores signal responsible financial behavior and prompt repayment, increasing the likelihood of approval and favorable terms. Conversely, lower credit scores may result in higher interest rates, stricter eligibility criteria, or outright rejections.

Moreover, credit scores can impact non-financial areas of individuals’ lives, such as rental applications, insurance premiums, and even employment opportunities. Landlords, insurance providers, and employers often utilize credit scores as a gauge of an individual’s reliability and trustworthiness.

Understanding the factors that influence credit scores empowers individuals to make informed financial decisions and take proactive steps to enhance their creditworthiness. Timely bill payments, prudent credit utilization, maintaining a diverse credit mix, and avoiding excessive credit inquiries are pivotal in bolstering credit scores.

Given the far-reaching implications of credit scores, consumers are encouraged to monitor their scores regularly and address any discrepancies or negative factors that may hinder their financial prospects. By comprehending the significance of credit scores and actively managing their credit profiles, individuals can position themselves for greater financial flexibility and opportunities.

Credit Bureau Usage by T-Mobile

When individuals apply for T-Mobile services, the company assesses their creditworthiness to determine eligibility and the terms of their agreement. In this process, T-Mobile relies on credit reports and credit scores provided by one or more of the major credit bureaus: Equifax, Experian, and TransUnion.

T-Mobile’s credit evaluation process typically involves accessing an applicant’s credit report from at least one of the major credit bureaus. This report contains a comprehensive overview of the individual’s credit history, including credit accounts, payment patterns, outstanding debts, and public records. By analyzing this information, T-Mobile can gauge the applicant’s creditworthiness and make informed decisions regarding service eligibility and deposit requirements.

It’s important to note that T-Mobile’s specific utilization of credit bureaus may vary based on factors such as the applicant’s location, the type of service being sought, and the company’s internal policies. While T-Mobile may primarily rely on one credit bureau for credit assessments, it’s not uncommon for companies to pull reports from multiple bureaus to gain a comprehensive understanding of an individual’s credit profile.

Understanding which credit bureau T-Mobile uses to evaluate credit scores is valuable for individuals seeking T-Mobile services. By familiarizing themselves with the credit reporting agencies utilized by T-Mobile, consumers can proactively monitor their credit reports and address any discrepancies or issues that may impact their creditworthiness.

Additionally, individuals can take steps to improve their credit profiles based on the specific factors considered by the credit bureau used by T-Mobile. This may include ensuring timely bill payments, managing credit utilization, and rectifying any errors in their credit reports to enhance their chances of securing T-Mobile services on favorable terms.

By comprehending T-Mobile’s credit assessment process and the involvement of credit bureaus, consumers can position themselves to navigate the application process with a clear understanding of the factors that influence T-Mobile’s credit decisions. This knowledge empowers individuals to take proactive measures to strengthen their creditworthiness and maximize their opportunities for accessing T-Mobile services.

Conclusion

In the realm of personal finance, credit scores and the role of credit bureaus are integral components that shape individuals’ financial opportunities and transactions. Understanding the dynamics of credit bureaus, the significance of credit scores, and their specific relevance to companies like T-Mobile is paramount for consumers navigating the financial landscape.

Credit bureaus, including Equifax, Experian, and TransUnion, serve as custodians of individuals’ credit information, compiling comprehensive reports that are utilized by various entities to evaluate creditworthiness. These reports, in turn, contribute to the calculation of credit scores, which play a pivotal role in determining individuals’ access to credit, interest rates, and eligibility for services.

When applying for services from companies like T-Mobile, individuals must comprehend the credit evaluation process and the involvement of credit bureaus. T-Mobile utilizes credit reports and credit scores from major bureaus to assess applicants’ creditworthiness and make informed decisions regarding service eligibility and terms.

By understanding which credit bureau T-Mobile uses and the factors considered in credit assessments, consumers can take proactive steps to manage and improve their credit profiles, thereby enhancing their prospects of securing T-Mobile services on favorable terms.

Ultimately, the interplay between credit bureaus, credit scores, and companies like T-Mobile underscores the importance of maintaining a healthy credit profile and actively monitoring one’s credit information. This knowledge empowers individuals to make informed financial decisions, cultivate responsible financial habits, and position themselves for greater financial flexibility and opportunities.

As consumers continue to engage with companies like T-Mobile and navigate the broader financial landscape, a comprehensive understanding of credit bureaus and credit scores will prove invaluable in shaping their financial well-being and unlocking a myriad of opportunities.