Finance

Which Investment Has The Least Liquidity?

Published: February 23, 2024

Discover which investment options in finance offer the least liquidity and understand the potential impact on your portfolio. Explore the pros and cons of low-liquidity assets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding Liquidity in Investments

Investing is a crucial aspect of personal finance, serving as a means to grow wealth and achieve financial goals. When considering investment options, one of the key factors to evaluate is liquidity. Liquidity refers to the ease with which an asset can be bought or sold in the market without causing a significant change in its price. In the realm of investments, liquidity plays a vital role in determining the flexibility and accessibility of funds. Understanding the concept of liquidity and its implications across various investment types is essential for making well-informed financial decisions.

Liquidity directly impacts an investor's ability to access their funds when needed. Investments with high liquidity can be quickly converted into cash, providing a sense of financial security and the ability to capitalize on emerging opportunities. On the other hand, investments with low liquidity may pose challenges when attempting to sell or convert them into cash promptly.

In this article, we will explore the concept of liquidity in investments and delve into specific types of investments that are known for their relatively low liquidity. By gaining insights into these investment categories, readers can develop a comprehensive understanding of the diverse liquidity profiles present in the financial landscape. This knowledge will empower individuals to make informed decisions aligned with their unique financial objectives and risk tolerance.

Understanding Liquidity in Investments

Liquidity is a fundamental concept in the world of investments, encompassing the ease of converting an asset into cash or quickly purchasing it without significantly impacting its price. This attribute holds immense significance for investors, as it directly influences their ability to access funds when needed and capitalize on market opportunities.

When an investment is highly liquid, it can be easily bought or sold in the market with minimal impact on its price. Common examples of liquid assets include stocks traded on major exchanges and government bonds. In contrast, investments with low liquidity may not be readily tradable, making it challenging to convert them into cash without potentially affecting their market value.

One of the key determinants of liquidity is the presence of an active market for the asset. Assets that are actively traded in robust markets tend to exhibit higher liquidity, as there is a readily available pool of buyers and sellers. Additionally, the time required to complete a transaction can influence an asset’s liquidity. For instance, publicly traded stocks can be swiftly sold in the open market, whereas selling a piece of real estate may take a longer period to finalize.

Moreover, the concept of liquidity extends beyond the speed of buying and selling assets. It also encompasses the ability to sell an asset at a fair market price without incurring substantial transaction costs. In essence, liquidity provides investors with the flexibility to adjust their investment portfolios in response to changing market conditions or personal financial needs.

Understanding the liquidity of various investment options is crucial for devising a well-rounded investment strategy. By comprehending the nuances of liquidity, investors can align their portfolios with their liquidity preferences, risk tolerance, and financial goals. Throughout this article, we will delve into specific investment categories known for their relatively low liquidity, shedding light on the distinct liquidity profiles that exist within the realm of finance.

Types of Investments

Investors have a myriad of options to consider when seeking avenues to grow their capital. Each investment type possesses unique characteristics, including varying levels of liquidity. Understanding the liquidity profiles of different investment categories is essential for constructing a diversified portfolio that aligns with individual financial objectives and risk tolerance.

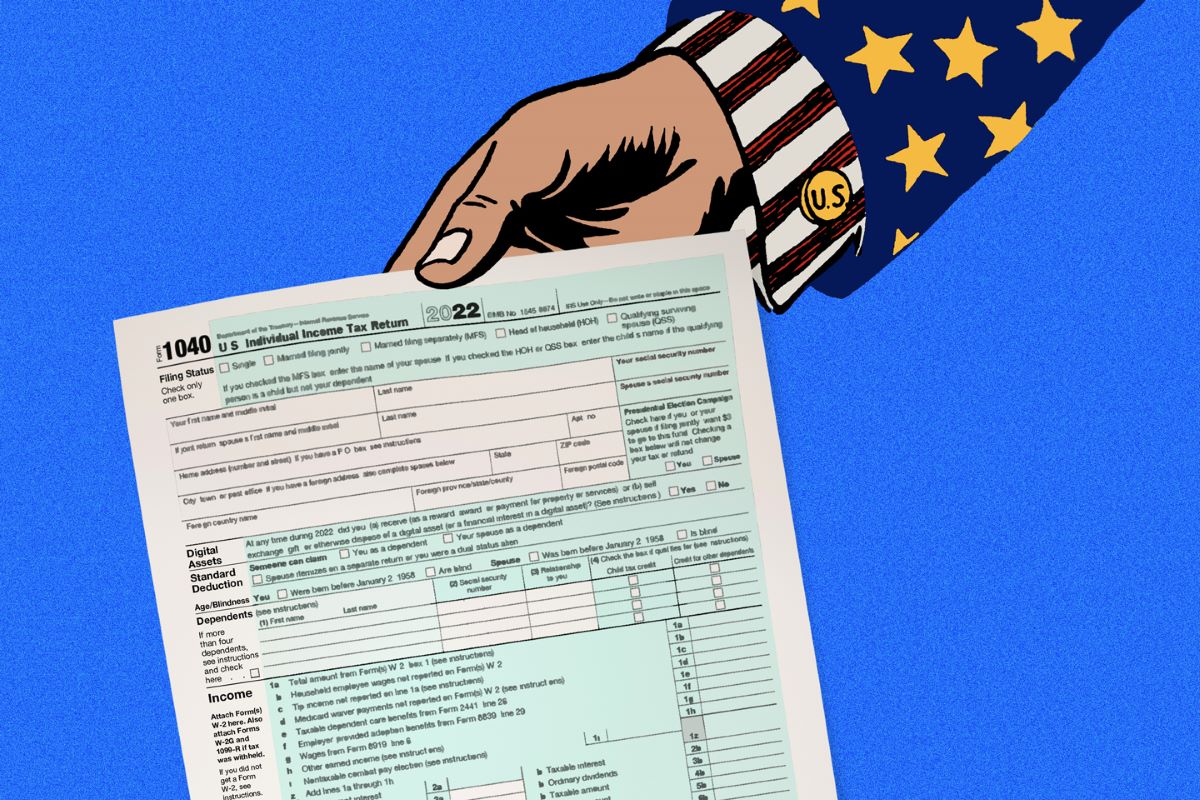

1. Stocks and Bonds: Stocks, or equities, represent ownership stakes in publicly traded companies and are known for their high liquidity. They can be readily bought and sold on major stock exchanges, providing investors with the flexibility to adjust their holdings as needed. On the other hand, bonds, particularly those issued by governments or highly-rated corporations, also offer relatively high liquidity, as they can be traded in the bond market.

2. Real Estate: Real estate investments, such as residential and commercial properties, exhibit lower liquidity compared to stocks and bonds. Selling a property typically involves a longer process and may require finding a suitable buyer. Additionally, real estate transactions often entail substantial transaction costs, further impacting liquidity.

3. Private Equity: Investments in private companies or non-publicly traded firms, commonly referred to as private equity, are characterized by low liquidity. These investments are not easily tradable on public markets, and exiting a private equity position often involves a lengthy process, potentially spanning several years.

4. Collectibles: Assets such as art, rare coins, and collectible items are considered to have limited liquidity. While these items can hold significant value, finding a buyer and completing a transaction may pose challenges, leading to lower liquidity compared to more traditional investment instruments.

By exploring these diverse investment categories and their associated liquidity profiles, investors can gain valuable insights into the varying degrees of liquidity present in the financial landscape. This understanding serves as a cornerstone for constructing a well-balanced investment portfolio that reflects individual preferences and long-term financial aspirations.

Real Estate

Real estate stands as a prominent investment avenue, offering the potential for long-term appreciation and the generation of rental income. While it holds allure as a tangible asset with the capacity to diversify investment portfolios, real estate is characterized by relatively low liquidity compared to traditional financial instruments.

When considering real estate investments, individuals may opt to acquire residential properties, commercial real estate, or participate in real estate investment trusts (REITs). While these investments can yield favorable returns, their liquidity profiles differ markedly from publicly traded securities.

One of the primary factors contributing to the lower liquidity of real estate investments is the time and effort involved in selling a property. Unlike publicly traded stocks, which can be swiftly sold on major exchanges, the process of selling real estate typically entails multiple steps. From listing the property, attracting potential buyers, and navigating negotiations to finalizing the transaction, the sale of real estate often demands a longer timeframe.

Furthermore, the transaction costs associated with real estate sales can impact liquidity. Expenses such as agent commissions, legal fees, and closing costs can diminish the net proceeds from a property sale, influencing an investor’s ability to swiftly convert the asset into cash without incurring substantial costs.

While real estate investments may exhibit lower liquidity, they offer unique advantages, including the potential for rental income and capital appreciation. Additionally, real estate can serve as a hedge against inflation and provide diversification within an investment portfolio. Investors seeking exposure to real estate while considering liquidity constraints may explore alternative options such as REITs, which provide a vehicle for investing in real estate while offering greater liquidity compared to direct property ownership.

Understanding the liquidity dynamics of real estate investments equips individuals with the knowledge to make informed decisions aligned with their financial objectives. By balancing the potential benefits of real estate with its liquidity considerations, investors can integrate real estate assets into their portfolios strategically, contributing to a well-diversified and resilient investment strategy.

Private Equity

Private equity investments represent an avenue for participating in the ownership of non-publicly traded companies, offering the potential for substantial returns over the long term. While these investments can yield lucrative outcomes, they are distinguished by their low liquidity, posing unique considerations for investors.

One of the defining characteristics of private equity is the limited market for trading these investments. Unlike publicly traded stocks, which can be bought and sold on major exchanges with relative ease, private equity holdings lack the liquidity provided by an active public market. As a result, investors in private equity often face challenges when seeking to exit their positions, as the process typically involves a protracted timeline.

Exiting a private equity investment can occur through various avenues, including initial public offerings (IPOs), acquisitions, or secondary market sales. However, these liquidity events may transpire over several years, requiring a patient approach from investors. The extended holding periods associated with private equity further contribute to its low liquidity, as investors may not have the flexibility to swiftly liquidate their positions in response to changing financial needs.

Furthermore, the illiquidity of private equity investments necessitates thorough due diligence and a comprehensive understanding of the investment horizon. Investors must carefully assess their liquidity preferences and long-term financial objectives before committing to private equity, as these investments typically require a prolonged investment horizon to realize their full potential.

Despite the challenges posed by low liquidity, private equity investments offer the prospect of significant capital appreciation and the ability to participate in the growth of promising businesses. Additionally, investors can benefit from the active involvement in the strategic direction of the invested companies, potentially contributing to value creation over time.

While private equity investments exhibit low liquidity, they can serve as valuable components of a well-diversified investment portfolio, offering the potential for enhanced returns and diversification benefits. By understanding the liquidity dynamics of private equity and aligning them with their investment objectives, individuals can navigate the unique characteristics of this asset class, contributing to a resilient and balanced investment strategy.

Collectibles

Investing in collectible assets, such as art, rare coins, vintage cars, and other valuable items, presents a distinct avenue for capital allocation. While these items can hold significant intrinsic value and appeal to collectors and enthusiasts, they are often characterized by limited liquidity compared to more traditional investment vehicles.

One of the primary factors contributing to the lower liquidity of collectibles is the specialized nature of the market. Unlike publicly traded securities or conventional financial instruments, the market for collectible assets is relatively niche, with a smaller pool of potential buyers. This can pose challenges when attempting to sell collectible items promptly, as finding a suitable buyer who is willing to pay the desired price may require time and effort.

Additionally, the valuation of collectible assets can be subjective, leading to potential discrepancies in pricing and market demand. The illiquidity of collectibles is further compounded by the need for specialized expertise in assessing the authenticity, condition, and market value of these items. As a result, the process of selling collectibles may involve engaging appraisers, auction houses, or specialized dealers, potentially extending the timeline required to complete a transaction.

Furthermore, the costs associated with buying and selling collectibles, such as auction fees, insurance, and storage expenses, can impact liquidity. These additional costs diminish the net proceeds from a sale, influencing an investor’s ability to swiftly convert their collectible assets into cash without incurring significant expenses.

Despite the challenges posed by limited liquidity, collectibles can offer unique benefits to investors, including the potential for capital appreciation and the enjoyment derived from owning culturally significant or historically valuable items. Additionally, investing in collectibles can serve as a means of diversification within an investment portfolio, providing exposure to alternative asset classes beyond traditional securities.

Understanding the liquidity dynamics of collectible investments is essential for individuals seeking to incorporate these assets into their investment strategy. By carefully evaluating the liquidity constraints and potential long holding periods associated with collectibles, investors can make informed decisions that align with their financial goals and risk tolerance, contributing to a well-rounded and resilient investment approach.

Conclusion

As investors navigate the diverse landscape of investment opportunities, the concept of liquidity emerges as a pivotal consideration influencing the accessibility and flexibility of their capital. By understanding the varying liquidity profiles of different investment types, individuals can construct well-balanced portfolios aligned with their financial objectives and risk preferences.

Throughout this exploration, it becomes evident that certain investments, such as stocks and bonds, offer high liquidity, allowing investors to swiftly buy or sell these assets in the open market. On the other hand, investments like real estate, private equity, and collectibles are characterized by lower liquidity, often requiring a more deliberate approach when seeking to convert them into cash.

While low liquidity may pose challenges in terms of swift asset conversion, these investments offer unique advantages, including the potential for long-term appreciation, income generation, and diversification benefits. Real estate investments, for example, provide the opportunity for rental income and can serve as a hedge against inflation, while private equity offers the potential for substantial returns and active involvement in the growth of non-publicly traded companies. Similarly, collectibles present the allure of owning culturally significant or historically valuable items, potentially offering capital appreciation.

By integrating investments with varying liquidity profiles into their portfolios, investors can achieve a balanced approach that accounts for both short-term liquidity needs and long-term wealth accumulation. Additionally, alternative investment options, such as real estate investment trusts (REITs) and diversified collectibles funds, can provide avenues for participating in these asset classes while offering greater liquidity compared to direct ownership.

Ultimately, understanding the liquidity dynamics of investments empowers individuals to make informed decisions, balancing the potential benefits of each asset class with their liquidity considerations. This comprehensive approach to investment management contributes to the creation of resilient and diversified portfolios, capable of weathering market fluctuations and aligning with evolving financial goals.